Key Insights

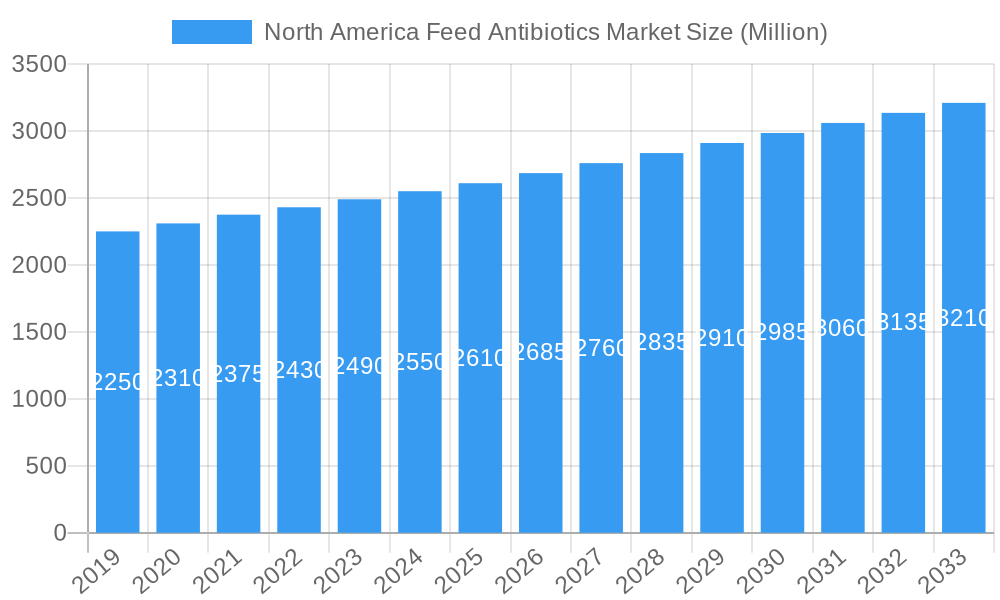

The North American Feed Antibiotics Market is poised for significant expansion, driven by escalating demand for animal protein and a heightened focus on animal health for food safety and efficient livestock production. The market was valued at $12.26 billion in the base year 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.07% through 2033. Key therapeutic classes, including Tetracyclines and Penicillins, are expected to maintain their market leadership owing to their broad-spectrum efficacy. Macrolides are also anticipated to show substantial growth, particularly for treating respiratory infections in poultry and swine. The poultry and swine segments will be the primary growth drivers, attributed to intensive farming practices. While the United States dominates the market, Mexico and Canada are emerging with considerable growth potential due to expanding livestock industries and the adoption of advanced animal husbandry techniques.

North America Feed Antibiotics Market Market Size (In Billion)

However, the market faces challenges, including increased regulatory scrutiny concerning antibiotic resistance and a rising consumer preference for antibiotic-free products. This trend is driving innovation and the adoption of alternative growth promoters and probiotics. Despite these challenges, feed antibiotics remain crucial for disease prevention and control in intensive farming, safeguarding herd health and productivity. Leading companies are investing in research and development to offer a range of solutions. The market's future hinges on balancing the benefits of feed antibiotics with the global imperative to combat antimicrobial resistance.

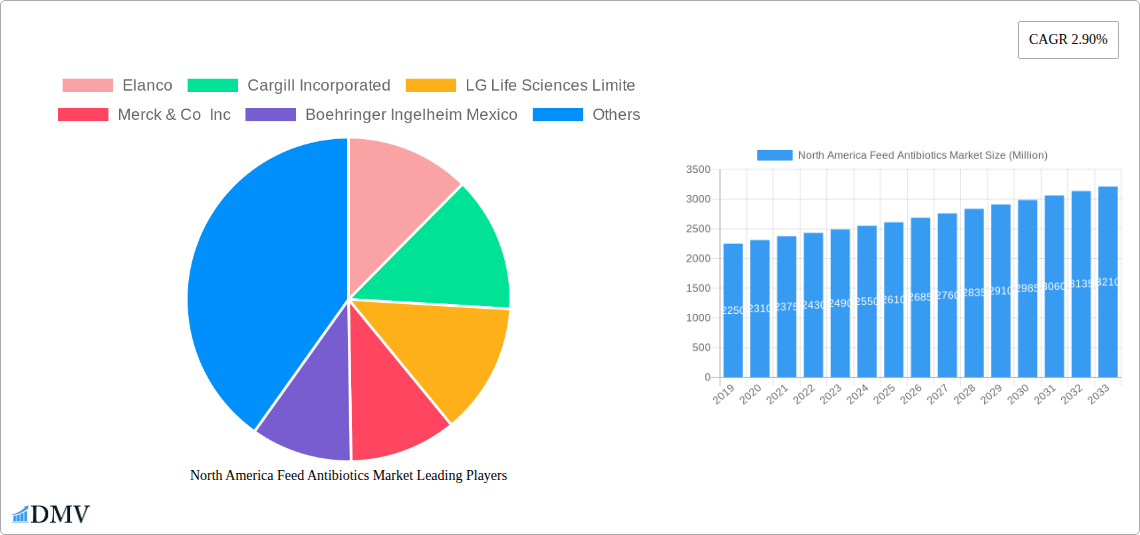

North America Feed Antibiotics Market Company Market Share

This comprehensive report delivers an in-depth analysis of the North America Feed Antibiotics Market. It provides critical insights into market dynamics, growth drivers, emerging trends, and competitive landscapes for the period 2019-2033. The study covers key market segments, prominent players, and future projections, making it an essential resource for stakeholders navigating the evolving animal feed additives sector. The analysis includes historical data (2019-2024), a base year (2025), and a forecast period (2025-2033).

North America Feed Antibiotics Market Market Composition & Trends

The North America Feed Antibiotics Market exhibits a moderate concentration, with key players like Elanco, Cargill Incorporated, and Merck & Co Inc strategically vying for market share. Innovation is largely driven by advancements in antibiotic efficacy, disease prevention, and the development of alternatives, spurred by increasing research and development investments estimated in the tens of Millions. The regulatory landscape is a significant factor, with evolving guidelines impacting the usage and availability of various feed grade antibiotics. Substitute products, including probiotics, prebiotics, and organic acids, are gaining traction, influencing consumer choices and market dynamics. End-user profiles range from large-scale commercial poultry farms and swine operations to specialized aquaculture producers, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) activities, valued in the Hundreds of Millions, are observed as companies seek to consolidate market presence and expand their product portfolios. The market share distribution is dynamic, with Tetracyclines and Penicillins currently holding significant portions due to their established efficacy and cost-effectiveness, though the trend is shifting towards alternatives. M&A deal values in recent years have averaged around XX Million, indicating strategic consolidation.

North America Feed Antibiotics Market Industry Evolution

The North America Feed Antibiotics Market has undergone a significant transformation over the historical period and is projected for substantial evolution in the coming forecast period. Driven by the ever-increasing demand for animal protein and the need for efficient disease management in livestock, the market has witnessed steady growth trajectories. Technological advancements have played a pivotal role, enabling the development of more potent and targeted feed antibiotics, improving animal health and nutrition, and consequently boosting livestock productivity. The adoption of novel delivery mechanisms and formulations has enhanced the bioavailability and effectiveness of these additives. Furthermore, a pronounced shift in consumer demands towards antibiotic-free meat and dairy products, coupled with growing concerns about antimicrobial resistance (AMR), has spurred significant investment in research and development for alternative feed additives. This evolving consumer preference is a critical factor shaping the industry's direction, pushing manufacturers to innovate and adapt their product offerings. While traditional antibiotics remain a cornerstone for disease prevention and treatment, the market is increasingly witnessing the integration of probiotics, prebiotics, essential oils, and organic acids as complementary or substitute solutions. This diversification not only addresses regulatory pressures but also caters to a growing segment of the market prioritizing animal welfare and sustainable farming practices. The overall growth rate of the feed antibiotics market has been consistently around X.X% historically, with projections indicating a slight deceleration in the traditional antibiotic segment and a significant surge in the alternative feed additives market. The adoption metrics for these alternatives are rapidly increasing, with an estimated XX% of producers now incorporating at least one form of non-antibiotic growth promoter. This dynamic evolution necessitates a keen understanding of both existing and emerging market forces to ensure strategic positioning.

Leading Regions, Countries, or Segments in North America Feed Antibiotics Market

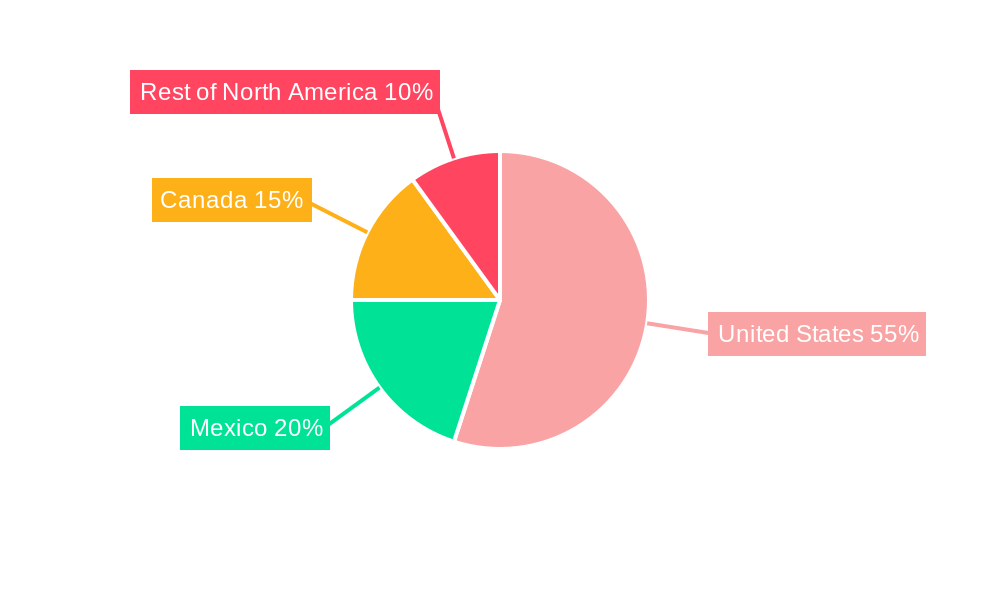

The United States stands as the dominant force within the North America Feed Antibiotics Market, driven by its expansive livestock industry, particularly in poultry and swine production, and significant investments in animal health research and development. The country's large aquaculture sector also contributes to the substantial demand for effective feed additives. Robust regulatory frameworks, while increasingly stringent regarding antibiotic usage, have also fostered innovation in developing safer and more efficient alternatives, further stimulating market growth.

Key drivers for the United States' dominance include:

- Investment Trends: Significant private and public investments in animal agriculture and biotechnology, estimated in the hundreds of millions, are channeled into improving animal health and productivity.

- Regulatory Support for Innovation: While regulations aim to curb antibiotic resistance, they also encourage the development and adoption of novel, scientifically validated feed additives.

- Technological Adoption: Early and widespread adoption of advanced farming technologies and feed formulations by large-scale producers ensures consistent demand for high-quality feed antibiotics.

Within the United States, the Poultry segment accounts for a substantial portion of the feed antibiotics market, owing to the high density of birds and the critical need for disease prevention to maintain production efficiency. Similarly, the Swine segment is a major consumer, driven by intensive farming practices. The Tetracyclines and Macrolides types of antibiotics have historically held a dominant share due to their broad spectrum of activity and cost-effectiveness in managing common bacterial infections in these animals. However, there is a discernible shift towards Cephalosporins and other classes as the industry seeks more targeted therapeutic options and navigates evolving resistance patterns.

Mexico and Canada represent significant, albeit secondary, markets. Mexico's growing population and expanding meat consumption fuel its demand for efficient animal production, making it a key growth region. Canada, with its established agricultural sector, particularly in Ruminants and Poultry, also contributes significantly to market volume. The Rest of North America, while smaller, presents niche opportunities, often driven by specialized agricultural practices or emerging markets.

The dominance of the United States is further underscored by the sheer scale of its agricultural output and the concentration of leading animal health companies within its borders, facilitating efficient distribution and technological dissemination. The interplay between extensive farming operations, significant R&D expenditure, and a complex yet adaptive regulatory environment collectively solidifies its leading position in the North America Feed Antibiotics Market.

North America Feed Antibiotics Market Product Innovations

Product innovation in the North America Feed Antibiotics Market is characterized by a dual focus on enhancing the efficacy of traditional antibiotics while concurrently developing novel, sustainable alternatives. Advances in formulation technology have led to the creation of slow-release antibiotics, improving drug delivery and reducing wastage, along with synergistic combinations that broaden the spectrum of activity and combat resistance. For instance, novel Tetracycline derivatives offer improved bioavailability and reduced gastrointestinal side effects. Simultaneously, the market is witnessing significant strides in probiotic and prebiotic blends, engineered to optimize gut health and immune response in livestock, thereby reducing the reliance on antibiotics. Organic acid complexes are also being refined for enhanced antimicrobial properties and improved feed preservation. Performance metrics for these innovations are rigorously tracked, with new products demonstrating improved growth promotion by up to X% and reduced incidence of specific diseases by XX% compared to older formulations. The unique selling proposition of emerging products often lies in their ability to meet stringent regulatory requirements while delivering superior animal health and economic benefits.

Propelling Factors for North America Feed Antibiotics Market Growth

Several key factors are propelling the North America Feed Antibiotics Market. Technologically, ongoing research into understanding animal gut microbiota and disease pathogenesis is leading to more targeted and effective feed additive solutions. Economically, the rising global demand for animal protein, driven by population growth and increasing disposable incomes, necessitates efficient and cost-effective livestock production methods that feed antibiotics facilitate. Regulatory shifts, while often restrictive on the direct use of certain antibiotics, are also encouraging innovation in approved feed additives and alternatives, creating new market opportunities. Furthermore, the imperative to combat antimicrobial resistance (AMR), though a challenge, is driving investment in R&D for a new generation of feed additives that promote animal health without contributing to resistance.

Obstacles in the North America Feed Antibiotics Market Market

The North America Feed Antibiotics Market faces significant obstacles. Foremost among these are the stringent and evolving regulatory challenges surrounding the use of antibiotics in animal feed, particularly the increasing restrictions on medically important antibiotics and the push for antibiotic-free production systems. Supply chain disruptions, exacerbated by geopolitical events and global pandemics, can lead to price volatility and availability issues for key raw materials and finished products, impacting market stability. Intense competitive pressures from both established players and emerging companies developing alternative solutions create a dynamic market environment. Public perception and growing consumer demand for antibiotic-free products also pose a significant restraint, driving producers to re-evaluate their reliance on traditional feed antibiotics. The cost-effectiveness of some alternative solutions also remains a barrier to widespread adoption in certain segments.

Future Opportunities in North America Feed Antibiotics Market

The North America Feed Antibiotics Market is ripe with future opportunities. The growing global demand for animal protein, particularly in developing economies within the region, presents a significant expansion opportunity for feed additive manufacturers. Advancements in biotechnology are unlocking the potential for novel bio-based feed additives, such as enzymes, peptides, and functional proteins, offering improved animal performance and health benefits. The increasing consumer awareness and preference for sustainable and ethically sourced animal products are creating a burgeoning market for natural and organic feed additives, including probiotics, prebiotics, and botanical extracts. Furthermore, the development of precision nutrition technologies and digital farming solutions will enable more targeted and efficient application of feed additives, optimizing their impact and value. The ongoing research into mitigating antimicrobial resistance will also open avenues for innovative solutions that complement or replace traditional antibiotics.

Major Players in the North America Feed Antibiotics Market Ecosystem

- Elanco

- Cargill Incorporated

- LG Life Sciences Limited

- Merck & Co Inc

- Boehringer Ingelheim Mexico

- BASF SE

- Zomedica Pharmaceuticals Corp

- Alltech Inc

- Zeotis

- American Regent Inc

Key Developments in North America Feed Antibiotics Market Industry

- 2023: Elanco launches a new generation of probiotics targeting gut health in poultry, aiming to reduce the need for antibiotics.

- 2023: Cargill Incorporated expands its portfolio of plant-based feed additives with a focus on improving Ruminant digestion.

- 2024: Merck & Co Inc announces significant investment in R&D for novel antimicrobial strategies in livestock, exploring phage therapy.

- 2024: BASF SE acquires a specialized company focusing on precision fermentation for feed additive production, signaling a move towards advanced biotechnologies.

- 2024: Boehringer Ingelheim Mexico receives regulatory approval for a new feed additive aimed at enhancing immune response in Swine.

- 2024: Zeotis introduces an innovative range of essential oil-based feed additives for Aquaculture, promoting growth and disease resistance.

- 2025: LG Life Sciences Limited is expected to launch a new formulation of Tetracyclines with improved pharmacokinetic properties for broad application.

Strategic North America Feed Antibiotics Market Market Forecast

The North America Feed Antibiotics Market is projected for robust growth, driven by the increasing need for efficient and sustainable animal protein production. Key growth catalysts include continued technological advancements in feed additives, particularly in the realm of probiotics, prebiotics, and natural compounds, which cater to the rising demand for antibiotic-free products. The market's potential is further amplified by ongoing investments in research and development focused on disease prevention and enhanced animal welfare. Despite regulatory hurdles, the strategic imperative to manage antimicrobial resistance will continue to foster innovation in alternative solutions. The forecast period anticipates a dynamic interplay between traditional and novel feed additives, with a significant upward trajectory for segments offering improved animal health outcomes and reduced environmental impact, thereby securing substantial market potential.

North America Feed Antibiotics Market Segmentation

-

1. Type

- 1.1. Tetracyclines

- 1.2. Penicillins

- 1.3. Sulfonamides

- 1.4. Macrolides

- 1.5. Aminoglycosides

- 1.6. Cephalosporins

- 1.7. Others

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. United States

- 3.2. Mexico

- 3.3. Canada

- 3.4. Rest of North America

North America Feed Antibiotics Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

- 4. Rest of North America

North America Feed Antibiotics Market Regional Market Share

Geographic Coverage of North America Feed Antibiotics Market

North America Feed Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Feed Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tetracyclines

- 5.1.2. Penicillins

- 5.1.3. Sulfonamides

- 5.1.4. Macrolides

- 5.1.5. Aminoglycosides

- 5.1.6. Cephalosporins

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Mexico

- 5.4.3. Canada

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tetracyclines

- 6.1.2. Penicillins

- 6.1.3. Sulfonamides

- 6.1.4. Macrolides

- 6.1.5. Aminoglycosides

- 6.1.6. Cephalosporins

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Mexico

- 6.3.3. Canada

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico North America Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tetracyclines

- 7.1.2. Penicillins

- 7.1.3. Sulfonamides

- 7.1.4. Macrolides

- 7.1.5. Aminoglycosides

- 7.1.6. Cephalosporins

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Mexico

- 7.3.3. Canada

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Canada North America Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tetracyclines

- 8.1.2. Penicillins

- 8.1.3. Sulfonamides

- 8.1.4. Macrolides

- 8.1.5. Aminoglycosides

- 8.1.6. Cephalosporins

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Mexico

- 8.3.3. Canada

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tetracyclines

- 9.1.2. Penicillins

- 9.1.3. Sulfonamides

- 9.1.4. Macrolides

- 9.1.5. Aminoglycosides

- 9.1.6. Cephalosporins

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Mexico

- 9.3.3. Canada

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Elanco

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cargill Incorporated

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 LG Life Sciences Limite

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Merck & Co Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Boehringer Ingelheim Mexico

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BASF SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zomedica Pharmaceuticals Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alltech Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zeotis

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 American Regent Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Elanco

List of Figures

- Figure 1: North America Feed Antibiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Feed Antibiotics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: North America Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Feed Antibiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: North America Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: North America Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: North America Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: North America Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Antibiotics Market?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the North America Feed Antibiotics Market?

Key companies in the market include Elanco, Cargill Incorporated, LG Life Sciences Limite, Merck & Co Inc, Boehringer Ingelheim Mexico, BASF SE, Zomedica Pharmaceuticals Corp, Alltech Inc, Zeotis, American Regent Inc.

3. What are the main segments of the North America Feed Antibiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Feed Production Drives the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Antibiotics Market?

To stay informed about further developments, trends, and reports in the North America Feed Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence