Key Insights

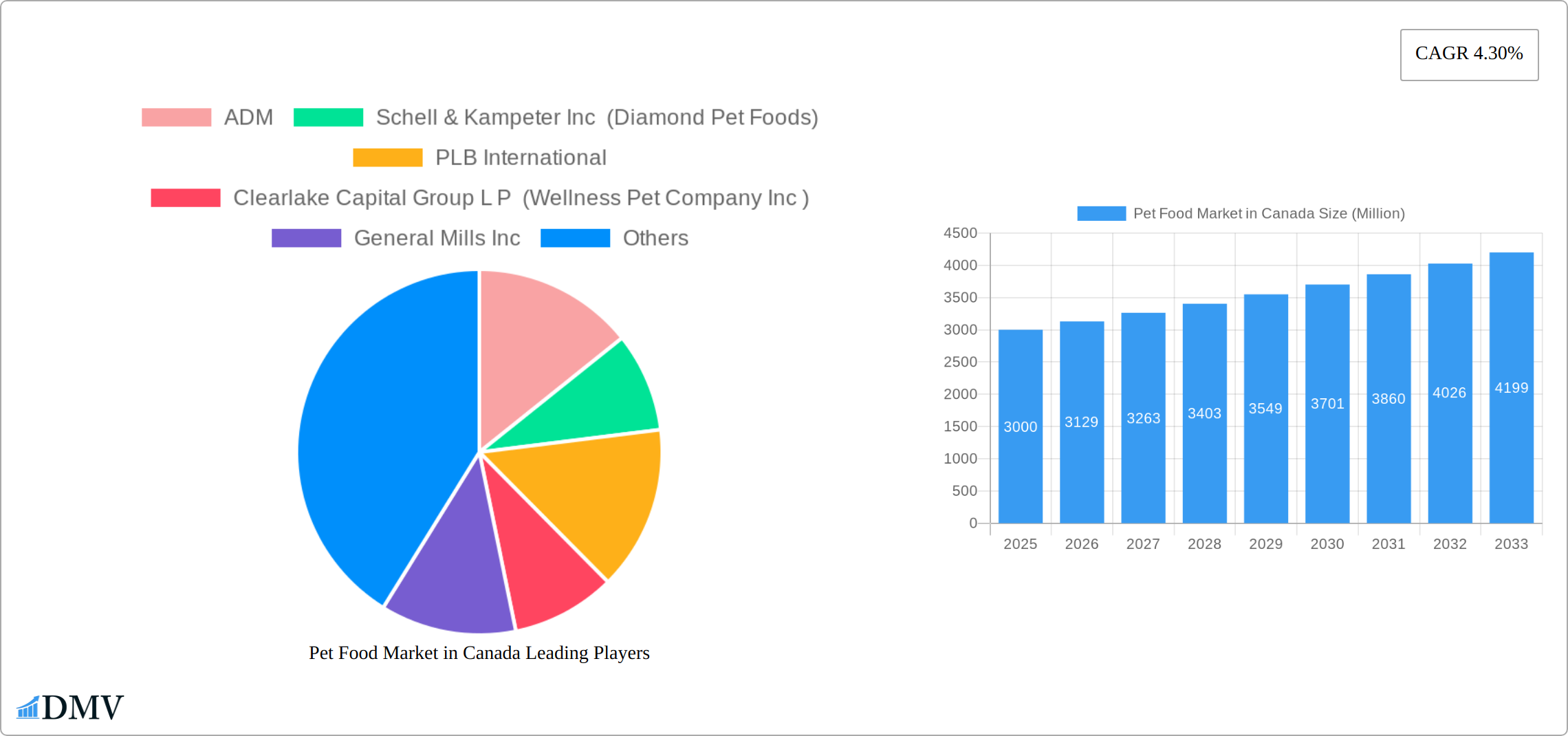

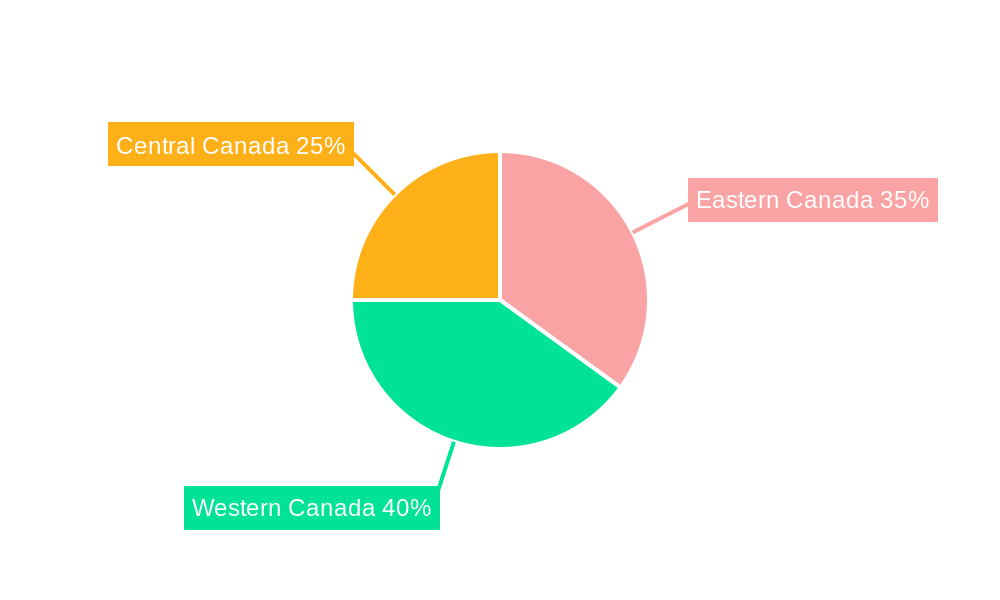

The Canadian pet food market, valued at approximately $3 billion CAD in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.30% from 2025 to 2033. This growth is fueled by several key factors. Firstly, increasing pet ownership, particularly among millennials and Gen Z, is driving demand. These demographics are known for their willingness to spend on premium pet products, including specialized diets and functional foods catering to specific health needs. Secondly, a rising awareness of pet health and nutrition is encouraging consumers to choose higher-quality, ingredient-focused pet foods. This trend is boosting the market share of premium and super-premium brands, while simultaneously impacting the sales of conventional, lower-priced options. Finally, the expanding online retail channel offers convenience and a wider selection, further fueling market expansion. The market is segmented by distribution channels (convenience stores, online, specialty stores, supermarkets/hypermarkets, other channels), pet food products (food, other veterinary diets), and pets (cats, dogs, other pets). While supermarkets/hypermarkets currently hold a dominant market share, online channels are rapidly gaining ground, offering strong growth potential in the forecast period. The regional distribution across Eastern, Western, and Central Canada reflects varying population densities and pet ownership patterns.

Pet Food Market in Canada Market Size (In Billion)

Competitive rivalry among established players like Mars Incorporated, Nestle (Purina), and Colgate-Palmolive (Hill's Pet Nutrition) remains intense. However, smaller, niche players focusing on specific dietary needs or sustainable sourcing strategies are also gaining traction. Growth is expected to be particularly strong in the segments of premium and specialized pet food, reflecting changing consumer preferences. While potential restraints include economic fluctuations and supply chain disruptions, the overall outlook for the Canadian pet food market remains positive due to the aforementioned strong drivers and the enduring bond between Canadians and their pets. The increasing humanization of pets and a greater focus on their wellbeing significantly contribute to the market's continued expansion.

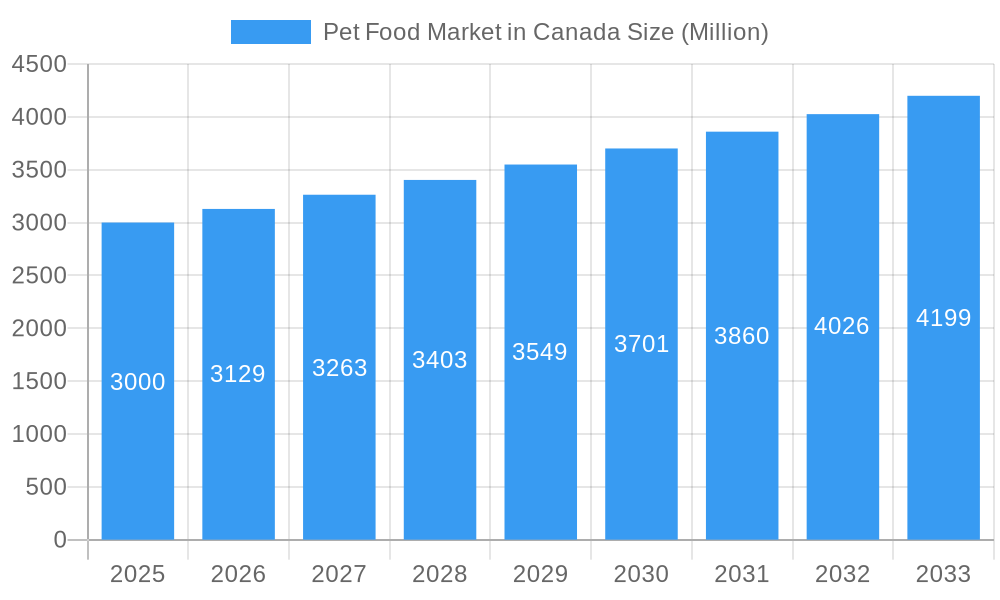

Pet Food Market in Canada Company Market Share

Pet Food Market in Canada: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Canadian pet food market, offering a comprehensive overview of its current state and future trajectory. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed business decisions within this rapidly evolving sector. The Canadian pet food market, valued at xx Million in 2025, is poised for significant growth, driven by increasing pet ownership and a rising demand for premium and specialized pet foods.

Pet Food Market in Canada Market Composition & Trends

The Canadian pet food market is characterized by a moderately concentrated landscape, with key players like Mars Incorporated, Nestle (Purina), and Colgate-Palmolive Company (Hill's Pet Nutrition Inc) holding significant market share. Innovation is a key driver, with companies continuously introducing new products catering to specific dietary needs and preferences. The regulatory environment, while generally stable, plays a significant role in shaping product formulation and labeling. Substitute products, such as homemade pet food, present a level of competition, while the increasing humanization of pets fuels demand for premium options. The market witnesses frequent mergers and acquisitions (M&A) activity, with notable deals exceeding xx Million in value over the past five years.

- Market Share Distribution (2025): Mars Incorporated (xx%), Nestle (Purina) (xx%), Colgate-Palmolive (Hill's) (xx%), Others (xx%).

- Significant M&A Activities (2019-2024): Deal values exceeding xx Million across several transactions involving key players.

- Key Innovation Catalysts: Growing consumer demand for natural, organic, and specialized pet foods.

- Regulatory Landscape: Primarily focused on food safety, labeling, and ingredient transparency.

- End-User Profiles: A diverse range of pet owners, from budget-conscious to premium-focused consumers.

Pet Food Market in Canada Industry Evolution

The Canadian pet food market has demonstrated a remarkable and sustained growth trajectory throughout the historical period spanning 2019-2024. This expansion is primarily attributed to the profound shift in pet ownership, where animals are increasingly viewed as integral family members. This "humanization" trend, coupled with a steady rise in disposable incomes across Canadian households, has directly translated into elevated consumer expenditure on high-quality pet food. Furthermore, significant advancements in pet food manufacturing technologies have been instrumental in developing products that are not only more nutritious but also highly palatable, further incentivizing market growth. A notable consumer shift towards premium and specialized pet foods underscores a growing consciousness regarding pet health and optimal nutrition. In response, manufacturers have strategically prioritized the inclusion of functional and health-promoting ingredients, such as prebiotics, probiotics, and antioxidants, to meet this evolving demand. The convenience offered by e-commerce has also played a pivotal role, with online sales channels experiencing a substantial uptake, significantly contributing to the market's overall positive growth momentum. During the historical period (2019-2024), the average annual growth rate (AAGR) stood at **[Insert historical AAGR value]%**. Looking ahead, the market is projected to maintain this robust expansion, with an anticipated AAGR of **[Insert forecast AAGR value]%** during the forecast period (2025-2033). The adoption of premium pet foods, specifically, saw a notable increase of **[Insert premium food adoption growth]%** from 2019 to 2024.

Leading Regions, Countries, or Segments in Pet Food Market in Canada

The Canadian pet food market demonstrates strong growth across various segments. Supermarkets/hypermarkets remain the dominant distribution channel, leveraging their widespread reach and established customer base. However, the online channel is witnessing rapid expansion, driven by convenience and wider product selection. Within pet food products, the "food" segment commands the largest share, while the "other veterinary diets" segment exhibits high growth potential due to increasing pet health awareness. Dogs and cats remain the primary pet groups driving market demand, although "other pets" show promising growth owing to increasing pet diversification.

- Key Drivers for Supermarkets/Hypermarkets: Established distribution networks, high consumer footfall, promotional opportunities.

- Key Drivers for Online Channel: Convenience, wider product selection, targeted marketing capabilities.

- Key Drivers for "Food" Segment: High pet ownership, continuous innovation in product formulations.

- Key Drivers for Dog and Cat Segments: High pet ownership, established market presence.

Pet Food Market in Canada Product Innovations

Recent product innovations within the Canadian pet food landscape are largely centered on bolstering pet health and catering to an array of specific dietary requirements and sensitivities. Manufacturers are increasingly prioritizing the use of natural and organic ingredients, with a growing emphasis on whole grains, a diverse range of fruits, and wholesome vegetables. Functional foods, strategically fortified with essential vitamins, minerals, and beneficial probiotics, are experiencing a significant surge in popularity. Furthermore, the market is witnessing the emergence and growing acceptance of novel protein sources, such as insect-based proteins and alternative seafood options. These innovations, exemplified by initiatives like Hill's Pet Nutrition's recent product launches, are not only addressing the growing demand for environmentally sustainable pet food choices but also providing viable solutions for pets with common allergies. These advancements are collectively driving the premiumization trend and significantly influencing contemporary consumer purchasing decisions.

Propelling Factors for Pet Food Market in Canada Growth

The burgeoning growth of the Canadian pet food market is propelled by a confluence of powerful driving forces. A foundational element is the continuous increase in pet ownership rates across Canada, with particularly strong adoption observed among younger demographics, contributing significantly to the overall market expansion. Coupled with this is the upward trend in disposable incomes, empowering consumers to allocate a larger share of their budget towards premium pet food options. Technological innovations in pet food manufacturing, encompassing advanced processing techniques and the development of cutting-edge packaging solutions, are crucial in enhancing product quality, extending shelf life, and improving overall consumer experience. The supportive framework of favorable government regulations, which consistently promote pet health and welfare standards, further bolsters the market's positive trajectory. Finally, a heightened consumer awareness regarding pet nutrition, preventative health measures, and the long-term well-being of their animal companions is a pivotal factor shaping purchasing behavior and driving demand for superior pet food products.

Obstacles in the Pet Food Market in Canada Market

Despite the overwhelmingly positive market outlook, the Canadian pet food sector encounters several notable challenges that necessitate ongoing strategic management. Disruptions within the global supply chain, particularly concerning the reliable sourcing of key ingredients and efficient logistics, can pose significant risks to product availability and can lead to unpredictable fluctuations in pricing. The intensely competitive landscape, characterized by the presence of both established industry giants and agile emerging players, demands continuous innovation, product differentiation, and adaptive business strategies to maintain market share. Volatility in the cost of raw materials represents another persistent challenge, directly impacting manufacturers' profitability margins and requiring careful cost management. Evolving regulatory frameworks, encompassing stringent requirements for product labeling, adherence to ingredient standards, and robust food safety compliance, necessitate ongoing adaptation and investment in compliance management systems. Lastly, potential economic downturns could exert pressure on consumer discretionary spending, potentially impacting the demand for premium pet food products.

Future Opportunities in Pet Food Market in Canada

Future opportunities lie in several areas. The growing demand for specialized pet foods catering to specific health conditions (e.g., allergies, obesity) presents a significant opportunity for innovation and growth. Expansion into e-commerce and direct-to-consumer channels can enhance market reach and consumer engagement. Utilizing data analytics to personalize pet food recommendations and enhance consumer experience is crucial. Further exploring sustainable sourcing and packaging options can cater to environmentally conscious consumers. Focusing on premiumization and value-added services, like personalized pet nutrition plans, can drive future growth.

Major Players in the Pet Food Market in Canada Ecosystem

- ADM

- Schell & Kampeter Inc (Diamond Pet Foods)

- PLB International

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- General Mills Inc

- Sunshine Mills Inc

- Mars Incorporated https://www.mars.com/

- Nestle (Purina) https://www.purina.ca/

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc) https://www.hillspet.ca/

- Virba

Key Developments in Pet Food Market in Canada Industry

- May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. This expands their product line and caters to the growing demand for cat treats.

- June 2023: Mars Incorporated launched its premium cat brand SHEBA in Canada, offering cat parents wet formulas through its SHEBA BISTRO line. This introduction strengthens their presence in the premium cat food segment.

- July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products for pets with sensitive stomachs and skin lines. This highlights a focus on sustainable and hypoallergenic options.

Strategic Pet Food Market in Canada Market Forecast

The Canadian pet food market is strategically poised for robust and sustained growth throughout the forecast period, extending from 2025 to 2033. The ongoing trend of premiumization, fueled by escalating consumer demand for higher-quality ingredients, specialized formulations, and tailored dietary solutions, will remain a primary engine of market expansion. The continuing evolution and widespread adoption of e-commerce platforms, alongside the growth of direct-to-consumer (DTC) sales channels, are projected to further accelerate market growth by enhancing accessibility and convenience for consumers. Innovations in product formulation, encompassing novel ingredients and functional benefits, coupled with advancements in sustainable packaging solutions and environmentally conscious manufacturing practices, will be critical in shaping the competitive landscape and differentiating offerings. Consequently, the overall Canadian pet food market is anticipated to reach a valuation of **[Insert projected market value] Million** by 2033, presenting substantial and lucrative opportunities for both established industry leaders and innovative new entrants alike.

Pet Food Market in Canada Segmentation

-

1. Pet Food Product

-

1.1. By Sub Product

-

1.1.1. Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.1.1.1. Kibbles

- 1.1.1.1.2. Other Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.2. Wet Pet Food

-

1.1.1. Dry Pet Food

-

1.2. Pet Nutraceuticals/Supplements

- 1.2.1. Milk Bioactives

- 1.2.2. Omega-3 Fatty Acids

- 1.2.3. Probiotics

- 1.2.4. Proteins and Peptides

- 1.2.5. Vitamins and Minerals

- 1.2.6. Other Nutraceuticals

-

1.3. Pet Treats

- 1.3.1. Crunchy Treats

- 1.3.2. Dental Treats

- 1.3.3. Freeze-dried and Jerky Treats

- 1.3.4. Soft & Chewy Treats

- 1.3.5. Other Treats

-

1.4. Pet Veterinary Diets

- 1.4.1. Diabetes

- 1.4.2. Digestive Sensitivity

- 1.4.3. Oral Care Diets

- 1.4.4. Renal

- 1.4.5. Urinary tract disease

- 1.4.6. Other Veterinary Diets

-

1.1. By Sub Product

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Pet Food Market in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Food Market in Canada Regional Market Share

Geographic Coverage of Pet Food Market in Canada

Pet Food Market in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 5.1.1. By Sub Product

- 5.1.1.1. Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.1.1.1. Kibbles

- 5.1.1.1.1.2. Other Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.2. Wet Pet Food

- 5.1.1.1. Dry Pet Food

- 5.1.2. Pet Nutraceuticals/Supplements

- 5.1.2.1. Milk Bioactives

- 5.1.2.2. Omega-3 Fatty Acids

- 5.1.2.3. Probiotics

- 5.1.2.4. Proteins and Peptides

- 5.1.2.5. Vitamins and Minerals

- 5.1.2.6. Other Nutraceuticals

- 5.1.3. Pet Treats

- 5.1.3.1. Crunchy Treats

- 5.1.3.2. Dental Treats

- 5.1.3.3. Freeze-dried and Jerky Treats

- 5.1.3.4. Soft & Chewy Treats

- 5.1.3.5. Other Treats

- 5.1.4. Pet Veterinary Diets

- 5.1.4.1. Diabetes

- 5.1.4.2. Digestive Sensitivity

- 5.1.4.3. Oral Care Diets

- 5.1.4.4. Renal

- 5.1.4.5. Urinary tract disease

- 5.1.4.6. Other Veterinary Diets

- 5.1.1. By Sub Product

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6. North America Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6.1.1. By Sub Product

- 6.1.1.1. Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.1.1.1. Kibbles

- 6.1.1.1.1.2. Other Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.2. Wet Pet Food

- 6.1.1.1. Dry Pet Food

- 6.1.2. Pet Nutraceuticals/Supplements

- 6.1.2.1. Milk Bioactives

- 6.1.2.2. Omega-3 Fatty Acids

- 6.1.2.3. Probiotics

- 6.1.2.4. Proteins and Peptides

- 6.1.2.5. Vitamins and Minerals

- 6.1.2.6. Other Nutraceuticals

- 6.1.3. Pet Treats

- 6.1.3.1. Crunchy Treats

- 6.1.3.2. Dental Treats

- 6.1.3.3. Freeze-dried and Jerky Treats

- 6.1.3.4. Soft & Chewy Treats

- 6.1.3.5. Other Treats

- 6.1.4. Pet Veterinary Diets

- 6.1.4.1. Diabetes

- 6.1.4.2. Digestive Sensitivity

- 6.1.4.3. Oral Care Diets

- 6.1.4.4. Renal

- 6.1.4.5. Urinary tract disease

- 6.1.4.6. Other Veterinary Diets

- 6.1.1. By Sub Product

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7. South America Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7.1.1. By Sub Product

- 7.1.1.1. Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.1.1.1. Kibbles

- 7.1.1.1.1.2. Other Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.2. Wet Pet Food

- 7.1.1.1. Dry Pet Food

- 7.1.2. Pet Nutraceuticals/Supplements

- 7.1.2.1. Milk Bioactives

- 7.1.2.2. Omega-3 Fatty Acids

- 7.1.2.3. Probiotics

- 7.1.2.4. Proteins and Peptides

- 7.1.2.5. Vitamins and Minerals

- 7.1.2.6. Other Nutraceuticals

- 7.1.3. Pet Treats

- 7.1.3.1. Crunchy Treats

- 7.1.3.2. Dental Treats

- 7.1.3.3. Freeze-dried and Jerky Treats

- 7.1.3.4. Soft & Chewy Treats

- 7.1.3.5. Other Treats

- 7.1.4. Pet Veterinary Diets

- 7.1.4.1. Diabetes

- 7.1.4.2. Digestive Sensitivity

- 7.1.4.3. Oral Care Diets

- 7.1.4.4. Renal

- 7.1.4.5. Urinary tract disease

- 7.1.4.6. Other Veterinary Diets

- 7.1.1. By Sub Product

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8. Europe Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8.1.1. By Sub Product

- 8.1.1.1. Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.1.1.1. Kibbles

- 8.1.1.1.1.2. Other Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.2. Wet Pet Food

- 8.1.1.1. Dry Pet Food

- 8.1.2. Pet Nutraceuticals/Supplements

- 8.1.2.1. Milk Bioactives

- 8.1.2.2. Omega-3 Fatty Acids

- 8.1.2.3. Probiotics

- 8.1.2.4. Proteins and Peptides

- 8.1.2.5. Vitamins and Minerals

- 8.1.2.6. Other Nutraceuticals

- 8.1.3. Pet Treats

- 8.1.3.1. Crunchy Treats

- 8.1.3.2. Dental Treats

- 8.1.3.3. Freeze-dried and Jerky Treats

- 8.1.3.4. Soft & Chewy Treats

- 8.1.3.5. Other Treats

- 8.1.4. Pet Veterinary Diets

- 8.1.4.1. Diabetes

- 8.1.4.2. Digestive Sensitivity

- 8.1.4.3. Oral Care Diets

- 8.1.4.4. Renal

- 8.1.4.5. Urinary tract disease

- 8.1.4.6. Other Veterinary Diets

- 8.1.1. By Sub Product

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9. Middle East & Africa Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9.1.1. By Sub Product

- 9.1.1.1. Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.1.1.1. Kibbles

- 9.1.1.1.1.2. Other Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.2. Wet Pet Food

- 9.1.1.1. Dry Pet Food

- 9.1.2. Pet Nutraceuticals/Supplements

- 9.1.2.1. Milk Bioactives

- 9.1.2.2. Omega-3 Fatty Acids

- 9.1.2.3. Probiotics

- 9.1.2.4. Proteins and Peptides

- 9.1.2.5. Vitamins and Minerals

- 9.1.2.6. Other Nutraceuticals

- 9.1.3. Pet Treats

- 9.1.3.1. Crunchy Treats

- 9.1.3.2. Dental Treats

- 9.1.3.3. Freeze-dried and Jerky Treats

- 9.1.3.4. Soft & Chewy Treats

- 9.1.3.5. Other Treats

- 9.1.4. Pet Veterinary Diets

- 9.1.4.1. Diabetes

- 9.1.4.2. Digestive Sensitivity

- 9.1.4.3. Oral Care Diets

- 9.1.4.4. Renal

- 9.1.4.5. Urinary tract disease

- 9.1.4.6. Other Veterinary Diets

- 9.1.1. By Sub Product

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10. Asia Pacific Pet Food Market in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10.1.1. By Sub Product

- 10.1.1.1. Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.1.1.1. Kibbles

- 10.1.1.1.1.2. Other Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.2. Wet Pet Food

- 10.1.1.1. Dry Pet Food

- 10.1.2. Pet Nutraceuticals/Supplements

- 10.1.2.1. Milk Bioactives

- 10.1.2.2. Omega-3 Fatty Acids

- 10.1.2.3. Probiotics

- 10.1.2.4. Proteins and Peptides

- 10.1.2.5. Vitamins and Minerals

- 10.1.2.6. Other Nutraceuticals

- 10.1.3. Pet Treats

- 10.1.3.1. Crunchy Treats

- 10.1.3.2. Dental Treats

- 10.1.3.3. Freeze-dried and Jerky Treats

- 10.1.3.4. Soft & Chewy Treats

- 10.1.3.5. Other Treats

- 10.1.4. Pet Veterinary Diets

- 10.1.4.1. Diabetes

- 10.1.4.2. Digestive Sensitivity

- 10.1.4.3. Oral Care Diets

- 10.1.4.4. Renal

- 10.1.4.5. Urinary tract disease

- 10.1.4.6. Other Veterinary Diets

- 10.1.1. By Sub Product

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schell & Kampeter Inc (Diamond Pet Foods)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PLB International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sunshine Mills Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mars Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nestle (Purina)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Pet Food Market in Canada Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pet Food Market in Canada Revenue (Million), by Pet Food Product 2025 & 2033

- Figure 3: North America Pet Food Market in Canada Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 4: North America Pet Food Market in Canada Revenue (Million), by Pets 2025 & 2033

- Figure 5: North America Pet Food Market in Canada Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Pet Food Market in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Pet Food Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Pet Food Market in Canada Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Pet Food Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Pet Food Market in Canada Revenue (Million), by Pet Food Product 2025 & 2033

- Figure 11: South America Pet Food Market in Canada Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 12: South America Pet Food Market in Canada Revenue (Million), by Pets 2025 & 2033

- Figure 13: South America Pet Food Market in Canada Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Pet Food Market in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Pet Food Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Pet Food Market in Canada Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Pet Food Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Pet Food Market in Canada Revenue (Million), by Pet Food Product 2025 & 2033

- Figure 19: Europe Pet Food Market in Canada Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 20: Europe Pet Food Market in Canada Revenue (Million), by Pets 2025 & 2033

- Figure 21: Europe Pet Food Market in Canada Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Pet Food Market in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Pet Food Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Pet Food Market in Canada Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Pet Food Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Pet Food Market in Canada Revenue (Million), by Pet Food Product 2025 & 2033

- Figure 27: Middle East & Africa Pet Food Market in Canada Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 28: Middle East & Africa Pet Food Market in Canada Revenue (Million), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Pet Food Market in Canada Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Pet Food Market in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Pet Food Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Pet Food Market in Canada Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Pet Food Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Pet Food Market in Canada Revenue (Million), by Pet Food Product 2025 & 2033

- Figure 35: Asia Pacific Pet Food Market in Canada Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 36: Asia Pacific Pet Food Market in Canada Revenue (Million), by Pets 2025 & 2033

- Figure 37: Asia Pacific Pet Food Market in Canada Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Pet Food Market in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Pet Food Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Pet Food Market in Canada Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Pet Food Market in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 2: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 3: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Pet Food Market in Canada Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 6: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 7: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Pet Food Market in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 13: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 14: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Pet Food Market in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 20: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 21: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Pet Food Market in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 33: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 34: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Pet Food Market in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Pet Food Market in Canada Revenue Million Forecast, by Pet Food Product 2020 & 2033

- Table 43: Global Pet Food Market in Canada Revenue Million Forecast, by Pets 2020 & 2033

- Table 44: Global Pet Food Market in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Pet Food Market in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Pet Food Market in Canada Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Food Market in Canada?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Pet Food Market in Canada?

Key companies in the market include ADM, Schell & Kampeter Inc (Diamond Pet Foods), PLB International, Clearlake Capital Group L P (Wellness Pet Company Inc ), General Mills Inc, Sunshine Mills Inc, Mars Incorporated, Nestle (Purina), Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), Virba.

3. What are the main segments of the Pet Food Market in Canada?

The market segments include Pet Food Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products for pets with sensitive stomachs and skin lines. They contain vitamins, omega-3 fatty acids, and antioxidants.June 2023: Mars Incorporated launched its premium cat brand SHEBA in Canada, offering cat parents wet formulas through its SHEBA BISTRO line.May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Food Market in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Food Market in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Food Market in Canada?

To stay informed about further developments, trends, and reports in the Pet Food Market in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence