Key Insights

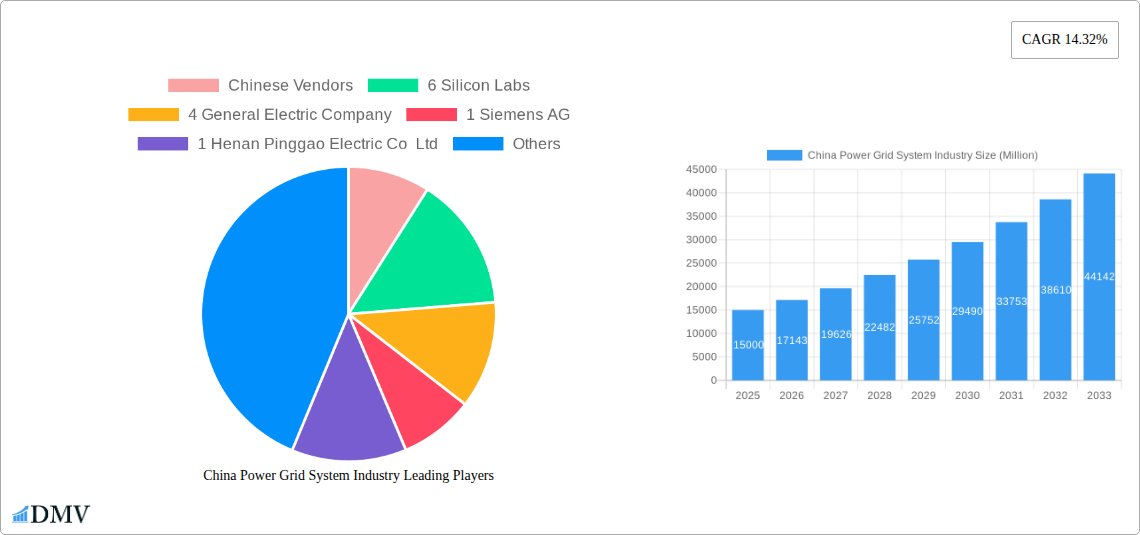

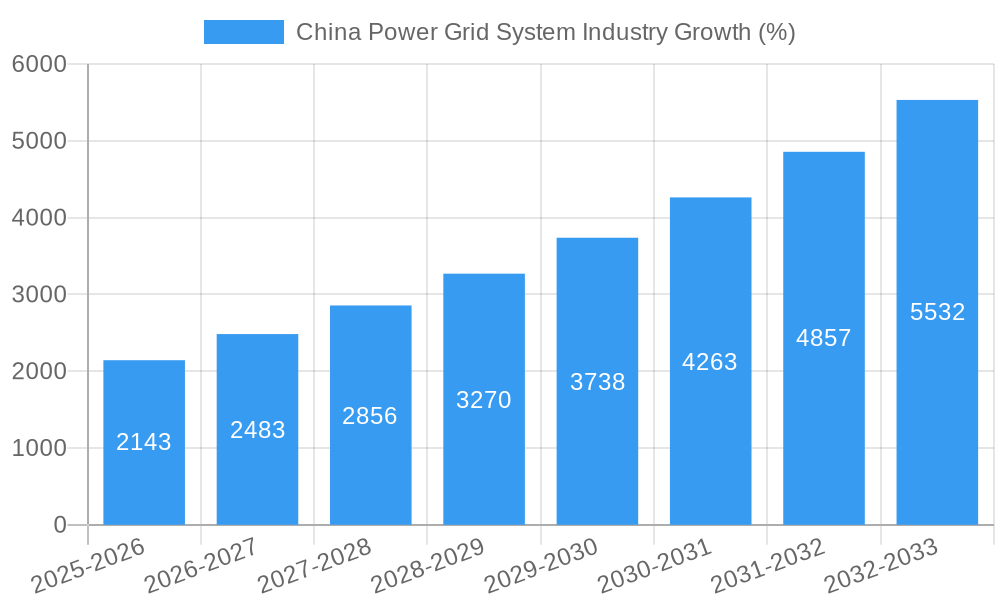

The China power grid system market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 14.32% from 2025 to 2033. This surge is primarily driven by the country's ambitious renewable energy integration targets, rapid urbanization leading to increased electricity demand, and ongoing investments in smart grid technologies to improve efficiency and reliability. Key growth segments include the transmission and distribution infrastructure, with significant demand for advanced transformers, substations, and high-voltage cables. The industrial sector remains the largest end-user, fueled by robust manufacturing activities, while the residential and commercial sectors are witnessing substantial growth driven by rising living standards and economic development. Despite the impressive growth trajectory, challenges remain, including the need for modernization of aging infrastructure, managing grid stability with increasing renewable energy penetration, and optimizing the integration of diverse energy sources. Chinese vendors like Huawei, ZTE, and numerous regional players dominate the market, competing with international giants such as ABB, Siemens, and General Electric. However, the increasing emphasis on technological advancement and the adoption of smart grid solutions is creating opportunities for international vendors specializing in advanced technologies like digitalization and AI-powered grid management.

The market's future hinges on China's continued commitment to sustainable development and its ongoing investments in grid infrastructure modernization. Government policies supporting renewable energy and smart grid development will significantly influence the market's trajectory. Furthermore, advancements in grid technologies, such as the adoption of HVDC transmission for long-distance power transport and smart meters for improved energy management, are poised to drive further growth. Competitive dynamics will continue to shape the market landscape, with both domestic and international players vying for market share through technological innovation, strategic partnerships, and aggressive expansion strategies. The integration of renewable energy sources, including solar and wind power, presents significant challenges related to grid stability and efficient energy distribution; successful navigation of these challenges will be crucial for sustainable market expansion.

China Power Grid System Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic China Power Grid System industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the key trends, challenges, and opportunities shaping this crucial sector. The report leverages extensive data analysis and expert insights to provide a clear, concise, and actionable understanding of the market landscape. The total market size in 2025 is estimated at xx Million USD.

China Power Grid System Industry Market Composition & Trends

This section meticulously evaluates the competitive landscape of the China Power Grid System industry, examining market concentration, technological advancements driving innovation, the regulatory environment, the presence of substitute products, end-user behavior, and significant M&A activities. The report dissects the market share distribution among key players, both domestic and international, and analyzes the financial implications of significant mergers and acquisitions, providing insights into deal values (in Millions of USD). For example, the intense competition between Chinese vendors like Huawei Technologies Co Ltd and ZTE Corporation, alongside international players such as ABB Ltd and Siemens AG, significantly shapes market dynamics. The regulatory landscape, with its focus on renewable energy integration and grid modernization, is a critical factor influencing investment decisions and technological adoption.

- Market Concentration: The market is characterized by a mix of large, established players and smaller, specialized firms. Precise market share figures for each player will be detailed in the full report.

- Innovation Catalysts: Government initiatives promoting smart grids and renewable energy integration are major drivers of innovation.

- Regulatory Landscape: Stringent regulations regarding grid stability and safety influence technology selection and deployment.

- Substitute Products: While limited direct substitutes exist, alternative energy sources and decentralized generation pose indirect competition.

- End-User Profiles: The report profiles industrial, commercial, and residential end-users, highlighting their distinct needs and preferences.

- M&A Activities: The report details significant M&A transactions, analyzing their impact on market consolidation and technological advancement. Total M&A deal value during the historical period is estimated at xx Million USD.

China Power Grid System Industry Industry Evolution

This section delves deep into the evolutionary trajectory of the China Power Grid System industry. It tracks market growth rates over the historical period (2019-2024) and projects future growth trends for the forecast period (2025-2033). Technological advancements, such as the integration of IoT sensors and AI-driven automation (as evidenced by SGCC's deployment of Nokia's solution in October 2022), and shifting consumer demands towards increased reliability and sustainability are closely examined. Specific data points including compound annual growth rates (CAGRs) and adoption rates of key technologies will be provided. The increasing integration of renewable energy sources, driving the need for sophisticated grid management systems, presents a significant growth opportunity. The transition towards a smarter, more efficient grid, facilitated by technological advancements, will be a key theme in this analysis.

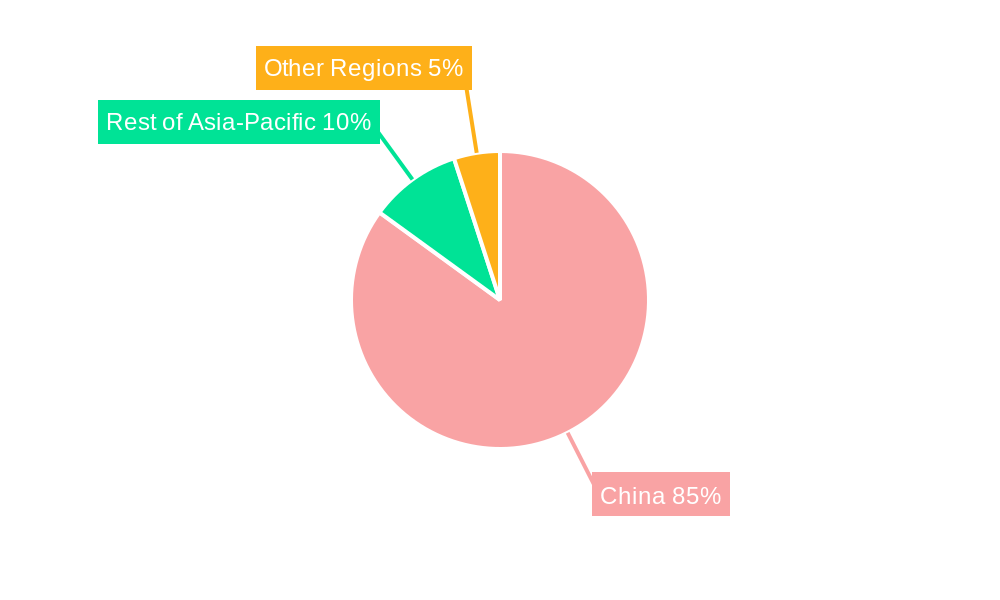

Leading Regions, Countries, or Segments in China Power Grid System Industry

This section identifies the dominant regions, countries, and segments within the China Power Grid System industry. Analyzing data across various segments (By Product: Transformers, substations, transmission lines, cables; By End User: Industrial, commercial, residential; By Application: Distribution, transmission, generation), the report pinpoints the leading areas and explores the underlying reasons for their dominance. Market size for each segment (in Millions of USD) will be presented.

- Dominant Segment (By Product): Transformers segment is projected to hold the largest market share in 2025.

- Dominant Segment (By End User): The industrial sector is expected to dominate end-user demand.

- Dominant Segment (By Application): The transmission application segment is likely to be the largest revenue generator.

Key Drivers:

- Investment Trends: Massive investments by the State Grid Corporation of China (as evidenced by their USD 74.5 Billion investment announcement in June 2022) are a primary driver.

- Regulatory Support: Government policies promoting grid modernization and renewable energy integration create a favorable environment for growth.

China Power Grid System Industry Product Innovations

This section showcases notable product innovations within the industry, detailing their applications and performance metrics. It highlights the unique selling propositions (USPs) of these innovations and analyzes the technological advancements that underpin them. The integration of advanced materials, improved efficiency, and enhanced safety features in transformers, substations, and transmission lines are key areas of innovation. The adoption of smart grid technologies, including real-time monitoring and predictive maintenance capabilities, will be further examined.

Propelling Factors for China Power Grid System Industry Growth

Several key factors propel the growth of the China Power Grid System industry. These include significant government investments in infrastructure development, the increasing demand for electricity driven by economic growth and urbanization, and the expanding adoption of renewable energy sources. Technological advancements, like the integration of smart grid technologies and IoT devices, further enhance efficiency and reliability, driving market expansion. The supportive regulatory environment, encouraging the deployment of renewable energy and grid modernization, also plays a crucial role.

Obstacles in the China Power Grid System Industry Market

Despite the significant growth potential, the China Power Grid System industry faces several obstacles. These include potential supply chain disruptions, impacting the availability of key components and materials. Furthermore, intense competition among both domestic and international players presents a significant challenge. Regulatory hurdles and the complexities of integrating renewable energy sources into the existing grid infrastructure add further complexity. Quantifiable impacts of these challenges on market growth will be analyzed in the full report.

Future Opportunities in China Power Grid System Industry

The future of the China Power Grid System industry holds immense opportunities. The increasing integration of renewable energy sources, particularly solar and wind power, will drive demand for advanced grid management systems and smart grid technologies. The expansion of the electric vehicle market will further increase electricity demand, creating opportunities for grid infrastructure upgrades. The development of microgrids and distributed generation systems, improving reliability and resilience, presents another promising area for future growth.

Major Players in the China Power Grid System Industry Ecosystem

The China Power Grid System industry involves a diverse range of players, including both domestic and international companies.

- Huawei Technologies Co Ltd

- ABB Ltd

- ZTE Corporation

- Jiangsu Linyang Energy Co Ltd

- Shenzhen Clou Electronics Co

- Henan Pinggao Electric Co Ltd

- Nigbo Sanxing Electric Co

- General Electric Company

- Silicon Labs

- Waision Group Holdings Limited

- Landis+Gyr Group AG

- International Business Machines Corporation

- Siemens AG

Key Developments in China Power Grid System Industry Industry

- June 2022: The State Grid Corporation of China announced a record investment of over USD 74.5 Billion in power grid projects, signaling significant growth opportunities. This investment significantly boosted market confidence and attracted further investment.

- October 2022: The SGCC's deployment of a Nokia solution for real-time monitoring of power production and distribution, utilizing IoT sensors, highlights the industry's increasing adoption of smart grid technologies. This development accelerated the adoption of IoT and automation solutions.

Strategic China Power Grid System Industry Market Forecast

The China Power Grid System industry is poised for substantial growth over the forecast period (2025-2033). Driven by government initiatives promoting grid modernization, the increasing integration of renewable energy sources, and robust economic growth, the market is expected to expand significantly. The continued adoption of smart grid technologies and the rising demand for reliable and efficient power delivery will further accelerate this expansion. The market will experience a CAGR of xx% during the forecast period.

China Power Grid System Industry Segmentation

- 1. Transmission Upgrades

- 2. Substation Automation

- 3. Advance Metering Infrastructure (AMI)

- 4. Distribution Automation

China Power Grid System Industry Segmentation By Geography

- 1. China

China Power Grid System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Increasing Investment Plans and Upcoming Smart Grid Projects Driving the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Upgrades

- 5.2. Market Analysis, Insights and Forecast - by Substation Automation

- 5.3. Market Analysis, Insights and Forecast - by Advance Metering Infrastructure (AMI)

- 5.4. Market Analysis, Insights and Forecast - by Distribution Automation

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Transmission Upgrades

- 6. China China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 8. India China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Chinese Vendors

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 6 Silicon Labs

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 4 General Electric Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 1 Siemens AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 1 Henan Pinggao Electric Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 2 ZTE Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 6 Shenzhen Clou Electronics Co

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 4 Jiangsu Linyang Energy Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 5 International Business Machines Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 International Vendors

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 5 Waision Group Holdings Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 3 ABB Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 2 Landis+Gyr Group AG

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 3 Huawei Technologies Co Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 7 Nigbo Sanxing Electric Co

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Chinese Vendors

List of Figures

- Figure 1: China Power Grid System Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Power Grid System Industry Share (%) by Company 2024

List of Tables

- Table 1: China Power Grid System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Power Grid System Industry Revenue Million Forecast, by Transmission Upgrades 2019 & 2032

- Table 3: China Power Grid System Industry Revenue Million Forecast, by Substation Automation 2019 & 2032

- Table 4: China Power Grid System Industry Revenue Million Forecast, by Advance Metering Infrastructure (AMI) 2019 & 2032

- Table 5: China Power Grid System Industry Revenue Million Forecast, by Distribution Automation 2019 & 2032

- Table 6: China Power Grid System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Power Grid System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Power Grid System Industry Revenue Million Forecast, by Transmission Upgrades 2019 & 2032

- Table 16: China Power Grid System Industry Revenue Million Forecast, by Substation Automation 2019 & 2032

- Table 17: China Power Grid System Industry Revenue Million Forecast, by Advance Metering Infrastructure (AMI) 2019 & 2032

- Table 18: China Power Grid System Industry Revenue Million Forecast, by Distribution Automation 2019 & 2032

- Table 19: China Power Grid System Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Power Grid System Industry?

The projected CAGR is approximately 14.32%.

2. Which companies are prominent players in the China Power Grid System Industry?

Key companies in the market include Chinese Vendors, 6 Silicon Labs, 4 General Electric Company, 1 Siemens AG, 1 Henan Pinggao Electric Co Ltd, 2 ZTE Corporation, 6 Shenzhen Clou Electronics Co, 4 Jiangsu Linyang Energy Co Ltd, 5 International Business Machines Corporation, International Vendors, 5 Waision Group Holdings Limited, 3 ABB Ltd, 2 Landis+Gyr Group AG, 3 Huawei Technologies Co Ltd, 7 Nigbo Sanxing Electric Co.

3. What are the main segments of the China Power Grid System Industry?

The market segments include Transmission Upgrades, Substation Automation, Advance Metering Infrastructure (AMI), Distribution Automation.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Increasing Investment Plans and Upcoming Smart Grid Projects Driving the Market Demand.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

June 2022: The State Grid Corporation of China announced that the company would invest an all-time high of more than USD 74.5 billion in power grid projects in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Power Grid System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Power Grid System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Power Grid System Industry?

To stay informed about further developments, trends, and reports in the China Power Grid System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence