Key Insights

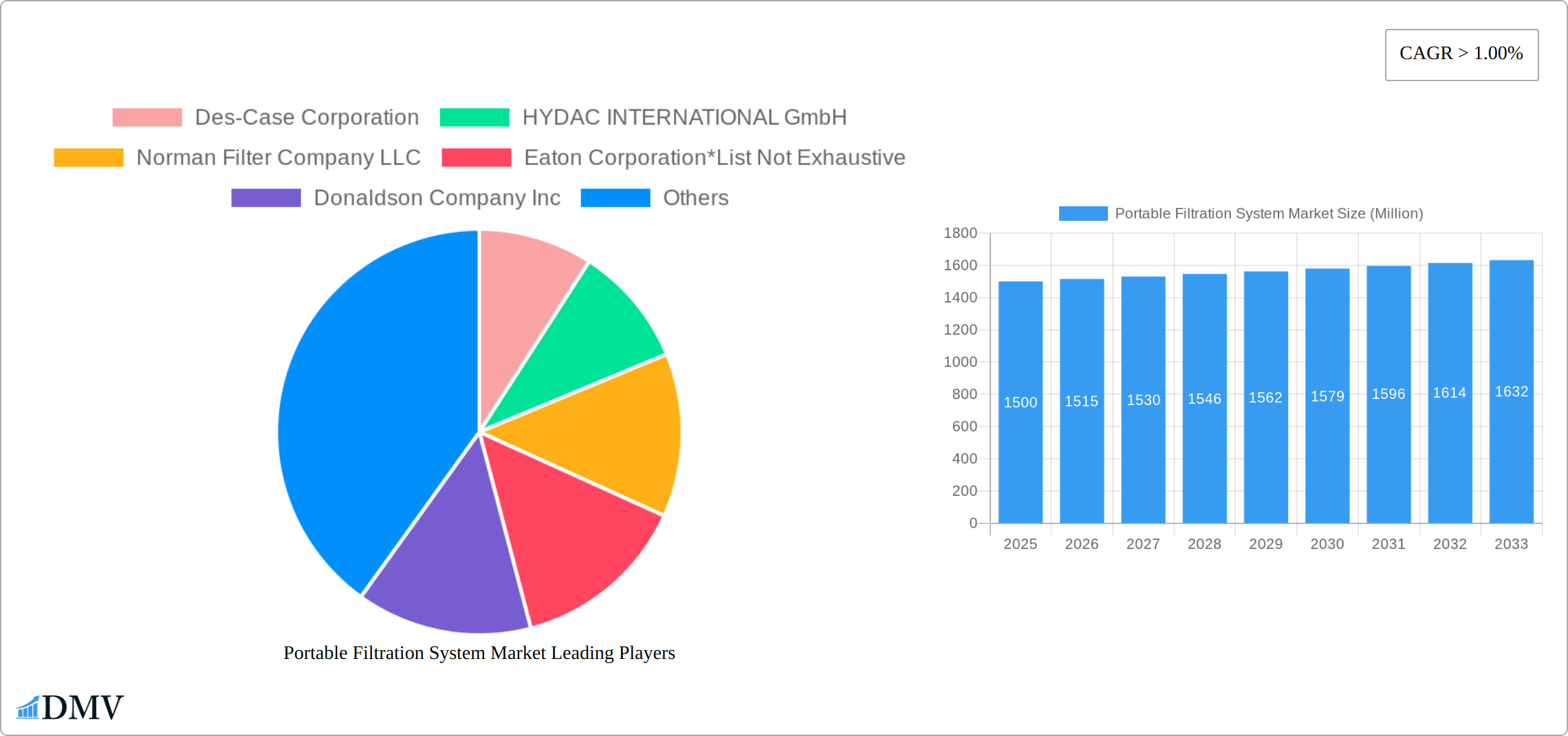

The portable filtration system market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 1.00% indicates a steady expansion, projected to continue through 2033. Key drivers include stringent environmental regulations necessitating cleaner processes across industries like oil and gas and power generation, coupled with the rising adoption of portable filtration units for enhanced efficiency and reduced operational costs. The pulp and paper industry, a significant end-user, contributes significantly to market volume due to its substantial need for water and air purification. Technological advancements leading to more compact, efficient, and durable systems further fuel market expansion. Growth is expected to be particularly strong in regions experiencing rapid industrialization, such as Asia-Pacific, where increasing infrastructure development and manufacturing activities create significant demand. However, the market faces certain restraints, including the high initial investment cost of advanced filtration systems and potential fluctuations in raw material prices. Despite these challenges, the overall market outlook remains positive, with continued growth projected across all major segments and geographical regions.

Portable Filtration System Market Market Size (In Billion)

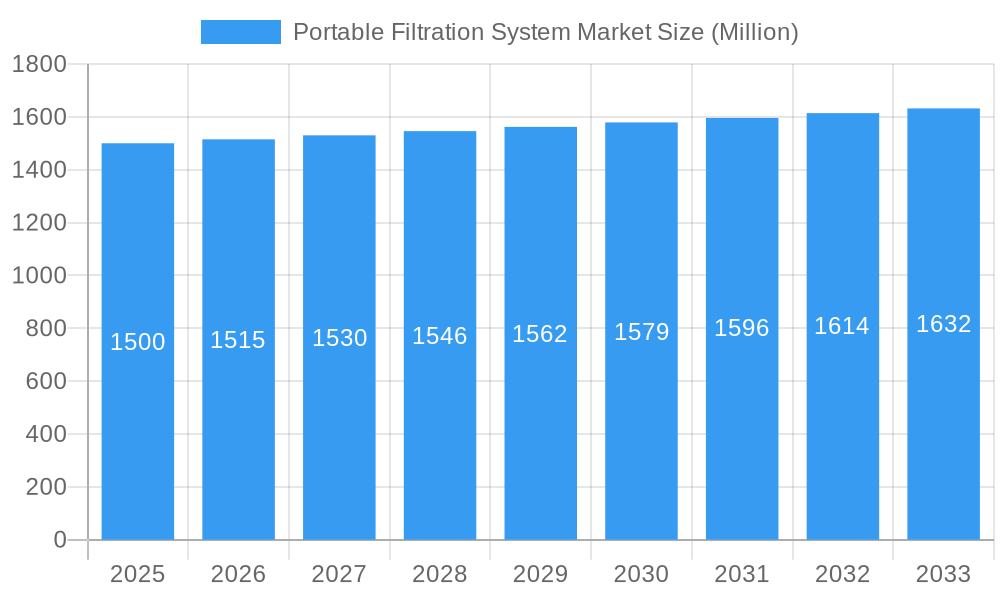

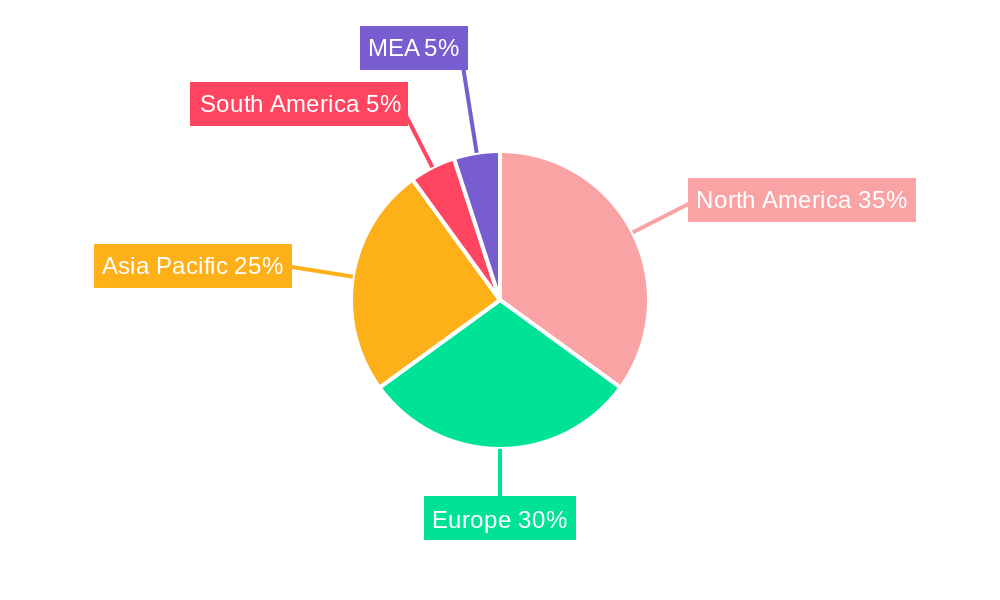

The market segmentation reveals the pulp and paper industry as a prominent end-user, followed by oil and gas and power generation. Leading players like Des-Case Corporation, HYDAC INTERNATIONAL GmbH, and Donaldson Company Inc. are actively shaping market dynamics through innovation and strategic expansions. The geographical breakdown indicates significant market presence in North America and Europe, with emerging markets in Asia-Pacific exhibiting considerable growth potential. The forecast period (2025-2033) promises further market expansion, fueled by technological innovations, increasing regulatory compliance needs, and expanding industrial applications. Competitive intensity is expected to rise as companies strive to enhance their product offerings and capture larger market shares in this dynamic and expanding industry. Continuous monitoring of regulatory changes and technological breakthroughs will be crucial for businesses operating in this sector.

Portable Filtration System Market Company Market Share

Portable Filtration System Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Portable Filtration System market, offering a comprehensive overview of market trends, growth drivers, challenges, and future opportunities. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the market dynamics and make informed strategic decisions. The global Portable Filtration System market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Portable Filtration System Market Composition & Trends

The Portable Filtration System market exhibits a moderately consolidated structure, with key players holding significant market share. Market concentration is influenced by factors such as technological advancements, economies of scale, and brand recognition. Des-Case Corporation, HYDAC INTERNATIONAL GmbH, and Donaldson Company Inc. are amongst the leading players, each commanding a substantial share (exact figures are detailed within the full report). Innovation is a key catalyst, driving the development of advanced filtration technologies catering to specific industry needs. Stringent environmental regulations across various sectors, particularly oil & gas and power generation, are shaping the market landscape, favoring solutions with enhanced efficiency and reduced environmental impact. Substitute products, such as chemical treatments, pose a competitive threat, while M&A activities are influencing market consolidation. The report analyzes several M&A deals, with the total value exceeding xx Million in the historical period (2019-2024).

- Market Share Distribution: Detailed breakdown of market share held by key players and emerging companies.

- M&A Activity Analysis: Review of completed and anticipated mergers and acquisitions, along with their impact on market dynamics.

- Regulatory Landscape: Assessment of current and future regulatory frameworks and their impact on product development and market access.

- Substitute Products Analysis: Evaluation of competitive threats from alternative filtration technologies.

Portable Filtration System Market Industry Evolution

The Portable Filtration System market has experienced substantial and dynamic growth over the historical period (2019-2024). This expansion is intrinsically linked to the accelerating pace of industrialization, rapid urbanization, and the implementation of increasingly stringent environmental regulations across a diverse spectrum of industries. The market landscape is continually shaped by ongoing technological innovations in filtration methodologies, leading to systems that offer enhanced operational efficiency, considerable reductions in lifecycle costs, and a demonstrably improved environmental footprint. The integration of advanced materials and sophisticated design principles has resulted in the development of filtration systems that are not only smaller and lighter but also more inherently portable and user-friendly. This transformative trend has been particularly impactful within the oil and gas sector, where the adoption of portable filtration systems has surged, enabling superior fluid management capabilities and significantly mitigating potential environmental risks. Throughout the period of 2019-2024, the market has demonstrated robust annual growth rates, averaging approximately **[Insert Specific Average Growth Rate Here]%**, with the oil and gas and power generation end-user segments emerging as the primary engines of this growth. Furthermore, a discernible global shift in consumer and industrial preferences towards sustainable and environmentally responsible solutions is acting as a significant catalyst, further propelling market expansion and innovation.

Leading Regions, Countries, or Segments in Portable Filtration System Market

The Oil and Gas segment currently commands a leading position within the Portable Filtration System market. This dominance is largely attributable to the sector's critical and unyielding need for efficient and reliable fluid management, especially within challenging and often remote operational environments. Compounding this is the escalating pressure from regulatory bodies worldwide to minimize environmental impact and ensure operational sustainability. Geographically, North America and Europe stand out as the preeminent regions, bolstered by robust industrial activity, substantial investments in critical infrastructure development, and a strong regulatory framework that encourages the adoption of advanced filtration technologies.

Key Drivers in the Oil and Gas Segment:

- Significant Capital Investments in Upstream and Downstream Operations: The ongoing and substantial capital expenditures allocated to oil and gas exploration, extraction, refining, and distribution projects directly translate into a sustained demand for robust, high-performance, and reliable portable filtration systems that can operate effectively in demanding conditions.

- Stringent and Evolving Environmental Regulations: The global and localized emphasis on reducing the environmental footprint of oil and gas operations, coupled with the introduction of increasingly stringent regulatory mandates, serves as a powerful incentive for companies to invest in and deploy advanced filtration solutions that ensure compliance and mitigate ecological impact.

- Pioneering Technological Advancements: The continuous development and integration of innovative filtration technologies, designed to effectively handle complex and challenging fluid compositions, improve separation efficiencies, and maximize overall operational output, are vital in fueling and sustaining market growth within this segment.

Factors Underpinning Segment Dominance:

The preeminent position of the oil and gas sector within the portable filtration system market is a confluence of several critical factors. Foremost among these is the sector's inherent and ongoing requirement for highly efficient, dependable, and adaptable fluid management solutions. This is further amplified by the rigorous environmental regulations that govern its operations, necessitating adherence to best practices for pollution control and resource management. The substantial financial investments directed towards enhancing operational safety, environmental stewardship, and overall performance are also key contributors. The high economic costs associated with operational downtime and equipment failure underscore the imperative for robust filtration systems that can effectively prevent contamination and minimize production disruptions, thereby solidifying the segment's significant market share.

Portable Filtration System Market Product Innovations

Recent product innovations focus on enhancing filtration efficiency, reducing system size and weight, and improving portability. Advances in membrane technology, intelligent sensors, and automated control systems have significantly improved the performance of portable filtration systems. Unique selling propositions include improved contaminant removal rates, reduced energy consumption, and enhanced ease of use. These advancements are particularly relevant to sectors with limited access to infrastructure or requiring rapid deployment capabilities.

Propelling Factors for Portable Filtration System Market Growth

A confluence of powerful forces is driving the remarkable growth trajectory of the Portable Filtration System market. Paramount among these are **technological advancements**, which are consistently yielding filtration systems that are not only more compact and lightweight but also demonstrably more efficient, cost-effective to operate, and easier to deploy. The global imperative for **stringent environmental regulations** across a multitude of industries is compelling businesses to embrace more sustainable operational practices, with advanced filtration solutions emerging as a cornerstone of this transition. The ever-increasing **demand from a wide array of end-user sectors**, with particular emphasis on the dynamic oil and gas and the vital power generation industries, is a significant contributor to market expansion. Moreover, a growing **awareness among industries regarding the tangible economic benefits** associated with preventing costly equipment damage and premature wear caused by particulate contamination is further stimulating demand and accelerating the adoption of these essential filtration technologies.

Obstacles in the Portable Filtration System Market

The Portable Filtration System market faces challenges such as fluctuations in raw material prices, supply chain disruptions impacting manufacturing and delivery, and intense competition from established and emerging players. Regulatory hurdles vary across different regions, and the high initial investment cost can deter small businesses. These factors can hinder market growth and necessitate careful consideration by industry players.

Future Opportunities in Portable Filtration System Market

Expanding into emerging markets with growing industrialization and infrastructure development presents significant opportunities. Developing advanced filtration technologies targeted at specific industry needs, integrating advanced analytics and IoT capabilities, and offering customized solutions will enable further market penetration. Focus on developing sustainable and environmentally friendly filtration solutions will align with global sustainability goals and increase market appeal.

Major Players in the Portable Filtration System Market Ecosystem

- Des-Case Corporation

- HYDAC INTERNATIONAL GmbH

- Norman Filter Company LLC

- Eaton Corporation

- Donaldson Company Inc

- MP Filtri S p A

- Bosch Rexroth AG

- Pall Corporation

- Trico Corporation

- Parker Hannifin Corp

Key Developments in Portable Filtration System Market Industry

- January 2023: Des-Case Corporation announced the successful launch of an innovative new range of portable filtration units, boasting significantly enhanced operational efficiency and improved performance characteristics, catering to evolving industry needs.

- June 2022: HYDAC INTERNATIONAL GmbH and a key competitor completed a strategic merger, resulting in the formation of a larger, more integrated entity with a substantially expanded market reach and a broadened portfolio of filtration solutions. (Comprehensive details concerning the strategic rationale and implications of this merger are thoroughly documented within the full report.)

- October 2021: The European Union enacted new, impactful environmental regulations that have directly influenced and shaped the design requirements and performance standards for portable filtration systems operating within its member states. (Specific legislative references and the precise nature of these regulatory changes are meticulously detailed within the comprehensive report.)

Strategic Portable Filtration System Market Forecast

The Portable Filtration System market is poised for substantial growth driven by technological innovations, increasing demand from various sectors, and supportive government regulations. Future opportunities lie in developing specialized filtration systems for emerging industries, focusing on sustainability, and integrating advanced technologies to improve efficiency and performance. The market's potential for expansion is considerable, with further market segmentation analysis revealing lucrative opportunities within specific geographic regions and industries.

Portable Filtration System Market Segmentation

-

1. End-User

- 1.1. Pulp and Paper

- 1.2. Oil and Gas

- 1.3. Power Generation

- 1.4. Others

Portable Filtration System Market Segmentation By Geography

- 1. North America

- 2. South America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Portable Filtration System Market Regional Market Share

Geographic Coverage of Portable Filtration System Market

Portable Filtration System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Battery-Powered Power Tools4.; Rapidly Growing Automotive Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost Associated With Cordless Power Tool Equipment

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to be a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Pulp and Paper

- 5.1.2. Oil and Gas

- 5.1.3. Power Generation

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Asia Pacific

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Pulp and Paper

- 6.1.2. Oil and Gas

- 6.1.3. Power Generation

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Pulp and Paper

- 7.1.2. Oil and Gas

- 7.1.3. Power Generation

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Pulp and Paper

- 8.1.2. Oil and Gas

- 8.1.3. Power Generation

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Asia Pacific Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Pulp and Paper

- 9.1.2. Oil and Gas

- 9.1.3. Power Generation

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Middle East and Africa Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Pulp and Paper

- 10.1.2. Oil and Gas

- 10.1.3. Power Generation

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Des-Case Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HYDAC INTERNATIONAL GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Norman Filter Company LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Donaldson Company Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MP Filtri S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bosch Rexroth AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pall Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trico Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Parker Hannifin Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Des-Case Corporation

List of Figures

- Figure 1: Global Portable Filtration System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 3: North America Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: South America Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: South America Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Asia Pacific Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Asia Pacific Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Middle East and Africa Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Middle East and Africa Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Global Portable Filtration System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Filtration System Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Portable Filtration System Market?

Key companies in the market include Des-Case Corporation, HYDAC INTERNATIONAL GmbH, Norman Filter Company LLC, Eaton Corporation*List Not Exhaustive, Donaldson Company Inc, MP Filtri S p A, Bosch Rexroth AG, Pall Corporation, Trico Corporation, Parker Hannifin Corp.

3. What are the main segments of the Portable Filtration System Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Battery-Powered Power Tools4.; Rapidly Growing Automotive Industry.

6. What are the notable trends driving market growth?

Oil and Gas Industry to be a Significant Segment.

7. Are there any restraints impacting market growth?

4.; High Cost Associated With Cordless Power Tool Equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Filtration System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Filtration System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Filtration System Market?

To stay informed about further developments, trends, and reports in the Portable Filtration System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence