Key Insights

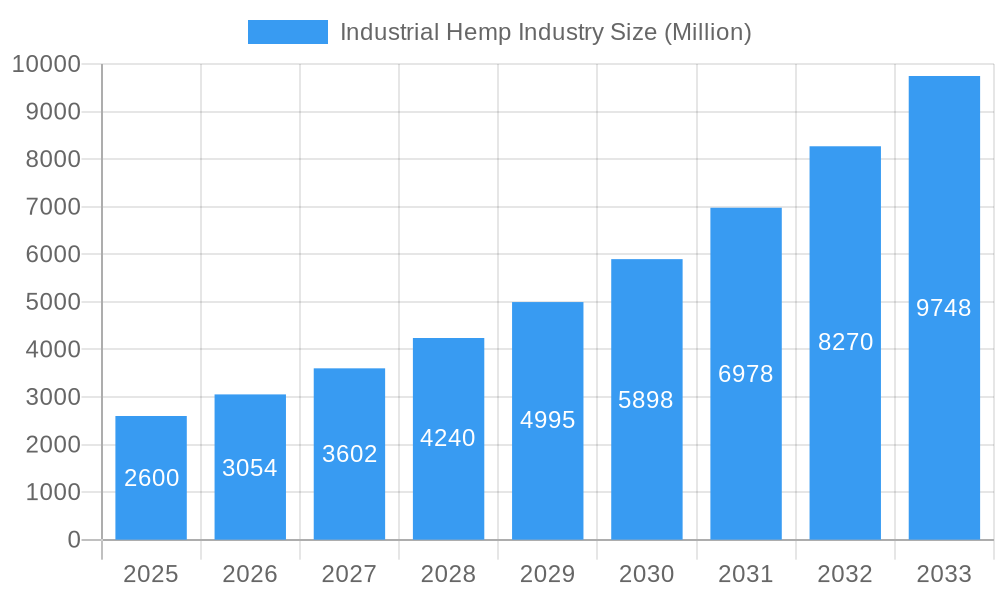

The industrial hemp market is experiencing robust growth, projected to reach \$2.60 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 17% through 2033. This expansion is driven by several factors. Increasing consumer awareness of hemp's sustainable nature and versatility is fueling demand across diverse applications, including textiles, construction materials, and food products. Furthermore, the burgeoning CBD market, a significant component of the hemp industry, is significantly contributing to overall market expansion. Government regulations are increasingly supportive of hemp cultivation and processing, further accelerating market growth. Technological advancements in extraction techniques are also improving the efficiency and cost-effectiveness of hemp product manufacturing, making it a more attractive option for businesses. However, challenges remain, including the need for standardized quality control measures and the potential for inconsistent regulatory frameworks across different regions. Competition among established players and new entrants is intense, leading to price fluctuations and the need for constant innovation.

Industrial Hemp Industry Market Size (In Billion)

Despite these challenges, the long-term outlook for the industrial hemp market remains positive. Continued research and development in hemp-based products, coupled with increasing consumer demand, will likely drive further market expansion. The significant presence of key players like International Flavors & Fragrances, Firmenich SA, and Charlotte's Web Holdings Inc. indicates a robust and competitive landscape, driving innovation and ensuring product quality. Future growth will depend on successful navigation of regulatory hurdles, the development of more sophisticated applications for hemp-derived materials, and the creation of sustainable supply chains that can meet the growing demand. The market segmentation, while not explicitly provided, is likely to include segments based on product type (e.g., seeds, fiber, CBD), application (e.g., textiles, food, construction), and geographic region.

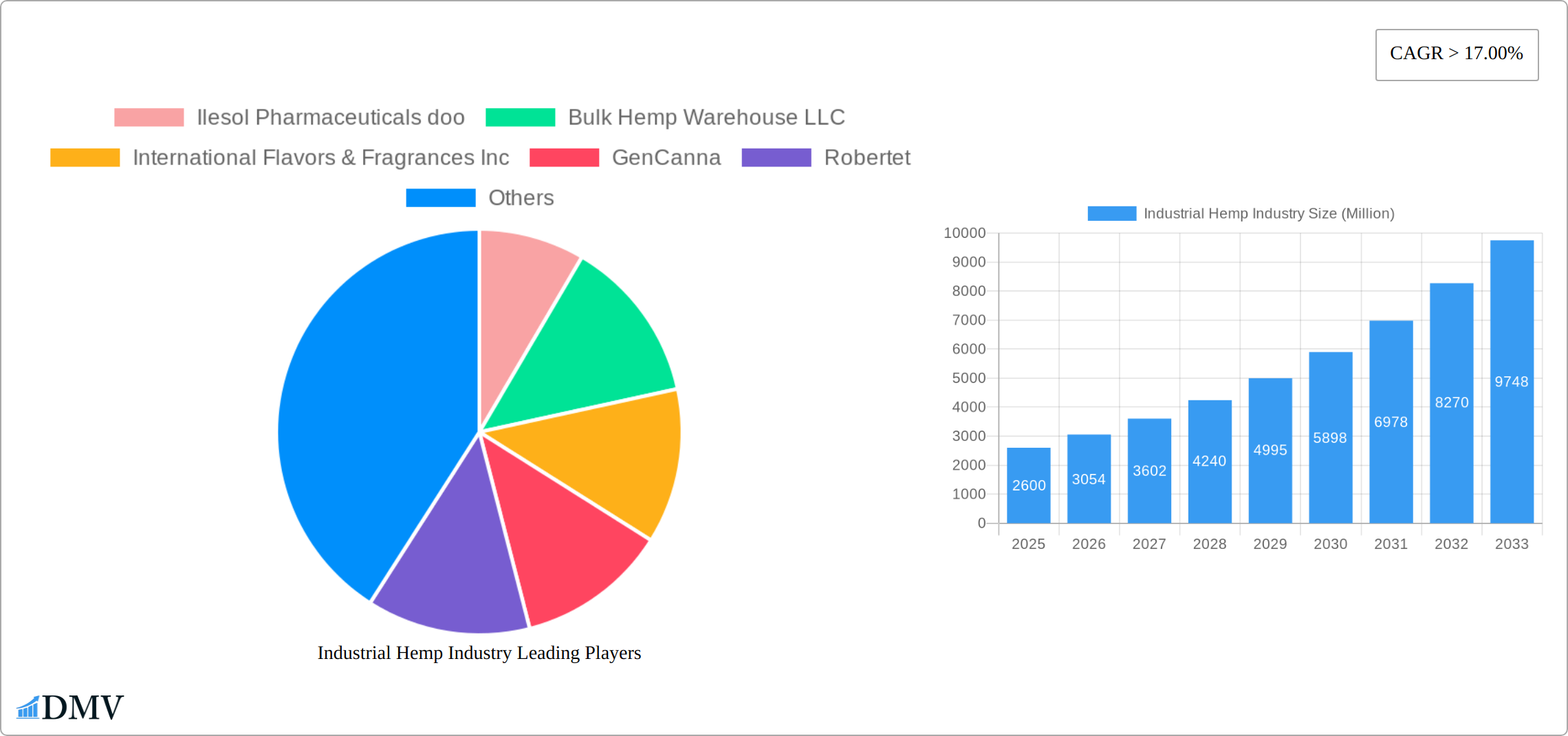

Industrial Hemp Industry Company Market Share

Industrial Hemp Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Industrial Hemp Industry, encompassing market size, trends, leading players, and future projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

Industrial Hemp Industry Market Composition & Trends

This section dives deep into the competitive landscape of the industrial hemp market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. We analyze the market share distribution among key players, revealing the dominance of certain segments and the impact of strategic partnerships. M&A activities, including deal values (estimated at xx Million in total for the period 2019-2024), are examined to showcase industry consolidation and growth strategies. The report further explores the evolving regulatory landscape, its influence on market expansion, and the emergence of substitute products impacting market share.

- Market Concentration: High fragmentation, with a few major players dominating specific segments (e.g., CBD, fiber, seed). Further consolidation expected.

- Innovation Catalysts: Advancements in extraction technologies, breeding programs for higher yield and specific cannabinoid profiles, and expansion into new applications.

- Regulatory Landscapes: Varying regulations across different regions and countries impacting market access and product development.

- Substitute Products: Competition from synthetic cannabinoids and other natural fibers in specific applications.

- End-User Profiles: Diverse range including food & beverage, cosmetics, textiles, construction, and pharmaceuticals.

- M&A Activities: Significant M&A activity observed, particularly in the CBD and cannabis-related sectors, with transactions valued at approximately xx Million in 2024.

Industrial Hemp Industry Evolution

This section provides a comprehensive overview of the Industrial Hemp Industry's evolution, tracing its growth trajectory from 2019 to 2024 and projecting its future development until 2033. We analyze market growth rates, technological advancements fueling industry expansion, and evolving consumer preferences shaping product innovation. The report reveals substantial growth driven by increased consumer awareness and acceptance of hemp-derived products. Specific data points on growth rates and technological adoption rates are provided to illustrate the market's dynamic nature. For example, the market experienced an estimated xx% Compound Annual Growth Rate (CAGR) between 2019 and 2024, driven by factors such as increasing consumer awareness and acceptance of hemp-derived products and the expansion of its applications across diverse industries. Technological advancements, such as improved extraction techniques and the development of new formulations, further propelled market growth.

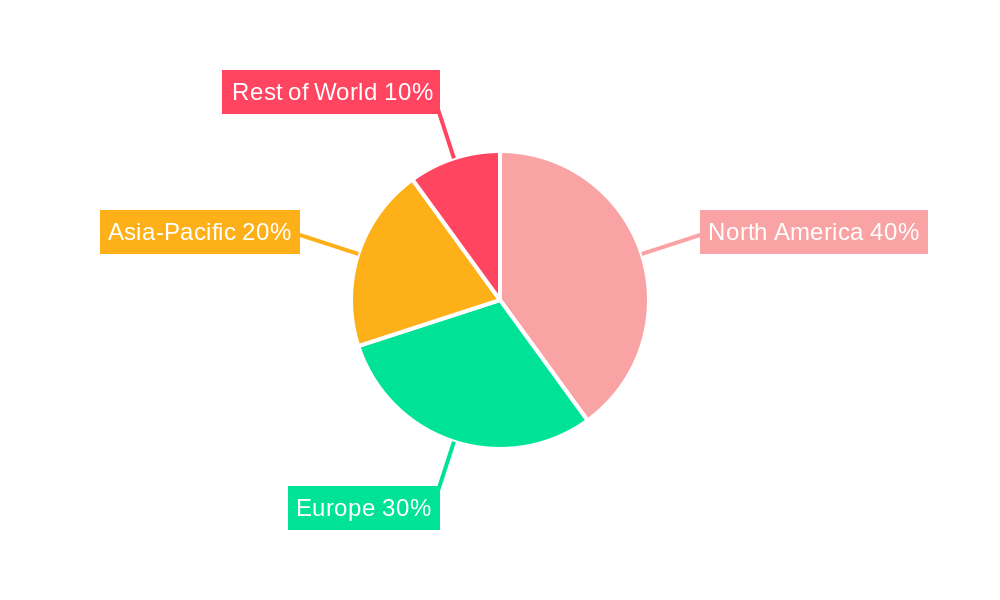

Leading Regions, Countries, or Segments in Industrial Hemp Industry

This section meticulously identifies the foremost regions, countries, and market segments within the dynamic industrial hemp industry. Our comprehensive analysis delves into the underlying drivers of market leadership, encompassing critical aspects such as capital investment trends, the evolution of regulatory frameworks, and the persistent strength of consumer demand. Illustrative examples are provided to vividly showcase the pivotal dynamics shaping the industry landscape.

- North America's Market Prowess: Characterized by proactive legislative support, substantial investments in cutting-edge research and development, and an insatiable consumer appetite for CBD-infused products and diverse hemp-based consumer goods.

- Europe's Emerging Strength: Driven by escalating regulatory acceptance, significant capital allocated to R&D initiatives, and a burgeoning demand for sustainable and eco-conscious materials derived from hemp.

- Dominant Product Segments: The market is currently dominated by high-value CBD products, versatile hemp fiber utilized in the textile industry, and nutrient-rich hemp seeds for both human consumption and animal feed applications.

The preeminent position of North America, particularly the United States, in the global industrial hemp market is a direct consequence of its pioneering legislative framework and widespread acceptance of hemp cultivation and processing. This early advantage has catalyzed substantial investments in research, development, and the establishment of robust processing infrastructure.

Industrial Hemp Industry Product Innovations

This section highlights innovative products, applications, and performance metrics, showcasing unique selling propositions and technological advancements. The market has witnessed a surge in innovative hemp-derived products, particularly in the CBD and cosmetic sectors. New extraction methods yield high-quality concentrates, broadening the applications in pharmaceuticals and other industries. Novel bio-based materials using hemp fiber are transforming the construction and textile industries.

Propelling Factors for Industrial Hemp Industry Growth

The industrial hemp industry is experiencing robust expansion, fueled by a confluence of powerful catalysts. Paramount among these are rapid technological advancements, particularly in sophisticated extraction and processing methodologies. Furthermore, a sustained surge in consumer preference for hemp-derived products, coupled with increasingly supportive regulatory environments across numerous jurisdictions, are significant growth engines. The growing global recognition of hemp's exceptional environmental benefits, including its low water requirements and carbon sequestration capabilities, further bolsters its appeal. The continuous discovery and expansion of hemp's applications across a wide spectrum of industries—from advanced textiles and bio-based construction materials to innovative pharmaceuticals and nutraceuticals—are collectively propelling the market forward.

Obstacles in the Industrial Hemp Industry Market

Despite its promising trajectory, the industrial hemp industry encounters several persistent challenges. The most significant hurdle remains the fragmented and often fluctuating nature of regulations across different countries and even within regions, creating an environment of considerable uncertainty for businesses and investors. Supply chain complexities, including logistics and product traceability, alongside inherent variability in hemp crop quality, can impede consistent market growth and product standardization. Moreover, the intensifying competitive landscape, characterized by the simultaneous presence of well-established industry incumbents and a wave of agile new entrants, exerts considerable market pressure and necessitates continuous innovation and strategic adaptation.

Future Opportunities in Industrial Hemp Industry

Future opportunities lie in exploring new applications of hemp in various industries, expanding into new markets with favorable regulatory environments, and developing innovative products with higher value-added benefits. Advancements in technology are anticipated to further boost efficiency and create new applications in areas like bioplastics and construction.

Major Players in the Industrial Hemp Industry Ecosystem

- Ilesol Pharmaceuticals doo

- Bulk Hemp Warehouse LLC

- International Flavors & Fragrances Inc

- GenCanna

- Robertet

- Firmenich SA

- Charlotte's Web Holdings Inc

- True Terpenes

- Puricon

- PharmaCielo Ltd

- Silver Lion Farms

- Bomar Agra Estates LLC

- Colorado Breeders Depot

- 33 Supply LLC

- Green Passion (Canway Schweiz GmbH)

- Victory Hemp Foods

- Hemp Oil Canada

- Manitoba Harvest (Tilray)

- HempFlax Group BV

- Entoura

- Bedrocan

- Signature Products

- Nutiva hemp Oil

- Temp Co Canada

- Hemp Acres USA

- List Not Exhaustive

Key Developments in Industrial Hemp Industry Industry

- January 2022: MariMed Inc. strategically enhanced its market footprint through the acquisition of Green Growth Group Inc., thereby expanding its operational capabilities within the burgeoning Illinois cannabis market.

- January 2022: In a move to solidify its vertical integration and operational control, MariMed Inc. acquired Kind Therapeutics USA LLC, significantly strengthening its position within the Maryland cannabis market. These strategic acquisitions underscore a clear trend towards industry consolidation and well-executed expansion plays by key market participants.

Strategic Industrial Hemp Industry Market Forecast

The industrial hemp market is on a definitive path toward substantial and sustained growth. This optimistic outlook is underpinned by a growing confluence of factors, including heightened consumer awareness regarding the benefits and versatility of hemp, continuous advancements in processing and cultivation technologies, and the ongoing implementation of more favorable and standardized regulatory frameworks globally. The expanding array of applications for hemp-derived products across diverse sectors—ranging from innovative food and beverage formulations to sustainable construction materials and sophisticated pharmaceutical ingredients—presents a wealth of untapped opportunities. Projections indicate robust market expansion throughout the forecast period (2025-2033), driven by these powerful macro trends and a marked increase in strategic investments dedicated to research and development aimed at unlocking hemp's full potential.

Industrial Hemp Industry Segmentation

-

1. Type

- 1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 1.2. Hemp Seed Oil

- 1.3. Cannabidiol (CBD) Hemp Oil

- 1.4. Hemp Protein (Supplement)

- 1.5. Hemp Extract (Without CBD)

-

2. Application

- 2.1. Food and Beverages

- 2.2. Healthcare Supplements

- 2.3. Other Applications

Industrial Hemp Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Nigeria

- 5.3. Qatar

- 5.4. Egypt

- 5.5. United Arab Emirates

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Industrial Hemp Industry Regional Market Share

Geographic Coverage of Industrial Hemp Industry

Industrial Hemp Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 17.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector

- 3.3. Market Restrains

- 3.3.1. Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Food and Beverage Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 5.1.2. Hemp Seed Oil

- 5.1.3. Cannabidiol (CBD) Hemp Oil

- 5.1.4. Hemp Protein (Supplement)

- 5.1.5. Hemp Extract (Without CBD)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.2. Healthcare Supplements

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 6.1.2. Hemp Seed Oil

- 6.1.3. Cannabidiol (CBD) Hemp Oil

- 6.1.4. Hemp Protein (Supplement)

- 6.1.5. Hemp Extract (Without CBD)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.2. Healthcare Supplements

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 7.1.2. Hemp Seed Oil

- 7.1.3. Cannabidiol (CBD) Hemp Oil

- 7.1.4. Hemp Protein (Supplement)

- 7.1.5. Hemp Extract (Without CBD)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.2. Healthcare Supplements

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 8.1.2. Hemp Seed Oil

- 8.1.3. Cannabidiol (CBD) Hemp Oil

- 8.1.4. Hemp Protein (Supplement)

- 8.1.5. Hemp Extract (Without CBD)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.2. Healthcare Supplements

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 9.1.2. Hemp Seed Oil

- 9.1.3. Cannabidiol (CBD) Hemp Oil

- 9.1.4. Hemp Protein (Supplement)

- 9.1.5. Hemp Extract (Without CBD)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.2. Healthcare Supplements

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 10.1.2. Hemp Seed Oil

- 10.1.3. Cannabidiol (CBD) Hemp Oil

- 10.1.4. Hemp Protein (Supplement)

- 10.1.5. Hemp Extract (Without CBD)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.2. Healthcare Supplements

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ilesol Pharmaceuticals doo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bulk Hemp Warehouse LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 International Flavors & Fragrances Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GenCanna

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robertet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Firmenich SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Charlotte's Web Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 True Terpenes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Puricon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PharmaCielo Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Silver Lion Farms

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bomar Agra Estates LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Colorado Breeders Depot

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 33 Supply LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Green Passion (Canway Schweiz GmbH)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Victory Hemp Foods

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hemp Oil Canada

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Manitoba Harvest (Tilray)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 HempFlax Group BV

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Entoura

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Bedrocan

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Signature Products

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Nutiva hemp Oil

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Temp Co Canada

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Hemp Acres USA*List Not Exhaustive

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Ilesol Pharmaceuticals doo

List of Figures

- Figure 1: Global Industrial Hemp Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Hemp Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 5: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 9: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 17: North America Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 21: North America Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: North America Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 29: Europe Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 33: Europe Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 41: South America Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 45: South America Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Industrial Hemp Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Hemp Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: India Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Japan Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: South Korea Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Malaysia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Thailand Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Thailand Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United States Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United States Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Canada Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Canada Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Mexico Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Mexico Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 47: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Germany Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: France Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Italy Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Italy Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Spain Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Spain Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Turkey Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Turkey Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Russia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Russia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: NORDIC Countries Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: NORDIC Countries Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 68: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 69: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 71: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Argentina Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Colombia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Colombia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 82: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 83: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 84: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 85: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 87: Saudi Arabia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Saudi Arabia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Nigeria Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Nigeria Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Qatar Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Qatar Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: Egypt Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Egypt Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: United Arab Emirates Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: United Arab Emirates Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Africa Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Africa Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: Rest of Middle East and Africa Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Rest of Middle East and Africa Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Hemp Industry?

The projected CAGR is approximately > 17.00%.

2. Which companies are prominent players in the Industrial Hemp Industry?

Key companies in the market include Ilesol Pharmaceuticals doo, Bulk Hemp Warehouse LLC, International Flavors & Fragrances Inc, GenCanna, Robertet, Firmenich SA, Charlotte's Web Holdings Inc, True Terpenes, Puricon, PharmaCielo Ltd, Silver Lion Farms, Bomar Agra Estates LLC, Colorado Breeders Depot, 33 Supply LLC, Green Passion (Canway Schweiz GmbH), Victory Hemp Foods, Hemp Oil Canada, Manitoba Harvest (Tilray), HempFlax Group BV, Entoura, Bedrocan, Signature Products, Nutiva hemp Oil, Temp Co Canada, Hemp Acres USA*List Not Exhaustive.

3. What are the main segments of the Industrial Hemp Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector.

6. What are the notable trends driving market growth?

Increasing Demand from the Food and Beverage Segment.

7. Are there any restraints impacting market growth?

Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector.

8. Can you provide examples of recent developments in the market?

January 2022: MariMed Inc. signed a definitive agreement to acquire Green Growth Group Inc., holder of a provisional Cannabis Craft License in Illinois.January 2022: MariMed Inc. entered a definitive agreement to acquire Kind Therapeutics USA LLC, a leading vertically integrated cannabis business in Maryland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Hemp Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Hemp Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Hemp Industry?

To stay informed about further developments, trends, and reports in the Industrial Hemp Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence