Key Insights

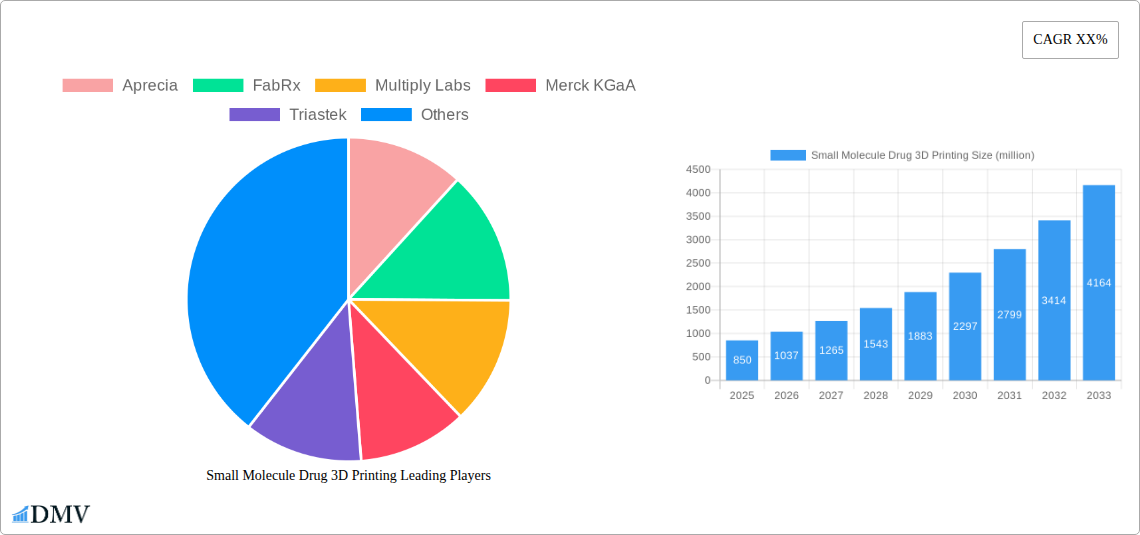

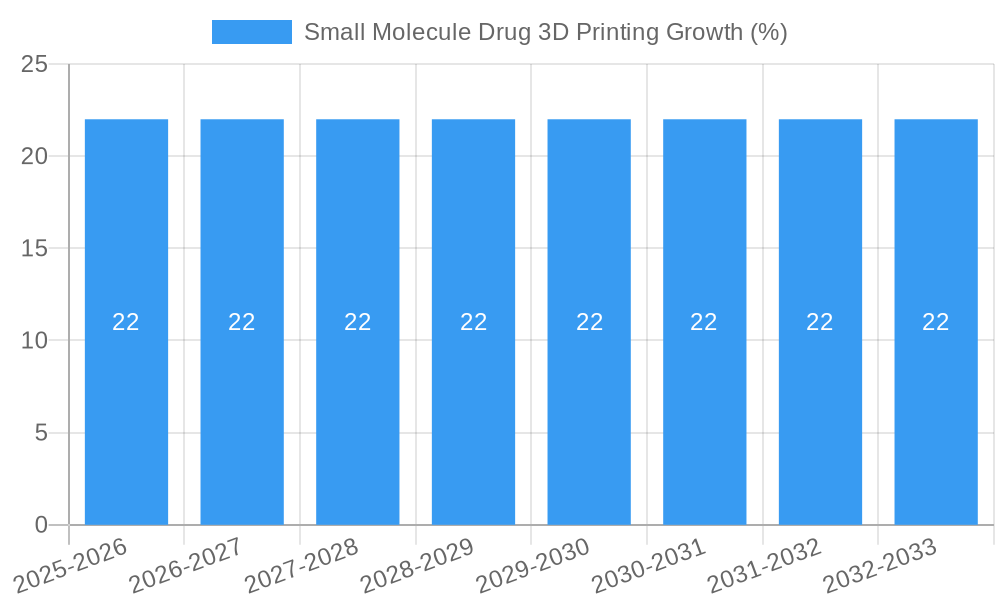

The global Small Molecule Drug 3D Printing market is poised for substantial growth, projected to reach an estimated market size of approximately $850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 22% anticipated through 2033. This remarkable expansion is primarily fueled by the increasing demand for personalized pharmaceuticals, where 3D printing offers unparalleled precision in tailoring dosages and drug combinations to individual patient needs. The technology's ability to accelerate concept research and technology development, particularly in the early stages of drug discovery and formulation, further bolsters market momentum. Furthermore, the shift towards more efficient and cost-effective large-scale production methods, enhanced by additive manufacturing's potential for reduced waste and streamlined processes, is a significant driver. Players like Aprecia, FabRx, and Multiply Labs are at the forefront, innovating with advanced printing techniques such as Material Extrusion and Binder Jetting to create novel drug delivery systems.

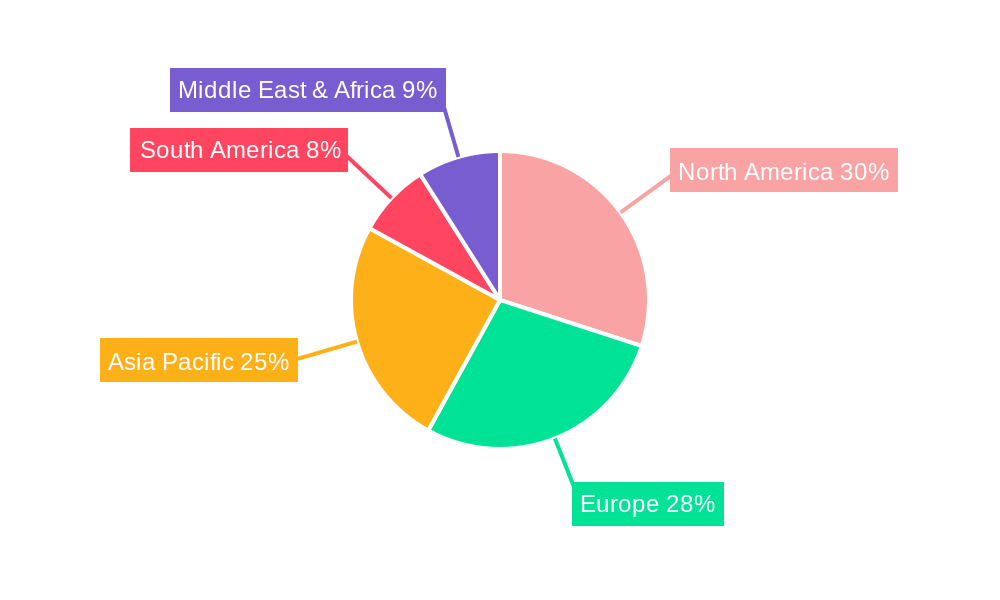

The market's trajectory is also influenced by key trends including the development of multi-drug printing capabilities, enabling the creation of single pills containing multiple active pharmaceutical ingredients for improved patient adherence and therapeutic outcomes. The growing integration of artificial intelligence and machine learning in drug design and printing processes is another critical trend, promising to further optimize formulation and personalize treatment. However, certain restraints, such as stringent regulatory hurdles for novel 3D printed pharmaceuticals and the initial high investment costs for advanced printing infrastructure, may temper the pace of adoption in some segments. Despite these challenges, the inherent advantages of precision, customization, and potential for innovation in drug delivery position Small Molecule Drug 3D Printing as a transformative force in the pharmaceutical landscape, with significant opportunities emerging across North America, Europe, and the rapidly advancing Asia Pacific region.

Small Molecule Drug 3D Printing Market Composition & Trends

The Small Molecule Drug 3D Printing market is characterized by a dynamic interplay of innovation, strategic investments, and evolving regulatory frameworks. Market concentration is gradually increasing as key players establish dominant positions through proprietary technologies and strategic partnerships. Innovation catalysts are primarily driven by the pursuit of personalized medicine, enabling tailored drug dosages and complex release profiles that were previously unattainable. The regulatory landscape, while still maturing, is becoming more conducive to the adoption of 3D printed pharmaceuticals, with agencies actively evaluating and approving innovative drug delivery systems. Substitute products, such as traditional tablet manufacturing, continue to hold a significant share, but the unique advantages of 3D printing, including localized production and rapid prototyping, are steadily eroding their dominance. End-user profiles range from large pharmaceutical giants like Merck KGaA and AstraZeneca exploring large-scale production and novel drug development, to specialized contract manufacturers and academic research institutions focused on concept research and technology development. Merger and acquisition (M&A) activities are anticipated to accelerate, with an estimated total M&A deal value projected to reach approximately 500 million by 2030, as companies seek to consolidate expertise and expand their market reach.

- Market Share Distribution: While specific current market share figures are proprietary, leading innovators are projected to capture over 60% of the market by 2033.

- M&A Deal Values: Projected M&A deal values are expected to grow from approximately 100 million in 2023 to 500 million by 2030.

- Innovation Focus: Personalized pharmaceutical applications and the development of novel drug formulations with controlled release mechanisms are the primary innovation drivers.

- Regulatory Evolution: Ongoing dialogue and collaboration between industry stakeholders and regulatory bodies like the FDA are crucial for market progression.

Small Molecule Drug 3D Printing Industry Evolution

The small molecule drug 3D printing industry has witnessed a remarkable trajectory of evolution since its nascent stages, driven by a confluence of technological breakthroughs, expanding application vistas, and a growing imperative for patient-centric healthcare solutions. The historical period from 2019 to 2024 laid the groundwork, marked by intensive research and development, early-stage pilot projects, and the initial exploration of 3D printing's potential beyond traditional pharmaceutical manufacturing paradigms. During this phase, early adopters focused on validating the feasibility of 3D printing small molecule drugs, addressing critical challenges related to material science, process control, and regulatory compliance. Initial market growth was modest, primarily confined to niche applications and concept research initiatives.

The base year of 2025 signifies a pivotal point, where the industry is poised for accelerated adoption and commercialization. Technological advancements have significantly matured, leading to more robust and reliable 3D printing platforms capable of handling a wider array of active pharmaceutical ingredients (APIs) and excipients. The development of specialized printing materials with enhanced bioavailability and controlled release properties has been a critical breakthrough. Furthermore, advancements in software for formulation design and process optimization are enabling greater precision and customization. Shifting consumer demands, fueled by an increasing awareness of personalized medicine and the desire for more convenient and effective drug delivery, are acting as a powerful tailwind. Patients and healthcare providers are increasingly seeking alternatives to conventional dosage forms, particularly for conditions requiring complex dosing regimens or specialized drug release profiles. This burgeoning demand is driving pharmaceutical companies to invest heavily in 3D printing technologies to meet these evolving needs.

The forecast period from 2025 to 2033 is projected to witness exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 25% to 30%. This surge will be propelled by several key factors, including the widespread validation of 3D printed drugs in clinical settings, broader regulatory approvals, and the scaling up of manufacturing capabilities. The increasing focus on personalized pharmaceuticals for chronic diseases, oncology, and pain management will be a significant contributor to this growth. As technology becomes more accessible and cost-effective, the application of small molecule drug 3D printing will extend beyond specialized treatments to broader therapeutic areas. The market's evolution is not just about producing pills faster or cheaper; it's about fundamentally reimagining drug development and delivery, offering unprecedented levels of customization and efficacy, thereby transforming patient care and pharmaceutical innovation.

Leading Regions, Countries, or Segments in Small Molecule Drug 3D Printing

The global landscape of small molecule drug 3D printing is increasingly defined by the burgeoning adoption and innovation within specific regions and application segments. While the United States and Europe have historically led research and development initiatives, Asia-Pacific, particularly China and South Korea, is rapidly emerging as a significant contender, driven by substantial government investment in advanced manufacturing and healthcare technologies, alongside a growing domestic pharmaceutical market.

Within the application segments, Personalized Pharmaceutical stands out as the most dominant driver of growth and adoption. This dominance is fueled by several key factors:

- Patient-Centric Healthcare Push: Global healthcare systems are increasingly prioritizing patient outcomes and tailored treatment plans. 3D printing enables the precise customization of drug dosages, tablet size, and release profiles to match individual patient needs, improving adherence and therapeutic efficacy. This is particularly crucial for patient populations with complex conditions like polypharmacy, pediatric patients, and those with swallowing difficulties.

- Addressing Unmet Medical Needs: Personalized pharmaceuticals can address specific unmet medical needs that traditional manufacturing struggles to cater to. For instance, creating unique multi-drug combinations within a single dosage form or developing drugs with highly specific release kinetics for targeted therapeutic effects.

- Regulatory Encouragement: Regulatory bodies are actively fostering innovation in personalized medicine, recognizing the potential of technologies like 3D printing to revolutionize patient care. This includes pathways for the approval of patient-specific or small-batch personalized drug formulations.

- Technological Sophistication: Advancements in material science and printing technologies have made it feasible to produce complex personalized formulations with high reproducibility and quality control, moving beyond mere concept to viable commercial solutions.

The Material Extrusion printing type is currently leading the market in terms of widespread adoption and commercial readiness due to its relative simplicity, cost-effectiveness, and versatility in handling a variety of pharmaceutical materials. Companies like FabRx have been instrumental in developing and refining this technology for pharmaceutical applications.

However, Large-scale Production is poised for significant growth as the technology matures and regulatory frameworks solidify. While currently in its nascent stages for 3D printing small molecule drugs, the potential for decentralized manufacturing, on-demand production, and reduced supply chain complexities offers compelling advantages that will drive its adoption in the long term. The development of high-throughput 3D printers and robust quality assurance protocols will be critical enablers for this segment.

Concept Research and Technology Development remains a vital segment, acting as the innovation engine for the entire ecosystem. Academic institutions and research-focused companies continue to explore novel printing methods, new pharmaceutical materials, and advanced drug delivery systems, paving the way for future breakthroughs. The synergistic interplay between these segments ensures a continuous pipeline of innovation and application expansion within the small molecule drug 3D printing market.

Small Molecule Drug 3D Printing Product Innovations

Product innovations in small molecule drug 3D printing are centered on enhancing therapeutic efficacy, patient compliance, and manufacturing flexibility. Key advancements include the development of multi-layered tablets capable of releasing different APIs at distinct time intervals, catering to complex treatment regimens. Novel excipients and binding agents are being engineered to optimize drug solubility, bioavailability, and stability within 3D printed matrices. Furthermore, innovations in printable inks and filament formulations allow for the precise incorporation of active pharmaceutical ingredients, ensuring accurate dosing and uniform drug distribution. The emergence of patient-specific dosage forms, tailored to individual metabolic rates and therapeutic needs, represents a significant leap forward, promising improved treatment outcomes and reduced side effects.

Propelling Factors for Small Molecule Drug 3D Printing Growth

The growth of the small molecule drug 3D printing market is propelled by a confluence of transformative technological, economic, and regulatory influences.

- Technological Advancements: Continuous innovation in 3D printing hardware, software, and material science enables the creation of complex drug delivery systems with unparalleled precision and customization. This includes advancements in resolution, speed, and the ability to handle diverse pharmaceutical formulations.

- Shift Towards Personalized Medicine: The increasing demand for tailored patient treatments, addressing individual genetic profiles, disease stages, and metabolic rates, directly aligns with the capabilities of 3D printing to produce personalized dosages and release profiles.

- Supply Chain Resilience and Decentralization: The potential for on-demand, localized manufacturing through 3D printing offers a compelling solution to mitigate supply chain vulnerabilities, reduce lead times, and ensure drug availability in remote or underserved areas.

- Regulatory Support and Evolving Frameworks: As regulatory bodies gain a deeper understanding of 3D printing technologies, they are developing clearer guidelines and approval pathways, fostering greater confidence and accelerating market entry for 3D printed pharmaceuticals.

Obstacles in the Small Molecule Drug 3D Printing Market

Despite its immense potential, the small molecule drug 3D printing market faces several significant hurdles. Regulatory complexities and the establishment of robust quality control standards for novel 3D printed dosage forms remain a considerable challenge, often leading to longer approval times and increased development costs. The initial capital investment required for advanced 3D printing equipment and the development of specialized pharmaceutical-grade materials can be substantial, posing a barrier to entry for smaller companies. Furthermore, scaling up production to meet the demands of large patient populations while maintaining cost-effectiveness compared to traditional manufacturing methods requires further technological maturation and process optimization. Supply chain disruptions for critical raw materials and the need for specialized training for personnel operating these advanced systems also present ongoing challenges.

Future Opportunities in Small Molecule Drug 3D Printing

The future of small molecule drug 3D printing is brimming with opportunities for innovation and market expansion. Emerging opportunities lie in the development of sophisticated multi-drug combination therapies printed into a single dosage form, offering simplified patient regimens. The expansion into novel drug delivery platforms, such as implantable devices and transdermal patches fabricated through 3D printing, presents significant potential. Furthermore, the application of artificial intelligence and machine learning in conjunction with 3D printing for predictive formulation design and automated quality control will revolutionize drug development and manufacturing. Exploring the integration of sensors within 3D printed drugs for real-time therapeutic monitoring also represents a promising avenue.

Major Players in the Small Molecule Drug 3D Printing Ecosystem

- Aprecia

- FabRx

- Multiply Labs

- Merck KGaA

- Triastek

- MSD

- AstraZeneca

- TNO

- DiHeSys

Key Developments in Small Molecule Drug 3D Printing Industry

- 2023: FabRx receives regulatory approval for its 3D printed medication in a key market, signifying a major step towards commercialization of personalized pharmaceuticals.

- 2023: Aprecia announces a strategic partnership with a leading pharmaceutical company to explore the 3D printing of complex pain management medications.

- 2022: Triastek successfully completes a clinical trial demonstrating the efficacy and safety of its 3D printed drug for a rare disease.

- 2022: Multiply Labs showcases a new high-speed binder jetting 3D printer capable of producing thousands of personalized pills per hour.

- 2021: Merck KGaA invests in advanced research into melt extrusion 3D printing for controlled-release drug formulations.

- 2021: AstraZeneca initiates a pilot program for the on-demand 3D printing of clinical trial materials.

- 2020: TNO publishes groundbreaking research on novel bio-inks for 3D printing sustained-release drug formulations.

- 2019: DiHeSys introduces a new platform for the rapid prototyping of small molecule drug formulations using photopolymerization techniques.

Strategic Small Molecule Drug 3D Printing Market Forecast

The strategic forecast for the small molecule drug 3D printing market is exceptionally robust, driven by the inherent advantages of personalized medicine and advanced manufacturing. The market is expected to experience significant growth, fueled by increasing investments in research and development, alongside a more streamlined regulatory environment. Key growth catalysts include the growing demand for tailored drug therapies, the development of more sophisticated and cost-effective 3D printing technologies, and the potential for decentralized, on-demand pharmaceutical production. The market's potential is further amplified by the continuous exploration of novel applications and the integration of AI and machine learning, promising a future where drug development and delivery are revolutionized for enhanced patient outcomes and pharmaceutical efficiency.

Small Molecule Drug 3D Printing Segmentation

-

1. Application

- 1.1. Large-scale Production

- 1.2. Personalized Pharmaceutical

- 1.3. Concept Research and Technology Development

-

2. Types

- 2.1. Material Extrusion

- 2.2. Binder Jetting

- 2.3. Powder Bed Fusion

- 2.4. Other

Small Molecule Drug 3D Printing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Small Molecule Drug 3D Printing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large-scale Production

- 5.1.2. Personalized Pharmaceutical

- 5.1.3. Concept Research and Technology Development

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Material Extrusion

- 5.2.2. Binder Jetting

- 5.2.3. Powder Bed Fusion

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large-scale Production

- 6.1.2. Personalized Pharmaceutical

- 6.1.3. Concept Research and Technology Development

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Material Extrusion

- 6.2.2. Binder Jetting

- 6.2.3. Powder Bed Fusion

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large-scale Production

- 7.1.2. Personalized Pharmaceutical

- 7.1.3. Concept Research and Technology Development

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Material Extrusion

- 7.2.2. Binder Jetting

- 7.2.3. Powder Bed Fusion

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large-scale Production

- 8.1.2. Personalized Pharmaceutical

- 8.1.3. Concept Research and Technology Development

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Material Extrusion

- 8.2.2. Binder Jetting

- 8.2.3. Powder Bed Fusion

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large-scale Production

- 9.1.2. Personalized Pharmaceutical

- 9.1.3. Concept Research and Technology Development

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Material Extrusion

- 9.2.2. Binder Jetting

- 9.2.3. Powder Bed Fusion

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Small Molecule Drug 3D Printing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large-scale Production

- 10.1.2. Personalized Pharmaceutical

- 10.1.3. Concept Research and Technology Development

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Material Extrusion

- 10.2.2. Binder Jetting

- 10.2.3. Powder Bed Fusion

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Aprecia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FabRx

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Multiply Labs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Triastek

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MSD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AstraZeneca

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TNO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Multiply Labs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DiHeSys

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aprecia

List of Figures

- Figure 1: Global Small Molecule Drug 3D Printing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Small Molecule Drug 3D Printing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Small Molecule Drug 3D Printing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Small Molecule Drug 3D Printing Revenue (million), by Types 2024 & 2032

- Figure 5: North America Small Molecule Drug 3D Printing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Small Molecule Drug 3D Printing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Small Molecule Drug 3D Printing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Small Molecule Drug 3D Printing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Small Molecule Drug 3D Printing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Small Molecule Drug 3D Printing Revenue (million), by Types 2024 & 2032

- Figure 11: South America Small Molecule Drug 3D Printing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Small Molecule Drug 3D Printing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Small Molecule Drug 3D Printing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Small Molecule Drug 3D Printing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Small Molecule Drug 3D Printing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Small Molecule Drug 3D Printing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Small Molecule Drug 3D Printing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Small Molecule Drug 3D Printing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Small Molecule Drug 3D Printing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Small Molecule Drug 3D Printing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Small Molecule Drug 3D Printing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Small Molecule Drug 3D Printing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Small Molecule Drug 3D Printing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Small Molecule Drug 3D Printing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Small Molecule Drug 3D Printing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Small Molecule Drug 3D Printing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Small Molecule Drug 3D Printing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Small Molecule Drug 3D Printing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Small Molecule Drug 3D Printing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Small Molecule Drug 3D Printing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Small Molecule Drug 3D Printing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Small Molecule Drug 3D Printing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Small Molecule Drug 3D Printing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Small Molecule Drug 3D Printing?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Small Molecule Drug 3D Printing?

Key companies in the market include Aprecia, FabRx, Multiply Labs, Merck KGaA, Triastek, MSD, AstraZeneca, TNO, Multiply Labs, DiHeSys.

3. What are the main segments of the Small Molecule Drug 3D Printing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Small Molecule Drug 3D Printing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Small Molecule Drug 3D Printing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Small Molecule Drug 3D Printing?

To stay informed about further developments, trends, and reports in the Small Molecule Drug 3D Printing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence