Key Insights

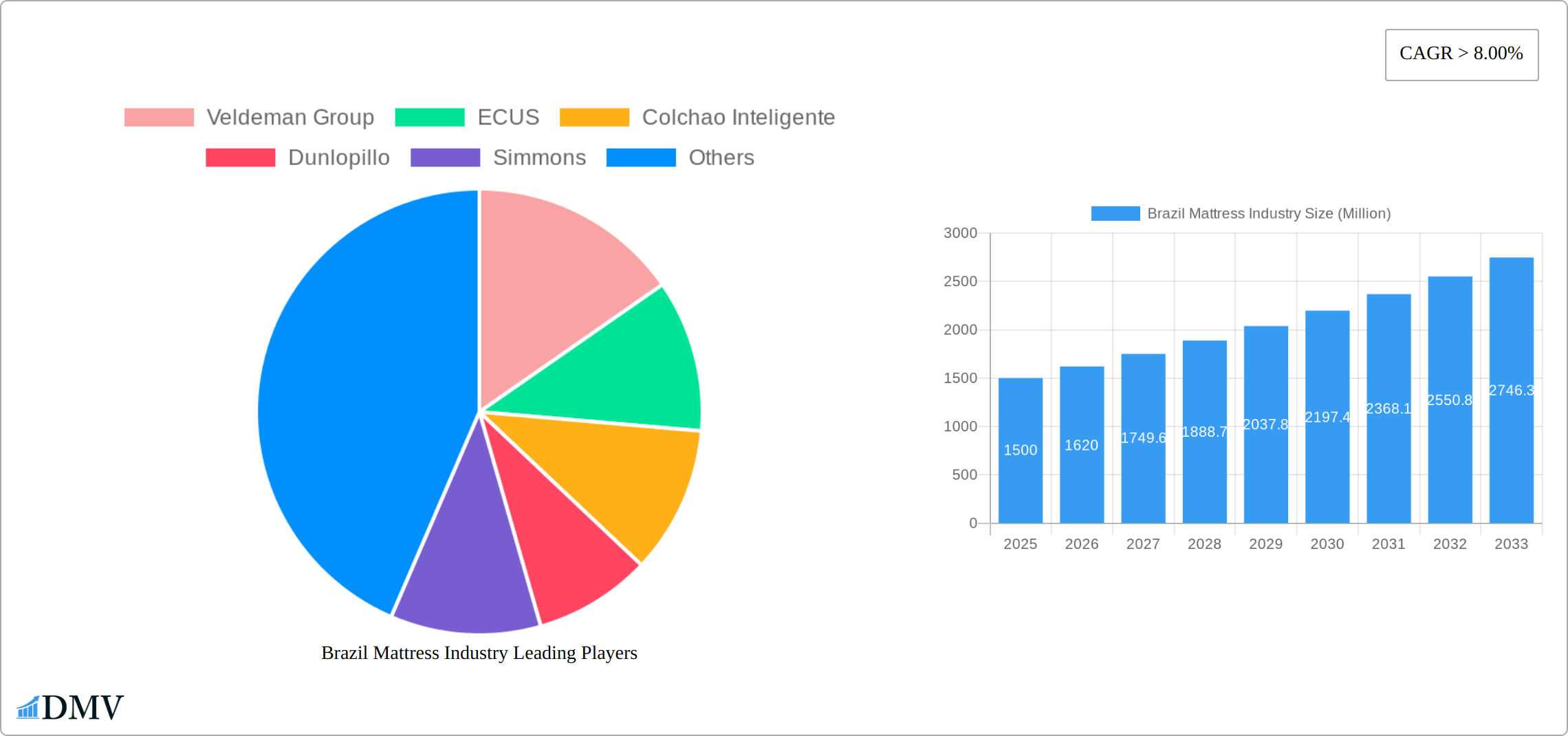

The Brazilian mattress market, valued at approximately $XXX million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes within the burgeoning Brazilian middle class are increasing demand for higher-quality, more comfortable mattresses. Simultaneously, a growing awareness of the importance of sleep hygiene and its impact on overall health is driving consumer preference towards premium mattress types like memory foam and latex. Furthermore, the expanding e-commerce sector in Brazil is providing increased access to a wider range of mattress brands and models, boosting online retail sales and overall market penetration. The market is segmented across various product types (spring, foam, latex, and others), distribution channels (offline and online retail), and end-users (residential and commercial). While the dominance of offline retail is expected to continue, the online segment shows significant growth potential, driven by increasing internet and smartphone penetration. Competition is fierce, with both international giants like Tempur Sealy International and regional players like Veldeman Group and Colchao Inteligente vying for market share. Challenges remain, including economic volatility and fluctuations in raw material costs, which could impact pricing and profitability.

The competitive landscape is characterized by a mix of international and domestic brands. International players benefit from established brand recognition and technological advancements, while local manufacturers leverage their understanding of regional preferences and pricing strategies. The market's evolution is shaped by shifting consumer preferences towards innovative mattress technologies offering enhanced comfort and health benefits. Companies are responding by incorporating advanced materials, ergonomic designs, and smart features into their products. Furthermore, strategic partnerships and collaborations are observed, leading to a more dynamic and innovative marketplace. The forecast for the Brazilian mattress market remains positive, driven by sustained economic growth, evolving consumer lifestyles, and continued innovation within the industry. Factors such as increasing urbanization and a young, growing population further contribute to the long-term growth prospects.

Brazil Mattress Industry: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Brazil mattress industry, providing crucial data and forecasts for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils the key trends, challenges, and opportunities shaping the future of sleep solutions in Brazil. The report's detailed segmentation, encompassing product types (Spring Mattress, Foam Mattress, Latex Mattress, Other Mattresses), distribution channels (Offline Retail, Online Retail), and end-users (Residential, Commercial), offers granular insights for informed decision-making. The projected market size surpasses xx Million by 2033, presenting significant growth potential for investors and industry players alike.

Brazil Mattress Industry Market Composition & Trends

The Brazilian mattress market is a dynamic and competitive landscape, characterized by the interplay of established international brands and agile local manufacturers. The market exhibits moderate concentration, with a few dominant players actively shaping its trajectory. Prominent entities such as Veldeman Group, ECUS, Colchao Inteligente, and Dunlopillo are at the forefront, each distinguished by unique market strategies and diverse product portfolios. The industry's innovation engine is fueled by continuous advancements in materials science and manufacturing technologies, leading to the development of mattresses that offer superior comfort, exceptional durability, and demonstrable health benefits. The evolving regulatory framework, particularly concerning product safety and environmental sustainability, is a significant influence on current industry practices. While substitute products like air mattresses and futons occupy niche segments, the residential sector remains the primary revenue generator, though the commercial segment is emerging as a significant growth avenue. Mergers and acquisitions (M&A) have been observed with moderate frequency in recent years, with reported deal values ranging from approximately XX Million to XX Million, indicative of ongoing consolidation efforts and strategic partnerships within the sector.

- Estimated Market Share Distribution (2025): Veldeman Group (XX%), ECUS (XX%), Colchao Inteligente (XX%), Others (XX%)

- Average M&A Deal Value (2019-2024): XX Million

Brazil Mattress Industry Industry Evolution

The Brazilian mattress industry has undergone substantial transformation between 2019 and 2024, with continued evolution projected into the future. This growth has been propelled by a confluence of favorable economic and societal factors, including the rise in disposable incomes, accelerated urbanization, and a heightened consumer consciousness regarding the critical importance of quality sleep. The historical period (2019-2024) experienced a Compound Annual Growth Rate (CAGR) of approximately XX%. Projections for the forecast period (2025-2033) indicate a sustained CAGR of XX%, underscoring the market's robust expansion potential. Technological breakthroughs, such as the widespread adoption of memory foam and the refinement of advanced spring systems, have revolutionized product offerings. Consumer demand has demonstrably shifted towards mattresses incorporating advanced technology and offering specialized benefits, reflecting a growing desire for personalized comfort and improved health outcomes. E-commerce has emerged as a preferred retail channel, particularly among younger demographics, leading to a significant surge in online mattress sales. The increasing preference for specific mattress types, such as memory foam and latex, is directly linked to a greater awareness of their health advantages and superior comfort. Furthermore, the burgeoning popularity of hybrid mattress designs, expertly blending the supportive structure of innerspring coils with the plush comfort of foam layers, signifies a consumer pursuit for an optimal balance of support and luxurious comfort.

Leading Regions, Countries, or Segments in Brazil Mattress Industry

The Southeast region of Brazil dominates the mattress market, driven by higher population density, increased purchasing power, and robust economic activity. Within product segments, the Spring Mattress segment maintains its lead, though the Foam Mattress and Latex Mattress segments are experiencing rapid growth, fueled by their affordability and health benefits. Offline retail remains the dominant distribution channel, but online retail is progressively gaining traction, especially in urban centers. The residential sector holds the largest market share within the end-user segment, however, growth in the commercial sector is promising, driven by the hospitality industry's increasing focus on customer experience.

- Key Drivers for Southeast Region Dominance: High population density, significant disposable incomes, strong infrastructure, and established retail networks.

- Key Drivers for Foam Mattress Growth: Affordability, comfort, and perceived health benefits.

- Key Drivers for Online Retail Growth: Increased internet penetration, convenience, and competitive pricing.

Brazil Mattress Industry Product Innovations

Recent product innovations within the Brazilian mattress market are primarily centered on elevating consumer comfort, extending product lifespan, and enhancing overall health benefits. Memory foam mattresses, now engineered with advanced pressure-relieving capabilities and customizable firmness levels, have witnessed a surge in consumer adoption. Hybrid mattresses, which skillfully integrate the robust support of innerspring coils with the cushioning embrace of multiple foam layers, represent another significant innovation, adeptly catering to a wide spectrum of consumer preferences. Demonstrating a forward-thinking approach, the market is also seeing the introduction of 'smart' mattresses equipped with integrated features like sophisticated sleep tracking technology and intelligent temperature regulation systems, signaling a clear trend towards technologically advanced sleep solutions. These advancements are not only enriching the overall consumer experience but are also acting as powerful catalysts for sustained market growth.

Propelling Factors for Brazil Mattress Industry Growth

The Brazilian mattress industry is experiencing robust growth, driven by several key factors. Firstly, a consistent increase in disposable incomes empowers consumers to allocate more resources towards investing in premium sleep solutions. Secondly, ongoing urbanization trends contribute to a heightened demand for comfortable, functional, and aesthetically pleasing home furnishings. Thirdly, supportive government initiatives aimed at promoting sustainable manufacturing practices are actively encouraging the adoption of eco-friendly materials and production methods. Technological advancements continue to play a crucial role, facilitating the development of novel and innovative mattress types that meet evolving consumer needs. Finally, a discernible shift in consumer preferences towards enhanced comfort and a greater emphasis on health and well-being are significant drivers propelling the market forward.

Obstacles in the Brazil Mattress Industry Market

Despite its growth potential, the Brazil mattress industry faces several obstacles. Fluctuations in raw material prices, particularly foam and spring components, impact production costs. Supply chain disruptions caused by logistical challenges can lead to delays and shortages. Intense competition from both domestic and international players requires continuous innovation and differentiation. Furthermore, economic downturns can impact consumer spending on non-essential items like mattresses. These factors influence the overall market dynamics and require strategic adaptations by industry participants.

Future Opportunities in Brazil Mattress Industry

The Brazilian mattress market offers significant future opportunities. The growing middle class, increasing awareness of sleep health, and rising demand for premium sleep solutions create a large addressable market. Expansion into underserved regions and the development of innovative product offerings will unlock growth potential. The integration of smart technology into mattresses and the adoption of sustainable manufacturing practices will further drive market expansion.

Major Players in the Brazil Mattress Industry Ecosystem

- Veldeman Group

- ECUS

- Colchao Inteligente

- Dunlopillo

- Simmons

- Ruf-Betten

- Emma

- Anjos Colchoes

- Sleemon

- Mlily

- Therapedic

- Corsicana

- Castor

- Mengshen

- Hilding Anders

- Tempur Sealy International Inc

Key Developments in Brazil Mattress Industry Industry

- 2022 Q3: Colchao Inteligente launched a new line of innovative, environmentally conscious mattresses, emphasizing sustainable materials and production.

- 2023 Q1: Veldeman Group strategically acquired a smaller, specialized mattress manufacturer, expanding its production capabilities and market reach.

- 2024 Q2: Simmons introduced a groundbreaking smart mattress featuring advanced sleep-tracking technology and personalized comfort adjustments.

- 2025 Q1: Major industry players have announced increased investment in their online retail channels and direct-to-consumer (DTC) strategies to capitalize on growing e-commerce trends.

Strategic Brazil Mattress Industry Market Forecast

The Brazilian mattress market is poised for sustained growth, fueled by economic expansion, rising consumer spending, and technological advancements. The increasing demand for premium and specialized mattresses, coupled with the expansion of online retail channels, will drive market expansion. The development of innovative products catering to specific consumer needs, together with the adoption of sustainable practices, will shape the future of this dynamic industry. The projected market size is expected to surpass xx Million by 2033, representing a significant opportunity for market participants.

Brazil Mattress Industry Segmentation

-

1. Product

- 1.1. Spring Mattress

- 1.2. Foam Mattress

- 1.3. Latex Mattress

- 1.4. Other Mattresses

-

2. Distribution Channel

- 2.1. Offline Retail

- 2.2. Online Retail

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Brazil Mattress Industry Segmentation By Geography

- 1. Brazil

Brazil Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience and Time-Saving; Changing Food Culture and Western Influence

- 3.3. Market Restrains

- 3.3.1. Power Supply Issues; Preference for Traditional Cooking Methods

- 3.4. Market Trends

- 3.4.1. Foam Mattress Production Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Mattress Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Spring Mattress

- 5.1.2. Foam Mattress

- 5.1.3. Latex Mattress

- 5.1.4. Other Mattresses

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail

- 5.2.2. Online Retail

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Veldeman Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ECUS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colchao Inteligente

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dunlopillo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Simmons

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ruf-Betten

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anjos Colchoes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sleemon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mlily

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Therapedic

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Corsicana

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Castor

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mengshen

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Hilding Anders

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Tempur Sealy International Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Veldeman Group

List of Figures

- Figure 1: Brazil Mattress Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Mattress Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Mattress Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Mattress Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Brazil Mattress Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Brazil Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Brazil Mattress Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Brazil Mattress Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Brazil Mattress Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 9: Brazil Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Mattress Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Brazil Mattress Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Mattress Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Mattress Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Brazil Mattress Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 15: Brazil Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Brazil Mattress Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 17: Brazil Mattress Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: Brazil Mattress Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 19: Brazil Mattress Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Mattress Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Mattress Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Brazil Mattress Industry?

Key companies in the market include Veldeman Group, ECUS, Colchao Inteligente, Dunlopillo, Simmons, Ruf-Betten, Emma, Anjos Colchoes, Sleemon, Mlily, Therapedic, Corsicana, Castor, Mengshen, Hilding Anders, Tempur Sealy International Inc.

3. What are the main segments of the Brazil Mattress Industry?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Convenience and Time-Saving; Changing Food Culture and Western Influence.

6. What are the notable trends driving market growth?

Foam Mattress Production Dominated the Market.

7. Are there any restraints impacting market growth?

Power Supply Issues; Preference for Traditional Cooking Methods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Mattress Industry?

To stay informed about further developments, trends, and reports in the Brazil Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence