Key Insights

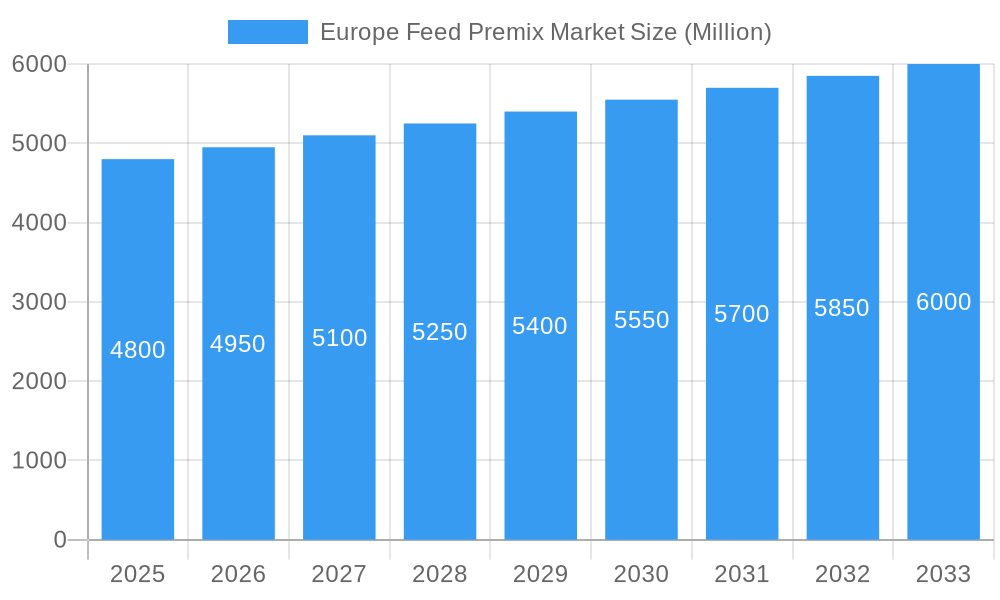

The European Feed Premix Market is forecast to achieve a valuation of approximately 98.2 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 10.4% from its 2025 base year. This growth is primarily driven by the increasing global demand for animal protein, which necessitates optimized animal nutrition and health for enhanced productivity and disease prevention. The adoption of scientifically formulated feed premixes, providing a balanced array of essential vitamins, minerals, amino acids, and antioxidants, is crucial for improving animal growth, feed conversion, and overall livestock well-being. Stringent European regulations on animal health and food safety also compel significant investment in high-quality premixes to ensure compliance and the production of safe animal products. Furthermore, farmers are increasingly recognizing the economic advantages of advanced premixes, including reduced veterinary expenses and higher yields, contributing to market expansion.

Europe Feed Premix Market Market Size (In Billion)

Market segmentation highlights the dominance of the Poultry and Ruminant segments, key contributors to European meat and dairy output. Their focus on optimizing feed efficiency and minimizing environmental impact will further drive demand for specialized premixes. Emerging trends include innovations in ingredient technology, such as functional ingredients like probiotics, prebiotics, and enzymes, aimed at improving gut health, nutrient digestibility, and immune function for healthier livestock and more sustainable agriculture. However, potential restraints include fluctuating raw material prices and concerns over antibiotic resistance, which may favor antibiotic-free premix solutions. Despite these challenges, the persistent drive towards precision nutrition and sustainable animal agriculture is expected to propel the European Feed Premix Market forward.

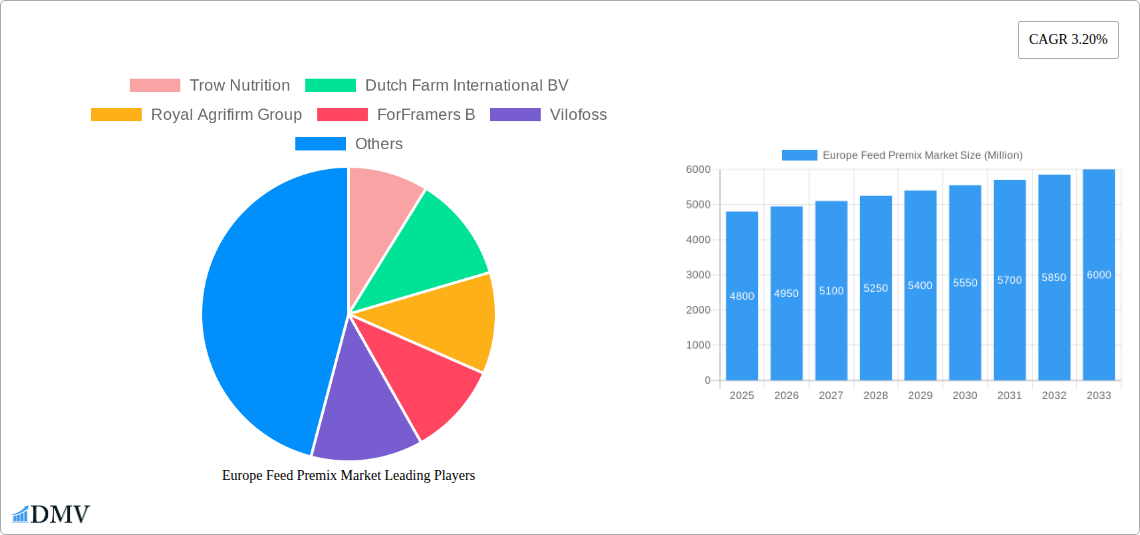

Europe Feed Premix Market Company Market Share

Europe Feed Premix Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a strategic analysis of the Europe Feed Premix Market, dissecting its current landscape, historical trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025–2033, this report equips stakeholders with critical insights into market dynamics, key players, and growth drivers. Our extensive research delves into segmentation by animal type (Ruminant, Poultry, Swine, Aquaculture, Other Animal Types) and ingredient (Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, Other Ingredients), offering a granular understanding of market performance.

Europe Feed Premix Market Market Composition & Trends

The Europe Feed Premix Market exhibits a moderate to highly concentrated structure, characterized by the presence of both global giants and specialized regional players. Innovation catalysts are primarily driven by the increasing demand for enhanced animal health and nutrition, sustainable farming practices, and the imperative to reduce antibiotic reliance. Regulatory landscapes, shaped by organizations like the European Food Safety Authority (EFSA), play a pivotal role, dictating ingredient usage, safety standards, and labeling requirements. Substitute products, such as complete feed formulations, exist but often lack the tailored nutritional precision offered by premixes. End-user profiles range from large-scale integrated poultry and swine operations to smaller, specialized ruminant farms and aquaculture facilities, each with unique nutritional demands. Mergers and acquisitions (M&A) activities are a significant trend, aimed at consolidating market share, expanding product portfolios, and gaining access to new technologies and distribution channels. For instance, recent M&A deals have seen valuations in the hundreds of millions of Euros as key players seek to strengthen their competitive positions. Key players are actively investing in R&D to develop novel premix formulations that address emerging challenges like climate change adaptation in livestock and the growing consumer preference for "antibiotic-free" meat products. The market share distribution indicates a steady growth in premixes designed for poultry and swine, driven by intensive farming practices in these sectors. The regulatory push towards responsible antibiotic use is fostering innovation in functional ingredients and probiotics within the premix sector.

Europe Feed Premix Market Industry Evolution

The Europe Feed Premix Market has undergone significant evolution throughout the historical period (2019–2024) and is projected to continue its robust growth trajectory through the forecast period (2025–2033). This evolution is deeply intertwined with the broader agricultural sector's transformation, driven by a confluence of technological advancements, shifting consumer demands, and an ever-evolving regulatory framework. Historically, the market was largely driven by basic nutritional fortification. However, the advent of precision nutrition, enabled by advancements in animal physiology and feed science, has revolutionized premix formulations. The adoption of sophisticated analytical tools for ingredient quality assessment and animal health monitoring has allowed for the creation of highly customized premixes, leading to improved feed conversion ratios (FCRs) and enhanced animal welfare. Technological advancements in manufacturing processes, including advanced blending techniques and quality control measures, have ensured the consistent efficacy and safety of premixes.

Consumer demand has been a powerful evolutionary force. Growing awareness regarding food safety, animal welfare, and the environmental impact of agriculture has propelled the demand for premixes that support healthier, more sustainably raised animals. This translates to a reduced reliance on antibiotic growth promoters and an increased focus on functional ingredients like probiotics, prebiotics, essential oils, and organic acids, which enhance gut health and immunity. The market has responded by innovating premixes that align with these consumer preferences, offering solutions that promote animal resilience and reduce the need for therapeutic interventions.

The regulatory landscape has also been a catalyst for change. Stricter regulations on antibiotic usage across Europe have necessitated the development of alternative strategies for disease prevention and growth promotion, with premixes playing a central role. For example, the ban on antibiotic growth promoters in many European countries has accelerated the market's pivot towards non-antibiotic solutions. This regulatory pressure, coupled with industry-led initiatives to promote responsible animal husbandry, has fostered a dynamic environment for premix innovation.

Growth rates in the Europe Feed Premix Market have consistently shown a positive trend, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is fueled by increasing livestock production to meet rising global protein demand, coupled with the continuous drive for efficiency and sustainability in animal farming. The adoption metrics for advanced premixes, particularly those incorporating functional ingredients, are showing a marked increase, indicating a shift towards higher-value, performance-enhancing solutions. The market is moving beyond basic nutrient supply to offering complex, science-backed solutions that contribute to overall farm profitability and environmental sustainability.

Leading Regions, Countries, or Segments in Europe Feed Premix Market

The Poultry segment consistently emerges as a dominant force within the Europe Feed Premix Market, driven by the sheer volume of production and the inherent efficiency of poultry farming. This dominance is further amplified by the specific nutritional requirements and rapid growth cycles of poultry species, necessitating precise and timely supplementation through premixes.

- Key Drivers in Poultry:

- Intensified Production: Europe boasts some of the world's most intensive poultry farming operations, requiring high-quality feed premixes to optimize growth, health, and feed conversion ratios.

- Disease Prevention: The concentrated nature of poultry farming makes animals susceptible to diseases. Premixes fortified with immune-boosting vitamins, minerals, and antioxidants are crucial for disease prevention, reducing the need for antibiotics.

- Cost-Effectiveness: Poultry production is highly sensitive to feed costs. Premixes that enhance FCR and reduce mortality contribute significantly to the economic viability of poultry operations.

- Regulatory Compliance: The stringent regulations on antibiotic use in Europe have spurred innovation in antibiotic-free poultry premixes, further bolstering this segment.

- Consumer Demand for Healthy Poultry Products: Growing consumer interest in lean protein and perceived health benefits of poultry meat indirectly supports the demand for high-quality premixes.

The Vitamins ingredient segment also holds substantial sway due to its indispensable role in virtually all animal diets. Vitamins are critical for a myriad of metabolic processes, immune function, and overall animal health. The increasing focus on reducing antibiotic usage has led to a greater emphasis on fortifying premixes with a comprehensive spectrum of vitamins to bolster natural immunity and resilience. The demand for specific vitamins, such as Vitamin D for bone health and Vitamin E for antioxidant properties, remains consistently high across all animal types.

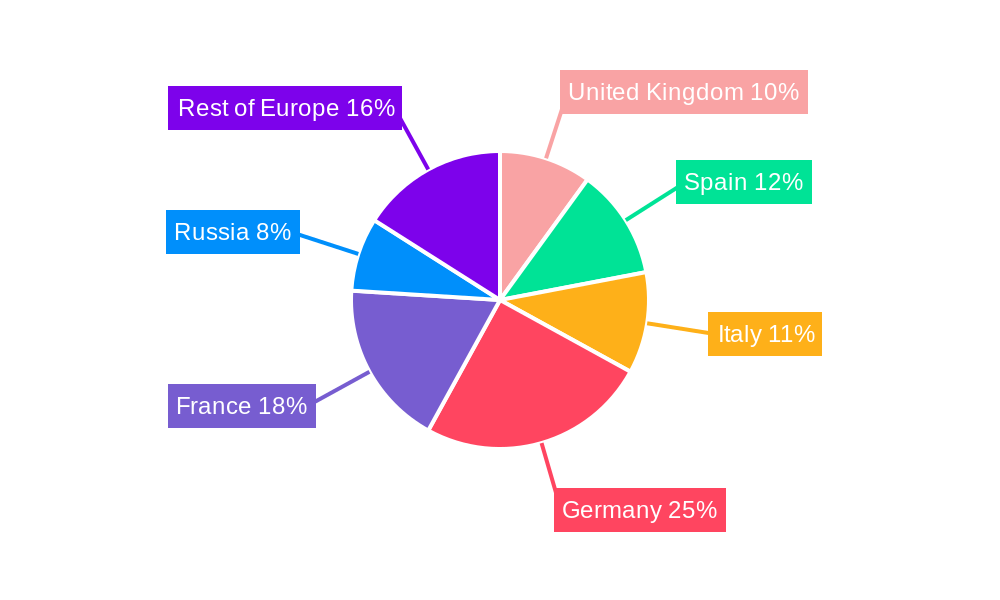

In terms of regional dominance, Western Europe, particularly countries like Germany, France, the Netherlands, and the United Kingdom, leads the market. This leadership is attributable to several factors:

- Advanced Agricultural Infrastructure: These nations possess highly developed agricultural sectors with large-scale, technologically advanced farming operations.

- High Disposable Income and Consumer Demand: A strong consumer base with high disposable income drives demand for high-quality animal protein products, indirectly boosting the feed premix market.

- Stringent Regulatory Enforcement: These countries are at the forefront of implementing and enforcing strict regulations on animal feed and health, pushing for premium and safer premix solutions.

- Significant R&D Investment: Major feed additive manufacturers and research institutions are concentrated in these regions, fostering continuous innovation and product development.

- Established Distribution Networks: Robust distribution channels ensure efficient delivery of premixes to farms across the region.

The Amino Acids segment is another critical ingredient category, essential for protein synthesis and overall growth in animals. The optimization of amino acid profiles in premixes is paramount for efficient nutrient utilization and reducing nitrogen excretion, aligning with environmental sustainability goals. The increasing demand for precision nutrition to meet specific animal needs, especially in high-performance breeds, further elevates the importance of amino acid fortification.

Europe Feed Premix Market Product Innovations

Product innovation in the Europe Feed Premix Market is currently focused on developing highly specialized formulations that enhance animal health, improve feed efficiency, and support sustainable farming practices. A key trend is the development of antibiotic-free premixes, incorporating functional ingredients such as probiotics, prebiotics, organic acids, and plant-based extracts to bolster gut health and immune response. For instance, novel probiotic strains are being integrated to improve nutrient absorption and combat pathogens. Performance-enhancing premixes are also gaining traction, designed to optimize growth rates, improve meat quality, and reduce the environmental footprint of livestock. These innovations are often backed by extensive research and development, demonstrating measurable performance metrics like improved feed conversion ratios, reduced mortality rates, and enhanced animal well-being. Unique selling propositions include customized solutions for specific farm challenges, improved shelf-life, and easier integration into existing feed production systems, all contributing to the increasing value and sophistication of premix offerings.

Propelling Factors for Europe Feed Premix Market Growth

The Europe Feed Premix Market is propelled by a confluence of powerful forces. Technologically, advancements in animal nutrition science and precision farming techniques are enabling the development of highly targeted and effective premix formulations. Economically, the rising global demand for animal protein, coupled with the need for efficient and cost-effective livestock production, creates a sustained market for premixes that improve feed conversion ratios and reduce overall farming costs. Regulatory influences, such as the European Union's stringent regulations on antibiotic usage, are acting as significant catalysts, driving the demand for antibiotic-free alternatives and functional ingredients that promote animal health naturally. Furthermore, increasing consumer awareness regarding food safety and animal welfare is pushing producers to adopt premixes that support healthier, more sustainably raised animals. The growing adoption of advanced farming technologies and the focus on livestock health management further contribute to this growth momentum.

Obstacles in the Europe Feed Premix Market Market

Despite robust growth, the Europe Feed Premix Market faces several obstacles. Regulatory complexities and evolving compliance requirements across different European member states can pose challenges for manufacturers and distributors, demanding continuous adaptation and investment. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact the availability and cost of key ingredients, affecting production and profitability. Intense competitive pressures from established players and new entrants, coupled with the commoditization of certain basic premix ingredients, can lead to price erosion. Additionally, the initial investment cost for advanced, specialized premixes can be a barrier for smaller farms. The increasing scrutiny on the environmental impact of animal agriculture, including nutrient runoff, necessitates the development of premixes that address these concerns, adding another layer of complexity.

Future Opportunities in Europe Feed Premix Market

Emerging opportunities in the Europe Feed Premix Market are abundant and diverse. The growing demand for specialized premixes catering to niche animal segments, such as organic or free-range farming, presents a significant avenue for growth. Technological advancements in areas like personalized nutrition, utilizing data analytics and artificial intelligence to tailor premixes to individual animal needs, offer immense potential. The increasing focus on gut health and immunity continues to drive the market for probiotics, prebiotics, and other functional ingredients, opening doors for innovative product development. Furthermore, the expansion of aquaculture, a sector with significant premix requirements, offers new market frontiers. The growing trend towards sustainable and environmentally friendly animal agriculture will also spur demand for premixes that optimize nutrient utilization and minimize waste. Exploring new geographic markets within and outside Europe with developing livestock sectors also represents a key opportunity.

Major Players in the Europe Feed Premix Market Ecosystem

- Trow Nutrition

- Dutch Farm International BV

- Royal Agrifirm Group

- ForFramers B

- Vilofoss

- BASF SE

- De Hues

- Koninklijke DSM NV

- Cargill Inc

Key Developments in Europe Feed Premix Market Industry

- 2023/07: Royal Agrifirm Group announced a strategic partnership to enhance its sustainability initiatives in animal nutrition, impacting premix offerings.

- 2023/05: BASF SE launched a new line of vitamin premixes designed for improved animal resilience and performance in poultry.

- 2022/11: Cargill Inc. acquired a significant stake in a European feed additive company, bolstering its premix portfolio and distribution network.

- 2022/08: Vilofoss expanded its research and development capabilities, focusing on innovative functional ingredients for swine premixes.

- 2021/04: Dutch Farm International BV introduced a new range of premixes for aquaculture, targeting rapid growth and health in farmed fish.

- 2020/09: Trow Nutrition unveiled a new antibiotic-free premix solution for ruminants, responding to market demand.

- 2020/01: De Hues invested in advanced blending technology to improve the homogeneity and efficacy of their premix products.

Strategic Europe Feed Premix Market Market Forecast

The strategic forecast for the Europe Feed Premix Market indicates sustained and robust growth, driven by an unwavering commitment to enhancing animal health, optimizing feed efficiency, and meeting the evolving demands of a conscious consumer base. The market's trajectory will be significantly shaped by the continued push towards sustainable animal agriculture, where premixes play a pivotal role in reducing environmental impact and promoting animal welfare. Innovations in functional ingredients, precision nutrition, and antibiotic-free solutions will be key growth catalysts, enabling farmers to achieve higher productivity while adhering to stringent regulatory frameworks. The market's future success lies in its ability to adapt to these dynamic forces, offering science-backed, cost-effective, and sustainable solutions that ensure the long-term viability of the European livestock sector. The estimated market size is projected to reach several billion Euros by 2033.

Europe Feed Premix Market Segmentation

-

1. Animal Type

- 1.1. Ruminant

- 1.2. Poultry

- 1.3. Swine

- 1.4. Acquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Amino Acids

- 2.5. Minerals

- 2.6. Other Ingredients

Europe Feed Premix Market Segmentation By Geography

- 1. United Kingdom

- 2. Spain

- 3. Italy

- 4. Germany

- 5. France

- 6. Russia

- 7. Rest of Europe

Europe Feed Premix Market Regional Market Share

Geographic Coverage of Europe Feed Premix Market

Europe Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Increasing Feed Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminant

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Acquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Amino Acids

- 5.2.5. Minerals

- 5.2.6. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Spain

- 5.3.3. Italy

- 5.3.4. Germany

- 5.3.5. France

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Kingdom Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminant

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Acquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Amino Acids

- 6.2.5. Minerals

- 6.2.6. Other Ingredients

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Spain Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminant

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Acquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Amino Acids

- 7.2.5. Minerals

- 7.2.6. Other Ingredients

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Italy Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminant

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Acquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Amino Acids

- 8.2.5. Minerals

- 8.2.6. Other Ingredients

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Germany Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminant

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Acquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Antibiotics

- 9.2.2. Vitamins

- 9.2.3. Antioxidants

- 9.2.4. Amino Acids

- 9.2.5. Minerals

- 9.2.6. Other Ingredients

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. France Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminant

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Acquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Antibiotics

- 10.2.2. Vitamins

- 10.2.3. Antioxidants

- 10.2.4. Amino Acids

- 10.2.5. Minerals

- 10.2.6. Other Ingredients

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Russia Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminant

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Acquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Antibiotics

- 11.2.2. Vitamins

- 11.2.3. Antioxidants

- 11.2.4. Amino Acids

- 11.2.5. Minerals

- 11.2.6. Other Ingredients

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Rest of Europe Europe Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 12.1.1. Ruminant

- 12.1.2. Poultry

- 12.1.3. Swine

- 12.1.4. Acquaculture

- 12.1.5. Other Animal Types

- 12.2. Market Analysis, Insights and Forecast - by Ingredient

- 12.2.1. Antibiotics

- 12.2.2. Vitamins

- 12.2.3. Antioxidants

- 12.2.4. Amino Acids

- 12.2.5. Minerals

- 12.2.6. Other Ingredients

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Trow Nutrition

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dutch Farm International BV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Royal Agrifirm Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ForFramers B

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Vilofoss

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BASF SE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 De Hues

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Koninklijke DSM NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cargill Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Trow Nutrition

List of Figures

- Figure 1: Europe Feed Premix Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: Europe Feed Premix Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 5: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 8: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 9: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 12: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 14: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 15: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 17: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 18: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 20: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 21: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Europe Feed Premix Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 24: Europe Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Premix Market?

The projected CAGR is approximately 10.4%.

2. Which companies are prominent players in the Europe Feed Premix Market?

Key companies in the market include Trow Nutrition, Dutch Farm International BV, Royal Agrifirm Group, ForFramers B, Vilofoss, BASF SE, De Hues, Koninklijke DSM NV, Cargill Inc.

3. What are the main segments of the Europe Feed Premix Market?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Increasing Feed Production Drives the Market.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Premix Market?

To stay informed about further developments, trends, and reports in the Europe Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence