Key Insights

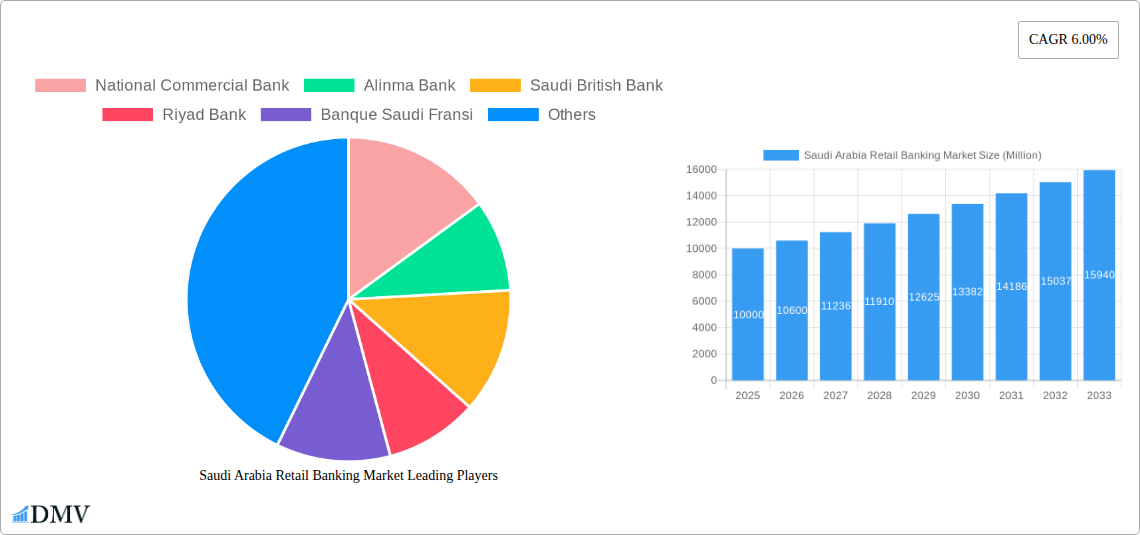

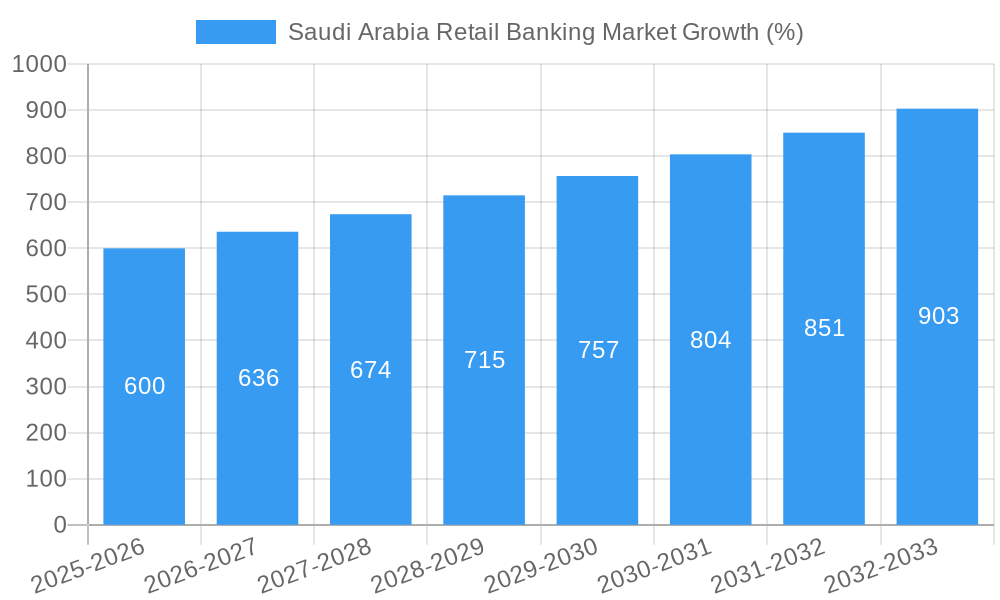

The Saudi Arabian retail banking market, characterized by a robust growth trajectory, is projected to experience significant expansion over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 6.00% indicates a healthy and dynamic sector fueled by several key drivers. The burgeoning young population, increasing disposable incomes, and government initiatives promoting financial inclusion are all contributing to the market's expansion. Technological advancements, particularly the rapid adoption of digital banking and fintech solutions, are further accelerating growth. Increased competition among established players like National Commercial Bank, Al Rajhi Bank, and Saudi British Bank, alongside the emergence of new fintech entrants, is fostering innovation and improving customer experiences. While the market faces some constraints, such as regulatory hurdles and potential economic fluctuations, the overall outlook remains positive. The segmentation within the market, though not explicitly defined, likely includes various product offerings such as personal loans, mortgages, savings accounts, and investment products. The consistent CAGR suggests a steady increase in market size, with substantial opportunities for both existing and new players.

The market’s growth is expected to be uneven across different segments, with digital banking and Islamic finance likely experiencing the fastest growth. The increasing adoption of mobile banking and online platforms reflects a broader shift towards digitalization within the Saudi economy. The strong emphasis on Islamic finance aligns with the country's religious and cultural context. Regional variations in growth may also exist, depending on factors like population density, economic activity, and level of financial literacy. Competitive pressures will likely lead to further product innovation, enhanced customer service, and potentially pricing adjustments to retain market share. Strategic partnerships and mergers and acquisitions could reshape the competitive landscape, influencing overall market dynamics in the coming years. The projected market size in 2033 will significantly surpass the 2025 base value, signifying a substantial expansion of the retail banking sector in Saudi Arabia.

Saudi Arabia Retail Banking Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia retail banking market, encompassing its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is indispensable for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The study incorporates historical data from 2019-2024 and projects market trends through 2033. Expect comprehensive coverage of market size, segmentation, growth drivers, challenges, and competitive landscapes.

Saudi Arabia Retail Banking Market Composition & Trends

This section delves into the intricate composition of the Saudi Arabia retail banking market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze the market share distribution amongst key players, including National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, and Al Rajhi Bank (list not exhaustive). The report quantifies market concentration using the Herfindahl-Hirschman Index (HHI) and assesses the impact of regulatory changes, such as those related to open banking and fintech licensing, on market dynamics. Furthermore, we provide a detailed analysis of recent M&A activities, including deal values and their implications for market consolidation. The analysis covers the significant impact of the 2022 merger of Samba Financial Group and NCB, creating the largest banking entity in Saudi Arabia with assets exceeding USD 239.7 Billion. We also explore the influence of substitute financial products, such as mobile payment platforms and peer-to-peer lending, on the traditional banking landscape.

- Market Concentration: XX% dominated by top 5 banks (estimated).

- M&A Deal Values (2019-2024): Total value exceeding xx Million USD.

- Regulatory Landscape: Analysis of key regulations impacting retail banking.

- Innovation Catalysts: Focus on digital banking adoption, fintech integration, and open banking initiatives.

Saudi Arabia Retail Banking Market Industry Evolution

This section provides a comprehensive overview of the Saudi Arabia retail banking market's evolution, detailing market growth trajectories, technological advancements, and the shifting preferences of consumers. We analyze historical growth rates and project future growth based on various macroeconomic factors and technological advancements in areas such as AI, big data, and blockchain. We examine the adoption rates of digital banking services, mobile payments, and other fintech solutions among different demographic groups. We also consider the impact of government initiatives and policies designed to support financial inclusion and promote digital transformation. The analysis incorporates data on customer acquisition costs, customer lifetime value, and other key performance indicators to illustrate the industry's performance and future potential. We detail the significant impact of Vision 2030 on the industry's transformation and future growth. This analysis considers both quantitative and qualitative data to provide a holistic understanding of the industry's evolution.

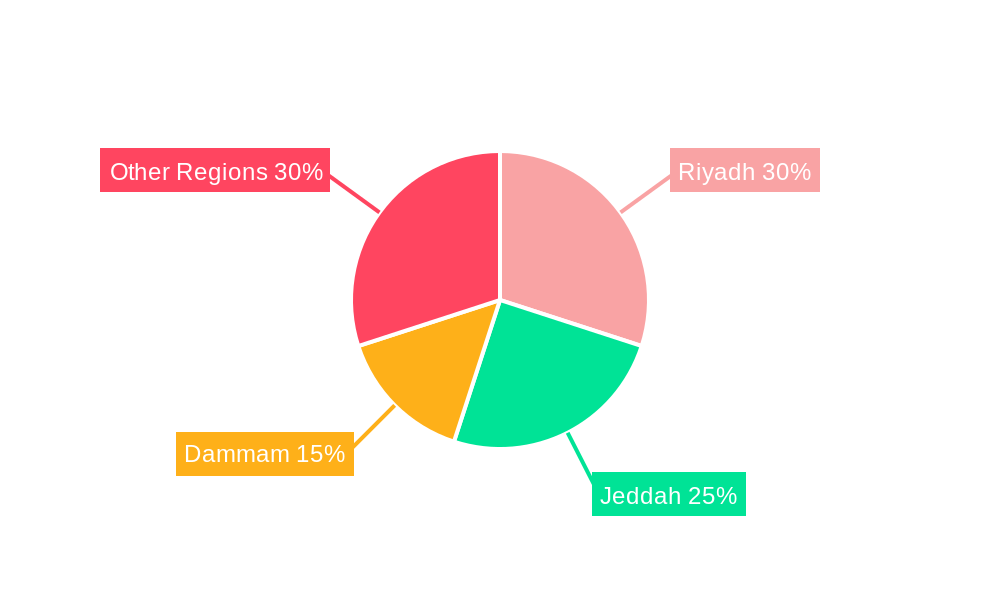

Leading Regions, Countries, or Segments in Saudi Arabia Retail Banking Market

This section identifies the dominant regions or segments within the Saudi Arabia retail banking market. We analyze factors driving the dominance of specific regions or segments, including investment trends, regulatory support, demographic characteristics, and economic activity. The analysis provides a detailed regional breakdown of market performance and discusses the potential for future growth in other areas.

- Key Drivers of Dominance (e.g., Riyadh):

- High population density and economic activity.

- Concentration of financial institutions and business headquarters.

- Strong government support for infrastructure development and economic diversification.

- Dominance Factors: In-depth analysis of specific market characteristics contributing to regional dominance.

Saudi Arabia Retail Banking Market Product Innovations

This section explores recent product innovations in the Saudi Arabia retail banking market. We discuss new product offerings, technological advancements, and the associated performance metrics. We highlight the unique selling propositions (USPs) of innovative products and analyze their impact on market competition and consumer behavior. The analysis includes the adoption rates of new products and their contribution to overall market growth. Examples include the introduction of new mobile banking applications with enhanced features and the development of personalized financial advice tools powered by AI.

Propelling Factors for Saudi Arabia Retail Banking Market Growth

Several key factors drive the growth of the Saudi Arabia retail banking market. These include ongoing technological advancements, supportive government policies (such as Vision 2030), and the rising financial inclusion initiatives. The increasing adoption of digital banking solutions, coupled with the growing penetration of smartphones and internet access, significantly contributes to market expansion. Moreover, the government's focus on economic diversification and the expansion of the private sector fuel the demand for financial services. This section details the impact of these elements, providing quantifiable examples.

Obstacles in the Saudi Arabia Retail Banking Market

Despite significant growth potential, the Saudi Arabia retail banking market faces certain challenges. These include increasing competition from fintech companies, regulatory hurdles, and potential risks related to cybersecurity and data privacy. The report quantifies the impact of these challenges on market growth and provides insights into potential mitigation strategies.

Future Opportunities in Saudi Arabia Retail Banking Market

The Saudi Arabia retail banking market presents numerous future opportunities, primarily driven by the continued adoption of digital technologies and the government’s push for financial inclusion. Opportunities lie in expanding financial services to underserved populations, developing innovative fintech solutions, and catering to the evolving needs of a growing and increasingly tech-savvy customer base. This section highlights the most promising areas for future market expansion.

Major Players in the Saudi Arabia Retail Banking Market Ecosystem

- Al Rajhi Bank

- Saudi National Bank

- Alawwal Bank

- Saudi Investment Bank

- Arab National Bank

- Banque Saudi Fransi

- Riyad Bank

- Saudi British Bank

- Alinma Bank

- National Commercial Bank (NCB)

(List Not Exhaustive)

Key Developments in Saudi Arabia Retail Banking Market Industry

- January 2022: Saudi National Bank announced the completion of the merger between Samba Financial Group and NCB, creating the largest banking entity in Saudi Arabia with assets exceeding USD 239.7 billion. This merger significantly reshaped the competitive landscape.

- February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its community housing initiative, providing 500 housing units (361 fully furnished and 139 supported by purchasing cards) to beneficiaries of the housing development program from 2017 to 2021. This highlights the increasing role of banks in social initiatives and community development.

Strategic Saudi Arabia Retail Banking Market Forecast

The Saudi Arabia retail banking market is poised for continued growth driven by digital transformation, government initiatives, and the expanding financial needs of a young and growing population. Opportunities abound in areas such as fintech adoption, financial inclusion, and the development of innovative financial products and services tailored to the specific needs of the Saudi Arabian market. The market's future trajectory is particularly promising given the government’s ongoing commitment to Vision 2030 and its efforts to modernize the financial sector. The forecast predicts sustained growth in the coming years, driven by the factors outlined in this report.

Saudi Arabia Retail Banking Market Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Distributional Channel

- 3.1. Direct Sales

- 3.2. Distributor

Saudi Arabia Retail Banking Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Retail Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.4. Market Trends

- 3.4.1. Increase in Saudi Retail Mortgage Loans Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Retail Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Distributional Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Commercial Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alinma Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi British Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riyad Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Banque Saudi Fransi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arab National Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Investment Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alawwal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi National Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Rajhi Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 National Commercial Bank

List of Figures

- Figure 1: Saudi Arabia Retail Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Retail Banking Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 4: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Distributional Channel 2019 & 2032

- Table 5: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 8: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Distributional Channel 2019 & 2032

- Table 9: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Retail Banking Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Saudi Arabia Retail Banking Market?

Key companies in the market include National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, Al Rajhi Bank**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Retail Banking Market?

The market segments include Product, Industry, Distributional Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

6. What are the notable trends driving market growth?

Increase in Saudi Retail Mortgage Loans Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

8. Can you provide examples of recent developments in the market?

February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its efforts in serving the housing sector within the donor community after the bank announced the completion of the delivery of its community housing initiative, which resulted in the provision of 500 housing units to the beneficiaries of the housing development program from 2017 to 2021, including 361 fully-furnished housing units and 139 housing units, supported by purchasing cards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Retail Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Retail Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Retail Banking Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Retail Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence