Key Insights

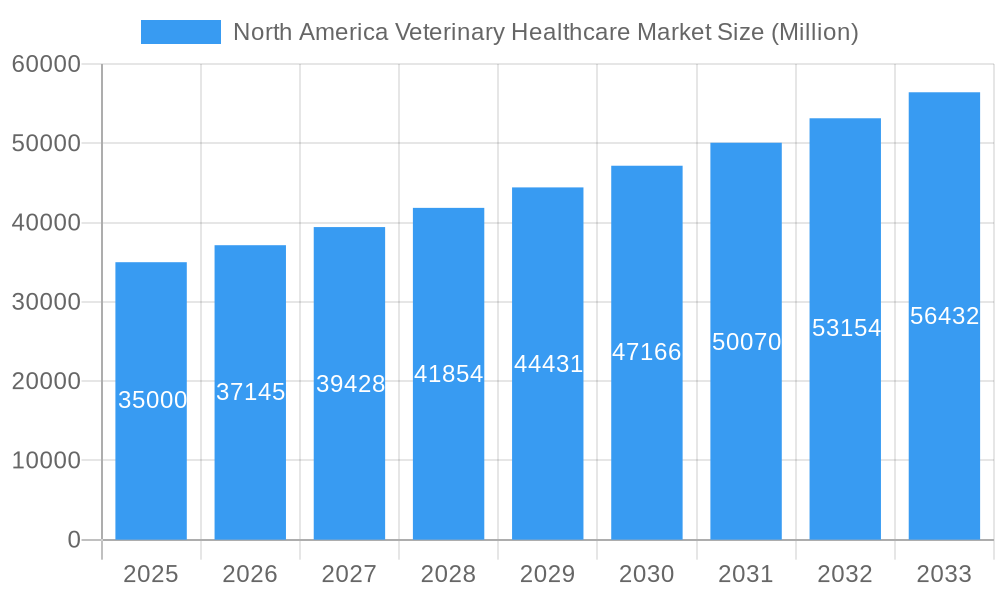

The North American veterinary healthcare market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This growth trajectory is underpinned by escalating pet ownership, particularly among younger demographics, and the pervasive trend of pet humanization, which elevates demand for premium veterinary services. Advancements in veterinary diagnostics and therapeutics, including personalized medicine, are also key drivers. The rising incidence of chronic conditions in companion animals necessitates more frequent and specialized veterinary interventions. The market encompasses pharmaceuticals (therapeutics) and diagnostics, segmented by product type, animal type (canine, feline, equine, etc.), and therapeutic areas like oncology and cardiology. Leading companies such as Zoetis, Merck, and Elanco are instrumental in market advancement through product innovation and strategic consolidations. A growing emphasis on preventative care and early disease detection further fuels market growth.

North America Veterinary Healthcare Market Market Size (In Billion)

The United States dominates the North American market, attributed to high pet ownership, increased discretionary spending, and a robust veterinary infrastructure. Canada and Mexico present substantial growth opportunities, supported by improved access to veterinary care and expanding pet insurance penetration. Despite challenges such as regulatory complexities and pricing pressures, the market's long-term outlook remains favorable, driven by rising pet healthcare expenditures and technological progress. Enhanced availability of advanced diagnostic tools, including point-of-care testing and modern imaging, is a significant growth catalyst for the diagnostics sector. The market's sustained growth reflects the deepening human-animal bond, positioning veterinary care as a crucial investment in animal welfare.

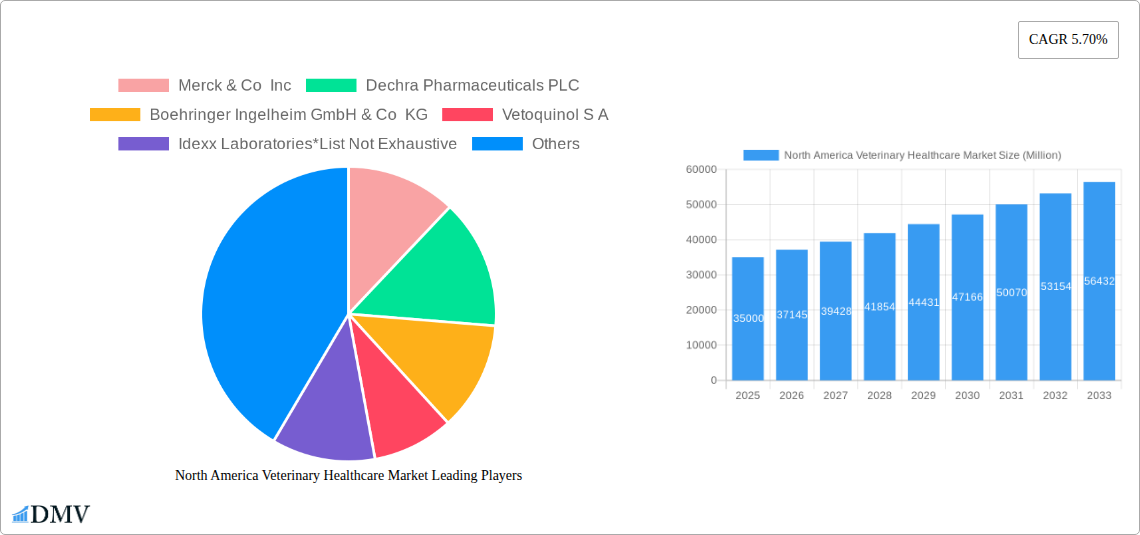

North America Veterinary Healthcare Market Company Market Share

North America Veterinary Healthcare Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Veterinary Healthcare Market, offering a comprehensive overview of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is estimated to be valued at xx Million in 2025.

North America Veterinary Healthcare Market Composition & Trends

The North America veterinary healthcare market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. However, the presence of numerous smaller, specialized companies fosters innovation and competition. Market share distribution is influenced by factors such as product portfolio breadth, R&D investments, and successful marketing strategies. Major players like Zoetis Inc and Idexx Laboratories command substantial shares, while others compete fiercely within specific segments. The regulatory landscape, predominantly governed by the FDA in the US and Health Canada in Canada, plays a significant role in product approvals and market access. Substitute products, such as home remedies or alternative therapies, represent a minor yet growing segment. The end-user profile includes veterinary clinics, hospitals, research institutions, and pharmaceutical companies. Mergers and acquisitions (M&A) are frequent, driving market consolidation and expansion. Significant M&A deals in recent years have involved companies like Ceva Santé Animale, exceeding xx Million in value.

- Market Concentration: Moderately concentrated with significant players commanding substantial shares.

- Innovation Catalysts: R&D investments in diagnostics, therapeutics, and animal health technologies.

- Regulatory Landscape: Stringent regulations enforced by FDA (US) and Health Canada.

- Substitute Products: Limited but growing segment of alternative therapies.

- End-User Profile: Veterinary clinics, hospitals, research institutions, pharmaceutical companies.

- M&A Activity: Frequent mergers and acquisitions driving market consolidation, with recent deals exceeding xx Million.

North America Veterinary Healthcare Market Industry Evolution

The North America veterinary healthcare market has experienced consistent growth throughout the historical period (2019-2024), driven by factors such as increasing pet ownership, rising pet healthcare expenditure, and advancements in veterinary medicine. Technological advancements, particularly in diagnostics and therapeutics, have significantly improved animal healthcare outcomes and fueled market expansion. The adoption of advanced diagnostic tools, such as advanced imaging techniques and molecular diagnostics, has increased, with an adoption rate of approximately xx% in 2024. This is alongside a growing demand for specialized veterinary services and a shift towards preventative care, driving growth in the market. The market demonstrates a compound annual growth rate (CAGR) of xx% during the historical period, projected to reach xx% during the forecast period (2025-2033). Shifting consumer demands include a preference for personalized medicine, increased access to telehealth services, and a growing interest in holistic and integrative approaches to animal health.

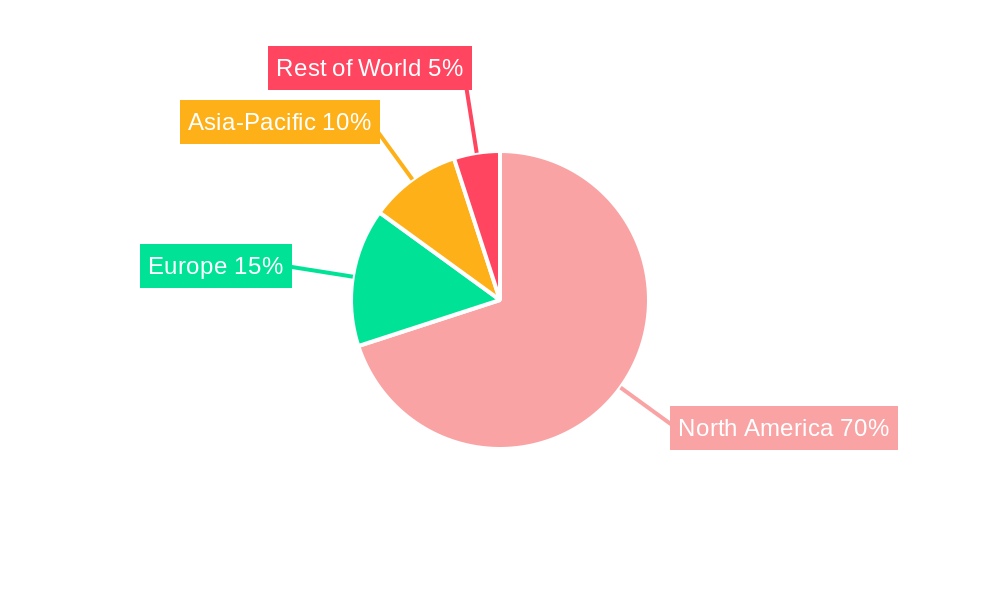

Leading Regions, Countries, or Segments in North America Veterinary Healthcare Market

The United States dominates the North American veterinary healthcare market, driven by high pet ownership rates, robust veterinary infrastructure, and significant investment in animal health research. Within product types, the therapeutics segment holds the largest market share, followed by diagnostics. The companion animal segment (dogs and cats) contributes significantly to market revenue due to increased pet humanization and higher spending on their healthcare.

- Key Drivers for US Dominance: High pet ownership, robust veterinary infrastructure, substantial R&D investment.

- Therapeutics Segment Dominance: Driven by demand for innovative treatments and advancements in veterinary pharmaceuticals.

- Diagnostics Segment Growth: Fueled by increased adoption of advanced diagnostic technologies and a shift towards preventative care.

- Companion Animal Segment: High pet humanization and increased spending on pet healthcare.

North America Veterinary Healthcare Market Product Innovations

Recent product innovations include advanced diagnostic tools like IDEXX's 4Dx Plus Test and SediVue Dx Urine Sediment Analyzer, enabling faster and more accurate diagnoses. New therapeutics, particularly in areas like oncology and infectious diseases, are constantly being developed, offering improved treatment options and enhanced animal welfare. These innovations often incorporate advanced technologies such as AI and machine learning to improve efficiency and accuracy. This continuous stream of innovations fuels market growth and helps to shape the industry's evolution.

Propelling Factors for North America Veterinary Healthcare Market Growth

Several factors fuel the growth of the North American veterinary healthcare market. Increasing pet ownership rates and the humanization of pets are key drivers, alongside the rising disposable incomes of pet owners, leading to greater willingness to invest in advanced healthcare for their animals. Technological advancements in diagnostics and therapeutics contribute significantly to market expansion. Furthermore, supportive regulatory frameworks and increased government funding for animal health research boost innovation and market growth.

Obstacles in the North America Veterinary Healthcare Market

Despite strong growth prospects, the market faces challenges. Stringent regulatory requirements for product approvals can slow down innovation and increase development costs. Supply chain disruptions can impact the availability of essential veterinary products and equipment. The market is becoming increasingly competitive, with established players facing pressure from smaller, specialized companies. These factors can influence market growth and profitability.

Future Opportunities in North America Veterinary Healthcare Market

The North American veterinary healthcare market presents significant opportunities for growth. The expanding pet insurance market increases access to veterinary care and boosts demand for services. The development and adoption of novel therapeutics, personalized medicine, and advanced diagnostics will continue to drive market growth. The emerging field of veterinary telehealth offers new avenues for service delivery and improved access to care.

Major Players in the North America Veterinary Healthcare Market Ecosystem

- Merck & Co Inc

- Dechra Pharmaceuticals PLC

- Boehringer Ingelheim GmbH & Co KG

- Vetoquinol S A

- Idexx Laboratories

- Bimeda Inc

- Ceva Sante Animale

- Neogen Corporation

- Elanco Animal Health Incorporated

- Zoetis Inc

Key Developments in North America Veterinary Healthcare Market Industry

- May 2022: Ceva Santé Animale acquired Artemis Technologies, Inc., expanding its presence in the North American oral rabies vaccine market. This acquisition strengthened Ceva's market position and product portfolio.

- January 2022: Idexx Laboratories launched several product and service enhancements, improving veterinary practice efficiency and diagnostic capabilities. These innovations provided deeper insights and facilitated faster clinical decisions, improving overall healthcare.

Strategic North America Veterinary Healthcare Market Forecast

The North America veterinary healthcare market is poised for sustained growth, driven by a confluence of factors including rising pet ownership, increased pet healthcare expenditure, and ongoing technological advancements. Emerging opportunities in areas like telehealth, personalized medicine, and preventative care will further fuel market expansion. The market is expected to demonstrate robust growth throughout the forecast period, presenting significant opportunities for both established players and new entrants.

North America Veterinary Healthcare Market Segmentation

-

1. Product Type

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.3. By Animal Type

- 1.3.1. Dogs and Cats

- 1.3.2. Horses

- 1.3.3. Ruminants

- 1.3.4. Swine

- 1.3.5. Poultry

- 1.3.6. Other Animal Types

-

1.1. By Therapeutics

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Veterinary Healthcare Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Veterinary Healthcare Market Regional Market Share

Geographic Coverage of North America Veterinary Healthcare Market

North America Veterinary Healthcare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Initiatives by Governments and Animal Welfare Associations; Increasing Productivity at the Risk of Emerging Zoonosis

- 3.3. Market Restrains

- 3.3.1. Lack of Veterinarians; High Costs Associated With Animal Healthcare

- 3.4. Market Trends

- 3.4.1. The Vaccine Segment is Anticipated to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.3. By Animal Type

- 5.1.3.1. Dogs and Cats

- 5.1.3.2. Horses

- 5.1.3.3. Ruminants

- 5.1.3.4. Swine

- 5.1.3.5. Poultry

- 5.1.3.6. Other Animal Types

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. By Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti-infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. By Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.3. By Animal Type

- 6.1.3.1. Dogs and Cats

- 6.1.3.2. Horses

- 6.1.3.3. Ruminants

- 6.1.3.4. Swine

- 6.1.3.5. Poultry

- 6.1.3.6. Other Animal Types

- 6.1.1. By Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. By Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti-infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. By Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.3. By Animal Type

- 7.1.3.1. Dogs and Cats

- 7.1.3.2. Horses

- 7.1.3.3. Ruminants

- 7.1.3.4. Swine

- 7.1.3.5. Poultry

- 7.1.3.6. Other Animal Types

- 7.1.1. By Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. By Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti-infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. By Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.3. By Animal Type

- 8.1.3.1. Dogs and Cats

- 8.1.3.2. Horses

- 8.1.3.3. Ruminants

- 8.1.3.4. Swine

- 8.1.3.5. Poultry

- 8.1.3.6. Other Animal Types

- 8.1.1. By Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Merck & Co Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dechra Pharmaceuticals PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Boehringer Ingelheim GmbH & Co KG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Vetoquinol S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Idexx Laboratories*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bimeda Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ceva Sante Animale

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Neogen Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Elanco Animal Health Incorporated

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Zoetis Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Merck & Co Inc

List of Figures

- Figure 1: North America Veterinary Healthcare Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Veterinary Healthcare Market Share (%) by Company 2025

List of Tables

- Table 1: North America Veterinary Healthcare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Veterinary Healthcare Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Veterinary Healthcare Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Veterinary Healthcare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America Veterinary Healthcare Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Veterinary Healthcare Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Veterinary Healthcare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: North America Veterinary Healthcare Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Veterinary Healthcare Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Veterinary Healthcare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: North America Veterinary Healthcare Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Veterinary Healthcare Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Veterinary Healthcare Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the North America Veterinary Healthcare Market?

Key companies in the market include Merck & Co Inc, Dechra Pharmaceuticals PLC, Boehringer Ingelheim GmbH & Co KG, Vetoquinol S A, Idexx Laboratories*List Not Exhaustive, Bimeda Inc, Ceva Sante Animale, Neogen Corporation, Elanco Animal Health Incorporated, Zoetis Inc.

3. What are the main segments of the North America Veterinary Healthcare Market?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Initiatives by Governments and Animal Welfare Associations; Increasing Productivity at the Risk of Emerging Zoonosis.

6. What are the notable trends driving market growth?

The Vaccine Segment is Anticipated to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Veterinarians; High Costs Associated With Animal Healthcare.

8. Can you provide examples of recent developments in the market?

May 2022: Ceva Santé Animale (Ceva) acquired the Canadian oral rabies vaccine manufacturer Artemis Technologies, Inc. With this acquisition, Ceva will expand its presence in the segment to North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Veterinary Healthcare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Veterinary Healthcare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Veterinary Healthcare Market?

To stay informed about further developments, trends, and reports in the North America Veterinary Healthcare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence