Key Insights

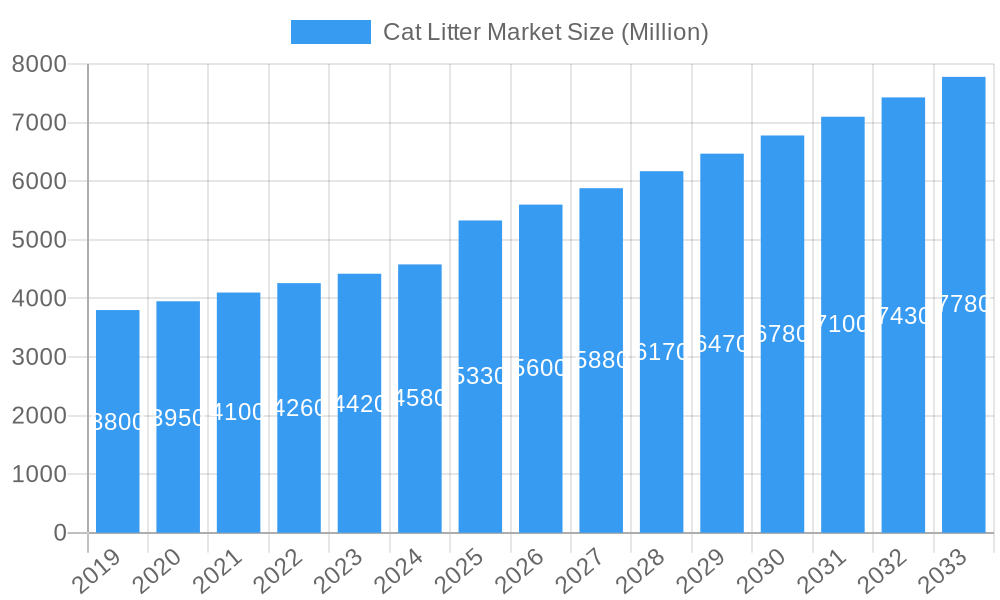

The global cat litter market is poised for significant expansion, projected to reach an estimated \$5.33 billion by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.40% through 2033. This sustained growth trajectory is fueled by several key drivers, most notably the increasing global pet ownership, with cats forming a substantial portion of the domestic animal population. As more households welcome feline companions, the demand for essential pet care products like cat litter naturally escalates. Furthermore, a rising trend in humanization of pets, where owners increasingly treat their animals as family members, translates into a greater willingness to invest in premium, high-quality, and specialized cat litter products that offer enhanced odor control, hygiene, and ease of use. The market is also benefiting from advancements in product innovation, with manufacturers continuously introducing novel litter formulations and materials that cater to specific pet needs and owner preferences, such as eco-friendly and biodegradable options.

Cat Litter Market Market Size (In Billion)

The market's dynamism is further characterized by evolving consumer preferences and distribution strategies. While traditional channels like specialized pet shops and hypermarkets remain significant, the rapid growth of online retail presents a substantial opportunity for market players. E-commerce platforms offer convenience, wider product selection, and competitive pricing, making them increasingly attractive to cat owners. The market is segmented by product type, with clumping litter holding a dominant share due to its superior clumping and odor-trapping capabilities, though non-clumping varieties continue to serve a segment of the market. Raw material segmentation reveals a strong reliance on clay-based litters, particularly bentonite, for their absorbency and cost-effectiveness. However, there is a discernible and growing interest in alternative materials such as silica gel, wood-based, and vegetal litters, driven by environmental consciousness and a desire for dust-free and hypoallergenic options. This shift towards sustainable and advanced materials, coupled with increasing disposable incomes and a burgeoning middle class in emerging economies, is expected to propel the market forward.

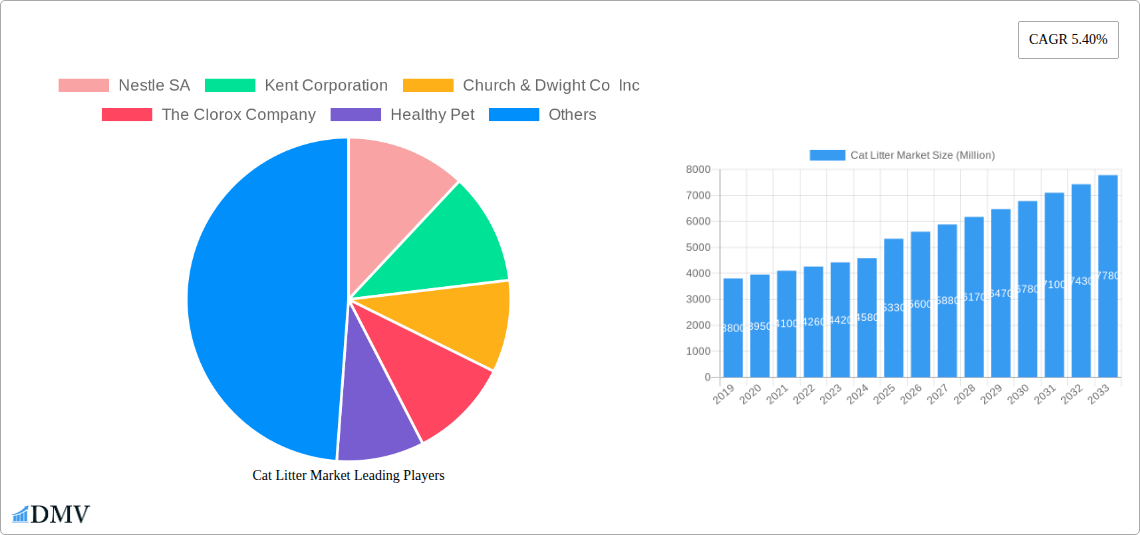

Cat Litter Market Company Market Share

Unlock actionable insights into the dynamic cat litter market with our in-depth report, covering a comprehensive study period from 2019 to 2033, with 2025 as the base and estimated year. This report delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Essential for stakeholders seeking to navigate the global cat litter market, this analysis provides critical data on clumping cat litter, non-clumping cat litter, clay cat litter, silica gel cat litter, and various other raw materials like wood cat litter and vegetal cat litter. Understand the impact of internet sales, specialized pet shops, and hypermarkets on distribution. Gain a competitive edge by understanding the strategies of major players including Nestle SA, Kent Corporation, Church & Dwight Co Inc, The Clorox Company, Healthy Pet, Barentz International BV, Omlet Limited, Oil-dri Corporation Of America, Mars Inc, and ZOLUX SAS.

Cat Litter Market Market Composition & Trends

The cat litter market exhibits a moderately concentrated landscape, driven by innovation in odor control, sustainability, and convenience. Key trends shaping the market include a growing preference for natural and eco-friendly cat litter options, such as wood cat litter and vegetal cat litter, reflecting heightened environmental awareness among pet owners. The demand for advanced formulations, particularly clumping cat litter and silica gel cat litter for superior absorption and odor neutralization, continues to rise. Regulatory landscapes are generally favorable, with a focus on pet safety and product quality. Substitute products, while present, often struggle to match the efficacy and convenience offered by specialized cat litter solutions. End-user profiles are diverse, ranging from budget-conscious consumers to premium pet owners willing to invest in specialized products. Mergers and acquisitions (M&A) are significant catalysts for market consolidation and growth, with recent activities indicating a strategic focus on expanding product portfolios and market reach. For instance, the acquisition of Ultra Pet by Oil-Dri Corporation of America for USD 46 Million exemplifies this trend, aiming to leverage combined expertise for enhanced product offerings and customer base expansion. Market share distribution is influenced by brand reputation, product differentiation, and distribution network strength. The cat litter market size is projected for substantial growth, fueled by increasing pet ownership worldwide and a rising disposable income for pet care. The cat litter industry is constantly evolving, with companies investing heavily in research and development to introduce novel solutions that cater to evolving consumer needs and preferences, ensuring a sustained upward trajectory for the market.

Cat Litter Market Industry Evolution

The cat litter market has witnessed remarkable evolution throughout the historical period of 2019–2024 and is poised for continued growth and innovation in the forecast period of 2025–2033. This evolution is primarily characterized by a significant shift in consumer preferences towards premium, natural, and sustainable cat litter products. The growing humanization of pets has led owners to seek out healthier and environmentally conscious options, driving demand for wood cat litter, bamboo cat litter, and other vegetal cat litter alternatives to traditional clay cat litter. Technological advancements have played a pivotal role in this transformation. Innovations in odor control technology, such as advanced activated carbon and specialized mineral formulations, have enhanced the performance of both clumping cat litter and non-clumping cat litter. The introduction of dust-free formulas has also been a key development, addressing concerns about respiratory health for both pets and owners. Silica gel cat litter, known for its exceptional absorbency and odor neutralization capabilities, has gained considerable traction. The rise of e-commerce and internet sales has revolutionized the distribution landscape, providing consumers with unprecedented access to a wider variety of products and facilitating direct-to-consumer models. This has also fostered greater competition and encouraged brands to focus on unique selling propositions and enhanced customer engagement. Pet owners are increasingly discerning, seeking out biodegradable cat litter and flushable cat litter options to minimize their environmental footprint. Furthermore, the development of specialized litters catering to specific feline needs, such as hypoallergenic or texture-sensitive options, has broadened the market's appeal. The global cat litter market growth is further bolstered by increasing urbanization and smaller living spaces, where effective odor management and waste disposal become paramount. Companies are investing in sustainable manufacturing processes and recyclable packaging to align with environmental concerns. The cat litter market trends indicate a sustained upward trajectory, driven by a confluence of demographic shifts, technological advancements, and evolving consumer values, all contributing to a more sophisticated and diverse market. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period, reaching an estimated value of over USD 15 Billion by 2033.

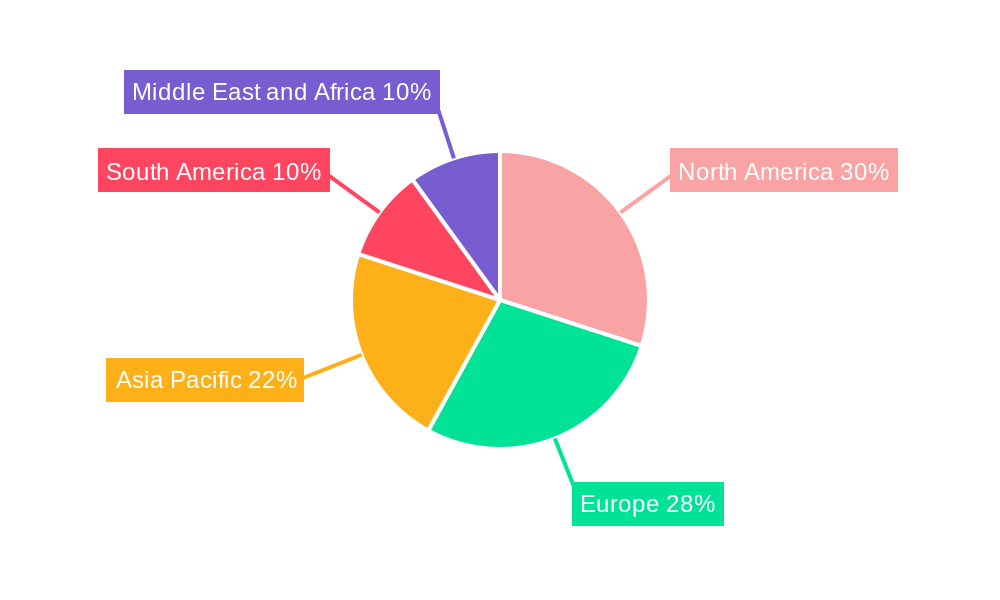

Leading Regions, Countries, or Segments in Cat Litter Market

North America currently dominates the cat litter market, driven by high pet ownership rates and a strong consumer willingness to spend on premium pet care products. The United States, in particular, represents a significant market share due to its vast cat population and the widespread adoption of advanced cat litter solutions.

Product Type Dominance: Clumping cat litter remains the most popular segment in North America and globally, accounting for an estimated 70% of the market. Its convenience for daily scooping and superior odor control makes it the preferred choice for a majority of cat owners. Non-clumping cat litter holds a smaller but steady share, often favored for its affordability and simplicity.

Raw Material Landscape: Clay cat litter continues to be the dominant raw material due to its cost-effectiveness and established performance. However, there is a significant and growing demand for silica cat litter owing to its exceptional absorbency and dust-free properties. The "Others" category, encompassing wood cat litter, bamboo cat litter, corn cat litter, and other vegetal cat litter options, is experiencing the fastest growth rate, fueled by increasing consumer interest in sustainable and biodegradable products. This segment is projected to grow at a CAGR of over 8% in the coming years.

Distribution Channel Dynamics: Internet sales are a rapidly expanding distribution channel, offering convenience, a wider selection, and competitive pricing. This channel is expected to capture a significant market share, projected to reach over 35% by 2033. Specialized pet shops remain crucial for offering expert advice and a curated selection of premium products. Hypermarkets and supermarkets continue to be strong contenders, providing accessibility and convenience for mass-market brands.

Key Drivers for Regional Dominance:

- High Disposable Income: North American consumers possess a high disposable income, allowing for greater expenditure on pet care, including premium cat litter.

- Strong Pet Humanization Trend: The deep emotional bond between owners and their pets drives demand for high-quality, specialized products.

- Robust Pet Food and Accessories Market: A well-established ecosystem for pet products supports the growth of the cat litter segment.

- Innovation and Product Development: Continuous introduction of new and improved cat litter formulations by leading manufacturers caters to evolving consumer demands.

- Awareness of Environmental Impact: Increasing concern over waste disposal is driving adoption of eco-friendly alternatives like wood cat litter and vegetal cat litter.

In-depth Analysis of Dominance Factors: The dominance of North America is underpinned by a sophisticated market infrastructure and a consumer base that values convenience, hygiene, and pet well-being. The rapid growth of online retail platforms has democratized access to a diverse range of cat litter products, further accelerating market expansion. The increasing adoption of smart litter boxes also contributes to the demand for advanced and responsive cat litter solutions.

Cat Litter Market Product Innovations

Product innovation in the cat litter market is intensely focused on enhancing odor control, reducing dust, and promoting sustainability. Recent advancements include the development of natural litters made from renewable resources like wood pulp and corn, offering biodegradable and flushable alternatives. Advanced clumping technologies provide superior moisture absorption and easier scooping, while odor neutralization is being boosted by innovative mineral blends and activated carbon technologies. PetSafe's ScoopFree Premium Natural Litter, derived from fossilized algae, exemplifies this trend with its 21-day odor control and 100% natural composition, free from fragrances, dyes, or chemicals. These innovations are crucial for differentiating brands and capturing the attention of environmentally conscious and health-aware pet owners.

Propelling Factors for Cat Litter Market Growth

The cat litter market is propelled by several key factors. Firstly, the escalating rate of pet ownership globally, particularly cat adoption, directly fuels demand. Secondly, the growing trend of pet humanization leads consumers to invest in premium and specialized cat litter for their feline companions' health and comfort. Technological advancements in odor control, dust reduction, and biodegradability further enhance product appeal. The expansion of e-commerce platforms provides wider accessibility and convenience, driving sales. Finally, increasing urbanization, leading to smaller living spaces, emphasizes the need for effective odor management solutions offered by superior cat litter products.

Obstacles in the Cat Litter Market Market

Despite robust growth, the cat litter market faces certain obstacles. Fluctuations in raw material prices, particularly for clay and specialized minerals, can impact production costs and profitability. Supply chain disruptions, exacerbated by global events, can lead to product shortages and delivery delays, affecting consumer satisfaction. Intense competition among numerous brands, both established and emerging, necessitates continuous innovation and aggressive marketing strategies, which can be resource-intensive. Furthermore, the disposal of used cat litter, especially traditional clay-based varieties, poses environmental concerns, prompting a shift towards more sustainable options but also presenting challenges in widespread adoption of newer materials.

Future Opportunities in Cat Litter Market

The cat litter market presents numerous future opportunities. The burgeoning demand for eco-friendly and sustainable products, such as biodegradable cat litter and litters made from recycled materials, offers significant growth potential. Innovations in smart litter box technology, requiring specialized litter formulations, will create new market niches. Expansion into emerging economies with increasing pet ownership rates and rising disposable incomes is a key avenue for growth. Furthermore, the development of highly specialized litters catering to specific health needs (e.g., hypoallergenic, senior cats) or behavioral preferences will cater to a growing segment of discerning pet owners, driving market diversification and value creation.

Major Players in the Cat Litter Market Ecosystem

- Nestle SA

- Kent Corporation

- Church & Dwight Co Inc

- The Clorox Company

- Healthy Pet

- Barentz International BV

- Omlet Limited

- Oil-dri Corporation Of America

- Mars Inc

- ZOLUX SAS

Key Developments in Cat Litter Market Industry

- May 2024: Oil-Dri Corporation of America finalized its USD 46 million acquisition of Ultra Pet, a leading crystal catheter company. This strategic move aims to leverage combined expertise and shared values to deliver superior products and expand their collective customer base, enhancing their presence in the advanced litter segment.

- February 2024: PetSafe introduced PetSafe ScoopFree Premium Natural Litter. This innovative product is 100% natural, made from fossilized algae, and boasts odor management for over 21 days without the use of added fragrances, dyes, or chemicals, directly addressing consumer demand for healthier and more effective solutions.

- February 2024: Kent Corporation’s brand, World's Best Cat Litter, partnered with Little Big Brands to redesign its logo, packaging, and color scheme. The new look emphasizes the brand's natural and sustainable attributes, reflecting a growing market preference for eco-conscious pet products.

Strategic Cat Litter Market Market Forecast

The strategic cat litter market forecast indicates continued robust growth driven by an expanding global pet population and an increasing humanization of pets, leading to higher spending on premium and specialized products. The sustained demand for effective odor control and hygiene, coupled with the rising consumer consciousness towards environmental sustainability, will significantly propel the adoption of eco-friendly cat litter and natural cat litter alternatives. Innovations in product technology, particularly in dust reduction, biodegradability, and advanced clumping capabilities, will further stimulate market expansion. The growth of e-commerce will continue to be a pivotal factor in accessibility and market penetration, while emerging economies present substantial untapped potential for market players looking to diversify their reach and capitalize on evolving pet care trends. The overall market outlook remains highly positive, promising sustained value creation and opportunities for strategic investment.

Cat Litter Market Segmentation

-

1. Product Type

- 1.1. Clumping

- 1.2. Non-Clumping

-

2. Raw Material

- 2.1. Clay

- 2.2. Silica

- 2.3. Others(Wood, Vegetal, Pellets, etc.)

-

3. Distribution Channel

- 3.1. Specialized Pet Shops

- 3.2. Internet Sales

- 3.3. Hypermarkets

- 3.4. Other Distribution Channels

Cat Litter Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Cat Litter Market Regional Market Share

Geographic Coverage of Cat Litter Market

Cat Litter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Clumping Litter Is In High Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clumping

- 5.1.2. Non-Clumping

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Clay

- 5.2.2. Silica

- 5.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialized Pet Shops

- 5.3.2. Internet Sales

- 5.3.3. Hypermarkets

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clumping

- 6.1.2. Non-Clumping

- 6.2. Market Analysis, Insights and Forecast - by Raw Material

- 6.2.1. Clay

- 6.2.2. Silica

- 6.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialized Pet Shops

- 6.3.2. Internet Sales

- 6.3.3. Hypermarkets

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clumping

- 7.1.2. Non-Clumping

- 7.2. Market Analysis, Insights and Forecast - by Raw Material

- 7.2.1. Clay

- 7.2.2. Silica

- 7.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialized Pet Shops

- 7.3.2. Internet Sales

- 7.3.3. Hypermarkets

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clumping

- 8.1.2. Non-Clumping

- 8.2. Market Analysis, Insights and Forecast - by Raw Material

- 8.2.1. Clay

- 8.2.2. Silica

- 8.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialized Pet Shops

- 8.3.2. Internet Sales

- 8.3.3. Hypermarkets

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clumping

- 9.1.2. Non-Clumping

- 9.2. Market Analysis, Insights and Forecast - by Raw Material

- 9.2.1. Clay

- 9.2.2. Silica

- 9.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialized Pet Shops

- 9.3.2. Internet Sales

- 9.3.3. Hypermarkets

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Cat Litter Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clumping

- 10.1.2. Non-Clumping

- 10.2. Market Analysis, Insights and Forecast - by Raw Material

- 10.2.1. Clay

- 10.2.2. Silica

- 10.2.3. Others(Wood, Vegetal, Pellets, etc.)

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialized Pet Shops

- 10.3.2. Internet Sales

- 10.3.3. Hypermarkets

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kent Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Church & Dwight Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Clorox Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Healthy Pet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Barentz International BV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omlet Limited*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oil-dri Corporation Of America

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mars Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ZOLUX SAS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Cat Litter Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cat Litter Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cat Litter Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cat Litter Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 5: North America Cat Litter Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: North America Cat Litter Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Cat Litter Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Cat Litter Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cat Litter Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cat Litter Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Cat Litter Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Cat Litter Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 13: Europe Cat Litter Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 14: Europe Cat Litter Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Cat Litter Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Cat Litter Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cat Litter Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cat Litter Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Cat Litter Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Cat Litter Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 21: Asia Pacific Cat Litter Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: Asia Pacific Cat Litter Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Cat Litter Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Cat Litter Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cat Litter Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cat Litter Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Cat Litter Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Cat Litter Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 29: South America Cat Litter Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 30: South America Cat Litter Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Cat Litter Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Cat Litter Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Cat Litter Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cat Litter Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Cat Litter Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Cat Litter Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 37: Middle East and Africa Cat Litter Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 38: Middle East and Africa Cat Litter Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Cat Litter Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Cat Litter Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cat Litter Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 3: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cat Litter Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 7: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Cat Litter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 15: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Cat Litter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 25: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Cat Litter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: India Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: China Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 33: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Cat Litter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Cat Litter Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 39: Global Cat Litter Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 40: Global Cat Litter Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Cat Litter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: United Arab Emirates Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Cat Litter Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cat Litter Market?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Cat Litter Market?

Key companies in the market include Nestle SA, Kent Corporation, Church & Dwight Co Inc, The Clorox Company, Healthy Pet, Barentz International BV, Omlet Limited*List Not Exhaustive, Oil-dri Corporation Of America, Mars Inc, ZOLUX SAS.

3. What are the main segments of the Cat Litter Market?

The market segments include Product Type, Raw Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Clumping Litter Is In High Demand.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

May 2024: Oil-Dri Corporation of America finalized its USD 46 million acquisition of Ultra Pet, a leading crystal catheter company. Both companies emphasize smooth integration, leveraging expertise and shared values to deliver superior products and grow their combined customer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cat Litter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cat Litter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cat Litter Market?

To stay informed about further developments, trends, and reports in the Cat Litter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence