Key Insights

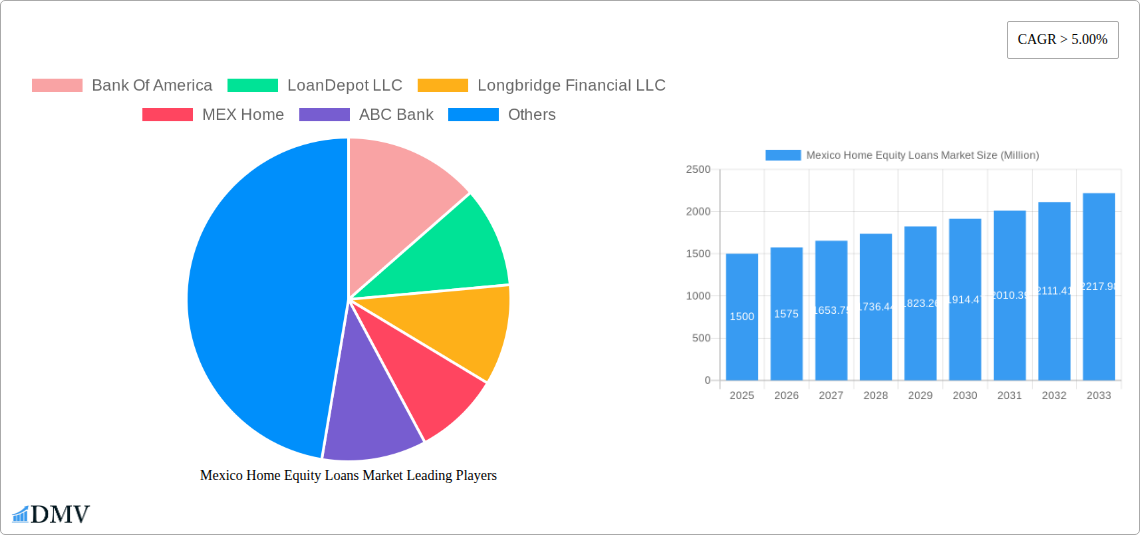

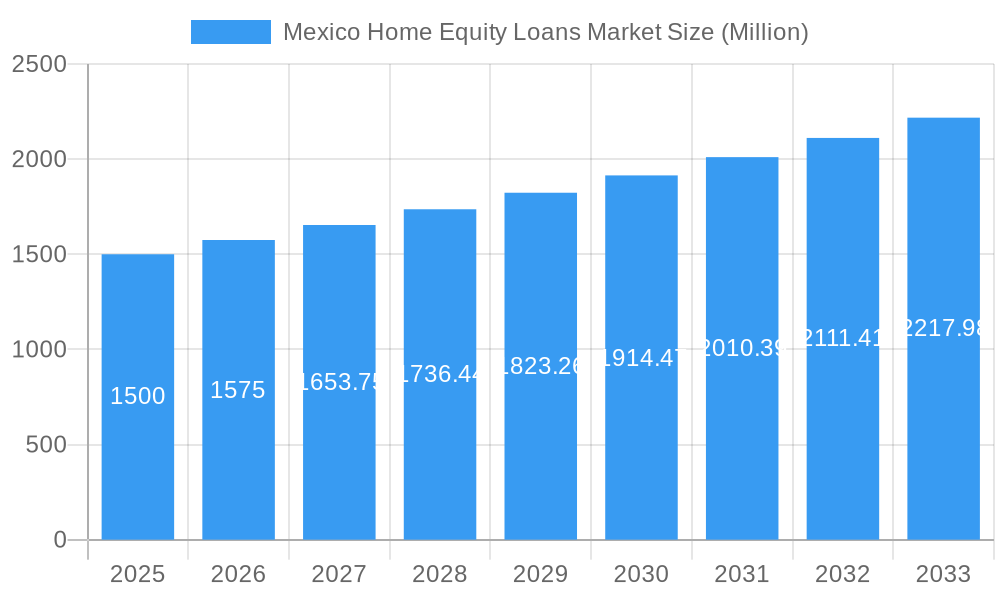

The Mexico Home Equity Loans Market is poised for significant expansion, projected to reach a market size of 747.9 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.56% during the forecast period of 2025-2033. This robust growth is propelled by several key factors, including escalating home values in major Mexican metropolitan areas, which increase homeowner equity. Concurrently, a burgeoning middle class with enhanced disposable income is fueling demand for home improvement, debt consolidation, and other significant purchases financed by home equity. While interest rates remain competitive, potential economic instability and real estate market fluctuations present challenges. Market segmentation includes loan type (fixed-rate, adjustable-rate), loan amount, and borrower demographics. Leading market participants such as Bank of America and LoanDepot LLC, alongside numerous regional banks, are driving competition through innovative loan products and superior customer service. Geographic expansion is primarily concentrated in urban centers with high property values and developed financial infrastructure.

Mexico Home Equity Loans Market Market Size (In Million)

The competitive arena features a blend of large national banks and specialized regional institutions. Dominant players leverage extensive networks and infrastructure, while regional banks excel in local market understanding and tailored client experiences. Success will depend on balancing risk management with effective customer acquisition, particularly given the Mexican market's sensitivity to economic shifts. Key to sustained growth are adept interest rate risk management, prudent underwriting, and adaptability to evolving regulatory landscapes. Future expansion hinges on macroeconomic stability, borrower affordability, and lender confidence. The ongoing development of Mexico's financial sector and the maturation of its home equity lending market are critical to its long-term trajectory.

Mexico Home Equity Loans Market Company Market Share

Mexico Home Equity Loans Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Mexico Home Equity Loans Market, offering valuable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is expected to reach xx Million by 2033, demonstrating significant growth potential.

Mexico Home Equity Loans Market Market Composition & Trends

This section delves into the intricate structure of the Mexico Home Equity Loans Market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The analysis considers the market share distribution among key players and explores the financial implications of M&A deals. We uncover the factors that drive market competition, the influence of regulatory frameworks on market expansion, and the evolving landscape of substitutes. The report also profiles key end-users, providing a detailed understanding of their needs and preferences.

- Market Concentration: The market is characterized by [Describe market concentration, e.g., a moderately concentrated market with a few major players holding a significant share].

- Innovation Catalysts: Technological advancements in lending platforms and digital financial services are key drivers of innovation.

- Regulatory Landscape: [Describe the regulatory environment, including any significant legislation or changes impacting the market].

- Substitute Products: [Describe substitute products and their market impact, e.g., personal loans, credit cards].

- End-User Profiles: [Describe the key end-user segments, their characteristics, and their home equity loan needs].

- M&A Activity: The report analyzes notable M&A deals, including their value and strategic implications. For example, the xx Million acquisition of [Company Name] by [Company Name] in [Year] significantly altered market dynamics. The total value of M&A transactions during the historical period (2019-2024) is estimated to be xx Million.

Mexico Home Equity Loans Market Industry Evolution

This section presents a detailed analysis of the Mexico Home Equity Loans Market's trajectory, examining its growth patterns, technological advancements, and evolving consumer demands. We provide specific data points on growth rates and adoption metrics, highlighting key trends and shifts in the market. The analysis also explores the impact of macroeconomic factors and emerging technologies on the industry's evolution. The market is projected to witness significant growth driven by [mention specific factors, e.g., increasing homeownership rates, favorable government policies]. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is expected to be xx%. Adoption rates for digital home equity loan platforms are anticipated to increase by xx% annually.

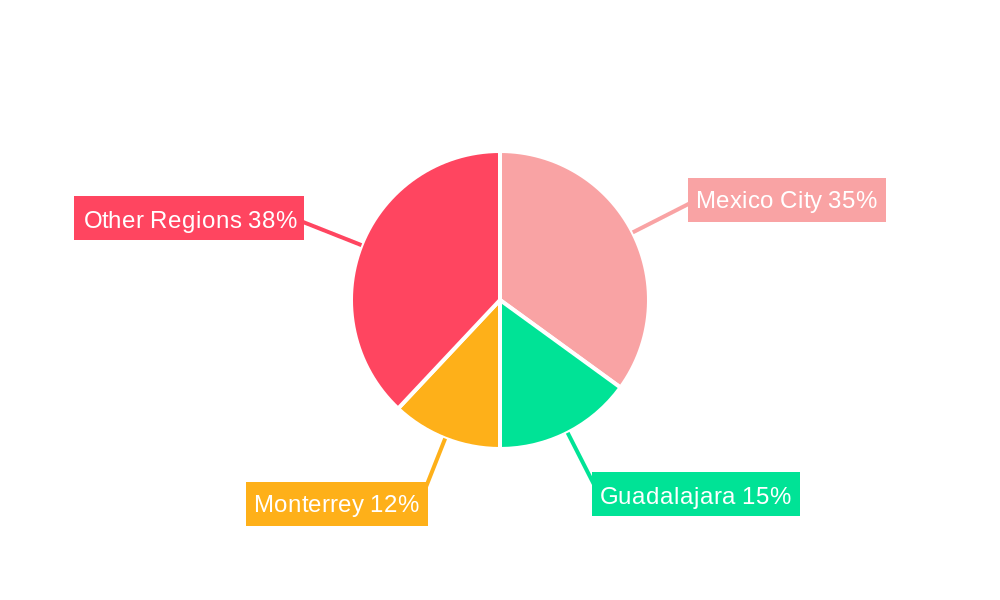

Leading Regions, Countries, or Segments in Mexico Home Equity Loans Market

This section identifies the dominant region, country, or segment within the Mexico Home Equity Loans Market. It provides a detailed analysis of the factors contributing to their dominance, including investment trends, regulatory support, and consumer behavior.

- Key Drivers for Dominant Region/Segment:

- Favorable regulatory environment.

- Stronger economic growth.

- Higher homeownership rates.

- Increased access to financing.

- Government initiatives supporting home equity loans.

[Paragraph providing in-depth analysis of the dominance factors. For example, "The dominance of [Region/Segment] is primarily attributed to its robust economy, coupled with supportive government policies encouraging homeownership and access to credit. This has resulted in a significantly higher demand for home equity loans compared to other regions." ]

Mexico Home Equity Loans Market Product Innovations

This section highlights the latest product innovations, applications, and performance metrics within the Mexico Home Equity Loans Market. Key innovations include streamlined online application processes, personalized loan options, and flexible repayment terms. These innovations improve accessibility and cater to diverse customer needs, leading to increased market penetration. Technological advancements such as AI-powered credit scoring and blockchain-based security are further enhancing efficiency and trust within the sector.

Propelling Factors for Mexico Home Equity Loans Market Growth

Several key factors contribute to the growth of the Mexico Home Equity Loans Market. These include increasing homeownership rates, favorable economic conditions, and the availability of innovative financial products. Government initiatives supporting homeownership and access to credit are also boosting market expansion. Furthermore, the growing adoption of digital lending platforms is enhancing accessibility and convenience for borrowers.

Obstacles in the Mexico Home Equity Loans Market Market

Despite significant growth potential, the Mexico Home Equity Loans Market faces certain challenges. These include stringent regulatory requirements, potential economic downturns, and intense competition among lenders. Fluctuations in interest rates also impact the market's stability and can affect consumer demand. These factors require careful consideration by industry players.

Future Opportunities in Mexico Home Equity Loans Market

The Mexico Home Equity Loans Market presents several future opportunities. The expansion of digital lending platforms, the development of innovative financial products, and the potential penetration into underserved markets offer significant growth prospects. Increased awareness of home equity loans as a financial tool can also contribute to market expansion.

Major Players in the Mexico Home Equity Loans Market Ecosystem

- Bank Of America

- LoanDepot LLC

- Longbridge Financial LLC

- MEX Home

- ABC Bank

- WaFd Bank

- Bank of Albuquerque

- Mexlend

- Pinnacle Bank

- New Mexico Bank And Trust

- [List continues…]

Key Developments in Mexico Home Equity Loans Market Industry

- August 2022: Rocket Mortgage launched a home equity loan, enhancing its product portfolio and catering to the rising demand for debt consolidation amidst inflation.

- February 2023: Guild Mortgage's acquisition of Legacy Mortgage expanded its presence in the Southwest, providing borrowers with a wider range of loan options.

Strategic Mexico Home Equity Loans Market Market Forecast

The Mexico Home Equity Loans Market is poised for sustained growth driven by various factors, including increasing homeownership rates, favorable economic conditions, and the emergence of innovative digital lending platforms. The market's potential is substantial, particularly given the increasing adoption of technology and the expanding reach of financial services to underserved populations. The forecast period (2025-2033) is expected to witness significant market expansion and growth in the overall market value.

Mexico Home Equity Loans Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Commercial Banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other Creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

Mexico Home Equity Loans Market Segmentation By Geography

- 1. Mexico

Mexico Home Equity Loans Market Regional Market Share

Geographic Coverage of Mexico Home Equity Loans Market

Mexico Home Equity Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.3. Market Restrains

- 3.3.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.4. Market Trends

- 3.4.1. Financial And Socioeconomic Factors Favouring The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Equity Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Commercial Banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other Creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank Of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LoanDepot LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longbridge Financial LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEX Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABC Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WaFd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Albuquerque

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mexlend

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinnacle Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Mexico Bank And Trust**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Of America

List of Figures

- Figure 1: Mexico Home Equity Loans Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Home Equity Loans Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 2: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 3: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 4: Mexico Home Equity Loans Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 6: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 7: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 8: Mexico Home Equity Loans Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Equity Loans Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Mexico Home Equity Loans Market?

Key companies in the market include Bank Of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, New Mexico Bank And Trust**List Not Exhaustive.

3. What are the main segments of the Mexico Home Equity Loans Market?

The market segments include Types, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 747.9 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

6. What are the notable trends driving market growth?

Financial And Socioeconomic Factors Favouring The Market.

7. Are there any restraints impacting market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

8. Can you provide examples of recent developments in the market?

On August 2022, Rocket Mortgage, Mexico's largest mortgage lender and a part of Rocket Companies introduced a home equity loan to give Americans one more way to pay off debt that has risen along with inflation. Detroit-based Rocket Mortgage is enabling the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Equity Loans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Equity Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Equity Loans Market?

To stay informed about further developments, trends, and reports in the Mexico Home Equity Loans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence