Key Insights

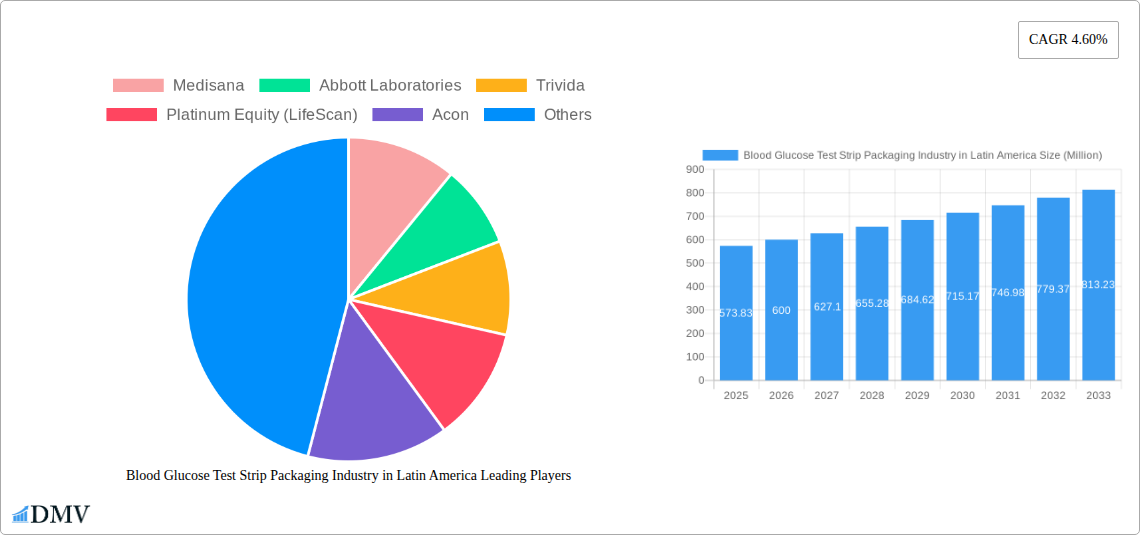

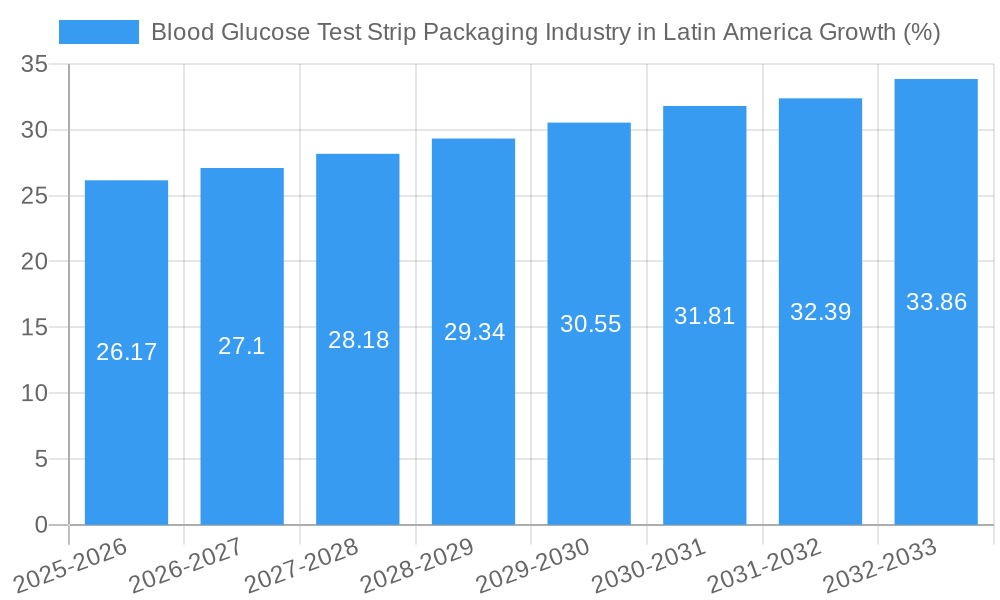

The Latin American blood glucose test strip packaging market, valued at $573.83 million in 2025, is projected to experience robust growth, driven by rising diabetes prevalence and increasing demand for convenient, reliable self-monitoring blood glucose (SMBG) devices. The market's Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033 reflects a steady expansion, fueled by factors such as improved healthcare infrastructure in certain regions, growing awareness of diabetes management, and increasing adoption of technologically advanced packaging solutions offering better product protection and patient convenience. This growth is further supported by the expanding geriatric population within Latin America, which is particularly susceptible to diabetes. However, challenges remain, including inconsistent healthcare access across the region and the price sensitivity of certain consumer segments which may limit market penetration in some areas. Specific growth opportunities lie in the introduction of innovative packaging materials that enhance product shelf life, improve ease of use, and minimize waste. Furthermore, collaborations between packaging manufacturers and SMBG device companies to offer integrated solutions can boost market expansion.

The market segmentation shows significant potential within the glucometer devices, blood glucose test strips, and lancets segments. The demand for reliable and user-friendly packaging is crucial for each of these segments, emphasizing the need for manufacturers to focus on packaging solutions that address specific needs such as moisture protection, tamper evidence, and child-resistant features. Considering the major players such as Abbott Laboratories, Roche, and others with established distribution networks, the competitive landscape is relatively consolidated, but opportunities exist for smaller companies to specialize in niche areas like sustainable packaging solutions or those designed for specific device types to capture market share. Given the rising demand for improved diabetes management, the Latin American blood glucose test strip packaging market presents significant investment potential and underscores the need for strategic partnerships and innovation within the packaging industry.

Blood Glucose Test Strip Packaging Industry in Latin America: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Blood Glucose Test Strip Packaging industry in Latin America, offering invaluable data and forecasts for stakeholders from 2019 to 2033. The study covers market size, segmentation, key players, growth drivers, challenges, and future opportunities, providing a 360° view of this dynamic market. With a focus on detailed market segmentation including Glucometer Devices, Blood Glucose Test Strips, and Lancets, this report is an essential resource for businesses, investors, and researchers seeking to understand and capitalize on the growth potential within the Latin American region. The base year for this report is 2025, with estimations for the same year and a forecast period spanning from 2025 to 2033.

Blood Glucose Test Strip Packaging Industry in Latin America Market Composition & Trends

This section delves into the competitive landscape of the Latin American blood glucose test strip packaging market, analyzing market concentration, innovation drivers, regulatory frameworks, and the impact of substitute products. The report examines end-user profiles (hospitals, clinics, home users) and provides an overview of significant mergers and acquisitions (M&A) activities within the industry. Market share distribution amongst key players will be detailed, with an estimated xx Million USD in M&A deal values recorded during the historical period.

- Market Concentration: The market is characterized by a combination of multinational corporations and regional players, with a moderate level of concentration. Abbott Laboratories and Roche hold significant market share, but smaller companies are also making an impact.

- Innovation Catalysts: Advancements in packaging technology, such as improved barrier properties and enhanced convenience features, are driving market growth. The integration of smart packaging, incorporating features like QR codes for authentication and traceability, is also gaining traction.

- Regulatory Landscape: Regulatory approvals and compliance requirements vary across Latin American countries, impacting market entry and product distribution. The report provides a detailed overview of these regulatory aspects.

- Substitute Products: While no direct substitutes exist, the market faces indirect competition from alternative diabetes management solutions.

- End-User Profiles: The primary end-users include hospitals, clinics, and individual consumers managing their diabetes through self-monitoring.

- M&A Activities: The report documents significant M&A activity in the historical period (2019-2024), highlighting key deals and their impact on market dynamics. Estimated total deal value is xx Million USD.

Blood Glucose Test Strip Packaging Industry in Latin America Industry Evolution

This section charts the evolution of the blood glucose test strip packaging industry in Latin America, examining historical and projected growth trajectories. The analysis explores technological advancements, such as the incorporation of smart packaging features, and how they are shaping market dynamics. Furthermore, it looks at evolving consumer demands, including the preference for convenient, user-friendly packaging solutions and the growing adoption of digital health technologies. The average annual growth rate (AAGR) for the historical period (2019-2024) is estimated at xx%, while the projected AAGR for the forecast period (2025-2033) is xx%. Adoption of advanced packaging materials is projected to increase by xx% during the forecast period. Increased consumer awareness and improved healthcare infrastructure are also contributing to market growth. Innovative packaging solutions tailored to individual user needs and preferences are driving market demand.

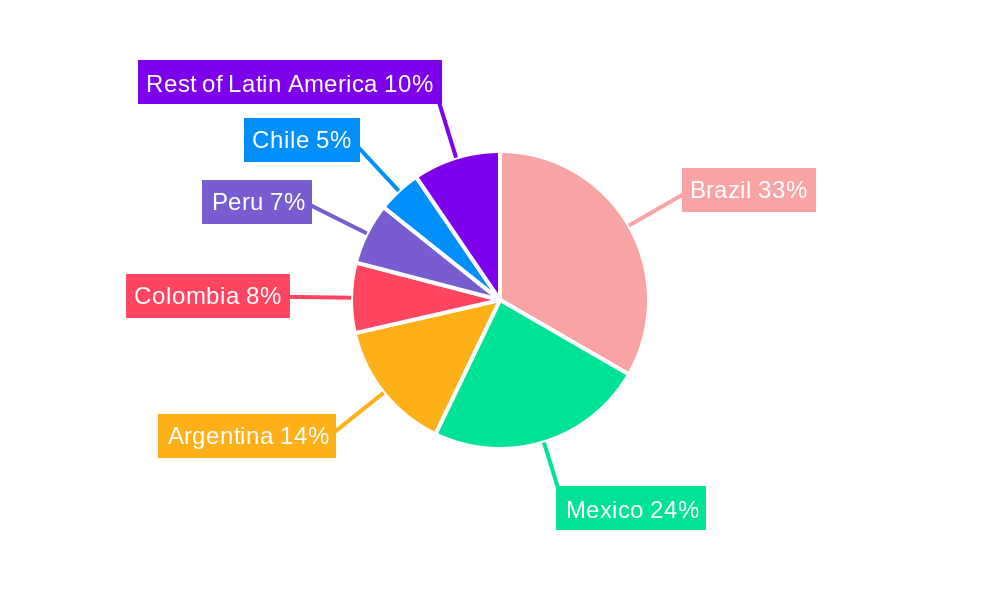

Leading Regions, Countries, or Segments in Blood Glucose Test Strip Packaging Industry in Latin America

This section identifies the leading regions, countries, and segments within the Latin American blood glucose test strip packaging market. Brazil and Mexico are expected to be the leading markets due to high prevalence of diabetes and increasing healthcare expenditure.

- Key Drivers:

- High Prevalence of Diabetes: The rising incidence of diabetes in key markets like Brazil and Mexico is a significant driver.

- Growing Healthcare Expenditure: Increasing investments in healthcare infrastructure and improved access to diagnostic tools are supporting market expansion.

- Government Initiatives: Government programs aimed at improving diabetes management and promoting self-monitoring contribute to market growth.

- Dominance Factors: The dominance of Brazil and Mexico can be attributed to a combination of factors, including larger populations, higher diabetes prevalence rates, increased healthcare spending, and favorable regulatory environments.

Brazil’s market share is projected to be xx% in 2025, while Mexico’s is projected to be xx%. The Blood Glucose Test Strips segment is expected to hold the largest market share due to the continuous need for test strips for regular blood glucose monitoring.

Blood Glucose Test Strip Packaging Industry in Latin America Product Innovations

Recent innovations in blood glucose test strip packaging focus on improving convenience, reducing waste, and enhancing security. Examples include innovative designs for single-use strips, tamper-evident packaging to prevent counterfeiting, and environmentally friendly materials. These innovations directly address unmet consumer needs and enhance product appeal, boosting sales and market share. The development of smart packaging that integrates digital features such as QR codes for product authentication and traceability is also driving market growth.

Propelling Factors for Blood Glucose Test Strip Packaging Industry in Latin America Growth

The growth of the Latin American blood glucose test strip packaging market is propelled by several key factors. The increasing prevalence of diabetes across the region is a primary driver, necessitating increased demand for test strips. Technological advancements in packaging materials and designs, offering improved convenience and functionality, are also boosting market expansion. Furthermore, government initiatives and healthcare programs supporting diabetes management play a crucial role in stimulating growth. Finally, rising healthcare expenditure and improved access to healthcare are contributing to market expansion.

Obstacles in the Blood Glucose Test Strip Packaging Industry in Latin America Market

The Latin American blood glucose test strip packaging market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can negatively impact production costs and availability. Stringent regulatory requirements and varying standards across different countries present hurdles for market entry and expansion. Additionally, intense competition from both domestic and international players puts pressure on profit margins. These challenges may lead to estimated xx% decrease in market growth by 2033 if not addressed appropriately.

Future Opportunities in Blood Glucose Test Strip Packaging Industry in Latin America

The Latin American blood glucose test strip packaging market presents significant future opportunities. Expansion into underserved rural areas and increasing consumer awareness campaigns can unlock untapped potential. Further innovations in packaging materials, particularly focusing on sustainability and environmental friendliness, are anticipated to drive demand. Exploring integration with connected devices and digital health platforms provides avenues for growth. Finally, partnerships with healthcare providers and government agencies are essential to maximize reach and impact.

Major Players in the Blood Glucose Test Strip Packaging Industry in Latin America Ecosystem

- Medisana

- Abbott Laboratories

- Trivida

- Platinum Equity (LifeScan)

- Acon

- Rossmax

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Bionime Corporation

- Arkray

- Ascensia

Key Developments in Blood Glucose Test Strip Packaging Industry in Latin America Industry

- June 2022: LifeScan announced the publication of Real World Evidence in Diabetes Technology and Therapeutics showing improved glycemic control using their Bluetooth-connected OneTouch Verio Reflect meter with the OneTouch Reveal app. This development showcases the growing importance of integrated digital health solutions and highlights the potential for innovative packaging to support these technologies.

- January 2022: Roche launched its Cobas pulse point-of-care blood glucose monitor for hospital professionals, including an automated glucose test strip reader. This underscores the continuous innovation in blood glucose monitoring and the need for adaptable packaging solutions for various devices.

Strategic Blood Glucose Test Strip Packaging Industry in Latin America Market Forecast

The Latin American blood glucose test strip packaging market is poised for significant growth over the forecast period (2025-2033), driven by increasing diabetes prevalence, technological advancements, and expanding healthcare infrastructure. Emerging opportunities in connected health and the growing adoption of digital diabetes management solutions create a positive outlook for the market. While challenges remain, particularly related to regulatory hurdles and supply chain volatility, the market's long-term growth prospects remain strong, with significant potential for market expansion and innovation in packaging solutions. The market size is expected to reach xx Million USD by 2033.

Blood Glucose Test Strip Packaging Industry in Latin America Segmentation

-

1. Self-Monitoring Blood Glucose Devices

- 1.1. Glucometer Devices

- 1.2. Blood Glucose Test Strips

- 1.3. Lancets

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Rest of Latin America

Blood Glucose Test Strip Packaging Industry in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Rest of Latin America

Blood Glucose Test Strip Packaging Industry in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Blood Glucose Test Strips Held the Largest Market Share in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 5.1.1. Glucometer Devices

- 5.1.2. Blood Glucose Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 6. Mexico Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 6.1.1. Glucometer Devices

- 6.1.2. Blood Glucose Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 7. Brazil Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 7.1.1. Glucometer Devices

- 7.1.2. Blood Glucose Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 8. Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 8.1.1. Glucometer Devices

- 8.1.2. Blood Glucose Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 9. Brazil Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 10. Argentina Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 11. Mexico Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Peru Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 13. Chile Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Medisana

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Abbott Laboratories

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Trivida

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Platinum Equity (LifeScan)

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Acon

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Rossmax

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Agamatrix Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 F Hoffmann-La Roche AG

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Bionime Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Arkray

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Ascensia

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Medisana

List of Figures

- Figure 1: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Blood Glucose Test Strip Packaging Industry in Latin America Share (%) by Company 2024

List of Tables

- Table 1: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 4: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 5: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Brazil Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Argentina Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Peru Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Chile Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Chile Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 24: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 25: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 30: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 31: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 36: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2019 & 2032

- Table 37: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 39: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Glucose Test Strip Packaging Industry in Latin America?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Blood Glucose Test Strip Packaging Industry in Latin America?

Key companies in the market include Medisana, Abbott Laboratories, Trivida, Platinum Equity (LifeScan), Acon, Rossmax, Agamatrix Inc, F Hoffmann-La Roche AG, Bionime Corporation, Arkray, Ascensia.

3. What are the main segments of the Blood Glucose Test Strip Packaging Industry in Latin America?

The market segments include Self-Monitoring Blood Glucose Devices, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 573.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Blood Glucose Test Strips Held the Largest Market Share in the current year..

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) had published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter synced via Bluetooth wireless technology - could support improved glycemic control for people with diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blood Glucose Test Strip Packaging Industry in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blood Glucose Test Strip Packaging Industry in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blood Glucose Test Strip Packaging Industry in Latin America?

To stay informed about further developments, trends, and reports in the Blood Glucose Test Strip Packaging Industry in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence