Key Insights

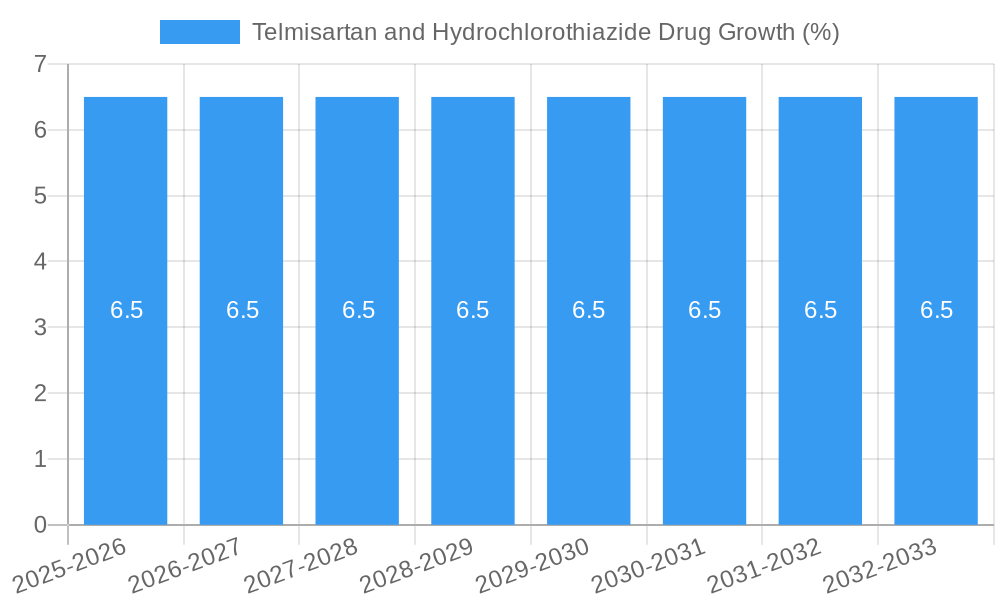

The Telmisartan and Hydrochlorothiazide drug market is poised for significant expansion, estimated to reach approximately USD 2,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth trajectory is primarily fueled by the increasing global prevalence of hypertension, a chronic condition that necessitates long-term management with effective combination therapies. The synergistic action of Telmisartan, an angiotensin II receptor blocker (ARB), and Hydrochlorothiazide, a thiazide diuretic, offers a potent and widely prescribed solution for controlling elevated blood pressure, making it a cornerstone in cardiovascular treatment. The growing awareness campaigns regarding cardiovascular health, coupled with an aging global population that is more susceptible to hypertension, further bolster market demand. Advancements in pharmaceutical manufacturing and increased accessibility to generic versions are also contributing to market penetration, particularly in emerging economies.

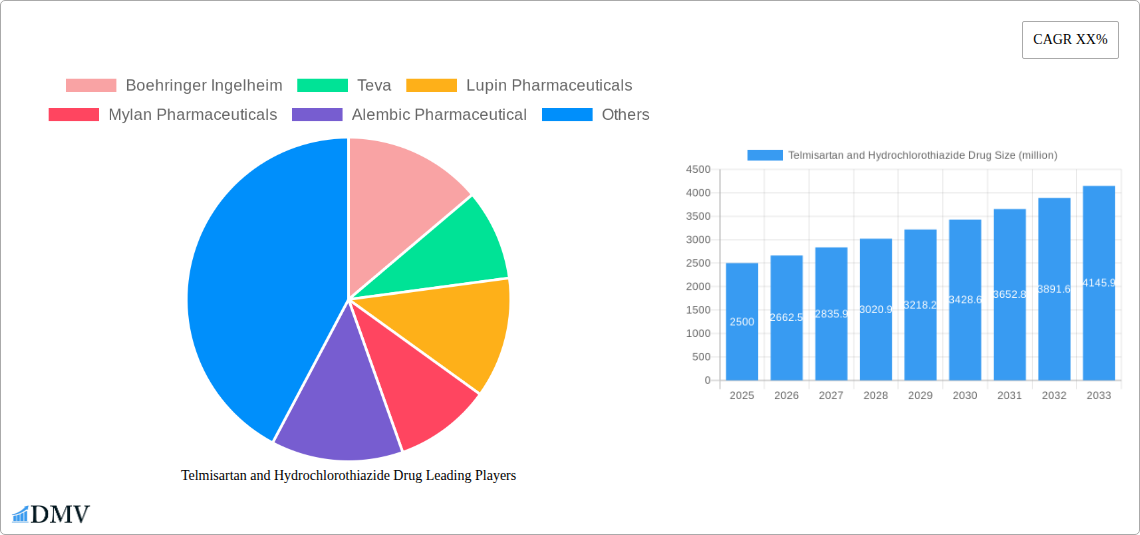

The market landscape for Telmisartan and Hydrochlorothiazide drugs is characterized by a dynamic interplay of established pharmaceutical giants and agile generic manufacturers. Key market drivers include the persistent rise in lifestyle-related diseases contributing to hypertension, the expanding healthcare infrastructure in developing regions, and the continuous innovation in drug formulations aimed at improving patient compliance and therapeutic outcomes. However, certain factors could potentially restrain market growth. These include stringent regulatory approvals for new drug combinations, pricing pressures due to the presence of numerous generic alternatives, and the ongoing development of novel therapeutic approaches for hypertension management, such as newer classes of antihypertensives. Despite these challenges, the established efficacy, cost-effectiveness, and widespread physician acceptance of Telmisartan and Hydrochlorothiazide formulations ensure their continued dominance and substantial market share in the foreseeable future. The market is segmented by application, with High Blood Pressure (Hypertension) being the dominant segment, and by type, with 80 mg/12.5 mg, 40 mg/12.5 mg, and 80 mg/25 mg tablets representing key product offerings.

This comprehensive report provides an in-depth analysis of the global Telmisartan and Hydrochlorothiazide drug market, a crucial combination therapy for managing hypertension. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report offers critical insights into market dynamics, growth trajectories, and the competitive landscape. Stakeholders will gain a profound understanding of market concentration, innovation catalysts, regulatory frameworks, substitute products, end-user profiles, and significant M&A activities. The report meticulously details industry evolution, highlighting market growth trends, technological advancements, and evolving consumer demands, supported by specific data points like growth rates and adoption metrics. It pinpoints leading regions, countries, and segments, examining drivers of dominance such as investment trends and regulatory support. Furthermore, the report delves into product innovations, performance metrics, and unique selling propositions, while also identifying key growth propellers and obstacles. Emerging opportunities and strategic market forecasts are presented to guide future investment and strategic planning. This report is an indispensable resource for pharmaceutical companies, investors, healthcare providers, and policymakers seeking to navigate the complexities of the Telmisartan and Hydrochlorothiazide drug market.

Telmisartan and Hydrochlorothiazide Drug Market Composition & Trends

The global Telmisartan and Hydrochlorothiazide drug market exhibits a moderate concentration, with a significant presence of both generic and branded manufacturers. Innovation catalysts are primarily driven by the continuous need for improved patient compliance and enhanced efficacy in managing high blood pressure (hypertension). The regulatory landscape, overseen by bodies like the FDA and EMA, plays a pivotal role in drug approvals, quality standards, and market access. Substitute products, primarily other antihypertensive drug classes and monotherapies, exert competitive pressure, necessitating strategic differentiation. End-user profiles predominantly consist of adult patients diagnosed with hypertension, with increasing awareness and access to healthcare fueling market demand. Merger and acquisition (M&A) activities, valued in the hundreds of millions of dollars, are observed as companies seek to expand their product portfolios and market reach.

- Market Share Distribution: Leading companies collectively hold a substantial market share, with generic players increasingly gaining traction due to cost-effectiveness.

- M&A Deal Values: Transactions are driven by strategic acquisitions of smaller players or partnerships to enhance R&D capabilities and distribution networks, with deal values ranging from xx million to over xx million dollars.

- Innovation Focus: Research and development efforts are concentrated on fixed-dose combinations, extended-release formulations, and improved patient adherence programs.

- Regulatory Impact: Stringent quality control measures and evolving pharmacovigilance requirements significantly influence market entry and ongoing operations.

- Substitute Pressure: The availability of diverse therapeutic options for hypertension requires continuous innovation and competitive pricing strategies.

Telmisartan and Hydrochlorothiazide Drug Industry Evolution

The Telmisartan and Hydrochlorothiazide drug industry has witnessed a steady evolution, primarily driven by the increasing prevalence of hypertension globally. Historically, from 2019 to 2024, the market experienced consistent growth, fueled by expanding healthcare access and greater awareness of cardiovascular disease risks. The base year of 2025 marks a significant point for projected growth, with an estimated market size of approximately xx million dollars. Throughout the forecast period of 2025–2033, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around xx%, reaching an estimated xx million dollars by the end of the study period. This growth trajectory is underpinned by several key factors. Technological advancements in drug formulation have led to the development of more convenient and effective combination therapies, improving patient adherence and therapeutic outcomes. For instance, the introduction of fixed-dose combinations (FDCs) has streamlined treatment regimens, reducing the pill burden for patients and subsequently enhancing their quality of life. This shift towards FDCs has been a major adoption metric, with an estimated xx% of newly diagnosed hypertensive patients opting for FDCs in recent years.

Furthermore, shifting consumer demands, influenced by factors such as an aging global population and a growing emphasis on preventative healthcare, are shaping the industry. As populations age, the incidence of chronic conditions like hypertension naturally increases, creating a larger patient pool. Simultaneously, a greater understanding of the long-term health consequences of uncontrolled hypertension is prompting individuals to seek proactive and effective treatment solutions. This has led to increased demand for reliable and well-researched antihypertensive medications like Telmisartan and Hydrochlorothiazide. The industry has responded by investing in research to understand the long-term safety profiles and efficacy of these drugs in diverse patient populations. Market growth rates are also influenced by the penetration of generic versions of Telmisartan and Hydrochlorothiazide, which have become increasingly accessible and affordable, thereby expanding the market reach, especially in emerging economies. The adoption of these drugs is further bolstered by physician recommendations and established clinical guidelines that emphasize the efficacy of this combination therapy for managing moderate to severe hypertension. The ongoing scientific research into the synergistic effects of Telmisartan and Hydrochlorothiazide continues to validate their therapeutic value, reinforcing their position in the hypertension treatment landscape and driving sustained market growth.

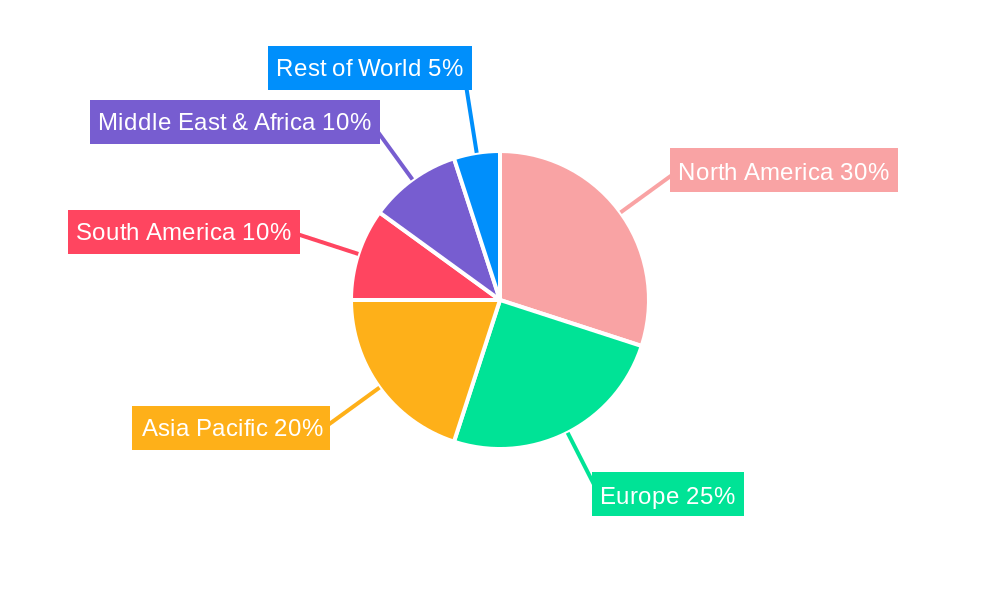

Leading Regions, Countries, or Segments in Telmisartan and Hydrochlorothiazide Drug

The global Telmisartan and Hydrochlorothiazide drug market is dominated by North America, particularly the United States, owing to its well-established healthcare infrastructure, high prevalence of hypertension, and significant healthcare expenditure. The application segment of High Blood Pressure (Hypertension) overwhelmingly leads, accounting for an estimated xx% of the total market, reflecting the widespread need for effective antihypertensive treatments. Within the product types, 80 mg/12.5 mg Tablets represent the largest share, driven by their efficacy in treating moderate to severe hypertension, followed by the 40 mg/12.5 mg Tablets and then the 80 mg/25 mg Tablets, which cater to specific patient needs and treatment titration.

- Key Drivers in North America:

- High Prevalence of Hypertension: An aging population and sedentary lifestyles contribute to a high incidence of cardiovascular diseases.

- Advanced Healthcare Infrastructure: Extensive hospital networks, advanced diagnostic capabilities, and widespread access to healthcare professionals ensure robust demand.

- Significant Healthcare Spending: High per capita healthcare expenditure allows for greater investment in advanced pharmaceuticals and treatment protocols.

- Favorable Reimbursement Policies: Comprehensive insurance coverage and reimbursement policies support patient access to essential medications.

The dominance of North America is further amplified by proactive public health campaigns aimed at hypertension awareness and management, coupled with strong regulatory frameworks that ensure the quality and efficacy of pharmaceutical products. Investment trends in research and development for cardiovascular drugs are substantial, fostering continuous innovation. The US market alone is projected to contribute an estimated xx% to the global Telmisartan and Hydrochlorothiazide drug market value by 2025.

In the Asia-Pacific region, countries like China and India are emerging as significant growth markets, driven by increasing hypertension rates due to lifestyle changes and growing disposable incomes, leading to improved healthcare access. The demand for the 40 mg/12.5 mg and 80 mg/12.5 mg tablet formulations is particularly high in these regions due to their cost-effectiveness and widespread use. Regulatory support in these developing markets is gradually strengthening, facilitating the entry of both branded and generic manufacturers.

The Europe market also represents a substantial share, with key countries like Germany, the UK, and France exhibiting consistent demand for Telmisartan and Hydrochlorothiazide due to an aging demographic and a strong emphasis on cardiovascular health. The segment of 80 mg/12.5 mg Tablets is a staple in European treatment protocols for hypertension management. Investment in generic drug manufacturing within Europe is also a notable trend, contributing to market accessibility.

The dominance of the High Blood Pressure (Hypertension) application is indisputable, while the "Others" segment, potentially including off-label uses or combinations for other cardiovascular conditions, remains niche. The product type segment is bifurcated between established and higher-dosage options, reflecting a tiered approach to hypertension management. The market dynamics are intricately linked to the specific needs of patient populations within these leading regions, further solidifying their leading positions.

Telmisartan and Hydrochlorothiazide Drug Product Innovations

Product innovation in the Telmisartan and Hydrochlorothiazide drug market centers on enhancing patient convenience and therapeutic efficacy. The development of fixed-dose combination (FDC) tablets, such as the 80 mg/12.5 mg and 40 mg/12.5 mg variants, has significantly improved patient adherence by reducing pill burden. Manufacturers are also exploring extended-release formulations to provide more consistent blood pressure control over a 24-hour period, minimizing peak-and-trough effects. Novel drug delivery systems and combination therapies with other cardiovascular agents are also under investigation to offer synergistic benefits and broader patient applicability. These innovations aim to differentiate products in a competitive market, offering improved outcomes and a superior patient experience, thereby driving higher adoption rates and patient satisfaction.

Propelling Factors for Telmisartan and Hydrochlorothiazide Drug Growth

The growth of the Telmisartan and Hydrochlorothiazide drug market is propelled by a confluence of technological, economic, and regulatory influences. Technologically, advancements in pharmaceutical formulation have enabled the creation of more effective and patient-friendly combination therapies, enhancing treatment adherence and outcomes. Economically, the increasing global prevalence of hypertension, attributed to lifestyle changes and an aging population, creates a perpetually expanding market. Furthermore, the growing disposable income in emerging economies is improving access to essential medications. Regulation also plays a crucial role; supportive government initiatives and healthcare policies that encourage the use of evidence-based antihypertensive treatments, coupled with the cost-effectiveness of generic alternatives, further fuel market expansion. The established efficacy and safety profile of Telmisartan and Hydrochlorothiazide, supported by extensive clinical trials, also contribute significantly to their widespread adoption by healthcare professionals worldwide.

Obstacles in the Telmisartan and Hydrochlorothiazide Drug Market

Despite robust growth, the Telmisartan and Hydrochlorothiazide drug market faces several obstacles. Regulatory hurdles, including stringent approval processes and evolving pharmacovigilance requirements, can delay market entry and increase compliance costs for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and raw material sourcing challenges, can impact product availability and pricing. Intense competitive pressures from numerous generic manufacturers, leading to price erosion, also pose a significant challenge. Furthermore, the development of novel antihypertensive agents and increasing adoption of lifestyle modification therapies as first-line treatments can limit the market share of established drugs. The potential for adverse drug reactions and the need for careful patient monitoring add complexity to treatment, potentially impacting physician prescribing patterns and patient acceptance.

Future Opportunities in Telmisartan and Hydrochlorothiazide Drug

Emerging opportunities in the Telmisartan and Hydrochlorothiazide drug market lie in untapped emerging economies with growing hypertension rates and improving healthcare access. Technological advancements in personalized medicine offer prospects for developing tailored treatment regimens based on patient genetic profiles, potentially enhancing drug efficacy and minimizing side effects. The increasing focus on preventative healthcare and the development of digital health solutions for patient monitoring and adherence can also create new avenues for market growth. Furthermore, exploring synergistic combinations with newer classes of cardiovascular drugs or leveraging advanced drug delivery systems to improve pharmacokinetic profiles present significant R&D opportunities. The growing awareness of the long-term benefits of controlled hypertension is also driving demand for reliable and cost-effective treatment options.

Major Players in the Telmisartan and Hydrochlorothiazide Drug Ecosystem

- Boehringer Ingelheim

- Teva

- Lupin Pharmaceuticals

- Mylan Pharmaceuticals

- Alembic Pharmaceutical

- Torrent Pharmaceuticals

- Macleods

- Zydus Pharmaceuticals

- Aurobindo

- Huahai Pharmaceutical

Key Developments in Telmisartan and Hydrochlorothiazide Drug Industry

- 2024 (Q1): Launch of a new generic Telmisartan and Hydrochlorothiazide combination by [Company Name] in key European markets, intensifying competition.

- 2023 (Q4): Boehringer Ingelheim announces positive Phase III trial results for an investigational fixed-dose combination therapy for hypertension, potentially impacting the market landscape.

- 2023 (Q2): Torrent Pharmaceuticals expands its manufacturing capacity for antihypertensive drugs, including Telmisartan and Hydrochlorothiazide, to meet growing global demand.

- 2022 (Q3): Mylan Pharmaceuticals (now Viatris) secures regulatory approval for its extended-release formulation of Telmisartan and Hydrochlorothiazide in the US, offering a new treatment option.

- 2021 (Q1): Lupin Pharmaceuticals announces strategic partnership with a regional distributor in Southeast Asia to enhance market penetration for its cardiovascular portfolio.

Strategic Telmisartan and Hydrochlorothiazide Drug Market Forecast

The strategic forecast for the Telmisartan and Hydrochlorothiazide drug market indicates continued growth, driven by the persistent global burden of hypertension and the proven efficacy of this combination therapy. Key growth catalysts include the expanding reach of generic alternatives, particularly in emerging markets, which will enhance accessibility and affordability. Furthermore, ongoing research into improved formulations and potential synergistic combinations with other cardiovascular agents promises to sustain innovation and broaden therapeutic applications. The increasing emphasis on proactive cardiovascular health management and favorable regulatory environments in many regions will further support market expansion. By capitalizing on these drivers, the market is poised for sustained development and significant value creation.

Telmisartan and Hydrochlorothiazide Drug Segmentation

-

1. Application

- 1.1. High Blood Pressure (Hypertension)

- 1.2. Others

-

2. Types

- 2.1. 80 mg/12.5 mg Tablets

- 2.2. 40 mg/12.5 mg Tablets

- 2.3. 80 mg/25 mg Tablets

Telmisartan and Hydrochlorothiazide Drug Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telmisartan and Hydrochlorothiazide Drug REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. High Blood Pressure (Hypertension)

- 5.1.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 80 mg/12.5 mg Tablets

- 5.2.2. 40 mg/12.5 mg Tablets

- 5.2.3. 80 mg/25 mg Tablets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. High Blood Pressure (Hypertension)

- 6.1.2. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 80 mg/12.5 mg Tablets

- 6.2.2. 40 mg/12.5 mg Tablets

- 6.2.3. 80 mg/25 mg Tablets

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. High Blood Pressure (Hypertension)

- 7.1.2. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 80 mg/12.5 mg Tablets

- 7.2.2. 40 mg/12.5 mg Tablets

- 7.2.3. 80 mg/25 mg Tablets

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. High Blood Pressure (Hypertension)

- 8.1.2. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 80 mg/12.5 mg Tablets

- 8.2.2. 40 mg/12.5 mg Tablets

- 8.2.3. 80 mg/25 mg Tablets

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. High Blood Pressure (Hypertension)

- 9.1.2. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 80 mg/12.5 mg Tablets

- 9.2.2. 40 mg/12.5 mg Tablets

- 9.2.3. 80 mg/25 mg Tablets

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Telmisartan and Hydrochlorothiazide Drug Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. High Blood Pressure (Hypertension)

- 10.1.2. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 80 mg/12.5 mg Tablets

- 10.2.2. 40 mg/12.5 mg Tablets

- 10.2.3. 80 mg/25 mg Tablets

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teva

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lupin Pharmaceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mylan Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alembic Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Torrent Pharmaceuticals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Macleods

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zydus Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aurobindo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huahai Pharmaceutical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim

List of Figures

- Figure 1: Global Telmisartan and Hydrochlorothiazide Drug Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 3: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 5: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 7: North America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 9: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 11: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 13: South America Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Telmisartan and Hydrochlorothiazide Drug Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Telmisartan and Hydrochlorothiazide Drug Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telmisartan and Hydrochlorothiazide Drug?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Telmisartan and Hydrochlorothiazide Drug?

Key companies in the market include Boehringer Ingelheim, Teva, Lupin Pharmaceuticals, Mylan Pharmaceuticals, Alembic Pharmaceutical, Torrent Pharmaceuticals, Macleods, Zydus Pharmaceuticals, Aurobindo, Huahai Pharmaceutical.

3. What are the main segments of the Telmisartan and Hydrochlorothiazide Drug?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telmisartan and Hydrochlorothiazide Drug," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telmisartan and Hydrochlorothiazide Drug report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telmisartan and Hydrochlorothiazide Drug?

To stay informed about further developments, trends, and reports in the Telmisartan and Hydrochlorothiazide Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence