Key Insights

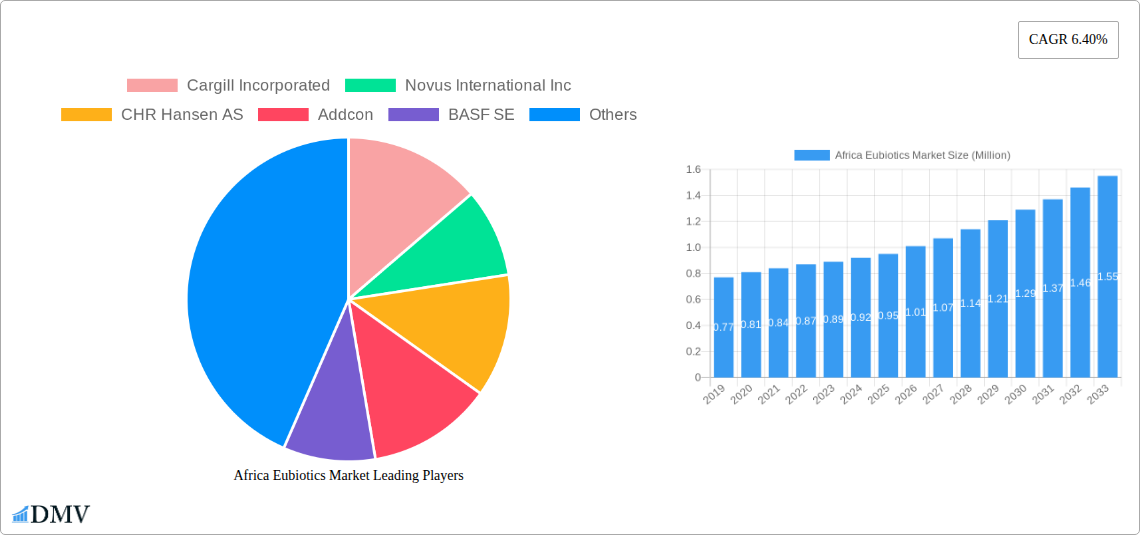

The African eubiotics market is poised for substantial growth, with a current market size of approximately USD 0.90 million. This robust expansion is fueled by a projected Compound Annual Growth Rate (CAGR) of 6.40% over the forecast period of 2025-2033. This growth is primarily driven by the escalating demand for animal protein across the continent, coupled with an increasing awareness among livestock producers regarding the benefits of eubiotics in improving animal health, performance, and reducing reliance on antibiotic growth promoters. Regulatory shifts and a growing emphasis on food safety and quality are further bolstering the adoption of eubiotic solutions. The market is segmented into various product types, including probiotics, prebiotics, organic acids, and essential oils, with probiotics and prebiotics expected to lead in market share due to their well-established efficacy and broad application.

Africa Eubiotics Market Market Size (In Million)

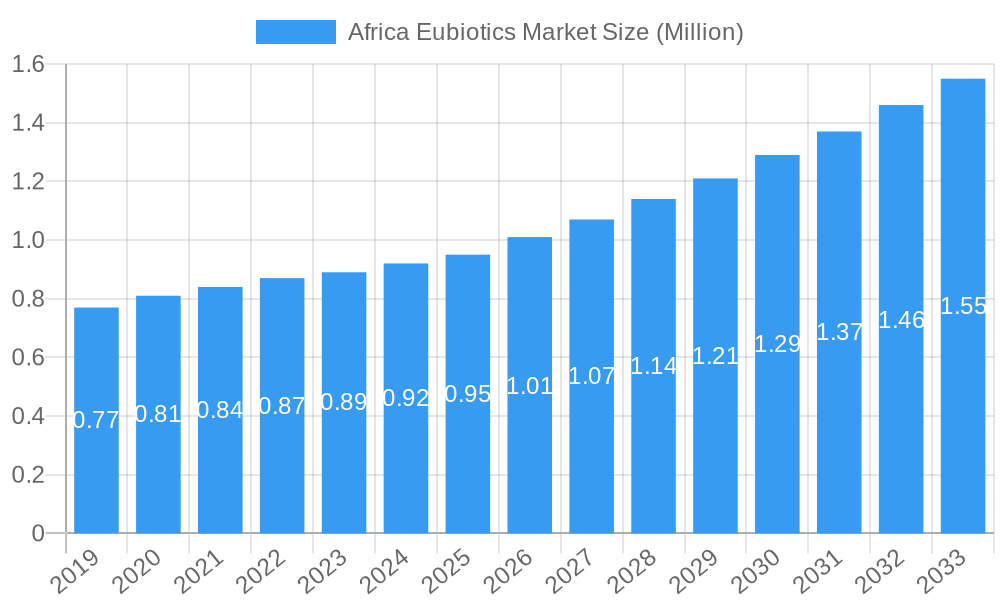

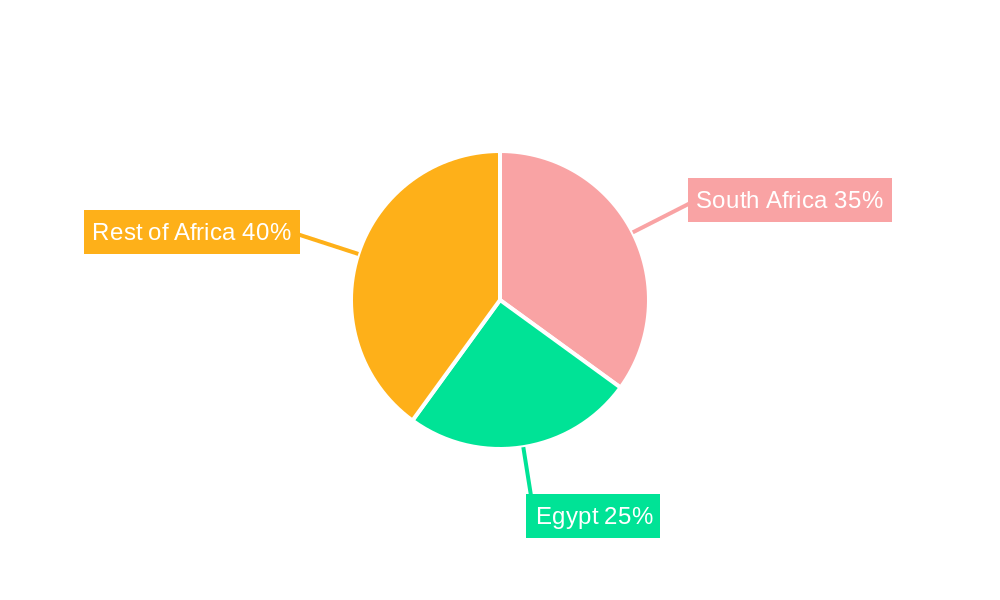

The eubiotics market in Africa is experiencing significant traction across diverse animal segments, including ruminants, poultry, swine, aquaculture, and pet food. Poultry and swine sectors, in particular, are anticipated to be key growth engines due to their high production volumes and the increasing focus on gut health for efficient feed utilization and disease prevention. Geographically, while South Africa and Egypt represent significant current markets, the "Rest of Africa" is expected to emerge as a high-potential region, driven by ongoing investments in animal agriculture and expanding livestock populations. Key players like Cargill Incorporated, Novus International Inc, and Chr. Hansen AS are actively engaged in the region, introducing innovative eubiotic solutions tailored to local challenges and market needs. However, challenges such as limited awareness in some sub-Saharan regions, cost-sensitivity of farmers, and the need for robust distribution networks may present hurdles to widespread adoption.

Africa Eubiotics Market Company Market Share

This in-depth report offers a definitive analysis of the Africa Eubiotics Market, providing critical insights into its current landscape, historical performance, and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand market dynamics, growth drivers, and competitive strategies.

Africa Eubiotics Market Market Composition & Trends

The Africa Eubiotics Market exhibits a dynamic composition influenced by a growing demand for animal health and sustainable feed additives. Market concentration is moderately fragmented, with key players vying for significant market share through strategic product development and regional expansion. Innovation catalysts are primarily driven by research into novel probiotic strains, advanced prebiotic formulations, and the efficacy of essential oils and organic acids in improving animal gut health and reducing reliance on antibiotics. The regulatory landscape is evolving, with increasing alignment with international standards for feed additives and animal welfare, albeit with regional variations. Substitute products, such as traditional feed additives and antibiotic growth promoters (AGPs), are gradually being phased out in favor of eubiotics due to growing concerns over antibiotic resistance. End-user profiles are diverse, encompassing large-scale commercial livestock operations, smallholder farms, and a burgeoning pet food industry. Mergers and acquisitions (M&A) activities are a key trend, with major players consolidating their positions and expanding their product portfolios. For instance, strategic acquisitions in the past have been valued in the hundreds of millions of dollars, indicating a strong appetite for market consolidation. The overall market share distribution is characterized by a few dominant players holding substantial portions, while emerging companies are focusing on niche segments and localized solutions. XXX (Market share distribution and M&A deal values are detailed within the report.)

Africa Eubiotics Market Industry Evolution

The Africa Eubiotics Market has witnessed remarkable evolution, driven by a confluence of factors including increasing meat consumption, growing awareness of animal welfare, and the global push to curb antibiotic use in animal agriculture. Over the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately 6.5%, propelled by early adoption in poultry and swine farming. The base year (2025) marks a pivotal point, with the market projected to expand significantly. Technological advancements have played a crucial role, with ongoing research leading to the development of more potent and stable probiotic strains and functional prebiotic ingredients tailored to specific animal digestive systems. For example, encapsulation technologies have enhanced the survival rate of probiotics through the animal's gastrointestinal tract, leading to improved efficacy. Shifting consumer demands for antibiotic-free meat products and ethically raised livestock have further amplified the growth trajectory. Government initiatives promoting sustainable agriculture and food safety standards are also contributing to the industry's robust expansion. The adoption metrics for eubiotics have risen considerably, with an estimated penetration rate of 35% in commercial poultry operations by 2024. The forecast period (2025-2033) is expected to see sustained growth, with projected CAGRs of around 7-8%, driven by expanding applications in aquaculture, ruminants, and pet food sectors. The industry's evolution is a testament to its adaptability and its critical role in addressing global challenges in food security and public health. XXX (Specific growth rates and adoption metrics are comprehensively detailed within the report.)

Leading Regions, Countries, or Segments in Africa Eubiotics Market

The Africa Eubiotics Market is characterized by distinct regional performance and segment dominance. South Africa consistently emerges as a leading region, driven by its well-established agricultural infrastructure, advanced farming practices, and higher disposable income for premium animal feed products. This dominance is further bolstered by significant investment in animal health research and development, coupled with proactive regulatory frameworks that encourage the adoption of eubiotic solutions.

Key drivers in South Africa include:

- Strong Poultry and Swine Sectors: These are major consumers of eubiotics, benefiting from improved feed conversion ratios and reduced disease incidence.

- Increasing Demand for Processed Meats: This fuels the need for efficient and healthy animal production.

- Government Support for Sustainable Agriculture: Policies promoting responsible antibiotic use indirectly boost eubiotics.

- Presence of Major Agribusiness Companies: These entities facilitate wider product distribution and adoption.

Among the segments, Probiotics, particularly Lactobacilli and Bifidobacteri strains, represent the largest and fastest-growing category. Their efficacy in promoting gut microflora balance and immune response makes them highly sought after across various animal types.

- Poultry is the leading animal type segment for eubiotics, owing to the high density of birds, rapid growth cycles, and susceptibility to digestive disorders, making eubiotics crucial for maintaining flock health and productivity. The global demand for affordable protein sources further accentuates poultry’s importance.

- Swine also exhibits substantial growth, as eubiotics are instrumental in improving gut health, reducing post-weaning diarrhea, and enhancing overall animal performance, thereby minimizing the need for antibiotic interventions.

- Prebiotics, such as Inulin and Fructo-Oligosaccharides (FOS), are gaining significant traction as complementary ingredients to probiotics, working synergistically to foster beneficial gut bacteria. Their application in pet food is also witnessing a notable surge due to the increasing humanization of pets and a focus on their digestive well-being.

- Organic Acids and Essential Oils are also vital, contributing to gut health management through their antimicrobial and anti-inflammatory properties, respectively, finding widespread application across ruminants, aquaculture, and other animal types.

While Egypt and the Rest of Africa show promising growth potential, driven by expanding agricultural sectors and increasing awareness, South Africa's mature market, coupled with strong segment performance, solidifies its position as the current leader in the African Eubiotics Market.

Africa Eubiotics Market Product Innovations

Product innovation in the Africa Eubiotics Market is characterized by advancements in formulation, delivery mechanisms, and synergistic combinations. Manufacturers are focusing on developing highly specific probiotic strains tailored to the unique gut microbiomes of different animal species, leading to enhanced efficacy and targeted gut health improvements. Novel encapsulation technologies are being employed to protect sensitive probiotic bacteria and essential oils from degradation in the feed manufacturing process and the harsh conditions of the animal's digestive tract, ensuring their viability and optimal performance. Furthermore, the development of multi-strain probiotic blends and synbiotics (combinations of probiotics and prebiotics) is a significant trend, offering synergistic benefits for gut health and immune modulation. The application of eubiotics is expanding beyond traditional livestock into aquaculture, pet food, and even equine nutrition, reflecting a broader understanding of their versatile benefits. Performance metrics such as improved feed conversion ratios, reduced incidence of digestive disorders, enhanced immune response, and decreased reliance on antibiotics are key indicators of successful product innovation in this market.

Propelling Factors for Africa Eubiotics Market Growth

The Africa Eubiotics Market is propelled by a multifaceted array of factors. Growing consumer demand for antibiotic-free animal products is a primary driver, directly influencing producers to seek alternative feed additives that ensure animal health without compromising human safety. Increasing awareness of animal welfare standards and the associated benefits of improved gut health are further stimulating adoption. Technologically, the advancement in microbial fermentation and encapsulation techniques has led to more effective and stable eubiotic products. Economically, the rising global population and the subsequent demand for animal protein necessitate more efficient and sustainable livestock production methods, where eubiotics play a crucial role. Regulatory bodies worldwide are also increasingly restricting the use of antibiotic growth promoters, creating a significant market opportunity for eubiotics. Furthermore, investment in research and development by leading agribusiness companies is continually expanding the knowledge base and product portfolio, making eubiotics a more viable and attractive option for a wider range of applications.

Obstacles in the Africa Eubiotics Market Market

Despite the robust growth, the Africa Eubiotics Market faces several obstacles. Regulatory fragmentation and inconsistencies across different African nations can hinder widespread adoption and create market access challenges for manufacturers. Limited awareness and understanding of eubiotic benefits among smallholder farmers, who constitute a significant portion of the agricultural landscape, present a barrier to widespread penetration. High upfront costs associated with eubiotic products compared to traditional feed additives can also be a deterrent, particularly for price-sensitive markets. Supply chain disruptions, exacerbated by logistical complexities and infrastructure limitations across the continent, can impact the consistent availability of products. Lastly, intense competition from established conventional feed additives and the continued, albeit declining, use of antibiotic growth promoters pose ongoing competitive pressures that need to be strategically addressed.

Future Opportunities in Africa Eubiotics Market

The Africa Eubiotics Market is poised for significant future opportunities. The expansion of the aquaculture sector presents a substantial untapped market, with eubiotics offering solutions for disease prevention and growth enhancement in farmed fish. The growing trend of pet humanization in Africa translates into increased demand for premium, health-promoting pet food, where eubiotics can play a vital role. Furthermore, advancements in personalized eubiotic solutions tailored to specific animal genetics and environmental conditions will create niche markets. The development of novel eubiotic delivery systems for easier application and improved efficacy, alongside the exploration of synergistic formulations with other functional feed ingredients, offers further avenues for innovation and market growth. Investments in research and development focused on the African microbiome and specific regional challenges will also unlock unique opportunities.

Major Players in the Africa Eubiotics Market Ecosystem

- Cargill Incorporated

- Novus International Inc

- CHR Hansen AS

- Addcon

- BASF SE

- EI Du Pont De Nemours & Company

- Beneo Group

- Kemin Industries Inc

- Behn Meyer Group

- Royal DSM

Key Developments in Africa Eubiotics Market Industry

- 2023: Chr. Hansen AS launches a new multi-strain probiotic formulation for poultry, demonstrating improved feed conversion ratios in trials across West Africa.

- 2023: Novus International Inc. expands its eubiotic product offerings in Egypt, focusing on swine and ruminant applications, following increased demand for antibiotic-free meat production.

- 2024: BASF SE announces a strategic partnership with a leading South African feed manufacturer to co-develop and market innovative organic acid-based eubiotics for the regional market.

- 2024: Kemin Industries Inc. introduces a novel encapsulated essential oil blend targeting improved gut health in aquaculture species, with pilot studies showing significant disease resistance benefits.

- 2024: Addcon initiates a series of farmer education workshops across Kenya and Nigeria, emphasizing the economic and health benefits of incorporating eubiotics into animal feed.

Strategic Africa Eubiotics Market Market Forecast

The strategic forecast for the Africa Eubiotics Market points towards sustained and accelerated growth, driven by an increasing commitment to sustainable animal agriculture and proactive public health initiatives. The ongoing shift away from antibiotic growth promoters, coupled with a rising global demand for animal protein, creates a fertile ground for eubiotic solutions. Significant opportunities lie in the expanding aquaculture and pet food segments, where tailored eubiotic applications can address specific health and performance needs. Continued investment in research and development, particularly in understanding the unique microbial landscapes of African livestock, will unlock innovative and region-specific products. Strategic collaborations between multinational corporations and local stakeholders will be crucial for navigating the diverse regulatory environments and distribution networks across the continent, ensuring broader market penetration and ultimately contributing to a healthier, more sustainable African animal husbandry sector.

Africa Eubiotics Market Segmentation

-

1. Type

-

1.1. Probiotics

- 1.1.1. Lactobacilli

- 1.1.2. Bifidobacteri

-

1.2. Prebiotics

- 1.2.1. Inulin

- 1.2.2. Fructo-Oligosaccharides

- 1.2.3. Galacto-Oligosaccharides

- 1.2.4. Other Prebiotics

- 1.3. Organic Acids

- 1.4. Essential Oils

-

1.1. Probiotics

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Pet Food

- 2.6. Horses

- 2.7. Other Animal Types

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Rest of Africa

Africa Eubiotics Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Rest of Africa

Africa Eubiotics Market Regional Market Share

Geographic Coverage of Africa Eubiotics Market

Africa Eubiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. Increasing Industrialization of Livestock

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Eubiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Probiotics

- 5.1.1.1. Lactobacilli

- 5.1.1.2. Bifidobacteri

- 5.1.2. Prebiotics

- 5.1.2.1. Inulin

- 5.1.2.2. Fructo-Oligosaccharides

- 5.1.2.3. Galacto-Oligosaccharides

- 5.1.2.4. Other Prebiotics

- 5.1.3. Organic Acids

- 5.1.4. Essential Oils

- 5.1.1. Probiotics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Pet Food

- 5.2.6. Horses

- 5.2.7. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Eubiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Probiotics

- 6.1.1.1. Lactobacilli

- 6.1.1.2. Bifidobacteri

- 6.1.2. Prebiotics

- 6.1.2.1. Inulin

- 6.1.2.2. Fructo-Oligosaccharides

- 6.1.2.3. Galacto-Oligosaccharides

- 6.1.2.4. Other Prebiotics

- 6.1.3. Organic Acids

- 6.1.4. Essential Oils

- 6.1.1. Probiotics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Pet Food

- 6.2.6. Horses

- 6.2.7. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Egypt Africa Eubiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Probiotics

- 7.1.1.1. Lactobacilli

- 7.1.1.2. Bifidobacteri

- 7.1.2. Prebiotics

- 7.1.2.1. Inulin

- 7.1.2.2. Fructo-Oligosaccharides

- 7.1.2.3. Galacto-Oligosaccharides

- 7.1.2.4. Other Prebiotics

- 7.1.3. Organic Acids

- 7.1.4. Essential Oils

- 7.1.1. Probiotics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Pet Food

- 7.2.6. Horses

- 7.2.7. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Africa Africa Eubiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Probiotics

- 8.1.1.1. Lactobacilli

- 8.1.1.2. Bifidobacteri

- 8.1.2. Prebiotics

- 8.1.2.1. Inulin

- 8.1.2.2. Fructo-Oligosaccharides

- 8.1.2.3. Galacto-Oligosaccharides

- 8.1.2.4. Other Prebiotics

- 8.1.3. Organic Acids

- 8.1.4. Essential Oils

- 8.1.1. Probiotics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Pet Food

- 8.2.6. Horses

- 8.2.7. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Novus International Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CHR Hansen AS

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Addcon

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BASF SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 EI Du Pont De Numours & Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Beneo Group*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemin Industries Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Behn Meyer Group

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Royal DSM

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: Africa Eubiotics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Eubiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Eubiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Africa Eubiotics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Africa Eubiotics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Africa Eubiotics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Africa Eubiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Africa Eubiotics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 7: Africa Eubiotics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Africa Eubiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Africa Eubiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Africa Eubiotics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Africa Eubiotics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Africa Eubiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Africa Eubiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Africa Eubiotics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 15: Africa Eubiotics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Africa Eubiotics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Eubiotics Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Africa Eubiotics Market?

Key companies in the market include Cargill Incorporated, Novus International Inc, CHR Hansen AS, Addcon, BASF SE, EI Du Pont De Numours & Company, Beneo Group*List Not Exhaustive, Kemin Industries Inc, Behn Meyer Group, Royal DSM.

3. What are the main segments of the Africa Eubiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

Increasing Industrialization of Livestock.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Eubiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Eubiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Eubiotics Market?

To stay informed about further developments, trends, and reports in the Africa Eubiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence