Key Insights

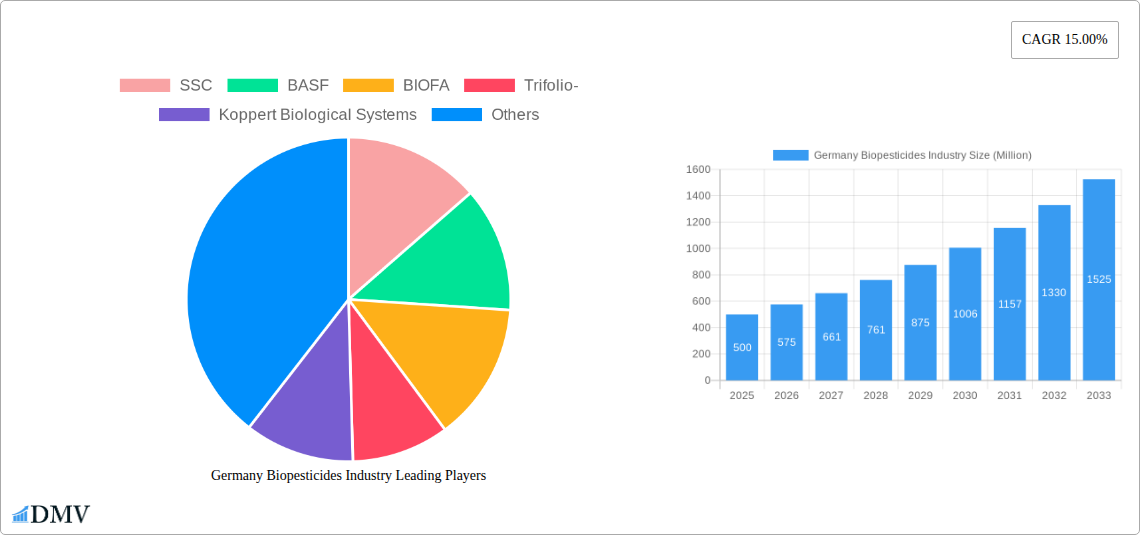

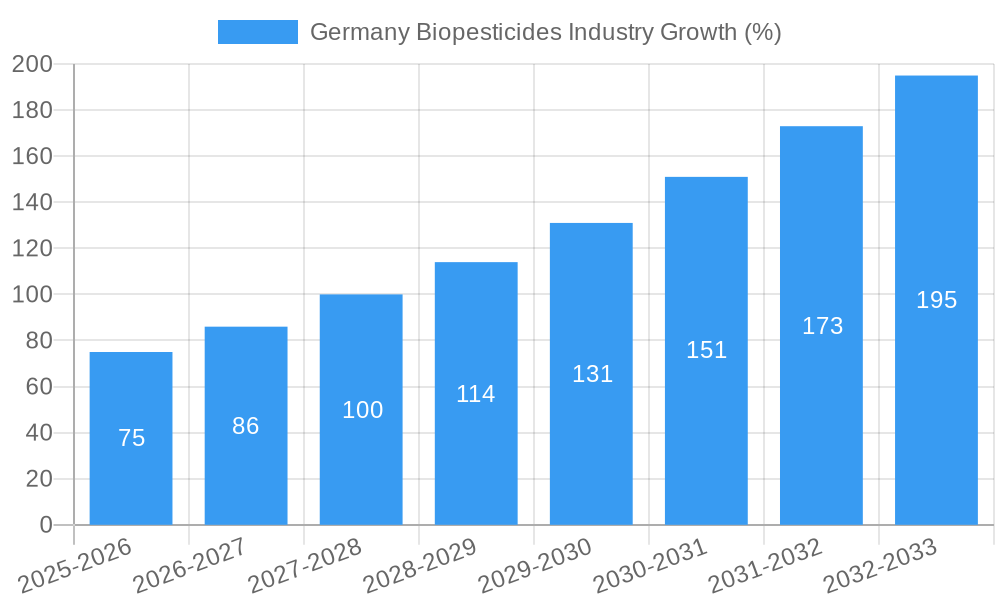

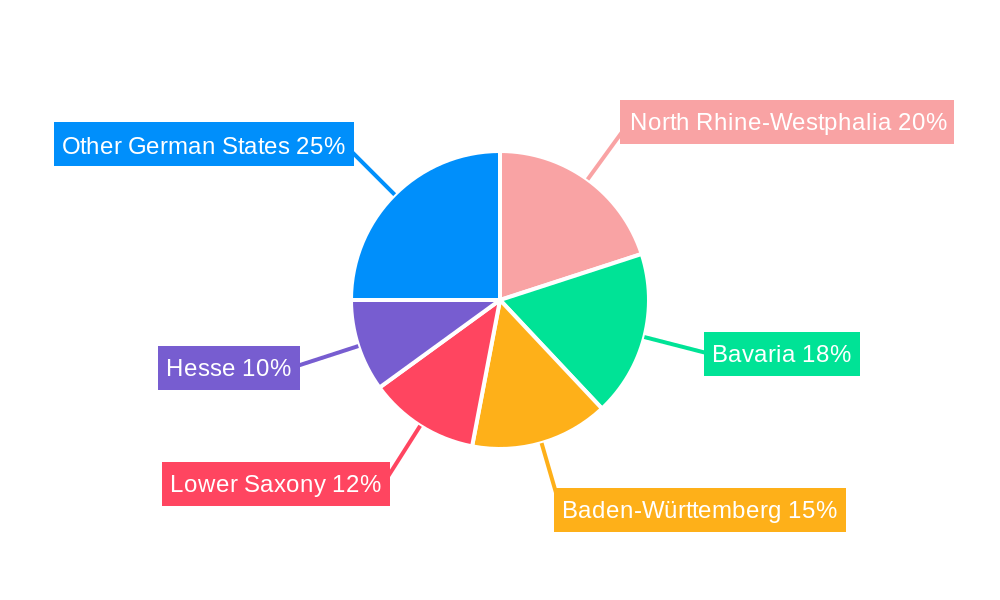

The German biopesticides market, valued at approximately €500 million in 2025, is experiencing robust growth, projected to reach €1.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 15%. This expansion is driven by increasing consumer demand for organically produced food, stringent regulations on synthetic pesticides, and growing awareness of the environmental impact of conventional agricultural practices. Key application areas include crop-based agriculture (representing a larger share due to the significant arable land in Germany), followed by non-crop applications such as horticulture and forestry. The market is segmented by type, with biopesticides based on microbial agents, botanicals, and bio-based insecticides holding significant market share. Major players like BASF, Bayer Crop Science, and Koppert Biological Systems are driving innovation and market penetration through the development of novel biopesticides and strategic partnerships. Regional variations exist, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, being key contributors due to their strong agricultural sectors. However, challenges persist, including the relatively higher cost of biopesticides compared to synthetic alternatives and the need for further research and development to enhance their efficacy and shelf life.

The competitive landscape is characterized by a mix of multinational corporations and specialized smaller companies. While large players leverage their extensive distribution networks and research capabilities, smaller firms focus on niche applications and innovative biopesticide formulations. Future growth will be fueled by government initiatives promoting sustainable agriculture, technological advancements in biopesticide production, and increasing farmer adoption driven by both economic and environmental considerations. The market's evolution will likely see a consolidation trend, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. Further research focusing on specific biopesticide types, their effectiveness against different pests and diseases, and the development of integrated pest management strategies will be crucial in achieving wider adoption and realizing the full potential of the German biopesticides market.

Germany Biopesticides Industry: Market Analysis and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Germany biopesticides market, offering valuable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. We forecast robust growth driven by increasing consumer demand for sustainable agriculture and stringent regulations on synthetic pesticides. The report values the market at €xx Million in 2025, projecting a CAGR of xx% from 2025 to 2033, reaching €xx Million by 2033.

Germany Biopesticides Industry Market Composition & Trends

This section dissects the competitive landscape, innovative drivers, regulatory framework, and market dynamics within the German biopesticides industry. The market exhibits a moderately concentrated structure, with key players like BASF, Bayer Crop Science, and Koppert Biological Systems holding significant market share. However, smaller niche players like BIOFA and Trifolio- are also making inroads. The combined market share of the top three players is estimated at xx% in 2025.

- Market Concentration: Moderately concentrated, with the top 3 players holding xx% market share in 2025.

- Innovation Catalysts: Growing consumer preference for organic produce and stringent regulations are driving innovation in biopesticide formulations.

- Regulatory Landscape: The EU's regulatory framework plays a significant role, influencing product approvals and market access. Stringent regulations on chemical pesticides are creating opportunities for biopesticides.

- Substitute Products: Synthetic pesticides remain the primary substitutes, but their market share is declining due to environmental concerns and regulatory pressures.

- End-User Profiles: Major end-users include agricultural producers (both large-scale farms and smaller organic farms), as well as non-crop applications in horticulture, forestry, and public health.

- M&A Activities: The past five years have witnessed xx M&A deals in the German biopesticides market, with a total deal value estimated at €xx Million. These deals reflect industry consolidation and the entry of larger players.

Germany Biopesticides Industry Evolution

The German biopesticides market has experienced significant growth over the historical period (2019-2024), driven by increasing awareness of the environmental impact of synthetic pesticides and growing consumer demand for organic and sustainably produced food. Technological advancements, such as the development of novel biopesticides with enhanced efficacy and improved delivery systems, have further fueled market expansion. The market witnessed a CAGR of xx% during the historical period and is projected to maintain strong growth momentum through 2033, fueled by increasing adoption of sustainable agricultural practices and favorable government policies supporting the use of biopesticides. Consumer demand for organic products has also been a key growth driver, pushing food producers and retailers to adopt biopesticides. Shifting consumer preferences toward eco-friendly products are contributing significantly to the rise of biopesticides, which align with environmentally conscious consumer choices.

Leading Regions, Countries, or Segments in Germany Biopesticides Industry

The German biopesticides market demonstrates strong regional distribution across different agricultural zones and states. Within the segment breakdown, both crop-based and non-crop-based applications show significant market potential.

Crop-Based Applications:

- Key Drivers: Government support for sustainable agriculture, increasing adoption of integrated pest management (IPM) strategies, and favorable climatic conditions in certain regions of Germany.

- Dominance Factors: High agricultural output in specific regions, extensive use of IPM methods, and availability of specialized biopesticide formulations for major crops.

Non-Crop Based Applications:

- Key Drivers: Growing demand for organic products in horticulture and landscaping, regulations on synthetic pesticides in public spaces, and increased focus on pest management in urban areas.

- Dominance Factors: Expanding urbanization, increasing preference for eco-friendly landscaping, and growing regulatory pressure towards reducing the use of synthetic pesticides in non-crop settings.

The dominance of specific regions and segments within the German biopesticides market is largely driven by a combination of these factors. The south and west of Germany show higher adoption rates, possibly due to climate and established agricultural practices.

Germany Biopesticides Industry Product Innovations

Recent years have seen significant innovations in biopesticide formulations, leading to enhanced efficacy, improved delivery mechanisms, and broader application spectrums. Novel formulations, such as microbial biopesticides (e.g., Bacillus thuringiensis) with increased efficacy against specific pests, and biopesticides derived from natural sources, like plant extracts, are gaining prominence. These innovations showcase unique selling propositions based on improved performance, enhanced environmental friendliness, and reduced reliance on synthetic pesticides. Technological advancements in precision application technologies, including targeted spray systems, are enhancing the effectiveness and sustainability of biopesticides.

Propelling Factors for Germany Biopesticides Industry Growth

The growth of the German biopesticides industry is propelled by several interconnected factors. Firstly, the stringent regulations on synthetic pesticides in Europe and Germany, pushing for environmentally friendly alternatives. Secondly, increasing consumer awareness of the environmental and health impacts of synthetic pesticides, resulting in higher demand for organically produced food. Thirdly, government initiatives and subsidies to promote sustainable agricultural practices and the adoption of biopesticides. Finally, continued technological advancements leading to improved efficacy and wider application of biopesticides.

Obstacles in the Germany Biopesticides Industry Market

Despite the positive growth trajectory, the German biopesticides market faces certain challenges. These include the higher cost compared to synthetic pesticides, limiting accessibility for some farmers. Secondly, the relatively shorter shelf life of some biopesticides, compared to their synthetic counterparts. Thirdly, the availability and consistency of supply can fluctuate. Finally, the effectiveness of biopesticides can vary based on environmental conditions, potentially impacting their efficacy. These obstacles need to be addressed for wider industry adoption.

Future Opportunities in Germany Biopesticides Industry

Future opportunities lie in the development of novel biopesticides with enhanced efficacy and broader spectrum activity. Exploring new application areas beyond traditional agriculture, like forestry and public health, represents another key opportunity. Furthermore, a focus on innovative delivery systems and precision application technologies, and collaborations with agricultural research institutions will support industry growth. The growing demand for organic food and increasing consumer awareness will continue to fuel market expansion.

Major Players in the Germany Biopesticides Industry Ecosystem

- SSC

- BASF

- BIOFA

- Trifolio-

- Koppert Biological Systems

- Bayer Crop Science

- Certris Europe

- Kimitech Group

Key Developments in Germany Biopesticides Industry Industry

- 2022 Q4: BASF launched a new biopesticide formulation for vegetable crops.

- 2023 Q1: Koppert Biological Systems announced a significant investment in R&D for novel biopesticides.

- 2023 Q2: Regulatory approval granted for a new biopesticide developed by a smaller German company. (Specific details not available)

- 2024 Q3: A merger between two smaller biopesticide companies was announced. (Specific details not available)

Strategic Germany Biopesticides Industry Market Forecast

The German biopesticides market is poised for continued robust growth over the forecast period (2025-2033). Favorable regulatory frameworks, increasing consumer demand for sustainable agriculture, and continuous technological innovation will drive market expansion. The focus on developing more effective and widely applicable biopesticides will increase market penetration, further boosting the overall market value. Exploring untapped market segments and collaborations within the industry will contribute to a positive outlook.

Germany Biopesticides Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Biopesticides Industry Segmentation By Geography

- 1. Germany

Germany Biopesticides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increased Practice of Organic Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Rhine-Westphalia Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Biopesticides Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SSC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BIOFA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trifolio-

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koppert Biological Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bayer Crop Science

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Certris Europe

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kimitech Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 SSC

List of Figures

- Figure 1: Germany Biopesticides Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Biopesticides Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Biopesticides Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Biopesticides Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Germany Biopesticides Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Germany Biopesticides Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Germany Biopesticides Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Germany Biopesticides Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Germany Biopesticides Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Germany Biopesticides Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Germany Biopesticides Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Germany Biopesticides Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Germany Biopesticides Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Germany Biopesticides Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Germany Biopesticides Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Germany Biopesticides Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Germany Biopesticides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Biopesticides Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: North Rhine-Westphalia Germany Biopesticides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: North Rhine-Westphalia Germany Biopesticides Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Bavaria Germany Biopesticides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Bavaria Germany Biopesticides Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Baden-Württemberg Germany Biopesticides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Baden-Württemberg Germany Biopesticides Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Lower Saxony Germany Biopesticides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Lower Saxony Germany Biopesticides Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Hesse Germany Biopesticides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Hesse Germany Biopesticides Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Germany Biopesticides Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 28: Germany Biopesticides Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 29: Germany Biopesticides Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 30: Germany Biopesticides Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 31: Germany Biopesticides Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Germany Biopesticides Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Germany Biopesticides Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 34: Germany Biopesticides Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Germany Biopesticides Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 36: Germany Biopesticides Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: Germany Biopesticides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Germany Biopesticides Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Biopesticides Industry?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Germany Biopesticides Industry?

Key companies in the market include SSC, BASF, BIOFA, Trifolio-, Koppert Biological Systems, Bayer Crop Science, Certris Europe, Kimitech Group.

3. What are the main segments of the Germany Biopesticides Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increased Practice of Organic Farming.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Biopesticides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Biopesticides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Biopesticides Industry?

To stay informed about further developments, trends, and reports in the Germany Biopesticides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence