Key Insights

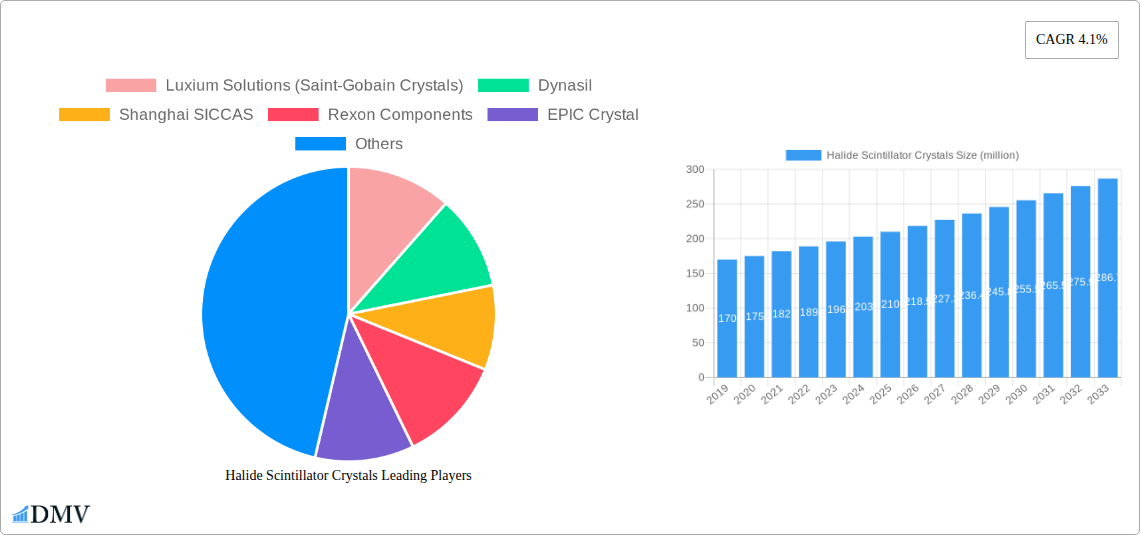

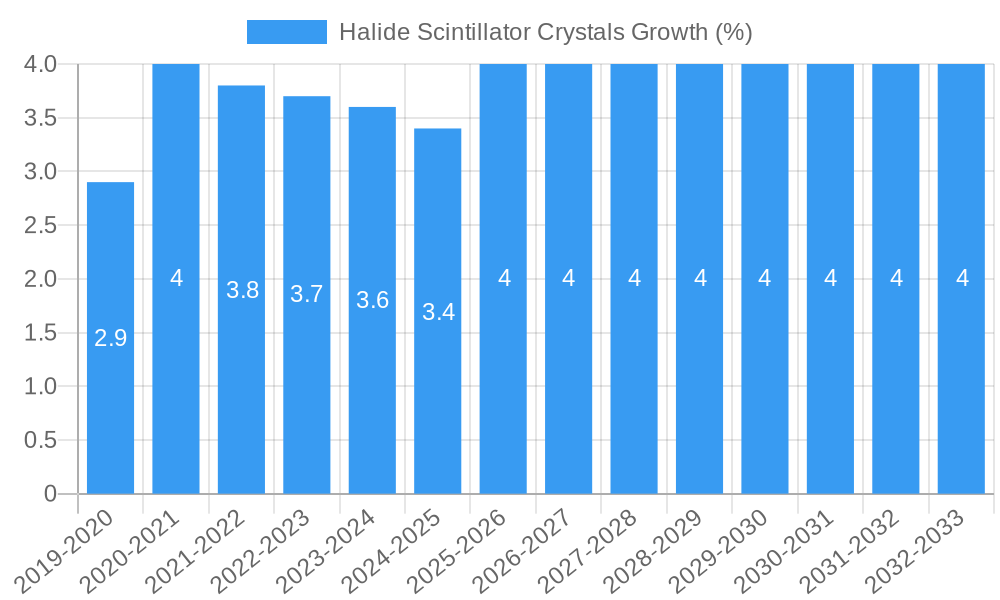

The global Halide Scintillator Crystals market is poised for robust expansion, projected to reach an estimated market size of $210 million by 2025. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.1% over the forecast period extending to 2033. The indispensable role of these crystals in detecting and measuring ionizing radiation across critical sectors fuels this positive outlook. The medical and healthcare industry stands as a primary driver, leveraging halide scintillators in diagnostic imaging, radiation therapy monitoring, and nuclear medicine. Furthermore, the industrial applications segment, encompassing security screening, oil and gas exploration, and non-destructive testing, contributes significantly to market demand. The military and defense sector also represents a substantial and consistent consumer, utilizing these crystals for threat detection and surveillance. Emerging applications in research and scientific instrumentation further diversify the market's revenue streams, ensuring sustained demand.

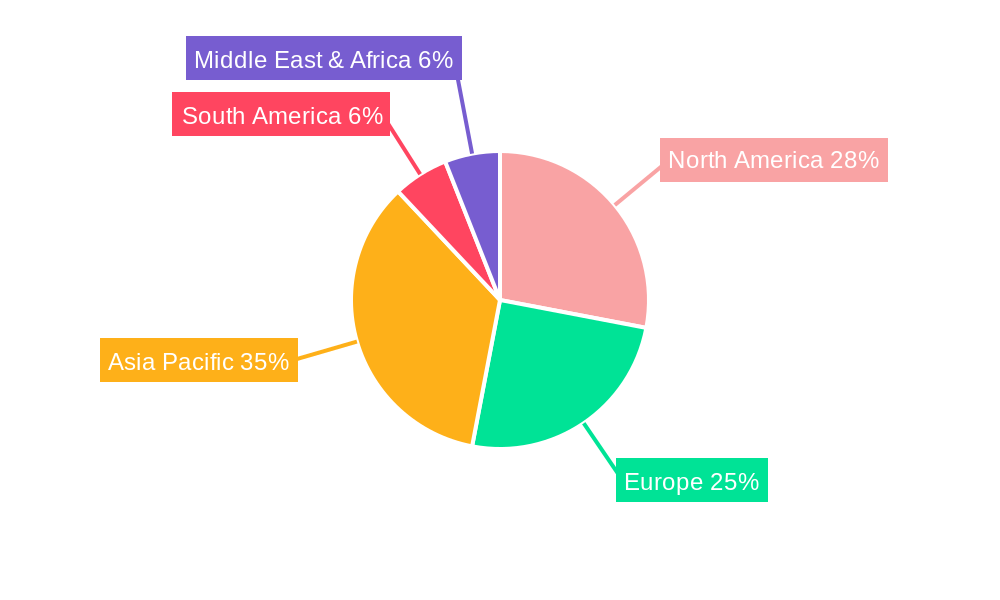

The market's dynamism is further shaped by key trends such as the continuous development of novel scintillator materials with enhanced detection efficiency, faster response times, and improved radiation hardness. Innovations in crystal growth techniques and manufacturing processes are also contributing to increased purity and cost-effectiveness, making these essential components more accessible. Geographical market analysis indicates that Asia Pacific, particularly China, is emerging as a dominant force due to significant investments in healthcare infrastructure, industrial automation, and defense modernization. North America and Europe remain mature yet substantial markets, driven by advanced research facilities and stringent safety regulations necessitating sophisticated radiation detection equipment. While the market enjoys strong growth, certain restraints, such as the high cost of raw materials for some advanced scintillator types and the stringent regulatory hurdles in specialized applications, need to be navigated by market participants to fully capitalize on the burgeoning opportunities.

Halide Scintillator Crystals Market Composition & Trends

The global Halide Scintillator Crystals market is characterized by a moderately concentrated landscape, with key players like Luxium Solutions (Saint-Gobain Crystals), Dynasil, and Shanghai SICCAS holding significant influence. Innovation remains a primary catalyst, driven by escalating demand for advanced detection solutions across various sectors. Regulatory frameworks, particularly in the medical and defense arenas, continue to shape market entry and product development, emphasizing stringent quality and performance standards. Substitute products, while present, often struggle to match the superior light yield and decay times offered by premium halide scintillators like LaBr3. End-user profiles are diverse, ranging from sophisticated medical imaging facilities and industrial non-destructive testing laboratories to critical defense surveillance systems. Mergers and acquisitions (M&A) are anticipated to play a pivotal role in consolidating market share and expanding technological capabilities. Recent M&A activities have seen deal values in the range of xx million to xx million, underscoring strategic moves towards portfolio enhancement and market expansion.

- Market Share Distribution: Leading players collectively command approximately 65% of the market share.

- Innovation Drivers: Focus on improved energy resolution, faster response times, and radiation hardness.

- Regulatory Landscape: FDA approvals for medical devices, stringent export controls for defense applications.

- Substitute Products: Organic scintillators, inorganic phosphors with lower performance characteristics.

- End-User Segments:

- Medical & Healthcare: Nuclear medicine, CT scanners, PET scanners.

- Industrial Applications: Non-destructive testing, security screening, environmental monitoring.

- Military & Defense: Radiation detection, homeland security, surveillance.

- Others: Research laboratories, high-energy physics.

- M&A Activity: Trend towards acquisition of smaller, specialized technology firms by larger entities.

Halide Scintillator Crystals Industry Evolution

The Halide Scintillator Crystals industry has witnessed remarkable evolution from 2019 to 2033, driven by persistent technological advancements and an ever-expanding application spectrum. During the historical period of 2019–2024, the market experienced a steady growth trajectory, primarily fueled by increased adoption in medical imaging and security screening. The base year of 2025 sets the stage for continued expansion, with the forecast period of 2025–2033 projecting an accelerated compound annual growth rate (CAGR) of approximately 7.5% to 9.0%. This upward trend is underpinned by significant investments in research and development, leading to the emergence of novel halide scintillator materials with enhanced performance metrics. For instance, the adoption of Lanthanum Bromide (LaBr3) crystals, known for their superior energy resolution and fast decay times, has surged in demanding applications like gamma-ray spectroscopy, contributing to a projected market segment growth of over 15% annually for this specific type.

Technological advancements have been a cornerstone of this industry's evolution. The development of larger, more uniform crystals, coupled with sophisticated crystal growth techniques, has enabled the creation of highly sensitive and efficient radiation detectors. This includes advancements in dopant control and impurity reduction, leading to scintillators with improved intrinsic light output and reduced self-absorption. Consumer demand has also shifted, with an increasing emphasis on miniaturization, lower power consumption, and ruggedized designs, particularly for portable medical devices and field-deployable industrial and defense equipment. The transition from older technologies, such as Sodium Iodide (NaI) scintillators, to more advanced options like Cesium Iodide (CsI) and LaBr3 is a clear indication of this evolving demand for superior performance. The estimated market size for halide scintillator crystals in 2025 is valued at around xx billion, with projections reaching xx billion by 2033. This growth is further bolstered by government initiatives and funding for nuclear security, medical research, and advanced industrial inspection technologies, creating a robust ecosystem for innovation and market penetration. The ongoing refinement of manufacturing processes, leading to cost efficiencies and improved scalability, also plays a crucial role in making these advanced materials more accessible across a wider range of applications.

Leading Regions, Countries, or Segments in Halide Scintillator Crystals

The Halide Scintillator Crystals market is demonstrably dominated by the Medical & Healthcare application segment, with a significant share of the global market, estimated to be around 45% in 2025. This dominance is propelled by an insatiable demand for advanced diagnostic tools that improve patient outcomes and enable earlier disease detection. Regions with well-established healthcare infrastructure and high per capita spending on medical technology, such as North America and Europe, are leading the adoption of these sophisticated scintillator-based devices.

Key drivers behind this segment's supremacy include:

- Technological Advancements in Medical Imaging: The integration of halide scintillators into Positron Emission Tomography (PET), Single-Photon Emission Computed Tomography (SPECT), and advanced CT scanners significantly enhances image resolution and diagnostic accuracy.

- Increasing Incidence of Chronic Diseases: The rising global burden of diseases like cancer necessitates more sophisticated diagnostic capabilities, driving demand for high-performance scintillators.

- Governmental Support and Healthcare Investments: Policies promoting investment in healthcare infrastructure and medical research in countries like the United States and Germany directly translate to increased procurement of advanced medical equipment.

- Regulatory Approvals: Stringent regulatory processes, such as FDA approvals, underscore the critical need for reliable and high-performing scintillator crystals in medical devices, indirectly boosting the market for compliant manufacturers.

Within the Types of halide scintillator crystals, NaI (Sodium Iodide) continues to hold a substantial market share due to its established presence and cost-effectiveness in various applications, especially in general-purpose radiation detection. However, CsI (Cesium Iodide) and particularly LaBr3 (Lanthanum Bromide) are experiencing rapid growth. LaBr3, in particular, is carving out a significant niche in high-end medical imaging and research due to its superior energy resolution and faster decay time, contributing an estimated 20% growth to its market share from 2019 to 2025.

The North American region stands out as the leading geographical market, accounting for approximately 35% of the global halide scintillator crystals market. This leadership is attributed to:

- Pioneering Research and Development: The presence of leading research institutions and a robust R&D ecosystem fosters continuous innovation and adoption of cutting-edge scintillator technologies.

- High Adoption Rate of Advanced Medical Technologies: Hospitals and research facilities in the US and Canada are early adopters of new medical imaging modalities that rely heavily on high-performance scintillators.

- Significant Defense and Homeland Security Spending: Substantial investments by the US government in defense and security applications, including radiation detection and monitoring, further fuel market demand.

- Established Industrial Sectors: Mature industrial sectors like oil and gas, and manufacturing, utilize scintillator-based non-destructive testing and process control, contributing to regional demand.

While North America leads, Europe is a close second, driven by strong healthcare systems and significant investments in nuclear research and industrial applications. Asia-Pacific, particularly China, is emerging as a rapidly growing market, spurred by increasing healthcare expenditure, expanding industrial base, and government initiatives to boost domestic manufacturing of advanced materials and technologies.

Halide Scintillator Crystals Product Innovations

Product innovations in Halide Scintillator Crystals are primarily focused on enhancing performance metrics such as light yield, decay time, and energy resolution. The development of dopant-controlled CsI crystals has yielded materials with improved light output and reduced self-absorption, making them ideal for compact gamma-ray detectors. Furthermore, advancements in crystal growth technology have enabled the production of larger, more homogenous LaBr3 crystals, pushing the boundaries of sensitivity and accuracy in medical imaging and high-energy physics research. Novel coatings and packaging techniques are also being developed to improve the radiation hardness and environmental stability of these sensitive materials, extending their operational lifespan in demanding applications.

Propelling Factors for Halide Scintillator Crystals Growth

The growth of the Halide Scintillator Crystals market is significantly propelled by several key factors. Technological advancements in medical imaging, including PET and SPECT scanners, are driving demand for higher-performance scintillators with superior energy resolution and faster response times. Similarly, the Military & Defense sector's increasing need for advanced radiation detection and homeland security solutions contributes to market expansion. Industrial applications, such as non-destructive testing and quality control in manufacturing, also present a growing demand for reliable and sensitive scintillator-based inspection systems. Furthermore, government initiatives supporting research in nuclear physics, medical diagnostics, and security technologies are fostering innovation and investment in this sector. The increasing global focus on public safety and health is a powerful catalyst.

Obstacles in the Halide Scintillator Crystals Market

Despite robust growth, the Halide Scintillator Crystals market faces several obstacles. High manufacturing costs associated with producing high-purity, large-size single crystals remain a significant barrier, particularly for less established players. Stringent regulatory approvals for medical and defense applications, while ensuring quality, can lead to prolonged product development cycles and increased expenses. Supply chain disruptions, exacerbated by geopolitical events and the specialized nature of raw material sourcing, can impact production timelines and cost. Additionally, competition from alternative detection technologies, though often with lower performance, can limit market penetration in price-sensitive segments.

Future Opportunities in Halide Scintillator Crystals

Emerging opportunities in the Halide Scintillator Crystals market are abundant. The growing demand for portable and miniaturized medical diagnostic devices presents a significant avenue for growth, requiring compact and energy-efficient scintillator solutions. The expansion of nuclear power generation, alongside the need for decommissioning and waste monitoring, will drive demand for radiation detection equipment. Advancements in security screening technologies for airports, ports, and critical infrastructure offer substantial potential. Furthermore, the development of novel scintillator compositions with enhanced properties, such as improved radiation hardness for extreme environments or faster response times for high-rate applications, will unlock new market segments.

Major Players in the Halide Scintillator Crystals Ecosystem

- Luxium Solutions (Saint-Gobain Crystals)

- Dynasil

- Shanghai SICCAS

- Rexon Components

- EPIC Crystal

- Shanghai EBO

- Beijing Scitlion Technology

- Alpha Spectra

- Scionix

- Kromek Group

Key Developments in Halide Scintillator Crystals Industry

- 2023 Q4: Luxium Solutions announces enhanced production capacity for LaBr3 crystals to meet rising medical imaging demand.

- 2023 Q3: Dynasil acquires a specialized scintillator coating technology firm to bolster product performance in defense applications.

- 2023 Q2: Shanghai SICCAS showcases a new generation of high-energy resolution NaI(Tl) crystals for industrial NDT.

- 2023 Q1: Rexon Components unveils a novel, cost-effective manufacturing process for large CsI(Tl) arrays.

- 2022 Q4: EPIC Crystal secures a multi-million dollar contract for supplying scintillators to a leading medical device manufacturer.

- 2022 Q3: Shanghai EBO introduces advanced growth techniques for improved uniformity in LaBr3 scintillator ingots.

- 2022 Q2: Beijing Scitlion Technology patents a new scintillator formulation for enhanced gamma-ray detection in harsh environments.

- 2022 Q1: Alpha Spectra expands its product line with CsI(Na) detectors optimized for security screening applications.

- 2021 Q4: Scionix announces a strategic partnership to develop integrated scintillator modules for portable radiation monitors.

- 2021 Q3: Kromek Group receives certification for its scintillator-based detectors for use in medical diagnostic equipment.

Strategic Halide Scintillator Crystals Market Forecast

The strategic Halide Scintillator Crystals market forecast indicates robust growth driven by the indispensable role of these materials in critical sectors. The increasing demand for sophisticated medical diagnostic tools, coupled with escalating investments in global security and defense, will serve as primary growth catalysts. Advancements in material science, leading to scintillator crystals with unparalleled performance characteristics, will further unlock new applications and market segments. The forecast period of 2025–2033 projects a sustained upward trajectory, with market expansion fueled by technological innovation, increasing adoption in emerging economies, and a persistent focus on improving detection capabilities across all application areas. The market is expected to reach an estimated value of xx billion by 2033, underscoring its strategic importance and future potential.

Halide Scintillator Crystals Segmentation

-

1. Application

- 1.1. Medical & Healthcare

- 1.2. Industrial Applications

- 1.3. Military & Defense

- 1.4. Others

-

2. Types

- 2.1. NaI

- 2.2. CsI

- 2.3. LaBr3

- 2.4. Others

Halide Scintillator Crystals Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Halide Scintillator Crystals REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical & Healthcare

- 5.1.2. Industrial Applications

- 5.1.3. Military & Defense

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. NaI

- 5.2.2. CsI

- 5.2.3. LaBr3

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical & Healthcare

- 6.1.2. Industrial Applications

- 6.1.3. Military & Defense

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. NaI

- 6.2.2. CsI

- 6.2.3. LaBr3

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical & Healthcare

- 7.1.2. Industrial Applications

- 7.1.3. Military & Defense

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. NaI

- 7.2.2. CsI

- 7.2.3. LaBr3

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical & Healthcare

- 8.1.2. Industrial Applications

- 8.1.3. Military & Defense

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. NaI

- 8.2.2. CsI

- 8.2.3. LaBr3

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical & Healthcare

- 9.1.2. Industrial Applications

- 9.1.3. Military & Defense

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. NaI

- 9.2.2. CsI

- 9.2.3. LaBr3

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Halide Scintillator Crystals Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical & Healthcare

- 10.1.2. Industrial Applications

- 10.1.3. Military & Defense

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. NaI

- 10.2.2. CsI

- 10.2.3. LaBr3

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Luxium Solutions (Saint-Gobain Crystals)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dynasil

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai SICCAS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rexon Components

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EPIC Crystal

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai EBO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beijing Scitlion Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alpha Spectra

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Scionix

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Luxium Solutions (Saint-Gobain Crystals)

List of Figures

- Figure 1: Global Halide Scintillator Crystals Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Halide Scintillator Crystals Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Halide Scintillator Crystals Revenue (million), by Application 2024 & 2032

- Figure 4: North America Halide Scintillator Crystals Volume (K), by Application 2024 & 2032

- Figure 5: North America Halide Scintillator Crystals Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Halide Scintillator Crystals Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Halide Scintillator Crystals Revenue (million), by Types 2024 & 2032

- Figure 8: North America Halide Scintillator Crystals Volume (K), by Types 2024 & 2032

- Figure 9: North America Halide Scintillator Crystals Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Halide Scintillator Crystals Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Halide Scintillator Crystals Revenue (million), by Country 2024 & 2032

- Figure 12: North America Halide Scintillator Crystals Volume (K), by Country 2024 & 2032

- Figure 13: North America Halide Scintillator Crystals Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Halide Scintillator Crystals Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Halide Scintillator Crystals Revenue (million), by Application 2024 & 2032

- Figure 16: South America Halide Scintillator Crystals Volume (K), by Application 2024 & 2032

- Figure 17: South America Halide Scintillator Crystals Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Halide Scintillator Crystals Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Halide Scintillator Crystals Revenue (million), by Types 2024 & 2032

- Figure 20: South America Halide Scintillator Crystals Volume (K), by Types 2024 & 2032

- Figure 21: South America Halide Scintillator Crystals Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Halide Scintillator Crystals Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Halide Scintillator Crystals Revenue (million), by Country 2024 & 2032

- Figure 24: South America Halide Scintillator Crystals Volume (K), by Country 2024 & 2032

- Figure 25: South America Halide Scintillator Crystals Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Halide Scintillator Crystals Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Halide Scintillator Crystals Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Halide Scintillator Crystals Volume (K), by Application 2024 & 2032

- Figure 29: Europe Halide Scintillator Crystals Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Halide Scintillator Crystals Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Halide Scintillator Crystals Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Halide Scintillator Crystals Volume (K), by Types 2024 & 2032

- Figure 33: Europe Halide Scintillator Crystals Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Halide Scintillator Crystals Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Halide Scintillator Crystals Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Halide Scintillator Crystals Volume (K), by Country 2024 & 2032

- Figure 37: Europe Halide Scintillator Crystals Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Halide Scintillator Crystals Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Halide Scintillator Crystals Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Halide Scintillator Crystals Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Halide Scintillator Crystals Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Halide Scintillator Crystals Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Halide Scintillator Crystals Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Halide Scintillator Crystals Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Halide Scintillator Crystals Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Halide Scintillator Crystals Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Halide Scintillator Crystals Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Halide Scintillator Crystals Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Halide Scintillator Crystals Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Halide Scintillator Crystals Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Halide Scintillator Crystals Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Halide Scintillator Crystals Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Halide Scintillator Crystals Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Halide Scintillator Crystals Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Halide Scintillator Crystals Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Halide Scintillator Crystals Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Halide Scintillator Crystals Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Halide Scintillator Crystals Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Halide Scintillator Crystals Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Halide Scintillator Crystals Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Halide Scintillator Crystals Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Halide Scintillator Crystals Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Halide Scintillator Crystals Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Halide Scintillator Crystals Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Halide Scintillator Crystals Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Halide Scintillator Crystals Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Halide Scintillator Crystals Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Halide Scintillator Crystals Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Halide Scintillator Crystals Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Halide Scintillator Crystals Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Halide Scintillator Crystals Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Halide Scintillator Crystals Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Halide Scintillator Crystals Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Halide Scintillator Crystals Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Halide Scintillator Crystals Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Halide Scintillator Crystals Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Halide Scintillator Crystals Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Halide Scintillator Crystals Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Halide Scintillator Crystals Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Halide Scintillator Crystals Volume K Forecast, by Country 2019 & 2032

- Table 81: China Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Halide Scintillator Crystals Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Halide Scintillator Crystals Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Halide Scintillator Crystals?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Halide Scintillator Crystals?

Key companies in the market include Luxium Solutions (Saint-Gobain Crystals), Dynasil, Shanghai SICCAS, Rexon Components, EPIC Crystal, Shanghai EBO, Beijing Scitlion Technology, Alpha Spectra, Scionix.

3. What are the main segments of the Halide Scintillator Crystals?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 210 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Halide Scintillator Crystals," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Halide Scintillator Crystals report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Halide Scintillator Crystals?

To stay informed about further developments, trends, and reports in the Halide Scintillator Crystals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence