Key Insights

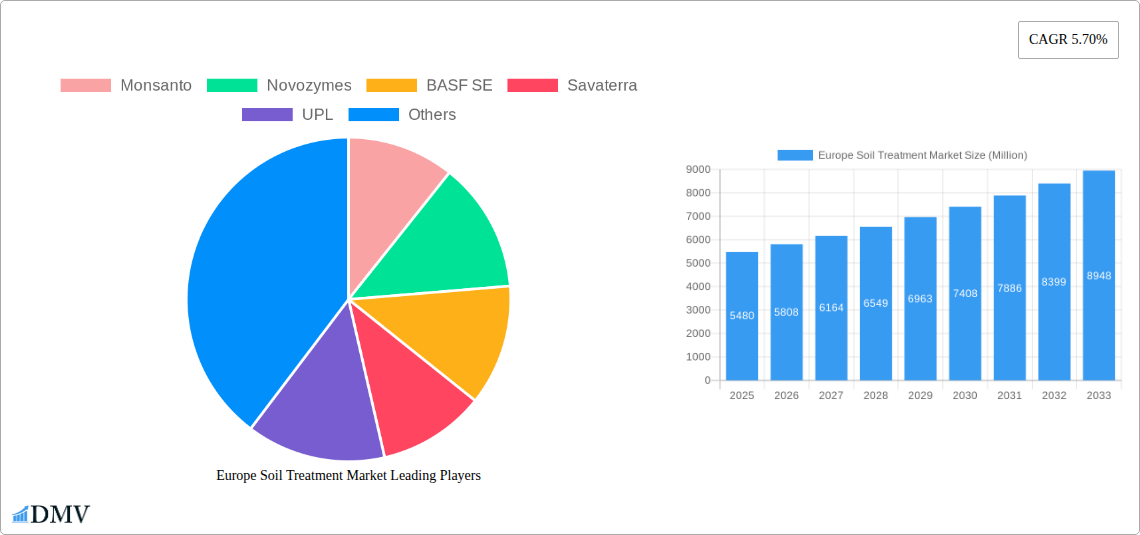

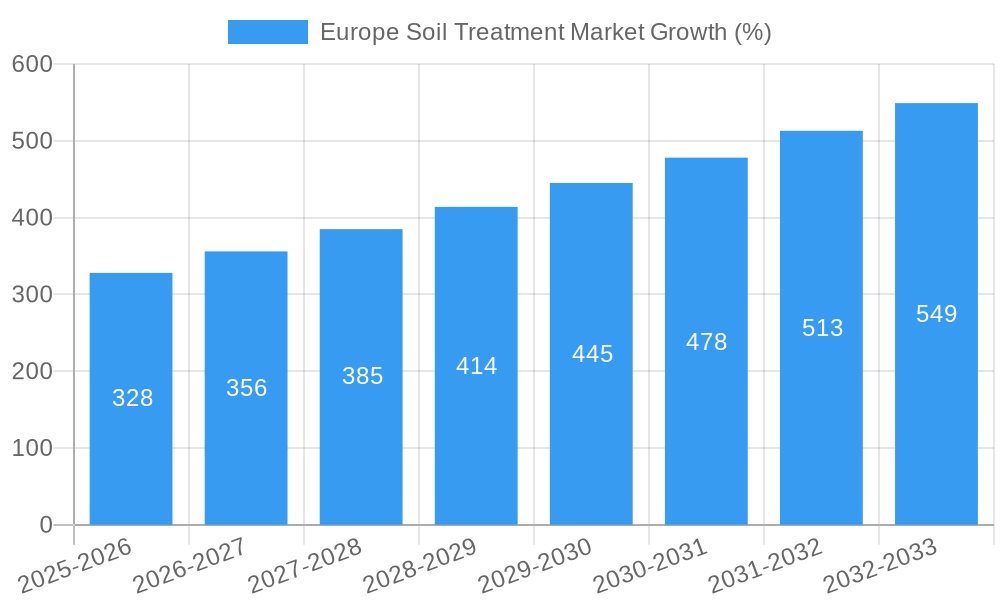

The European soil treatment market, valued at €5.48 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of soil degradation due to intensive agriculture and climate change is fueling demand for effective soil amendment and remediation solutions. Furthermore, rising consumer awareness of sustainable agricultural practices and the environmental benefits of healthy soil are boosting adoption of eco-friendly soil treatments. Stringent environmental regulations in several European countries are also encouraging the use of innovative and less-polluting technologies for soil improvement. Growth is particularly strong in segments utilizing biological treatments, reflecting a shift towards more environmentally benign methods. Organic amendments, which enhance soil fertility naturally, are also witnessing considerable market traction. Germany, France, and the United Kingdom represent the largest national markets, owing to their substantial agricultural sectors and advanced adoption of soil health management practices.

The market segmentation reveals a clear preference for physiochemical and biological treatment technologies. Within the treatment type segment, organic amendments and pH adjusters are experiencing faster growth compared to soil protection products, indicating a focus on improving soil fertility and balancing soil acidity. Key players like Monsanto, Novozymes, BASF SE, and Syngenta AG are driving innovation and expanding their market presence through strategic partnerships and product diversification. While challenges such as the high initial investment costs associated with some soil treatment technologies and fluctuating raw material prices exist, the long-term benefits of improved soil health and increased crop yields are expected to offset these hurdles, sustaining the market's positive growth trajectory throughout the forecast period. The ongoing research and development efforts focused on developing more efficient and sustainable soil treatment solutions further bolster market prospects.

Europe Soil Treatment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Soil Treatment Market, offering a comprehensive overview of market dynamics, growth drivers, and future opportunities from 2019 to 2033. The study covers key segments, leading players, and emerging trends, equipping stakeholders with crucial data for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025, with historical data spanning 2019-2024.

Europe Soil Treatment Market Composition & Trends

This section delves into the competitive landscape of the European soil treatment market, analyzing market concentration, innovation drivers, regulatory frameworks, and the role of mergers and acquisitions (M&A). The market exhibits a moderately consolidated structure, with key players like Monsanto, Novozymes, BASF SE, Savaterra, UPL, Fertago, Biosoil EU BV, and Syngenta AG holding significant market share. Market share distribution varies across segments, with Physiochemical treatments currently dominating.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Catalysts: Growing demand for sustainable agriculture practices and stricter environmental regulations are driving innovation in biological and eco-friendly soil treatment technologies.

- Regulatory Landscape: EU regulations on pesticide use and soil health are shaping product development and market access. Compliance costs represent a significant factor for smaller players.

- Substitute Products: Organic amendments and cover cropping are emerging as substitutes, particularly in niche segments focusing on organic farming.

- End-User Profiles: The market caters to a diverse range of end-users, including large-scale commercial farms, smallholder farmers, and horticultural businesses.

- M&A Activities: The past five years have witnessed xx M&A deals in the European soil treatment market, with a total estimated value of xx Million. These transactions primarily involved smaller companies being acquired by larger multinational corporations to expand their product portfolios and geographical reach.

Europe Soil Treatment Market Industry Evolution

The European soil treatment market has witnessed significant evolution over the past decade, driven by technological advancements, changing agricultural practices, and increasing environmental awareness. Market growth has been consistently positive, with an average annual growth rate of xx% during the historical period (2019-2024). This growth is expected to continue, albeit at a slightly moderated pace, driven by the increasing adoption of precision agriculture techniques and the growing demand for high-yield, sustainable farming practices. The shift towards sustainable agriculture is pushing the market towards biological and eco-friendly soil treatments. Adoption rates for biological treatments have increased from xx% in 2019 to xx% in 2024, demonstrating a clear preference for environmentally benign solutions. Furthermore, advancements in soil testing technologies and data analytics are improving the efficacy and precision of soil treatment applications, leading to better yield outcomes and resource optimization. Specific advancements include the development of targeted nutrient delivery systems and the use of biostimulants to enhance plant health and resilience. The growing awareness of soil degradation and its impact on food security is further propelling demand for effective soil treatment solutions.

Leading Regions, Countries, or Segments in Europe Soil Treatment Market

The Western European region currently dominates the European soil treatment market, driven by factors such as higher agricultural intensity, advanced farming practices, and strong regulatory frameworks supporting sustainable agriculture. Within Western Europe, countries like France, Germany, and the UK show high demand, primarily due to their large agricultural sectors and strong government support for environmentally friendly farming practices.

Key Drivers:

- High Agricultural Intensity: Western European countries have a high density of agricultural land and farms, creating high demand for soil treatment solutions.

- Technological Advancement: Adoption of advanced agricultural technologies is higher in these regions, leading to higher demand for precise soil treatments.

- Government Support and Subsidies: Various government initiatives and subsidies promote sustainable agricultural practices, further boosting the adoption of soil treatment technologies.

Segment Dominance:

- By Technology: Physiochemical treatments currently hold the largest market share due to their established presence and cost-effectiveness, however, biological treatments are experiencing the highest growth rate fueled by increasing awareness of environmental concerns. Thermal treatments hold a smaller, niche market.

- By Type: Organic amendments are gaining popularity due to increasing consumer demand for organic products and the growing focus on sustainable farming. pH adjusters remain a crucial segment, particularly in regions with challenging soil conditions. Soil protection solutions, encompassing mulching and cover cropping, are also experiencing growth.

Europe Soil Treatment Market Product Innovations

Recent innovations in the European soil treatment market include the development of bio-based soil conditioners with enhanced nutrient-release properties, smart sensors for precise soil analysis and targeted treatment, and advanced formulations of biopesticides for improved pest control. These innovations offer improved efficacy, reduced environmental impact, and cost-effectiveness. Companies are increasingly focusing on developing customized soil treatment solutions tailored to specific soil types and crop requirements. Unique selling propositions often center around enhanced sustainability, improved crop yields, and reduced environmental footprint.

Propelling Factors for Europe Soil Treatment Market Growth

Several factors are driving growth in the European soil treatment market. Technological advancements in precision agriculture are enabling targeted and efficient application of soil treatments, improving overall efficiency and reducing input costs. Increasing government regulations promoting sustainable agriculture practices are making the adoption of environmentally friendly soil treatments more imperative. Finally, the growing awareness of soil health's crucial role in food security and climate change mitigation is boosting demand for sustainable soil management practices.

Obstacles in the Europe Soil Treatment Market

Challenges faced by the European soil treatment market include stringent regulatory hurdles for new product approvals, potential supply chain disruptions due to geopolitical factors and extreme weather events, and intense competition among established and emerging players. These factors can lead to increased costs and delays in product launches, thus impacting market growth. For example, the approval process for new biopesticides can take several years, hindering innovation.

Future Opportunities in Europe Soil Treatment Market

Future opportunities lie in developing innovative, sustainable soil treatment solutions tailored to specific regional needs, such as drought-resistant formulations for Southern European countries. The growing interest in precision agriculture and digital farming presents opportunities for integrating smart technologies into soil treatment applications. Furthermore, exploring new markets, such as urban farming and vertical agriculture, could unlock further growth potential.

Major Players in the Europe Soil Treatment Market Ecosystem

- Monsanto

- Novozymes

- BASF SE

- Savaterra

- UPL

- Fertago

- Biosoil EU BV

- Syngenta AG

Key Developments in Europe Soil Treatment Market Industry

- January 2023: BASF SE launches a new bio-based soil conditioner with enhanced nutrient release properties.

- June 2022: Syngenta AG acquires a small biotechnology company specializing in microbial soil inoculants.

- October 2021: New EU regulations on pesticide use come into effect, influencing product development and market access.

Strategic Europe Soil Treatment Market Forecast

The European soil treatment market is poised for continued growth, driven by sustainable agriculture practices, technological advancements, and increasing awareness of soil health's importance. The focus on eco-friendly solutions and precision agriculture will reshape the market landscape, favoring innovative companies offering tailored solutions and optimized application methods. Opportunities exist across various segments, including bio-based products, smart sensors, and digital platforms for soil management. The market's future potential is significant, especially in regions focused on sustainable agriculture and food security.

Europe Soil Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Soil Treatment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Soil Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. International Demand for Agricultural Produce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Soil Treatment Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Monsanto

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Novozymes

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BASF SE

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Savaterra

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 UPL

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fertago

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Biosoil EU BV

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Syngenta AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Monsanto

List of Figures

- Figure 1: Europe Soil Treatment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Soil Treatment Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Soil Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Soil Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Soil Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Soil Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Soil Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Soil Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Soil Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Soil Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Soil Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Soil Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Soil Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Soil Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Soil Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Soil Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Soil Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Soil Treatment Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Europe Soil Treatment Market?

Key companies in the market include Monsanto, Novozymes, BASF SE, Savaterra, UPL, Fertago, Biosoil EU BV, Syngenta AG.

3. What are the main segments of the Europe Soil Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

International Demand for Agricultural Produce.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Soil Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Soil Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Soil Treatment Market?

To stay informed about further developments, trends, and reports in the Europe Soil Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence