Key Insights

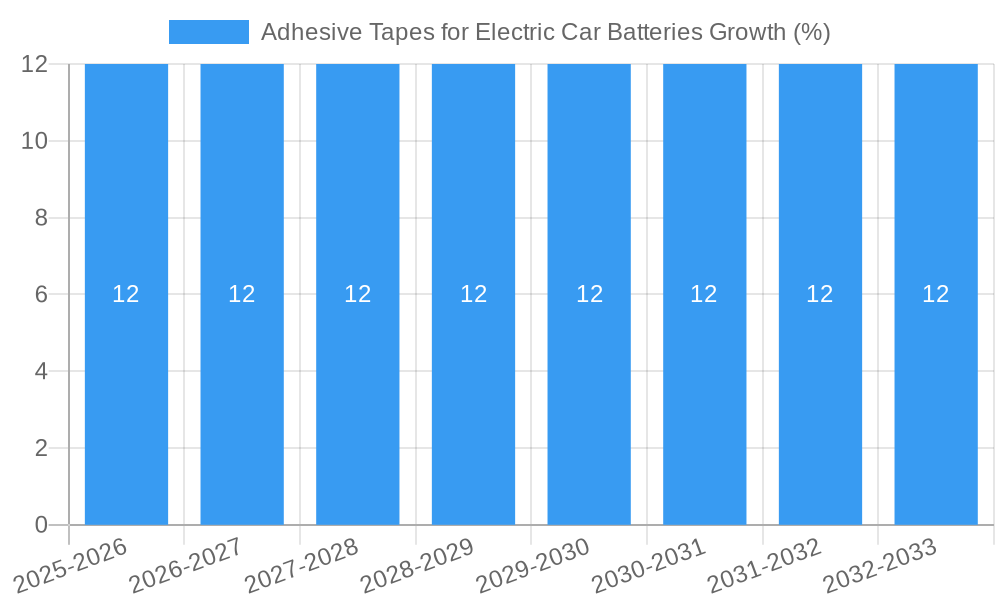

The global market for Adhesive Tapes for Electric Car Batteries is poised for substantial growth, driven by the accelerating adoption of electric vehicles (EVs) worldwide. With an estimated market size of approximately $1.8 billion in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This robust expansion is fueled by the critical role adhesive tapes play in battery pack assembly, offering essential functionalities such as thermal management, electrical insulation, structural integrity, and protection against vibration and environmental factors. As battery energy density increases and thermal runaway remains a concern, the demand for specialized, high-performance adhesive tapes designed for the unique challenges of EV battery systems is surging. Key applications span across both commercial vehicles and passenger cars, with significant development in double-sided tapes for enhanced adhesion and thermal conductivity.

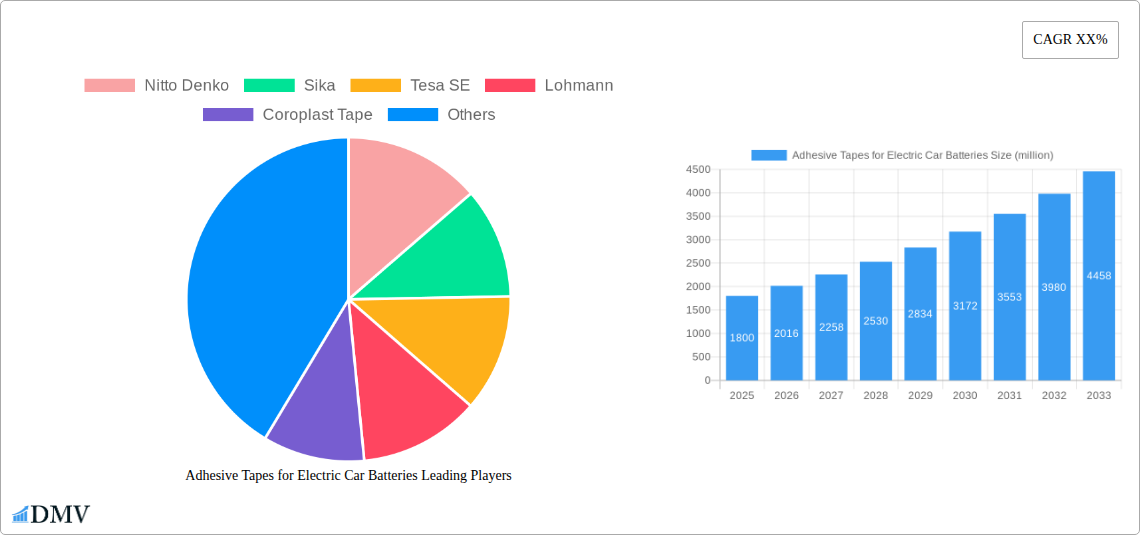

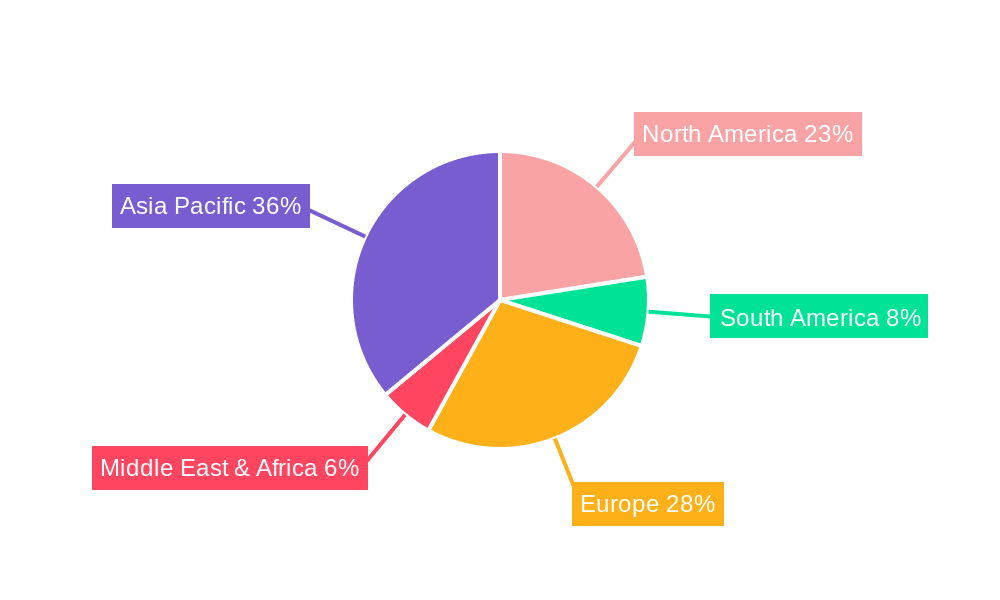

The market is characterized by intense innovation and a competitive landscape featuring established players like 3M, Nitto Denko, and Sika, alongside emerging specialists. These companies are actively developing advanced adhesive solutions that can withstand extreme temperatures, dissipate heat efficiently, and comply with stringent safety regulations in the automotive industry. Restraints such as the high cost of specialized materials and the need for rigorous testing and validation processes are present. However, these are being offset by the strong market drivers of government incentives for EVs, growing environmental consciousness, and advancements in battery technology. Regions like Asia Pacific, particularly China, are leading in both production and consumption due to their dominant position in EV manufacturing, followed closely by North America and Europe. The continuous evolution of battery chemistries and pack designs will further necessitate the development of tailored adhesive tape solutions, ensuring sustained market vitality.

Sure, here is the SEO-optimized and insightful report description for Adhesive Tapes for Electric Car Batteries, incorporating your specified requirements:

Adhesive Tapes for Electric Car Batteries Market Composition & Trends

The global market for adhesive tapes for electric car batteries is characterized by a dynamic and evolving landscape, driven by the exponential growth of the electric vehicle (EV) sector. Market concentration remains moderate, with a significant portion held by established players like 3M, Nitto Denko, and Avery Dennison, alongside emerging specialists. Innovation catalysts are primarily centered around enhancing thermal management, electrical insulation, and structural integrity of battery packs. Regulatory landscapes, particularly evolving safety standards for EV battery components, are increasingly dictating product development and material certifications. Substitute products, such as traditional mechanical fasteners or liquid adhesives, are facing intense competition from advanced adhesive tape solutions offering superior performance and ease of application. End-user profiles are predominantly EV manufacturers, battery module suppliers, and Tier-1 automotive component providers, all seeking reliable and high-performance bonding solutions. Mergers & Acquisitions (M&A) activities are gaining traction, with strategic acquisitions aimed at expanding product portfolios, gaining access to new technologies, and consolidating market share. M&A deal values are projected to reach figures in the hundreds of million, reflecting the strategic importance of this niche market. The market share distribution is witnessing a gradual shift towards specialized adhesive tape manufacturers demonstrating strong R&D capabilities and a deep understanding of EV battery chemistries and operating conditions. Market penetration is projected to reach xx million by the end of the forecast period. The competitive intensity is expected to rise, with companies like Sika, Tesa SE, and Lohmann actively investing in product development and market expansion to capture a larger share of the estimated xx million market opportunity within the study period.

Adhesive Tapes for Electric Car Batteries Industry Evolution

The adhesive tapes for electric car batteries industry is on a trajectory of robust and sustained growth, mirroring the global surge in electric vehicle adoption. Over the study period from 2019 to 2033, the market has witnessed a significant transformation, moving from a nascent stage to a critical component in battery pack design and manufacturing. The historical period (2019-2024) saw initial adoption driven by the need for lightweighting and improved assembly processes in early EV models. During this phase, the market size was estimated to be around xx million in 2019, growing to an estimated xx million by 2024, indicating a compound annual growth rate (CAGR) of approximately xx%. This growth was fueled by the increasing demand for thermal interface materials (TIMs) to manage heat generated by battery cells, thereby enhancing performance and lifespan. Technological advancements have been a cornerstone of this evolution. Early adhesive tapes focused on basic adhesion and insulation, but the industry has rapidly progressed to incorporate sophisticated functionalities. Innovations such as electrically conductive adhesives (ECAs) for improved current transfer, high-performance thermal runaway barrier tapes, and vibration-damping tapes have become increasingly prevalent. The base year, 2025, is projected to see the market reach an estimated xx million, with the estimated year also at xx million, reflecting a continued strong growth phase. The forecast period (2025-2033) is anticipated to witness an accelerated CAGR of xx%, driven by a confluence of factors including stricter thermal management regulations, the development of higher energy density battery chemistries, and the scaling up of EV production globally. Consumer demands are also subtly influencing the market; as EVs become more mainstream, end-users expect greater battery reliability, safety, and longevity, placing a premium on advanced adhesive solutions. The adoption of specialized tapes for battery pack assembly is projected to exceed xx million units by 2033. The increasing complexity of battery architectures, including pouch cells, cylindrical cells, and prismatic cells, necessitates a diverse range of adhesive tape solutions tailored to specific needs, further driving market expansion. The projected market size by 2033 is expected to reach a substantial xx million, underscoring the critical role of adhesive tapes in the future of electric mobility.

Leading Regions, Countries, or Segments in Adhesive Tapes for Electric Car Batteries

The dominance in the adhesive tapes for electric car batteries market is currently held by regions and countries at the forefront of electric vehicle manufacturing and battery production. Asia-Pacific, particularly China, spearheads this dominance, driven by its colossal EV market and extensive battery manufacturing ecosystem. The region benefits from strong government support for EV adoption, substantial investment in battery gigafactories, and a well-established supply chain for automotive components. This has led to a significant concentration of demand for various types of adhesive tapes.

Key Drivers of Dominance in Asia-Pacific:

- Unparalleled EV Market Size: China alone accounts for a substantial portion of global EV sales, creating immense demand for battery pack components, including specialized adhesive tapes.

- Battery Manufacturing Hub: The region is home to the world's largest battery manufacturers, such as CATL and LG Energy Solution (with significant operations in the region), necessitating a vast supply of high-performance tapes for their production lines.

- Government Incentives and Policies: Proactive government policies promoting EV adoption and domestic manufacturing have fostered a favorable environment for the adhesive tape industry.

- Robust Supply Chain Integration: The presence of an integrated supply chain, from raw material suppliers to EV manufacturers, facilitates efficient sourcing and adoption of advanced adhesive tape solutions.

Within the Application segment, Passenger Cars represent the largest share of demand, as this segment is the primary driver of global EV sales. However, the Commercial Vehicles segment is rapidly emerging as a significant growth area, with an increasing number of electric buses, trucks, and vans requiring robust and reliable battery solutions, thus driving demand for specialized tapes.

In terms of Types, Double-sided adhesive tapes are experiencing particularly strong growth. Their ability to bond dissimilar materials, distribute stress evenly, and provide sealing properties makes them indispensable for assembling battery modules, thermal management systems, and battery pack enclosures. Single-sided tapes also play a crucial role in insulation and protection applications.

The market size for Passenger Cars applications is estimated to be xx million in 2025, while Commercial Vehicles are projected to reach xx million by 2025. The Double-sided tape segment is expected to account for xx million in 2025, with Single-sided tapes following at xx million. The growth in these segments is further amplified by investments in new battery technologies and the increasing complexity of battery pack designs, which demand advanced bonding and sealing solutions. Companies like Nitto Denko, Avery Dennison, and 3M are heavily invested in this region, leveraging their technological expertise to meet the specific demands of Asia-Pacific's rapidly expanding EV battery market.

Adhesive Tapes for Electric Car Batteries Product Innovations

Product innovation in adhesive tapes for electric car batteries is critically focused on enhancing safety, performance, and manufacturability. Recent advancements include the development of high-temperature resistant tapes capable of withstanding extreme operating conditions within battery packs, crucial for preventing thermal runaway and ensuring operational longevity. Electrically conductive adhesive tapes are emerging as key solutions for streamlining current transfer pathways, reducing the need for traditional welding or complex wiring, thereby improving efficiency and reducing weight. Furthermore, advanced thermal interface tapes with exceptionally low thermal resistance are now available, significantly improving heat dissipation from battery cells to cooling systems, a vital aspect for high-performance EVs. These innovations, such as specialized flame-retardant tapes and electrically insulating tapes with superior dielectric strength, directly contribute to the overall safety and reliability of EV battery systems, meeting the rigorous demands of the automotive industry. The market for these advanced tapes is projected to reach xx million by the end of the study period.

Propelling Factors for Adhesive Tapes for Electric Car Batteries Growth

The adhesive tapes for electric car batteries market is propelled by a confluence of technological, economic, and regulatory factors. The rapid global expansion of the electric vehicle sector is the primary economic driver, fueling unprecedented demand for advanced battery components. Technological advancements in battery chemistries, leading to higher energy densities and operating temperatures, necessitate the use of specialized tapes for thermal management, electrical insulation, and structural integrity. Regulatory mandates aimed at enhancing EV safety, particularly concerning thermal runaway prevention, are compelling manufacturers to adopt high-performance adhesive tape solutions. For instance, stringent safety certifications and testing protocols are increasingly requiring materials that can demonstrate superior fire resistance and electrical insulation properties. Economic incentives for EV adoption, such as government subsidies and tax credits, further boost EV sales, indirectly driving the demand for battery assembly materials. The quest for lighter and more efficient battery pack designs also favors the adoption of adhesive tapes over traditional fasteners, contributing to overall vehicle performance and range.

Obstacles in the Adhesive Tapes for Electric Car Batteries Market

Despite robust growth, the adhesive tapes for electric car batteries market faces several obstacles. Stringent and evolving regulatory landscapes can create compliance challenges for manufacturers, requiring significant investment in testing and certification. Supply chain disruptions, particularly in the availability of specialized raw materials or fluctuations in their pricing, can impact production costs and lead times. Competitive pressures from alternative bonding technologies and the constant drive for cost reduction by automotive OEMs can pose a threat to premium adhesive tape solutions. Furthermore, the need for extensive qualification and validation processes by battery manufacturers before adopting new adhesive tapes can lead to extended sales cycles. The cost sensitivity of the mass-market EV segment also presents a barrier, as manufacturers often seek the most economical solutions that still meet performance requirements. Market impediments are estimated to impact potential growth by up to xx%.

Future Opportunities in Adhesive Tapes for Electric Car Batteries

Emerging opportunities in the adhesive tapes for electric car batteries market are vast and ripe for innovation. The increasing adoption of solid-state batteries presents a new frontier, requiring novel adhesive solutions for bonding solid electrolytes and managing unique thermal and electrical characteristics. The development of smart battery packs with integrated sensors and advanced monitoring systems opens avenues for conductive and sensor-integrated adhesive tapes. Expansion into emerging EV markets, particularly in developing economies, offers significant untapped potential. Furthermore, the growing demand for battery recycling and second-life applications may necessitate specialized adhesive tapes for disassembling and reassembling battery modules, creating a circular economy opportunity. The development of bio-based and sustainable adhesive tapes is also an emerging trend, aligning with the environmental ethos of the EV industry.

Major Players in the Adhesive Tapes for Electric Car Batteries Ecosystem

- Nitto Denko

- Sika

- Tesa SE

- Lohmann

- Coroplast Tape

- Avery Dennison

- 3M

- ATP adhesive systems AG

- Adhtapes

- CCT Tapes

- Saint-Gobain

- HB Fuller

- Henkel

- GBS Adhesive Tape Co.,Ltd.

- Donlee

- Haotian New Material Technology Co.,Ltd

- Dongguan Yihong Adhesive Technology Co.,Ltd.

- Fuyin New Materials

- Guangzhou De Hongxi Packaging Material Co.,Ltd

Key Developments in Adhesive Tapes for Electric Car Batteries Industry

- 2023: 3M introduces a new line of high-performance thermal interface materials for EV battery packs, enhancing heat dissipation.

- 2023: Nitto Denko announces a strategic partnership with a leading battery manufacturer to co-develop advanced electrical insulation tapes.

- 2024: Sika expands its portfolio with the acquisition of a specialist in thermally conductive adhesives for EV battery applications.

- 2024: Tesa SE launches a new series of double-sided tapes optimized for lightweighting battery pack enclosures.

- 2024: Avery Dennison showcases innovative electrically conductive adhesive tapes designed to simplify EV battery assembly.

- 2024: Lohmann develops a new generation of flame-retardant adhesive tapes meeting the latest automotive safety standards.

- 2024: Coroplast Tape introduces advanced vibration-damping tapes to improve the acoustic performance of EV battery modules.

Strategic Adhesive Tapes for Electric Car Batteries Market Forecast

The adhesive tapes for electric car batteries market is poised for significant expansion, driven by the accelerating global transition to electric mobility. Future growth will be shaped by continued innovation in thermal management, electrical insulation, and structural bonding solutions tailored to next-generation battery technologies, including solid-state batteries. The increasing stringency of automotive safety regulations worldwide will further solidify the demand for high-performance, certified adhesive tapes. Economic catalysts, such as government support for EVs and declining battery costs, will continue to fuel EV sales, directly translating into higher consumption of battery assembly materials. Emerging markets represent a substantial opportunity for market penetration, as EV adoption gains momentum in new geographies. The market is projected to grow to xx million by 2033, reflecting its critical role in the future of sustainable transportation.

Adhesive Tapes for Electric Car Batteries Segmentation

-

1. Application

- 1.1. Commercial Vehicles

- 1.2. Passenger Cars

-

2. Types

- 2.1. Single-sided

- 2.2. Double-sided

Adhesive Tapes for Electric Car Batteries Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Adhesive Tapes for Electric Car Batteries REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicles

- 5.1.2. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Single-sided

- 5.2.2. Double-sided

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicles

- 6.1.2. Passenger Cars

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Single-sided

- 6.2.2. Double-sided

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicles

- 7.1.2. Passenger Cars

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Single-sided

- 7.2.2. Double-sided

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicles

- 8.1.2. Passenger Cars

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Single-sided

- 8.2.2. Double-sided

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicles

- 9.1.2. Passenger Cars

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Single-sided

- 9.2.2. Double-sided

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Adhesive Tapes for Electric Car Batteries Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicles

- 10.1.2. Passenger Cars

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Single-sided

- 10.2.2. Double-sided

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nitto Denko

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sika

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tesa SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lohmann

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coroplast Tape

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avery Dennison

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ATP adhesive systems AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adhtapes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CCT Tapes

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saint-Gobain

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HB Fuller

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Henkel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GBS Adhesive Tape Co.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ltd.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Donlee

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Haotian New Material Technology Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Dongguan Yihong Adhesive Technology Co.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ltd.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Fuyin New Materials

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Guangzhou De Hongxi Packaging Material Co.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Ltd

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Nitto Denko

List of Figures

- Figure 1: Global Adhesive Tapes for Electric Car Batteries Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Adhesive Tapes for Electric Car Batteries Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Adhesive Tapes for Electric Car Batteries Revenue (million), by Application 2024 & 2032

- Figure 4: North America Adhesive Tapes for Electric Car Batteries Volume (K), by Application 2024 & 2032

- Figure 5: North America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Adhesive Tapes for Electric Car Batteries Revenue (million), by Types 2024 & 2032

- Figure 8: North America Adhesive Tapes for Electric Car Batteries Volume (K), by Types 2024 & 2032

- Figure 9: North America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Adhesive Tapes for Electric Car Batteries Revenue (million), by Country 2024 & 2032

- Figure 12: North America Adhesive Tapes for Electric Car Batteries Volume (K), by Country 2024 & 2032

- Figure 13: North America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Adhesive Tapes for Electric Car Batteries Revenue (million), by Application 2024 & 2032

- Figure 16: South America Adhesive Tapes for Electric Car Batteries Volume (K), by Application 2024 & 2032

- Figure 17: South America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Adhesive Tapes for Electric Car Batteries Revenue (million), by Types 2024 & 2032

- Figure 20: South America Adhesive Tapes for Electric Car Batteries Volume (K), by Types 2024 & 2032

- Figure 21: South America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Adhesive Tapes for Electric Car Batteries Revenue (million), by Country 2024 & 2032

- Figure 24: South America Adhesive Tapes for Electric Car Batteries Volume (K), by Country 2024 & 2032

- Figure 25: South America Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Adhesive Tapes for Electric Car Batteries Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Adhesive Tapes for Electric Car Batteries Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Adhesive Tapes for Electric Car Batteries Volume (K), by Application 2024 & 2032

- Figure 29: Europe Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Adhesive Tapes for Electric Car Batteries Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Adhesive Tapes for Electric Car Batteries Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Adhesive Tapes for Electric Car Batteries Volume (K), by Types 2024 & 2032

- Figure 33: Europe Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Adhesive Tapes for Electric Car Batteries Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Adhesive Tapes for Electric Car Batteries Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Adhesive Tapes for Electric Car Batteries Volume (K), by Country 2024 & 2032

- Figure 37: Europe Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Adhesive Tapes for Electric Car Batteries Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Adhesive Tapes for Electric Car Batteries Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Adhesive Tapes for Electric Car Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Adhesive Tapes for Electric Car Batteries Volume K Forecast, by Country 2019 & 2032

- Table 81: China Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Adhesive Tapes for Electric Car Batteries Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Adhesive Tapes for Electric Car Batteries Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adhesive Tapes for Electric Car Batteries?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Adhesive Tapes for Electric Car Batteries?

Key companies in the market include Nitto Denko, Sika, Tesa SE, Lohmann, Coroplast Tape, Avery Dennison, 3M, ATP adhesive systems AG, Adhtapes, CCT Tapes, Saint-Gobain, HB Fuller, Henkel, GBS Adhesive Tape Co., Ltd., Donlee, Haotian New Material Technology Co., Ltd, Dongguan Yihong Adhesive Technology Co., Ltd., Fuyin New Materials, Guangzhou De Hongxi Packaging Material Co., Ltd.

3. What are the main segments of the Adhesive Tapes for Electric Car Batteries?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adhesive Tapes for Electric Car Batteries," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adhesive Tapes for Electric Car Batteries report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adhesive Tapes for Electric Car Batteries?

To stay informed about further developments, trends, and reports in the Adhesive Tapes for Electric Car Batteries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence