Key Insights

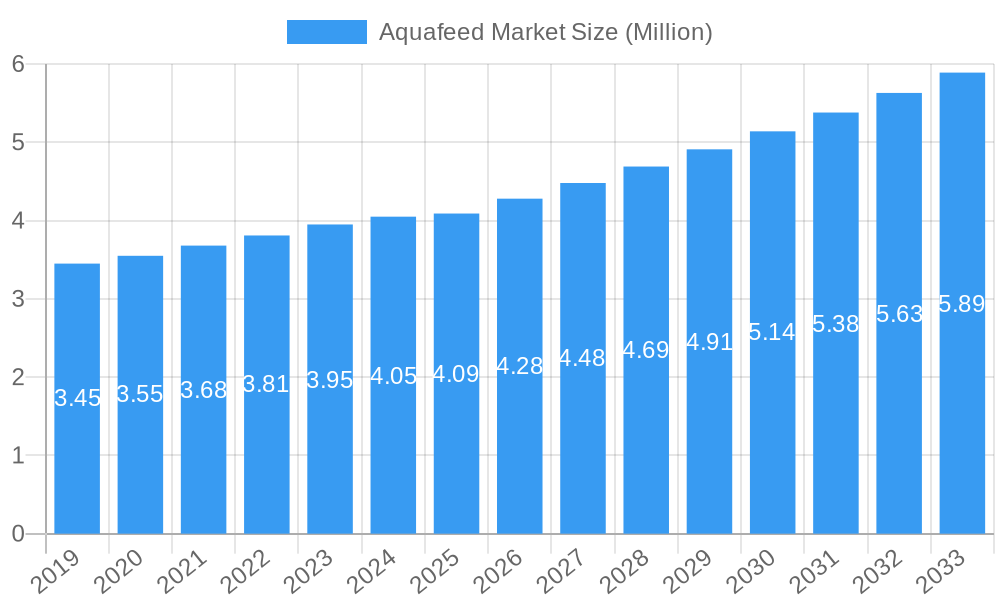

The global Aquafeed Market is poised for significant expansion, projected to reach approximately USD 4.09 billion in value by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.50% through 2033. This robust growth is underpinned by a confluence of favorable market dynamics and evolving consumer preferences. A primary driver is the escalating global demand for seafood, propelled by its perceived health benefits and its role as a sustainable protein source compared to traditional livestock. As populations grow and disposable incomes rise, particularly in emerging economies, the consumption of fish and shellfish is set to increase, consequently boosting the demand for high-quality aquafeed. Technological advancements in aquaculture practices, including the development of more efficient feed formulations and sustainable farming techniques, are also instrumental in fueling market growth. These innovations aim to optimize fish growth, improve feed conversion ratios, and minimize environmental impact, making aquaculture a more attractive and viable industry. The increasing adoption of precision aquaculture, where feed is tailored to the specific nutritional needs of different species at various life stages, further contributes to the efficiency and profitability of the sector.

Aquafeed Market Market Size (In Million)

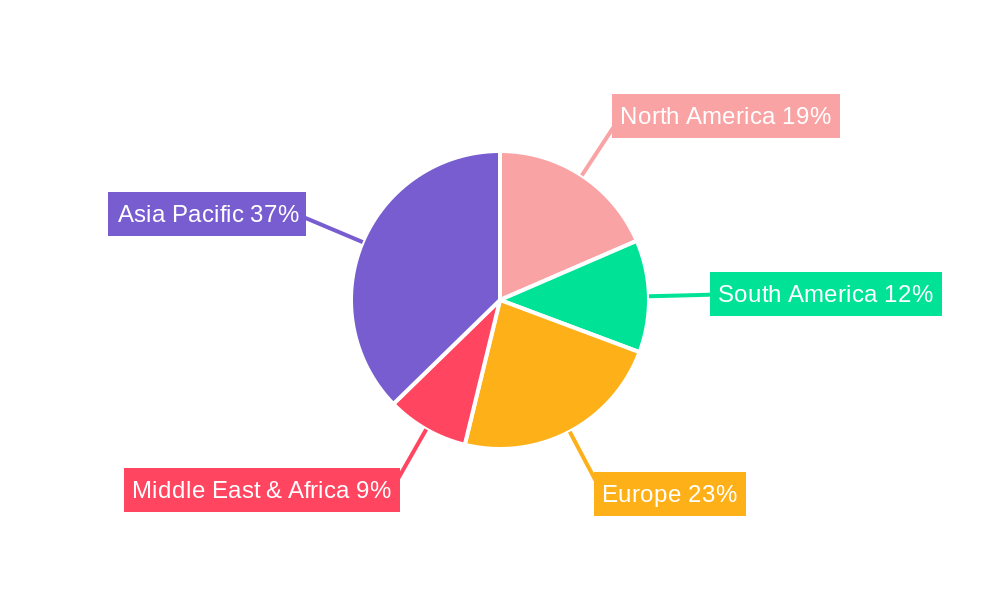

The market is segmented into diverse categories, reflecting the specialized nature of aquaculture. Fish feed, encompassing a wide array of species like ray-finned fish, mackerel, ribbon fish, cuttlefish, and catfish, represents a substantial portion of the aquafeed landscape. Beyond fish, the growing aquaculture of mollusks and crustaceans also necessitates specialized feed solutions, indicating a broadening market scope. Geographically, the Asia Pacific region, particularly China and India, is anticipated to be a dominant force due to its extensive aquaculture production and burgeoning domestic consumption. North America and Europe are also significant markets, driven by established aquaculture industries and increasing consumer awareness. However, the market faces certain restraints, including the volatility of raw material prices, such as fishmeal and fish oil, which are key ingredients in aquafeed. Environmental regulations and concerns regarding the sustainability of sourcing these raw materials can also pose challenges. Nevertheless, ongoing research and development efforts focused on alternative protein sources and innovative feed additives are expected to mitigate these restraints and pave the way for sustained market expansion.

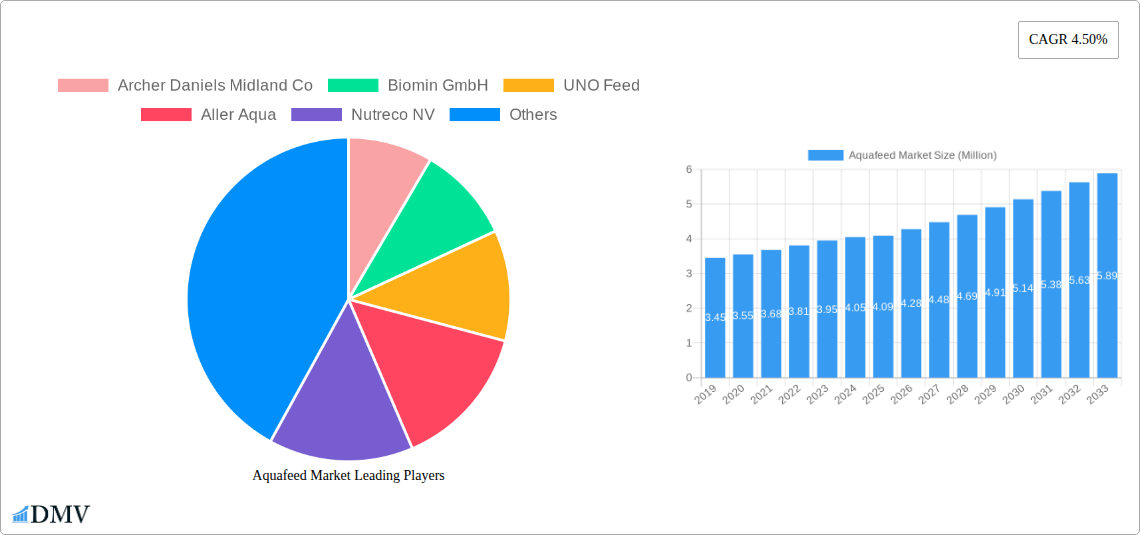

Aquafeed Market Company Market Share

Unlock critical insights into the dynamic global aquafeed market with this in-depth report. Covering the historical period from 2019 to 2024, the base year 2025, and projecting through 2033, this analysis delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, challenges, and future opportunities. Gain a competitive edge by understanding market dynamics, key players, and strategic forecasts in the ever-expanding aquaculture sector. This report is your essential guide to navigating the complexities of fish feed, aquaculture nutrition, and sustainable aquatic feed solutions.

Aquafeed Market Market Composition & Trends

The aquafeed market is characterized by a moderate to high degree of concentration, with major global players holding significant market share. Innovation remains a key catalyst, driven by the constant need for enhanced feed efficiency, sustainability, and species-specific nutritional profiles. Regulatory landscapes, particularly concerning feed ingredients and environmental impact, are evolving, influencing production practices and market entry. Substitute products, such as alternative protein sources and processed feeds, are gaining traction, prompting feed manufacturers to adapt their strategies. End-user profiles vary from small-scale fish farmers to large integrated aquaculture operations, each with distinct purchasing behaviors and demands. Mergers and acquisitions (M&A) are prevalent, with significant deal values of $1,500 Million reported in recent years, signaling industry consolidation and strategic expansion.

- Market Share Distribution: Leading companies collectively hold approximately 65% of the global aquafeed market.

- Innovation Drivers: Increased demand for high-performance feeds, reduced environmental footprint, and novel ingredient utilization.

- Regulatory Influence: Strict guidelines on ingredient sourcing, traceability, and sustainability certifications are shaping market practices.

- Substitute Product Landscape: Growing adoption of insect-based feeds, algae-based ingredients, and processed by-products.

- M&A Deal Value: Significant consolidation activities underscore the strategic importance of market presence and technological acquisition.

Aquafeed Market Industry Evolution

The aquafeed market has witnessed remarkable growth and evolution, driven by the escalating demand for sustainable seafood and the expansion of aquaculture globally. Over the historical period (2019-2024), the market demonstrated a robust Compound Annual Growth Rate (CAGR) of 8.5%, underscoring its status as a high-growth sector. This trajectory is further projected to continue, with an estimated CAGR of 9.2% during the forecast period (2025-2033). Technological advancements have been pivotal, with the development of precision feeding systems, advanced feed formulations incorporating functional ingredients, and the exploration of novel protein sources like insect meal and algae. These innovations aim to optimize nutrient utilization, improve fish health, and minimize waste. Shifting consumer demands for ethically sourced, healthy, and sustainably produced seafood have directly influenced the aquaculture feed industry, pushing for more environmentally friendly and efficient feed solutions. The base year 2025 is expected to see a market value of $120,000 Million, reflecting continued expansion.

The industry's evolution is deeply intertwined with advancements in animal nutrition science, genetics, and sustainable resource management. Early aquafeeds were largely based on traditional ingredients like fishmeal and fish oil. However, concerns about the sustainability of these resources have spurred intensive research into alternative ingredients. The adoption rate of these novel ingredients, while steadily increasing, is influenced by cost-effectiveness, availability, and regulatory approvals. For instance, the integration of plant-based proteins has been ongoing, but challenges related to anti-nutritional factors have necessitated sophisticated processing techniques.

Furthermore, the development of species-specific feeds has become a significant trend. Different aquatic species, including various types of fish feed such as Ray-finned Fish Feed, Mackerel Feed, Ribbon Fish Feed, Cuttlefish Feed, and Catfish Feed, as well as Mollusk Feed and Crustacean Feed, have unique dietary requirements. Aquafeed manufacturers are investing heavily in research and development to tailor formulations that maximize growth rates, improve feed conversion ratios (FCR), and enhance disease resistance for each target species. The increasing sophistication of feed production technologies, including extrusion and pelleting techniques, ensures optimal nutrient bioavailability and palatability. The global market value for aquafeed is estimated to reach $185,000 Million by the end of the forecast period in 2033, driven by these ongoing evolutions.

Leading Regions, Countries, or Segments in Aquafeed Market

The Fish Feed segment overwhelmingly dominates the global aquafeed market, accounting for an estimated 75% of the total market value. Within this segment, Ray-finned Fish Feed represents the largest sub-segment due to the vast diversity and widespread cultivation of these species, including popular varieties like tilapia, salmon, and trout. The dominance of fish feed is driven by several interconnected factors. Aquaculture's primary focus remains on finfish production, a sector that has seen substantial investment and technological advancement over the past decades. The increasing global demand for protein sources, coupled with the limitations of wild fisheries, has propelled finfish aquaculture to the forefront, directly driving the demand for specialized fish feed.

Asia-Pacific stands out as the leading region in the aquafeed market, primarily due to its established and rapidly expanding aquaculture industry. Countries like China, India, Vietnam, and Indonesia are major contributors to global aquaculture production, consequently leading in aquafeed consumption. This regional dominance is fueled by a confluence of factors: a large population with a growing appetite for seafood, favorable climatic conditions for aquaculture, government support and policies promoting the sector, and a well-established network of small and medium-scale farmers who form the backbone of aquaculture in the region. Investment trends in Asia-Pacific have consistently leaned towards enhancing aquaculture infrastructure and optimizing feed production to meet the burgeoning demand.

- Dominant Segment: Fish Feed (estimated 75% market share).

- Ray-finned Fish Feed: The largest sub-segment, driven by the global popularity and diverse cultivation of species like tilapia, salmon, and trout.

- Mackerel Feed: Growing demand due to the commercial importance of mackerel aquaculture.

- Ribbon Fish Feed: Significant consumption in regions with established ribbon fish farming.

- Cuttlefish Feed: Niche but growing demand driven by specialized aquaculture practices.

- Catfish Feed: Consistent demand from major catfish producing regions.

- Other Fish Feeds: Encompasses a wide array of species, contributing to the overall segment growth.

- Leading Segment Driver: The inherent biological requirements and widespread cultivation of finfish species globally.

- Leading Region: Asia-Pacific.

- Key Drivers in Asia-Pacific:

- Vast Aquaculture Production: Dominates global output, creating substantial demand for aquafeed.

- Government Support and Investment: Policies and funding initiatives aimed at boosting aquaculture sector.

- Large Consumer Base: High per capita seafood consumption drives production and feed needs.

- Technological Adoption: Increasing integration of advanced feed technologies to improve efficiency.

- Key Drivers in Asia-Pacific:

- Second Leading Segment: Crustacean Feed, driven by the significant global production of shrimp and prawns.

- Emerging Segment: Mollusk Feed, showing steady growth with advancements in shellfish aquaculture techniques.

Aquafeed Market Product Innovations

Aquafeed product innovation is intensely focused on enhancing nutritional efficiency and sustainability. Recent developments include the introduction of microencapsulated diets, like the one launched by Zeigler Brothers in April 2022, featuring easily absorbed microparticles that protect sensitive nutrients such as fatty acids and vitamins, ensuring optimal bioavailability for shrimp post-larvae. The February 2022 launch of "BUGS IN" by Taiyo Feed Mill Pvt Ltd, an insect-based feed derived from Black Soldier Fly Larvae, highlights the industry's pivot towards sustainable and novel protein sources for fish and turtles. These innovations address critical challenges in aquaculture, such as feed waste reduction, improved growth performance, and enhanced immune responses in aquatic organisms, leading to higher FCR and reduced environmental impact.

Propelling Factors for Aquafeed Market Growth

The aquafeed market is propelled by several key growth factors. Firstly, the surging global demand for protein-rich seafood, fueled by population growth and increasing health consciousness, directly drives aquaculture expansion. Secondly, technological advancements in feed formulation, including the incorporation of functional ingredients, probiotics, and prebiotics, enhance fish health and growth performance, leading to improved feed conversion ratios. Thirdly, the increasing adoption of sustainable aquaculture practices, driven by consumer preference and regulatory pressures, encourages the development and use of eco-friendly aquafeeds. Finally, significant investments in research and development by leading companies are continuously introducing innovative and cost-effective feed solutions, further stimulating market growth. The market value is expected to reach $185,000 Million by 2033.

Obstacles in the Aquafeed Market Market

Despite its robust growth, the aquafeed market faces several obstacles. Regulatory hurdles concerning the use of novel ingredients and the sourcing of raw materials can impede market entry and product development. Supply chain disruptions, exacerbated by geopolitical events and climate change impacts on raw material availability, can lead to price volatility and shortages. Intense competition among numerous players, both global and regional, puts pressure on profit margins. Furthermore, the high cost associated with R&D for innovative feed formulations and the initial investment required for sustainable ingredient sourcing can be a barrier for smaller companies. The reliance on certain traditional ingredients also presents a vulnerability to price fluctuations.

Future Opportunities in Aquafeed Market

Emerging opportunities in the aquafeed market are diverse and promising. The development and commercialization of alternative protein sources, such as insect meal, algae, and microbial proteins, present significant potential for sustainable and cost-effective feed solutions. Advancements in precision aquaculture and smart feeding technologies offer opportunities for optimized feed delivery, reduced waste, and improved resource management. The expansion of aquaculture into new geographical regions and the increasing diversification of farmed aquatic species will create new market segments and demand for specialized feeds. Furthermore, the growing consumer demand for traceable and sustainably produced seafood will continue to drive innovation in sustainable aquaculture feed and organic fish feed.

Major Players in the Aquafeed Market Ecosystem

- Archer Daniels Midland Co

- Biomin GmbH

- UNO Feed

- Aller Aqua

- Nutreco NV

- BASF SE

- Growel Feeds Private Limited

- Avanti

- Altech Inc

- Cargill Inc

Key Developments in Aquafeed Market Industry

- April 2022: Zeigler Brothers introduced a new generation of shrimp post-larvae prepared diets, offering a successful alternative to Artemia with easily absorbed, microencapsulated microparticles safeguarding sensitive nutrients.

- April 2022: The ICAR-Central Institute of Fisheries Education in Mumbai launched the Mobile Fish Feed Mill (CIFE Model), developed by the FNBP Division, by Jatindra Nath Swain, Secretary (Fisheries).

- February 2022: Taiyo Feed Mill Pvt Ltd, headquartered in Chennai, launched "BUGS IN," India's first insect-based fish and turtle feed derived from Black Soldier Fly Larvae, promoting sustainable and wholesome nutrition.

Strategic Aquafeed Market Market Forecast

The strategic forecast for the aquafeed market indicates continued strong growth driven by an increasing global appetite for seafood and advancements in aquaculture technology. The sustained investment in R&D for sustainable and efficient feed formulations, particularly those utilizing alternative protein sources like insect meal and algae, will be a key growth catalyst. The market is poised to benefit from wider adoption of precision feeding systems and the expansion of aquaculture into new regions. Regulatory support for sustainable practices and growing consumer preference for ethically sourced seafood will further solidify the market's upward trajectory, with market value projected to reach $185,000 Million by 2033.

Aquafeed Market Segmentation

-

1. Type

-

1.1. Fish Feed

- 1.1.1. Ray-finned Fish Feed

- 1.1.2. Mackerel Feed

- 1.1.3. Ribbon Fish Feed

- 1.1.4. Cuttlefish Feed

- 1.1.5. Catfish Feed

- 1.1.6. Other Fish Feeds

- 1.2. Mollusk Feed

- 1.3. Crustacean Feed

- 1.4. Other Types

-

1.1. Fish Feed

Aquafeed Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aquafeed Market Regional Market Share

Geographic Coverage of Aquafeed Market

Aquafeed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Dental Diseases in Pets and Increase in Animal Health Expenditure; Rising pet humanization; Changing Landscape of the Retail Sector

- 3.3. Market Restrains

- 3.3.1. Lack of Knowledge of Pet Oral Care and Veterinary Dentistry; Limited Accessibility of Specialized Professionals and Services in Developing Countries

- 3.4. Market Trends

- 3.4.1. Increase in Fish Seed Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fish Feed

- 5.1.1.1. Ray-finned Fish Feed

- 5.1.1.2. Mackerel Feed

- 5.1.1.3. Ribbon Fish Feed

- 5.1.1.4. Cuttlefish Feed

- 5.1.1.5. Catfish Feed

- 5.1.1.6. Other Fish Feeds

- 5.1.2. Mollusk Feed

- 5.1.3. Crustacean Feed

- 5.1.4. Other Types

- 5.1.1. Fish Feed

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fish Feed

- 6.1.1.1. Ray-finned Fish Feed

- 6.1.1.2. Mackerel Feed

- 6.1.1.3. Ribbon Fish Feed

- 6.1.1.4. Cuttlefish Feed

- 6.1.1.5. Catfish Feed

- 6.1.1.6. Other Fish Feeds

- 6.1.2. Mollusk Feed

- 6.1.3. Crustacean Feed

- 6.1.4. Other Types

- 6.1.1. Fish Feed

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fish Feed

- 7.1.1.1. Ray-finned Fish Feed

- 7.1.1.2. Mackerel Feed

- 7.1.1.3. Ribbon Fish Feed

- 7.1.1.4. Cuttlefish Feed

- 7.1.1.5. Catfish Feed

- 7.1.1.6. Other Fish Feeds

- 7.1.2. Mollusk Feed

- 7.1.3. Crustacean Feed

- 7.1.4. Other Types

- 7.1.1. Fish Feed

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fish Feed

- 8.1.1.1. Ray-finned Fish Feed

- 8.1.1.2. Mackerel Feed

- 8.1.1.3. Ribbon Fish Feed

- 8.1.1.4. Cuttlefish Feed

- 8.1.1.5. Catfish Feed

- 8.1.1.6. Other Fish Feeds

- 8.1.2. Mollusk Feed

- 8.1.3. Crustacean Feed

- 8.1.4. Other Types

- 8.1.1. Fish Feed

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fish Feed

- 9.1.1.1. Ray-finned Fish Feed

- 9.1.1.2. Mackerel Feed

- 9.1.1.3. Ribbon Fish Feed

- 9.1.1.4. Cuttlefish Feed

- 9.1.1.5. Catfish Feed

- 9.1.1.6. Other Fish Feeds

- 9.1.2. Mollusk Feed

- 9.1.3. Crustacean Feed

- 9.1.4. Other Types

- 9.1.1. Fish Feed

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fish Feed

- 10.1.1.1. Ray-finned Fish Feed

- 10.1.1.2. Mackerel Feed

- 10.1.1.3. Ribbon Fish Feed

- 10.1.1.4. Cuttlefish Feed

- 10.1.1.5. Catfish Feed

- 10.1.1.6. Other Fish Feeds

- 10.1.2. Mollusk Feed

- 10.1.3. Crustacean Feed

- 10.1.4. Other Types

- 10.1.1. Fish Feed

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Archer Daniels Midland Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biomin GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UNO Feed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aller Aqua

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nutreco NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Growel Feeds Private Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avanti

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Altech Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cargill Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Archer Daniels Midland Co

List of Figures

- Figure 1: Global Aquafeed Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aquafeed Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Aquafeed Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aquafeed Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Aquafeed Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aquafeed Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America Aquafeed Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Aquafeed Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Aquafeed Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aquafeed Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Aquafeed Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aquafeed Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aquafeed Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aquafeed Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa Aquafeed Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Aquafeed Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aquafeed Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aquafeed Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Aquafeed Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Aquafeed Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Aquafeed Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aquafeed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Aquafeed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Aquafeed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Aquafeed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Aquafeed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Aquafeed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Aquafeed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aquafeed Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aquafeed Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Aquafeed Market?

Key companies in the market include Archer Daniels Midland Co, Biomin GmbH, UNO Feed, Aller Aqua, Nutreco NV, BASF SE, Growel Feeds Private Limited, Avanti, Altech Inc, Cargill Inc.

3. What are the main segments of the Aquafeed Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.09 Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Dental Diseases in Pets and Increase in Animal Health Expenditure; Rising pet humanization; Changing Landscape of the Retail Sector.

6. What are the notable trends driving market growth?

Increase in Fish Seed Production.

7. Are there any restraints impacting market growth?

Lack of Knowledge of Pet Oral Care and Veterinary Dentistry; Limited Accessibility of Specialized Professionals and Services in Developing Countries.

8. Can you provide examples of recent developments in the market?

April 2022: A new generation of shrimp post-larvae prepared diets, introduced by the Zeigler Brothers, who say it will be a successful alternative to the usage of Artemia. Zeigler claims the diet includes easily absorbed microparticles that have been "microencapsulated to safeguard sensitive colors, fatty acids, enzymes, vitamins, and other nutrients" in an easily digestible matrix.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aquafeed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aquafeed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aquafeed Market?

To stay informed about further developments, trends, and reports in the Aquafeed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence