Key Insights

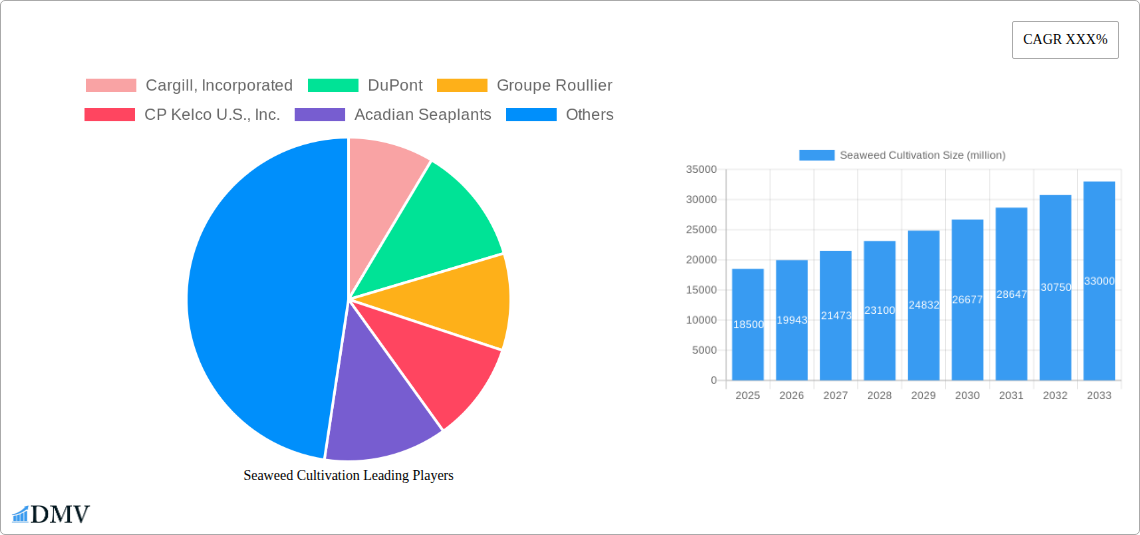

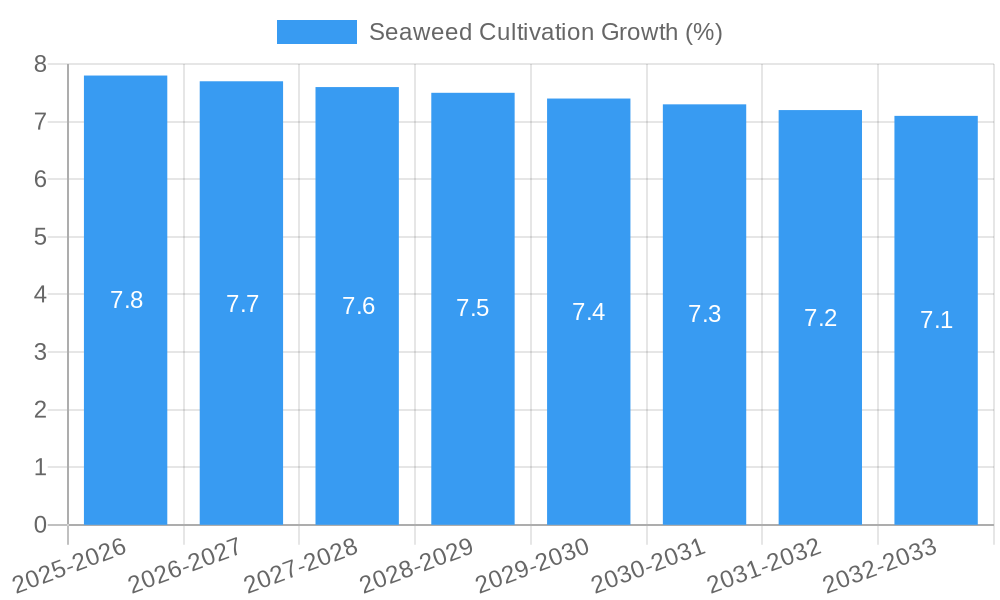

The global Seaweed Cultivation market is poised for significant expansion, driven by increasing demand for sustainable food sources, advanced agricultural inputs, and high-value pharmaceutical ingredients. Valued at approximately $18,500 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 7.8% through 2033. This growth is underpinned by growing awareness of seaweed's nutritional benefits and its potential as a versatile raw material for various industries. Key applications like Food and Feed are expected to dominate, fueled by the rising global population and the need for efficient protein alternatives. Agriculture will also see substantial growth, as seaweed-based fertilizers and soil conditioners offer eco-friendly solutions to enhance crop yields and soil health, aligning with the global shift towards sustainable farming practices.

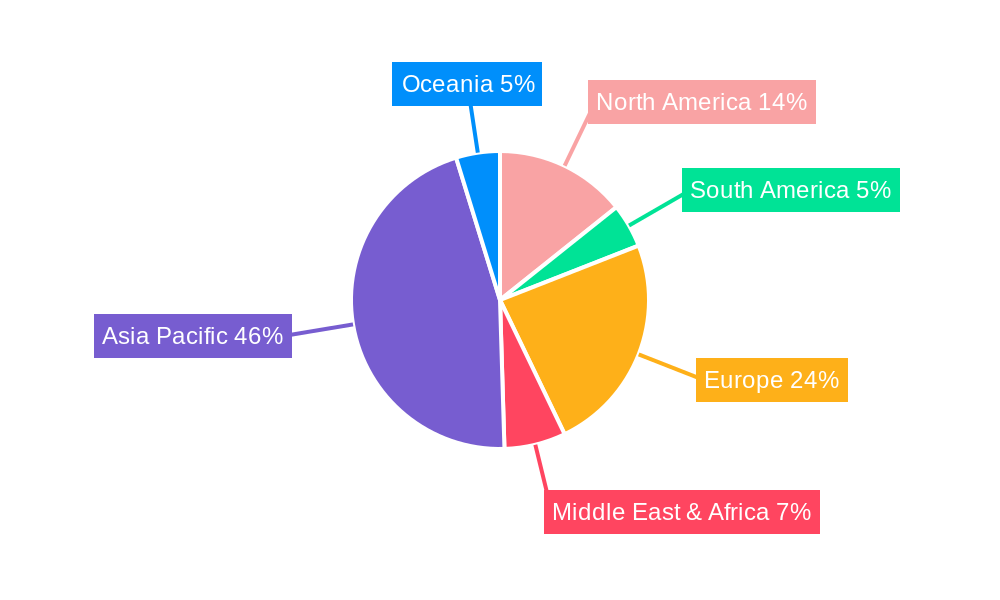

The market's trajectory is further bolstered by technological advancements in cultivation techniques, including offshore farming and improved processing methods, which enhance efficiency and product quality. Emerging applications in the pharmaceutical and nutraceutical sectors, leveraging seaweed's rich bioactive compounds, also present significant growth opportunities. Despite the optimistic outlook, restraints such as stringent regulatory frameworks in some regions, potential environmental impacts if not managed sustainably, and the need for significant initial investment in infrastructure may pose challenges. However, the inherent sustainability of seaweed cultivation, its ability to absorb carbon dioxide, and its potential to contribute to food security are powerful drivers that are expected to outweigh these limitations, propelling the market forward. The Asia Pacific region, particularly China, is anticipated to remain the largest market due to established cultivation practices and strong domestic demand.

This comprehensive report delves deep into the burgeoning seaweed cultivation market, analyzing its intricate dynamics, future potential, and key players. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study provides invaluable insights for stakeholders navigating this rapidly evolving industry. We explore the significant market opportunities presented by the increasing demand for sustainable solutions in Food, Feed, Agriculture, and Pharmaceuticals, driven by advancements in Aquaculture and Wild Harvesting techniques.

Seaweed Cultivation Market Composition & Trends

The seaweed cultivation market exhibits a dynamic composition, characterized by a growing number of dedicated players and increasing investment. While the market is becoming more competitive, a few key companies hold significant market share, driving innovation and consolidation.

- Market Share Distribution: The global seaweed cultivation market share is currently fragmented but is expected to see increased concentration as larger entities acquire smaller, specialized firms. Forecasts indicate a market value projected to exceed several million by the forecast period.

- Innovation Catalysts: Continuous research and development in seaweed aquaculture, biostimulants, and extraction technologies are fueling market growth. Advances in genetic selection and cultivation methods are improving yields and product quality.

- Regulatory Landscapes: Government initiatives promoting sustainable aquaculture and the use of seaweed-derived products are creating a favorable environment. However, evolving regulations regarding cultivation practices and product approvals can present challenges.

- Substitute Products: While direct substitutes for certain seaweed applications are limited, alternative ingredients in animal feed and fertilizers are present. However, the unique nutritional and functional properties of seaweed offer a competitive advantage.

- End-User Profiles: Key end-users include food manufacturers seeking natural ingredients and thickeners, agricultural companies utilizing seaweed as organic fertilizers and biostimulants, pharmaceutical firms exploring bioactive compounds, and the animal feed industry incorporating nutrient-rich biomass.

- M&A Activities: The seaweed cultivation market is witnessing strategic mergers and acquisitions as companies aim to expand their product portfolios, geographical reach, and technological capabilities. Deal values are expected to reach millions, indicating significant investor confidence.

Seaweed Cultivation Industry Evolution

The seaweed cultivation industry has undergone a remarkable transformation, evolving from traditional harvesting methods to sophisticated, large-scale aquaculture operations. This evolution is marked by a sustained upward trajectory in market growth, driven by a confluence of technological breakthroughs and a significant shift in consumer preferences towards sustainable and natural products. Over the Historical Period (2019–2024), the industry has witnessed an average annual growth rate of approximately xx%, a testament to its inherent potential. This growth is further amplified by ongoing Industry Developments that are continuously enhancing efficiency and expanding the application spectrum of seaweed.

Technological advancements have been instrumental in this evolution. Innovations in seaweed farming, including advanced nursery techniques, efficient harvesting machinery, and sophisticated processing methods for extracting high-value compounds, have dramatically improved productivity and reduced operational costs. These advancements are crucial for meeting the increasing global demand for seaweed-based products. Furthermore, research into the diverse bioactive compounds found in seaweed, such as alginates, fucoidans, and polyphenols, has unlocked new applications in pharmaceuticals and nutraceuticals, pushing the boundaries of what was previously thought possible.

Consumer demand has pivoted significantly towards sustainability and natural ingredients. Consumers are increasingly aware of the environmental benefits of seaweed cultivation, such as its ability to absorb carbon dioxide and nutrients from the ocean, making it a truly sustainable resource. This awareness translates into a higher demand for seaweed-based food products, organic fertilizers, and animal feed supplements. The perceived health benefits and functional properties of seaweed are also major drivers of consumer choice. As a result, the seaweed cultivation industry is poised for continued robust growth in the coming years, with projections indicating a market value set to reach millions by 2033. The adoption rate of new seaweed-based products and farming technologies is expected to accelerate, further solidifying the industry's trajectory.

Leading Regions, Countries, or Segments in Seaweed Cultivation

The seaweed cultivation market is experiencing dominance from specific regions and segments, driven by a combination of favorable environmental conditions, robust government support, and significant investment trends. Among the Application segments, Agriculture stands out as a key driver of growth, closely followed by Food and Feed. The Type segment of Aquaculture is experiencing more rapid expansion compared to Wild Harvesting, owing to its controlled environment, scalability, and potential for higher yields.

Dominant Region Analysis: Asia-Pacific, particularly countries like China and Indonesia, currently leads the seaweed cultivation market. This dominance is attributed to:

- Favorable Climate and Coastal Geography: Extensive coastlines and suitable water temperatures provide ideal conditions for large-scale seaweed farming.

- Established Traditional Practices: Centuries of experience in seaweed harvesting and rudimentary cultivation have laid a strong foundation for modern aquaculture.

- Government Support and Investment: National policies promoting the blue economy and substantial government funding for research and infrastructure development have been critical. For instance, government subsidies for seaweed farming in China have enabled massive production volumes.

- High Domestic Demand: A large population with established dietary preferences for seaweed and its derivatives fuels consistent domestic consumption.

Dominant Segment Analysis (Application - Agriculture): The agriculture segment is a significant growth engine within the seaweed cultivation market.

- Growing Demand for Organic Fertilizers: With increasing global focus on sustainable agriculture and reducing chemical fertilizer use, seaweed-based biostimulants and fertilizers are gaining traction. These products enhance soil health, improve nutrient uptake, and boost crop yields.

- Innovation in Biostimulants: Companies are developing sophisticated seaweed extracts that promote plant growth, stress tolerance, and disease resistance, offering a competitive edge over conventional fertilizers.

- Market Penetration: The adoption of seaweed-derived agricultural inputs is steadily increasing across North America, Europe, and other emerging agricultural markets.

Dominant Segment Analysis (Type - Aquaculture): Aquaculture is revolutionizing seaweed production.

- Scalability and Controlled Production: Aquaculture allows for predictable yields, consistent quality, and expansion to meet burgeoning demand, unlike the limitations of wild harvesting.

- Technological Advancements: Innovations in submersible farms, integrated multi-trophic aquaculture (IMTA), and advanced monitoring systems are enhancing efficiency and sustainability.

- Reduced Environmental Impact: Compared to conventional agriculture, seaweed aquaculture can have a net positive environmental impact by absorbing excess nutrients and carbon dioxide.

Seaweed Cultivation Product Innovations

Product innovation is a cornerstone of the seaweed cultivation market, driving expansion across diverse applications. Advanced extraction techniques are yielding high-purity bioactive compounds for pharmaceuticals, such as potent antioxidants and anti-inflammatory agents, contributing to a market segment valued in the millions. In the food sector, novel seaweed-based ingredients are emerging as natural thickeners, emulsifiers, and flavor enhancers, meeting consumer demand for clean-label products. For agriculture, the development of refined seaweed biostimulants and organic fertilizers is enhancing crop resilience and nutrient absorption, with projected market adoption rates in the double digits. These innovations are characterized by their sustainability, natural origin, and superior performance metrics.

Propelling Factors for Seaweed Cultivation Growth

Several key factors are propelling the seaweed cultivation market forward. Technologically, advancements in aquaculture techniques, including offshore farming and improved processing technologies, are significantly increasing yield and efficiency. Economically, the rising global demand for sustainable and natural products across the Food, Feed, Agriculture, and Pharmaceuticals sectors presents a substantial market opportunity. Regulatory support, with governments increasingly promoting seaweed cultivation as a sustainable blue economy initiative and offering incentives, further bolsters industry growth. For instance, favorable policies for organic food production are directly benefiting seaweed-based agricultural inputs.

Obstacles in the Seaweed Cultivation Market

Despite its growth potential, the seaweed cultivation market faces several obstacles. Regulatory challenges related to permitting for new aquaculture sites and varying international standards can slow down expansion. Supply chain disruptions, particularly for specialized equipment and processing capabilities, can impact operational efficiency and market availability. Competitive pressures from established players and the development of alternative ingredients in certain applications also pose a challenge. Furthermore, the initial investment required for large-scale seaweed cultivation can be substantial, potentially limiting market entry for smaller enterprises.

Future Opportunities in Seaweed Cultivation

The seaweed cultivation market is ripe with future opportunities. Emerging markets in regions with extensive coastlines and growing demand for sustainable resources present significant expansion potential. Technological innovations, such as the development of genetically optimized seaweed strains for specific applications and the integration of artificial intelligence in aquaculture management, will unlock new efficiencies and product possibilities. Consumer trends favoring plant-based diets and natural health products will continue to drive demand for seaweed in food and pharmaceuticals. The potential for seaweed as a biofuel feedstock also represents a nascent but promising avenue for future growth.

Major Players in the Seaweed Cultivation Ecosystem

- Cargill, Incorporated

- DuPont

- Groupe Roullier

- CP Kelco U.S., Inc.

- Acadian Seaplants

- Qingdao Gather Great Ocean Algae Industry Group

- Qingdao Seawin Biotech Group Co. Ltd.

- Seaweed Energy Solutions AS

- The Seaweed Company

- Seasol

- CEAMSA

- COMPO EXPERT

- Leili

- AtSeaNova

- Mara Seaweed

- AquAgri Processing Pvt. Ltd.

Key Developments in Seaweed Cultivation Industry

- 2023: Launch of new seaweed-based biostimulants for enhanced crop resilience in drought conditions by COMPO EXPERT.

- 2023: Significant expansion of offshore seaweed aquaculture farms by The Seaweed Company to meet growing European demand for food ingredients.

- 2022: Acquisition of a leading seaweed processing technology firm by Cargill, Incorporated, to bolster its functional ingredients portfolio.

- 2022: Breakthrough in the extraction of high-purity fucoidan for pharmaceutical applications by Acadian Seaplants.

- 2021: Qingdao Gather Great Ocean Algae Industry Group announces plans for a multi-million dollar investment in advanced seaweed cultivation research and development.

- 2020: DuPont introduces a new line of seaweed-derived hydrocolloids for the food industry, focusing on clean-label solutions.

- 2019: Seaweed Energy Solutions AS secures significant funding for pilot projects exploring seaweed cultivation for biofuel production.

Strategic Seaweed Cultivation Market Forecast

- 2023: Launch of new seaweed-based biostimulants for enhanced crop resilience in drought conditions by COMPO EXPERT.

- 2023: Significant expansion of offshore seaweed aquaculture farms by The Seaweed Company to meet growing European demand for food ingredients.

- 2022: Acquisition of a leading seaweed processing technology firm by Cargill, Incorporated, to bolster its functional ingredients portfolio.

- 2022: Breakthrough in the extraction of high-purity fucoidan for pharmaceutical applications by Acadian Seaplants.

- 2021: Qingdao Gather Great Ocean Algae Industry Group announces plans for a multi-million dollar investment in advanced seaweed cultivation research and development.

- 2020: DuPont introduces a new line of seaweed-derived hydrocolloids for the food industry, focusing on clean-label solutions.

- 2019: Seaweed Energy Solutions AS secures significant funding for pilot projects exploring seaweed cultivation for biofuel production.

Strategic Seaweed Cultivation Market Forecast

The seaweed cultivation market is poised for robust and sustainable growth, driven by a powerful combination of increasing global demand for natural and eco-friendly products and continuous technological innovation. The expanding applications in Food, Feed, Agriculture, and Pharmaceuticals, coupled with the inherent environmental benefits of aquaculture, create a highly favorable market outlook. Strategic investments in advanced cultivation techniques and processing technologies will further enhance efficiency and unlock new high-value product streams. The market is projected to exceed several million by 2033, presenting significant opportunities for stakeholders to capitalize on this dynamic and environmentally conscious industry.

Seaweed Cultivation Segmentation

-

1. Application

- 1.1. Food

- 1.2. Feed

- 1.3. Agriculture

- 1.4. Pharmaceuticals

-

2. Type

- 2.1. Aquaculture

- 2.2. Wild Harvesting

Seaweed Cultivation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Seaweed Cultivation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.2. Feed

- 5.1.3. Agriculture

- 5.1.4. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aquaculture

- 5.2.2. Wild Harvesting

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.2. Feed

- 6.1.3. Agriculture

- 6.1.4. Pharmaceuticals

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aquaculture

- 6.2.2. Wild Harvesting

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.2. Feed

- 7.1.3. Agriculture

- 7.1.4. Pharmaceuticals

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aquaculture

- 7.2.2. Wild Harvesting

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.2. Feed

- 8.1.3. Agriculture

- 8.1.4. Pharmaceuticals

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aquaculture

- 8.2.2. Wild Harvesting

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.2. Feed

- 9.1.3. Agriculture

- 9.1.4. Pharmaceuticals

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aquaculture

- 9.2.2. Wild Harvesting

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Seaweed Cultivation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.2. Feed

- 10.1.3. Agriculture

- 10.1.4. Pharmaceuticals

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aquaculture

- 10.2.2. Wild Harvesting

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuPont

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Groupe Roullier

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CP Kelco U.S. Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acadian Seaplants

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qingdao Gather Great Ocean Algae Industry Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Seawin Biotech Group Co. Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seaweed Energy Solutions AS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Seaweed Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seasol

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CEAMSA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 COMPO EXPERT

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Leili

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AtSeaNova

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mara Seaweed

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AquAgri Processing Pvt. Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Seaweed Cultivation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Seaweed Cultivation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Seaweed Cultivation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Seaweed Cultivation Revenue (million), by Type 2024 & 2032

- Figure 5: North America Seaweed Cultivation Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Seaweed Cultivation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Seaweed Cultivation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Seaweed Cultivation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Seaweed Cultivation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Seaweed Cultivation Revenue (million), by Type 2024 & 2032

- Figure 11: South America Seaweed Cultivation Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Seaweed Cultivation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Seaweed Cultivation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Seaweed Cultivation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Seaweed Cultivation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Seaweed Cultivation Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Seaweed Cultivation Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Seaweed Cultivation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Seaweed Cultivation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Seaweed Cultivation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Seaweed Cultivation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Seaweed Cultivation Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Seaweed Cultivation Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Seaweed Cultivation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Seaweed Cultivation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Seaweed Cultivation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Seaweed Cultivation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Seaweed Cultivation Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Seaweed Cultivation Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Seaweed Cultivation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Seaweed Cultivation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Seaweed Cultivation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Seaweed Cultivation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Seaweed Cultivation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Seaweed Cultivation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Seaweed Cultivation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Seaweed Cultivation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Seaweed Cultivation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Seaweed Cultivation Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Seaweed Cultivation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Seaweed Cultivation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Seaweed Cultivation?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Seaweed Cultivation?

Key companies in the market include Cargill, Incorporated, DuPont, Groupe Roullier, CP Kelco U.S., Inc., Acadian Seaplants, Qingdao Gather Great Ocean Algae Industry Group, Qingdao Seawin Biotech Group Co. Ltd., Seaweed Energy Solutions AS, The Seaweed Company, Seasol, CEAMSA, COMPO EXPERT, Leili, AtSeaNova, Mara Seaweed, AquAgri Processing Pvt. Ltd..

3. What are the main segments of the Seaweed Cultivation?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Seaweed Cultivation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Seaweed Cultivation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Seaweed Cultivation?

To stay informed about further developments, trends, and reports in the Seaweed Cultivation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence