Key Insights

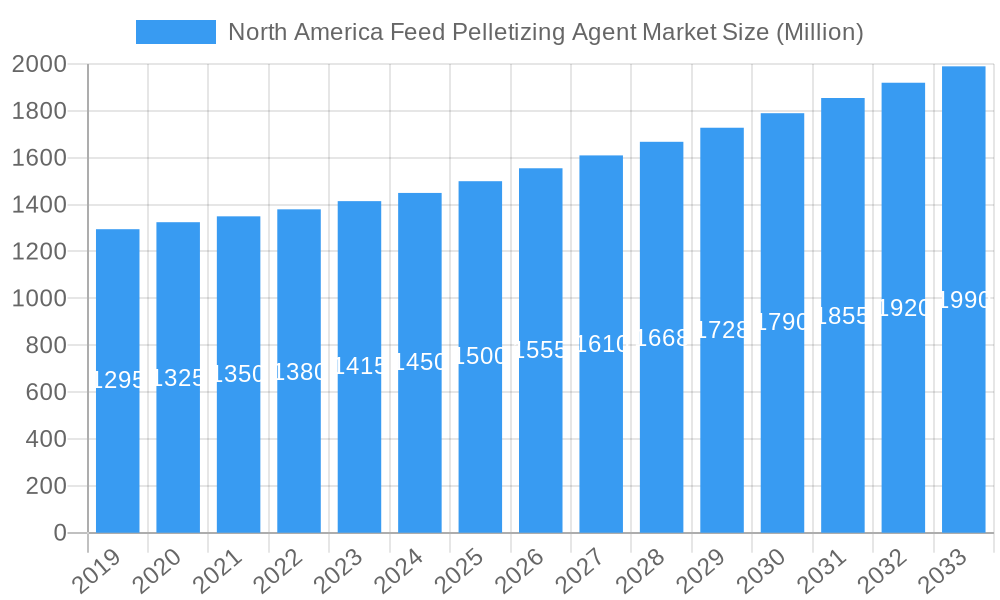

The North American Feed Pelletizing Agent Market is poised for steady expansion, projected to reach approximately $1,500 million in 2025, with a Compound Annual Growth Rate (CAGR) of 3.70% through 2033. This growth is primarily fueled by the increasing demand for high-quality, efficient animal feed production across the region's robust agricultural sector. Key drivers include the growing global population and the subsequent rise in demand for animal protein, necessitating enhanced feed formulations for improved animal health, growth rates, and overall productivity. Furthermore, the adoption of advanced pelletizing technologies and the recognition of feed pelletizing agents' role in reducing feed wastage and improving nutrient absorption are significant growth catalysts. The market benefits from a strong emphasis on animal welfare and sustainable farming practices, which encourage the use of effective pelletizing agents to create palatable and digestible feed.

North America Feed Pelletizing Agent Market Market Size (In Billion)

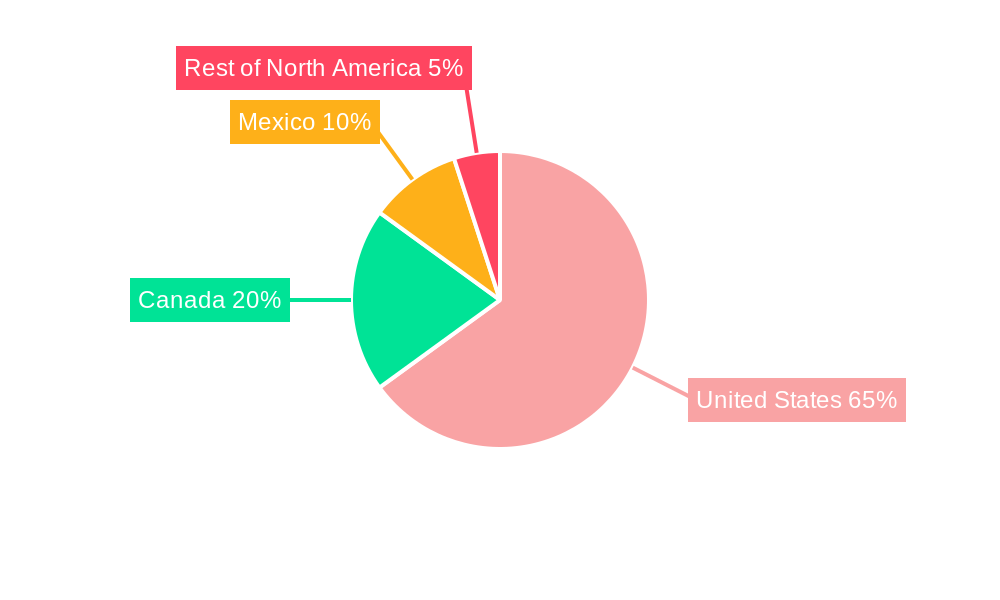

The market's segmentation reveals a dynamic landscape. The "Natural" segment is anticipated to witness robust growth, driven by consumer preference for natural ingredients in animal feed and regulatory shifts favoring eco-friendly solutions. Simultaneously, the "Synthetic" segment, offering cost-effectiveness and specific performance characteristics, will continue to hold a significant market share. Within animal types, "Ruminant" and "Poultry" segments are expected to lead demand due to the sheer volume of feed produced for these categories. Geographically, the United States dominates the North American market, owing to its large-scale livestock operations and advanced agricultural infrastructure, followed by Canada and Mexico. Emerging trends include the development of novel pelletizing agents with binding, lubricating, and anti-caking properties, as well as a focus on agents that contribute to feed safety and reduce environmental impact. Restraints such as fluctuating raw material prices and the need for consistent regulatory compliance are present, but the overall outlook remains positive for market participants.

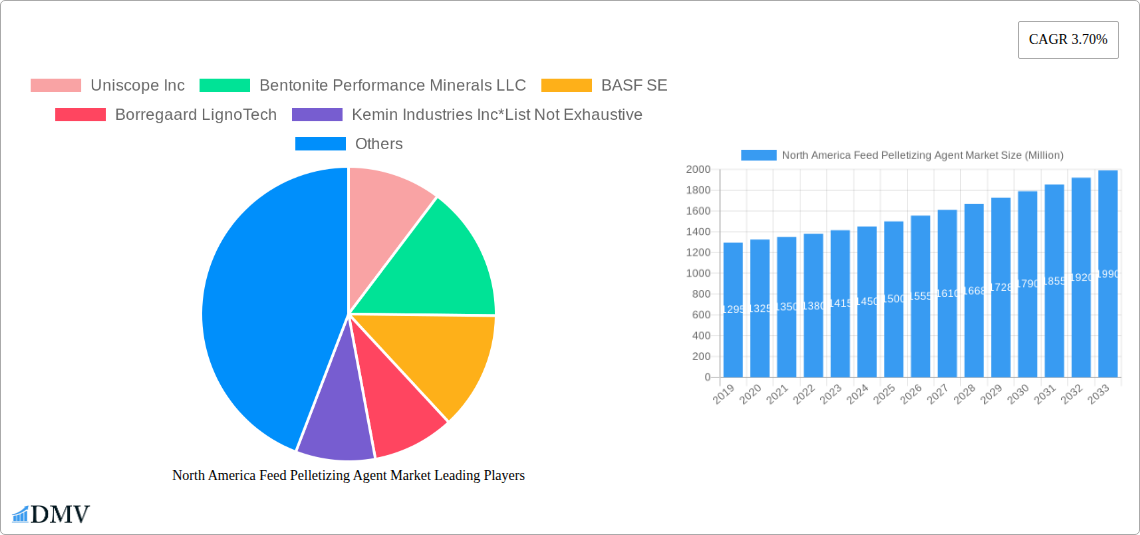

North America Feed Pelletizing Agent Market Company Market Share

North America Feed Pelletizing Agent Market: Comprehensive Industry Analysis & Forecast (2019-2033)

This in-depth report delivers a definitive analysis of the North America Feed Pelletizing Agent Market, projecting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this study meticulously dissects market dynamics, identifying key growth drivers, emerging opportunities, and potential challenges. Stakeholders will gain unparalleled insights into market concentration, technological advancements, regulatory landscapes, and the competitive ecosystem, empowering strategic decision-making in this vital sector of animal nutrition.

North America Feed Pelletizing Agent Market Market Composition & Trends

The North America Feed Pelletizing Agent Market exhibits a moderately concentrated structure, with a handful of major players, including Uniscope Inc, Bentonite Performance Minerals LLC, BASF SE, Borregaard LignoTech, Kemin Industries Inc, Adisseo SAS, and Cra-Vac Industries Inc, holding significant market share. Innovation serves as a key catalyst, driven by the increasing demand for improved feed quality, enhanced animal performance, and reduced production costs. The regulatory landscape, while generally supportive of feed safety and efficacy, necessitates continuous compliance with evolving standards. Substitute products, such as alternative binding agents or different pelleting techniques, pose a moderate threat, but the superior performance and cost-effectiveness of specialized pelletizing agents often mitigate this risk. End-user profiles are diverse, encompassing large-scale commercial feed producers, integrated livestock operations, and smaller, specialized animal feed manufacturers. Mergers and acquisitions (M&A) activities have been sporadic but impactful, consolidating market share and fostering technological integration. For instance, recent M&A deals in the broader animal feed additive sector have valued in the range of $50 Million to $200 Million, indicating strategic consolidation efforts.

- Market Share Distribution: Leading players hold approximately 65% of the market.

- Innovation Catalysts: Focus on natural binders, improved digestibility, and cost reduction.

- Regulatory Landscape: FDA regulations and regional animal welfare standards are key considerations.

- Substitute Products: Alternative binding agents and pelleting technologies present a minor threat.

- End-User Profiles: Commercial feed manufacturers and integrated livestock operations dominate demand.

- M&A Activities: Strategic acquisitions are aimed at enhancing product portfolios and market reach.

North America Feed Pelletizing Agent Market Industry Evolution

The North America Feed Pelletizing Agent Market has witnessed a consistent upward trajectory throughout the historical period of 2019–2024, driven by the fundamental need for efficient and high-quality animal feed. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This growth is underpinned by several evolutionary forces. Firstly, the increasing global demand for animal protein, propelled by a growing population and rising disposable incomes, directly fuels the expansion of the livestock sector, consequently boosting the demand for effective feed pelletizing agents. Technological advancements have played a pivotal role in this evolution. Manufacturers are continually investing in research and development to create novel pelletizing agents that offer enhanced pellet durability, reduced fines, improved digestibility, and better palatability for animals. This includes the development of more sustainable and naturally derived binders that cater to the growing consumer preference for ethically produced animal products. The adoption of advanced pellet mill technologies, which often require specialized pelletizing agents for optimal performance, further contributes to market growth.

Shifting consumer demands are also shaping the industry. There is a heightened awareness regarding animal welfare, feed efficiency, and the reduction of environmental impact associated with animal agriculture. Pelletizing agents that contribute to reduced feed waste, improved nutrient utilization, and lower greenhouse gas emissions are gaining traction. For example, the development of binders that improve pellet hardness can lead to reduced dust and spoilage, thereby minimizing waste and improving the overall sustainability of feed production. Furthermore, the demand for specialized feed formulations for different animal types and life stages necessitates the use of tailored pelletizing agents that can meet specific nutritional and processing requirements. The aquaculture segment, in particular, is a rapidly expanding area, with a growing need for high-quality, durable feed pellets that can withstand underwater conditions. The historical adoption rate of advanced pelletizing technologies has seen an uptick of around 15% year-on-year, indicating a proactive industry response to evolving demands. The estimated market size in 2025 is projected to be around $1,500 Million, with significant growth anticipated in the coming years.

Leading Regions, Countries, or Segments in North America Feed Pelletizing Agent Market

The United States stands as the dominant region within the North America Feed Pelletizing Agent Market, commanding a substantial market share driven by its vast and highly industrialized agricultural sector. This dominance is further amplified by the significant presence of large-scale livestock operations, particularly in poultry and swine production, which represent key consumer segments for feed pelletizing agents. The country's advanced agricultural infrastructure, coupled with a strong emphasis on technological adoption and research and development in animal nutrition, positions it as a frontrunner.

- Key Drivers in the United States:

- Extensive Livestock Industry: The sheer scale of poultry, swine, and ruminant farming necessitates large volumes of pelleted feed.

- Technological Advancement & R&D: Significant investment in feed science and pelleting technology.

- Government Support & Subsidies: Policies promoting agricultural efficiency and innovation.

- High Demand for Animal Protein: Rising domestic consumption and export opportunities.

- Presence of Major Feed Manufacturers: Concentration of companies with substantial pelletizing needs.

In-depth analysis reveals that the Poultry segment, across all North American countries, is a primary driver of demand. The efficiency and consistency required in poultry feed pellet production are paramount for optimizing growth rates and minimizing feed conversion ratios. Pellet durability and reduced fines are critical for preventing respiratory issues and ensuring optimal nutrient intake for birds. The Synthetic type of pelletizing agent currently holds a larger market share due to its established performance and cost-effectiveness, although natural alternatives are gaining traction. Geographically, while the United States leads, Canada and Mexico are exhibiting steady growth, driven by their expanding livestock sectors and increasing adoption of modern feed production techniques. Mexico, in particular, presents a high-growth potential market due to its rapidly modernizing agricultural practices and increasing demand for animal protein. The "Rest of North America" category, while smaller, also contributes to the overall market, with niche demands and specialized applications emerging. The estimated market size for the United States alone is projected to exceed $1,000 Million in 2025.

North America Feed Pelletizing Agent Market Product Innovations

Product innovation in the North America Feed Pelletizing Agent Market is characterized by a drive towards enhancing pellet quality, improving animal health, and promoting sustainability. Manufacturers are developing advanced pelletizing agents that not only ensure superior pellet durability and reduced fines, critical for efficient feed handling and animal consumption, but also offer added nutritional benefits. Innovations include lignosulfonate-based binders derived from sustainable wood processing byproducts, offering excellent binding properties with an eco-friendly profile. Furthermore, advancements in synthetic polymers are leading to agents that improve pellet hardness at lower inclusion rates, thus reducing overall feed costs for producers. Companies are also focusing on developing agents that enhance nutrient digestibility and bioavailability, contributing to better animal growth and reduced environmental impact. Performance metrics such as improved durability indices (e.g., increasing pellet strength by up to 20%) and reduced production of fines (often by 15-25%) are key selling propositions.

Propelling Factors for North America Feed Pelletizing Agent Market Growth

The North America Feed Pelletizing Agent Market is propelled by several key factors. Firstly, the escalating global demand for animal protein necessitates increased and more efficient livestock production, directly driving the need for high-quality pelleted feed. Secondly, technological advancements in feed milling and pelletizing processes require specialized agents to optimize performance, leading to improved pellet durability and reduced fines. Thirdly, a growing emphasis on animal welfare and feed efficiency encourages the adoption of agents that contribute to better animal health and nutrient utilization. The economic imperative for feed producers to minimize waste and optimize costs further fuels demand for effective pelletizing solutions.

Obstacles in the North America Feed Pelletizing Agent Market Market

Despite robust growth, the North America Feed Pelletizing Agent Market faces certain obstacles. Volatility in raw material prices, particularly for synthetic binders, can impact production costs and profit margins. Stringent regulatory requirements for feed additives, although promoting safety, can also lead to increased research and development expenses and longer approval times for new products. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of key ingredients. Furthermore, intense competition among established players and the potential emergence of novel, cost-effective binding technologies can exert downward pressure on pricing.

Future Opportunities in North America Feed Pelletizing Agent Market

Emerging opportunities in the North America Feed Pelletizing Agent Market lie in the expanding aquaculture sector, which demands specialized and durable feed pellets. The increasing consumer preference for natural and sustainable products is creating a significant market for plant-based and environmentally friendly pelletizing agents. Furthermore, innovations in precision nutrition are leading to the development of customized pelletizing agents that cater to specific animal types, life stages, and dietary needs, opening up niche market segments. The growing adoption of smart farming technologies also presents opportunities for integrated solutions that optimize feed production and animal performance.

Major Players in the North America Feed Pelletizing Agent Market Ecosystem

- Uniscope Inc

- Bentonite Performance Minerals LLC

- BASF SE

- Borregaard LignoTech

- Kemin Industries Inc

- Adisseo SAS

- Cra-Vac Industries Inc

Key Developments in North America Feed Pelletizing Agent Market Industry

- 2023: Launch of new generation lignosulfonate-based pelletizing agents offering enhanced binding and environmental benefits.

- 2022: Strategic partnership between a major feed producer and a pelletizing agent manufacturer to optimize feed quality for the swine industry.

- 2021: Introduction of a novel synthetic binder with improved performance at lower inclusion rates, leading to significant cost savings for feed mills.

- 2020: Increased focus on R&D for natural pelletizing agents driven by consumer demand for sustainable animal products.

- 2019: Acquisition of a smaller pelletizing agent producer by a global chemical company to expand its animal nutrition portfolio.

Strategic North America Feed Pelletizing Agent Market Market Forecast

The North America Feed Pelletizing Agent Market is poised for continued expansion, driven by an insatiable global appetite for animal protein and an unwavering commitment to feed efficiency and animal welfare. The market will likely witness a steady increase in demand for both high-performance synthetic and increasingly popular natural pelletizing agents, catering to diverse needs across ruminant, poultry, swine, and aquaculture segments. Innovations in sustainable sourcing and enhanced nutrient delivery will remain key differentiators, shaping competitive strategies. The estimated market value in 2025 is projected to reach $1,500 Million, with a strong growth outlook driven by technological advancements and supportive industry trends.

North America Feed Pelletizing Agent Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Feed Pelletizing Agent Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Feed Pelletizing Agent Market Regional Market Share

Geographic Coverage of North America Feed Pelletizing Agent Market

North America Feed Pelletizing Agent Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Animal Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Pelletizing Agent Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Feed Pelletizing Agent Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Feed Pelletizing Agent Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Feed Pelletizing Agent Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Feed Pelletizing Agent Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Uniscope Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bentonite Performance Minerals LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BASF SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Borregaard LignoTech

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kemin Industries Inc*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Adisseo SAS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cra-Vac Industries Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Uniscope Inc

List of Figures

- Figure 1: North America Feed Pelletizing Agent Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Feed Pelletizing Agent Market Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Feed Pelletizing Agent Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Pelletizing Agent Market?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the North America Feed Pelletizing Agent Market?

Key companies in the market include Uniscope Inc, Bentonite Performance Minerals LLC, BASF SE, Borregaard LignoTech, Kemin Industries Inc*List Not Exhaustive, Adisseo SAS, Cra-Vac Industries Inc.

3. What are the main segments of the North America Feed Pelletizing Agent Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Animal Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Pelletizing Agent Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Pelletizing Agent Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Pelletizing Agent Market?

To stay informed about further developments, trends, and reports in the North America Feed Pelletizing Agent Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence