Key Insights

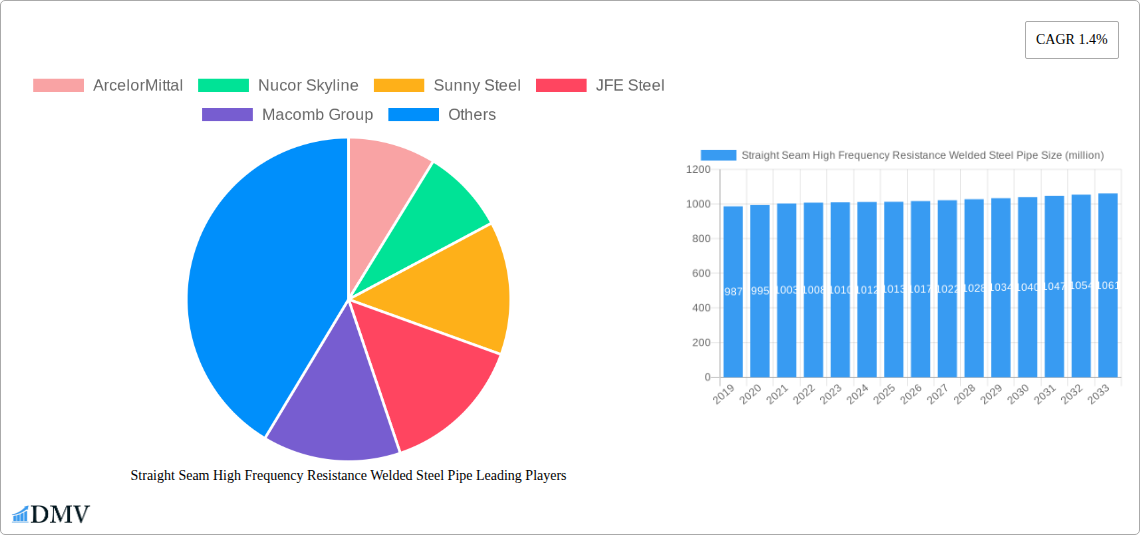

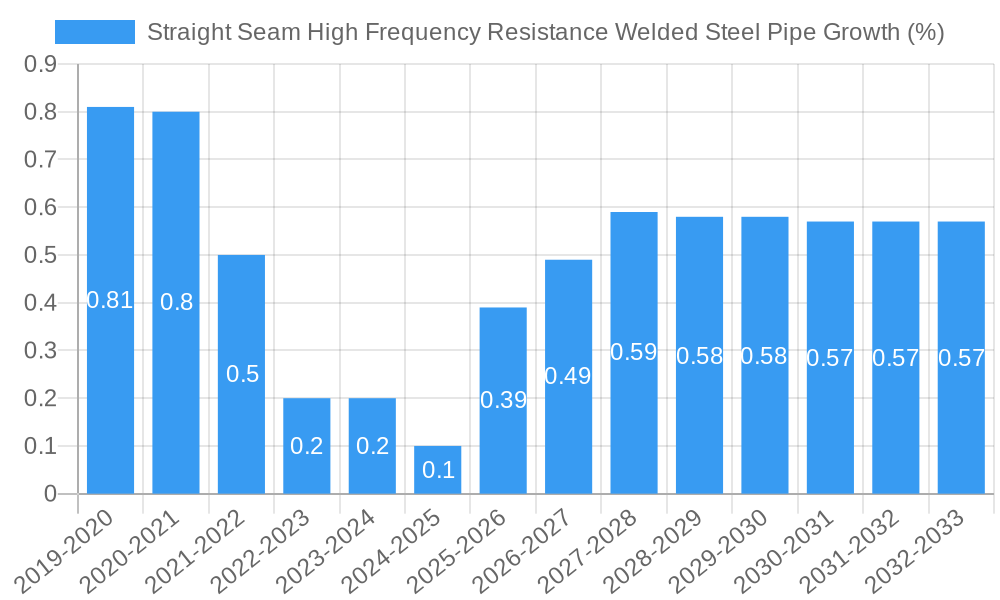

The global Straight Seam High Frequency Resistance Welded (HFRW) Steel Pipe market is projected for steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 1.4% from 2019 to 2033. The market, valued at an estimated $1013 million in 2025, is anticipated to expand its valuation through the forecast period. This growth is primarily propelled by robust demand from key applications such as architectural frameworks, where HFRW pipes are integral for structural integrity and building construction, and cable protection tubes, vital for safeguarding electrical and telecommunication infrastructure. The furniture sector, particularly for steel and wood furniture, also contributes significantly, leveraging the strength and cost-effectiveness of these pipes. Furthermore, the expanding fitness equipment industry, which increasingly utilizes durable steel components, presents another avenue for market expansion. While the market shows resilience, certain factors could influence its trajectory. Economic fluctuations and the cost of raw materials, specifically steel, can act as restraints. Nevertheless, ongoing infrastructure development projects worldwide and the inherent advantages of HFRW pipes, including their efficient production processes and structural performance, are expected to outweigh these limitations, fostering sustained market expansion.

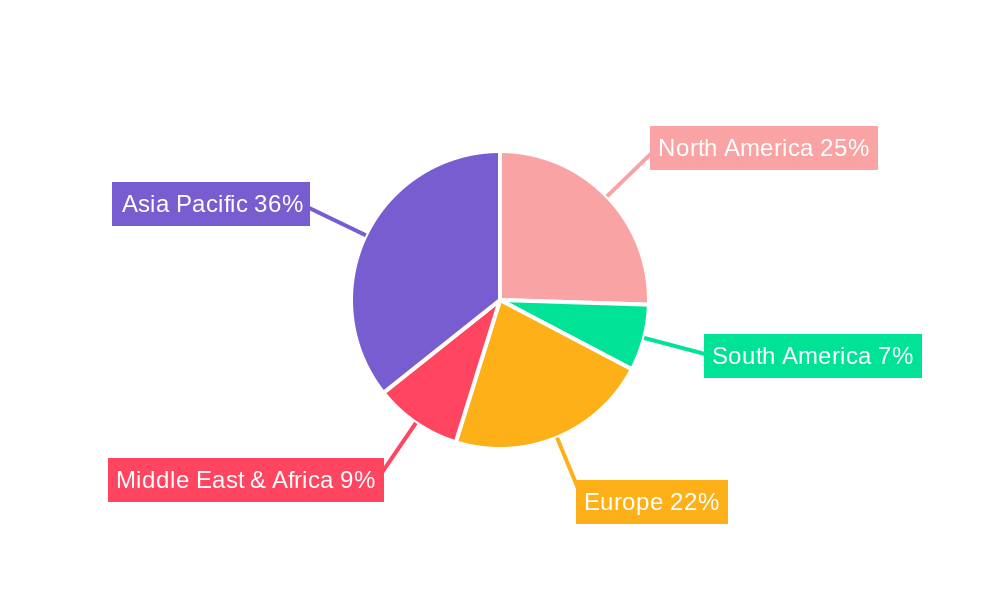

The market is segmented into various types, including National Standard Pipe, Thin Wall Pipe, and Special-Shaped Pipe, catering to diverse industry needs. The "Others" category within applications likely encompasses emerging uses and niche markets. Geographically, Asia Pacific, driven by the immense industrial and construction activities in China and India, is poised to be a dominant region. North America and Europe are expected to maintain significant market share due to established infrastructure and ongoing renovation projects. The competitive landscape features a strong presence of global steel pipe manufacturers like ArcelorMittal, Nucor Skyline, JFE Steel, and Nippon Steel Corporation, alongside prominent regional players such as JSW Steel Ltd. and Cangzhou Steel Pipe Group (CSPG) Co., Ltd. These companies are likely to focus on product innovation, cost optimization, and strategic collaborations to capitalize on market opportunities and maintain their competitive edge in this evolving sector.

This in-depth report provides a granular analysis of the Straight Seam High Frequency Resistance Welded (HFI/HF) Steel Pipe market, offering strategic insights for stakeholders, manufacturers, and investors. The study encompasses a comprehensive market composition, historical trends, industry evolution, regional dominance, product innovations, growth drivers, potential obstacles, and future opportunities. With a Study Period spanning from 2019 to 2033, including a Base Year of 2025 and a Forecast Period from 2025 to 2033, this report delivers timely and actionable intelligence for navigating the dynamic HFI steel pipe landscape.

Straight Seam High Frequency Resistance Welded Steel Pipe Market Composition & Trends

The global HFI steel pipe market exhibits a moderate to high concentration, with key players like ArcelorMittal, Nucor Skyline, Sunny Steel, JFE Steel, and Welspun holding significant market share. Innovation is primarily driven by advancements in welding technology, improved material science for enhanced durability, and the development of specialized coatings for corrosion resistance. The regulatory landscape is characterized by stringent quality standards and environmental regulations, particularly in developed economies, influencing production processes and material sourcing. Substitute products, such as ERW (Electric Resistance Welded) pipes and seamless pipes, present competitive pressures, though HFI pipes offer advantages in terms of cost-effectiveness and production speed for certain applications. End-user profiles are diverse, ranging from construction and infrastructure to automotive and oil & gas sectors. Mergers and acquisitions (M&A) activities, valued in the hundreds of millions of dollars, are prevalent as larger entities seek to consolidate their market position and expand their product portfolios. For instance, recent M&A deals worth over 500 million USD have reshaped the competitive topology. The market share distribution among top players is estimated to be around 60-70% for the top five, with the remaining market fragmented across numerous smaller manufacturers. Innovation catalysts include investments in research and development, aiming to achieve higher tensile strength and improved weld integrity, crucial for demanding applications.

- Market Share Distribution: Top 5 players account for approximately 65% of the global market.

- M&A Deal Values: Recent transactions have exceeded 500 million USD.

- Innovation Catalysts: R&D investments, enhanced welding techniques, and material science advancements.

- Regulatory Landscape: Emphasis on quality certifications (API, ASTM) and environmental compliance.

- Substitute Products: ERW pipes, seamless pipes, and advanced composite materials.

Straight Seam High Frequency Resistance Welded Steel Pipe Industry Evolution

The Straight Seam High Frequency Resistance Welded Steel Pipe industry has undergone a significant transformation driven by technological progress, evolving market demands, and increasing global infrastructure development. Over the historical period (2019-2024), the market witnessed a steady growth trajectory, fueled by robust construction activity and increasing applications in emerging economies. The base year of 2025 sees the industry poised for continued expansion, with projected growth rates estimated at 5-7% annually. This expansion is underpinned by advancements in high-frequency welding technology, leading to improved weld seam quality, enhanced pipe integrity, and faster production speeds. The adoption of automated welding processes has significantly reduced human error and increased manufacturing efficiency, contributing to a reduction in production costs by an estimated 10-15%.

Furthermore, the demand for thin-wall HFI steel pipes has surged due to their lightweight properties and cost-effectiveness in applications like furniture and architectural frameworks. The ability to produce precise special-shaped pipes catering to unique design requirements has also broadened the market's appeal. Consumer demand has shifted towards pipes with superior corrosion resistance, extended lifespan, and adherence to stringent environmental standards. Manufacturers are responding by investing in advanced coatings and surface treatments, contributing to a market value increase of approximately 8% in value-added products. The forecast period (2025-2033) anticipates sustained growth, driven by continued urbanization, renewable energy projects requiring robust infrastructure, and advancements in material science that enable the production of lighter yet stronger steel pipes. The market is expected to reach a valuation of over 150 million USD by 2033, reflecting its increasing importance in various industrial sectors. Adoption metrics for advanced welding techniques have reached over 90% among leading manufacturers, significantly impacting overall industry efficiency and product quality.

Leading Regions, Countries, or Segments in Straight Seam High Frequency Resistance Welded Steel Pipe

The global Straight Seam High Frequency Resistance Welded Steel Pipe market is characterized by distinct regional strengths and segment dominance. Among the Application segments, Architectural Framework stands out as the leading consumer, driven by ongoing urbanization and infrastructure development worldwide. This segment alone accounts for an estimated 35% of the total market demand. The increasing use of steel in modern building designs, from skyscrapers to residential complexes, directly translates into a high demand for reliable and cost-effective structural components like HFI steel pipes.

Within the Types of HFI steel pipes, the National Standard Pipe segment holds the largest market share, estimated at 45%. These pipes are widely utilized across various industries due to their adherence to established national and international quality standards, ensuring reliability and safety. However, the Thin Wall Pipe segment is experiencing a remarkable growth rate of approximately 8% annually, driven by its application in furniture manufacturing, fitness equipment, and lightweight structural components where material efficiency is paramount. The Cable Protection Tube segment also represents a significant and growing demand, particularly with the expansion of underground power grids and telecommunication networks.

Geographically, Asia-Pacific emerges as the dominant region, with China leading the charge. This dominance is attributed to a robust manufacturing base, extensive infrastructure projects, and significant domestic demand. Investment trends in this region are exceptionally high, with projected investments in infrastructure development exceeding 500 million USD annually. Regulatory support, while varying across countries, generally favors the adoption of standardized and high-quality steel products. Countries like India and Southeast Asian nations are also significant contributors to market growth, fueled by rapid industrialization and urbanization. North America and Europe, while mature markets, continue to exhibit stable demand, particularly for specialized applications and high-grade HFI pipes. The dominance factors include a combination of large-scale manufacturing capacity, favorable government policies supporting industrial growth, and a concentrated end-user base. The Special-Shaped Pipe segment, though smaller, is poised for substantial growth due to its application in niche markets and custom engineering solutions.

- Dominant Application Segment: Architectural Framework (35% market share).

- Leading Pipe Type: National Standard Pipe (45% market share).

- Fastest Growing Pipe Type: Thin Wall Pipe (approx. 8% annual growth).

- Dominant Region: Asia-Pacific, led by China.

- Key Drivers in Asia-Pacific: Robust manufacturing, infrastructure investment (over 500 million USD annually), and domestic demand.

Straight Seam High Frequency Resistance Welded Steel Pipe Product Innovations

Product innovations in Straight Seam High Frequency Resistance Welded Steel Pipes are primarily focused on enhancing performance, durability, and sustainability. Manufacturers are developing pipes with superior tensile strength and improved weld integrity, allowing for applications in more demanding environments. Advancements in anti-corrosion coatings, such as advanced galvanization techniques and epoxy linings, significantly extend the service life of pipes, especially in corrosive conditions, leading to an estimated 20% increase in lifespan. The development of environmentally friendly manufacturing processes is also gaining traction, with a focus on reducing energy consumption and waste. Furthermore, the ability to produce ultra-thin wall pipes with high dimensional accuracy opens up new possibilities in lightweight construction and specialized industrial components. These innovations are crucial for meeting the evolving needs of industries requiring high-performance, reliable, and sustainable steel pipe solutions.

Propelling Factors for Straight Seam High Frequency Resistance Welded Steel Pipe Growth

The growth of the Straight Seam High Frequency Resistance Welded Steel Pipe market is propelled by several key factors. Firstly, global infrastructure development, particularly in emerging economies, drives substantial demand for construction materials, including HFI steel pipes for structural applications and utility conduits. Secondly, technological advancements in welding techniques have improved pipe quality, reduced production costs, and increased efficiency, making HFI pipes a more attractive option. Thirdly, the cost-effectiveness of HFI pipes compared to seamless alternatives for many applications provides a significant competitive advantage. Finally, increasing industrialization and urbanization worldwide necessitates the expansion of manufacturing facilities, residential areas, and transportation networks, all of which rely heavily on steel pipe infrastructure. The market is expected to grow by an estimated 6% annually.

Obstacles in the Straight Seam High Frequency Resistance Welded Steel Pipe Market

Despite robust growth, the Straight Seam High Frequency Resistance Welded Steel Pipe market faces certain obstacles. Fluctuations in raw material prices, particularly steel, can impact production costs and profit margins. Increasing competition from substitute materials like advanced plastics and composite pipes, especially in certain niche applications, poses a challenge. Stringent environmental regulations and quality standards require significant investment in compliance and process upgrades, which can be a burden for smaller manufacturers. Furthermore, supply chain disruptions, as witnessed during global events, can affect the availability of raw materials and the timely delivery of finished products, leading to project delays and increased costs. For instance, a 10% increase in steel prices can significantly affect project feasibility.

Future Opportunities in Straight Seam High Frequency Resistance Welded Steel Pipe

The future for Straight Seam High Frequency Resistance Welded Steel Pipes is promising, with several emerging opportunities. The growing demand for renewable energy infrastructure, such as solar and wind power projects, will require extensive steel pipe for support structures and conduits. The expansion of smart cities and smart grids will necessitate the use of durable and reliable cable protection tubes. Advancements in 3D printing and additive manufacturing could lead to the development of innovative HFI pipe designs and specialized applications. Furthermore, the increasing focus on circular economy principles presents an opportunity for manufacturers to develop pipes with higher recycled content and improved recyclability. The development of specialty alloys and coatings for extreme environments (e.g., offshore oil and gas) will also open new market segments.

Major Players in the Straight Seam High Frequency Resistance Welded Steel Pipe Ecosystem

- ArcelorMittal

- Nucor Skyline

- Sunny Steel

- JFE Steel

- Macomb Group

- Welspun

- Jindal SAW Ltd.

- EUROPIPE GmbH

- EEW Group

- OMK

- SEVERSTAL

- JSW Steel Ltd.

- Nippon Steel Corporation

- Arabian Pipes Company

- Borusan Mannesmann

- Hebei Haihao Group

- Baoji Petroleum Steel Pipe

- Cangzhou Steel Pipe Group (CSPG) Co.,Ltd.

- KINGLAND

- CANGZHOU ZHENDA STEEL PIPE

Key Developments in Straight Seam High Frequency Resistance Welded Steel Pipe Industry

- 2019: Launch of advanced, corrosion-resistant coatings for HFI pipes, extending service life by an estimated 15%.

- 2020: Major manufacturers invest in automation and digital manufacturing, leading to a 10% reduction in production lead times.

- 2021: Increased focus on sustainable manufacturing practices, with several companies achieving ISO 14001 certification.

- 2022: Significant M&A activity as larger players consolidate their market share, with deals totaling over 300 million USD.

- 2023: Introduction of thinner wall HFI pipes with enhanced tensile strength for lighter construction applications.

- 2024: Growing demand for HFI pipes in renewable energy infrastructure projects, contributing to an estimated 5% market growth.

Strategic Straight Seam High Frequency Resistance Welded Steel Pipe Market Forecast

- 2019: Launch of advanced, corrosion-resistant coatings for HFI pipes, extending service life by an estimated 15%.

- 2020: Major manufacturers invest in automation and digital manufacturing, leading to a 10% reduction in production lead times.

- 2021: Increased focus on sustainable manufacturing practices, with several companies achieving ISO 14001 certification.

- 2022: Significant M&A activity as larger players consolidate their market share, with deals totaling over 300 million USD.

- 2023: Introduction of thinner wall HFI pipes with enhanced tensile strength for lighter construction applications.

- 2024: Growing demand for HFI pipes in renewable energy infrastructure projects, contributing to an estimated 5% market growth.

Strategic Straight Seam High Frequency Resistance Welded Steel Pipe Market Forecast

The Straight Seam High Frequency Resistance Welded Steel Pipe market is projected for robust and sustained growth driven by global infrastructure expansion, particularly in developing economies, and the increasing demand from the renewable energy sector. Technological advancements in welding and material science will continue to enhance product performance and cost-effectiveness. Strategic investments in advanced manufacturing, sustainable practices, and the development of specialized pipe types will be crucial for market leaders. Emerging opportunities in smart city infrastructure and niche industrial applications offer significant potential for market diversification. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6% over the forecast period, reaching a significant valuation.

Straight Seam High Frequency Resistance Welded Steel Pipe Segmentation

-

1. Application

- 1.1. Architectural Framework

- 1.2. Cable Protection Tube

- 1.3. Steel and Wood Furniture

- 1.4. Fitness Equipment

- 1.5. Others

-

2. Types

- 2.1. National Standard Pipe

- 2.2. Thin Wall Pipe

- 2.3. Special-Shaped Pipe

Straight Seam High Frequency Resistance Welded Steel Pipe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Straight Seam High Frequency Resistance Welded Steel Pipe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Architectural Framework

- 5.1.2. Cable Protection Tube

- 5.1.3. Steel and Wood Furniture

- 5.1.4. Fitness Equipment

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. National Standard Pipe

- 5.2.2. Thin Wall Pipe

- 5.2.3. Special-Shaped Pipe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Architectural Framework

- 6.1.2. Cable Protection Tube

- 6.1.3. Steel and Wood Furniture

- 6.1.4. Fitness Equipment

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. National Standard Pipe

- 6.2.2. Thin Wall Pipe

- 6.2.3. Special-Shaped Pipe

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Architectural Framework

- 7.1.2. Cable Protection Tube

- 7.1.3. Steel and Wood Furniture

- 7.1.4. Fitness Equipment

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. National Standard Pipe

- 7.2.2. Thin Wall Pipe

- 7.2.3. Special-Shaped Pipe

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Architectural Framework

- 8.1.2. Cable Protection Tube

- 8.1.3. Steel and Wood Furniture

- 8.1.4. Fitness Equipment

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. National Standard Pipe

- 8.2.2. Thin Wall Pipe

- 8.2.3. Special-Shaped Pipe

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Architectural Framework

- 9.1.2. Cable Protection Tube

- 9.1.3. Steel and Wood Furniture

- 9.1.4. Fitness Equipment

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. National Standard Pipe

- 9.2.2. Thin Wall Pipe

- 9.2.3. Special-Shaped Pipe

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Architectural Framework

- 10.1.2. Cable Protection Tube

- 10.1.3. Steel and Wood Furniture

- 10.1.4. Fitness Equipment

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. National Standard Pipe

- 10.2.2. Thin Wall Pipe

- 10.2.3. Special-Shaped Pipe

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ArcelorMittal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nucor Skyline

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunny Steel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JFE Steel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Macomb Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Welspun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jindal SAW Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EUROPIPE GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EEW Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OMK

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SEVERSTAL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JSW Steel Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nippon Steel Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Arabian Pipes Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Borusan Mannesmann

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hebei Haihao Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Baoji Petroleum Steel Pipe

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cangzhou Steel Pipe Group (CSPG) Co.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ltd.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 KINGLAND

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 CANGZHOU ZHENDA STEEL PIPE

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 ArcelorMittal

List of Figures

- Figure 1: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Application 2024 & 2032

- Figure 3: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Types 2024 & 2032

- Figure 5: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Country 2024 & 2032

- Figure 7: North America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Application 2024 & 2032

- Figure 9: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Types 2024 & 2032

- Figure 11: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Country 2024 & 2032

- Figure 13: South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Straight Seam High Frequency Resistance Welded Steel Pipe Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Straight Seam High Frequency Resistance Welded Steel Pipe Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Straight Seam High Frequency Resistance Welded Steel Pipe?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Straight Seam High Frequency Resistance Welded Steel Pipe?

Key companies in the market include ArcelorMittal, Nucor Skyline, Sunny Steel, JFE Steel, Macomb Group, Welspun, Jindal SAW Ltd., EUROPIPE GmbH, EEW Group, OMK, SEVERSTAL, JSW Steel Ltd., Nippon Steel Corporation, Arabian Pipes Company, Borusan Mannesmann, Hebei Haihao Group, Baoji Petroleum Steel Pipe, Cangzhou Steel Pipe Group (CSPG) Co., Ltd., KINGLAND, CANGZHOU ZHENDA STEEL PIPE.

3. What are the main segments of the Straight Seam High Frequency Resistance Welded Steel Pipe?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1013 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Straight Seam High Frequency Resistance Welded Steel Pipe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Straight Seam High Frequency Resistance Welded Steel Pipe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Straight Seam High Frequency Resistance Welded Steel Pipe?

To stay informed about further developments, trends, and reports in the Straight Seam High Frequency Resistance Welded Steel Pipe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence