Key Insights

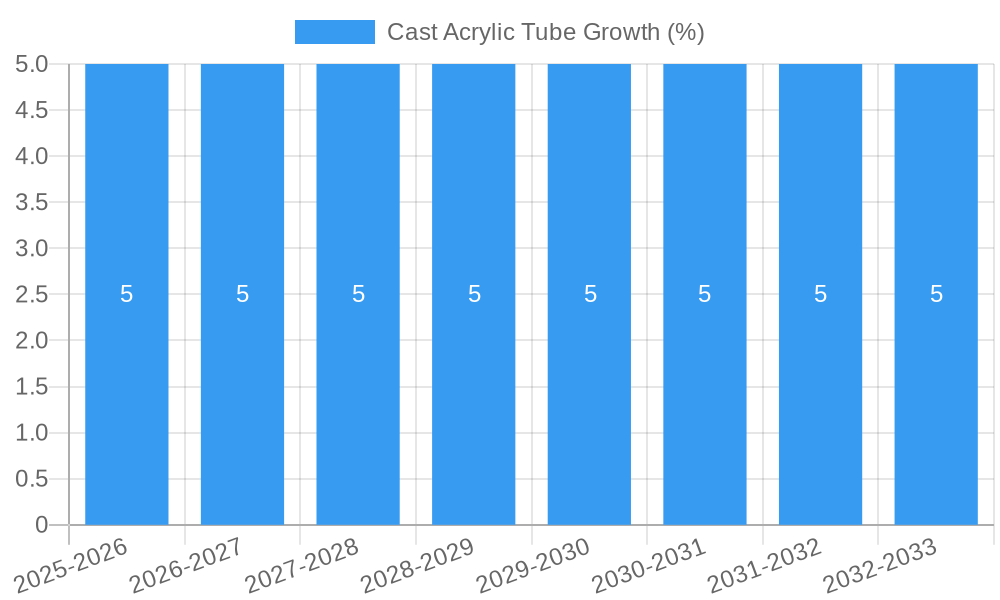

The global Cast Acrylic Tube market is poised for robust expansion, projected to reach a significant market size by 2033. Driven by the increasing demand for its superior clarity, durability, and versatility across diverse industrial and consumer applications, the market is experiencing a healthy Compound Annual Growth Rate (CAGR). Key growth catalysts include the burgeoning use of cast acrylic tubes in laboratory equipment for their chemical resistance and transparency, essential for scientific research and experimentation. Furthermore, their application in connecting pipes within various fluid handling systems, where non-corrosive and transparent conduits are crucial, is another significant driver. The expanding healthcare sector's need for sterile and easily cleanable components also contributes to this upward trajectory.

Emerging trends in the cast acrylic tube market are centered on advancements in manufacturing processes that enhance product quality and offer customized solutions. While the market is largely driven by innovation and application diversification, certain restraints may emerge, such as the fluctuating prices of raw materials and the availability of alternative materials like glass or polycarbonate in specific niche applications. However, the inherent advantages of cast acrylic, including its impact resistance and ease of fabrication, are expected to outweigh these challenges. The market's segmentation by application highlights the dominance of laboratory equipment and connecting pipes, while the types, such as battery casting and continuous casting, reflect specialized manufacturing techniques catering to specific end-user requirements, ensuring sustained market growth and development.

Cast Acrylic Tube Market: Comprehensive Industry Analysis & Strategic Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Cast Acrylic Tube market, exploring its intricate composition, evolutionary trends, and strategic future trajectory. Covering a study period from 2019 to 2033, with a base year of 2025, this report leverages meticulous research to deliver actionable insights for stakeholders across the entire value chain. Understand market concentration, innovation catalysts, regulatory landscapes, substitute products, end-user profiles, and M&A activities, essential for strategic decision-making.

Cast Acrylic Tube Market Composition & Trends

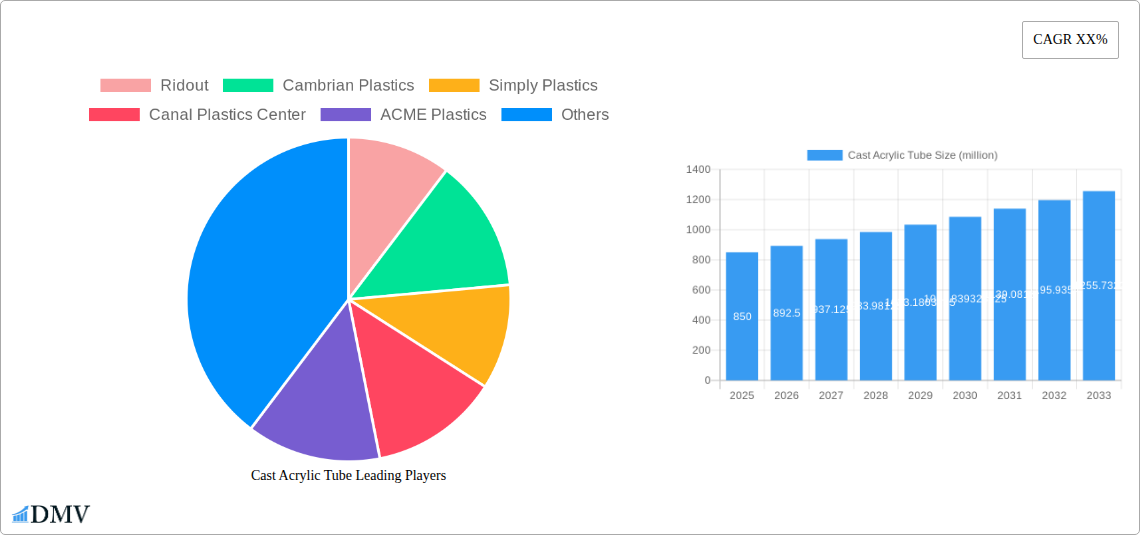

The global Cast Acrylic Tube market exhibits a dynamic and evolving composition, driven by a confluence of factors including innovation, regulatory frameworks, and the constant search for superior material alternatives. Market concentration remains a key area of analysis, with insights into the dominant players and their respective market shares. In the historical period (2019-2024), the market has witnessed significant developments, with a projected total market value of approximately $XXX million by the end of 2024. Innovation catalysts are primarily focused on enhancing optical clarity, UV resistance, and mechanical strength, catering to an increasingly sophisticated demand. Regulatory landscapes, while generally supportive of acrylic materials due to their versatility and safety profiles, can vary regionally, impacting production and application standards. Substitute products, such as polycarbonate and glass, present a competitive challenge, necessitating continuous differentiation through superior performance and cost-effectiveness. End-user profiles are diverse, spanning industries that require precision, durability, and aesthetic appeal. Mergers and acquisitions (M&A) activities have been a recurring theme, with estimated M&A deal values in the $XXX million range over the historical period, signaling consolidation and strategic expansion by key industry participants.

- Market Share Distribution: Analysis includes detailed breakdown of key players' market penetration.

- M&A Deal Values: Quantifiable data on historical and projected M&A investment trends.

- Innovation Focus: Emphasis on advancements in optical properties, durability, and specialized formulations.

- Regulatory Impact: Evaluation of regional compliance and standards affecting market access.

- Substitute Product Analysis: Competitive landscape against polycarbonate, glass, and other transparent materials.

Cast Acrylic Tube Industry Evolution

The Cast Acrylic Tube industry has undergone a significant evolution, characterized by robust market growth trajectories, continuous technological advancements, and a noticeable shift in consumer demands. From the historical period of 2019 to 2024, the market has experienced an average annual growth rate of approximately XX.X%, a testament to its increasing adoption across diverse sectors. Technological advancements have been instrumental, particularly in improving the precision of casting processes, leading to tubes with superior dimensional accuracy and surface finish. Developments in polymerization techniques have also enabled the production of cast acrylic tubes with enhanced properties, such as increased impact resistance and chemical inertness, making them suitable for more demanding applications.

Consumer demands have evolved from basic functional requirements to a sophisticated appreciation for aesthetic appeal, performance under specific conditions, and sustainability. This has propelled the development of specialized cast acrylic tubes, including those with colored pigments, UV filtering capabilities, and flame-retardant properties. The adoption metrics for cast acrylic tubes in emerging applications, such as specialized laboratory equipment and advanced display technologies, are showing a steep upward trend. The estimated total market value is projected to reach approximately $XXX million by the estimated year of 2025, underscoring the market's consistent expansion. As we move through the forecast period of 2025–2033, further innovation in areas like bio-based acrylics and smart functionalities is anticipated, promising to redefine the industry landscape and broaden the application spectrum. The continuous pursuit of higher performance and customizability ensures that cast acrylic tubes remain a preferred material for a multitude of innovative solutions.

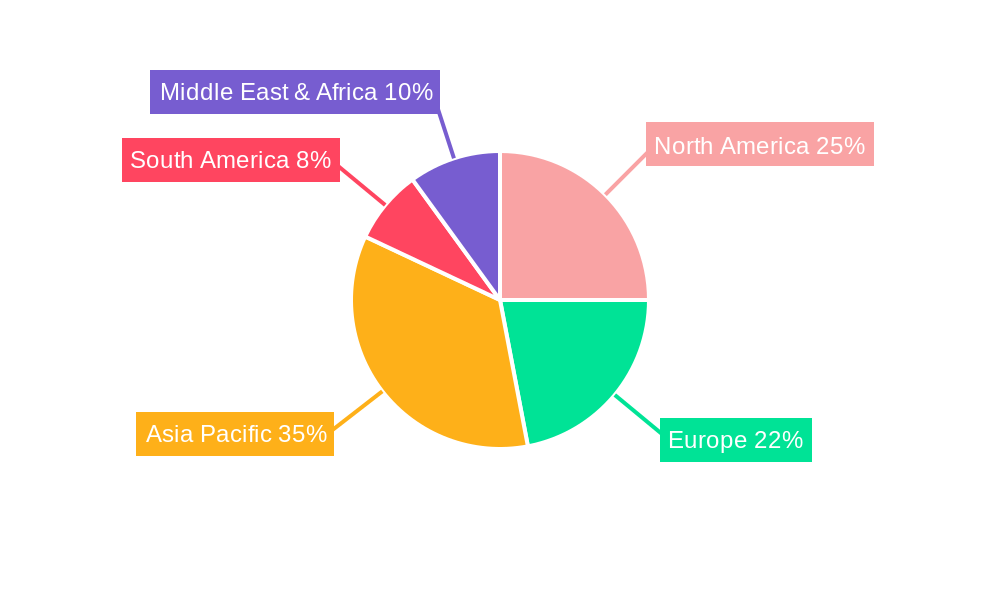

Leading Regions, Countries, or Segments in Cast Acrylic Tube

The global Cast Acrylic Tube market's dominance is influenced by a complex interplay of regional economic strengths, technological adoption rates, and specific application demands. Among the key application segments, Laboratory Equipment stands out as a significant driver of growth. This dominance is propelled by the sector's unwavering need for materials that offer exceptional clarity for visual inspection, chemical resistance for handling diverse reagents, and biocompatibility for sensitive research. The increasing global investment in scientific research and development, particularly in areas like pharmaceuticals, biotechnology, and advanced materials science, directly translates to a higher demand for high-quality cast acrylic tubes. Countries with strong pharmaceutical and biotech industries, such as the United States, Germany, and Japan, are therefore leading consumers.

The Types of cast acrylic tubes also play a crucial role in segment performance. While Continuous Casting offers scalability and cost-effectiveness for large-volume production, Battery Casting has seen a surge in importance due to the burgeoning electric vehicle and renewable energy storage sectors. This specialized casting method allows for the precise fabrication of tubes with intricate geometries essential for battery components, driving demand in regions with significant battery manufacturing hubs. Investment trends in renewable energy infrastructure and government incentives for electric vehicle adoption are key regulatory support mechanisms fostering this growth.

Geographically, North America and Europe currently represent the largest markets for cast acrylic tubes, owing to their well-established industrial bases, high disposable incomes, and advanced technological infrastructure. However, the Asia-Pacific region is rapidly emerging as a critical growth engine, fueled by rapid industrialization, increasing manufacturing capabilities, and a growing middle class driving demand across various consumer and industrial applications. The supportive government policies encouraging manufacturing and innovation in countries like China and India further bolster this regional expansion. The combined market value for these leading segments is estimated to be a significant portion of the total market, reaching approximately $XXX million in 2025.

- Dominant Application: Laboratory Equipment:

- Driver: High demand for optical clarity, chemical resistance, and biocompatibility in research and development.

- Key Regions: North America and Europe, with significant contributions from Asia-Pacific nations with strong pharmaceutical industries.

- Investment Trends: Increased government and private funding in life sciences and R&D.

- Dominant Type: Battery Casting:

- Driver: Explosive growth in the electric vehicle and energy storage sectors requiring specialized acrylic components.

- Key Regions: Asia-Pacific, driven by major battery manufacturing hubs.

- Regulatory Support: Government incentives for EV adoption and renewable energy projects.

Cast Acrylic Tube Product Innovations

Recent product innovations in the Cast Acrylic Tube market are revolutionizing its application potential. Manufacturers are focusing on developing tubes with enhanced UV resistance for outdoor applications, improved scratch resistance for high-traffic areas, and superior thermal stability for demanding industrial environments. Advancements in specialized formulations now allow for cast acrylic tubes with tailored optical properties, such as specific light diffusion or enhanced refractive indices, catering to the architectural and lighting industries. Furthermore, the integration of antimicrobial properties is opening new avenues in healthcare and food service. Performance metrics are continuously being pushed, with new products exhibiting increased tensile strength, greater impact resistance (exceeding XX J/m), and improved chemical inertness against a wider range of solvents. These innovations not only broaden the application spectrum but also solidify cast acrylic tubes' position as a premium material solution.

Propelling Factors for Cast Acrylic Tube Growth

The growth of the Cast Acrylic Tube market is propelled by a combination of technological, economic, and regulatory influences. Technologically, advancements in extrusion and casting techniques are leading to tubes with improved optical clarity, enhanced mechanical properties, and greater dimensional accuracy, making them ideal for sophisticated applications. Economically, the increasing demand for lightweight yet durable materials across industries like automotive, aerospace, and construction presents a significant opportunity. Government initiatives promoting energy efficiency and sustainable building practices often favor acrylics due to their excellent insulation properties and recyclability. Furthermore, the expanding use of acrylic tubes in high-growth sectors such as LED lighting, aquariums, and point-of-purchase displays contributes substantially to market expansion. The projected growth rate is expected to be around XX.X% annually during the forecast period, indicating strong market momentum.

Obstacles in the Cast Acrylic Tube Market

Despite its robust growth, the Cast Acrylic Tube market faces several obstacles. Intense competition from substitute materials like polycarbonate and glass, which offer different sets of properties and price points, poses a continuous challenge. Fluctuations in raw material prices, primarily derived from petrochemicals, can impact production costs and profitability, leading to potential price volatility for end-users. Stringent environmental regulations concerning plastic waste management and disposal can also present hurdles, requiring manufacturers to invest in sustainable production and recycling initiatives. Additionally, supply chain disruptions, as witnessed in recent global events, can affect the availability of raw materials and the timely delivery of finished products, impacting market stability. These factors collectively necessitate strategic planning and operational resilience for sustained market success.

Future Opportunities in Cast Acrylic Tube

The future of the Cast Acrylic Tube market is rich with emerging opportunities. The growing demand for sustainable and eco-friendly materials presents a significant opening for bio-based and recycled acrylics. Innovations in smart functionalities, such as integrated sensors or self-healing properties, could unlock new applications in the Internet of Things (IoT) and advanced construction. The expansion of the renewable energy sector, particularly in solar energy and battery storage, will continue to drive demand for specialized acrylic components. Emerging markets in developing economies offer untapped potential, driven by rapid industrialization and infrastructure development. Furthermore, advancements in additive manufacturing (3D printing) could enable the creation of highly customized and complex cast acrylic tube designs, catering to niche and specialized industry needs.

Major Players in the Cast Acrylic Tube Ecosystem

- Ridout

- Cambrian Plastics

- Simply Plastics

- Canal Plastics Center

- ACME Plastics

- Professional Plastics

- UVPlastic

- FixtureDisplays

- Regal Plastic Supply

- Plastic-Craft

- Delvie's Plastics

- Misumi

- Röhm

- A-1 Acrylic's

- Spartech

- Trident Plastics

- KF Plastics

- Plastics Online

- WeProFab

- Blanson

- P&M Plastics and Rubber

- H.D.Plastics

Key Developments in Cast Acrylic Tube Industry

- 2023/Q4: Launch of new ultra-clear, UV-resistant cast acrylic tubes by Röhm, enhancing outdoor application suitability.

- 2023/Q3: Spartech acquires a specialized acrylic extrusion company, expanding its product portfolio and manufacturing capacity for high-precision acrylic tubing.

- 2022/Q4: Professional Plastics introduces a line of antimicrobial cast acrylic tubes for healthcare and food service industries, addressing evolving hygiene demands.

- 2022/Q2: Cambrian Plastics invests in advanced casting technology to improve dimensional accuracy and surface finish for critical laboratory equipment applications.

- 2021/Q3: Misumi expands its online catalog to include a wider range of customizable cast acrylic tube options, catering to the growing demand for tailored solutions.

- 2020/Q1: Blanson announces a significant increase in production capacity for battery casting tubes, anticipating robust growth in the electric vehicle market.

Strategic Cast Acrylic Tube Market Forecast

The strategic Cast Acrylic Tube market forecast is optimistic, driven by persistent innovation and expanding application frontiers. Growth catalysts include the increasing demand for high-performance materials in cutting-edge technologies like renewable energy and advanced medical devices. The market's ability to adapt to sustainability trends by offering recyclable and potentially bio-based alternatives will further bolster its appeal. Emerging economies represent substantial untapped potential, poised to drive significant volume growth in the coming years. Continued investment in research and development by major players will ensure a steady stream of new products with enhanced functionalities, solidifying cast acrylic tubes' position as a versatile and indispensable material in a wide array of industries. The market is projected to witness sustained growth, with an estimated value of approximately $XXX million by 2033.

Cast Acrylic Tube Segmentation

-

1. Application

- 1.1. Laboratory Equipment

- 1.2. Connecting Pipes

- 1.3. Other

-

2. Types

- 2.1. Battery Casting

- 2.2. Continuous Casting

Cast Acrylic Tube Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cast Acrylic Tube REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Laboratory Equipment

- 5.1.2. Connecting Pipes

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Battery Casting

- 5.2.2. Continuous Casting

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Laboratory Equipment

- 6.1.2. Connecting Pipes

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Battery Casting

- 6.2.2. Continuous Casting

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Laboratory Equipment

- 7.1.2. Connecting Pipes

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Battery Casting

- 7.2.2. Continuous Casting

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Laboratory Equipment

- 8.1.2. Connecting Pipes

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Battery Casting

- 8.2.2. Continuous Casting

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Laboratory Equipment

- 9.1.2. Connecting Pipes

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Battery Casting

- 9.2.2. Continuous Casting

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cast Acrylic Tube Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Laboratory Equipment

- 10.1.2. Connecting Pipes

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Battery Casting

- 10.2.2. Continuous Casting

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ridout

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cambrian Plastics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Simply Plastics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canal Plastics Center

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ACME Plastics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Professional Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UVPlastic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FixtureDisplays

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Regal Plastic Supply

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Plastic-Craft

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Delvie's Plastics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Misumi

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Röhm

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 A-1 Acrylic's

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Spartech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Trident Plastics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 KF Plastics

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Plastics Online

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 WeProFab

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Blanson

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 P&M Plastics and Rubber

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 H.D.Plastics

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Ridout

List of Figures

- Figure 1: Global Cast Acrylic Tube Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cast Acrylic Tube Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cast Acrylic Tube Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cast Acrylic Tube Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cast Acrylic Tube Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cast Acrylic Tube Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cast Acrylic Tube Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cast Acrylic Tube Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cast Acrylic Tube Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cast Acrylic Tube Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cast Acrylic Tube Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cast Acrylic Tube Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cast Acrylic Tube Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cast Acrylic Tube Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cast Acrylic Tube Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cast Acrylic Tube Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cast Acrylic Tube Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cast Acrylic Tube Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cast Acrylic Tube Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cast Acrylic Tube Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cast Acrylic Tube Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cast Acrylic Tube Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cast Acrylic Tube Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cast Acrylic Tube Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cast Acrylic Tube Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cast Acrylic Tube Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cast Acrylic Tube Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cast Acrylic Tube Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cast Acrylic Tube Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cast Acrylic Tube Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cast Acrylic Tube Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cast Acrylic Tube Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cast Acrylic Tube Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cast Acrylic Tube Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cast Acrylic Tube Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cast Acrylic Tube Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cast Acrylic Tube Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cast Acrylic Tube Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cast Acrylic Tube Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cast Acrylic Tube Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cast Acrylic Tube Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cast Acrylic Tube?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cast Acrylic Tube?

Key companies in the market include Ridout, Cambrian Plastics, Simply Plastics, Canal Plastics Center, ACME Plastics, Professional Plastics, UVPlastic, FixtureDisplays, Regal Plastic Supply, Plastic-Craft, Delvie's Plastics, Misumi, Röhm, A-1 Acrylic's, Spartech, Trident Plastics, KF Plastics, Plastics Online, WeProFab, Blanson, P&M Plastics and Rubber, H.D.Plastics.

3. What are the main segments of the Cast Acrylic Tube?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cast Acrylic Tube," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cast Acrylic Tube report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cast Acrylic Tube?

To stay informed about further developments, trends, and reports in the Cast Acrylic Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence