Key Insights

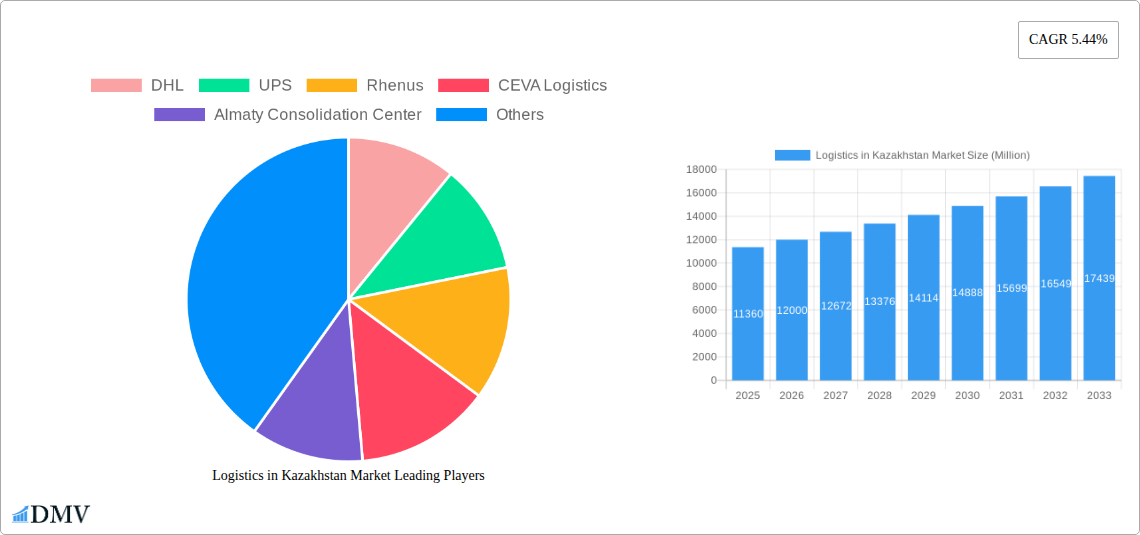

The Kazakhstan logistics market, valued at $11.36 billion in 2025, is projected to experience robust growth, driven by the nation's expanding economy and strategic geographic location along the crucial trade routes connecting Asia and Europe. A Compound Annual Growth Rate (CAGR) of 5.44% from 2025 to 2033 indicates a significant market expansion. Key growth drivers include increasing e-commerce penetration, rising cross-border trade facilitated by government initiatives promoting logistics infrastructure development, and the burgeoning energy and agricultural sectors demanding efficient logistics solutions. The market is segmented by function (freight transport, warehousing, cold chain logistics, last-mile delivery, etc.) and end-user (construction, oil & gas, agriculture, manufacturing, etc.), offering diverse opportunities for market participants. While challenges like infrastructure limitations in certain regions and seasonal fluctuations in some sectors exist, ongoing investments in modernizing transportation networks and technological advancements (such as improved tracking and supply chain management systems) are mitigating these constraints. The presence of both international giants like DHL and UPS alongside local players like KTZ – Freight Transportation JSC indicates a competitive landscape with opportunities for both established and emerging businesses. The substantial growth potential of the last-mile delivery segment, fueled by the rise of e-commerce, represents a particularly promising area for future investment.

Logistics in Kazakhstan Market Market Size (In Billion)

The forecast period (2025-2033) suggests continued expansion, with the market likely exceeding $17 billion by 2033. Growth will be fueled by government initiatives focused on diversifying the economy beyond oil and gas, stimulating related industries like manufacturing and agriculture that are reliant on efficient logistics. Competition will remain intense, with companies focusing on innovation, enhancing service offerings, and expanding their network capabilities to capture market share. The cold chain logistics sector is also poised for significant expansion, driven by increased demand for perishable goods and pharmaceuticals. Overall, the Kazakhstan logistics market presents a compelling investment opportunity for businesses seeking to capitalize on a dynamic and growing economy.

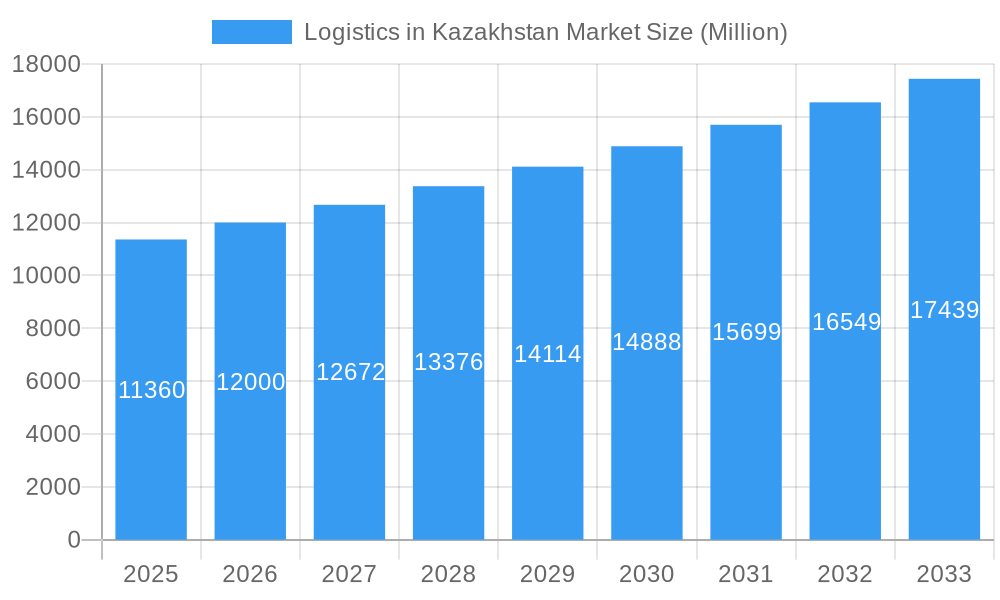

Logistics in Kazakhstan Market Company Market Share

Logistics in Kazakhstan Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Kazakhstan logistics market, encompassing market size, trends, key players, and future projections from 2019 to 2033. With a focus on both historical data (2019-2024) and future forecasts (2025-2033), this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The base year for this analysis is 2025, and the estimated market value in 2025 is projected at xx Million.

Logistics in Kazakhstan Market Market Composition & Trends

This section delves into the competitive landscape of the Kazakhstan logistics market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. The analysis includes a review of M&A activities, with estimates of deal values, and market share distribution amongst key players. The Kazakhstan logistics market, valued at xx Million in 2024, shows a significant growth trajectory, driven by factors including infrastructure development and increasing cross-border trade. Market concentration is moderate, with a few large players such as DHL, UPS, and KTZ – Freight Transportation JSC holding significant market share, yet allowing room for smaller players to thrive in specialized segments.

- Market Share Distribution (2024): DHL (xx%), UPS (xx%), KTZ – Freight Transportation JSC (xx%), Others (xx%). These figures are estimates, as precise public data on market share is limited.

- M&A Activity (2019-2024): A total estimated value of xx Million in M&A deals were recorded, highlighting consolidation and strategic investments within the sector. Specific deal details are limited due to data privacy.

- Regulatory Landscape: Kazakhstan's regulatory environment influences the logistics sector through policies on infrastructure development, customs procedures, and transport regulations, impacting operational costs and efficiency.

- Innovation Catalysts: The increasing adoption of technology such as blockchain, IoT, and AI is driving innovation, leading to improved supply chain visibility, efficiency, and cost optimization.

Logistics in Kazakhstan Market Industry Evolution

This section explores the evolution of the Kazakhstan logistics market, analyzing growth trajectories, technological advancements, and evolving consumer demands. The market demonstrates robust growth, fueled by increased e-commerce adoption, the development of robust infrastructure, and Kazakhstan's strategic geographic location, facilitating trade between Europe and Asia. Technological advancements like digital freight platforms and automated warehousing systems are reshaping the industry. Shifting consumer demands are pushing the logistics sector to adapt with services like enhanced cold chain logistics and last-mile delivery solutions.

The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a projected value of xx Million by 2033. This growth is attributed to several factors, including:

- Increasing foreign direct investment in Kazakhstan's infrastructure projects.

- Growth in e-commerce and the subsequent demand for efficient last-mile delivery solutions.

- The government’s continued focus on improving trade facilitation and regulatory reforms.

Leading Regions, Countries, or Segments in Logistics in Kazakhstan Market

This section identifies the dominant regions and segments within the Kazakhstan logistics market by function and end-user. Almaty, being the largest city and economic hub, dominates the logistics sector. Freight transport remains the largest segment, driven by the nation's robust oil & gas, mining, and agricultural sectors.

By Function:

- Freight Transport: Dominates due to the high volume of goods movement across Kazakhstan. Key drivers include the expansion of rail networks and increasing trade volumes.

- Freight Forwarding: Experiencing substantial growth due to increasing international trade and the need for efficient cross-border logistics solutions.

- Warehousing: Growth is driven by the expansion of e-commerce and the need for efficient storage and distribution facilities.

By End-User:

- Oil and Gas and Quarrying: A significant driver, owing to the importance of the sector in Kazakhstan's economy.

- Manufacturing and Automotive: The sector is growing, demanding efficient logistics for supply chain management.

Logistics in Kazakhstan Market Product Innovations

The Kazakhstan logistics market is witnessing the adoption of cutting-edge technologies to enhance efficiency and transparency. Innovations include the implementation of real-time tracking systems, the use of drones for delivery in remote areas, and the increasing adoption of advanced warehouse management systems (WMS). These innovations provide enhanced visibility, optimize resource allocation, and improve overall supply chain performance. Unique selling propositions revolve around speed, reliability, and cost optimization.

Propelling Factors for Logistics in Kazakhstan Market Growth

Several factors contribute to the growth of the Kazakhstan logistics market. Technological advancements, such as the adoption of digital platforms and automated systems, significantly enhance efficiency and reduce operational costs. Economic growth and government support for infrastructure development bolster the market. Furthermore, Kazakhstan's strategic geographic location between Europe and Asia creates immense opportunities for transit and trade.

Obstacles in the Logistics in Kazakhstan Market Market

Despite considerable growth potential, the Kazakhstan logistics market faces challenges. Infrastructure limitations in certain regions, particularly regarding road networks, can lead to delays and increased transport costs. Bureaucratic hurdles and regulatory complexities can pose significant challenges for businesses. Moreover, fierce competition among logistics providers can lead to pressure on pricing and profitability.

Future Opportunities in Logistics in Kazakhstan Market

The Kazakhstan logistics market offers promising future opportunities. The expansion of e-commerce is driving demand for last-mile delivery solutions and efficient warehousing services. The increasing adoption of technological advancements like IoT and AI offers scope for innovation and improved supply chain management. The government’s ongoing investment in infrastructure further enhances the attractiveness of the market for logistics players.

Major Players in the Logistics in Kazakhstan Market Ecosystem

- DHL

- UPS

- Rhenus

- CEVA Logistics

- Almaty Consolidation Center

- KAZTRANSGAZ AO

- KTZ - Freight Transportation JSC

- GAC

- SCAT

- Agility

- CJ Logistics

- Panalpina

- Zhezkazgan Air

- DSV

- Air Astana

- Intergas Central Asia

Key Developments in Logistics in Kazakhstan Market Industry

- November 2022: Nurminen Logistics launched regular rail services from Europe to Kazakhstan, collaborating with Kazakh State Railways, highlighting Kazakhstan's role as a crucial logistics hub connecting Europe and Asia. This development significantly boosted trade between the EU and Kazakhstan.

- September 2022: South Korean 3PL Taewoong Logistics partnered with Shin-Line to establish warehouses in Kazakhstan, reflecting the dynamic shifts in supply chains in response to geopolitical events.

Strategic Logistics in Kazakhstan Market Market Forecast

The Kazakhstan logistics market is poised for continued growth, driven by government investments, infrastructure improvements, and rising e-commerce activities. The increasing focus on enhancing efficiency and adopting technological solutions further strengthens the market's potential. Opportunities abound for logistics providers who can effectively navigate the market's challenges and capitalize on emerging trends. The market is expected to experience a sustained period of growth, driven by both domestic and international trade.

Logistics in Kazakhstan Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.1.5. Pipeline

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

- 1.5. Cold Cha

-

1.1. Freight Transport

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Telecommunications

- 2.7. Other End Users (Pharmaceutical and Healthcare)

Logistics in Kazakhstan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics in Kazakhstan Market Regional Market Share

Geographic Coverage of Logistics in Kazakhstan Market

Logistics in Kazakhstan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Cost - Intensive4.; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Kazakhstan Freight & Logistics Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.1.5. Pipeline

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.5. Cold Cha

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Telecommunications

- 5.2.7. Other End Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Shipping and Inland Water

- 6.1.1.3. Air

- 6.1.1.4. Rail

- 6.1.1.5. Pipeline

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services

- 6.1.5. Cold Cha

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Construction

- 6.2.2. Oil and Gas and Quarrying

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Manufacturing and Automotive

- 6.2.5. Distributive Trade

- 6.2.6. Telecommunications

- 6.2.7. Other End Users (Pharmaceutical and Healthcare)

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Shipping and Inland Water

- 7.1.1.3. Air

- 7.1.1.4. Rail

- 7.1.1.5. Pipeline

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services

- 7.1.5. Cold Cha

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Construction

- 7.2.2. Oil and Gas and Quarrying

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Manufacturing and Automotive

- 7.2.5. Distributive Trade

- 7.2.6. Telecommunications

- 7.2.7. Other End Users (Pharmaceutical and Healthcare)

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Shipping and Inland Water

- 8.1.1.3. Air

- 8.1.1.4. Rail

- 8.1.1.5. Pipeline

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services

- 8.1.5. Cold Cha

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Construction

- 8.2.2. Oil and Gas and Quarrying

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Manufacturing and Automotive

- 8.2.5. Distributive Trade

- 8.2.6. Telecommunications

- 8.2.7. Other End Users (Pharmaceutical and Healthcare)

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Shipping and Inland Water

- 9.1.1.3. Air

- 9.1.1.4. Rail

- 9.1.1.5. Pipeline

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services

- 9.1.5. Cold Cha

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Construction

- 9.2.2. Oil and Gas and Quarrying

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Manufacturing and Automotive

- 9.2.5. Distributive Trade

- 9.2.6. Telecommunications

- 9.2.7. Other End Users (Pharmaceutical and Healthcare)

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Logistics in Kazakhstan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Shipping and Inland Water

- 10.1.1.3. Air

- 10.1.1.4. Rail

- 10.1.1.5. Pipeline

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services

- 10.1.5. Cold Cha

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Construction

- 10.2.2. Oil and Gas and Quarrying

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Manufacturing and Automotive

- 10.2.5. Distributive Trade

- 10.2.6. Telecommunications

- 10.2.7. Other End Users (Pharmaceutical and Healthcare)

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DHL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UPS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rhenus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CEVA Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Almaty Consolidation Center

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KAZTRANSGAZ AO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KTZ - Freight Transportation JSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GAC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SCAT

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Agility

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CJ Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Panalpina

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zhezkazgan Air

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DSV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Air Astana

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Intergas Central Asia

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 DHL

List of Figures

- Figure 1: Global Logistics in Kazakhstan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Logistics in Kazakhstan Market Revenue (Million), by Function 2025 & 2033

- Figure 3: North America Logistics in Kazakhstan Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America Logistics in Kazakhstan Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Logistics in Kazakhstan Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Logistics in Kazakhstan Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Logistics in Kazakhstan Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics in Kazakhstan Market Revenue (Million), by Function 2025 & 2033

- Figure 9: South America Logistics in Kazakhstan Market Revenue Share (%), by Function 2025 & 2033

- Figure 10: South America Logistics in Kazakhstan Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America Logistics in Kazakhstan Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Logistics in Kazakhstan Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Logistics in Kazakhstan Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics in Kazakhstan Market Revenue (Million), by Function 2025 & 2033

- Figure 15: Europe Logistics in Kazakhstan Market Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Logistics in Kazakhstan Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Logistics in Kazakhstan Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Logistics in Kazakhstan Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Logistics in Kazakhstan Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics in Kazakhstan Market Revenue (Million), by Function 2025 & 2033

- Figure 21: Middle East & Africa Logistics in Kazakhstan Market Revenue Share (%), by Function 2025 & 2033

- Figure 22: Middle East & Africa Logistics in Kazakhstan Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa Logistics in Kazakhstan Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Logistics in Kazakhstan Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics in Kazakhstan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics in Kazakhstan Market Revenue (Million), by Function 2025 & 2033

- Figure 27: Asia Pacific Logistics in Kazakhstan Market Revenue Share (%), by Function 2025 & 2033

- Figure 28: Asia Pacific Logistics in Kazakhstan Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific Logistics in Kazakhstan Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Logistics in Kazakhstan Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics in Kazakhstan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 11: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 17: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 29: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Function 2020 & 2033

- Table 38: Global Logistics in Kazakhstan Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Logistics in Kazakhstan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics in Kazakhstan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics in Kazakhstan Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Logistics in Kazakhstan Market?

Key companies in the market include DHL, UPS, Rhenus, CEVA Logistics, Almaty Consolidation Center, KAZTRANSGAZ AO, KTZ - Freight Transportation JSC, GAC, SCAT, Agility, CJ Logistics, Panalpina, Zhezkazgan Air, DSV, Air Astana, Intergas Central Asia.

3. What are the main segments of the Logistics in Kazakhstan Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.36 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce.

6. What are the notable trends driving market growth?

Kazakhstan Freight & Logistics Market Trends.

7. Are there any restraints impacting market growth?

4.; Cost - Intensive4.; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

Nov 2022: Nurminen Logistics, a logistics company, began operating regular rail services from Europe to Kazakhstan in collaboration with Kazakh State Railways. Kazakhstan serves as a logistics hub, connecting Europe to the vast Asian markets. In 2020, the EU accounted for 29.7% of Kazakhstan's total goods trade. The route will be used to transport goods for customers in Northern and Central Europe. The goods will be transported in 40 HC shipping containers. The first shipment from Helsinki to Kazakhstan began its journey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics in Kazakhstan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics in Kazakhstan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics in Kazakhstan Market?

To stay informed about further developments, trends, and reports in the Logistics in Kazakhstan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence