Key Insights

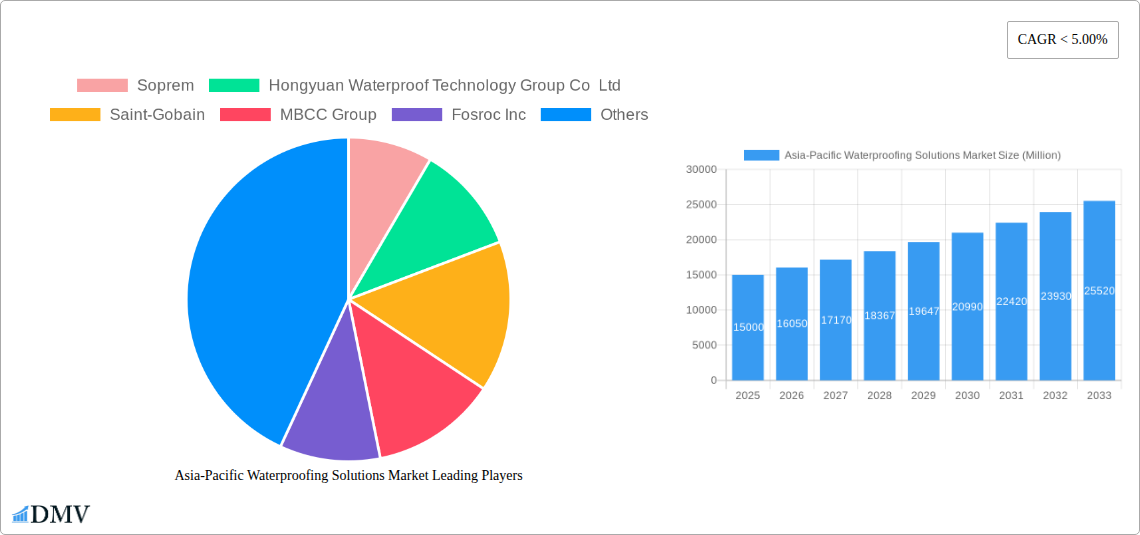

The Asia-Pacific waterproofing solutions market is poised for substantial expansion, propelled by accelerating urbanization, extensive infrastructure development, and heightened awareness of building resilience. The market, valued at $15.04 billion in the base year 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 7.4%, reaching an estimated $28 billion by 2033. Key growth drivers include robust investments in residential and commercial construction across major economies, heightened demand for advanced waterproofing due to regional climate vulnerabilities and the imperative to mitigate water damage, and the influence of stringent building codes mandating enhanced water resistance. Furthermore, the burgeoning adoption of sustainable and eco-friendly waterproofing materials is shaping industry innovation.

Asia-Pacific Waterproofing Solutions Market Market Size (In Billion)

Market expansion varies across the region, with economically advanced nations like China and Australia leading in market share. However, rapidly developing economies in India and Southeast Asia are also experiencing significant demand surges. The market is segmented by product type, application, and end-use. The rise of high-rise constructions and intricate infrastructure projects is fueling demand for specialized waterproofing solutions, creating opportunities for product innovation and customization. The competitive landscape remains dynamic, characterized by both multinational corporations and local enterprises. Continuous advancements in waterproofing material technology, emphasizing superior performance, durability, and environmental sustainability, will continue to define the market's trajectory.

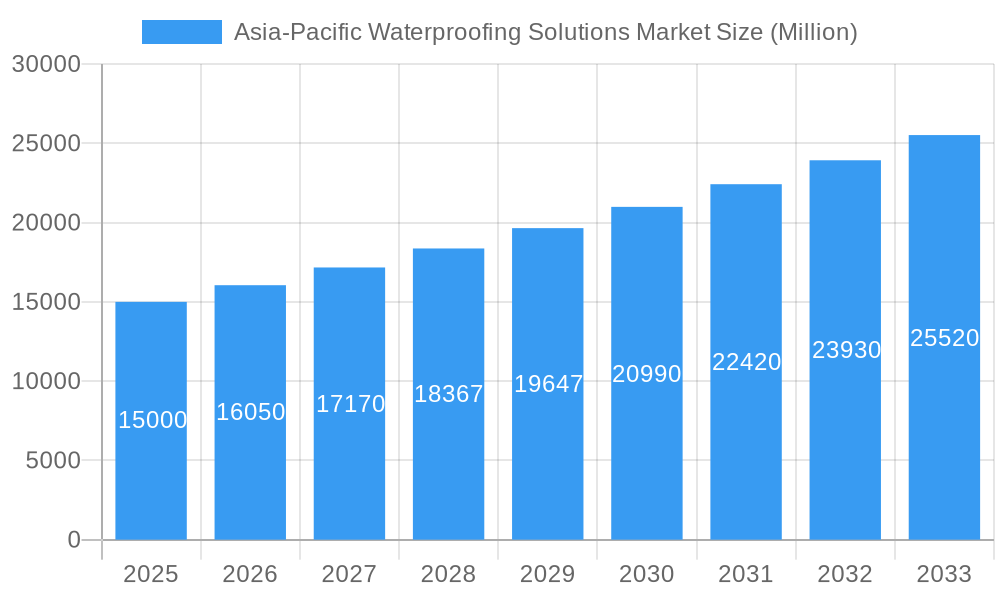

Asia-Pacific Waterproofing Solutions Market Company Market Share

Asia-Pacific Waterproofing Solutions Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific waterproofing solutions market, offering a comprehensive overview of market dynamics, competitive landscape, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period. This report is indispensable for stakeholders seeking to understand the market's evolution, identify key players, and capitalize on emerging opportunities.

Asia-Pacific Waterproofing Solutions Market Composition & Trends

The Asia-Pacific waterproofing solutions market is characterized by a moderately consolidated structure, with key players like Sika AG, Oriental Yuhong, and Saint-Gobain holding significant market share. However, the presence of numerous regional players contributes to competitive intensity. Market concentration is expected to shift slightly in the coming years, driven by mergers and acquisitions (M&A) activity and the emergence of innovative solutions. The regulatory landscape, varying across different countries within the region, plays a crucial role in shaping market growth. Stringent building codes and environmental regulations are pushing the adoption of sustainable and high-performance waterproofing solutions. Substitute products, such as advanced coatings and membranes, are increasingly challenging traditional waterproofing methods. The end-user profile is diverse, spanning residential, commercial, industrial, and infrastructure sectors, with infrastructure projects driving significant demand. Recent M&A activity, exemplified by Sika's acquisition of MBCC Group in May 2023 (a deal valued at xx Million), highlights the strategic importance of the market and the consolidation trend.

- Market Share Distribution (2025): Sika AG (xx%), Oriental Yuhong (xx%), Saint-Gobain (xx%), Others (xx%)

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Demand for sustainable solutions, advancements in polymer technology, and the integration of smart building technologies.

- Regulatory Landscape: Differing building codes across countries influence product specifications and adoption rates.

Asia-Pacific Waterproofing Solutions Market Industry Evolution

The Asia-Pacific waterproofing solutions market has witnessed significant growth over the historical period (2019-2024), fueled by rapid urbanization, increasing infrastructure development, and rising construction activities across the region. The market experienced a CAGR of xx% during this period, with notable growth in key segments like infrastructure and commercial construction. Technological advancements, such as the development of self-healing membranes and high-performance polymer-based products, have driven market innovation. These advancements have improved product durability, reduced maintenance costs, and enhanced overall performance. Shifting consumer demands, particularly towards environmentally friendly and energy-efficient solutions, are reshaping product development strategies. The increased focus on sustainability is driving the adoption of green building materials and practices, impacting the demand for eco-friendly waterproofing solutions. Moreover, government initiatives promoting sustainable infrastructure development are further accelerating market growth.

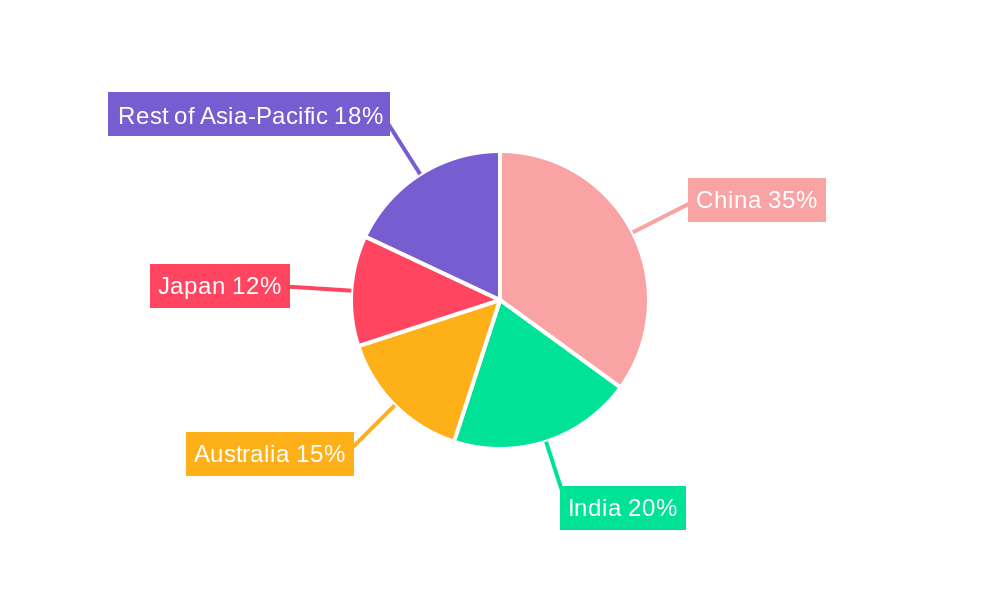

Leading Regions, Countries, or Segments in Asia-Pacific Waterproofing Solutions Market

China dominates the Asia-Pacific waterproofing solutions market, driven by extensive infrastructure projects, rapid urbanization, and a strong construction sector. Other key markets include India, Japan, and Australia.

- Dominant End-Use Sector: Infrastructure, fueled by substantial government investments in transportation networks, water management systems, and other large-scale projects.

- Fastest-Growing Sub-Product: Chemicals, driven by increasing demand for high-performance and specialized waterproofing solutions.

Key Drivers for China's Dominance:

- Massive infrastructure investments.

- Rapid urbanization and rising construction activities.

- Government initiatives supporting sustainable infrastructure.

Key Drivers for India's Growth:

- Increasing residential and commercial construction.

- Government policies promoting affordable housing.

Asia-Pacific Waterproofing Solutions Market Product Innovations

Recent innovations in waterproofing solutions include the development of self-healing membranes, which automatically repair minor damages, enhancing durability and longevity. Other notable advancements include the use of nanotechnology to improve water resistance and the integration of smart sensors to monitor building performance and prevent leaks. These innovations offer unique selling propositions such as extended product lifespan, reduced maintenance costs, and enhanced building safety. Advanced polymer-based materials also play a key role, providing improved flexibility, adhesion, and resistance to various environmental factors.

Propelling Factors for Asia-Pacific Waterproofing Solutions Market Growth

The Asia-Pacific waterproofing solutions market is experiencing rapid growth due to several factors. First, rapid urbanization and industrialization across the region are driving significant demand for new construction and infrastructure development. Second, rising disposable incomes and improving living standards are boosting the demand for improved housing and better building materials. Finally, governmental initiatives promoting sustainable infrastructure projects, such as green buildings and energy-efficient structures, are contributing to the market’s expansion. The implementation of stringent building codes and environmental regulations also encourage the adoption of high-performance and environmentally friendly waterproofing solutions.

Obstacles in the Asia-Pacific Waterproofing Solutions Market

The Asia-Pacific waterproofing solutions market faces certain challenges. Fluctuations in raw material prices, coupled with supply chain disruptions, can impact production costs and profitability. Moreover, intense competition among established players and the emergence of new entrants can create price pressures. Finally, variations in building codes and regulations across different countries add complexity to market operations. These obstacles can hinder the consistent growth trajectory of the market.

Future Opportunities in Asia-Pacific Waterproofing Solutions Market

The Asia-Pacific waterproofing solutions market presents significant growth opportunities. The increasing adoption of green building practices and the rising demand for sustainable construction materials present a prime opportunity for environmentally friendly products. The development and adoption of innovative technologies, such as smart waterproofing systems and self-healing membranes, also offer substantial potential. Finally, expanding into untapped markets in Southeast Asia and other emerging economies presents considerable prospects for market expansion.

Major Players in the Asia-Pacific Waterproofing Solutions Market Ecosystem

- Soprem

- Hongyuan Waterproof Technology Group Co Ltd

- Saint-Gobain

- MBCC Group

- Fosroc Inc

- Ardex Group

- Sika AG

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

Key Developments in Asia-Pacific Waterproofing Solutions Market Industry

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group, expanding its research capabilities in waterproofing membranes and thermal insulation coatings. This collaboration signifies a push towards innovation and expansion within the market.

- May 2023: Sika's acquisition of MBCC Group significantly reshaped the market landscape, consolidating market share and integrating diverse waterproofing solutions under a single entity. This consolidation has implications for competition and product offerings.

- March 2023: Oriental Yuhong's strategic cooperation with Luoyang Longfeng Construction Investment Co., Ltd. further strengthened its position in the market by enhancing resource exchange and broadening its product portfolio. This emphasizes a strategy of strategic partnerships for growth.

Strategic Asia-Pacific Waterproofing Solutions Market Forecast

The Asia-Pacific waterproofing solutions market is poised for continued growth, driven by sustained infrastructure development, urbanization, and the increasing adoption of sustainable building practices. Emerging technologies, such as self-healing membranes and smart waterproofing systems, will play a key role in shaping future market trends. The market's potential is significant, particularly in rapidly developing economies within the region. The forecast period promises strong growth opportunities for innovative companies offering high-performance and sustainable waterproofing solutions.

Asia-Pacific Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Asia-Pacific Waterproofing Solutions Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waterproofing Solutions Market Regional Market Share

Geographic Coverage of Asia-Pacific Waterproofing Solutions Market

Asia-Pacific Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Soprem

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hongyuan Waterproof Technology Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saint-Gobain

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardex Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Keshun Waterproof Technology Co ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lonseal Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oriental Yuhong

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Soprem

List of Figures

- Figure 1: Asia-Pacific Waterproofing Solutions Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Waterproofing Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 4: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 5: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 10: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 11: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waterproofing Solutions Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Asia-Pacific Waterproofing Solutions Market?

Key companies in the market include Soprem, Hongyuan Waterproof Technology Group Co Ltd, Saint-Gobain, MBCC Group, Fosroc Inc, Ardex Group, Sika AG, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong.

3. What are the main segments of the Asia-Pacific Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.04 billion as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: To further develop its portfolio of building products, including waterproofing solutions, Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd. This agreement is expected to result in the exchange of resources in the field of construction materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence