Key Insights

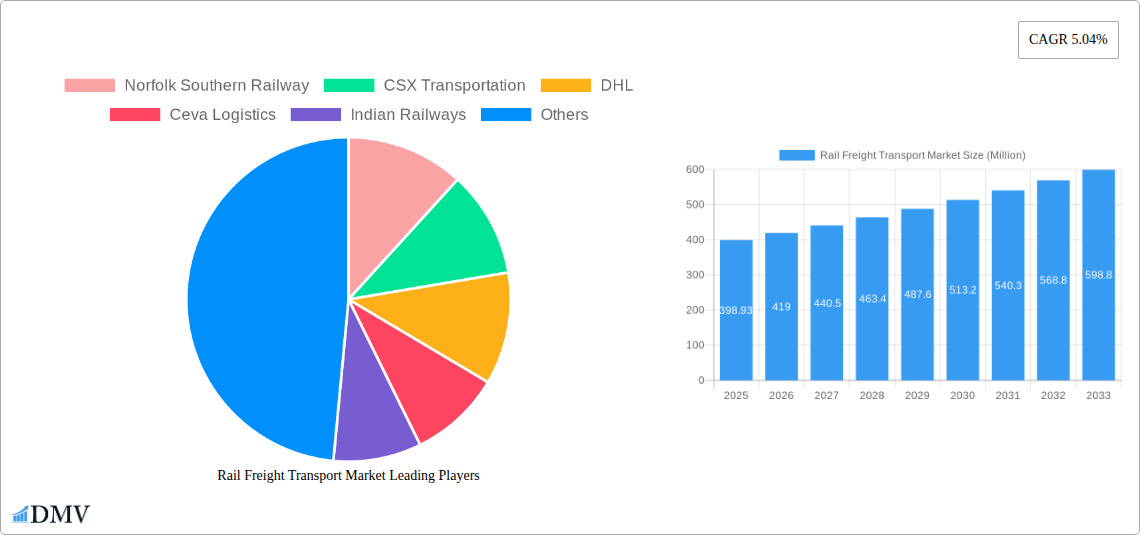

The global rail freight transport market, valued at $398.93 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.04% from 2025 to 2033. This expansion is fueled by several key factors. Increasing global trade and e-commerce necessitate efficient and cost-effective long-haul transportation solutions, making rail freight a competitive alternative to road transport, especially for bulk commodities and intermodal shipments. Furthermore, government initiatives promoting sustainable transportation, coupled with investments in rail infrastructure upgrades and modernization across various regions, are significantly boosting market growth. The rising demand for faster and more reliable delivery times, particularly in sectors like manufacturing and logistics, is further driving the adoption of rail freight. However, challenges such as fluctuating fuel prices, competition from other modes of transport, and potential infrastructure limitations in certain regions could act as restraints.

The market segmentation reveals diverse opportunities. Containerized cargo, due to its efficiency and scalability, commands a significant share, followed by bulk liquid and non-containerized segments. Geographically, North America and Europe currently hold substantial market share, driven by well-established rail networks and strong industrial bases. However, the Asia-Pacific region, particularly India and China, is poised for rapid growth, fueled by infrastructure development and expanding economies. The competitive landscape is characterized by a mix of large multinational corporations like Union Pacific Railroad, Canadian Pacific Railway, and DHL, alongside regional players. These companies are constantly striving to enhance their services, adopt advanced technologies like IoT and AI for optimized operations, and expand their network coverage to maintain a competitive edge in this growing market. The next decade will witness intensified competition and strategic partnerships aimed at consolidating market share and leveraging emerging opportunities within the rail freight sector.

Rail Freight Transport Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the global Rail Freight Transport Market, offering valuable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, technological advancements, and future growth projections. The report is meticulously researched, using both historical data (2019-2024) and forecasting models (2025-2033) to provide a robust and reliable assessment of the market's trajectory. Expect detailed analysis of key segments, leading players, and emerging trends shaping the future of rail freight transportation. The market size is estimated at XXX Million in 2025 and is projected to reach XXX Million by 2033, exhibiting a CAGR of XX%.

Rail Freight Transport Market Market Composition & Trends

This section provides a detailed analysis of the Rail Freight Transport market's current state, focusing on market concentration, innovation, regulatory factors, substitution effects, end-user profiles, and merger and acquisition (M&A) activity. We analyze market share distribution among key players, identifying the dominant forces and emerging competitors. The report also examines the influence of regulatory frameworks on market growth and the impact of substitute modes of transportation. M&A activity is assessed by analyzing deal values and their influence on market consolidation.

- Market Concentration: The market is characterized by a combination of large, established players and smaller, specialized firms. Market share is concentrated among a few major players, but the presence of numerous smaller companies creates a competitive landscape.

- Innovation Catalysts: Technological advancements, such as autonomous train technology and improved logistics software, are driving significant innovation. Increased efficiency and reduced operational costs are key drivers of innovation.

- Regulatory Landscape: Government regulations regarding safety, emissions, and infrastructure development significantly influence market dynamics. Changes in regulatory frameworks can either stimulate or hinder market growth.

- Substitute Products: Road and maritime transport are the primary substitutes. The report examines their competitive advantages and disadvantages relative to rail freight.

- End-User Profiles: The report segments end-users based on industry, highlighting the specific needs and preferences of each segment. Key end-user sectors include manufacturing, agriculture, and retail.

- M&A Activities: The report analyzes recent M&A activities, including deal values (e.g., Union Pacific's USD 1 Billion deal with Wabtec in January 2023), and their impact on market structure and competition. Total M&A deal value in the last 5 years is estimated at XXX Million.

Rail Freight Transport Market Industry Evolution

This section traces the evolution of the rail freight transport market, exploring its growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2033. Growth rates, adoption metrics, and key milestones are highlighted. This analysis emphasizes the shifts in transportation preferences and how technological innovations have addressed these changes, providing an in-depth understanding of the industry's transformation. The growing emphasis on sustainability and efficiency are analyzed, along with their impact on the adoption of new technologies and the overall market growth. The increasing demand for efficient and reliable transportation solutions in a globalized economy fuels market expansion.

Leading Regions, Countries, or Segments in Rail Freight Transport Market

This section pinpoints the dominant regions, countries, or segments within the Rail Freight Transport Market across service type, cargo type, and destination. Key drivers for dominance, such as investment trends and regulatory support, are identified. In-depth analysis illuminates the factors contributing to the leading positions.

By Service Type:

- Transportation: This segment holds the largest market share due to the fundamental role of freight transportation in global supply chains.

- Services Allied to Transportation: This segment is witnessing significant growth due to increasing focus on optimizing logistics and infrastructure maintenance.

By Type of Cargo:

- Containerized (Includes Intermodal): This segment benefits from standardized handling and efficient intermodal transfers.

- Non-containerized: This segment includes bulk commodities requiring specialized handling and transportation.

- Liquid Bulk: This segment demands specialized infrastructure and handling procedures.

By Destination:

- Domestic: Domestic freight transport constitutes a major portion of the market.

- International: International rail freight is growing with expanding global trade.

Key Drivers: Increased government investment in rail infrastructure, favorable regulatory policies promoting rail transport, and growing demand for efficient and sustainable logistics solutions are major contributors to the dominance of specific segments and regions.

Rail Freight Transport Market Product Innovations

Recent product innovations in the rail freight sector focus on enhanced efficiency, safety, and sustainability. This includes the development of advanced train control systems, improved locomotive designs, and the integration of digital technologies for real-time monitoring and optimization. These innovations deliver improved fuel efficiency, reduced emissions, and increased operational reliability. The unique selling propositions (USPs) of these products center around their ability to deliver significant cost savings, enhanced safety features, and reduced environmental impact.

Propelling Factors for Rail Freight Transport Market Growth

Several factors drive the growth of the Rail Freight Transport Market. Technological advancements, like automation and digitization, are improving efficiency and reducing operational costs. Economic factors, including growing global trade and rising demand for efficient logistics, are boosting market growth. Supportive regulatory frameworks further incentivize the adoption of rail freight. For example, government investments in rail infrastructure and incentives for using eco-friendly transportation modes are contributing to market expansion.

Obstacles in the Rail Freight Transport Market Market

Challenges faced by the Rail Freight Transport market include regulatory hurdles related to infrastructure development and cross-border transport. Supply chain disruptions, particularly those related to infrastructure bottlenecks and labor shortages, impact operational efficiency. Intense competition from other transportation modes, such as road and sea freight, presents a significant challenge.

Future Opportunities in Rail Freight Transport Market

Future opportunities exist in expanding into new markets, particularly in developing economies with growing infrastructure needs. Technological advancements, such as high-speed rail and autonomous train technology, offer significant potential for market growth. Emerging consumer trends toward sustainability are also driving demand for more eco-friendly freight solutions.

Major Players in the Rail Freight Transport Market Ecosystem

- Norfolk Southern Railway

- CSX Transportation

- DHL

- Ceva Logistics

- Indian Railways

- Canadian Pacific Railway

- United Parcel Service (UPS)

- Union Pacific Railroad

- Japan Freight Railway Company (JR Freight)

- Canadian National Railway

- Pacific National

- SCT Logistics

- Qube Holdings Ltd

- Hector Rail

- Kerry Logistics

- Colas Rail

- Network Rail

- DSV

- P&O Ferrymasters

- Kuehne + Nagel

- Harsco Rail

- Railtech Infraventure Pvt Ltd

- NARSTCO Rail Maintenance Services

- Patriot Rail Company LLC

- WSP

- Amalgamated Construction (AMCO) Ltd

- Keewatin Railway Company and A & B Rai

- BNSF Railway

- DB Cargo

- Geneese & Wyoming Inc

- SNCF

- Russian Railways (RZD)

- Swiss Federal Railways

Key Developments in Rail Freight Transport Market Industry

- May 2023: Etihad Rail and DHL Global Forwarding sign a 20-year partnership to establish a joint venture for freight transport within the UAE, leveraging the national rail network. This signifies a significant shift towards rail freight as a major mode of transport in the region.

- January 2023: Union Pacific Railroad signs a USD 1 Billion (EUR 986.4 Million) deal with Wabtec to modernize its locomotive fleet, enhancing reliability and haulage capacity by over 80% and 55%, respectively. This reflects the industry's focus on technological upgrades to improve efficiency and operational capabilities.

Strategic Rail Freight Transport Market Market Forecast

The Rail Freight Transport Market is poised for continued growth, driven by increasing demand for efficient and sustainable logistics solutions, technological advancements, and supportive government policies. The market's future is bright, with significant potential for expansion in both established and emerging markets. Continued investments in infrastructure and the adoption of innovative technologies will further fuel market expansion. The forecast period shows a positive outlook, with steady growth projected throughout 2025-2033.

Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service Type

- 3.1. Transportation

- 3.2. Services

Rail Freight Transport Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Gulf Cooperation Council

- 5. Other Countries

Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency and Environmental Sustainability; Infrastructure Development; Rising Consumer Demand

- 3.3. Market Restrains

- 3.3.1. High Fragmentation of the Logistics Industry; Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Increase in International transportation through Rail Freight

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.4.5. Other Countries

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. North America Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6.1.1. Containerized (Includes Intermodal)

- 6.1.2. Non-containerized

- 6.1.3. Liquid Bulk

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Service Type

- 6.3.1. Transportation

- 6.3.2. Services

- 6.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 7. Europe Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 7.1.1. Containerized (Includes Intermodal)

- 7.1.2. Non-containerized

- 7.1.3. Liquid Bulk

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Service Type

- 7.3.1. Transportation

- 7.3.2. Services

- 7.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 8. Asia Pacific Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 8.1.1. Containerized (Includes Intermodal)

- 8.1.2. Non-containerized

- 8.1.3. Liquid Bulk

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Service Type

- 8.3.1. Transportation

- 8.3.2. Services

- 8.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 9. Rest of the World Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 9.1.1. Containerized (Includes Intermodal)

- 9.1.2. Non-containerized

- 9.1.3. Liquid Bulk

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Service Type

- 9.3.1. Transportation

- 9.3.2. Services

- 9.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 10. Other Countries Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 10.1.1. Containerized (Includes Intermodal)

- 10.1.2. Non-containerized

- 10.1.3. Liquid Bulk

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Service Type

- 10.3.1. Transportation

- 10.3.2. Services

- 10.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 11. North America Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Rest of Europe

- 13. Asia Pacific Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Australia

- 13.1.4 Japan

- 13.1.5 Rest of Asia Pacific

- 14. Rest of the World Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 South Africa

- 14.1.3 Gulf Cooperation Council

- 15. Other Countries Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Norfolk Southern Railway

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 CSX Transportation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 DHL

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Ceva Logistics

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Indian Railways

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Canadian Pacific Railway

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 United Parcel Service (UPS)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Union Pacific Railroad

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Japan Freight Railway Company (JR Freight)**List Not Exhaustive 7 3 Other Players in the Market

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Canadian National Railway

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Pacific National SCT Logistics Qube Holdings Ltd Hector Rail Kerry Logistics Colas Rail Network Rail Ceva Logistics DSV P&O Ferrymasters Kuehne + Nagel Harsco Rail Railtech Infraventure Pvt Ltd NARSTCO Rail Maintenance Services Patriot Rail Company LLC WSP Amalgamated Construction (AMCO) Ltd Keewatin Railway Company and A & B Rai

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 BNSF Railway

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 DB Cargo

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Geneese & Wyoming Inc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 SNCF

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Russian Railways (RZD)

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Swiss Federal Railways

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.1 Norfolk Southern Railway

List of Figures

- Figure 1: Global Rail Freight Transport Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Other Countries Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Other Countries Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Rail Freight Transport Market Revenue (Million), by Type of Cargo 2024 & 2032

- Figure 13: North America Rail Freight Transport Market Revenue Share (%), by Type of Cargo 2024 & 2032

- Figure 14: North America Rail Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 15: North America Rail Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 16: North America Rail Freight Transport Market Revenue (Million), by Service Type 2024 & 2032

- Figure 17: North America Rail Freight Transport Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: North America Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Rail Freight Transport Market Revenue (Million), by Type of Cargo 2024 & 2032

- Figure 21: Europe Rail Freight Transport Market Revenue Share (%), by Type of Cargo 2024 & 2032

- Figure 22: Europe Rail Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 23: Europe Rail Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 24: Europe Rail Freight Transport Market Revenue (Million), by Service Type 2024 & 2032

- Figure 25: Europe Rail Freight Transport Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: Europe Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Rail Freight Transport Market Revenue (Million), by Type of Cargo 2024 & 2032

- Figure 29: Asia Pacific Rail Freight Transport Market Revenue Share (%), by Type of Cargo 2024 & 2032

- Figure 30: Asia Pacific Rail Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: Asia Pacific Rail Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: Asia Pacific Rail Freight Transport Market Revenue (Million), by Service Type 2024 & 2032

- Figure 33: Asia Pacific Rail Freight Transport Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 34: Asia Pacific Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Rest of the World Rail Freight Transport Market Revenue (Million), by Type of Cargo 2024 & 2032

- Figure 37: Rest of the World Rail Freight Transport Market Revenue Share (%), by Type of Cargo 2024 & 2032

- Figure 38: Rest of the World Rail Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 39: Rest of the World Rail Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 40: Rest of the World Rail Freight Transport Market Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Rest of the World Rail Freight Transport Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Rest of the World Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Rest of the World Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Other Countries Rail Freight Transport Market Revenue (Million), by Type of Cargo 2024 & 2032

- Figure 45: Other Countries Rail Freight Transport Market Revenue Share (%), by Type of Cargo 2024 & 2032

- Figure 46: Other Countries Rail Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 47: Other Countries Rail Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 48: Other Countries Rail Freight Transport Market Revenue (Million), by Service Type 2024 & 2032

- Figure 49: Other Countries Rail Freight Transport Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 50: Other Countries Rail Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Other Countries Rail Freight Transport Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 3: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 5: Global Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Africa Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Gulf Cooperation Council Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 28: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 29: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 30: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Mexico Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 35: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 36: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 37: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 43: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 44: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 45: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: India Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: China Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 52: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 53: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 54: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Brazil Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Africa Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Gulf Cooperation Council Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 59: Global Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 60: Global Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 61: Global Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Freight Transport Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Rail Freight Transport Market?

Key companies in the market include Norfolk Southern Railway, CSX Transportation, DHL, Ceva Logistics, Indian Railways, Canadian Pacific Railway, United Parcel Service (UPS), Union Pacific Railroad, Japan Freight Railway Company (JR Freight)**List Not Exhaustive 7 3 Other Players in the Market, Canadian National Railway, Pacific National SCT Logistics Qube Holdings Ltd Hector Rail Kerry Logistics Colas Rail Network Rail Ceva Logistics DSV P&O Ferrymasters Kuehne + Nagel Harsco Rail Railtech Infraventure Pvt Ltd NARSTCO Rail Maintenance Services Patriot Rail Company LLC WSP Amalgamated Construction (AMCO) Ltd Keewatin Railway Company and A & B Rai, BNSF Railway, DB Cargo, Geneese & Wyoming Inc, SNCF, Russian Railways (RZD), Swiss Federal Railways.

3. What are the main segments of the Rail Freight Transport Market?

The market segments include Type of Cargo, Destination, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency and Environmental Sustainability; Infrastructure Development; Rising Consumer Demand.

6. What are the notable trends driving market growth?

Increase in International transportation through Rail Freight.

7. Are there any restraints impacting market growth?

High Fragmentation of the Logistics Industry; Data Security Concerns.

8. Can you provide examples of recent developments in the market?

May 2023: Etihad Rail, developer and operator of the UAE National Rail Network, has signed a 20-year partnership agreement with DHL Global Forwarding to set up a joint venture as part of the country's efforts to strengthen its freighter network. As part of the agreement, DHL will adopt rail as one of its major modes of transport to distribute goods throughout the UAE via the railway network, which connects the country's key industrial centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence