Key Insights

The Vietnam aquafeed market, projected to reach $2.63 billion by 2025, is anticipated to grow at a CAGR of 4.6% between 2025 and 2033. This growth is driven by the expanding Vietnamese aquaculture sector, propelled by rising global seafood demand and government support for sustainable practices. Increased consumer preference for protein and omega-3 rich seafood, coupled with technological advancements in feed formulation for enhanced digestibility and reduced environmental impact, are key growth enablers. The adoption of intensive farming and heightened awareness of high-quality feed's role in fish health also contribute significantly. Challenges include raw material price volatility, stringent regulations, and disease impact. The competitive landscape features established players like Charoen Pokphand Group and Archer Daniels Midland Co., alongside emerging specialized firms. Market segmentation by feed type and species offers opportunities for tailored solutions to meet diverse nutritional needs.

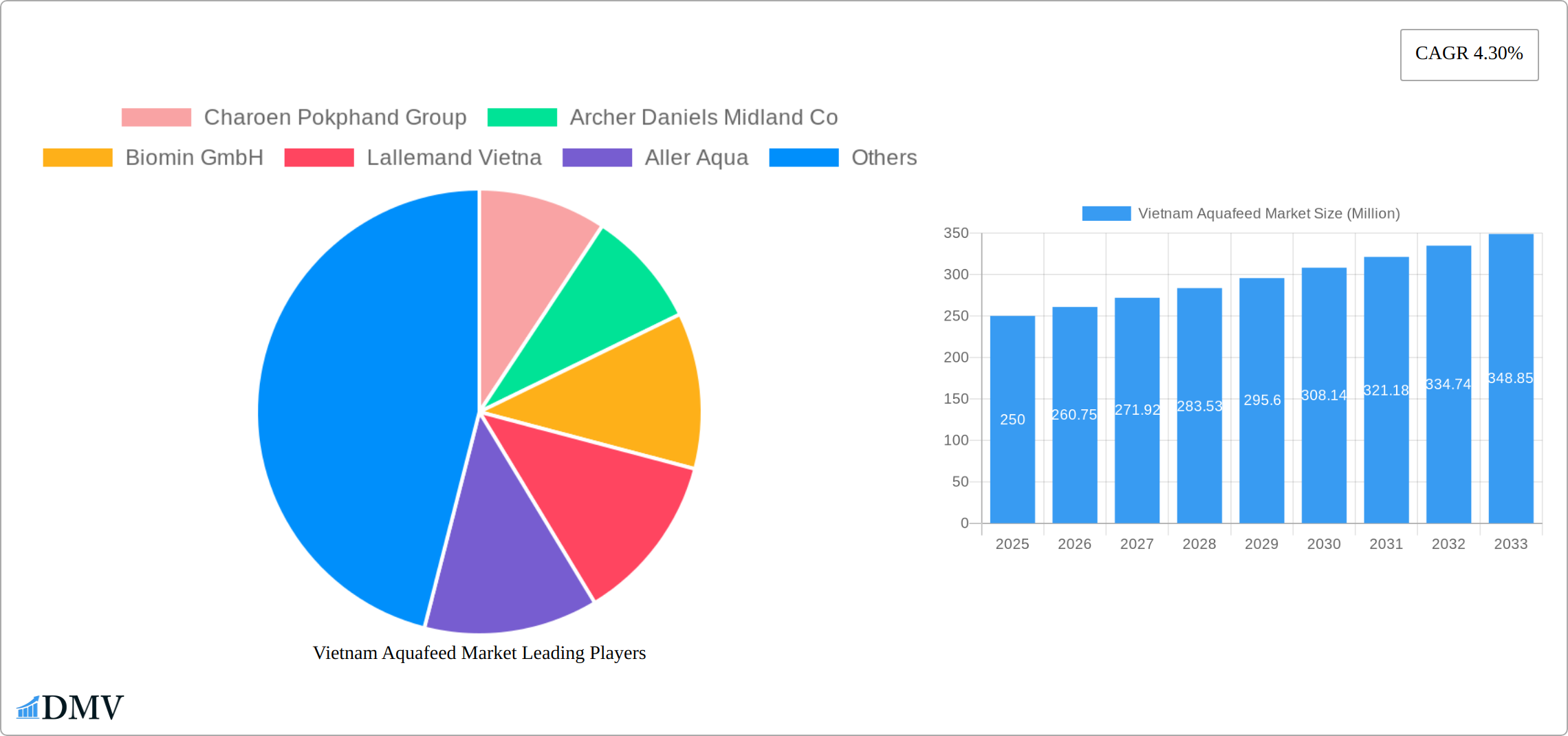

Vietnam Aquafeed Market Market Size (In Billion)

The forecast period of 2025-2033 indicates substantial growth potential. The market's localization within Vietnam underscores its reliance on domestic aquaculture. The base year of 2025 provides a critical benchmark for future market projections. Historical data analysis from 2019-2024 informs and refines these forecasts. The competitive environment, comprising global and local entities, suggests a dynamic market ripe for both established and new entrants. Granular segmentation by feed type and species provides deeper insights into market demands.

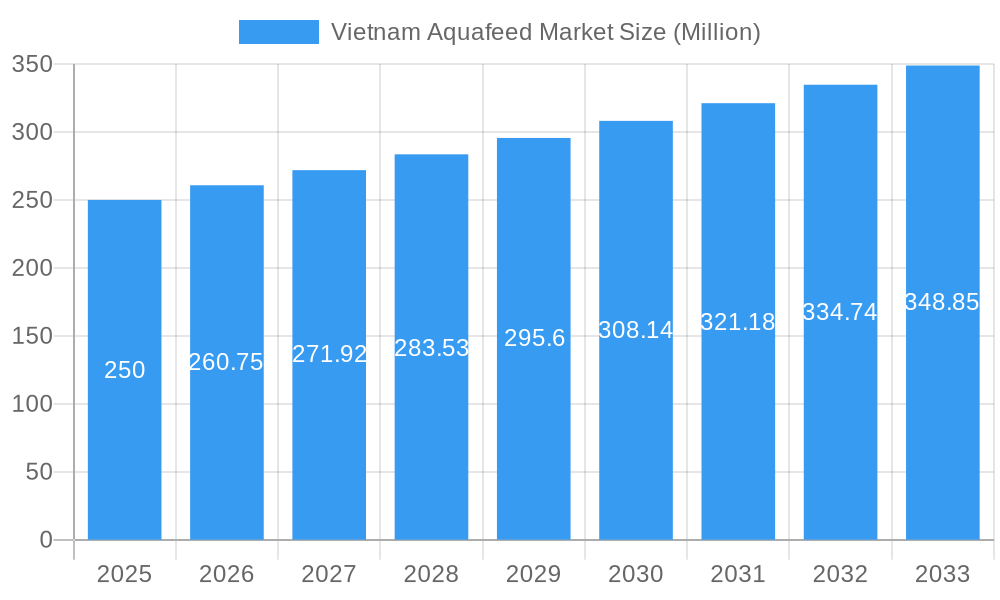

Vietnam Aquafeed Market Company Market Share

Vietnam Aquafeed Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Vietnam aquafeed market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions within this burgeoning sector. The market is projected to reach xx Million USD by 2033, demonstrating significant growth potential.

Vietnam Aquafeed Market Composition & Trends

The Vietnam aquafeed market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Charoen Pokphand Group, Cargill Inc, and De Heus LLC are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. Innovation is driven by the increasing demand for sustainable and high-performance aquafeed, prompting the adoption of advanced technologies in feed formulation and production. The regulatory landscape is evolving, with a focus on enhancing feed safety and quality. Substitute products, such as insect-based protein sources, are gaining traction, while M&A activities are shaping market dynamics. Deal values in recent years have averaged xx Million USD, reflecting the industry's consolidation trend.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share (2025).

- Innovation Catalysts: Demand for sustainable and high-performance feeds, technological advancements in feed formulation.

- Regulatory Landscape: Evolving towards stricter feed safety and quality standards.

- Substitute Products: Increased adoption of insect-based and other alternative protein sources.

- M&A Activity: Significant M&A activity, with average deal values of xx Million USD in recent years.

- End-User Profile: Primarily composed of large-scale aquaculture farms and smaller independent producers.

Vietnam Aquafeed Market Industry Evolution

The Vietnam aquafeed market is on a significant growth trajectory, underpinned by the burgeoning aquaculture industry and a consistently rising demand for seafood products from both domestic and international consumers. The market experienced a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period spanning 2019-2024. Projections indicate a continued upward trend, with an anticipated CAGR of XX% during the forecast period from 2025 to 2033. This expansion is being propelled by several key factors. Technological innovations, including the implementation of advanced precision feeding systems and sophisticated feed formulation techniques, are playing a pivotal role in optimizing feed conversion ratios and consequently reducing overall production costs for aquafeed manufacturers. Concurrently, evolving consumer preferences are increasingly leaning towards seafood that is perceived as healthier and produced through sustainable practices, thereby creating a strong demand for premium and high-quality aquafeed solutions. The integration of cutting-edge technologies such as automation and data analytics into feed production processes is further enhancing operational efficiency and boosting productivity. Moreover, a heightened global and local awareness regarding the importance of sustainable aquaculture is a significant driver, fostering a greater demand for environmentally responsible and eco-friendly aquafeed products.

Leading Regions, Countries, or Segments in Vietnam Aquafeed Market

The Mekong Delta region dominates the Vietnam aquafeed market, accounting for approximately xx% of total consumption in 2025. This dominance is driven by several factors:

- High Aquaculture Production: The Mekong Delta is a major center for aquaculture production in Vietnam, particularly for shrimp and catfish.

- Government Support: Significant government investments in aquaculture development in the region, including the USD 149 million initiative launched in September 2021.

- Favorable Climate: The region's climate is conducive to aquaculture, leading to high production yields.

- Established Infrastructure: Well-developed infrastructure supporting feed production and distribution.

- Concentrated Feed Producers: Many major aquafeed producers are located in or near the Mekong Delta, facilitating efficient distribution.

Within feed types, shrimp feed holds the largest market share, followed by catfish and other finfish. This is largely due to the significant production volumes of shrimp and catfish in Vietnam.

Vietnam Aquafeed Market Product Innovations

Recent innovations in Vietnam's aquafeed market focus on improving feed efficiency, sustainability, and product quality. New feed formulations incorporate alternative protein sources to reduce reliance on traditional fishmeal and soymeal. Precision feeding technologies and data analytics are being deployed to optimize feed delivery and reduce waste. The development of functional feeds enriched with probiotics and immunostimulants is enhancing fish health and disease resistance. These innovations are aimed at improving profitability for aquaculture producers and contributing to the sustainability of the aquaculture industry.

Propelling Factors for Vietnam Aquafeed Market Growth

Several factors are driving growth in the Vietnam aquafeed market. These include:

- Expansion of Aquaculture: Vietnam's aquaculture sector is expanding rapidly, increasing the demand for aquafeed.

- Rising Seafood Consumption: Growing domestic and international demand for seafood.

- Government Support: Government initiatives aimed at promoting sustainable aquaculture practices.

- Technological Advancements: Innovations in feed formulation and production are improving feed efficiency and quality.

- Increasing Investment: Foreign and domestic investments in the aquaculture sector are boosting production and driving feed demand.

Obstacles in the Vietnam Aquafeed Market

The Vietnam aquafeed market faces some challenges, including:

- Regulatory hurdles: Stricter regulations related to feed safety and environmental protection can increase compliance costs.

- Supply chain disruptions: Global supply chain disruptions can affect the availability and price of raw materials.

- Competition: Intense competition among aquafeed producers can put pressure on profit margins.

- Disease outbreaks: Disease outbreaks in aquaculture can significantly impact feed demand.

- Climate change: The impact of climate change on aquaculture production could affect feed demand.

Future Opportunities in Vietnam Aquafeed Market

The Vietnam aquafeed market is poised for continued expansion, presenting a multitude of promising opportunities for stakeholders:

- Diversification into High-Value Species Aquaculture: The escalating global and domestic demand for premium seafood species such as groupers and cobia presents a substantial opportunity for the development and supply of specialized aquafeeds tailored to the unique nutritional requirements of these species, commanding higher market values.

- Catalyzing Sustainable Aquaculture Practices: With a growing global consumer consciousness and preference for seafood produced through environmentally sound and sustainable methods, there is an increasing demand for eco-friendly aquafeed products. Manufacturers focusing on sustainable sourcing, production, and reduced environmental impact will find a receptive market.

- Innovation in Functional Feeds: The demand for aquafeeds that go beyond basic nutrition to actively enhance fish health, improve immune response, and bolster disease resistance is on the rise. Investing in research and development for functional feeds with added benefits like probiotics, prebiotics, and immune stimulants offers a significant avenue for growth.

- Embracing Technological Advancements: Continuous innovation in feed formulation science, coupled with the adoption of advanced production technologies like extrusion, pelleting, and micronutrient encapsulation, will be crucial for increasing feed efficiency, minimizing nutrient loss, and further reducing production costs.

- Strategic Expansion into Emerging Markets: As Vietnam continues to strengthen its position as a major seafood exporter, there is a parallel opportunity to expand the reach of domestic aquafeed production. Identifying and penetrating new export markets with specific quality and certification requirements will drive demand for high-standard aquafeed.

- Vertical Integration and Value Chain Optimization: Opportunities exist for greater vertical integration within the aquafeed value chain, from raw material sourcing to end-product development, leading to improved cost control and enhanced product quality.

Major Players in the Vietnam Aquafeed Market Ecosystem

- Charoen Pokphand Group

- Archer Daniels Midland Co

- Biomin GmbH

- Lallemand Vietnam

- Aller Aqua

- Nutreco NV

- BASF SE

- De Heus LLC

- Altech Inc

- Cargill Inc

- INVE Aquaculture Inc

Key Developments in Vietnam Aquafeed Market Industry

- November 2022: Skretting, a global leader in aquafeed, further solidified its presence in Vietnam with the inauguration of its new fish feed factory, Lotus II. This state-of-the-art facility boasts an impressive annual production capacity of 100,000 tons, significantly contributing to the domestic supply of high-quality fish feed and supporting the growth of Vietnam's aquaculture sector.

- June 2022: Sheng Long Group, a prominent Vietnam-based entity, announced the successful opening of a new aquafeed mill. This strategic expansion by Sheng Long Group directly addresses the increasing demand for aquafeed by augmenting domestic production capacity and strengthening the local supply chain.

- September 2021: The Vietnamese Ministry of Agriculture and Rural Development unveiled a substantial initiative, a USD 149 Million investment aimed at catalyzing the development of the aquaculture sector, particularly within the vital Mekong Delta region. This significant governmental backing is expected to foster increased investment, encourage technological adoption, and ultimately boost demand and growth across the entire aquafeed market value chain.

- Ongoing Innovations in Ingredient Sourcing: The industry is witnessing a growing trend towards utilizing alternative and sustainable protein sources, such as insect meal and algae, in aquafeed formulations to reduce reliance on traditional fishmeal and soy, thereby contributing to more environmentally responsible aquaculture.

- Digitalization of Feed Management: Companies are increasingly adopting digital platforms and software solutions for inventory management, production planning, and quality control in aquafeed manufacturing, leading to enhanced operational efficiency and data-driven decision-making.

Strategic Vietnam Aquafeed Market Forecast

The Vietnam aquafeed market is poised for continued strong growth, driven by the expanding aquaculture sector, rising seafood consumption, and supportive government policies. Technological advancements and the adoption of sustainable practices will further shape market dynamics. The market's robust growth trajectory, coupled with increasing investments and innovations, presents significant opportunities for both established players and new entrants. The projected market value of xx Million USD by 2033 underscores the substantial potential of this dynamic market.

Vietnam Aquafeed Market Segmentation

-

1. Feed Type

-

1.1. Species

- 1.1.1. White Leg Shrimp (Litopenaeus vannamei)

- 1.1.2. Giant Tiger Prawn (Penaeus Monodon)

- 1.1.3. Pangasius

- 1.1.4. Carp

- 1.1.5. Catfish

- 1.1.6. Tilapia

- 1.1.7. Other Species

-

1.1. Species

Vietnam Aquafeed Market Segmentation By Geography

- 1. Vietnam

Vietnam Aquafeed Market Regional Market Share

Geographic Coverage of Vietnam Aquafeed Market

Vietnam Aquafeed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Export Demand for Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 5.1.1. Species

- 5.1.1.1. White Leg Shrimp (Litopenaeus vannamei)

- 5.1.1.2. Giant Tiger Prawn (Penaeus Monodon)

- 5.1.1.3. Pangasius

- 5.1.1.4. Carp

- 5.1.1.5. Catfish

- 5.1.1.6. Tilapia

- 5.1.1.7. Other Species

- 5.1.1. Species

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Charoen Pokphand Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Archer Daniels Midland Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biomin GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lallemand Vietna

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aller Aqua

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutreco NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 De Heus LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Altech Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 INVE Aquaculture Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Charoen Pokphand Group

List of Figures

- Figure 1: Vietnam Aquafeed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Aquafeed Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Aquafeed Market Revenue billion Forecast, by Feed Type 2020 & 2033

- Table 2: Vietnam Aquafeed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Vietnam Aquafeed Market Revenue billion Forecast, by Feed Type 2020 & 2033

- Table 4: Vietnam Aquafeed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Aquafeed Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Vietnam Aquafeed Market?

Key companies in the market include Charoen Pokphand Group, Archer Daniels Midland Co, Biomin GmbH, Lallemand Vietna, Aller Aqua, Nutreco NV, BASF SE, De Heus LLC, Altech Inc, Cargill Inc, INVE Aquaculture Inc.

3. What are the main segments of the Vietnam Aquafeed Market?

The market segments include Feed Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in Export Demand for Aquaculture Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Skretting opened its new fish feed factory, Lotus II, in Vietnam. The fish feed factory consists of two independent lines with a production capacity of 100,000 tons per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Aquafeed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Aquafeed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Aquafeed Market?

To stay informed about further developments, trends, and reports in the Vietnam Aquafeed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence