Key Insights

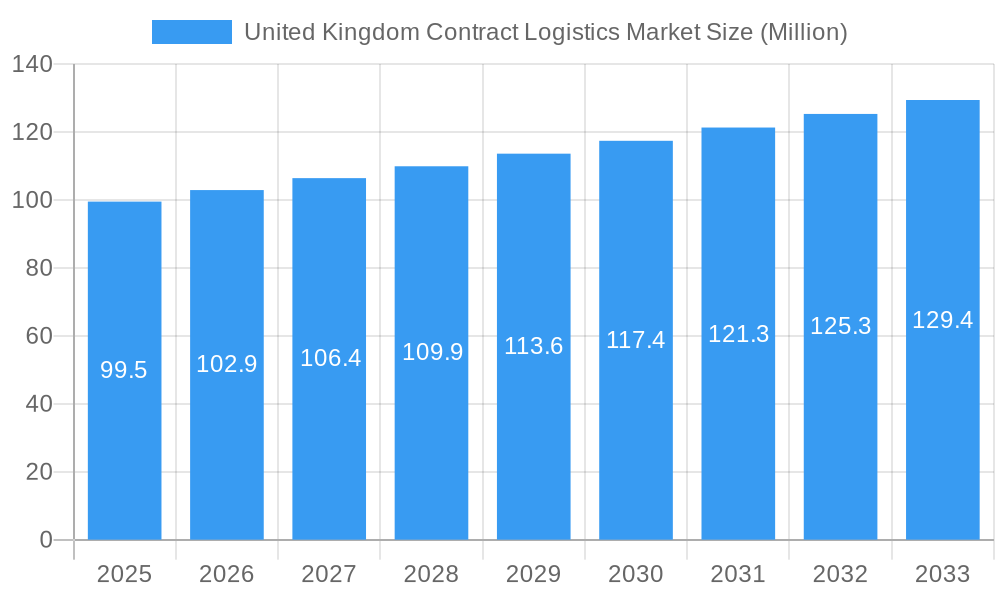

The United Kingdom contract logistics market, valued at approximately £99.5 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing adoption of e-commerce and the need for efficient supply chain management are major catalysts. Businesses are outsourcing logistics functions to specialized providers to reduce operational costs, improve efficiency, and gain access to advanced technologies. The growth is further fueled by the expansion of the manufacturing and automotive sectors, along with the burgeoning consumer goods and retail industries in the UK. While specific regional breakdowns for the UK are not provided, it's reasonable to expect variations based on factors like population density, industrial concentration, and proximity to major ports. Areas with significant manufacturing hubs will likely exhibit higher market penetration. The market is segmented by type (insourced versus outsourced) and by end-user industry (Manufacturing & Automotive, Consumer Goods & Retail, Pharmaceuticals & Healthcare, Hi-tech, and Others). Outsourcing is expected to dominate, reflecting the ongoing trend toward specialization and efficiency gains. However, some companies may retain certain logistics functions in-house, particularly those with highly specialized needs or sensitive products.

United Kingdom Contract Logistics Market Market Size (In Million)

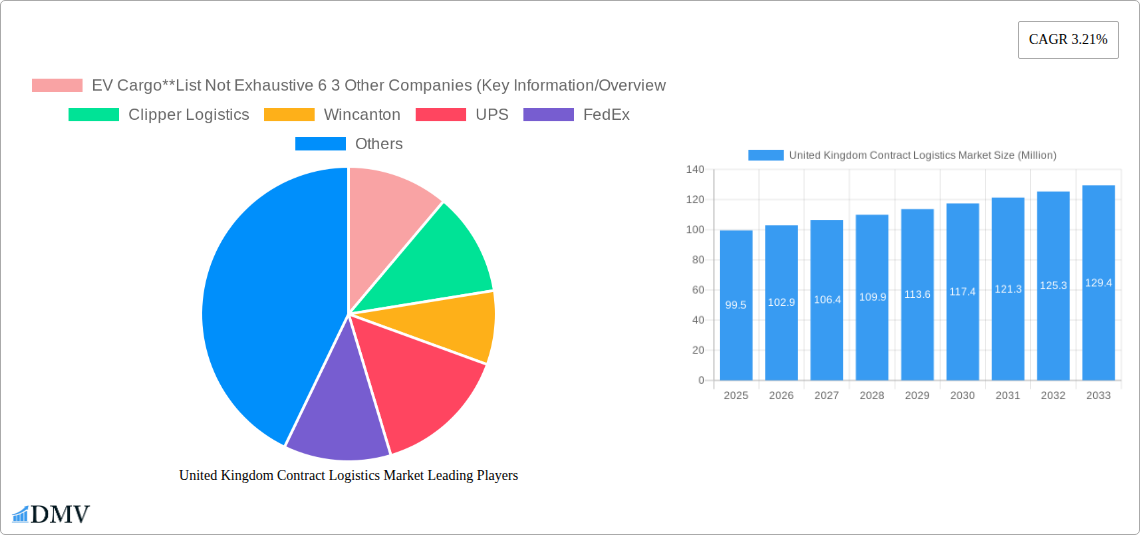

Competition in the UK contract logistics market is intense, with a mix of global giants like UPS, FedEx, and DHL, alongside significant regional players such as Clipper Logistics, Wincanton, and Eddie Stobart. These companies compete based on pricing, service quality, technological capabilities, and geographical reach. The market is characterized by ongoing consolidation, with larger players acquiring smaller firms to expand their market share and service offerings. Future growth will likely be influenced by technological advancements, such as automation, AI-powered optimization, and the increasing use of data analytics for improved decision-making within supply chains. Government regulations and environmental concerns will also play a role, with a likely increase in demand for sustainable and environmentally friendly logistics solutions. Overall, the UK contract logistics market offers attractive opportunities for both established players and new entrants, but success will hinge on adaptability, innovation, and a strong focus on customer service.

United Kingdom Contract Logistics Market Company Market Share

United Kingdom Contract Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United Kingdom contract logistics market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025, this study offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is expected to reach £XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033).

United Kingdom Contract Logistics Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, regulatory factors, and substitution effects within the UK contract logistics market. We examine the market share distribution among key players, revealing a moderately concentrated market with significant opportunities for growth and consolidation. The report also analyzes M&A activities, quantifying deal values and their impact on market structure. The increasing adoption of advanced technologies, stringent regulations, and evolving consumer preferences are key factors influencing market dynamics.

- Market Concentration: The UK contract logistics market exhibits a moderately concentrated structure, with the top five players holding approximately XX% of the market share in 2024.

- Innovation Catalysts: Automation, AI, and blockchain technologies are driving efficiency and transparency improvements.

- Regulatory Landscape: Brexit and evolving environmental regulations significantly impact operational costs and strategies.

- Substitute Products: The emergence of alternative fulfillment models presents both challenges and opportunities.

- End-User Profiles: The report segments end-users across manufacturing, retail, healthcare, and other sectors, analyzing their distinct logistics needs.

- M&A Activities: The report tracks significant mergers and acquisitions, detailing deal values and their strategic implications. Total M&A deal value between 2019-2024 was estimated at £XX Million.

United Kingdom Contract Logistics Market Industry Evolution

The United Kingdom's contract logistics market has experienced significant transformation between 2019 and 2024, characterized by dynamic growth, rapid technological integration, and an adaptive response to evolving consumer expectations. Over this period, the market has seen a robust compound annual growth rate (CAGR), projected to continue its upward trajectory from 2025 to 2033. Key drivers of this evolution include the relentless expansion of e-commerce, necessitating sophisticated fulfillment strategies and accelerated delivery capabilities. The burgeoning trend towards omnichannel distribution has further complicated supply chains, demanding seamless integration of online and offline retail operations. Simultaneously, a heightened awareness of environmental impact is pushing the industry towards the widespread adoption of sustainable logistics practices, from green warehousing solutions to optimized route planning to reduce carbon footprints. Technological advancements are at the forefront of this transformation. Investments in automation, including robotics and automated guided vehicles (AGVs), are revolutionizing warehouse operations, boosting efficiency, and reducing labor costs. Furthermore, the pervasive application of data analytics and Artificial Intelligence (AI) is enhancing supply chain visibility, enabling predictive maintenance, optimizing inventory management, and providing valuable insights for strategic decision-making.

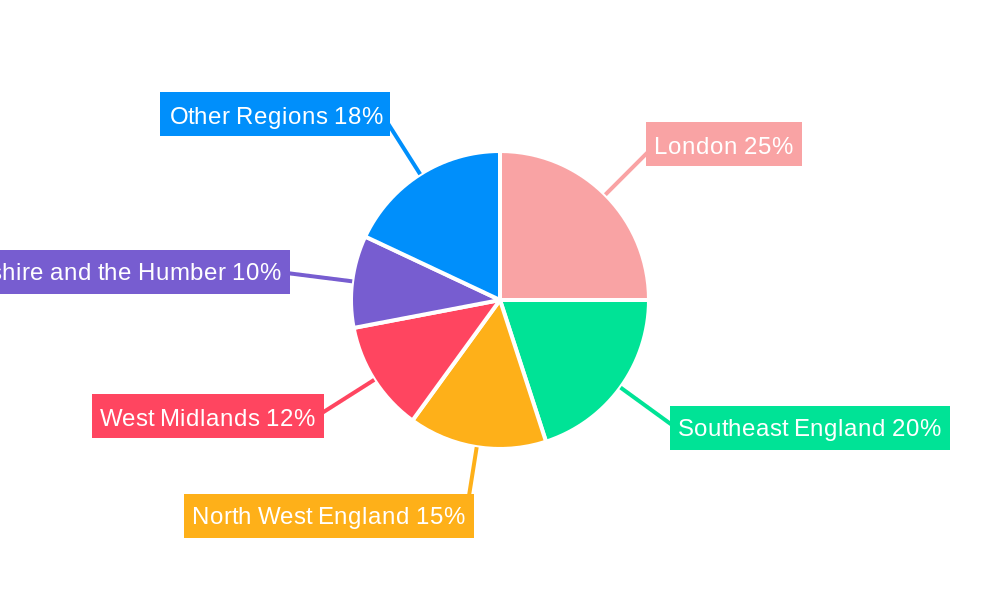

Leading Regions, Countries, or Segments in United Kingdom Contract Logistics Market

The United Kingdom's contract logistics landscape is characterized by a concentration of activity in specific regions and a clear hierarchy among its end-user segments. Understanding these focal points is crucial for identifying market opportunities and strategic advantages.

- By Type: Outsourced contract logistics remains the undisputed leader, a testament to businesses increasingly recognizing the strategic value of delegating non-core logistical functions to specialized third-party providers. This allows companies to focus on their core competencies while benefiting from the expertise, scale, and advanced infrastructure of logistics partners.

- By End-User: The Manufacturing and Automotive sector continues to command the largest share of the contract logistics market. This dominance is driven by the complexity of their supply chains, the high volume of goods, the need for specialized handling and storage, and the stringent just-in-time (JIT) delivery requirements inherent in these industries. The Consumer Goods and Retail sector follows closely, with its growth intrinsically linked to the e-commerce boom and the increasing demand for efficient inventory management and rapid last-mile delivery. Other significant contributors include Pharmaceuticals and Healthcare, Food and Beverage, and Technology sectors, each with unique logistical demands.

Dominance Factors:

- Geographic Hubs: South East England stands out as a preeminent region due to its unparalleled concentration of businesses, its world-class transportation infrastructure including major ports and airports, and its proximity to key consumer markets. Other significant logistics hubs include the Midlands, the North West, and Scotland, each offering distinct advantages in terms of connectivity, skilled labor, and operational costs.

- Sector-Specific Demand: The sustained demand from the Manufacturing and Automotive sectors is a primary driver, stemming from their need for intricate supply chain management, including inbound and outbound logistics, warehousing, and value-added services like kitting and assembly. The agility and responsiveness required by the fast-paced Consumer Goods and Retail sector, especially in light of e-commerce growth, also contribute significantly to its market dominance.

United Kingdom Contract Logistics Market Product Innovations

Recent innovations focus on enhancing supply chain visibility, optimizing warehouse operations, and improving sustainability. The adoption of warehouse management systems (WMS), transportation management systems (TMS), and advanced analytics is transforming operational efficiency. Companies are leveraging AI and machine learning to improve forecasting accuracy and optimize resource allocation. The focus on sustainable solutions includes the adoption of electric vehicles and renewable energy sources in warehouse operations.

Propelling Factors for United Kingdom Contract Logistics Market Growth

The United Kingdom's contract logistics market is experiencing a robust surge driven by a confluence of powerful trends. The unyielding growth of e-commerce, coupled with escalating consumer expectations for speed and convenience, is a primary catalyst, necessitating increasingly sophisticated and efficient fulfillment operations. This demand translates directly into a greater reliance on contract logistics providers who can offer scalable and agile solutions. Complementing this are significant technological advancements. The widespread adoption of automation, from robotic picking and packing to automated warehousing systems, is dramatically improving operational efficiency, accuracy, and speed. Furthermore, the pervasive use of data analytics and AI is unlocking unprecedented levels of supply chain visibility, enabling proactive problem-solving, predictive insights, and optimized inventory management. Beyond technological innovation, supportive government initiatives play a crucial role. Policies promoting the adoption of sustainable logistics practices, including investments in green infrastructure and incentives for emissions reduction, are not only aligning the industry with environmental goals but also creating new market opportunities for providers offering eco-friendly solutions.

Obstacles in the United Kingdom Contract Logistics Market

The UK contract logistics market faces several challenges. Brexit-related complexities and trade barriers have disrupted supply chains. Fluctuations in fuel prices and labor shortages impact operational costs. Intense competition among established and emerging players presents a further obstacle. These challenges, while significant, offer opportunities for innovative companies to differentiate themselves.

Future Opportunities in United Kingdom Contract Logistics Market

Future opportunities include the expansion of last-mile delivery services, the adoption of drone technology, and the development of sustainable logistics solutions. The growing demand for omnichannel distribution and personalized logistics offers further potential. Companies that can adapt quickly to evolving consumer demands and integrate innovative technologies will be best positioned to succeed.

Major Players in the United Kingdom Contract Logistics Market Ecosystem

- EV Cargo

- Clipper Logistics

- Wincanton

- UPS

- FedEx

- CEVA Logistics

- XP Supply Chain

- DHL Supply Chain

- Rhenus Logistics

- Eddie Stobart

Key Developments in United Kingdom Contract Logistics Market Industry

- July 2023: CEVA Logistics demonstrated a strong commitment to sustainability by pledging to power its entire UK warehouse network with 100% low-carbon electricity by 2025. This ambitious goal includes a significant expansion of rooftop solar panel generation and the widespread implementation of 100% LED lighting across its facilities by the end of 2023, underscoring a proactive approach to environmental responsibility within the logistics sector.

- April 2023: Maersk, a global leader in integrated logistics, significantly bolstered its UK warehousing capacity with the lease of a new, expansive 685,000 sq ft facility at SEGRO Logistics Park East Midlands Gateway. This strategic expansion highlights the growing demand for modern, well-located warehousing solutions to support the dynamic needs of the UK market, particularly in servicing major distribution networks and e-commerce fulfillment.

- Q1 2023: A notable trend observed in early 2023 was the increasing investment in temperature-controlled warehousing solutions across the UK. Driven by the growth in pharmaceuticals, healthcare, and specialized food products, logistics providers are enhancing their capabilities to handle sensitive goods, reflecting a growing demand for specialized contract logistics services.

- Late 2022 - Early 2023: Several major contract logistics players have been actively investing in advanced data analytics platforms and visibility tools. This focus aims to provide clients with real-time tracking, performance monitoring, and predictive analytics capabilities, thereby enhancing supply chain resilience and efficiency in an increasingly complex global environment.

Strategic United Kingdom Contract Logistics Market Forecast

The UK contract logistics market is poised for continued growth, driven by technological advancements, e-commerce expansion, and the increasing focus on sustainability. The market’s future will be shaped by companies’ ability to embrace innovation, enhance operational efficiency, and adapt to the evolving needs of their clients. This report provides a roadmap for success in this dynamic and rapidly evolving sector.

United Kingdom Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. Pharmaceuticals and Healthcare

- 2.4. Hi-tech

- 2.5. Other En

United Kingdom Contract Logistics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Contract Logistics Market Regional Market Share

Geographic Coverage of United Kingdom Contract Logistics Market

United Kingdom Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Growing demand for contract logistics in the manufacturing segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. Pharmaceuticals and Healthcare

- 5.2.4. Hi-tech

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EV Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clipper Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wincanton

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XP Supply Chain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Supply Chain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eddie Sobert

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EV Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

List of Figures

- Figure 1: United Kingdom Contract Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Contract Logistics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United Kingdom Contract Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United Kingdom Contract Logistics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: United Kingdom Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Contract Logistics Market?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the United Kingdom Contract Logistics Market?

Key companies in the market include EV Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, Clipper Logistics, Wincanton, UPS, FedEx, CEVA Logistics, XP Supply Chain, DHL Supply Chain, Rhenus Logistics, Eddie Sobert.

3. What are the main segments of the United Kingdom Contract Logistics Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.5 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Growing demand for contract logistics in the manufacturing segment.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

July 2023: By 2025, CEVA Logistics is expected to switch all of its contract logistics and freight warehouses to 100% low-carbon electricity. The commitment will be based on a mix of low-carbon electricity purchases (renewable & nuclear) from local utilities, as well as increasing its generation of electricity through rooftop solar panels (which CEVA will triple by 2025). CEVA also aimed to achieve 100% LED lighting in warehousing facilities by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Contract Logistics Market?

To stay informed about further developments, trends, and reports in the United Kingdom Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence