Key Insights

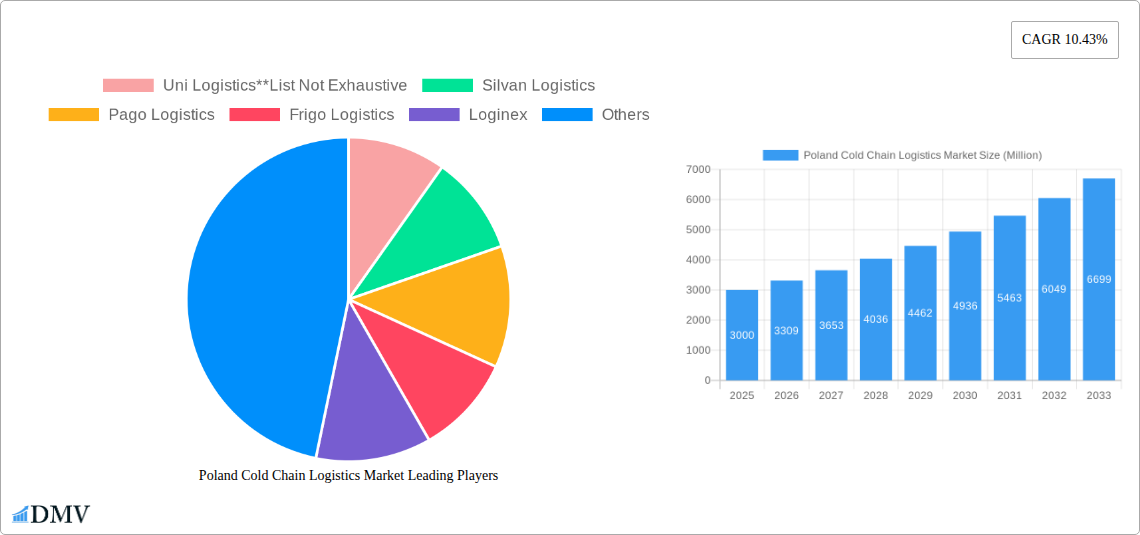

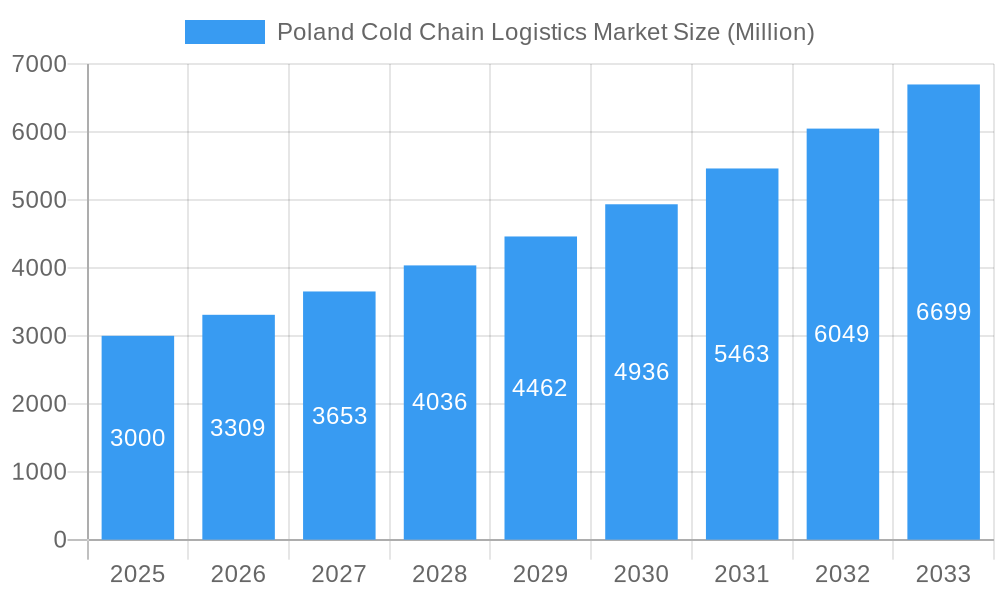

The Polish cold chain logistics market, valued at €3.0 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.43% from 2025 to 2033. This significant expansion is driven by several key factors. The increasing demand for fresh produce, dairy products, and processed foods, fueled by evolving consumer preferences for healthier diets and readily available convenience items, is a primary catalyst. Furthermore, the growth of e-commerce, particularly in grocery delivery services, necessitates efficient and reliable cold chain solutions to maintain product quality and prevent spoilage. Stringent regulations regarding food safety and hygiene are also pushing companies to invest in advanced cold chain technologies and logistics management systems, contributing to market growth. The market is segmented by service (storage, transportation, value-added services like blast freezing and inventory management), temperature (chilled, frozen, ambient), and end-user (horticulture, dairy, meat, fish, poultry, processed foods, pharmaceuticals, life sciences, and chemicals). The presence of established players like Uni Logistics, Silvan Logistics, and Pago Logistics, alongside emerging companies, indicates a competitive yet dynamic market landscape. The focus on sustainable and technologically advanced solutions, including temperature-controlled containers and real-time tracking systems, will further shape market dynamics in the coming years.

Poland Cold Chain Logistics Market Market Size (In Billion)

The Polish cold chain logistics market's growth trajectory is further influenced by Poland's strategic location within the European Union, facilitating efficient cross-border transportation and trade. However, challenges remain. Infrastructure limitations, particularly in rural areas, and the need for skilled labor pose potential restraints on the market's full potential. Investment in infrastructure upgrades and workforce training programs are crucial for sustained growth. The increasing adoption of automation and data analytics in cold chain management, including the use of IoT sensors for real-time monitoring and predictive maintenance, will play a crucial role in optimizing efficiency and reducing costs. This focus on technological advancements, combined with growing consumer demand and regulatory pressures, points to a promising future for the Polish cold chain logistics market.

Poland Cold Chain Logistics Market Company Market Share

Poland Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Poland cold chain logistics market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this study unveils crucial market dynamics for stakeholders across the cold chain ecosystem. The report's meticulous research encompasses market sizing, segmentation, competitive landscape, and emerging trends, providing actionable intelligence for informed decision-making. The market is expected to reach xx Million USD by 2033, showcasing substantial growth potential.

Poland Cold Chain Logistics Market Composition & Trends

This section delves into the intricate structure of the Polish cold chain logistics market, examining market concentration, innovation, regulatory frameworks, and competitive dynamics. We analyze the market share distribution among key players, revealing the competitive intensity. The report also investigates the impact of mergers and acquisitions (M&A) activities, providing a quantified assessment of deal values (xx Million USD in the last 5 years). Furthermore, the influence of substitute products, evolving end-user preferences, and the overall regulatory landscape on market growth are thoroughly explored.

- Market Concentration: A detailed analysis of the market share held by top players, revealing the level of market fragmentation. (e.g., Top 5 players hold xx% of the market).

- Innovation Catalysts: Examination of technological advancements driving efficiency and cost reduction within the cold chain, including automation and IoT integration.

- Regulatory Landscape: Assessment of the impact of EU and national regulations on cold chain operations, highlighting compliance challenges and opportunities.

- Substitute Products: Analysis of alternative solutions impacting the market and their competitive implications.

- End-User Profiles: Detailed profiles of key end-users across various sectors, including their specific cold chain logistics requirements.

- M&A Activity: Analysis of recent M&A deals, detailing transaction values and their strategic implications for market consolidation.

Poland Cold Chain Logistics Market Industry Evolution

This in-depth analysis charts the evolution of the Poland cold chain logistics market, meticulously tracing its growth trajectory from 2019 to 2033. We examine the interplay of various factors influencing market expansion, including technological advancements, shifting consumer preferences, and evolving economic conditions. The report provides specific data points, such as compound annual growth rates (CAGR) for different segments and adoption rates of new technologies. We explore the impact of factors like increased demand for perishable goods, rising consumer awareness of food safety, and government initiatives promoting infrastructure development within the cold chain sector. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Poland Cold Chain Logistics Market

This section identifies the leading regions, countries, and segments within the Polish cold chain logistics market. We analyze the dominance factors driving growth in specific areas. The analysis encompasses all segments: by service (storage, transportation, value-added services), by temperature (chilled, frozen, ambient), and by end-user (horticulture, dairy, meat, fish, poultry, processed food, pharma, life sciences, chemicals, and others).

Key Drivers:

- Storage: High demand for temperature-controlled warehousing due to increased import/export of perishable goods.

- Transportation: Growth in refrigerated trucking and rail transport driven by expanding e-commerce and rising food consumption.

- Value-Added Services: Increasing demand for specialized services such as blast freezing, labeling, and inventory management driven by the need for enhanced product quality and supply chain efficiency.

- Chilled: Significant growth in the chilled segment due to rising demand for fresh produce and dairy products.

- Frozen: Expanding frozen segment fueled by increasing consumption of frozen foods and the need for long-term storage.

- Horticulture: Growth driven by the increasing demand for fresh fruits and vegetables.

- Dairy Products: High demand for efficient cold chain solutions due to the perishable nature of dairy products.

- Pharma & Life Sciences: Stringent regulatory requirements and sensitivity of pharmaceuticals fuel growth in this sector.

Dominance Factors: Detailed analysis explaining the factors contributing to the leadership of specific regions, segments, and end-users within the Polish cold chain logistics market. This will include factors such as infrastructure development, government policies, and economic activity.

Poland Cold Chain Logistics Market Product Innovations

This section highlights recent product innovations within the Polish cold chain logistics market. We analyze the applications of these innovations, focusing on their performance metrics, unique selling propositions, and technological advancements contributing to increased efficiency and cost-effectiveness. The emphasis will be placed on technologies such as temperature monitoring systems, automated guided vehicles (AGVs), and blockchain solutions for enhancing traceability and transparency.

Propelling Factors for Poland Cold Chain Logistics Market Growth

Several factors are driving the growth of the Poland cold chain logistics market. Technological advancements, such as IoT-enabled monitoring and automation, improve efficiency and reduce losses. Economic factors, including rising disposable incomes and increased consumption of perishable goods, also contribute significantly. Supportive government regulations and investments in cold chain infrastructure further stimulate market growth. The expansion of e-commerce and online grocery delivery further fuels demand for efficient cold chain solutions.

Obstacles in the Poland Cold Chain Logistics Market

Despite significant growth potential, the Polish cold chain logistics market faces challenges. Regulatory hurdles and inconsistent implementation of food safety standards can increase operational costs. Supply chain disruptions due to geopolitical events or unexpected weather patterns can lead to significant losses. Intense competition among existing players and the emergence of new entrants create pressure on pricing and profitability. These factors can collectively impact the overall growth trajectory of the market.

Future Opportunities in Poland Cold Chain Logistics Market

The Polish cold chain logistics market presents numerous opportunities. Expanding e-commerce and online grocery delivery create demand for last-mile delivery solutions. The growing demand for high-quality, value-added services will open avenues for specialized cold chain providers. Adoption of advanced technologies like AI and blockchain offers potential for enhanced efficiency and transparency. Government initiatives promoting sustainable cold chain practices also pave the way for growth opportunities for environmentally conscious businesses.

Major Players in the Poland Cold Chain Logistics Market Ecosystem

- Uni Logistics

- Silvan Logistics

- Pago Logistics

- Frigo Logistics

- Loginex

- Chenczke Group

- Eco Containers

- Mandersloot

- Green Yard

- New Cold Logistics

Key Developments in Poland Cold Chain Logistics Market Industry

- June 2023: NewCold announces the construction of a new EUR 112 million (USD 120.22 million) temperature-controlled warehouse in Nowy Modlin, near Warsaw. This significant investment reflects growing demand and signifies market expansion.

- February 2023: Maersk introduces "Container Protect Essential," enhancing protection for shipments imported from Poland, Austria, and Switzerland, improving cold chain reliability and security.

Strategic Poland Cold Chain Logistics Market Forecast

The Poland cold chain logistics market is poised for continued growth, driven by a confluence of factors. Expanding e-commerce, rising disposable incomes, and increased focus on food safety all contribute to a positive outlook. Investments in infrastructure, technological advancements, and supportive government policies further bolster the market's future potential. This creates a favorable environment for both established players and new entrants to thrive and capture significant market share in the coming years.

Poland Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Poland Cold Chain Logistics Market Segmentation By Geography

- 1. Poland

Poland Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Poland Cold Chain Logistics Market

Poland Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Poland’s Foreign Trade in Agri-Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Uni Logistics**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Silvan Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pago Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Frigo Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Loginex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chenczke Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Containers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mandersloot

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Green Yard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Cold Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Uni Logistics**List Not Exhaustive

List of Figures

- Figure 1: Poland Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Poland Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Poland Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Poland Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Poland Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Poland Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Poland Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Logistics Market?

The projected CAGR is approximately 10.43%.

2. Which companies are prominent players in the Poland Cold Chain Logistics Market?

Key companies in the market include Uni Logistics**List Not Exhaustive, Silvan Logistics, Pago Logistics, Frigo Logistics, Loginex, Chenczke Group, Eco Containers, Mandersloot, Green Yard, New Cold Logistics.

3. What are the main segments of the Poland Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.00 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Poland’s Foreign Trade in Agri-Food Products.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

June 2023: NewCold has announced the construction of a new EUR 112 million (USD 120.22 million) temperature-controlled warehouse in the city of Nowy Modlin, close to Warsaw, Poland, which will be the second NewCold facility in Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence