Key Insights

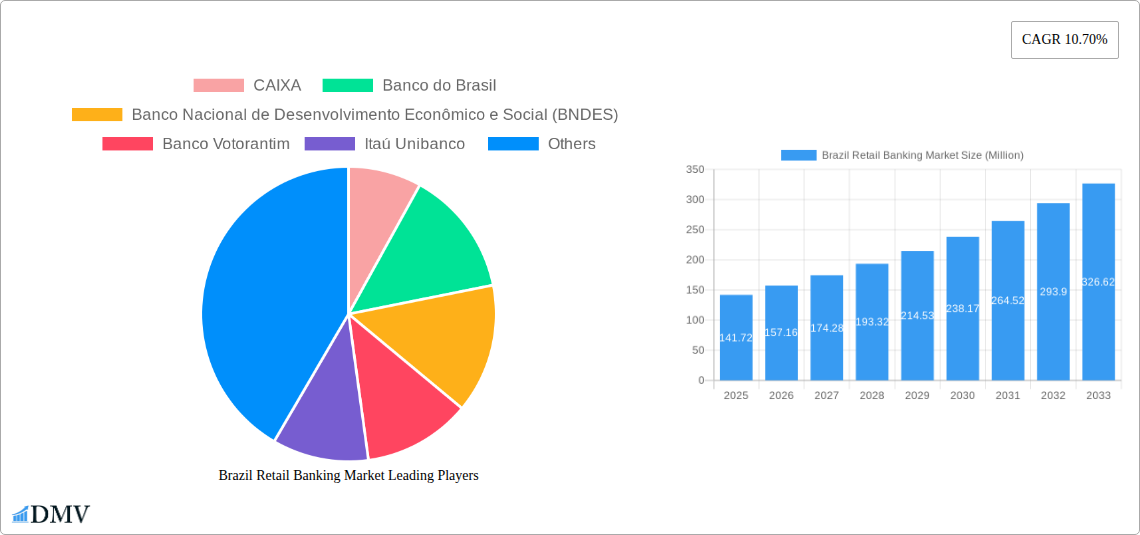

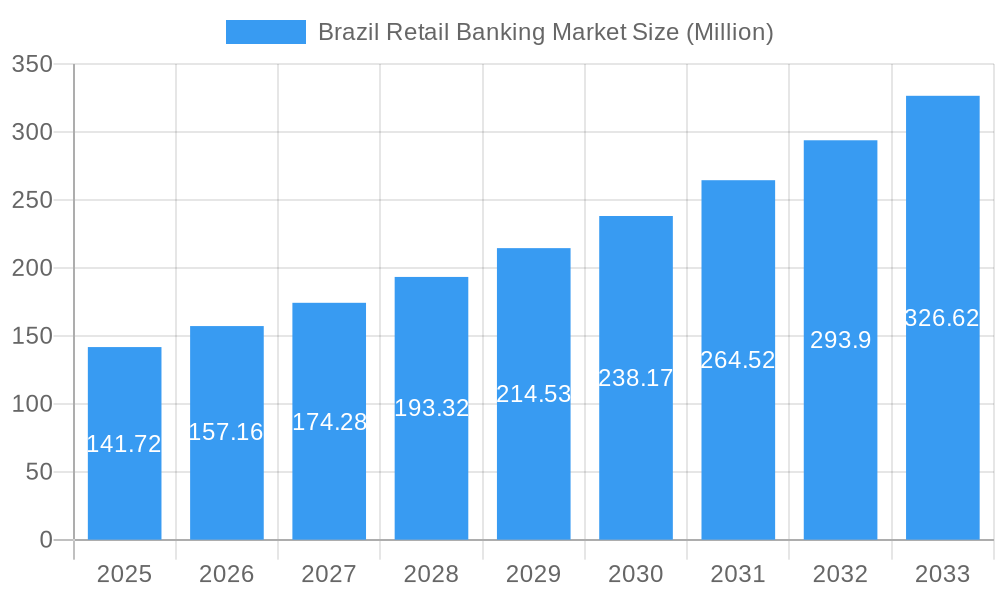

The Brazilian retail banking market, valued at $141.72 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.70% from 2025 to 2033. This expansion is driven by several key factors. Increasing smartphone penetration and internet access across Brazil are fueling the adoption of digital banking services, leading to greater financial inclusion and convenience for consumers. Government initiatives aimed at promoting financial literacy and access to credit are also contributing to market growth. Furthermore, the rising middle class and a growing young population represent a significant untapped market for retail banking products and services, particularly in areas like credit cards and personal loans. Competition among established players like CAIXA, Banco do Brasil, Itaú Unibanco, and Bradesco, alongside the emergence of fintech companies, is intensifying innovation and driving down costs for consumers.

Brazil Retail Banking Market Market Size (In Million)

However, the market faces certain challenges. Economic volatility in Brazil can impact consumer spending and credit demand, potentially slowing down market growth in certain periods. Stringent regulatory oversight and compliance requirements also add to operational costs for banks. Despite these constraints, the long-term outlook for the Brazilian retail banking market remains positive. The continued expansion of digital banking, coupled with increasing financial inclusion and the nation's economic potential, will likely propel further growth in the coming years. The market segmentation by product (transactional accounts, savings accounts, debit/credit cards, loans) and channel (direct sales, distributors) presents opportunities for tailored service offerings, allowing banks to capture specific market niches and maximize their revenue streams. The dominance of established banks is likely to continue, but the presence of fintechs will contribute to a dynamic and competitive landscape.

Brazil Retail Banking Market Company Market Share

Brazil Retail Banking Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Brazil retail banking market, covering the period from 2019 to 2033. It offers a comprehensive overview of market dynamics, competitive landscapes, and future growth prospects, providing invaluable insights for stakeholders seeking to understand and capitalize on this dynamic sector. With a focus on key players like Itaú Unibanco, Bradesco, and Banco do Brasil, this report dissects market trends, technological advancements, and regulatory changes, equipping you with the strategic knowledge needed to navigate this evolving market. The base year for this report is 2025, with forecasts extending to 2033.

Brazil Retail Banking Market Composition & Trends

This section evaluates the Brazilian retail banking market's structure, identifying key trends and influential factors. The market exhibits high concentration, with a few dominant players controlling a significant portion of the market share. Itaú Unibanco and Bradesco, for example, hold a combined market share of approximately xx%, reflecting a consolidated market structure. The analysis incorporates an examination of the competitive landscape, including:

- Market Share Distribution: Itaú Unibanco (xx%), Bradesco (xx%), Banco do Brasil (xx%), CAIXA (xx%), Santander Brasil (xx%), Banco Votorantim (xx%), Others (xx%).

- Innovation Catalysts: The increasing adoption of fintech solutions and open banking initiatives are driving innovation, leading to more personalized and efficient banking services.

- Regulatory Landscape: Government regulations significantly impact the market, particularly concerning consumer protection, data privacy, and financial inclusion. The Central Bank of Brazil's initiatives are key drivers of change.

- Substitute Products: The rise of digital payment platforms and alternative financial services presents challenges to traditional banking services. This necessitates innovation and diversification among market players.

- End-User Profiles: The report analyzes the diverse end-user segments, including individuals, small and medium-sized enterprises (SMEs), and large corporations. The demand for financial services varies across these groups.

- M&A Activities: While specific deal values are not publicly available for all transactions, the past few years have witnessed a number of M&A activities valuing at approximately xx Million in total, primarily focused on consolidating market share and expanding service offerings.

Brazil Retail Banking Market Industry Evolution

The Brazilian retail banking market has witnessed a period of significant transformation. From 2019 to 2024, the market experienced an average annual growth rate (AAGR) of approximately xx%, driven by factors including increasing financial inclusion, expanding digital adoption, and a growing middle class. Technological advancements, particularly in mobile banking and digital payments, have been key to this growth. The shift in consumer preferences towards digital channels is evident in the rising adoption of mobile banking apps and online banking services, with penetration rates reaching xx% by 2024. The anticipated growth trajectory for the forecast period (2025-2033) projects an AAGR of xx%, driven by continuing digitalization and government initiatives aimed at expanding financial inclusion. The market is poised for further consolidation, with larger banks likely to dominate while smaller players adapt and innovate to compete. The rising demand for personalized financial solutions and a focus on customer experience will also shape the industry's evolution.

Leading Regions, Countries, or Segments in Brazil Retail Banking Market

The Brazilian retail banking market is characterized by diverse regional variations. The Southeast region is the dominant market, accounting for approximately xx% of total revenue, due to factors including higher population density, higher income levels, and advanced infrastructure. The analysis distinguishes leading segments both by product and by channel:

By Product:

- Loans: This remains a dominant segment fueled by rising consumer demand for credit. Key drivers include government-backed lending schemes and the increasing availability of digital lending platforms.

- Transactional Accounts: The widespread adoption of digital banking has driven growth in this segment.

- Credit Cards: This sector is showing steady growth, driven by increasing consumer spending and the accessibility of digital credit card application processes.

By Channel:

- Digital Channels: The rapid growth of mobile banking and online banking services is transforming this sector, becoming the preferred channel for many customers. Key drivers include convenience, cost-effectiveness, and accessibility.

- Direct Sales: While facing challenges from digital channels, direct sales channels remain important for personalized financial advice and complex product offerings.

Brazil Retail Banking Market Product Innovations

Recent innovations in the Brazilian retail banking market focus on enhancing customer experience and improving operational efficiency. The introduction of advanced analytics and AI-driven solutions for risk management and fraud detection are prominent. Personalized financial advice leveraging big data analytics is increasingly commonplace. Furthermore, several banks have implemented advanced mobile banking applications with improved user interfaces, enhanced security features, and integrated financial management tools. This contributes to customer satisfaction and improves engagement.

Propelling Factors for Brazil Retail Banking Market Growth

Several key factors are driving the expansion of the Brazil retail banking market:

- Technological Advancements: The widespread adoption of digital technologies and the rise of fintech companies are leading to innovative solutions and improved customer experiences.

- Economic Growth: Continued economic expansion in Brazil, with growth anticipated at xx% in 2025, fuels increased demand for financial services.

- Government Initiatives: Government programs focused on financial inclusion, such as initiatives to expand access to credit and banking services for underserved populations, positively impact market growth.

Obstacles in the Brazil Retail Banking Market

Despite the positive outlook, the Brazilian retail banking market faces several challenges:

- Regulatory Scrutiny: Strict regulatory measures can impede innovation and increase compliance costs for banks.

- Economic Volatility: Economic instability and fluctuations in the Brazilian real can impact consumer spending and credit demand.

- Competitive Pressure: The entry of new fintech players intensifies competition, forcing established banks to innovate and adapt to maintain market share. The effect of this competition is a decrease in profit margins by approximately xx% from 2023 to 2024.

Future Opportunities in Brazil Retail Banking Market

The future of the Brazil retail banking market presents considerable opportunities:

- Expansion into Underserved Markets: Targeting unbanked and underbanked populations offers significant growth potential.

- Adoption of Open Banking: Leveraging open banking principles can create new revenue streams and enhance customer experiences.

- Growth of Fintech Partnerships: Collaborating with fintech companies to deliver innovative solutions can give banks a competitive edge.

Major Players in the Brazil Retail Banking Market Ecosystem

- CAIXA

- Banco do Brasil

- Banco Nacional de Desenvolvimento Econômico e Social (BNDES)

- Banco Votorantim

- Itaú Unibanco

- Bradesco

- Santander Brasil

Key Developments in Brazil Retail Banking Market Industry

- March 2022: Banco do Brasil reopened the CDC Anticipation IRPF with attractive interest rates, boosting consumer lending.

- March 2022: CAIXA inaugurated new facilities in Ariquemes (RO), expanding its service reach and social program operations.

- March 2022: Itaú Unibanco opened a specialized service center for corporate clients in São Paulo, enhancing its business banking offerings.

- May 2022: CAIXA inaugurated new units in Alenquer (PA) and Rio das Ostras (RJ), broadening its presence and service offerings.

Strategic Brazil Retail Banking Market Market Forecast

The Brazilian retail banking market is poised for sustained growth over the forecast period (2025-2033). The continued digitalization of banking services, government initiatives to promote financial inclusion, and a recovering economy will drive market expansion. This growth will be particularly evident in segments such as mobile banking and digital lending, as well as in the expansion of services to underserved populations. The market is predicted to reach approximately xx Million by 2033, presenting substantial opportunities for both established players and new entrants.

Brazil Retail Banking Market Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Channel

- 2.1. Direct Sales

- 2.2. Distributor

Brazil Retail Banking Market Segmentation By Geography

- 1. Brazil

Brazil Retail Banking Market Regional Market Share

Geographic Coverage of Brazil Retail Banking Market

Brazil Retail Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Digital Payments Are Driving a Profound Change in Brazil's Banking Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Direct Sales

- 5.2.2. Distributor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CAIXA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Banco do Brasil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banco Nacional de Desenvolvimento Econômico e Social (BNDES)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Banco Votorantim

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Itaú Unibanco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bradesco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Santander Brasil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 CAIXA

List of Figures

- Figure 1: Brazil Retail Banking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Retail Banking Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Retail Banking Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Brazil Retail Banking Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 3: Brazil Retail Banking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Retail Banking Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Brazil Retail Banking Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 6: Brazil Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Retail Banking Market?

The projected CAGR is approximately 10.70%.

2. Which companies are prominent players in the Brazil Retail Banking Market?

Key companies in the market include CAIXA , Banco do Brasil , Banco Nacional de Desenvolvimento Econômico e Social (BNDES) , Banco Votorantim, Itaú Unibanco , Bradesco , Santander Brasil .

3. What are the main segments of the Brazil Retail Banking Market?

The market segments include Product, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Digital Payments Are Driving a Profound Change in Brazil's Banking Sector.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

May 2022: CAIXA inaugurated a new unit in Rio das Ostras (RJ). Located at Rodovia Amaral Peixoto, 4170, Balneário Remanso Rio das Ostras -RJ, the unit will offer the entire portfolio of CAIXA products and services and operate the social programs of the federal government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Retail Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Retail Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Retail Banking Market?

To stay informed about further developments, trends, and reports in the Brazil Retail Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence