Key Insights

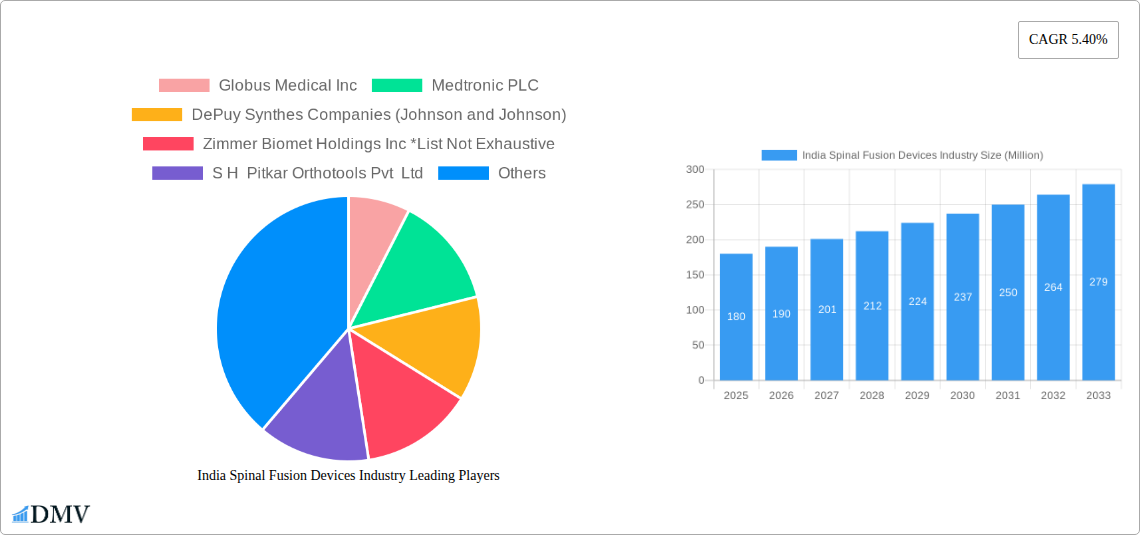

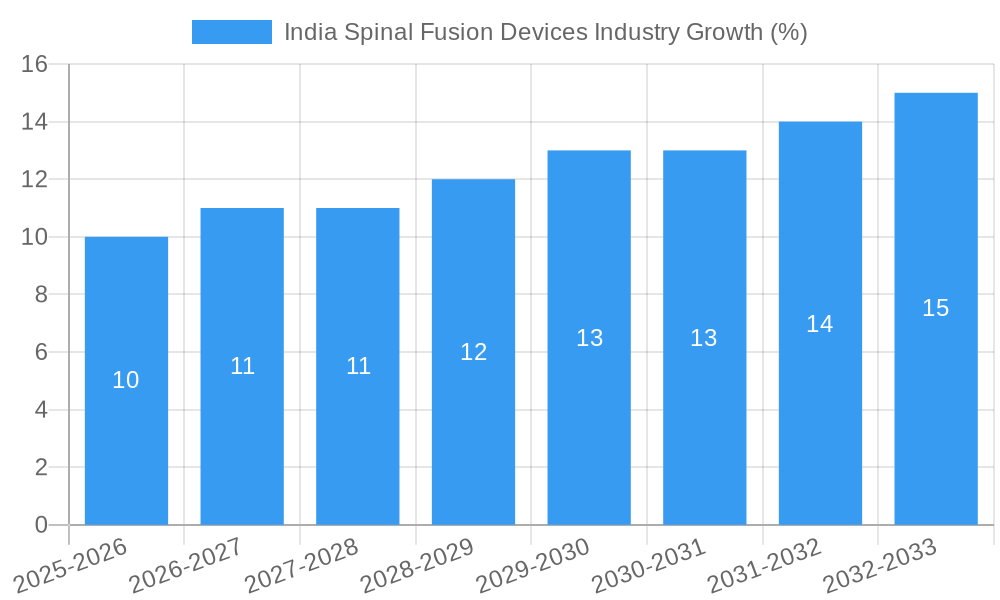

The India spinal fusion devices market, valued at approximately ₹1500 crore (approximately $180 million USD) in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.40% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of degenerative spine diseases like osteoarthritis and spondylitis, coupled with an aging population, fuels increased demand for spinal fusion surgeries. Furthermore, a growing awareness of minimally invasive surgical techniques (MISS) and their associated benefits, such as reduced recovery times and smaller incisions, is significantly impacting market dynamics. Technological advancements in spinal implant design, leading to improved biocompatibility and durability, also contribute to market growth. While the market faces constraints such as high procedure costs potentially limiting access for a significant portion of the population and the availability of skilled surgeons, particularly in rural areas, the overall outlook remains positive. The segmented market, encompassing devices for cervical, thoracic, and lumbar fusion, alongside open and minimally invasive surgical approaches, presents diverse opportunities for market players. Lumbar fusion devices currently hold the largest segment share, reflective of the higher prevalence of lumbar spine disorders. The adoption of MISS is expected to see significant growth over the forecast period, further stimulating market expansion.

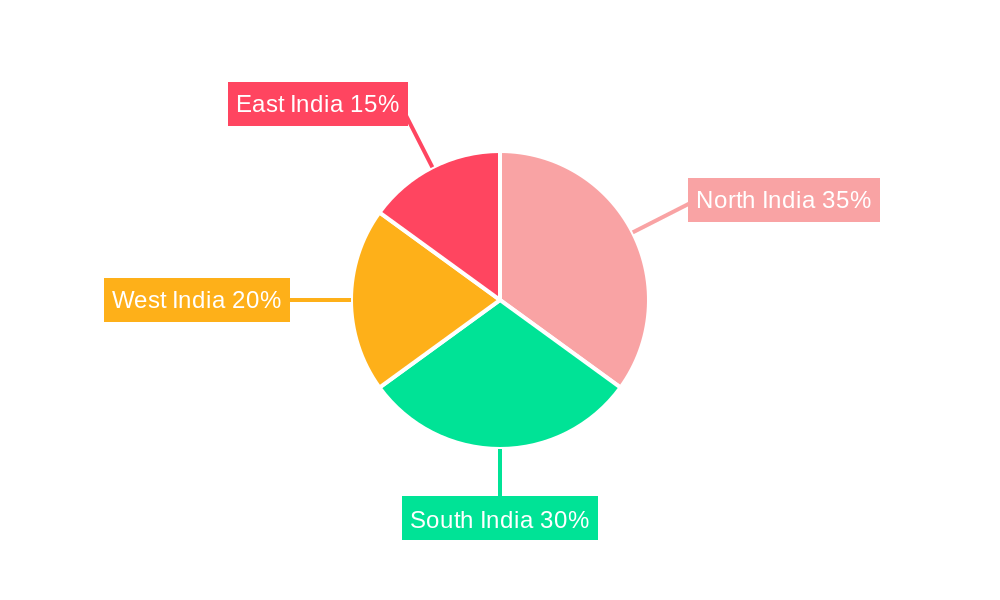

The leading players in this market include multinational corporations like Globus Medical Inc., Medtronic PLC, DePuy Synthes (Johnson & Johnson), and Zimmer Biomet Holdings Inc., alongside domestic players such as S H Pitkar Orthotools Pvt Ltd and Matrix Meditec Pvt Ltd. These companies are strategically investing in research and development, expanding their product portfolios, and forging collaborations to enhance their market position. The regional distribution of the market reveals notable variations in growth potential across North, South, East, and West India, with higher demand anticipated in regions with greater access to advanced healthcare infrastructure and higher disposable incomes. The significant growth trajectory and diverse market segments indicate attractive prospects for continued investment and expansion within the India spinal fusion devices market.

India Spinal Fusion Devices Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India Spinal Fusion Devices market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an indispensable resource for stakeholders seeking to navigate this dynamic sector. The Indian spinal fusion devices market is projected to reach xx Million by 2033, driven by factors such as rising prevalence of spinal disorders, increasing geriatric population, and growing adoption of minimally invasive surgical techniques.

India Spinal Fusion Devices Industry Market Composition & Trends

This section delves into the intricate landscape of the Indian spinal fusion devices market, evaluating key aspects influencing its growth and evolution. We analyze market concentration, revealing the market share distribution among leading players like Globus Medical Inc, Medtronic PLC, DePuy Synthes Companies (Johnson & Johnson), Zimmer Biomet Holdings Inc, S H Pitkar Orthotools Pvt Ltd, and Matrix Meditec Pvt Ltd (List Not Exhaustive). We explore the innovation drivers, such as advancements in minimally invasive surgery and biomaterials, impacting the market dynamics. The regulatory landscape's role in shaping market access and product approvals is meticulously examined. Furthermore, the report assesses the impact of substitute products and analyzes the changing end-user profiles—hospitals, surgical centers, and clinics. Finally, it investigates the M&A activities within the sector, including deal values and their implications for market consolidation. The market share distribution in 2025 is estimated as follows: Medtronic PLC (25%), Johnson & Johnson (20%), Zimmer Biomet (15%), Globus Medical (10%), others (30%). M&A deal values in the historical period (2019-2024) totaled approximately xx Million.

India Spinal Fusion Devices Industry Evolution

This section provides a detailed chronological analysis of the India spinal fusion devices market's evolution from 2019 to 2033. We examine market growth trajectories, highlighting periods of significant expansion and contraction. Technological advancements, such as the introduction of novel biomaterials and minimally invasive surgical techniques, are analyzed for their impact on market penetration and adoption rates. The report also tracks shifting consumer demands, focusing on the preferences of surgeons and patients for specific device types and surgical approaches. Data points such as compound annual growth rates (CAGR) for various segments during the historical and forecast periods will be provided, along with adoption metrics for specific technologies like 3D-printed implants and robotic-assisted surgery. For instance, the adoption rate of minimally invasive spine surgery is projected to increase by xx% from 2025 to 2033. The market experienced a CAGR of xx% during 2019-2024 and is projected to grow at a CAGR of xx% during 2025-2033.

Leading Regions, Countries, or Segments in India Spinal Fusion Devices Industry

This section identifies the dominant regions, countries, or segments within the Indian spinal fusion devices market. We analyze market performance across different geographical areas and various device types (Cervical Fusion Device, Thoracic Fusion Device, Lumbar Fusion Device) and surgical approaches (Open Spine Surgery, Minimally Invasive Spine Surgery).

- Key Drivers for Dominance:

- Lumbar Fusion Devices: High prevalence of lumbar spinal stenosis and degenerative disc disease.

- Minimally Invasive Spine Surgery: Growing surgeon preference due to reduced trauma and faster patient recovery times.

- Metropolitan Areas: Higher concentration of specialized hospitals and surgical centers.

The dominance of the lumbar fusion device segment is attributed to the high prevalence of age-related spinal degeneration in India's growing elderly population. The increasing adoption of minimally invasive spine surgery is driven by its advantages in terms of reduced patient trauma and shorter recovery periods. Furthermore, the concentration of specialized spinal care facilities in metropolitan areas contributes to higher market penetration in these regions. Investment in healthcare infrastructure and favorable regulatory policies further fuel the growth of these segments.

India Spinal Fusion Devices Industry Product Innovations

This section showcases recent product innovations in the Indian spinal fusion devices market. Advancements in biomaterials, such as the development of more biocompatible and osteoconductive materials, have led to improved implant integration and reduced complications. The introduction of 3D-printed implants allows for customized designs tailored to individual patient anatomy. Furthermore, the integration of smart technologies, such as sensors for monitoring implant stability, promises enhanced patient outcomes. These innovations are associated with improved osseointegration rates, reduced complication rates, and better long-term clinical outcomes. Unique selling propositions include enhanced biocompatibility, customized designs, and integrated monitoring capabilities.

Propelling Factors for India Spinal Fusion Devices Industry Growth

Several factors contribute to the growth of the India spinal fusion devices market. Technological advancements, such as minimally invasive surgical techniques and the development of advanced biomaterials, are key drivers. The increasing prevalence of spinal disorders, coupled with a rising geriatric population, fuels demand for spinal fusion procedures. Government initiatives to improve healthcare infrastructure and favorable regulatory policies further stimulate market expansion. Moreover, rising disposable incomes and increasing healthcare expenditure contribute to the growth of the market.

Obstacles in the India Spinal Fusion Devices Industry Market

Despite the positive growth outlook, the Indian spinal fusion devices market faces several challenges. High costs associated with spinal fusion surgeries can limit accessibility for a significant portion of the population. Strict regulatory approvals and reimbursement processes can create delays in product launches. Supply chain disruptions and the dependence on imports of certain components pose risks to market stability. Intense competition among established and emerging players also presents a significant challenge. These factors result in limited market penetration and high costs, affecting market growth.

Future Opportunities in India Spinal Fusion Devices Industry

The Indian spinal fusion devices market presents several promising opportunities. The increasing adoption of minimally invasive surgical techniques offers significant potential for market expansion. The rising prevalence of spinal disorders among younger populations creates a new patient segment. Technological advancements, such as robotic-assisted surgery, and the development of novel biomaterials present new opportunities for innovation and market differentiation. Expansion into underserved regions and untapped markets can further drive growth. These trends will fuel the growth of the market significantly.

Major Players in the India Spinal Fusion Devices Industry Ecosystem

- Globus Medical Inc

- Medtronic PLC

- DePuy Synthes Companies (Johnson & Johnson)

- Zimmer Biomet Holdings Inc

- S H Pitkar Orthotools Pvt Ltd

- Matrix Meditec Pvt Ltd

Key Developments in India Spinal Fusion Devices Industry Industry

- January 2023: Medtronic PLC launches a new minimally invasive spinal fusion system in India.

- March 2022: Globus Medical Inc. secures regulatory approval for a novel biomaterial-based spinal implant.

- June 2021: A strategic partnership is formed between DePuy Synthes and a local Indian distributor to enhance market penetration.

Strategic India Spinal Fusion Devices Industry Market Forecast

The Indian spinal fusion devices market is poised for continued growth, driven by technological advancements, increasing prevalence of spinal disorders, and rising healthcare expenditure. The growing adoption of minimally invasive procedures and the development of advanced biomaterials will further propel market expansion. The increasing focus on improving healthcare access in underserved regions presents significant untapped potential. These factors indicate a highly promising future for the market.

India Spinal Fusion Devices Industry Segmentation

-

1. Type

- 1.1. Cervical Fusion Device

- 1.2. Thoracic Fusion Device

- 1.3. Lumbar Fusion Device

-

2. Surgery

- 2.1. Open Spine Surgery

- 2.2. Minimally Invasive Spine Surgery

India Spinal Fusion Devices Industry Segmentation By Geography

- 1. India

India Spinal Fusion Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Aging Population in India; Rising Incidences and Prevalence of Spinal Problems; Rising Medical Tourism

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Issues; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Minimally Invasive Spine Surgery is Expected to Register a Healthy Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cervical Fusion Device

- 5.1.2. Thoracic Fusion Device

- 5.1.3. Lumbar Fusion Device

- 5.2. Market Analysis, Insights and Forecast - by Surgery

- 5.2.1. Open Spine Surgery

- 5.2.2. Minimally Invasive Spine Surgery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Globus Medical Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Medtronic PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DePuy Synthes Companies (Johnson and Johnson)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zimmer Biomet Holdings Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 S H Pitkar Orthotools Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Matrix Meditec Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Globus Medical Inc

List of Figures

- Figure 1: India Spinal Fusion Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Spinal Fusion Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: India Spinal Fusion Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Spinal Fusion Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Spinal Fusion Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Spinal Fusion Devices Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: India Spinal Fusion Devices Industry Revenue Million Forecast, by Surgery 2019 & 2032

- Table 6: India Spinal Fusion Devices Industry Volume K Units Forecast, by Surgery 2019 & 2032

- Table 7: India Spinal Fusion Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Spinal Fusion Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 9: India Spinal Fusion Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Spinal Fusion Devices Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 11: North India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: South India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: East India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: West India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: India Spinal Fusion Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: India Spinal Fusion Devices Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 21: India Spinal Fusion Devices Industry Revenue Million Forecast, by Surgery 2019 & 2032

- Table 22: India Spinal Fusion Devices Industry Volume K Units Forecast, by Surgery 2019 & 2032

- Table 23: India Spinal Fusion Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Spinal Fusion Devices Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Spinal Fusion Devices Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the India Spinal Fusion Devices Industry?

Key companies in the market include Globus Medical Inc, Medtronic PLC, DePuy Synthes Companies (Johnson and Johnson), Zimmer Biomet Holdings Inc *List Not Exhaustive, S H Pitkar Orthotools Pvt Ltd, Matrix Meditec Pvt Ltd.

3. What are the main segments of the India Spinal Fusion Devices Industry?

The market segments include Type, Surgery.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Aging Population in India; Rising Incidences and Prevalence of Spinal Problems; Rising Medical Tourism.

6. What are the notable trends driving market growth?

Minimally Invasive Spine Surgery is Expected to Register a Healthy Growth Rate.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Issues; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Spinal Fusion Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Spinal Fusion Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Spinal Fusion Devices Industry?

To stay informed about further developments, trends, and reports in the India Spinal Fusion Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence