Key Insights

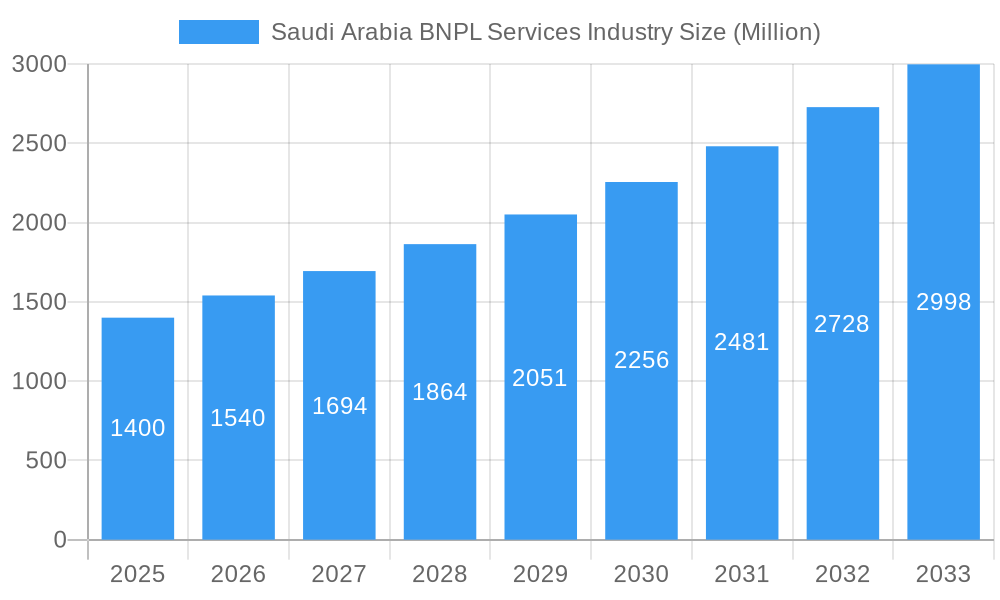

The Saudi Arabian Buy Now, Pay Later (BNPL) services industry is experiencing robust growth, projected to reach a market size of $1.4 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 10% through 2033. This expansion is fueled by several key factors. Firstly, the increasing adoption of e-commerce and digital payments within the Kingdom is creating a fertile ground for BNPL services. Consumers, particularly younger demographics, are drawn to the convenience and flexibility offered by these payment options. Secondly, the government's ongoing efforts to diversify the economy and promote digital transformation are creating a supportive regulatory environment. Finally, the presence of both international players like Mastercard and Visa, alongside localized companies such as Tamara, Tabby, and Postpay, fosters competition and drives innovation within the market. This competition ensures consumers have a range of options tailored to their needs, further accelerating market penetration.

Saudi Arabia BNPL Services Industry Market Size (In Billion)

Despite the promising outlook, the industry faces certain challenges. Maintaining robust risk management practices and mitigating potential defaults will be critical for sustainable growth. Ensuring responsible lending and protecting consumer rights will also be key considerations for both providers and regulators. Furthermore, maintaining the pace of innovation and adapting to evolving consumer preferences will be necessary for BNPL companies to stay ahead in this dynamic marketplace. The industry's future success hinges on balancing rapid growth with sustainable and responsible practices. The forecast period of 2025-2033 promises significant expansion, positioning Saudi Arabia as a key regional hub for BNPL services. This growth trajectory is expected to be driven by continued e-commerce expansion and the adoption of digital financial services amongst the Saudi population.

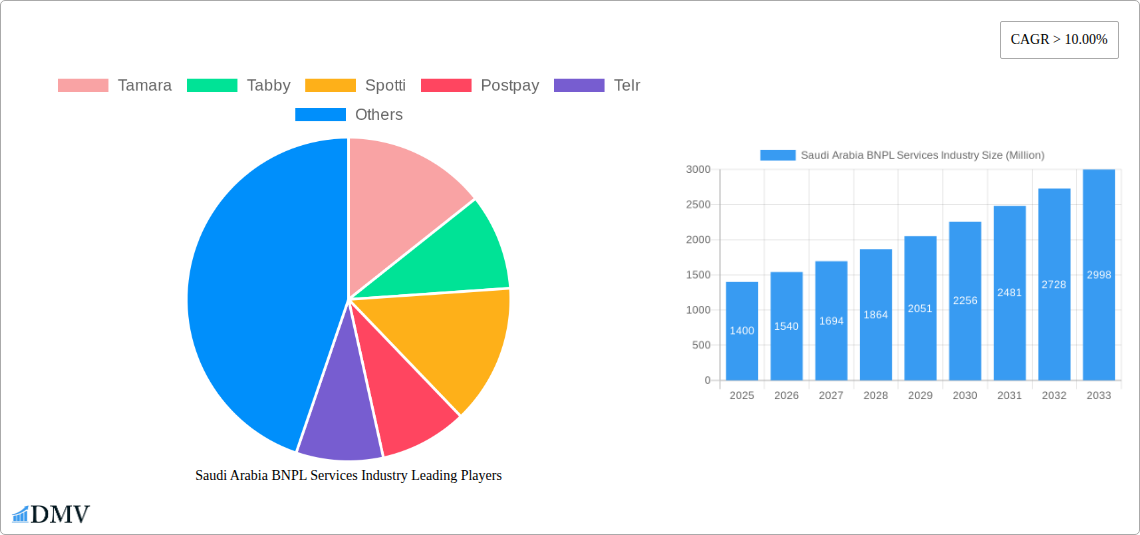

Saudi Arabia BNPL Services Industry Company Market Share

Saudi Arabia BNPL Services Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning Buy Now, Pay Later (BNPL) services industry in Saudi Arabia, covering the period 2019-2033. With a focus on market trends, competitive landscape, and future growth projections, this report is an essential resource for investors, businesses, and stakeholders seeking to understand and capitalize on this rapidly evolving sector. The base year for this analysis is 2025, with estimations for 2025 and a forecast period extending to 2033. The historical period covered is 2019-2024. The total market value in 2025 is estimated at XXX Million.

Saudi Arabia BNPL Services Industry Market Composition & Trends

This section delves into the intricate composition and dynamic trends shaping the Saudi Arabian BNPL market. We analyze market concentration, revealing the market share distribution amongst key players like Tamara, Tabby, Spotti, and Postpay. We explore the innovative catalysts driving growth, including technological advancements and evolving consumer preferences. The regulatory landscape, including its impact on market expansion, is thoroughly examined. Furthermore, we assess the influence of substitute products and the profiles of end-users, providing valuable insights into consumer behavior and spending patterns. Finally, we analyze significant M&A activities, including deal values (estimated at XXX Million in total for the period 2019-2024), and their implications for market consolidation and future growth.

- Market Concentration: Tamara and Tabby hold a significant combined market share of approximately XX%, while other players like Spotti and Postpay compete for the remaining share.

- Innovation Catalysts: Rapid smartphone adoption and increasing e-commerce penetration are key drivers.

- Regulatory Landscape: The Saudi Arabian Monetary Authority (SAMA) is actively shaping regulations for BNPL services to mitigate risks.

- Substitute Products: Traditional credit cards and installment plans remain competitive alternatives.

- End-User Profiles: The primary user base consists of young, tech-savvy individuals and online shoppers.

- M&A Activities: Several strategic partnerships and acquisitions have occurred, consolidating market share and driving innovation (e.g., the combined value of M&A deals in the period 2019-2024 is estimated at XXX Million).

Saudi Arabia BNPL Services Industry Industry Evolution

This section provides a detailed examination of the evolution of the Saudi Arabia BNPL services industry. We analyze the market growth trajectories, showcasing year-on-year growth rates (averaging approximately XX% from 2019 to 2024). We illustrate technological advancements, highlighting the shift towards mobile-first solutions and the integration of AI and machine learning for risk assessment and fraud prevention. The report also explores the evolving consumer demands, including preferences for seamless checkout experiences, flexible repayment options, and transparent fee structures. Adoption metrics are presented, reflecting the increasing prevalence of BNPL usage amongst Saudi Arabian consumers. The total transaction value is expected to reach XXX Million by 2033, representing a significant surge in adoption.

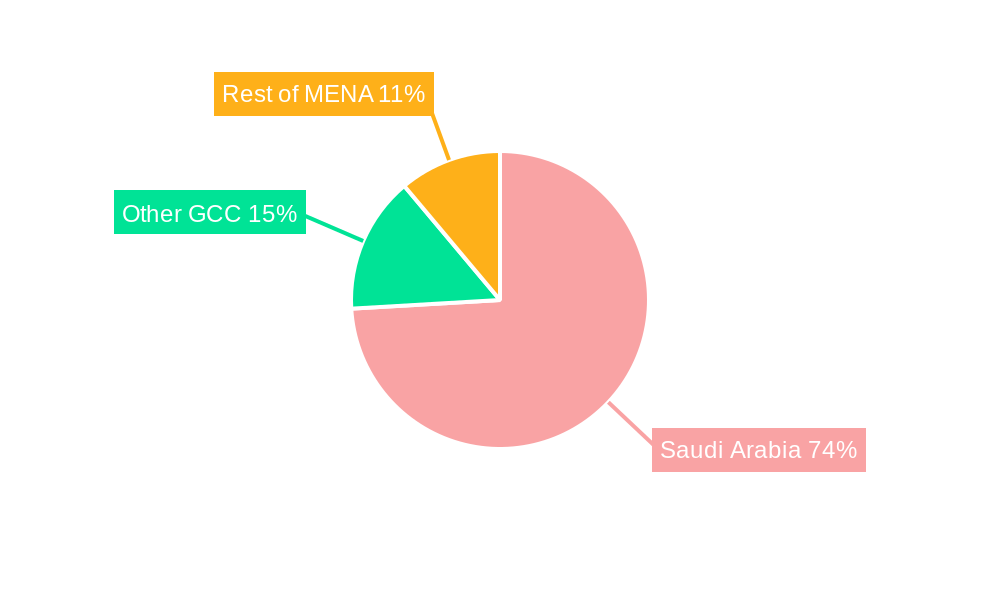

Leading Regions, Countries, or Segments in Saudi Arabia BNPL Services Industry

This section identifies the dominant region(s) or segment(s) within the Saudi Arabian BNPL market. While the market is largely concentrated nationwide, certain urban centers with higher e-commerce penetration show significantly higher adoption rates. This analysis highlights the key drivers behind this dominance using a combination of paragraphs and bullet points.

- Key Drivers:

- Investment Trends: Significant venture capital investments are flowing into the sector.

- Regulatory Support: A supportive regulatory environment is encouraging market growth.

- High Smartphone Penetration: Widespread smartphone usage facilitates the adoption of BNPL apps.

- Growing E-commerce Sector: The expansion of online retail creates a fertile ground for BNPL services.

The dominance of specific regions is largely attributed to higher internet and smartphone penetration, a younger demographic more receptive to digital payment methods, and robust e-commerce infrastructure.

Saudi Arabia BNPL Services Industry Product Innovations

The Saudi Arabian BNPL market is characterized by ongoing product innovation. Companies are introducing features such as customizable repayment plans, loyalty programs, and integrated budgeting tools to enhance user experience and drive customer acquisition. The integration of open banking APIs is improving credit scoring and risk assessment, leading to more efficient and inclusive BNPL services. This has resulted in an increase in transaction volume and a broadening of the customer base.

Propelling Factors for Saudi Arabia BNPL Services Industry Growth

The robust growth of the Saudi Arabian BNPL market is driven by a confluence of factors. Technological advancements, such as the widespread adoption of mobile payments and the development of sophisticated risk management systems, are central to this growth. Furthermore, favorable economic conditions, including rising disposable incomes and a young, digitally engaged population, are fueling the increasing demand for convenient payment solutions. Supportive regulatory frameworks are also encouraging the growth of the sector. For example, the Saudi Arabian Monetary Authority’s (SAMA) initiatives to promote financial inclusion have been instrumental in supporting BNPL expansion.

Obstacles in the Saudi Arabia BNPL Services Industry Market

Despite its rapid growth, the Saudi Arabian BNPL market faces several challenges. Regulatory uncertainty remains a concern, potentially impacting investor confidence and slowing market expansion. Supply chain disruptions, though less significant than in other sectors, can affect the availability of goods and services purchased via BNPL, impacting customer satisfaction. The increasing intensity of competition, with both established players and new entrants vying for market share, puts pressure on profit margins and necessitates continuous innovation to maintain a competitive edge. The risk of increased consumer debt is another important concern needing careful management by regulators and providers.

Future Opportunities in Saudi Arabia BNPL Services Industry

The future of the Saudi Arabian BNPL market is bright, with numerous opportunities for growth. Expansion into underserved segments of the population, particularly those with limited access to traditional financial services, holds significant potential. The integration of BNPL into other payment ecosystems, such as ride-sharing apps and food delivery platforms, will further expand the reach and utility of these services. Moreover, the adoption of innovative technologies, like blockchain and AI, offers opportunities to improve security, efficiency, and customer experience.

Key Developments in Saudi Arabia BNPL Services Industry Industry

- June 2022: Postpay partnered with Tap Payments to expand payment options for businesses.

- January 2023: ToYou and Tabby launched a joint BNPL service.

Strategic Saudi Arabia BNPL Services Industry Market Forecast

The Saudi Arabian BNPL market is poised for continued strong growth, driven by increasing e-commerce adoption, favorable demographics, and supportive regulatory policies. The expanding reach of smartphones and internet penetration, coupled with continuous product innovation and strategic partnerships, will further fuel this expansion. The market is projected to experience substantial growth, with the total transaction value expected to reach XXX Million by 2033, highlighting the immense potential of this dynamic sector.

Saudi Arabia BNPL Services Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS (Point of Sale)

-

2. End User

- 2.1. Kitchen Appliances

- 2.2. Electronic Appliances

- 2.3. Fashion and Personal Care

- 2.4. Healthcare

Saudi Arabia BNPL Services Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia BNPL Services Industry Regional Market Share

Geographic Coverage of Saudi Arabia BNPL Services Industry

Saudi Arabia BNPL Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.4. Market Trends

- 3.4.1. Raising E-Commerce Platforms with Online Payment Methods Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia BNPL Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS (Point of Sale)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Kitchen Appliances

- 5.2.2. Electronic Appliances

- 5.2.3. Fashion and Personal Care

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tamara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tabby

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spotti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Postpay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cashew Payments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VISA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affirm Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zippay**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tamara

List of Figures

- Figure 1: Saudi Arabia BNPL Services Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia BNPL Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 2: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 3: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 9: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia BNPL Services Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Saudi Arabia BNPL Services Industry?

Key companies in the market include Tamara, Tabby, Spotti, Postpay, Telr, Mastercard, Cashew Payments, VISA, Affirm Inc, Zippay**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia BNPL Services Industry?

The market segments include Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

6. What are the notable trends driving market growth?

Raising E-Commerce Platforms with Online Payment Methods Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

8. Can you provide examples of recent developments in the market?

January 2023: ToYou, a delivery app established in Saudi Arabia, and the shopping and payment app Tabby partnered to create a new BNPL service in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia BNPL Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia BNPL Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia BNPL Services Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia BNPL Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence