Key Insights

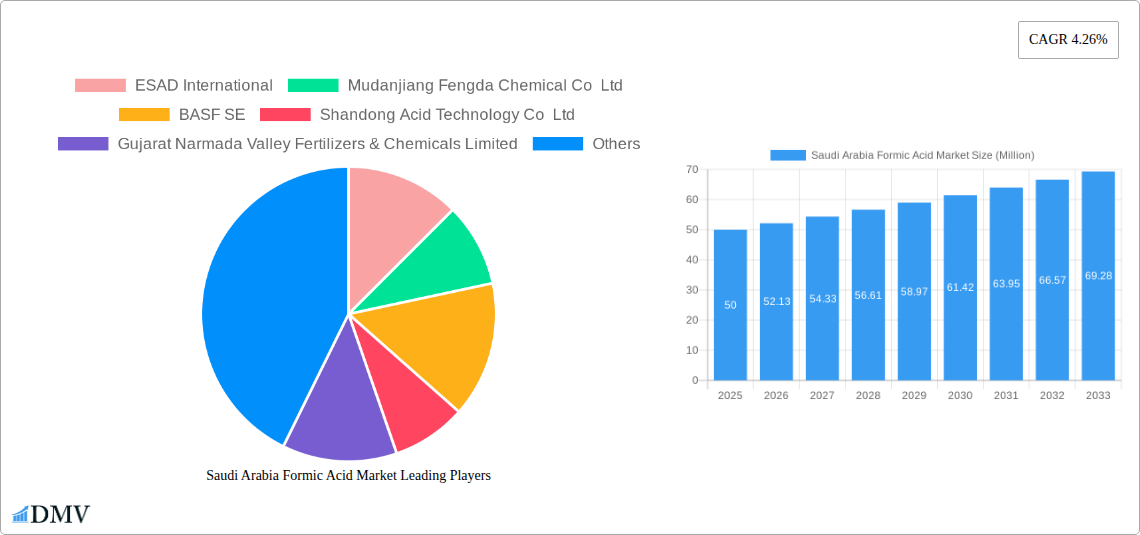

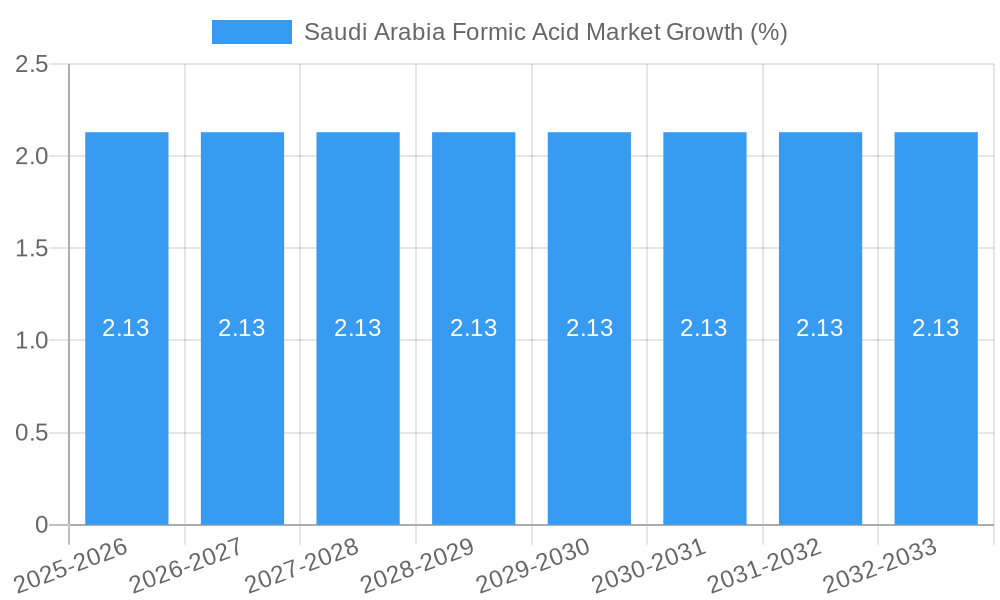

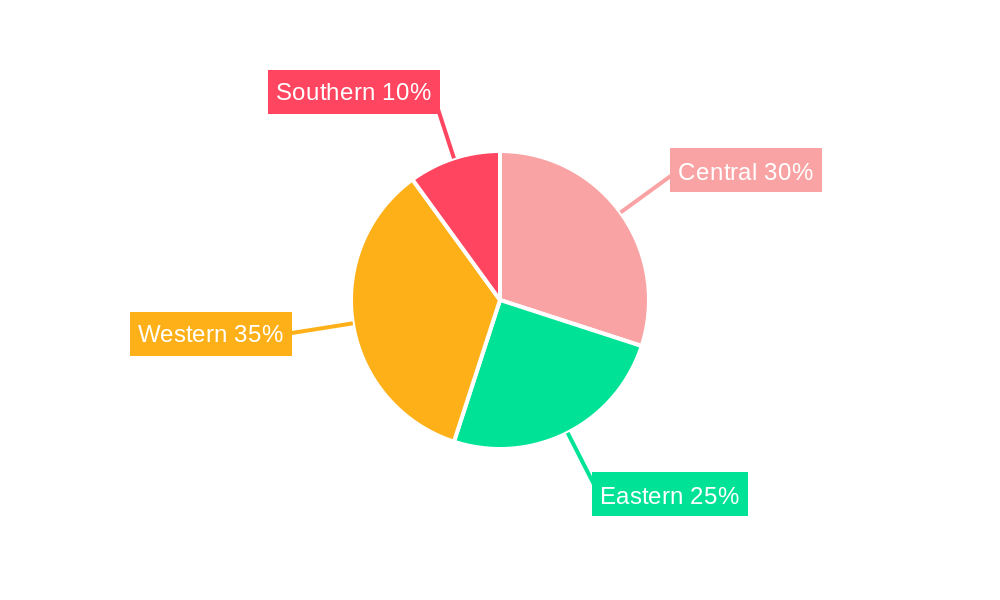

The Saudi Arabia formic acid market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.26% from 2025 to 2033. This expansion is fueled by increasing demand across diverse sectors within the Kingdom. The animal feed and silage additives segment is a major contributor, reflecting a growing livestock industry and a focus on enhancing feed efficiency. The burgeoning textile industry in Saudi Arabia also significantly contributes to formic acid demand, particularly in dyeing and finishing processes. Furthermore, the expanding pharmaceutical sector, employing formic acid as an intermediary in various drug syntheses, adds to market momentum. Growth is further supported by the increasing adoption of formic acid in cleaners and cosmetics, indicating diversification beyond traditional applications. While specific restraint data isn't provided, potential challenges could include price volatility of raw materials, stringent environmental regulations, and competition from alternative chemicals. Regional variations within Saudi Arabia (Central, Eastern, Western, Southern) likely exist, driven by uneven industrial development and differing concentrations of key industries. Understanding these regional nuances is crucial for targeted market penetration strategies. Future growth will depend on sustained economic expansion, government support for related industries (e.g., agriculture, textiles), and technological advancements leading to more efficient and sustainable formic acid production.

The competitive landscape features both international players like BASF SE and PETRONAS, alongside domestic companies such as ESAD International and Shandong Acid Technology Co Ltd. This mix reflects a market with opportunities for both established global entities and local businesses catering to specific market needs. Strategic partnerships, technological innovation, and a focus on sustainable practices will be key differentiators for companies seeking a strong foothold in this expanding market. Analyzing the historical data (2019-2024) alongside projected figures provides a comprehensive understanding of the market's trajectory and offers valuable insights for investors and businesses considering entry or expansion within the Saudi Arabia formic acid industry. The market's continued growth offers significant opportunities for those able to adapt to evolving industry demands and technological advancements.

Saudi Arabia Formic Acid Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia formic acid market, offering a comprehensive overview of market trends, growth drivers, challenges, and future opportunities from 2019 to 2033. The study covers key segments, prominent players, and emerging technological advancements, providing crucial insights for stakeholders seeking to navigate this dynamic market. With a base year of 2025 and a forecast period extending to 2033, this report offers invaluable data for strategic decision-making. The total market size is estimated to reach xx Million by 2033.

Saudi Arabia Formic Acid Market Market Composition & Trends

This section delves into the competitive landscape of the Saudi Arabia formic acid market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a moderate level of concentration, with key players like BASF SE and others holding significant market shares. Innovation is driven primarily by the demand for higher-purity formic acid and the development of sustainable production methods. Regulatory frameworks, including environmental regulations, significantly influence market dynamics. Substitute products, such as acetic acid, pose a competitive threat. End-user industries, including animal feed, leather tanning, and textiles, shape market demand. M&A activity has been relatively limited, with a total deal value estimated at xx Million over the historical period (2019-2024), primarily driven by consolidation efforts amongst smaller players.

- Market Share Distribution (2024): BASF SE (xx%), ESAD International (xx%), other players (xx%).

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Sustainable production, higher purity demands.

- Major Substitute Products: Acetic acid.

Saudi Arabia Formic Acid Market Industry Evolution

The Saudi Arabia formic acid market has experienced steady growth during the historical period (2019-2024), driven by increasing demand from various end-user sectors. The compound annual growth rate (CAGR) during this period was approximately xx%. Technological advancements, such as the development of more efficient production processes, have played a crucial role in market expansion. Shifting consumer preferences towards sustainable and eco-friendly products have also positively impacted demand. The forecast period (2025-2033) is expected to witness continued growth, fueled by increasing industrial activity and rising awareness of formic acid's diverse applications. The market is projected to expand at a CAGR of xx% during this period, reaching xx Million by 2033.

Leading Regions, Countries, or Segments in Saudi Arabia Formic Acid Market

The application segment dominating the Saudi Arabia formic acid market is Animal Feed and Silage Additives, driven by growing livestock production and increasing demand for efficient feed preservatives. This segment’s dominance is underpinned by several key factors.

- Key Drivers for Animal Feed and Silage Additives Segment:

- Increasing livestock population and meat consumption.

- Growing awareness of the benefits of formic acid as a feed preservative and silage additive.

- Government initiatives promoting sustainable livestock farming.

- Dominance Factors: High consumption rates, strong government support for agricultural development, and readily available raw materials contributing to lower production costs.

The textile dyeing and finishing segment also shows significant potential, driven by the country's expanding textile industry. While leather tanning and pharmaceutical intermediaries represent smaller segments, they demonstrate promising future growth opportunities.

Saudi Arabia Formic Acid Market Product Innovations

Recent product innovations in the Saudi Arabia formic acid market have focused on developing higher-purity grades to meet the stringent requirements of specific applications, such as pharmaceuticals. Advancements in production technologies have led to more efficient and sustainable processes, reducing the environmental footprint. The focus on enhanced purity and sustainability offers unique selling propositions, attracting environmentally conscious consumers.

Propelling Factors for Saudi Arabia Formic Acid Market Growth

The growth of the Saudi Arabia formic acid market is propelled by several factors: Firstly, the expanding industrial sector, particularly in chemicals and textiles, is driving demand. Secondly, government initiatives supporting sustainable agriculture and livestock farming are boosting the consumption of formic acid as a feed additive and preservative. Finally, technological advancements leading to more efficient and cost-effective production methods further enhance market growth.

Obstacles in the Saudi Arabia Formic Acid Market Market

The Saudi Arabia formic acid market faces challenges, including potential supply chain disruptions due to global economic uncertainties and price volatility of raw materials. Furthermore, stringent environmental regulations can impact production costs and profitability. Intense competition from both domestic and international players also presents a challenge to market participants.

Future Opportunities in Saudi Arabia Formic Acid Market

Future opportunities lie in exploring new applications of formic acid, particularly in bio-based materials and renewable energy sectors. Expanding into untapped market segments, such as cleaning agents and cosmetics, also holds significant potential. Developing innovative and sustainable production processes will remain crucial for maintaining competitiveness and attracting environmentally-conscious customers.

Major Players in the Saudi Arabia Formic Acid Market Ecosystem

- ESAD International

- Mudanjiang Fengda Chemical Co Ltd

- BASF SE

- Shandong Acid Technology Co Ltd

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Petroliam Nasional Berhad (PETRONAS)

- Chemsol

- Huanghua Pengfa Chemical Co Ltd

Key Developments in Saudi Arabia Formic Acid Market Industry

- 2022 Q4: BASF SE announced a new production facility expansion in Saudi Arabia.

- 2023 Q1: A new joint venture between ESAD International and a local company was formed, focusing on sustainable formic acid production. (Further details xx)

Strategic Saudi Arabia Formic Acid Market Market Forecast

The Saudi Arabia formic acid market is poised for significant growth in the forecast period (2025-2033). The increasing demand from various sectors, coupled with technological advancements and government support for sustainable practices, will be key drivers of market expansion. The exploration of new applications and the focus on eco-friendly production methods will further contribute to market growth and unlock significant untapped potential.

Saudi Arabia Formic Acid Market Segmentation

-

1. Application

- 1.1. Animal Feed and Silage Additives

- 1.2. Leather Tanning

- 1.3. Textile Dying and Finishing

- 1.4. Intermediary in Pharmaceuticals

- 1.5. Other Applications (Cleaners, Cosmetics, etc.)

Saudi Arabia Formic Acid Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Formic Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Animal Feed and Silage Additives; Increasing Investments in the Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Presence of Alternatives like Urea Sulfate; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand for Formic Acid from Animal Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Animal Feed and Silage Additives

- 5.1.2. Leather Tanning

- 5.1.3. Textile Dying and Finishing

- 5.1.4. Intermediary in Pharmaceuticals

- 5.1.5. Other Applications (Cleaners, Cosmetics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Central Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ESAD International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mudanjiang Fengda Chemical Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BASF SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shandong Acid Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Petroliam Nasional Berhad (PETRONAS)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chemsol

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Huanghua Pengfa Chemical Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ESAD International

List of Figures

- Figure 1: Saudi Arabia Formic Acid Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Formic Acid Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Application 2019 & 2032

- Table 5: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 11: Eastern Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 13: Western Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southern Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Formic Acid Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Saudi Arabia Formic Acid Market?

Key companies in the market include ESAD International, Mudanjiang Fengda Chemical Co Ltd, BASF SE, Shandong Acid Technology Co Ltd , Gujarat Narmada Valley Fertilizers & Chemicals Limited, Petroliam Nasional Berhad (PETRONAS), Chemsol, Huanghua Pengfa Chemical Co Ltd.

3. What are the main segments of the Saudi Arabia Formic Acid Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Animal Feed and Silage Additives; Increasing Investments in the Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for Formic Acid from Animal Feed.

7. Are there any restraints impacting market growth?

Presence of Alternatives like Urea Sulfate; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in milliliters .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Formic Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Formic Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Formic Acid Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Formic Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence