Key Insights

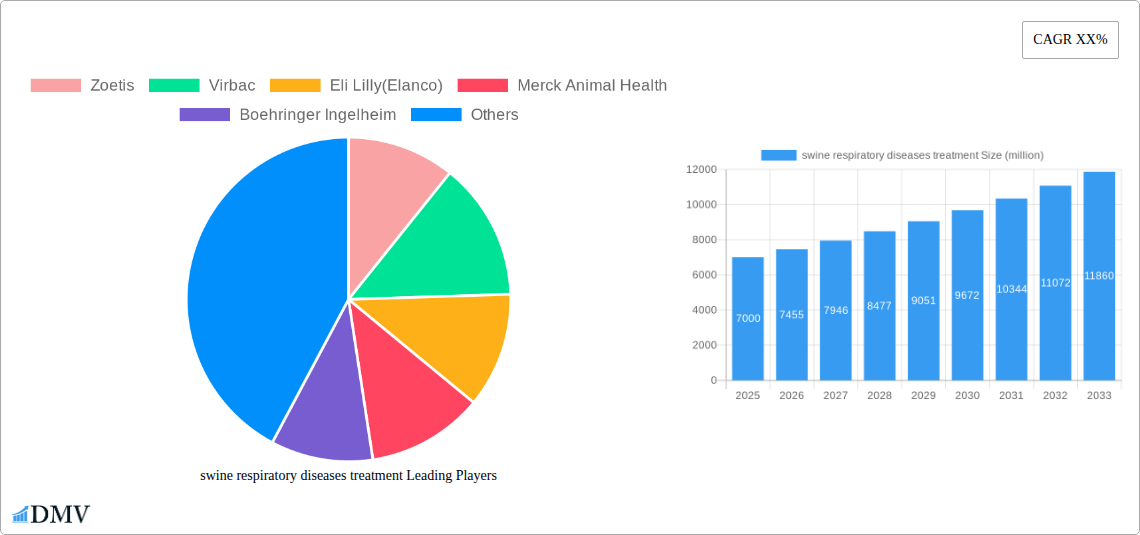

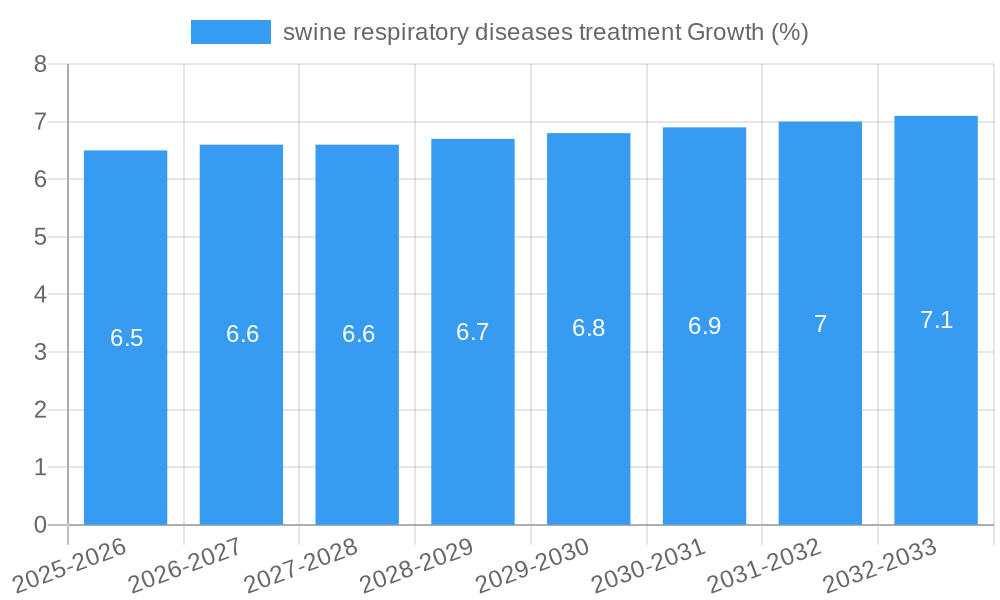

The global swine respiratory diseases treatment market is poised for substantial growth, projected to reach an estimated USD 7,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing global demand for pork, a direct consequence of a growing human population and rising disposable incomes, particularly in emerging economies. Furthermore, intensified livestock farming practices, while increasing efficiency, unfortunately also create environments more conducive to the rapid spread of respiratory pathogens among swine herds. This necessitates a proactive approach to disease management, fueling the demand for effective treatment solutions. Advancements in diagnostic tools, coupled with a greater emphasis on animal welfare and biosecurity measures within the swine industry, also contribute significantly to market growth.

The market is segmented into various applications, with veterinary hospitals and clinics representing the largest share due to their central role in disease diagnosis and treatment initiation. Pharmacies also hold a significant position, serving as accessible points for farmers to procure medications. The "Others" category, encompassing on-farm treatments and direct sales, also contributes to the overall market landscape. By type, Mycoplasma and bacterial infections are leading segments, reflecting their prevalence and economic impact on swine production. Viral infections, while also a concern, are being increasingly addressed through vaccination and improved herd management. Key players like Zoetis, Virbac, and Merck Animal Health are at the forefront of innovation, investing heavily in research and development to introduce novel therapeutics and diagnostics, further shaping the competitive dynamics of this vital market.

swine respiratory diseases treatment Market Composition & Trends

The global swine respiratory diseases treatment market demonstrates a dynamic composition, characterized by moderate to high market concentration driven by established veterinary pharmaceutical giants. Key players like Zoetis, Merck Animal Health, and Boehringer Ingelheim command significant market share, estimated in the hundreds of millions of dollars. Innovation remains a crucial catalyst, with ongoing research and development in novel antimicrobial agents, vaccines, and diagnostic tools. The regulatory landscape, while stringent, fosters a competitive environment where companies strive for efficacy and safety approvals, contributing to market growth in the hundreds of millions. Substitute products, primarily preventative measures and improved biosecurity protocols, exist but do not entirely negate the need for treatment, with the overall market value in the billions of dollars annually. End-user profiles are diverse, encompassing large-scale commercial swine operations, smaller independent farms, and integrated agricultural enterprises, all seeking cost-effective and efficient disease management solutions. Mergers and acquisitions (M&A) activities have been strategic, with deal values often reaching tens to hundreds of millions of dollars, consolidating market presence and expanding product portfolios.

- Market Share Distribution: Leading companies collectively hold over 70% of the market share.

- Innovation Catalysts: Focus on multidrug resistance reduction, rapid diagnostics, and improved delivery systems.

- Regulatory Landscapes: Strict approval processes for efficacy, safety, and withdrawal periods, influencing product development cycles.

- Substitute Products: Biosecurity enhancements, vaccination programs, and genetic resistance breeding contribute to a multi-billion dollar preventative segment.

- End-User Profiles: Commercial farms dominate demand, followed by specialized breeding operations and research facilities.

- M&A Activities: Strategic acquisitions to gain access to new technologies, patent portfolios, and geographical markets, with recent deals valued at over 50 million dollars.

swine respiratory diseases treatment Industry Evolution

The swine respiratory diseases treatment industry has undergone significant evolution, driven by increasing global demand for pork and the persistent challenges posed by prevalent respiratory pathogens in swine herds. The historical period from 2019 to 2024 witnessed a steady market growth, with an estimated compound annual growth rate (CAGR) of approximately 5.5% to 7.0%. This growth was fueled by a rising awareness of the economic impact of respiratory diseases, which can lead to substantial production losses, estimated in the hundreds of millions of dollars annually due to reduced feed conversion, increased mortality, and extended growth periods. Technological advancements have played a pivotal role in this evolution. The development of more sophisticated diagnostic tools, such as polymerase chain reaction (PCR) and enzyme-linked immunosorbent assay (ELISA) kits, has enabled earlier and more accurate identification of causative agents, including Mycoplasma hyopneumoniae, Pasteurella multocida, Actinobacillus pleuropneumoniae, and various viral agents like Porcine Reproductive and Respiratory Syndrome virus (PRRSv). This diagnostic precision directly impacts treatment efficacy, allowing for targeted therapeutic interventions.

Shifting consumer demands, particularly regarding antibiotic use and animal welfare, have also shaped the industry. There's a growing preference for treatments that minimize antibiotic residues and promote overall herd health. This has spurred innovation in areas like immunotherapy, alternative antimicrobials, and advanced vaccine technologies. The base year of 2025 marks a crucial inflection point, with the market projected to reach a valuation in the billions of dollars. The forecast period from 2025 to 2033 anticipates continued robust growth, with an estimated CAGR ranging from 6.0% to 8.0%. This optimistic outlook is supported by ongoing investments in research and development by major players such as Eli Lilly (Elanco), Virbac, and Huvepharma, who are actively exploring new therapeutic avenues. The adoption rate of novel treatments, including combination therapies and precision medicine approaches, is expected to accelerate. Furthermore, the increasing global swine population, particularly in emerging economies, will continue to drive demand for effective respiratory disease management solutions. The industry's trajectory is one of increasing sophistication, moving beyond broad-spectrum treatments to more targeted and sustainable approaches that address the complex interplay of pathogens, environmental factors, and host immunity in swine respiratory health. The projected market value is estimated to exceed several billion dollars by 2033.

Leading Regions, Countries, or Segments in swine respiratory diseases treatment

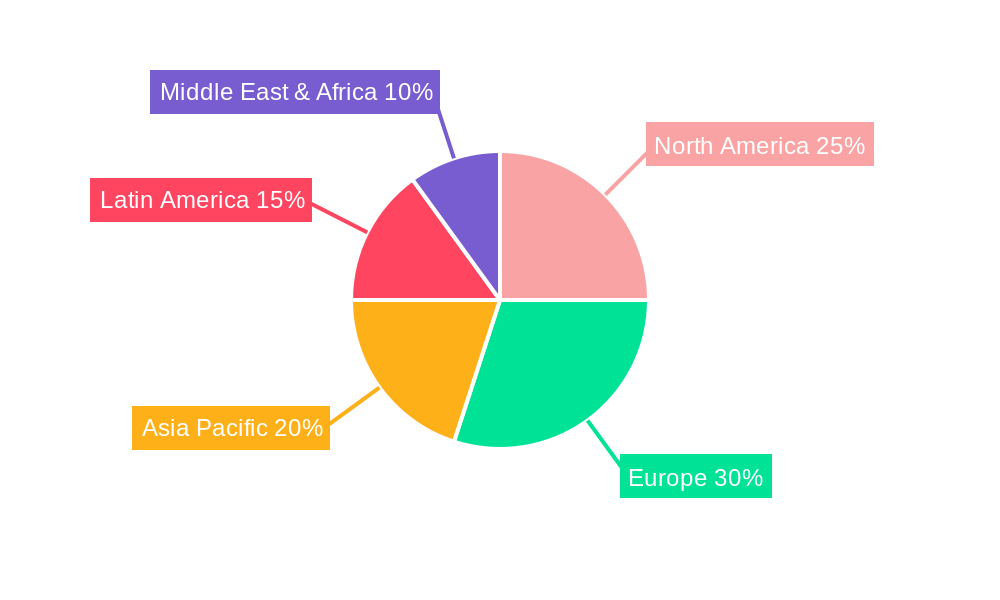

The swine respiratory diseases treatment market's leadership is predominantly influenced by a confluence of factors, with North America and Europe currently holding significant sway, driven by their advanced agricultural infrastructures and substantial swine populations. Within these regions, the Application segment of Veterinary Hospitals and Veterinary Clinics are the dominant end-users, accounting for an estimated 60% of the market share. This dominance stems from the critical role these facilities play in diagnosing, treating, and managing respiratory outbreaks in commercial swine operations. They are equipped with advanced diagnostic capabilities and access to a wide range of pharmaceutical products, ensuring prompt and effective intervention.

The Types segment of Bacteria and Virus are the primary drivers of demand for treatment solutions, representing approximately 75% of the overall market value. Pathogens such as Actinobacillus pleuropneumoniae, Pasteurella multocida, and Porcine Reproductive and Respiratory Syndrome virus (PRRSv) are endemic in many swine-producing regions, necessitating continuous treatment and prevention strategies. The economic losses associated with these infections, often in the hundreds of millions of dollars annually, underscore the critical need for effective therapies.

- Dominant Regions: North America (particularly the United States) and Europe (led by countries like Spain, Denmark, and Germany) are leading markets.

- Key Drivers in North America: Large-scale integrated swine production, significant investment in animal health research, and a strong presence of major pharmaceutical companies.

- Key Drivers in Europe: High density of swine farms, stringent disease surveillance programs, and supportive regulatory frameworks for veterinary medicines.

- Dominant Application Segments:

- Veterinary Hospitals & Clinics: Account for over 60% of the market. These facilities are crucial for diagnosing and prescribing treatments, often purchasing in bulk for resale or direct administration.

- Pharmacies: Represent a growing segment, particularly for over-the-counter (OTC) treatments or when veterinarians prescribe specific medications for farm-level administration.

- Others (e.g., On-Farm Treatment): While direct farm-level purchasing occurs, the oversight of veterinary professionals in clinics and hospitals remains paramount for complex disease management.

- Dominant Disease Types:

- Bacteria: Infections caused by Actinobacillus pleuropneumoniae, Pasteurella multocida, and Mycoplasma hyopneumoniae are consistently high-demand areas for antibiotic and supportive therapies.

- Virus: PRRSv remains a major challenge, driving demand for antiviral research, supportive care treatments, and proactive vaccination strategies.

- Investment Trends: Significant R&D expenditure by companies like Merck Animal Health and Boehringer Ingelheim in developing novel antibiotics and vaccines specifically targeting bacterial and viral respiratory pathogens.

- Regulatory Support: Favorable regulatory environments in leading regions facilitate the approval and market entry of new and effective swine respiratory disease treatments, contributing to a market value in the billions.

swine respiratory diseases treatment Product Innovations

Product innovations in swine respiratory diseases treatment are focused on enhanced efficacy, reduced resistance development, and improved delivery methods. Recent advancements include the development of novel antimicrobial compounds with unique mechanisms of action, designed to combat multi-drug resistant bacterial strains. Furthermore, next-generation vaccines targeting key viral and bacterial respiratory pathogens are offering broader protection and longer-lasting immunity, significantly impacting herd health and reducing treatment needs. Precision medicine approaches, leveraging rapid diagnostics to tailor treatments to specific infections, are also gaining traction, ensuring optimal outcomes and minimizing unnecessary drug exposure. The performance metrics for these innovations are measured by improvements in mortality rates, morbidity reduction, and enhanced growth performance, with companies reporting significant positive impacts on farm economics, amounting to millions in saved costs per operation.

Propelling Factors for swine respiratory diseases treatment Growth

Several key factors are propelling the growth of the swine respiratory diseases treatment market. Firstly, the increasing global demand for pork, driven by population growth and rising disposable incomes, directly translates to a larger swine population requiring robust health management solutions, including treatments for respiratory ailments, contributing to market expansion valued in the billions. Secondly, the persistent challenge of evolving and emerging respiratory pathogens necessitates continuous innovation in therapeutic and preventative strategies, driving R&D investments by leading companies. Thirdly, stringent biosecurity measures in commercial swine operations, while beneficial, can sometimes create environments where infections, once introduced, spread rapidly, increasing the need for effective treatments. Finally, government initiatives and veterinary associations promoting animal health and welfare, alongside the economic imperative for producers to minimize production losses due to disease, further fuel market demand for effective treatments, with individual herd savings potentially reaching hundreds of thousands of dollars.

Obstacles in the swine respiratory diseases treatment Market

Despite robust growth, the swine respiratory diseases treatment market faces several obstacles. The increasing global concern and regulatory pressure surrounding antibiotic resistance are a significant restraint, pushing for the development and adoption of alternative treatments and antimicrobial stewardship programs. This can slow the market for traditional antibiotics. Supply chain disruptions, exacerbated by geopolitical events and raw material availability, can impact the production and accessibility of essential veterinary pharmaceuticals, leading to price volatility and potential shortages valued in the millions of dollars. Furthermore, the high cost of R&D for novel treatments, coupled with lengthy approval processes, presents a financial hurdle for companies, especially for smaller innovators. Finally, fluctuating feed prices and overall economic conditions in the agricultural sector can impact producers' purchasing power for veterinary medicines, influencing market demand.

Future Opportunities in swine respiratory diseases treatment

Emerging opportunities in the swine respiratory diseases treatment market are abundant. The growing adoption of precision agriculture technologies presents a significant avenue for growth, enabling early disease detection and targeted interventions. Advancements in genomic sequencing and bioinformatics will unlock new possibilities for identifying genetic predispositions to respiratory diseases and developing tailored preventative and therapeutic strategies. The expanding market in emerging economies, with their rapidly growing swine industries, offers substantial untapped potential for both established and new market entrants, promising billions in future revenue. Furthermore, the increasing focus on sustainable animal agriculture is driving demand for environmentally friendly treatments and biosecurity solutions, creating a niche for innovative products that align with these evolving consumer and regulatory expectations.

Major Players in the swine respiratory diseases treatment Ecosystem

- Zoetis

- Virbac

- Eli Lilly (Elanco)

- Merck Animal Health

- Boehringer Ingelheim

- Ceva Sante Animale

- Norbrook

- Thermo Fisher Scientific Inc

- Vetoquinol

- Bimeda holdings PLC

- Huvepharma

Key Developments in swine respiratory diseases treatment Industry

- 2023: Launch of a novel vaccine targeting a prevalent strain of Porcine Respiratory Disease Complex (PRDC) by Boehringer Ingelheim, improving herd immunity and reducing treatment costs by millions.

- 2023: Merck Animal Health acquired a company specializing in advanced diagnostic solutions for swine respiratory pathogens, enhancing their integrated disease management offerings.

- 2024: Zoetis announced significant R&D investment in developing next-generation antimicrobial therapies to combat rising resistance in swine bacterial infections.

- 2024: Eli Lilly (Elanco) released a new extended-release injectable antibiotic formulation designed for improved efficacy and reduced handling stress in swine.

- 2024: Ceva Sante Animale introduced an innovative immunostimulant product aimed at enhancing the natural defense mechanisms of pigs against viral respiratory challenges.

Strategic swine respiratory diseases treatment Market Forecast

The strategic swine respiratory diseases treatment market forecast indicates sustained growth driven by ongoing innovation and an expanding global pork demand. The increasing adoption of advanced diagnostics and precision medicine will allow for more targeted and effective treatments, reducing reliance on broad-spectrum antibiotics and mitigating resistance concerns. Investments in novel vaccines and immunotherapies are poised to play a crucial role in preventative health strategies. Furthermore, the growing emphasis on animal welfare and sustainable farming practices will create opportunities for the development and market penetration of eco-friendly and residue-free treatment options. Emerging markets, with their rapidly developing swine industries, represent significant untapped potential, promising substantial market expansion in the coming years.

swine respiratory diseases treatment Segmentation

-

1. Application

- 1.1. Veterinary Hospitals

- 1.2. Veterinary Clinics

- 1.3. Pharmacies

- 1.4. Others

-

2. Types

- 2.1. Mycoplasma

- 2.2. Bacteria

- 2.3. Virus

- 2.4. Others

swine respiratory diseases treatment Segmentation By Geography

- 1. CA

swine respiratory diseases treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. swine respiratory diseases treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Veterinary Hospitals

- 5.1.2. Veterinary Clinics

- 5.1.3. Pharmacies

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mycoplasma

- 5.2.2. Bacteria

- 5.2.3. Virus

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zoetis

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Virbac

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eli Lilly(Elanco)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck Animal Health

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Boehringer Ingelheim

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ceva Sante Animale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Norbrook

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vetoquinol

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bimeda holdings PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huvepharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Zoetis

List of Figures

- Figure 1: swine respiratory diseases treatment Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: swine respiratory diseases treatment Share (%) by Company 2024

List of Tables

- Table 1: swine respiratory diseases treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: swine respiratory diseases treatment Revenue million Forecast, by Application 2019 & 2032

- Table 3: swine respiratory diseases treatment Revenue million Forecast, by Types 2019 & 2032

- Table 4: swine respiratory diseases treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: swine respiratory diseases treatment Revenue million Forecast, by Application 2019 & 2032

- Table 6: swine respiratory diseases treatment Revenue million Forecast, by Types 2019 & 2032

- Table 7: swine respiratory diseases treatment Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the swine respiratory diseases treatment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the swine respiratory diseases treatment?

Key companies in the market include Zoetis, Virbac, Eli Lilly(Elanco), Merck Animal Health, Boehringer Ingelheim, Ceva Sante Animale, Norbrook, Thermo Fisher Scientific Inc, Vetoquinol, Bimeda holdings PLC, Huvepharma.

3. What are the main segments of the swine respiratory diseases treatment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "swine respiratory diseases treatment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the swine respiratory diseases treatment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the swine respiratory diseases treatment?

To stay informed about further developments, trends, and reports in the swine respiratory diseases treatment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence