Key Insights

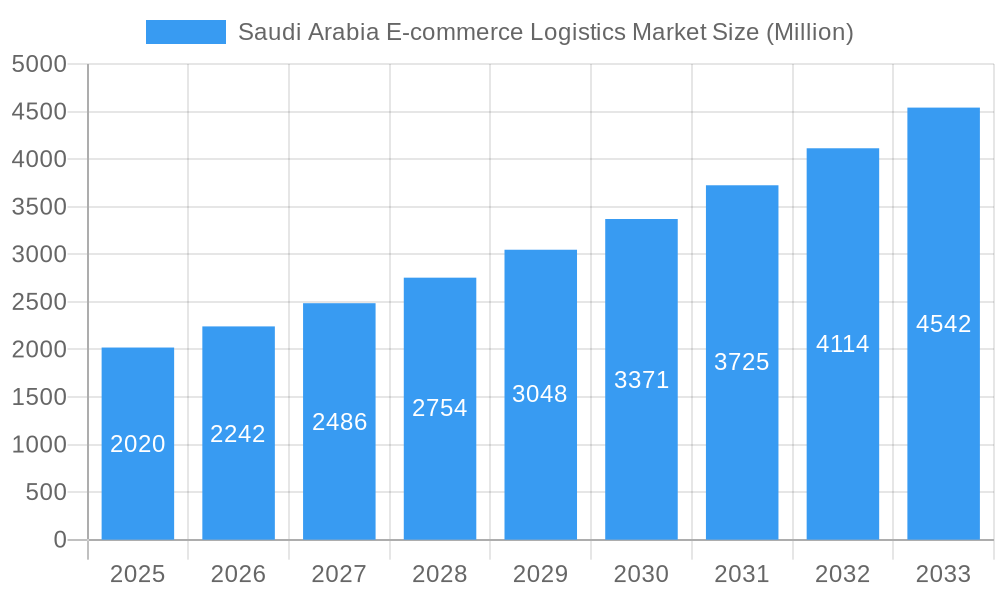

The Saudi Arabian e-commerce logistics market is experiencing robust growth, projected to reach \$2.02 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.94% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Saudi Arabia, driven by increasing internet and smartphone penetration, coupled with government initiatives promoting digital transformation and economic diversification (Vision 2030), are significantly boosting demand for efficient and reliable logistics solutions. Rising consumer spending power and a preference for online shopping across various product categories, including fashion and apparel, consumer electronics, and home appliances, further contribute to market growth. The market is segmented by service type (transportation, warehousing, inventory management, value-added services), business model (B2B and B2C), destination (domestic and international), and product type, reflecting the diverse needs of the e-commerce ecosystem. While challenges such as infrastructure limitations in certain regions and the need for advanced technological integration remain, the overall market outlook is positive, with significant opportunities for logistics providers to capitalize on the expanding e-commerce landscape.

Saudi Arabia E-commerce Logistics Market Market Size (In Billion)

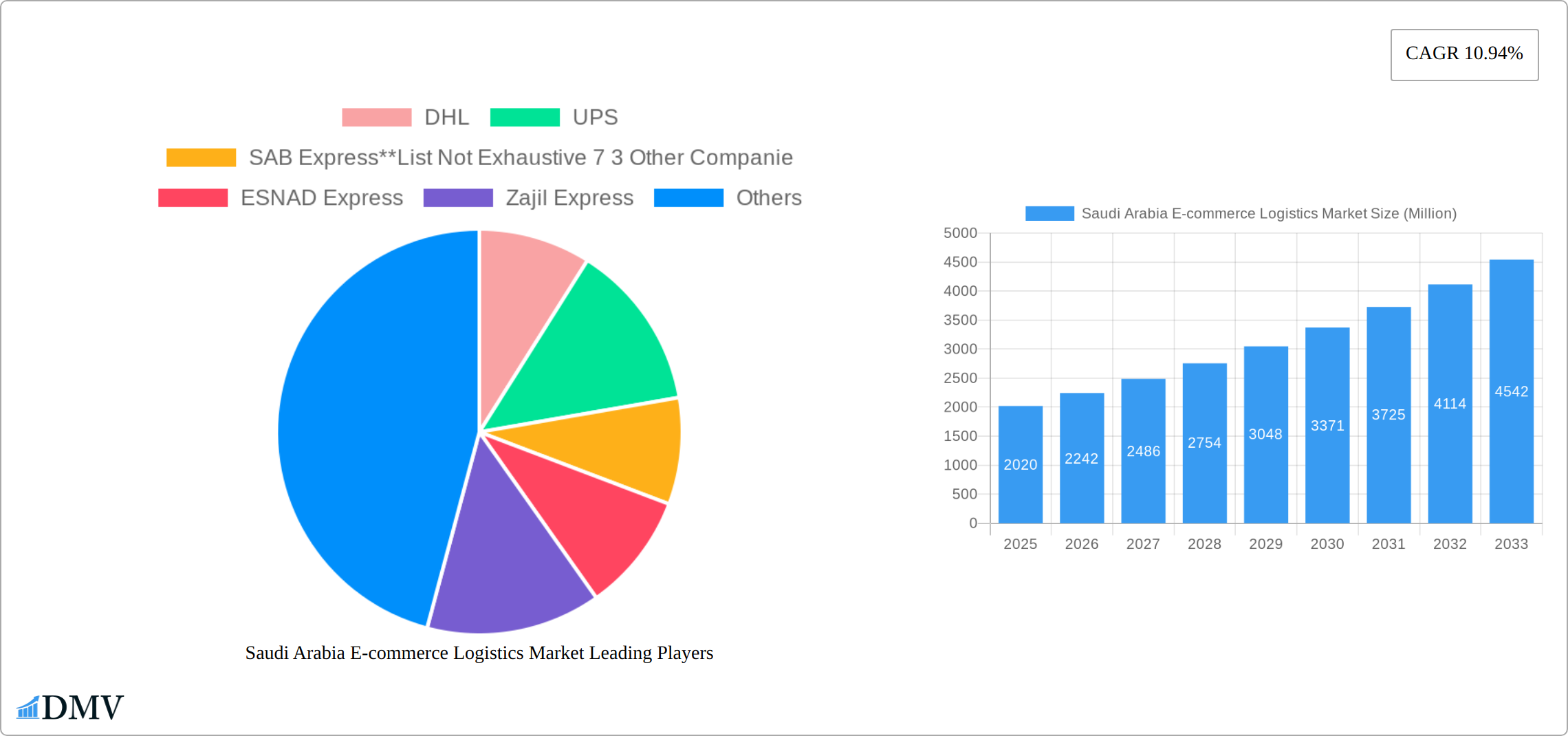

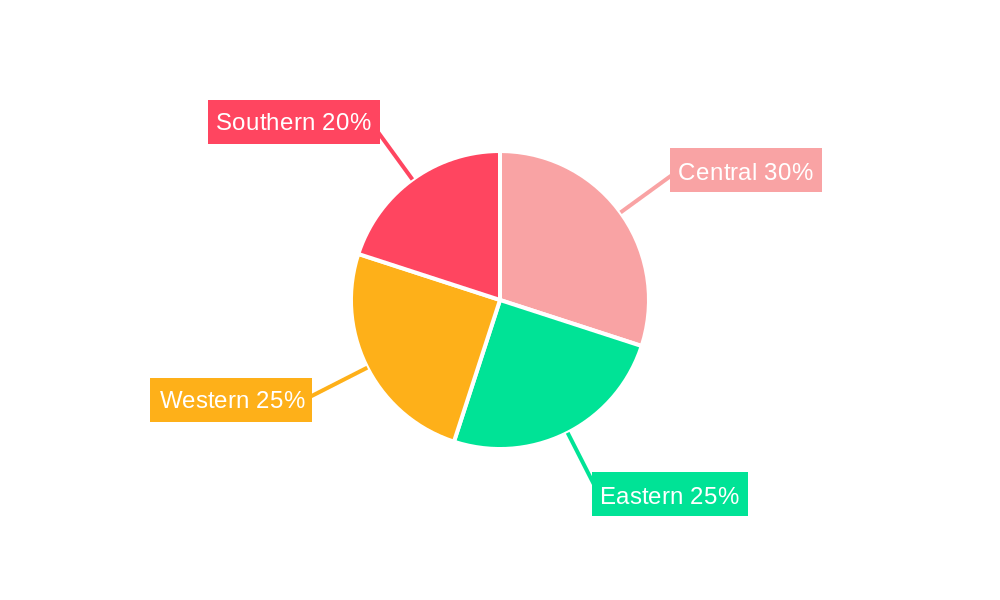

The competitive landscape is dynamic, with both international giants like DHL and UPS, and local players like SAB Express, ESNAD Express, and Zajil Express, vying for market share. The increasing adoption of technology, such as advanced tracking systems, automated warehousing, and data analytics, is transforming the industry. Logistics providers are focusing on enhancing efficiency, improving delivery times, and offering value-added services like customized packaging and labeling to cater to the evolving demands of e-commerce businesses and consumers. The regional distribution of the market, across Central, Eastern, Western, and Southern Saudi Arabia, presents both opportunities and challenges. Strategic investments in infrastructure and technological upgrades in less-developed regions are crucial for ensuring nationwide reach and optimizing logistics operations. Expansion into international e-commerce is likely to fuel further growth, as cross-border shipments become increasingly prevalent.

Saudi Arabia E-commerce Logistics Market Company Market Share

Saudi Arabia E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Saudi Arabia e-commerce logistics market, offering crucial insights for stakeholders across the supply chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, and future potential. Valued at xx Million in 2025, the market is poised for significant expansion, driven by factors like rising e-commerce adoption and government initiatives.

Saudi Arabia E-commerce Logistics Market Composition & Trends

This section evaluates the Saudi Arabia e-commerce logistics market's competitive landscape, highlighting market concentration, innovation, regulatory factors, and M&A activity. We analyze the market share distribution among key players, including DHL, UPS, SAB Express, ESNAD Express, Zajil Express, SMSA Express, Aramex, Ali Express, Alma Express, and Saudi Post, alongside 7-3 other companies. The report delves into the impact of regulatory changes on market dynamics and examines the role of substitute products and services. Furthermore, it profiles end-users across B2B and B2C segments and analyzes significant M&A deals, detailing their values and impact on market consolidation. The analysis includes a deep dive into the market's overall value, segmented by service type, business model, and product category. Market concentration is assessed, revealing the dominant players and their respective market shares. Innovative solutions, such as the adoption of biofuels and electric vehicles by Naqel Express, are examined.

- Market Share Distribution: A detailed breakdown of market share held by key players in 2025 (DHL: xx%, UPS: xx%, SAB Express: xx%, etc.).

- M&A Activity: Analysis of recent mergers and acquisitions, including deal values and their strategic implications for market consolidation. For example, the recent Aramco-DHL JV is analyzed in depth.

- Regulatory Landscape: Assessment of government regulations and their impact on market growth and competition.

- Innovation Catalysts: Examination of technological advancements driving efficiency and innovation within the logistics sector.

Saudi Arabia E-commerce Logistics Market Industry Evolution

The Saudi Arabia e-commerce logistics market has witnessed remarkable evolution from 2019 to 2024, driven by a confluence of potent factors that are poised to shape its trajectory through 2033. The burgeoning penetration of e-commerce, fueled by increasing internet accessibility and widespread smartphone adoption, has been a primary catalyst. This growth is further amplified by strong government backing for digital transformation initiatives, exemplified by Vision 2030's emphasis on a digital economy, and substantial investments in modernizing logistics infrastructure. Technological advancements are revolutionizing operational efficiency and cost-effectiveness. Automation in warehousing, the strategic application of Artificial Intelligence (AI) for route optimization and demand forecasting, and sophisticated data analytics for inventory management are becoming indispensable. Simultaneously, consumer expectations have escalated, demanding faster delivery times (same-day and next-day delivery becoming standard) and greater flexibility in delivery options, including click-and-collect and scheduled deliveries. These evolving consumer preferences are directly influencing the strategic development of logistics networks. Our analysis includes detailed compound annual growth rates (CAGR) for key segments, highlighting the dynamic nature of the market. The rise of specialized B2C fulfillment services and the widespread adoption of advanced Warehouse Management Systems (WMS) signify a maturing industry. Furthermore, the sector is increasingly embracing sustainability, with a growing focus on environmentally friendly transportation solutions, such as electric vehicles and optimized delivery routes, to reduce carbon footprints. Macroeconomic indicators like consistent GDP growth and a rising consumer disposable income continue to underpin the market's overall robust performance.

Leading Regions, Countries, or Segments in Saudi Arabia E-commerce Logistics Market

This section provides a comprehensive identification of the leading regions, countries, and distinct segments within the Saudi Arabia e-commerce logistics market. Our analysis is multifaceted, examining performance across key service types including Transportation (express delivery, last-mile delivery, freight forwarding), Warehousing (fulfillment centers, storage, cold chain logistics), Inventory Management, and Value-added Services (reverse logistics, packaging, customization). We delineate performance based on business models, differentiating between Business-to-Business (B2B) and Business-to-Consumer (B2C) operations, and by destination, categorizing into Domestic and International logistics. The product category breakdown further elucidates market dynamics, with a focus on Fashion and Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty and Personal Care, and a consolidation of Other Products. The dominance of each segment is rigorously analyzed through its revenue contribution, projected growth rates, and current market share.

- Key Drivers (by segment):

- Domestic Logistics: Primarily driven by the exponential growth of domestic e-commerce, enhanced by improving last-mile delivery networks and a rising preference for local online retailers.

- Transportation: Fueled by the demand for express and same-day delivery services, necessitated by evolving consumer expectations for speed and convenience, alongside the expansion of dedicated e-commerce logistics providers.

- B2C Fulfillment: Characterized by the increasing need for specialized fulfillment centers capable of handling high volumes of individual orders, with an emphasis on efficient picking, packing, and shipping processes.

- Fashion and Apparel: A leading segment driven by the high frequency of online purchases, the growing influence of social media on shopping trends, and the increasing adoption of fast fashion models.

- Consumer Electronics: Benefiting from increasing disposable incomes and the rapid pace of technological innovation, leading to frequent upgrades and online purchases of electronic gadgets.

- Dominance Factors: The dominance of specific regions, such as Riyadh, Jeddah, and Dammam, is intrinsically linked to their status as major economic hubs with robust existing infrastructure, high population density, and significant e-commerce adoption rates. Government support for logistics development in these key areas, including the establishment of smart logistics cities and improved transportation networks, further solidifies their leading positions. Regulatory policies that streamline import/export procedures and provide incentives for logistics investment also play a crucial role. Consumer preferences for readily available goods, coupled with the convenience of doorstep delivery, are paramount. The presence of a well-established retail landscape that is increasingly embracing omnichannel strategies also contributes to the dominance of these segments. Furthermore, the accessibility to major ports and airports in these regions facilitates efficient international trade, boosting the international logistics segment.

Saudi Arabia E-commerce Logistics Market Product Innovations

This section details the latest product innovations and technological advancements within the Saudi Arabia e-commerce logistics market. We examine new service offerings, software solutions, and technological integrations that enhance efficiency, transparency, and customer experience. This includes the use of advanced tracking systems, predictive analytics, and automated warehousing solutions. The focus is on identifying unique selling propositions and how these innovations deliver competitive advantages. The section highlights the increasing adoption of sustainable logistics practices, such as the utilization of electric vehicles and eco-friendly packaging materials, in response to growing environmental concerns.

Propelling Factors for Saudi Arabia E-commerce Logistics Market Growth

The Saudi Arabia e-commerce logistics market is propelled by a potent combination of factors. The accelerated growth of e-commerce, underpinned by a continuously increasing internet penetration rate and the ubiquitous use of smartphones, forms the bedrock of this expansion. Complementing this, proactive government initiatives are playing a pivotal role. Vision 2030's strategic focus on digital transformation, coupled with substantial investments in upgrading and expanding logistics infrastructure—including advanced road networks, dedicated logistics hubs, and efficient port facilities—is creating a fertile ground for growth. The widespread adoption of cutting-edge technologies such as AI for predictive analytics and route optimization, automation in warehousing for enhanced speed and accuracy, and sophisticated data analytics for streamlined inventory management are significantly boosting operational efficiency and reducing costs. Furthermore, a growing middle class with rising disposable incomes is a key driver, leading to increased consumer spending on online purchases across various categories. The increasing comfort and trust in online shopping among consumers, aided by secure payment gateways and improved return policies, further fuels this growth.

Obstacles in the Saudi Arabia E-commerce Logistics Market

Despite its robust growth, the Saudi Arabia e-commerce logistics market encounters several significant obstacles. A primary challenge remains the imperative for further infrastructure development, particularly in expanding the reach and efficiency of delivery networks to remote and less populated areas. This can lead to increased delivery times and costs in these regions. Regulatory complexities and bureaucratic hurdles can sometimes impede the smooth operation and expansion of logistics businesses, requiring navigation through intricate procedures. Intense competition from established local and international players, alongside the continuous emergence of new entrants, exerts considerable pressure on pricing and profit margins, necessitating strategic differentiation. Supply chain disruptions, stemming from geopolitical events, regional instability, or unforeseen circumstances such as natural disasters or global health crises, can significantly impact market stability, leading to delays and increased operational costs. The report attempts to quantify the impact of these obstacles where feasible, for instance, by estimating the potential percentage increase in delivery times due to underdeveloped infrastructure in specific geographical zones or the financial implications of supply chain disruptions on operational expenses.

Future Opportunities in Saudi Arabia E-commerce Logistics Market

The Saudi Arabia e-commerce logistics market presents numerous opportunities for future growth. The expansion of e-commerce into previously underserved regions offers potential for market penetration. The adoption of innovative technologies, including blockchain for enhanced security and transparency, and the development of more sustainable logistics solutions, will drive efficiency and differentiation. The growing demand for specialized logistics services, such as cold chain logistics for perishable goods, presents a niche market opportunity.

Key Developments in Saudi Arabia E-commerce Logistics Market Industry

- February 2024: Naqel Express's partnership with Red Sea Global, showcasing the adoption of sustainable transportation solutions and its impact on market dynamics.

- February 2024: Aramco and DHL's joint venture, ASMO, signifying a shift towards modern procurement and logistics services and increased foreign investment in the sector.

Strategic Saudi Arabia E-commerce Logistics Market Forecast

The Saudi Arabia e-commerce logistics market is projected to experience significant growth over the forecast period (2025-2033). This expansion will be driven by continued e-commerce adoption, government support, technological advancements, and the expansion of the middle class. The increasing focus on sustainability and the emergence of new logistics technologies will reshape the market landscape. The market's potential is substantial, particularly given the government's ongoing investments in infrastructure and digitalization.

Saudi Arabia E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing Inventory Management

- 1.3. Value-added Services (Labelling, Packaging)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furnniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys. Food Products)

Saudi Arabia E-commerce Logistics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-commerce Logistics Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Logistics Market

Saudi Arabia E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Poor Infrastructure and Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce Sales is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing Inventory Management

- 5.1.3. Value-added Services (Labelling, Packaging)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furnniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys. Food Products)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SAB Express**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ESNAD Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zajil Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SMSA Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aramex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ali Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alma Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Post

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Saudi Arabia E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Logistics Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Logistics Market?

Key companies in the market include DHL, UPS, SAB Express**List Not Exhaustive 7 3 Other Companie, ESNAD Express, Zajil Express, SMSA Express, Aramex, Ali Express, Alma Express, Saudi Post.

3. What are the main segments of the Saudi Arabia E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives.

6. What are the notable trends driving market growth?

Growth in e-Commerce Sales is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Poor Infrastructure and Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

February 2024: Naqel Express by SPL for Logistics Services announced a partnership with Red Sea Global. NAQEL Express, a fully owned subsidiary of Saudi Post Logistics, will operate all long-haul and local transportation services for The Red Sea and provide logistics equipment, labor, and supply chain technologies. As part of the partnership, Naqel Express will be using biofueled and electric vehicles. This aligns with RSG’s smart and sustainable mobility strategy, which prioritizes the use of hydrogen, electric, and biofueled vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence