Key Insights

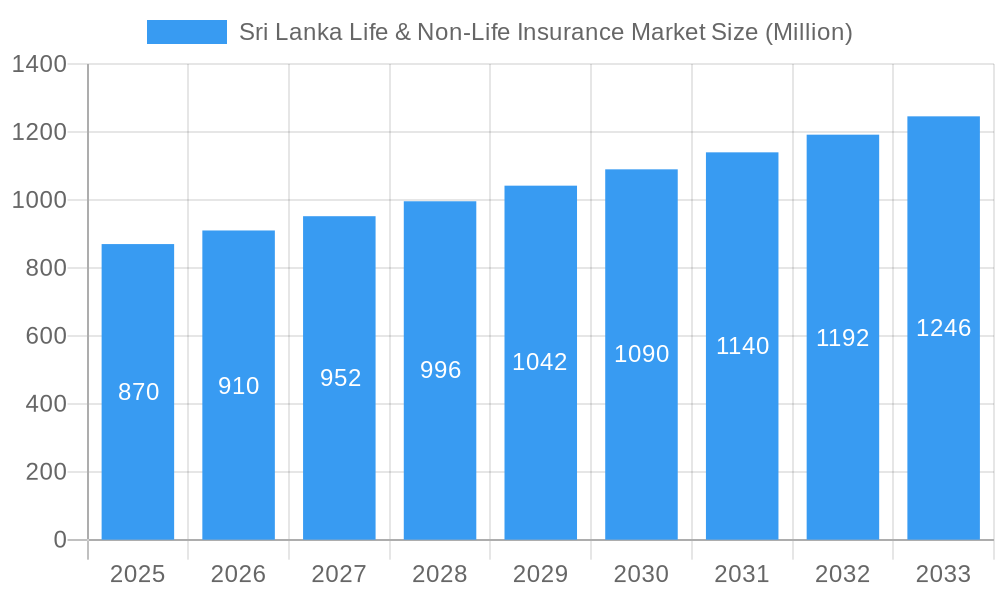

The Sri Lanka life and non-life insurance market, valued at $870 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.53% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing awareness of insurance products and services, particularly among the growing middle class, is a significant factor. Government initiatives promoting financial inclusion and the expansion of digital distribution channels are also contributing to market growth. Furthermore, rising health consciousness and an increasing prevalence of lifestyle diseases are boosting demand for life insurance. The market segmentation reveals a dynamic landscape, with life insurance and non-life insurance segments competing for market share, and distribution channels like agencies, banks, and direct sales playing crucial roles. The competitive landscape is characterized by a mix of established domestic players like Ceylinco Insurance, Sri Lanka Insurance, and Janashakthi Insurance, alongside international players such as AIA Insurance and Allianz Insurance, creating a vibrant and competitive environment.

Sri Lanka Life & Non-Life Insurance Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace compared to previous years. Factors such as economic fluctuations and regulatory changes could influence the market's trajectory. However, the long-term prospects remain positive, driven by the country's expanding economy and rising disposable incomes. Opportunities exist for insurers to innovate in product offerings, leverage technology for efficient operations and enhanced customer experience, and focus on niche markets to achieve sustainable growth. Strategic partnerships and mergers and acquisitions could also reshape the market landscape. Understanding consumer preferences and adapting to evolving technological advancements will be critical for success in this dynamic market.

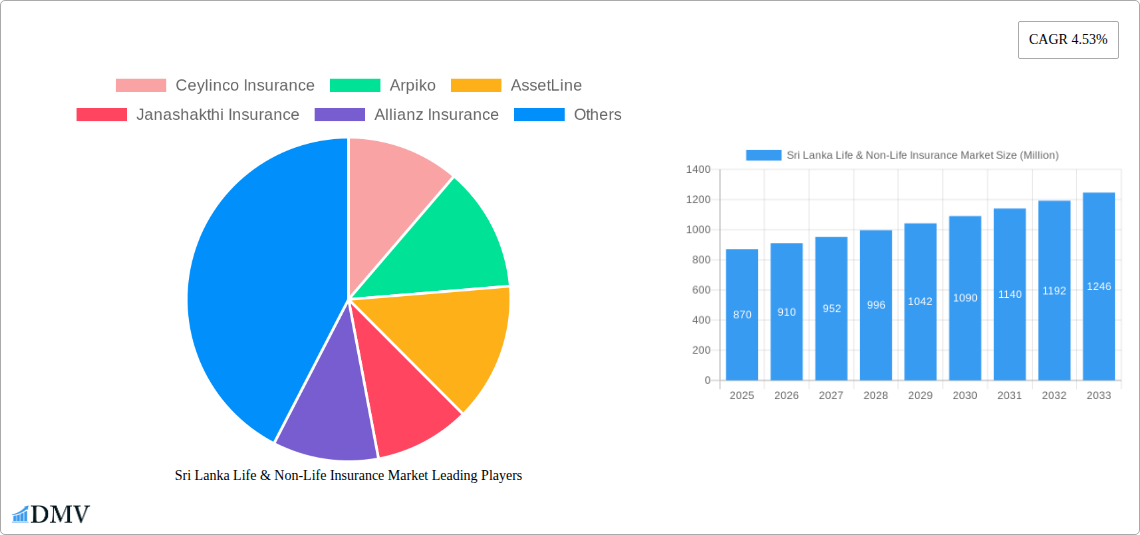

Sri Lanka Life & Non-Life Insurance Market Company Market Share

Sri Lanka Life & Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Sri Lanka life and non-life insurance market, covering the period from 2019 to 2033. With a focus on market trends, competitive landscape, and future growth potential, this report is an essential resource for insurers, investors, and industry stakeholders. We delve deep into market segmentation, key players, and recent developments, offering actionable insights for strategic decision-making. The base year for this report is 2025, with forecasts extending to 2033.

Sri Lanka Life & Non-Life Insurance Market Composition & Trends

This section analyzes the Sri Lanka insurance market's structure, identifying key trends and influencing factors. We examine market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and significant M&A activity. The report includes detailed metrics such as market share distribution across leading players and the value of key M&A deals.

Market Concentration: The Sri Lanka insurance market exhibits a moderately concentrated landscape, with a few dominant players controlling a significant share of the market. The report provides a breakdown of market share by company, including Ceylinco Insurance, Sri Lanka Insurance, AIA Insurance, Union Assurance, and Janashakthi Insurance. Smaller players account for the remaining market share. The xx Million market size exhibits a [predicted level of concentration/competition] level of competitiveness. Further analysis is provided on how this concentration impacts market dynamics.

Innovation Catalysts: Technological advancements, particularly in digital insurance and data analytics, are driving innovation. Insurers are increasingly adopting digital distribution channels and using data-driven insights for personalized offerings. The report details examples of innovative products and services, analyzing their market impact.

Regulatory Landscape: The regulatory environment influences market operations, product offerings, and pricing strategies. The report offers a comprehensive overview of the regulatory landscape and its impact on market dynamics.

Substitute Products: The report explores alternative financial products that could potentially substitute insurance products. This includes evaluating consumer preference shifts and the influence of other financial products on the insurance market.

End-User Profiles: The analysis includes an examination of the diverse end-user profiles and their specific insurance needs, covering demographics, income levels, and risk profiles.

M&A Activity: The report details significant M&A activity in the Sri Lanka insurance sector during the historical period. The report includes the value of mergers and acquisitions, analyzing their strategic implications for market competition and consolidation. For example, we discuss the impact of [Mention a significant merger or acquisition if any, otherwise predict potential scenarios]. The total estimated value of M&A activity during the review period is approximately xx Million.

Sri Lanka Life & Non-Life Insurance Market Industry Evolution

This section details the Sri Lanka insurance market's evolution, focusing on market growth trajectories, technological advancements, and shifting consumer preferences. The report provides in-depth analysis, incorporating data points like growth rates and technology adoption metrics across different segments of the market. The analysis incorporates detailed growth forecasts across different segments, highlighting significant changes and trends during 2019-2024 and projecting future development paths. The overall market growth is projected to reach xx Million by 2033, driven by [state key factors]. This section will showcase a comprehensive breakdown of the Life and Non-Life sectors individually.

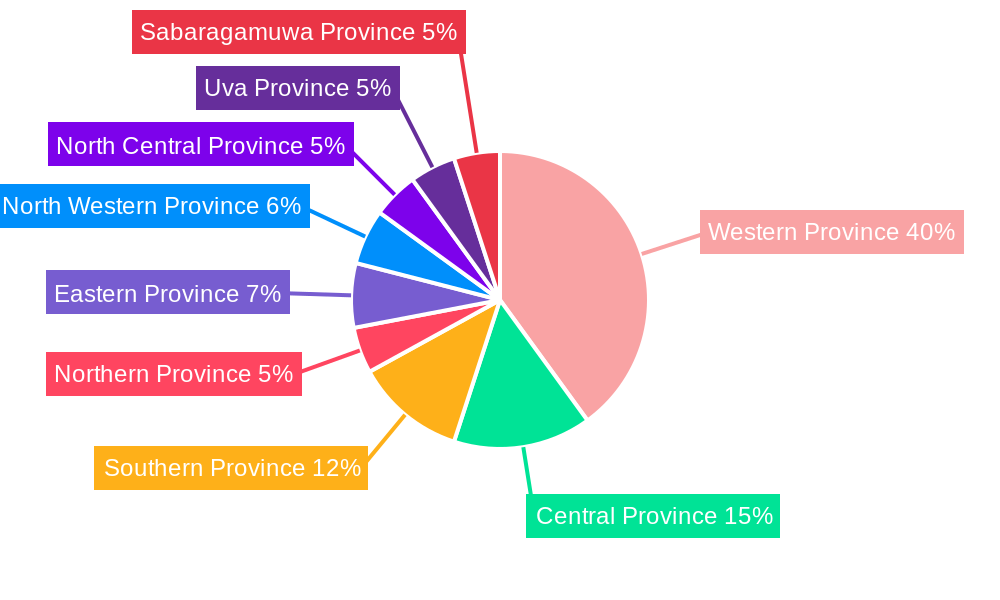

Leading Regions, Countries, or Segments in Sri Lanka Life & Non-Life Insurance Market

This section identifies dominant regions, countries, or segments within the Sri Lanka life and non-life insurance market. We analyze the key drivers contributing to their dominance, including investment trends and regulatory support.

By Type:

- Life Insurances: [Dominant region/segment and reasoning, e.g., Urban areas show higher life insurance penetration due to increased disposable income and awareness.]

- Non-Life Insurances: [Dominant region/segment and reasoning, e.g., The Colombo district leads in non-life insurance due to higher concentration of businesses and assets requiring protection.]

By Distribution Channel:

- Agency: [Dominant factors and analysis]

- Banks: [Dominant factors and analysis]

- Direct: [Dominant factors and analysis]

- Other Distribution Channels: [Dominant factors and analysis]

The dominance of each segment is comprehensively analyzed, incorporating factors like customer preferences, regulatory frameworks, and infrastructural support.

Sri Lanka Life & Non-Life Insurance Market Product Innovations

This section details recent product innovations, their applications, and performance metrics within the Sri Lanka life and non-life insurance market. It highlights unique selling propositions (USPs) and technological advancements, such as the incorporation of AI-powered risk assessment tools or the launch of microinsurance products tailored to specific demographics. The report will illustrate the impact of these innovations on market share and customer engagement.

Propelling Factors for Sri Lanka Life & Non-Life Insurance Market Growth

Several factors are driving growth in the Sri Lanka insurance market. These include increasing disposable incomes, rising awareness of insurance products, technological advancements facilitating digital distribution and personalized offerings, and supportive government policies aimed at promoting financial inclusion. Specific examples of these drivers will be provided in the report, quantifying their impact on market expansion.

Obstacles in the Sri Lanka Life & Non-Life Insurance Market

Despite significant growth potential, the Sri Lanka insurance market faces challenges. These include regulatory hurdles in streamlining processes, supply chain disruptions impacting operational efficiency, and intense competition from both domestic and international players. The report quantitatively assesses the impact of these obstacles on market growth.

Future Opportunities in Sri Lanka Life & Non-Life Insurance Market

The Sri Lanka insurance market presents significant opportunities. The increasing penetration of smartphones and internet access presents opportunities for digital insurance products. Growth in specific underserved segments, like rural populations, holds great potential. Furthermore, innovative product offerings aligned with evolving consumer needs and preferences will drive growth.

Major Players in the Sri Lanka Life & Non-Life Insurance Market Ecosystem

- Ceylinco Insurance

- Arpiko

- AssetLine

- Janashakthi Insurance

- Allianz Insurance

- Sri Lanka Insurance

- Continental Insurance Lanka

- AIA Insurance

- Union Assurance

- MSBL Insurance

Key Developments in Sri Lanka Life & Non-Life Insurance Market Industry

March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to launch the CABE program, fostering entrepreneurship in the agriculture sector. This initiative is expected to increase insurance penetration in rural areas.

January 2022: Ceylinco General Insurance launched ‘Drive Thru Claims,’ streamlining the claims process for enhanced customer experience and efficiency.

Strategic Sri Lanka Life & Non-Life Insurance Market Forecast

The Sri Lanka life and non-life insurance market is poised for robust growth over the forecast period (2025-2033). Technological advancements, evolving consumer needs, and supportive regulatory measures will drive market expansion. This section offers specific projections on the market size and segment growth, highlighting key opportunities for insurers to capitalize on the market's growth potential.

Sri Lanka Life & Non-Life Insurance Market Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Other Non-Life Insurance

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Sri Lanka Life & Non-Life Insurance Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Sri Lanka Life & Non-Life Insurance Market

Sri Lanka Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Other Non-Life Insurance

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceylinco Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arpiko

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AssetLine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janashakthi Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sri Lanka Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental Insurance Lanka**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIA Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Union Assurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MSBL Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ceylinco Insurance

List of Figures

- Figure 1: Sri Lanka Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sri Lanka Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Sri Lanka Life & Non-Life Insurance Market?

Key companies in the market include Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka**List Not Exhaustive, AIA Insurance, Union Assurance, MSBL Insurance.

3. What are the main segments of the Sri Lanka Life & Non-Life Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to nurture the agriculture sector. The Certificate in Agri-Business and Entrepreneurship (CABE) program is a first-of-its-kind qualification available in Sri Lanka to transform farmers into “Agriprenuers.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence