Key Insights

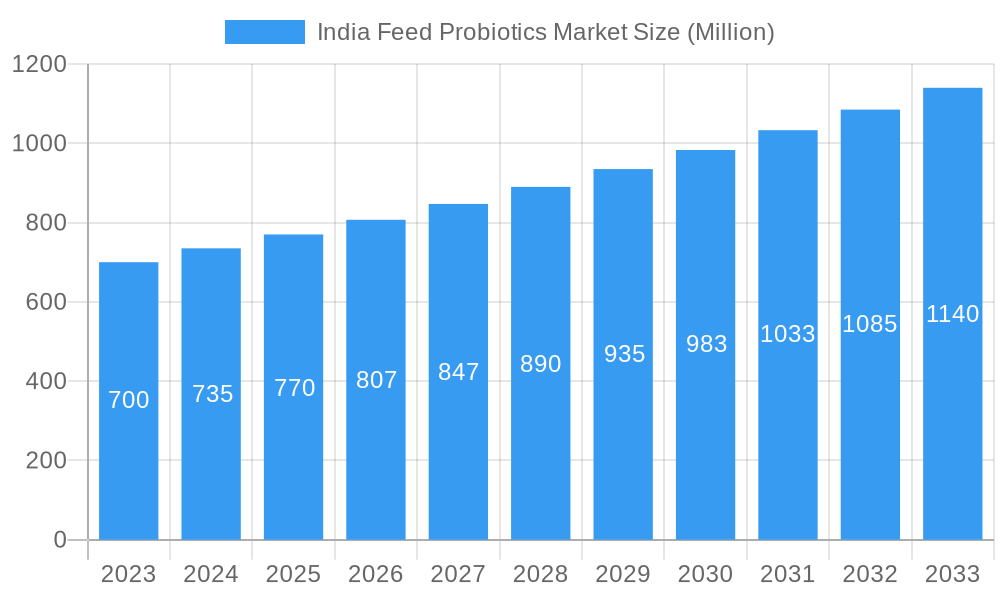

The Indian feed probiotics market is projected for significant expansion, with an estimated market size of 98.4 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.71%. This growth is driven by rising demand for animal protein, increasing farmer awareness of probiotic benefits for animal health and productivity, and the adoption of sustainable, antibiotic-free farming. The poultry segment, especially broilers and layers, is expected to lead, while aquaculture shows emerging potential for improved feed efficiency and disease reduction. Key probiotic strains such as Lactobacilli, Bifidobacteria, and Enterococcus are recognized for enhancing gut health, nutrient absorption, and immune function.

India Feed Probiotics Market Market Size (In Million)

Supportive government initiatives for animal husbandry and food safety, coupled with R&D investments in novel probiotic formulations, further influence market trajectory. Challenges include the cost of premium products, limited farmer education in some areas, and stringent regulatory processes. Nevertheless, sustained demand for healthier animal products and the global shift towards natural growth promoters will continue to drive the Indian feed probiotics market. Leading companies like DSM Nutritional Products AG, Kemin Industries, and Chr. Hansen A/S are expanding portfolios and distribution to leverage these opportunities.

India Feed Probiotics Market Company Market Share

This report offers a comprehensive analysis of the India feed probiotics market, a vital sector for animal health, sustainable agriculture, and food security. Covering the base year of 2025 and a forecast period extending to 2033, this research provides critical insights into market dynamics, key players, and future trends to support strategic decision-making.

India Feed Probiotics Market Market Composition & Trends

The India feed probiotics market is characterized by a moderate to high level of concentration, with established global players vying for market share alongside emerging domestic manufacturers. Innovation is a primary catalyst, driven by the increasing demand for antibiotic-free animal production and the growing awareness of gut health's role in animal performance. Regulatory landscapes are evolving, with supportive government initiatives for animal health and welfare indirectly bolstering the probiotics sector. Substitute products, such as antibiotics and other feed additives, present a competitive challenge, but the long-term benefits of probiotics in reducing antibiotic resistance and improving animal well-being are increasingly recognized. End-user profiles are diverse, encompassing poultry farmers, dairy operations, aquaculture producers, and swine breeders, all seeking cost-effective and sustainable solutions. Mergers and acquisitions (M&A) activities, though currently at a nascent stage, are expected to intensify as companies seek to expand their product portfolios and geographic reach.

- Market Share Distribution: Dominated by a few key players, with a growing presence of specialized regional manufacturers.

- M&A Deal Values: Anticipated to rise significantly in the coming years as consolidation efforts gain momentum.

- Innovation Catalysts: Rising demand for antibiotic-free feed, enhanced animal performance, and environmental sustainability.

- Regulatory Landscapes: Favorable government policies promoting animal health and food safety are key drivers.

- Substitute Products: Antibiotics, prebiotics, organic acids, and enzymes continue to be competitive alternatives.

- End-User Profiles: Diverse, including poultry, aquaculture, dairy, and swine sectors, each with unique needs.

India Feed Probiotics Market Industry Evolution

The India feed probiotics market has witnessed remarkable evolution, transforming from a niche segment to a cornerstone of modern animal husbandry. Driven by a confluence of factors including the global push for antibiotic reduction, the escalating demand for animal protein, and a growing understanding of the intricate link between gut microbiota and animal health, the industry has experienced significant growth. Technological advancements in strain identification, fermentation processes, and encapsulation techniques have led to the development of highly effective and stable probiotic formulations. These advancements have not only enhanced the efficacy of probiotics in improving feed conversion ratios, reducing mortality rates, and bolstering immunity but have also addressed challenges related to storage and delivery.

Consumer demand for safer and healthier animal products, free from antibiotic residues, has been a pivotal influence. This shift in consumer preference is compelling feed manufacturers and animal producers to seek alternative solutions, with probiotics emerging as a preferred choice. The Indian government's increasing focus on animal health, biosecurity, and sustainable agricultural practices has further propelled the market. Initiatives promoting disease prevention and reducing the reliance on antibiotics have created a fertile ground for probiotic adoption. The market has also seen a rise in research and development activities aimed at identifying novel probiotic strains suited to the Indian environmental conditions and specific animal breeds, leading to customized solutions.

The integration of probiotics into animal feed is no longer viewed as a supplementary practice but as an integral component of animal nutrition and health management. This evolving perception, coupled with consistent product innovation and growing industry awareness, has cemented the trajectory of sustained growth for the India feed probiotics market. The market is projected to witness a compound annual growth rate (CAGR) of approximately 10-12% over the forecast period, reaching an estimated INR 5,500 Million by 2025. Adoption metrics are steadily increasing, with probiotics being incorporated into an estimated 25-30% of poultry feed formulations and 15-20% of aquaculture feed in major producing regions.

Leading Regions, Countries, or Segments in India Feed Probiotics Market

The India feed probiotics market is experiencing dynamic growth across its various segments, with Poultry emerging as the dominant animal sector. This dominance is driven by the sheer scale of the poultry industry in India, characterized by high production volumes, rapid growth cycles, and an increasing demand for efficient feed conversion and disease prevention. Within the poultry segment, Broilers represent the largest sub-segment, benefiting immensely from probiotic supplementation for faster growth, improved feed utilization, and reduced susceptibility to common poultry diseases. Layers also contribute significantly, with probiotics supporting egg production quality and hen health.

The Aquaculture segment is a rapidly growing contributor, fueled by India's vast coastline and inland water bodies, coupled with the rising global demand for seafood. Probiotics are crucial in aquaculture for maintaining water quality, preventing disease outbreaks in farmed species like fish and shrimp, and improving overall survival rates. The Ruminants segment, particularly Dairy Cattle, is also a significant area of growth, as probiotics are increasingly recognized for their role in improving digestive health, nutrient absorption, and milk production efficiency. The need to enhance milk yield and quality in the face of growing demand for dairy products is a key driver.

The Sub Additive segment of Lactobacilli and Bifidobacteria holds a substantial market share due to their well-established efficacy in improving gut health and immune function across various animal species. Enterococcus also plays a vital role, particularly in managing gut pathogens.

Dominant Animal Segment: Poultry (Broiler, Layer, Other Poultry Birds)

- Key Drivers: High production volume, rapid growth cycles, demand for improved feed efficiency, and a proactive approach to disease management.

- Investment Trends: Significant investments in poultry farming infrastructure and technology, including advanced feed formulations.

- Regulatory Support: Government focus on reducing antibiotic use in animal agriculture indirectly supports probiotic adoption in poultry.

- Adoption Metrics: Probiotics are increasingly becoming a standard additive in commercial poultry feed, with adoption rates estimated to be over 30% in key producing regions.

Emerging Animal Segment: Aquaculture (Fish, Shrimp, Other Aquaculture Species)

- Key Drivers: Growing domestic and export demand for seafood, increasing focus on sustainable aquaculture practices, and the need for disease control in intensive farming systems.

- Investment Trends: Growing private and public investments in aquaculture development and technology adoption.

- Regulatory Support: Emphasis on eco-friendly farming methods encourages the use of natural growth promoters like probiotics.

- Adoption Metrics: Rapidly increasing, with a significant portion of shrimp and fish feed now incorporating probiotics.

Dominant Sub-Additive: Lactobacilli & Bifidobacteria

- Key Drivers: Scientifically proven benefits for gut health, immune modulation, and pathogen inhibition across a wide range of animal species.

- Innovation Focus: Continuous research into specific strain combinations for targeted applications and improved stability.

- Market Penetration: High market penetration due to their long-standing reputation and broad applicability.

India Feed Probiotics Market Product Innovations

Product innovations in the India feed probiotics market are focused on developing highly effective, stable, and targeted probiotic solutions. Companies are investing in advanced encapsulation technologies to protect probiotic strains from harsh feed processing conditions and the acidic environment of the animal's gastrointestinal tract, thereby ensuring better viability and efficacy. Research into novel probiotic strains, isolated from indigenous sources or engineered for specific functionalities such as enhanced pathogen inhibition, improved nutrient digestion, and immune modulation, is a key area of development. Applications are expanding beyond gut health to encompass broader immune support, stress reduction, and even potential improvements in meat or milk quality. Performance metrics are being rigorously evaluated through in-vitro and in-vivo studies, demonstrating significant improvements in feed conversion ratios, reduced mortality, and enhanced growth rates.

Propelling Factors for India Feed Probiotics Market Growth

The India feed probiotics market is propelled by a confluence of powerful factors. The global and national imperative to reduce antibiotic usage in animal agriculture, driven by concerns over antimicrobial resistance, is a primary driver, making probiotics a crucial antibiotic alternative. The escalating demand for animal protein, coupled with a growing middle class in India, necessitates more efficient and sustainable animal production systems, where probiotics play a vital role in optimizing feed conversion and improving animal health. Increasing awareness among farmers and feed manufacturers about the scientific benefits of probiotics for gut health, immunity, and overall animal performance is fostering wider adoption. Furthermore, supportive government policies aimed at promoting animal welfare, food safety, and sustainable agricultural practices indirectly bolster the market. Technological advancements in probiotic strain selection, fermentation, and delivery systems are also enhancing product efficacy and accessibility, further driving growth.

Obstacles in the India Feed Probiotics Market Market

Despite the robust growth trajectory, the India feed probiotics market faces several obstacles. The cost of high-quality probiotic formulations can still be a deterrent for smaller farmers, impacting their adoption rates, especially in price-sensitive segments. Lack of widespread awareness and education among a segment of the farming community regarding the specific benefits and proper usage of probiotics remains a challenge. The availability of counterfeit or substandard products in the market can erode consumer trust and hinder the adoption of genuine, high-efficacy probiotics. Stringent regulatory pathways for novel probiotic strains and their applications, although evolving, can sometimes slow down the introduction of new products. Additionally, logistical challenges related to maintaining the cold chain for certain probiotic products in a vast and diverse country like India can impact product integrity and efficacy.

Future Opportunities in India Feed Probiotics Market

The India feed probiotics market is ripe with future opportunities. The increasing demand for antibiotic-free and natural animal products presents a significant avenue for growth, as consumers and regulators push for healthier food chains. Expansion into niche animal segments, such as specialized breeding stock or exotic animals, offers untapped potential. The development of multi-strain probiotics tailored for specific regional challenges, animal breeds, and feed types can cater to a more diverse customer base. Furthermore, the integration of probiotics with other feed additives and advancements in precision nutrition can lead to synergistic effects, creating premium product offerings. The growing emphasis on gut microbiome research opens doors for personalized probiotic solutions that address specific health and performance issues in livestock and poultry.

Major Players in the India Feed Probiotics Market Ecosystem

- DSM Nutritional Products AG

- Kemin Industries

- Evonik Industries AG

- Marubeni Corporation (Orffa International Holding B V)

- Blue Aqua International Co Ltd

- Kerry Group PLC

- Cargill Inc

- CHR Hansen A/S

- IFF(Danisco Animal Nutrition)

- Adisseo

Key Developments in India Feed Probiotics Market Industry

- October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries, indirectly benefiting probiotic integration strategies.

- July 2022: Kemin Industries has introduced Enterosure probiotic products to control the growth of pathogenic bacteria in poultry and livestock, enhancing their portfolio for disease prevention.

- September 2021: Orffa expanded its aquaculture portfolio by introducing three product lines that consist of ingredients and specialties, including unique blends of branded additives, strengthening their presence in a key growth segment.

Strategic India Feed Probiotics Market Market Forecast

The India feed probiotics market is poised for robust growth driven by an increasing demand for antibiotic-free animal production and a heightened focus on animal health and sustainability. The market will likely witness significant expansion as farmers and feed manufacturers recognize the long-term economic and health benefits of probiotics in improving feed efficiency, reducing disease incidence, and enhancing overall animal performance. Continued investment in research and development will lead to the introduction of more targeted and effective probiotic strains, catering to the diverse needs of India's animal agriculture sector. Emerging opportunities in aquaculture and ruminant segments, coupled with favorable government initiatives, will further propel market penetration. The strategic implementation of innovative marketing strategies and educational outreach programs will be crucial for overcoming existing barriers and capitalizing on the immense potential of this market. The market is projected to reach an estimated INR 7,000 Million by 2030.

India Feed Probiotics Market Segmentation

-

1. Sub Additive

- 1.1. Bifidobacteria

- 1.2. Enterococcus

- 1.3. Lactobacilli

- 1.4. Pediococcus

- 1.5. Streptococcus

- 1.6. Other Probiotics

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Dairy Cattle

- 2.3.2. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

India Feed Probiotics Market Segmentation By Geography

- 1. India

India Feed Probiotics Market Regional Market Share

Geographic Coverage of India Feed Probiotics Market

India Feed Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Bifidobacteria

- 5.1.2. Enterococcus

- 5.1.3. Lactobacilli

- 5.1.4. Pediococcus

- 5.1.5. Streptococcus

- 5.1.6. Other Probiotics

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Dairy Cattle

- 5.2.3.2. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DSM Nutritional Products AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kemin Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evonik Industries AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marubeni Corporation (Orffa International Holding B V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Aqua International Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Group PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CHR Hansen A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DSM Nutritional Products AG

List of Figures

- Figure 1: India Feed Probiotics Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Feed Probiotics Market Share (%) by Company 2025

List of Tables

- Table 1: India Feed Probiotics Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 2: India Feed Probiotics Market Revenue million Forecast, by Animal 2020 & 2033

- Table 3: India Feed Probiotics Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Feed Probiotics Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 5: India Feed Probiotics Market Revenue million Forecast, by Animal 2020 & 2033

- Table 6: India Feed Probiotics Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feed Probiotics Market?

The projected CAGR is approximately 5.71%.

2. Which companies are prominent players in the India Feed Probiotics Market?

Key companies in the market include DSM Nutritional Products AG, Kemin Industries, Evonik Industries AG, Marubeni Corporation (Orffa International Holding B V, Blue Aqua International Co Ltd, Kerry Group PLC, Cargill Inc, CHR Hansen A/S, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the India Feed Probiotics Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.July 2022: Kemin Industries has introduced Enterosure probiotic products to control the growth of pathogenic bacteria in poultry and livestock.September 2021: Orffa expanded its aquaculture portfolio by introducing three product lines that consist of ingredients and specialties. This product consists of a unique blend of branded additives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feed Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feed Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feed Probiotics Market?

To stay informed about further developments, trends, and reports in the India Feed Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence