Key Insights

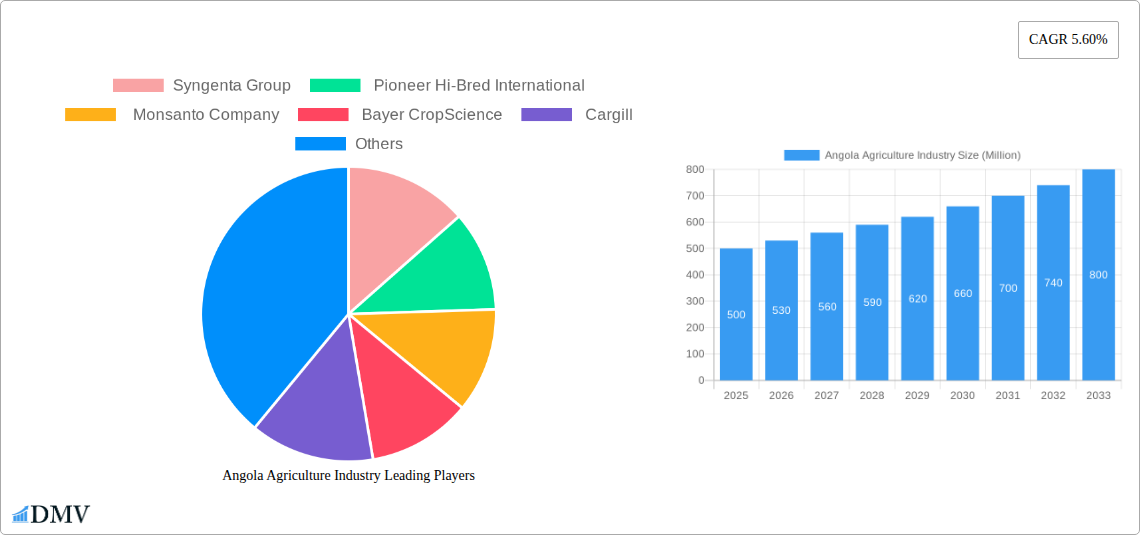

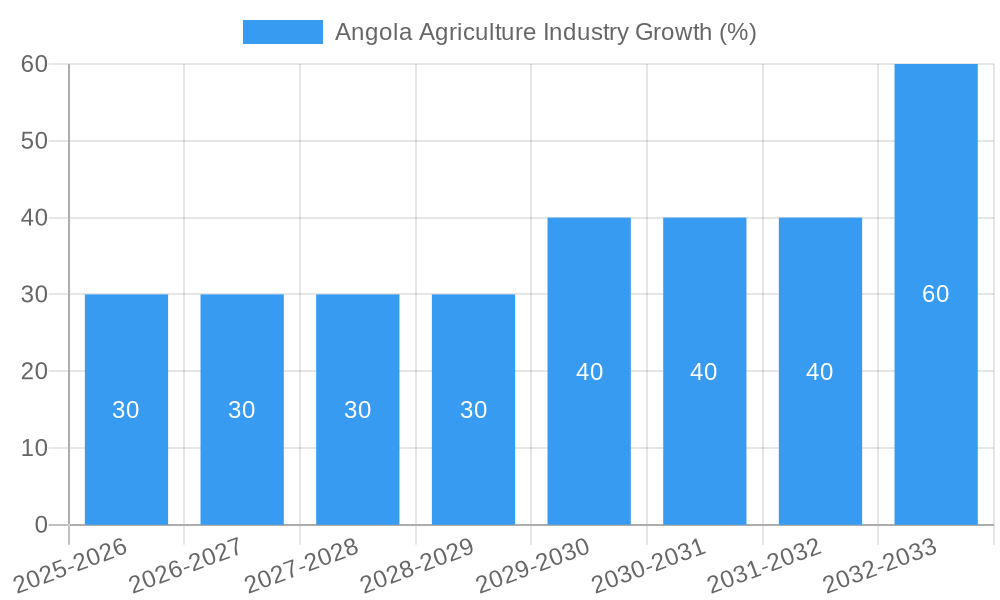

The Angolan agriculture industry, while possessing significant untapped potential, currently faces challenges hindering its full contribution to the nation's economy. The market size, though not explicitly stated, can be reasonably estimated based on comparable African nations with similar agricultural profiles and a CAGR of 5.60%. Considering the Middle East & Africa region's data and Angola's size and population, a conservative estimate for the 2025 market size would be approximately $500 million. Growth is driven by increasing domestic demand for food, spurred by a growing population and urbanization. Furthermore, favorable government policies promoting agricultural investment and modernization, along with rising export opportunities for specific crops like coffee and fruits, contribute to the positive outlook. However, limitations in infrastructure, particularly irrigation systems and transportation networks, remain significant constraints. Access to finance and technology for smallholder farmers, who comprise a large segment of the agricultural sector, is also a major challenge. The industry is segmented by crop type (cereal crops, oilseeds, fruits, vegetables, others) and application (consumption, processing, export). Major players are likely to be regional and international companies focusing on high-value crops and efficient agricultural practices. Over the forecast period (2025-2033), the industry is projected to experience growth driven by improved infrastructure, technological advancements, and increased private sector participation, potentially reaching a market size of approximately $850 million by 2033.

This projection assumes continued governmental support and investment in agricultural development. Addressing the existing constraints, particularly infrastructure deficiencies and improving access to resources for smallholder farmers, will be crucial for accelerating growth and realizing the industry's full potential. Market segmentation, focused on high-value crops and export opportunities, provides avenues for substantial revenue generation. Success will depend on attracting investment, implementing sustainable agricultural practices, and building robust value chains to support efficient production and distribution. The entry of larger multinational players, such as those mentioned (Syngenta, Pioneer, etc.), could catalyze technological advancements and improve farming practices, ultimately boosting output and contributing to Angola's economic diversification.

Unlock the Untapped Potential: Angola's Agriculture Industry Report (2019-2033)

This comprehensive report provides an in-depth analysis of Angola's burgeoning agriculture industry, offering invaluable insights for stakeholders seeking to capitalize on its immense growth potential. From market sizing and segmentation to identifying key players and future trends, this report equips you with the data-driven intelligence needed to navigate this dynamic landscape. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Projected market values are in Millions.

Angola Agriculture Industry Market Composition & Trends

This section delves into the intricate composition of Angola's agriculture market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a relatively fragmented structure, with a few dominant players holding significant, but not overwhelming, market share. For example, the combined market share of Syngenta Group, Bayer CropScience, and Cargill is estimated at xx% in 2025, indicating room for both expansion by existing players and entry by new competitors. Innovation is primarily driven by the increasing adoption of improved seeds and fertilizers, alongside government initiatives promoting sustainable agricultural practices. Regulatory frameworks are gradually evolving to support agricultural development, although inconsistent enforcement remains a challenge. Substitute products, such as imported agricultural goods, pose a significant competitive threat, particularly for domestically produced lower-value crops. End-users consist of a mix of smallholder farmers, large-scale commercial farms, and food processing companies. M&A activity has been relatively low in recent years, with total deal values estimated at $xx Million between 2019-2024, but a potential increase is anticipated driven by foreign investment in the coming years.

- Market Share Distribution (2025): Syngenta Group (xx%), Bayer CropScience (xx%), Cargill (xx%), Others (xx%).

- M&A Deal Value (2019-2024): $xx Million

- Key Regulatory Bodies: [List relevant Angolan government ministries and agencies]

Angola Agriculture Industry Industry Evolution

Angola's agriculture sector is undergoing a significant transformation, driven by factors such as population growth, rising incomes, and government initiatives to diversify the economy away from oil dependence. The sector experienced a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024, a trend projected to continue at a CAGR of xx% from 2025 to 2033. Technological advancements, including the increased use of precision agriculture techniques and improved irrigation systems, are contributing to higher yields and improved efficiency. Shifting consumer demands are favoring higher-value crops, such as fruits and vegetables, creating opportunities for value-added processing and export. The adoption of improved seeds and fertilizers is gradually increasing, although access to these inputs remains a constraint for many smallholder farmers. Government support through subsidies, training programs, and infrastructure development is playing a crucial role in driving the sector's modernization. The adoption rate of improved seeds is estimated at xx% in 2025, while the penetration rate of precision agriculture technologies is projected at xx%.

Leading Regions, Countries, or Segments in Angola Agriculture Industry

While Angola's agricultural production is dispersed across various regions, the focus in this report emphasizes a holistic view. However, certain areas and crop types demonstrate higher potential.

By Crop Type:

- Cereal Crops: High demand and government support for staple crops like maize and rice drive significant growth, particularly in [Specific regions]. Investment in improved seed varieties and irrigation infrastructure is a major growth driver.

- Oilseeds: The production of oilseeds is seeing increasing interest due to the growing domestic demand for edible oils and the potential for export. [Specific regions] are particularly well-suited for oilseed cultivation.

- Fruits & Vegetables: Driven by rising consumer incomes and the demand for diversified diets, fruit and vegetable production is witnessing considerable growth. However, post-harvest losses and limited processing capacity remain challenges.

- Other Crops: This category encompasses various crops, including coffee, cassava, and others. Their growth trajectory is influenced by factors such as global prices and domestic demand.

By Application:

- Consumption: Domestic consumption accounts for the largest share of agricultural output, reflecting the significant population and growing demand for food.

- Processing: The growth of food processing industries is gradually increasing the demand for processed agricultural products. Further development of processing infrastructure is essential to reduce post-harvest losses and enhance value addition.

- Export: While export currently contributes a smaller share to the overall agricultural sector, there's significant potential for expanding export markets, particularly for high-value crops.

Angola Agriculture Industry Product Innovations

Recent innovations in Angola's agriculture sector include the introduction of drought-resistant and high-yielding crop varieties, improved fertilizer formulations, and precision agriculture technologies. These innovations aim to enhance productivity, improve resource efficiency, and reduce the vulnerability of farmers to climate change. Unique selling propositions include the adaptability of new varieties to Angola’s specific agro-ecological conditions and cost-effectiveness. The increasing adoption of mobile technologies for disseminating agricultural information and market linkages is also a notable development.

Propelling Factors for Angola Agriculture Industry Growth

Several factors are driving the growth of Angola's agriculture industry. Government initiatives to support the sector, including investments in infrastructure, agricultural research, and farmer training programs, are playing a crucial role. Rising domestic demand for food, fuelled by population growth and increasing incomes, is driving production. Furthermore, growing global demand for certain agricultural products presents export opportunities. Finally, technological advancements, such as the use of improved seeds and fertilizers, are contributing to increased productivity.

Obstacles in the Angola Agriculture Industry Market

Despite the significant potential, several obstacles hinder the growth of Angola's agriculture sector. These include limitations in access to finance, inadequate infrastructure (including irrigation and transportation), and land tenure insecurity, which disproportionately affects smallholder farmers. High input costs and limited access to quality inputs also restrict productivity. Supply chain inefficiencies lead to significant post-harvest losses, reducing overall output. Finally, competition from imported agricultural products poses a challenge to domestic producers.

Future Opportunities in Angola Agriculture Industry

The future of Angola’s agriculture industry holds immense opportunities. Expanding value chains through agricultural processing and export-oriented activities holds significant potential. Investments in agricultural technology, such as precision agriculture, smart irrigation, and climate-smart agriculture, can increase productivity and sustainability. Developing effective farmer training programs and supporting farmer cooperatives can enhance smallholder productivity and resilience. Finally, attracting foreign investment and fostering public-private partnerships can stimulate growth and innovation within the sector.

Major Players in the Angola Agriculture Industry Ecosystem

- Syngenta Group

- Pioneer Hi-Bred International

- Monsanto Company

- Bayer CropScience

- Cargill

Key Developments in Angola Agriculture Industry Industry

- 2022 Q4: Launch of a government initiative to promote sustainable agriculture practices.

- 2023 Q1: Significant investment by a private company in a new agricultural processing facility.

- 2023 Q3: Introduction of a new high-yielding maize variety adapted to Angolan conditions.

- [Year] [Month]: [Specific development and its impact]

- [Year] [Month]: [Specific development and its impact]

Strategic Angola Agriculture Industry Market Forecast

The Angolan agriculture sector is poised for substantial growth in the coming years, driven by strong domestic demand, supportive government policies, and increased investments in technology and infrastructure. While challenges remain, the sector's potential to contribute significantly to economic diversification and food security is undeniable. The forecast predicts a continued increase in production and value, creating opportunities for domestic and international investors, as well as boosting the livelihoods of Angolan farmers. The long-term outlook is positive, provided that the necessary investments in research and development, infrastructure, and farmer support are made.

Angola Agriculture Industry Segmentation

- 1. Cereals and Grains

- 2. Pulses and Oilseeds

- 3. Fruits and Vegetables

- 4. Commercial Crops

- 5. Cereals and Grains

- 6. Pulses and Oilseeds

- 7. Fruits and Vegetables

- 8. Commercial Crops

Angola Agriculture Industry Segmentation By Geography

- 1. Angola

Angola Agriculture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Favorable Government Policies Encouraging Agricultural Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cereals and Grains

- 5.2. Market Analysis, Insights and Forecast - by Pulses and Oilseeds

- 5.3. Market Analysis, Insights and Forecast - by Fruits and Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Commercial Crops

- 5.5. Market Analysis, Insights and Forecast - by Cereals and Grains

- 5.6. Market Analysis, Insights and Forecast - by Pulses and Oilseeds

- 5.7. Market Analysis, Insights and Forecast - by Fruits and Vegetables

- 5.8. Market Analysis, Insights and Forecast - by Commercial Crops

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Cereals and Grains

- 6. UAE Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Syngenta Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pioneer Hi-Bred International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Monsanto Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bayer CropScience

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cargill

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Syngenta Group

List of Figures

- Figure 1: Angola Agriculture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Angola Agriculture Industry Share (%) by Company 2024

List of Tables

- Table 1: Angola Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 3: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 4: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 5: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 6: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 7: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 8: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 9: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 10: Angola Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Angola Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: UAE Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Saudi Arabia Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of MEA Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 17: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 18: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 19: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 20: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 21: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 22: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 23: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 24: Angola Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Agriculture Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Angola Agriculture Industry?

Key companies in the market include Syngenta Group , Pioneer Hi-Bred International, Monsanto Company , Bayer CropScience , Cargill.

3. What are the main segments of the Angola Agriculture Industry?

The market segments include Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Favorable Government Policies Encouraging Agricultural Production.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Agriculture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Agriculture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Agriculture Industry?

To stay informed about further developments, trends, and reports in the Angola Agriculture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence