Key Insights

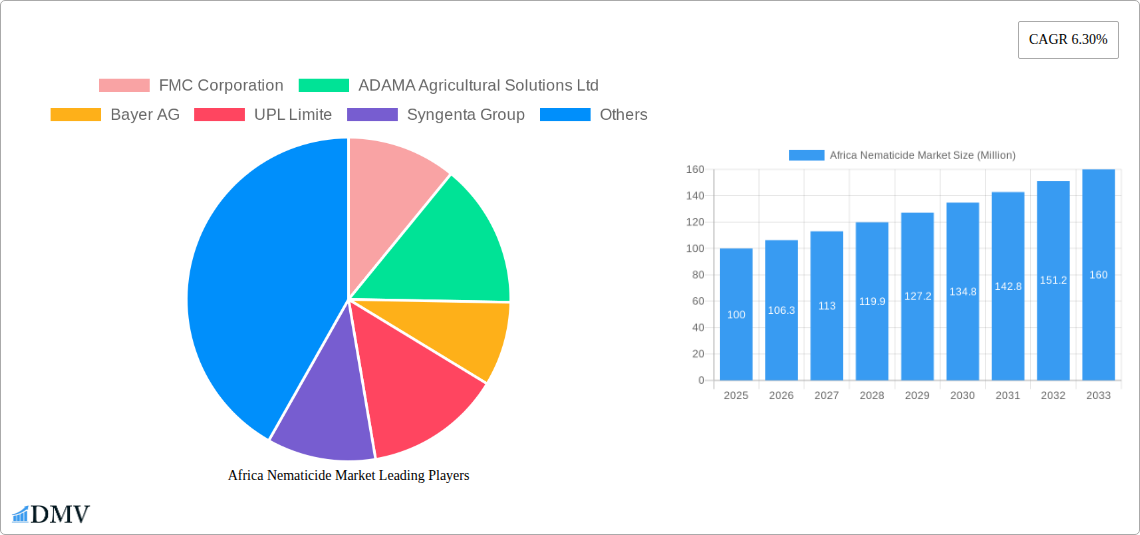

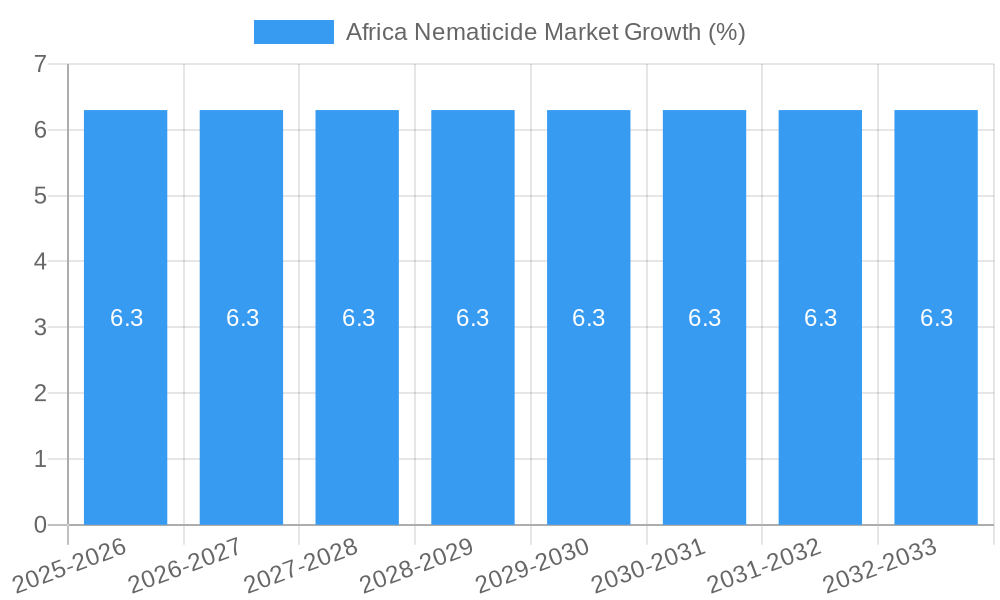

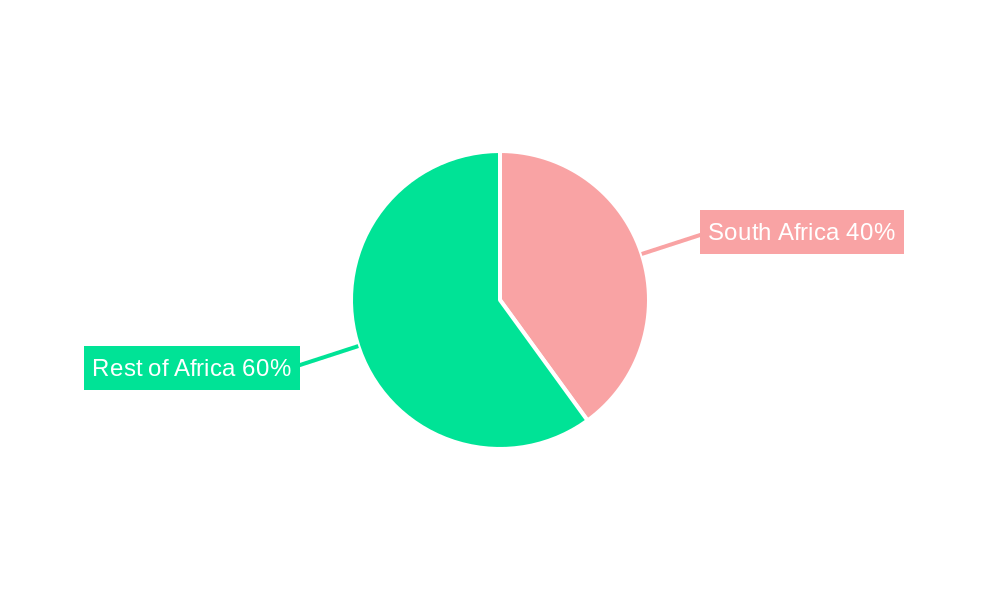

The African nematicide market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is driven by several key factors. Increasing agricultural intensification across the continent necessitates effective pest management strategies, with nematodes posing a significant threat to crop yields. The rising demand for high-quality food and agricultural produce, coupled with growing awareness of nematode-related crop losses, fuels the adoption of nematicides. Government initiatives promoting sustainable agricultural practices and improved crop protection are further contributing to market growth. South Africa currently dominates the regional market due to its advanced agricultural infrastructure and higher adoption rates of modern pest management techniques. However, significant growth potential exists in other African nations as agricultural practices modernize and awareness of nematode control increases. The market is segmented by application mode (chemigation, foliar, fumigation, seed treatment, soil treatment) and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), reflecting the diverse agricultural landscape of Africa. Key players like FMC Corporation, Adama Agricultural Solutions Ltd, Bayer AG, UPL Limited, and Syngenta Group are actively involved in catering to this growing demand, introducing innovative nematicide formulations and enhancing distribution networks across the continent.

Market restraints include the high cost of nematicides, particularly for smallholder farmers, and concerns surrounding their environmental impact. The need for sustainable and environmentally friendly nematicide alternatives, such as bio-pesticides, is growing, presenting both a challenge and an opportunity for market players. Furthermore, variations in agricultural practices and infrastructure across different African countries influence the market's growth trajectory. The market's future hinges on addressing these challenges through targeted research and development, the promotion of integrated pest management strategies, and facilitating access to cost-effective nematicide solutions for smallholder farmers. The forecast period (2025-2033) anticipates continued growth, driven by increasing awareness, technological advancements, and supportive government policies.

Africa Nematicide Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Africa Nematicide Market, offering crucial data and forecasts for stakeholders from 2019 to 2033. The study covers market size, segmentation, competitive landscape, and future growth projections, empowering businesses to make informed strategic decisions. With a base year of 2025 and an estimated market value of xx Million, this report is an indispensable resource for understanding the dynamic forces shaping this vital sector.

Africa Nematicide Market Composition & Trends

This section dissects the structure and dynamics of the Africa nematicide market. We analyze market concentration, revealing the market share distribution amongst key players like FMC Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limited, and Syngenta Group. The report delves into innovation catalysts, examining the role of R&D investments (like ADAMA's October 2021 investment in a new chemist's center) in driving product development and market expansion. We also explore the regulatory landscape, identifying key policies influencing market access and product registration. The impact of substitute products, including bio-nematicides and integrated pest management strategies, is assessed. Further, the report profiles end-users, focusing on their needs and preferences across various crop types. Finally, a detailed examination of mergers and acquisitions (M&A) activities, including deal values and their implications for market consolidation, is presented.

- Market Concentration: xx% concentrated amongst top 5 players in 2024, projected to xx% by 2033.

- M&A Activity: Analysis of significant deals, including deal values (e.g., ADAMA's acquisition of Huifeng in May 2021 valued at xx Million).

- Regulatory Landscape: Assessment of key regulations impacting nematicide usage and registration across different African countries.

- Innovation Catalysts: Detailed analysis of R&D investments and their contribution to technological advancements.

Africa Nematicide Market Industry Evolution

This section charts the evolution of the Africa nematicide market from 2019 to 2033, providing a granular view of its growth trajectory. We analyze historical data (2019-2024) and present a forecast (2025-2033) for market size and growth rates, segmented by application mode and crop type. We examine the influence of technological advancements, such as the development of novel nematicide formulations and application technologies, and how these are driving market growth. We also assess the impact of shifting consumer preferences, focusing on the increasing demand for sustainable and eco-friendly nematicide solutions, like those promoted by Bayer's partnership with Oerth Bio (January 2023). The analysis incorporates factors such as evolving agricultural practices, climate change impacts, and the increasing awareness of nematicide resistance. Specific data points such as annual growth rates for different segments and adoption rates of new technologies are provided. The report further investigates the influence of changing farming practices and the growing adoption of precision agriculture techniques.

Leading Regions, Countries, or Segments in Africa Nematicide Market

This section pinpoints the leading regions, countries, and segments within the African nematicide market. We analyze market dominance factors for South Africa and the Rest of Africa, considering key drivers across different application modes (Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment) and crop types (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental).

- South Africa:

- Key Drivers: High agricultural production, established infrastructure, and relatively advanced regulatory frameworks.

- Dominance Factors: Large-scale commercial farming operations, high nematicide adoption rates.

- Rest of Africa:

- Key Drivers: Growing agricultural sector, increasing investment in agricultural infrastructure, rising awareness of nematode damage.

- Dominance Factors: Expansion of commercial farming, increasing demand for high-yielding crops.

- Leading Application Mode: Soil Treatment (xx% market share in 2024, projected to increase to xx% by 2033) driven by its effectiveness and ease of application.

- Leading Crop Type: Fruits & Vegetables (xx% market share in 2024, projected to increase to xx% by 2033) due to high value and susceptibility to nematode damage.

Africa Nematicide Market Product Innovations

This section highlights recent product innovations in the Africa nematicide market. We examine new formulations, application technologies, and their performance metrics, focusing on unique selling propositions (USPs) and technological advancements that improve efficacy, reduce environmental impact, and enhance farmer usability. This includes a discussion of the trend toward bio-nematicides and other environmentally friendly solutions.

Propelling Factors for Africa Nematicide Market Growth

Several factors are driving the growth of the Africa nematicide market. These include the increasing prevalence of nematodes affecting various crops, leading to significant yield losses. The expansion of commercial agriculture across the continent is another key driver, alongside rising investments in agricultural infrastructure and technology. Government initiatives promoting sustainable agricultural practices also play a role. Furthermore, the growing awareness among farmers about the benefits of nematicide use contributes to market expansion.

Obstacles in the Africa Nematicide Market

The Africa nematicide market faces challenges, including stringent regulatory approvals for new nematicides, impacting market entry and expansion. Supply chain disruptions, particularly during times of geopolitical instability or adverse weather events, can impact product availability and pricing. Furthermore, intense competition among existing players can exert pressure on profit margins. The high cost of certain nematicides can also limit accessibility for smallholder farmers.

Future Opportunities in Africa Nematicide Market

The Africa nematicide market presents significant opportunities. The increasing adoption of precision agriculture and integrated pest management (IPM) strategies creates demand for sophisticated nematicide application technologies. The rising awareness of environmentally friendly nematicides offers opportunities for biopesticide manufacturers. Untapped markets in less-developed regions represent a significant potential for growth. Expansion into new crop types and applications (e.g., using nematicides for turf and ornamental plants) also creates future opportunities.

Major Players in the Africa Nematicide Market Ecosystem

Key Developments in Africa Nematicide Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio, leading to more sustainable crop protection solutions and potentially impacting market competition.

- October 2021: ADAMA's investment in a new chemist's center boosted R&D, indicating a commitment to innovation within the nematicide sector.

- May 2021: ADAMA's acquisition of a 51% stake in Huifeng's crop protection facilities strengthened its global product line and market position.

Strategic Africa Nematicide Market Forecast

The Africa nematicide market is poised for significant growth over the forecast period (2025-2033), driven by factors such as increasing agricultural production, rising investments in agricultural infrastructure, and the growing adoption of modern farming practices. The demand for sustainable and eco-friendly nematicides will continue to increase, creating opportunities for innovative products and technologies. The market is expected to witness further consolidation through M&A activity, shaping the competitive landscape and driving further growth. The expanding use of precision agriculture techniques will drive demand for advanced nematicide application technologies.

Africa Nematicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Africa Nematicide Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Nematicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. The focus of African farmers on nematode management to achieve optimal crop health and maximize yield is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. South Africa Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Nematicide Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 FMC Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ADAMA Agricultural Solutions Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bayer AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 UPL Limite

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Syngenta Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 FMC Corporation

List of Figures

- Figure 1: Africa Nematicide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Nematicide Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Nematicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Nematicide Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Africa Nematicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 4: Africa Nematicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 5: Africa Nematicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: Africa Nematicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 7: Africa Nematicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 8: Africa Nematicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 9: Africa Nematicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 10: Africa Nematicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 11: Africa Nematicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Africa Nematicide Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Africa Nematicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Africa Nematicide Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: South Africa Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Sudan Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Sudan Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Uganda Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Uganda Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Tanzania Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Kenya Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Rest of Africa Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Africa Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Africa Nematicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 28: Africa Nematicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 29: Africa Nematicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 30: Africa Nematicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 31: Africa Nematicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 32: Africa Nematicide Market Volume Kiloton Forecast, by Application Mode 2019 & 2032

- Table 33: Africa Nematicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 34: Africa Nematicide Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 35: Africa Nematicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Africa Nematicide Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: Nigeria Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nigeria Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: South Africa Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Egypt Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Egypt Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: Kenya Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Kenya Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Ethiopia Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ethiopia Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Morocco Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Morocco Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Ghana Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ghana Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Algeria Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Algeria Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Tanzania Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Tanzania Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Ivory Coast Africa Nematicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Ivory Coast Africa Nematicide Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Nematicide Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Africa Nematicide Market?

Key companies in the market include FMC Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group.

3. What are the main segments of the Africa Nematicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

The focus of African farmers on nematode management to achieve optimal crop health and maximize yield is expected to drive the market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.May 2021: ADAMA acquired 51% ownership of Huifeng's crop protection manufacturing facilities, resulting in a stronger global product line for the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Nematicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Nematicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Nematicide Market?

To stay informed about further developments, trends, and reports in the Africa Nematicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence