Key Insights

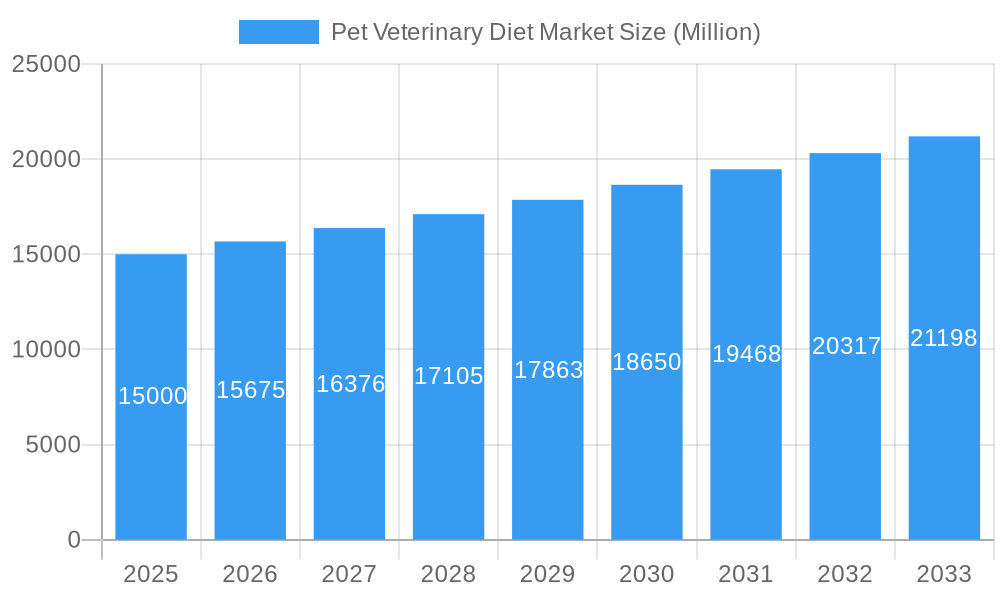

The global pet veterinary diet market is experiencing robust growth, driven by increasing pet ownership, rising pet humanization trends, and a growing awareness of preventative healthcare among pet owners. The market's compound annual growth rate (CAGR) of 4.50% from 2019 to 2024 indicates a significant expansion, projected to continue through 2033. Key segments contributing to this growth include diets addressing specific health conditions like diabetes, digestive sensitivities, and renal issues. The increasing prevalence of chronic diseases in pets, coupled with advancements in veterinary nutrition, fuels demand for specialized pet foods. Cats and dogs remain the dominant pet segments, although the "other pets" category is experiencing growth driven by increasing exotic pet ownership. Distribution channels are diversifying, with online sales gaining traction alongside traditional retail outlets such as supermarkets and specialty pet stores. Major players like Nestle Purina, Mars Incorporated, and Hill's Pet Nutrition are driving innovation and market competition, leading to product diversification and improved quality. The market faces challenges such as fluctuating raw material prices and regulatory hurdles, but the long-term outlook remains positive.

Pet Veterinary Diet Market Market Size (In Billion)

The market is segmented by pet type (cats, dogs, others), sub-product (diabetes, digestive sensitivity, oral care, renal, urinary tract, other), and distribution channel (convenience stores, online, specialty stores, supermarkets/hypermarkets, others). The rising prevalence of obesity and related health problems in pets is a key driver, particularly in developed nations. Growing consumer disposable incomes and willingness to spend on premium pet products contribute significantly to the market's expansion. Future growth will likely be influenced by the development of personalized nutrition solutions tailored to individual pet needs, as well as increased focus on sustainable and ethically sourced ingredients. The competitive landscape is characterized by a mix of large multinational corporations and smaller specialized companies, leading to continuous innovation and competitive pricing strategies.

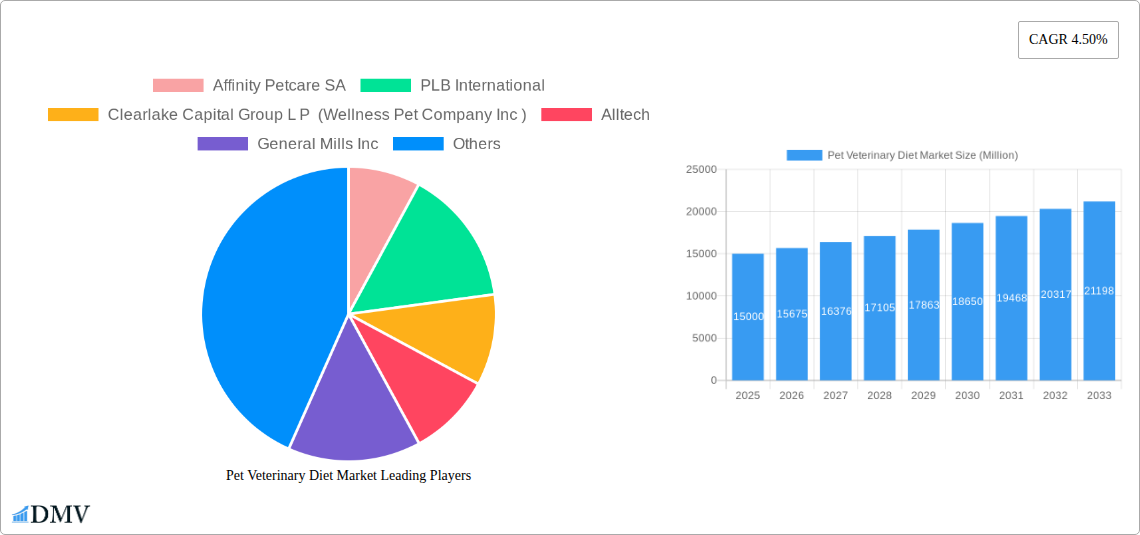

Pet Veterinary Diet Market Company Market Share

Pet Veterinary Diet Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the global Pet Veterinary Diet Market, offering crucial insights for stakeholders seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by sub-product (Diabetes, Digestive Sensitivity, Oral Care Diets, Renal, Urinary tract disease, Other Veterinary Diets), pet type (Cats, Dogs, Other Pets), and distribution channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players analyzed include Affinity Petcare SA, PLB International, Clearlake Capital Group L P (Wellness Pet Company Inc), Alltech, General Mills Inc, Mars Incorporated, Nestle (Purina), Colgate-Palmolive Company (Hill's Pet Nutrition Inc), Schell & Kampeter Inc (Diamond Pet Foods), and Heristo Aktiengesellschaft.

Pet Veterinary Diet Market Composition & Trends

The Pet Veterinary Diet market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market also exhibits a high degree of innovation, driven by advancements in pet nutrition science and increasing consumer demand for specialized diets catering to specific health needs. The regulatory landscape, while generally supportive of animal welfare, varies across different regions, influencing product development and marketing strategies. Substitute products, such as home-cooked meals, pose a challenge, although the convenience and proven efficacy of veterinary diets remain a key differentiator. End-users are primarily pet owners, veterinarians, and animal hospitals. The market has witnessed significant M&A activity in recent years, with deals valued at xx Million annually, reflecting industry consolidation and a focus on expanding product portfolios and market reach.

- Market Share Distribution: Nestle (Purina) and Mars Incorporated hold the largest market share, followed by Colgate-Palmolive (Hill's) and other key players.

- Innovation Catalysts: Advances in nutritional science, personalized pet care, and growing awareness of pet health are key drivers of innovation.

- Regulatory Landscape: Varying regulations across regions impact product labeling, formulation, and marketing claims.

- M&A Activity: Recent years have shown considerable activity in acquisitions and mergers.

Pet Veterinary Diet Market Industry Evolution

The Pet Veterinary Diet market has witnessed robust and sustained expansion during the historical period (2019-2024). This growth has been significantly influenced by a confluence of factors including the escalating rates of pet ownership globally, a marked increase in discretionary spending on pet healthcare, and a heightened consumer awareness regarding the profound impact of nutrition on a pet's overall health and well-being. Technological innovations have been instrumental in shaping this landscape, with advancements in ingredient sourcing ensuring higher quality and efficacy, the development of precision nutrition formulations tailored to specific needs, and the implementation of sophisticated packaging solutions that enhance product appeal and shelf-life. Consumer preferences are increasingly gravitating towards highly specialized dietary solutions designed to address a spectrum of health concerns, such as diabetes management, allergy alleviation, and the support of sensitive digestive systems, thereby stimulating continuous innovation in product development. The market's growth trajectory is projected to maintain its positive momentum throughout the forecast period (2025-2033), underpinned by evolving trends like the 'humanization' of pets, the burgeoning e-commerce sector for pet food, and the expanding accessibility and scope of veterinary services. Consequently, the adoption rate of specialized veterinary diets is on a consistent and upward climb.

- Historical Growth Rate (2019-2024): While specific CAGR figures vary across reports, the market demonstrated a strong positive growth trend, significantly exceeding general pet food market growth.

- Projected Growth Rate (2025-2033): The market is anticipated to continue its upward trajectory, with projected CAGR expected to remain robust, driven by the aforementioned trends.

- Adoption Rate of Specialized Diets (2025): The adoption rate is projected to see continued growth, reflecting increased owner proactivity in managing pet health through targeted nutrition.

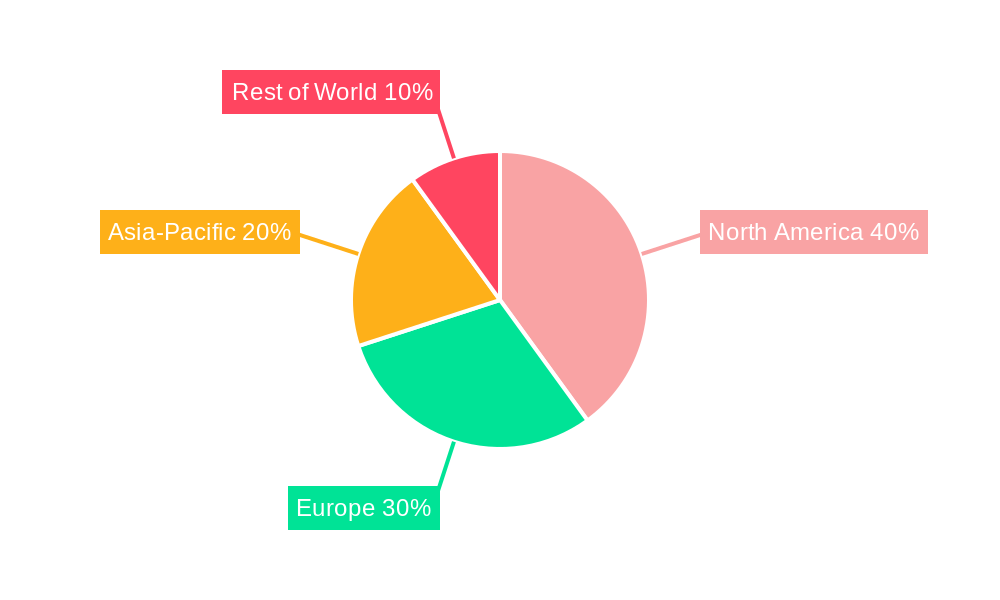

Leading Regions, Countries, or Segments in Pet Veterinary Diet Market

The North American and European markets currently dominate the global Pet Veterinary Diet market due to high pet ownership rates, increased disposable incomes, and strong regulatory frameworks promoting pet health and welfare. Within the product segments, diets for renal and digestive sensitivities show particularly strong growth. The online channel is experiencing rapid expansion, while specialty stores retain a significant presence in distribution.

- Key Drivers in North America: High pet ownership, strong consumer spending, and robust veterinary infrastructure.

- Key Drivers in Europe: High pet ownership rate in specific countries, increased focus on pet health, and regulatory support for specialized pet food.

- Dominant Sub-Product Segments: Renal and digestive sensitivity diets show the highest growth, followed by diabetes and urinary tract disease diets.

- Dominant Distribution Channels: Specialty stores and supermarkets/hypermarkets hold significant shares, but online channels are rapidly gaining momentum.

Pet Veterinary Diet Market Product Innovations

Recent innovations in pet veterinary diets include the development of functional foods with added prebiotics and probiotics to support gut health, hypoallergenic formulations for pets with allergies, and diets specifically designed to manage chronic conditions like osteoarthritis and diabetes. These innovations emphasize tailored nutrition to meet the diverse health needs of pets and improve their quality of life. Companies are also focusing on enhancing the palatability of veterinary diets through improved taste and texture.

Propelling Factors for Pet Veterinary Diet Market Growth

Several factors are driving the growth of the Pet Veterinary Diet market. The increasing humanization of pets and rising pet healthcare expenditure are key contributors. Technological advancements like advanced nutrition formulations and customized diets are further bolstering the market's expansion. Favorable government regulations and increased public awareness concerning pet health and wellness are also playing crucial roles.

Obstacles in the Pet Veterinary Diet Market

The Pet Veterinary Diet market faces certain challenges, including fluctuations in raw material prices, stringent regulatory requirements regarding ingredient sourcing and labeling, and potential supply chain disruptions. Competitive pressures from generic brands and the increasing prevalence of alternative pet food options also pose constraints on market growth.

Future Opportunities in Pet Veterinary Diet Market

The Pet Veterinary Diet market is ripe with future opportunities. A key avenue for expansion lies in tapping into emerging economies that are experiencing a surge in pet ownership, thereby creating new consumer bases. Further development of highly personalized nutrition solutions, leveraging cutting-edge technologies such as genomics and AI-driven diagnostics, presents a significant opportunity to offer truly bespoke dietary plans. The growing consumer demand for ethically sourced and environmentally responsible products also opens doors for innovative approaches in organic, sustainable, and traceable pet food options. Moreover, forging strategic alliances and collaborative initiatives with veterinary professionals and pet care influencers is crucial for enhancing market penetration, building trust, and effectively expanding product distribution networks to reach a wider audience.

Major Players in the Pet Veterinary Diet Market Ecosystem

- Affinity Petcare SA

- PLB International

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- Alltech

- General Mills Inc

- Mars Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc)

- Schell & Kampeter Inc (Diamond Pet Foods)

- Heristo Aktiengesellschaft

Key Developments in Pet Veterinary Diet Market Industry

- April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific, signifying an increased investment in the region and likely leading to new product introductions.

- March 2023: Hill's Pet Nutrition launched its Diet ONC Care line for pets with cancer, expanding its product portfolio into a high-growth niche market.

- January 2023: Purina Pro Plan Veterinary Diets partnered with the AVMF to expand the REACH program, potentially increasing brand awareness and sales by associating with a charitable initiative.

Strategic Pet Veterinary Diet Market Forecast

The Pet Veterinary Diet market is poised for continued growth, driven by persistent technological advancements and expanding consumer awareness of pet health. The expanding middle class in developing economies presents a significant opportunity, while innovative product formulations targeting specific health needs will further fuel this positive trajectory. The market’s future hinges on successful navigation of regulatory hurdles and effective management of supply chains, ensuring continued growth and sustainability.

Pet Veterinary Diet Market Segmentation

-

1. Sub Product

- 1.1. Diabetes

- 1.2. Digestive Sensitivity

- 1.3. Oral Care Diets

- 1.4. Renal

- 1.5. Urinary tract disease

- 1.6. Other Veterinary Diets

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Pet Veterinary Diet Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Veterinary Diet Market Regional Market Share

Geographic Coverage of Pet Veterinary Diet Market

Pet Veterinary Diet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Diabetes

- 5.1.2. Digestive Sensitivity

- 5.1.3. Oral Care Diets

- 5.1.4. Renal

- 5.1.5. Urinary tract disease

- 5.1.6. Other Veterinary Diets

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. North America Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 6.1.1. Diabetes

- 6.1.2. Digestive Sensitivity

- 6.1.3. Oral Care Diets

- 6.1.4. Renal

- 6.1.5. Urinary tract disease

- 6.1.6. Other Veterinary Diets

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 7. South America Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 7.1.1. Diabetes

- 7.1.2. Digestive Sensitivity

- 7.1.3. Oral Care Diets

- 7.1.4. Renal

- 7.1.5. Urinary tract disease

- 7.1.6. Other Veterinary Diets

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 8. Europe Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 8.1.1. Diabetes

- 8.1.2. Digestive Sensitivity

- 8.1.3. Oral Care Diets

- 8.1.4. Renal

- 8.1.5. Urinary tract disease

- 8.1.6. Other Veterinary Diets

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 9. Middle East & Africa Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 9.1.1. Diabetes

- 9.1.2. Digestive Sensitivity

- 9.1.3. Oral Care Diets

- 9.1.4. Renal

- 9.1.5. Urinary tract disease

- 9.1.6. Other Veterinary Diets

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 10. Asia Pacific Pet Veterinary Diet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 10.1.1. Diabetes

- 10.1.2. Digestive Sensitivity

- 10.1.3. Oral Care Diets

- 10.1.4. Renal

- 10.1.5. Urinary tract disease

- 10.1.6. Other Veterinary Diets

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Affinity Petcare SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PLB International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alltech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nestle (Purina)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schell & Kampeter Inc (Diamond Pet Foods

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Heristo aktiengesellschaft

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Affinity Petcare SA

List of Figures

- Figure 1: Global Pet Veterinary Diet Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Pet Veterinary Diet Market Revenue (undefined), by Sub Product 2025 & 2033

- Figure 3: North America Pet Veterinary Diet Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 4: North America Pet Veterinary Diet Market Revenue (undefined), by Pets 2025 & 2033

- Figure 5: North America Pet Veterinary Diet Market Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Pet Veterinary Diet Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Pet Veterinary Diet Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Pet Veterinary Diet Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Pet Veterinary Diet Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Pet Veterinary Diet Market Revenue (undefined), by Sub Product 2025 & 2033

- Figure 11: South America Pet Veterinary Diet Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 12: South America Pet Veterinary Diet Market Revenue (undefined), by Pets 2025 & 2033

- Figure 13: South America Pet Veterinary Diet Market Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Pet Veterinary Diet Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Pet Veterinary Diet Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Pet Veterinary Diet Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Pet Veterinary Diet Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Pet Veterinary Diet Market Revenue (undefined), by Sub Product 2025 & 2033

- Figure 19: Europe Pet Veterinary Diet Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 20: Europe Pet Veterinary Diet Market Revenue (undefined), by Pets 2025 & 2033

- Figure 21: Europe Pet Veterinary Diet Market Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Pet Veterinary Diet Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Europe Pet Veterinary Diet Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Pet Veterinary Diet Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Pet Veterinary Diet Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Pet Veterinary Diet Market Revenue (undefined), by Sub Product 2025 & 2033

- Figure 27: Middle East & Africa Pet Veterinary Diet Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 28: Middle East & Africa Pet Veterinary Diet Market Revenue (undefined), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Pet Veterinary Diet Market Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Pet Veterinary Diet Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Pet Veterinary Diet Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Pet Veterinary Diet Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Pet Veterinary Diet Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Pet Veterinary Diet Market Revenue (undefined), by Sub Product 2025 & 2033

- Figure 35: Asia Pacific Pet Veterinary Diet Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 36: Asia Pacific Pet Veterinary Diet Market Revenue (undefined), by Pets 2025 & 2033

- Figure 37: Asia Pacific Pet Veterinary Diet Market Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Pet Veterinary Diet Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Pet Veterinary Diet Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Pet Veterinary Diet Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Pet Veterinary Diet Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 2: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 3: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 6: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 7: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 13: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 14: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 20: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 21: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 33: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 34: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 43: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Pets 2020 & 2033

- Table 44: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Pet Veterinary Diet Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Pet Veterinary Diet Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Veterinary Diet Market?

The projected CAGR is approximately 7.43%.

2. Which companies are prominent players in the Pet Veterinary Diet Market?

Key companies in the market include Affinity Petcare SA, PLB International, Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, General Mills Inc, Mars Incorporated, Nestle (Purina), Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), Schell & Kampeter Inc (Diamond Pet Foods, Heristo aktiengesellschaft.

3. What are the main segments of the Pet Veterinary Diet Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.March 2023: Colgate-Palmolive Company's pet care subsidiary Hill’s Pet Nutrition launched its new line of prescription diets to support pets diagnosed with cancer. This prescription line, Diet ONC Care, offers complete and balanced formulas in both dry and wet forms for cats and dogs.January 2023: Purina Pro Plan Veterinary Diets, a brand of Nestlé Purina PetCare, partnered with the American Veterinary Medical Foundation (AVMF) to help expand the AVMF Reaching Every Animal with Charitable Care (REACH) program. This program offers grants to veterinarians who provide immediate treatment for pets whose owners are experiencing financial hardship. This strategy helps increase the sales of veterinary diets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Veterinary Diet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Veterinary Diet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Veterinary Diet Market?

To stay informed about further developments, trends, and reports in the Pet Veterinary Diet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence