Key Insights

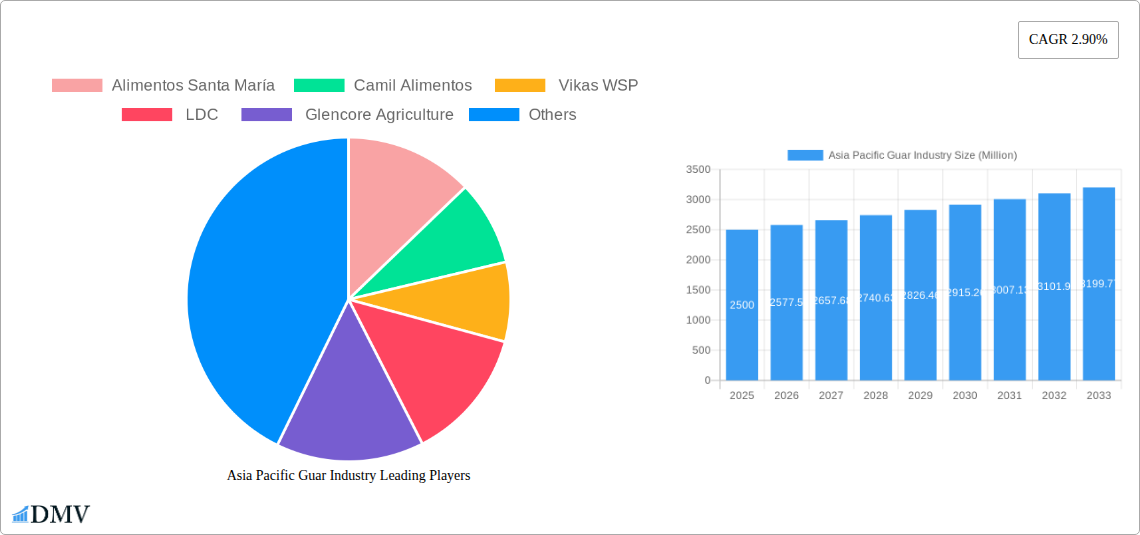

The Asia-Pacific guar industry, encompassing major players like Alimentos Santa María, Camil Alimentos, and Vikas WSP, demonstrates robust growth potential, driven by increasing demand from the food and beverage, oil and gas, and pharmaceutical sectors. The region's large population and burgeoning economies, particularly in India and China, significantly contribute to this demand. While precise market size figures for 2025 are unavailable, a conservative estimate based on the provided CAGR of 2.90% and a reasonable starting point suggests a market size exceeding $X billion (depending on the actual, undisclosed market size "XXX" mentioned; this calculation requires that figure). This growth is further fueled by expanding applications of guar gum as a thickening agent, stabilizer, and emulsifier across various industries. India, with its significant production capacity, plays a crucial role in shaping regional supply dynamics. However, price volatility related to crop yields and global supply chains represents a significant constraint. China and Japan, while exhibiting substantial consumption, rely more on imports, creating opportunities for regional producers and exporters. The forecast period (2025-2033) presents promising growth avenues for businesses capitalizing on technological advancements in guar gum processing and diversification into niche applications, particularly within value-added products.

Asia Pacific Guar Industry Market Size (In Billion)

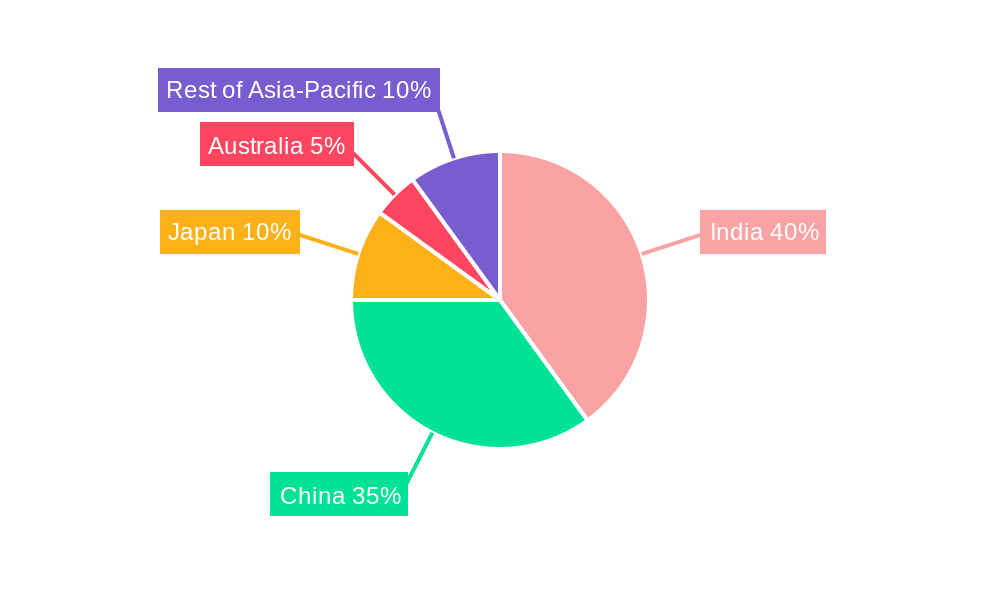

Further analysis indicates that Australia, though a smaller contributor compared to India and China, shows a steady growth trajectory, fuelled by its export-oriented economy and focus on high-value applications. The market segmentation by country allows a granular understanding of production, consumption, import/export patterns, and price trends. This detail enables strategic decision-making for businesses operating within or seeking entry into this dynamic market. Understanding regional variations is key to successful market penetration; customized strategies are necessary to effectively navigate diverse regulatory environments and consumer preferences across the Asia-Pacific region. The long-term outlook for the Asia-Pacific guar industry remains positive, contingent upon sustainable production practices and addressing the challenges posed by supply chain vulnerabilities and price fluctuations. Continued innovation and product diversification will be essential to sustain the industry's growth momentum.

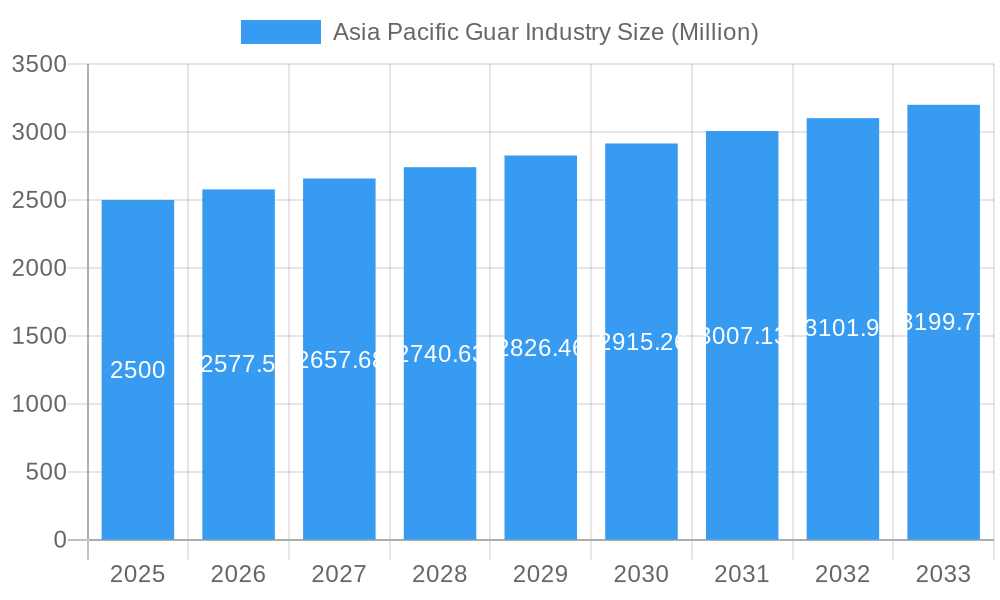

Asia Pacific Guar Industry Company Market Share

Asia Pacific Guar Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific guar industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's composition, trends, and future potential. Key players such as Alimentos Santa María, Camil Alimentos, Vikas WSP, LDC, Glencore Agriculture, AGD, GuarCorp, Arcor, Flo Chemical, and Molinos are analyzed, along with regional breakdowns of production, consumption, import/export volumes and values, and price trends across India, China, Japan, and Australia. The report's detailed analysis empowers businesses to make informed strategic decisions, leveraging the market's growth trajectory and opportunities.

Asia Pacific Guar Industry Market Composition & Trends

This section evaluates the competitive landscape of the Asia Pacific guar industry, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user dynamics. The report assesses market share distribution among key players, revealing the dominance of specific companies and their strategies. Furthermore, it examines mergers and acquisitions (M&A) activity within the sector, quantifying deal values and their impact on market structure. The analysis reveals a moderately concentrated market with xx% market share held by the top 5 players in 2025. Key innovation drivers include advancements in guar gum processing techniques and the expansion of applications across various industries. Regulatory landscapes vary across countries, influencing production, trade, and pricing. Substitute products such as xanthan gum and cellulose derivatives pose competitive challenges. The major end-users include the food & beverage, oil & gas, and textile industries.

- Market Share Distribution (2025): Top 5 players hold xx%, with the remaining share distributed among smaller players.

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a combined value of approximately US$ xx Million.

- Key Innovation Catalysts: Improved extraction methods, novel applications in pharmaceuticals and cosmetics.

- Regulatory Landscape: Varied across countries, with some regions having stricter regulations on guar gum production and labeling.

Asia Pacific Guar Industry Industry Evolution

The Asia Pacific guar industry has witnessed significant evolution during the historical period (2019-2024). Market growth has been driven by increasing demand from diverse sectors, such as food and beverages (especially in the expanding Asian middle class), oil and gas extraction (as a thickening agent), and textiles (as a sizing agent). Technological advancements have enhanced guar gum extraction and processing efficiency, leading to improved product quality and reduced costs. Consumer demands for natural and sustainable ingredients have further boosted market growth.

The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace compared to the historical period. Factors such as supply chain resilience, price volatility, and emerging substitutes will influence the overall growth trajectory. Technological innovation will continue to play a pivotal role, with increasing focus on developing novel guar-based products with enhanced functionality and sustainability features. The report details projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

Leading Regions, Countries, or Segments in Asia Pacific Guar Industry

India dominates the Asia Pacific guar industry, accounting for the largest share of global production and export. The Indian market is characterized by a robust cultivation base, advanced processing facilities, and significant domestic consumption. China holds a significant position as a major consumer and importer of guar gum, driven by its thriving food and industrial sectors. Japan and Australia have relatively smaller but established guar markets, primarily driven by import reliance.

India:

- Production (2025): xx Million tonnes

- Consumption (2025): xx Million tonnes

- Market Value (2025): US$ xx Million

- Exports (2025): xx Million tonnes valued at US$ xx Million

- Price Trend: Fluctuating, influenced by global supply and demand.

China:

- Production (2025): xx Million tonnes

- Consumption (2025): xx Million tonnes

- Market Value (2025): US$ xx Million

- Imports (2025): xx Million tonnes valued at US$ xx Million

- Price Trend: Generally stable, with minor fluctuations influenced by domestic production levels.

Japan:

- Production (2025): xx Million tonnes

- Consumption (2025): xx Million tonnes

- Market Value (2025): US$ xx Million

- Imports (2025): xx Million tonnes valued at US$ xx Million

- Price Trend: Aligned with global guar gum pricing trends.

Australia:

- Production (2025): xx Million tonnes

- Consumption (2025): xx Million tonnes

- Market Value (2025): US$ xx Million

- Imports (2025): xx Million tonnes valued at US$ xx Million

- Price Trend: Influenced by both domestic production and global market dynamics.

Asia Pacific Guar Industry Product Innovations

Recent innovations in the guar industry focus on enhancing product functionality, improving sustainability, and expanding applications. Modified guar gums with enhanced viscosity, stability, and clarity are gaining traction. These advancements cater to the evolving needs of various industries, particularly the food and pharmaceutical sectors. New applications in areas such as water treatment, personal care, and biofuel production are also emerging, creating new opportunities for market expansion.

Propelling Factors for Asia Pacific Guar Industry Growth

Several factors are propelling the growth of the Asia Pacific guar industry. The increasing demand for natural thickening agents in the food and beverage industry, driven by consumer preference for clean-label products, is a significant driver. The expansion of the oil and gas sector, particularly in regions like India and China, fuels demand for guar gum as an effective drilling fluid additive. Government policies promoting sustainable agriculture and agro-processing in several countries also contribute to market growth. Technological advancements leading to cost-effective guar gum processing enhance its competitiveness.

Obstacles in the Asia Pacific Guar Industry Market

Despite its growth potential, the Asia Pacific guar industry faces several challenges. Price volatility due to fluctuating supply and demand remains a significant concern. Climate change and unpredictable weather patterns impacting guar cultivation pose risks to production. Competition from substitute products, particularly synthetic gums, represents another challenge. Moreover, logistical challenges, particularly in transporting guar gum from remote cultivation areas, can impact supply chain efficiency. Regulatory compliance across different countries adds complexity to market operations.

Future Opportunities in Asia Pacific Guar Industry

The Asia Pacific guar industry presents substantial future opportunities. Exploring new applications in emerging sectors such as pharmaceuticals, cosmetics, and bioplastics will open up new markets. Investing in research and development to enhance guar gum's functionality and develop specialized products caters to niche demands. Sustainable and environmentally friendly guar cultivation practices will enhance market acceptance and improve sustainability. Collaborations and partnerships between guar gum producers, processors, and end-users foster innovation and market development.

Major Players in the Asia Pacific Guar Industry Ecosystem

- Alimentos Santa María

- Camil Alimentos

- Vikas WSP

- LDC

- Glencore Agriculture

- AGD

- GuarCorp

- Arcor

- Flo Chemical

- Molinos

Key Developments in Asia Pacific Guar Industry Industry

- 2022-Q3: Launch of a new, sustainably sourced guar gum by GuarCorp.

- 2023-Q1: Acquisition of a guar processing facility in India by LDC.

- 2024-Q2: Introduction of a modified guar gum with enhanced viscosity by Flo Chemical.

- 2025-Q1: Significant investment in guar gum R&D by Camil Alimentos.

Strategic Asia Pacific Guar Industry Market Forecast

The Asia Pacific guar industry is poised for continued growth over the forecast period, fueled by robust demand across various sectors, coupled with continuous innovation and technological advancements. The increasing awareness of guar gum's unique properties and its versatility as a natural, sustainable ingredient will drive market expansion. New applications in emerging sectors, alongside sustainable farming practices, will further contribute to the market's positive growth trajectory, making it an attractive sector for both established players and new entrants.

Asia Pacific Guar Industry Segmentation

-

1. India

- 1.1. Production Analysis

- 1.2. Consumption Analysis and Market Value

- 1.3. Import Analysis by Volume and Value

- 1.4. Export Analysis by Volume and Value

- 1.5. Price Trend Analysis

-

2. China

- 2.1. Production Analysis

- 2.2. Consumption Analysis and Market Value

- 2.3. Import Analysis by Volume and Value

- 2.4. Export Analysis by Volume and Value

- 2.5. Price Trend Analysis

-

3. Japan

- 3.1. Production Analysis

- 3.2. Consumption Analysis and Market Value

- 3.3. Import Analysis by Volume and Value

- 3.4. Export Analysis by Volume and Value

- 3.5. Price Trend Analysis

-

4. Australia

- 4.1. Production Analysis

- 4.2. Consumption Analysis and Market Value

- 4.3. Import Analysis by Volume and Value

- 4.4. Export Analysis by Volume and Value

- 4.5. Price Trend Analysis

-

5. India

- 5.1. Production Analysis

- 5.2. Consumption Analysis and Market Value

- 5.3. Import Analysis by Volume and Value

- 5.4. Export Analysis by Volume and Value

- 5.5. Price Trend Analysis

-

6. China

- 6.1. Production Analysis

- 6.2. Consumption Analysis and Market Value

- 6.3. Import Analysis by Volume and Value

- 6.4. Export Analysis by Volume and Value

- 6.5. Price Trend Analysis

-

7. Japan

- 7.1. Production Analysis

- 7.2. Consumption Analysis and Market Value

- 7.3. Import Analysis by Volume and Value

- 7.4. Export Analysis by Volume and Value

- 7.5. Price Trend Analysis

-

8. Australia

- 8.1. Production Analysis

- 8.2. Consumption Analysis and Market Value

- 8.3. Import Analysis by Volume and Value

- 8.4. Export Analysis by Volume and Value

- 8.5. Price Trend Analysis

Asia Pacific Guar Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Guar Industry Regional Market Share

Geographic Coverage of Asia Pacific Guar Industry

Asia Pacific Guar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Application in Various Industry is Driving Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Guar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by India

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis and Market Value

- 5.1.3. Import Analysis by Volume and Value

- 5.1.4. Export Analysis by Volume and Value

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by China

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis and Market Value

- 5.2.3. Import Analysis by Volume and Value

- 5.2.4. Export Analysis by Volume and Value

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Japan

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis and Market Value

- 5.3.3. Import Analysis by Volume and Value

- 5.3.4. Export Analysis by Volume and Value

- 5.3.5. Price Trend Analysis

- 5.4. Market Analysis, Insights and Forecast - by Australia

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis and Market Value

- 5.4.3. Import Analysis by Volume and Value

- 5.4.4. Export Analysis by Volume and Value

- 5.4.5. Price Trend Analysis

- 5.5. Market Analysis, Insights and Forecast - by India

- 5.5.1. Production Analysis

- 5.5.2. Consumption Analysis and Market Value

- 5.5.3. Import Analysis by Volume and Value

- 5.5.4. Export Analysis by Volume and Value

- 5.5.5. Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by China

- 5.6.1. Production Analysis

- 5.6.2. Consumption Analysis and Market Value

- 5.6.3. Import Analysis by Volume and Value

- 5.6.4. Export Analysis by Volume and Value

- 5.6.5. Price Trend Analysis

- 5.7. Market Analysis, Insights and Forecast - by Japan

- 5.7.1. Production Analysis

- 5.7.2. Consumption Analysis and Market Value

- 5.7.3. Import Analysis by Volume and Value

- 5.7.4. Export Analysis by Volume and Value

- 5.7.5. Price Trend Analysis

- 5.8. Market Analysis, Insights and Forecast - by Australia

- 5.8.1. Production Analysis

- 5.8.2. Consumption Analysis and Market Value

- 5.8.3. Import Analysis by Volume and Value

- 5.8.4. Export Analysis by Volume and Value

- 5.8.5. Price Trend Analysis

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by India

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alimentos Santa María

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Camil Alimentos

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vikas WSP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LDC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Glencore Agriculture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GuarCorp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arcor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Flo Chemical

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Molinos

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alimentos Santa María

List of Figures

- Figure 1: Asia Pacific Guar Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Guar Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Guar Industry Revenue Million Forecast, by India 2020 & 2033

- Table 2: Asia Pacific Guar Industry Volume Metric Tons Forecast, by India 2020 & 2033

- Table 3: Asia Pacific Guar Industry Revenue Million Forecast, by China 2020 & 2033

- Table 4: Asia Pacific Guar Industry Volume Metric Tons Forecast, by China 2020 & 2033

- Table 5: Asia Pacific Guar Industry Revenue Million Forecast, by Japan 2020 & 2033

- Table 6: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Japan 2020 & 2033

- Table 7: Asia Pacific Guar Industry Revenue Million Forecast, by Australia 2020 & 2033

- Table 8: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Australia 2020 & 2033

- Table 9: Asia Pacific Guar Industry Revenue Million Forecast, by India 2020 & 2033

- Table 10: Asia Pacific Guar Industry Volume Metric Tons Forecast, by India 2020 & 2033

- Table 11: Asia Pacific Guar Industry Revenue Million Forecast, by China 2020 & 2033

- Table 12: Asia Pacific Guar Industry Volume Metric Tons Forecast, by China 2020 & 2033

- Table 13: Asia Pacific Guar Industry Revenue Million Forecast, by Japan 2020 & 2033

- Table 14: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Japan 2020 & 2033

- Table 15: Asia Pacific Guar Industry Revenue Million Forecast, by Australia 2020 & 2033

- Table 16: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Australia 2020 & 2033

- Table 17: Asia Pacific Guar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 18: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Region 2020 & 2033

- Table 19: Asia Pacific Guar Industry Revenue Million Forecast, by India 2020 & 2033

- Table 20: Asia Pacific Guar Industry Volume Metric Tons Forecast, by India 2020 & 2033

- Table 21: Asia Pacific Guar Industry Revenue Million Forecast, by China 2020 & 2033

- Table 22: Asia Pacific Guar Industry Volume Metric Tons Forecast, by China 2020 & 2033

- Table 23: Asia Pacific Guar Industry Revenue Million Forecast, by Japan 2020 & 2033

- Table 24: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Japan 2020 & 2033

- Table 25: Asia Pacific Guar Industry Revenue Million Forecast, by Australia 2020 & 2033

- Table 26: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Australia 2020 & 2033

- Table 27: Asia Pacific Guar Industry Revenue Million Forecast, by India 2020 & 2033

- Table 28: Asia Pacific Guar Industry Volume Metric Tons Forecast, by India 2020 & 2033

- Table 29: Asia Pacific Guar Industry Revenue Million Forecast, by China 2020 & 2033

- Table 30: Asia Pacific Guar Industry Volume Metric Tons Forecast, by China 2020 & 2033

- Table 31: Asia Pacific Guar Industry Revenue Million Forecast, by Japan 2020 & 2033

- Table 32: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Japan 2020 & 2033

- Table 33: Asia Pacific Guar Industry Revenue Million Forecast, by Australia 2020 & 2033

- Table 34: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Australia 2020 & 2033

- Table 35: Asia Pacific Guar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Asia Pacific Guar Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 37: China Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: China Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 39: Japan Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 41: South Korea Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Korea Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 43: India Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 45: Australia Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Australia Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 47: New Zealand Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: New Zealand Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 49: Indonesia Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Indonesia Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 51: Malaysia Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Malaysia Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 53: Singapore Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Singapore Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 55: Thailand Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Thailand Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 57: Vietnam Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Vietnam Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 59: Philippines Asia Pacific Guar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Philippines Asia Pacific Guar Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Guar Industry?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the Asia Pacific Guar Industry?

Key companies in the market include Alimentos Santa María , Camil Alimentos , Vikas WSP , LDC , Glencore Agriculture, AGD, GuarCorp , Arcor , Flo Chemical , Molinos .

3. What are the main segments of the Asia Pacific Guar Industry?

The market segments include India, China, Japan, Australia, India, China, Japan, Australia.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Application in Various Industry is Driving Production.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Guar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Guar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Guar Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Guar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence