Key Insights

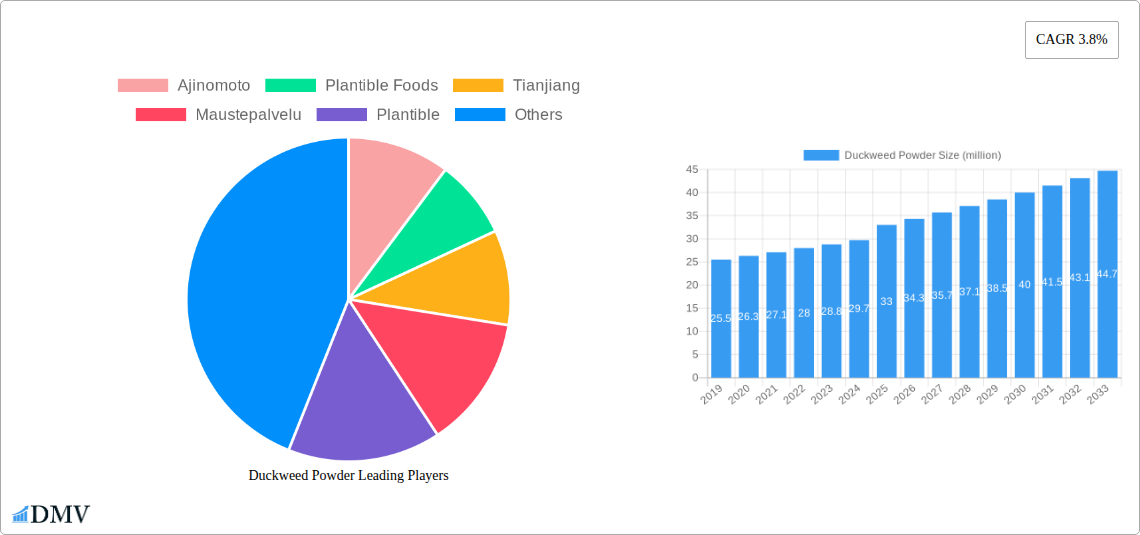

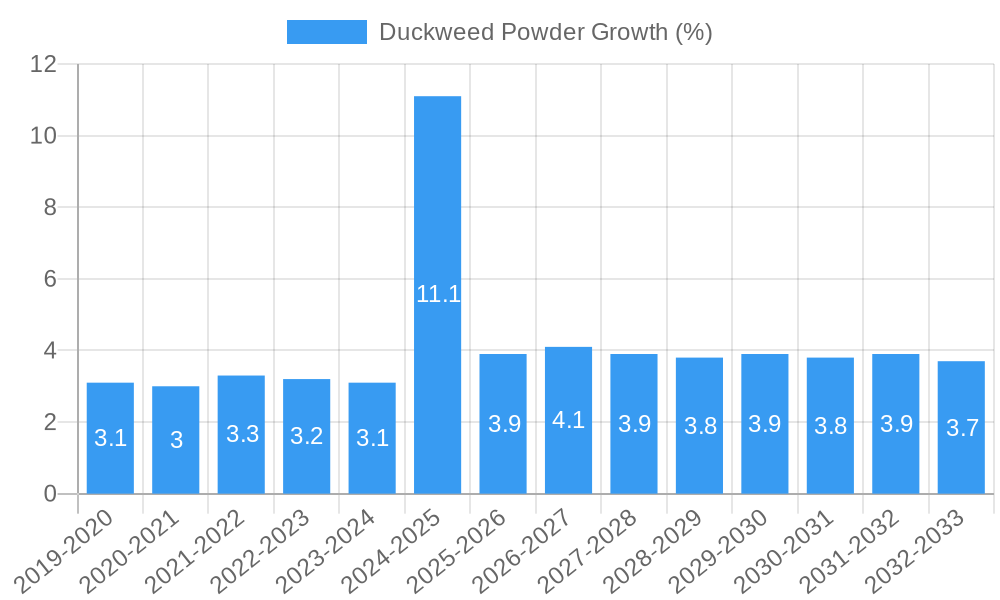

The global Duckweed Powder market is poised for robust growth, projected to reach an estimated $33 million in 2025. This expansion is underpinned by a compound annual growth rate (CAGR) of 3.8% during the forecast period of 2025-2033. This upward trajectory is primarily driven by the increasing consumer demand for sustainable and nutrient-rich food ingredients, coupled with the expanding applications of duckweed powder across various industries. The unique nutritional profile of duckweed, rich in protein, vitamins, and minerals, is attracting significant interest from the food and beverage sector, where it is being incorporated into a wide array of products, from nutritional supplements and plant-based meat alternatives to functional foods. The convenience of powdered forms further enhances its appeal for manufacturers seeking efficient ingredient solutions.

The market is characterized by a dynamic interplay of trends and restraints. Key growth drivers include the burgeoning plant-based diet movement, the growing awareness of the environmental benefits of duckweed cultivation (low water footprint, rapid growth), and ongoing research into its diverse health benefits. The market segments of online sales and offline sales are both expected to contribute to this growth, with e-commerce platforms offering greater accessibility and specialized retailers catering to niche markets. In terms of types, both bagged and canned formats will see adoption, catering to different consumer preferences and storage needs. Major players like Ajinomoto, Plantible Foods, and Rubisco Foods are actively investing in research and development, as well as expanding their production capacities to meet the anticipated demand. However, challenges such as the need for standardized cultivation practices, efficient processing technologies, and overcoming initial consumer perception may present some hurdles.

Duckweed Powder Market Composition & Trends

The duckweed powder market is characterized by moderate concentration, with key players like Ajinomoto, Plantible Foods, Tianjiang, Maustepalvelu, Plantible, Rubisco Foods, Parabel USA, Prodex, Alligga, and Bioway Organic Ingredients driving innovation. The study reveals a dynamic landscape shaped by evolving regulatory frameworks for novel food ingredients and a growing demand for sustainable protein and nutrient sources. Innovation catalysts include advancements in cultivation and extraction technologies, enabling higher yields and purer duckweed powder formulations. Substitute products, such as soy protein and spirulina, present competition, but duckweed's unique nutritional profile and rapid growth cycle offer distinct advantages. End-user profiles span the food and beverage, nutraceutical, and animal feed industries, each with specific formulation needs and quality expectations. Mergers and acquisitions (M&A) activity, while not currently at a multi-million dollar scale for individual deals, signals strategic consolidation and investment in this burgeoning sector. The market share distribution is in flux as new entrants and established players expand their offerings and market reach. XXX

- Market Concentration: Moderate, with a few key players driving innovation.

- Innovation Catalysts: Advanced cultivation and extraction techniques.

- Regulatory Landscape: Evolving, with increasing focus on novel food ingredient approvals.

- Substitute Products: Soy protein, spirulina, and other plant-based proteins.

- End-User Segments: Food & Beverage, Nutraceuticals, Animal Feed.

- M&A Activity: Emerging, with strategic investments in promising companies.

Duckweed Powder Industry Evolution

The duckweed powder industry has witnessed a significant evolution, driven by a confluence of factors including increasing consumer awareness regarding sustainable food sources, the demand for nutrient-dense ingredients, and significant technological advancements in cultivation and processing. Over the historical period (2019–2024), the market experienced a nascent growth phase, primarily fueled by research and development initiatives and early adoption by niche markets. The base year of 2025 marks a pivotal point, with projected growth accelerating into the forecast period (2025–2033). This acceleration is underpinned by the development of more efficient and scalable duckweed farming techniques, leading to consistent quality and reduced production costs. Technological breakthroughs in areas like hydroponics and controlled environment agriculture have significantly boosted yields, making duckweed powder a more viable and cost-effective ingredient. Consumer demand is shifting towards plant-based alternatives for protein and functional ingredients, directly benefiting duckweed powder. This demand is further amplified by a growing global consciousness around environmental sustainability, as duckweed is a remarkably fast-growing and resource-efficient aquatic plant. The industry's growth trajectory is also influenced by its versatility, finding applications in diverse sectors from high-protein food products and supplements to animal feed and even biofertilizers. Adoption metrics are steadily increasing as regulatory approvals expand and as more food manufacturers and nutraceutical companies integrate duckweed powder into their product lines. The market is poised for substantial expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately 15-20% anticipated over the study period, reaching an estimated market size in the hundreds of millions by 2033.

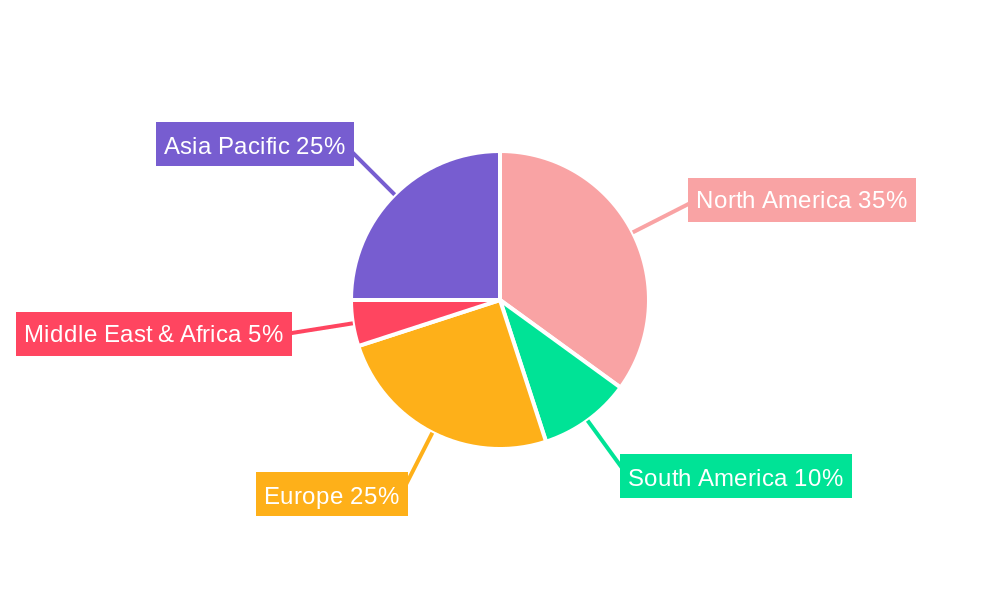

Leading Regions, Countries, or Segments in Duckweed Powder

The global duckweed powder market is witnessing a dynamic regional and segmental landscape, with North America currently emerging as a dominant force, closely followed by Europe. This dominance is propelled by robust investment trends in sustainable agriculture and a proactive regulatory environment that is increasingly supportive of novel plant-based ingredients. The United States, in particular, is at the forefront, driven by the presence of key innovators like Plantible Foods and Parabel USA, and a strong consumer appetite for health and wellness products. The Application segment of Online Sales is experiencing exponential growth, reflecting the broader e-commerce trend in food and supplement markets. Consumers are increasingly purchasing duckweed powder directly through online platforms for its convenience and wider product selection. Conversely, Offline Sales, encompassing traditional retail channels, are also significant, particularly in established markets where consumer purchasing habits are more ingrained. However, online channels are projected to outpace offline growth due to their accessibility and ability to reach a wider consumer base.

Within the Types segment, Bagged duckweed powder commands a larger market share. This is attributed to its versatility in packaging sizes, catering to both bulk industrial users and individual consumers. Bagged products are more adaptable for various applications, from food manufacturing to direct nutritional supplement use. Canned duckweed powder, while less prevalent currently, holds potential for specific niche applications requiring extended shelf-life and product integrity, and its market share is expected to grow as processing and preservation technologies advance.

- Dominant Region: North America (with the United States leading).

- Key Drivers in North America:

- Significant investment in sustainable agriculture and food technology.

- Supportive regulatory frameworks for novel ingredients.

- Strong consumer demand for plant-based and health-conscious products.

- Presence of leading duckweed powder manufacturers.

- Dominant Application Segment: Online Sales, driven by e-commerce trends and consumer convenience.

- Growth Factors for Online Sales:

- Increased internet penetration and smartphone usage.

- Direct-to-consumer (DTC) models adopted by manufacturers.

- Broader product availability and competitive pricing online.

- Dominant Type: Bagged duckweed powder, due to its versatility and adaptability.

- Growth Potential for Bagged Products:

- Catering to diverse industrial and consumer needs.

- Cost-effectiveness in production and distribution.

Duckweed Powder Product Innovations

Product innovations in the duckweed powder market are rapidly enhancing its appeal and application potential. Manufacturers are focusing on developing ultra-pure, highly concentrated duckweed protein isolates and functional ingredient blends. These innovations address specific nutritional needs, such as high-protein, low-carb formulations for sports nutrition and functional foods. Advancements in extraction methods are yielding powders with improved solubility, palatability, and reduced anti-nutritional factors, making them more user-friendly for a wider range of food and beverage applications. Performance metrics are improving, with enhanced protein digestibility and bioavailability being key selling propositions. Unique selling propositions include duckweed's comprehensive amino acid profile, rich in essential amino acids, and its potent antioxidant properties. Technological advancements are enabling the development of specialized duckweed powders tailored for use in plant-based meats, dairy alternatives, and even in pharmaceutical applications as a nutrient-rich excipient.

Propelling Factors for Duckweed Powder Growth

Several key growth drivers are propelling the duckweed powder market forward. Technologically, advancements in sustainable cultivation techniques, such as advanced hydroponics and controlled environment agriculture, are leading to more efficient and consistent production. Economically, the rising demand for plant-based proteins and functional ingredients, driven by health and wellness trends, is creating a significant market pull. Regulatory support for novel food ingredients and sustainable sourcing practices is also a crucial factor, encouraging investment and market entry. Furthermore, the increasing awareness of duckweed's environmental benefits, including its rapid growth and minimal resource requirements, aligns with global sustainability goals, further fueling its adoption.

- Technological Advancements: Improved cultivation, harvesting, and extraction methods ensuring higher yields and purity.

- Economic Demand: Surging consumer interest in plant-based proteins, functional foods, and dietary supplements.

- Regulatory Support: Favorable policies and approvals for novel food ingredients.

- Sustainability Focus: Growing demand for eco-friendly and resource-efficient food sources.

Obstacles in the Duckweed Powder Market

Despite its promising growth, the duckweed powder market faces certain obstacles. Regulatory challenges, particularly in securing widespread approvals for novel food ingredients across different regions, can slow down market penetration. Supply chain disruptions, from cultivation to processing and distribution, can impact availability and cost-effectiveness. Competitive pressures from established alternative protein sources like soy and pea protein, which have larger market shares and more developed supply chains, pose a significant challenge. Additionally, consumer education and perception are crucial; overcoming potential skepticism about unfamiliar ingredients and highlighting the benefits of duckweed powder requires sustained marketing and outreach efforts.

- Regulatory Hurdles: Navigating complex and varying approval processes for novel food ingredients globally.

- Supply Chain Volatility: Potential disruptions in cultivation, processing, and logistics impacting consistent supply and pricing.

- Competition: Intense competition from well-established plant-based protein sources with mature markets.

- Consumer Education: The need to build awareness and trust regarding the benefits and safety of duckweed powder.

Future Opportunities in Duckweed Powder

Emerging opportunities in the duckweed powder market are abundant, driven by evolving consumer preferences and technological advancements. The expansion into new geographic markets, particularly in Asia and Latin America where plant-based diets are gaining traction, presents significant growth potential. The development of specialized duckweed powders for niche applications, such as infant nutrition, pet food fortification, and even in the cosmetics industry for its skincare benefits, opens up new revenue streams. Furthermore, advancements in biotechnological applications, including the extraction of specific bioactive compounds from duckweed for pharmaceutical and nutraceutical purposes, represent a high-value opportunity. Collaborations between research institutions and industry players will be crucial in unlocking these future opportunities.

Major Players in the Duckweed Powder Ecosystem

- Ajinomoto

- Plantible Foods

- Tianjiang

- Maustepalvelu

- Plantible

- Rubisco Foods

- Parabel USA

- Prodex

- Alligga

- Bioway Organic Ingredients

Key Developments in Duckweed Powder Industry

- 2023/08: Plantible Foods secures significant funding to scale up its duckweed protein production, signaling strong investor confidence in the market.

- 2022/11: Alligga launches a new line of duckweed-based protein powders targeting the sports nutrition market.

- 2022/05: Ajinomoto announces research collaborations to explore novel applications of duckweed derivatives in functional foods.

- 2021/10: Parabel USA expands its cultivation facilities to meet growing demand for its duckweed protein ingredients.

- 2020/07: Bioway Organic Ingredients introduces certified organic duckweed powder to its product portfolio.

Strategic Duckweed Powder Market Forecast

The strategic outlook for the duckweed powder market is exceptionally positive, driven by a confluence of factors that position it for sustained and robust growth. The increasing global demand for sustainable and nutrient-dense food ingredients, coupled with ongoing technological innovations in cultivation and processing, will continue to fuel market expansion. Projections indicate a significant rise in the adoption of duckweed powder across the food and beverage, nutraceutical, and animal feed sectors. Market forecasts highlight a strong potential for innovation in specialized product formulations and new application areas, further diversifying revenue streams. The strategic imperative for market players lies in capitalizing on these opportunities through continued research and development, market penetration, and by addressing evolving consumer needs for healthier and more sustainable food choices.

Duckweed Powder Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Bagged

- 2.2. Canned

Duckweed Powder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Duckweed Powder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Bagged

- 5.2.2. Canned

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Bagged

- 6.2.2. Canned

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Bagged

- 7.2.2. Canned

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Bagged

- 8.2.2. Canned

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Bagged

- 9.2.2. Canned

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Duckweed Powder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Bagged

- 10.2.2. Canned

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ajinomoto

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plantible Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tianjiang

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Maustepalvelu

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plantible

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rubisco Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Parabel USA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prodex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alligga

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bioway Organic Ingredients

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ajinomoto

List of Figures

- Figure 1: Global Duckweed Powder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Duckweed Powder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Duckweed Powder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Duckweed Powder Revenue (million), by Types 2024 & 2032

- Figure 5: North America Duckweed Powder Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Duckweed Powder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Duckweed Powder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Duckweed Powder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Duckweed Powder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Duckweed Powder Revenue (million), by Types 2024 & 2032

- Figure 11: South America Duckweed Powder Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Duckweed Powder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Duckweed Powder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Duckweed Powder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Duckweed Powder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Duckweed Powder Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Duckweed Powder Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Duckweed Powder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Duckweed Powder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Duckweed Powder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Duckweed Powder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Duckweed Powder Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Duckweed Powder Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Duckweed Powder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Duckweed Powder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Duckweed Powder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Duckweed Powder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Duckweed Powder Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Duckweed Powder Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Duckweed Powder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Duckweed Powder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Duckweed Powder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Duckweed Powder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Duckweed Powder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Duckweed Powder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Duckweed Powder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Duckweed Powder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Duckweed Powder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Duckweed Powder Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Duckweed Powder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Duckweed Powder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Duckweed Powder?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Duckweed Powder?

Key companies in the market include Ajinomoto, Plantible Foods, Tianjiang, Maustepalvelu, Plantible, Rubisco Foods, Parabel USA, Prodex, Alligga, Bioway Organic Ingredients.

3. What are the main segments of the Duckweed Powder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 33 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Duckweed Powder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Duckweed Powder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Duckweed Powder?

To stay informed about further developments, trends, and reports in the Duckweed Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence