Key Insights

The North American spectator sports market is poised for significant expansion, projected to reach $235.23 billion by 2025. This robust growth is driven by a compound annual growth rate (CAGR) of 6%. Key factors fueling this upward trend include the increasing accessibility of live events through digital platforms and streaming services, leading to enhanced fan engagement and expanded media rights revenue. Strategic merchandising, encompassing licensed apparel and memorabilia, also contributes substantially to the market's value. The burgeoning popularity of fantasy sports and esports is opening new avenues for consumer interaction and revenue generation. While traditional ticket sales remain a primary revenue stream, the growing influence of sponsorships, particularly from major brands targeting specific demographics, is a vital contributor to market expansion. The United States leads the North American market, followed by Canada, with major sports like baseball, basketball, football, and hockey driving diversity and innovation.

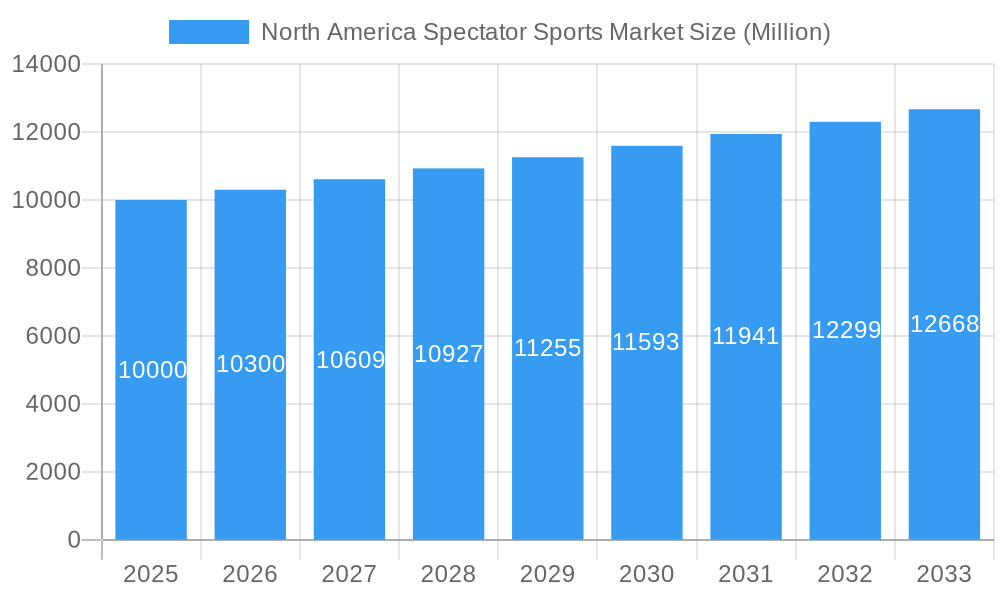

North America Spectator Sports Market Market Size (In Billion)

Despite favorable growth, the market faces challenges such as the impact of economic downturns on consumer spending and intense competition for fan attention and media coverage. Adapting to evolving media consumption habits requires continuous innovation from leagues and teams. The presence of established industry leaders and emerging digital marketing firms highlights the sector's dynamic nature. Future growth will hinge on the successful integration of technology to elevate the fan experience both in-stadium and digitally. Personalized fan experiences and innovative sponsorship models will be critical for navigating future challenges and capitalizing on emerging opportunities. The forecast period from 2025 to 2033 anticipates substantial growth, propelled by ongoing investments in infrastructure and technological advancements aimed at enhancing fan engagement.

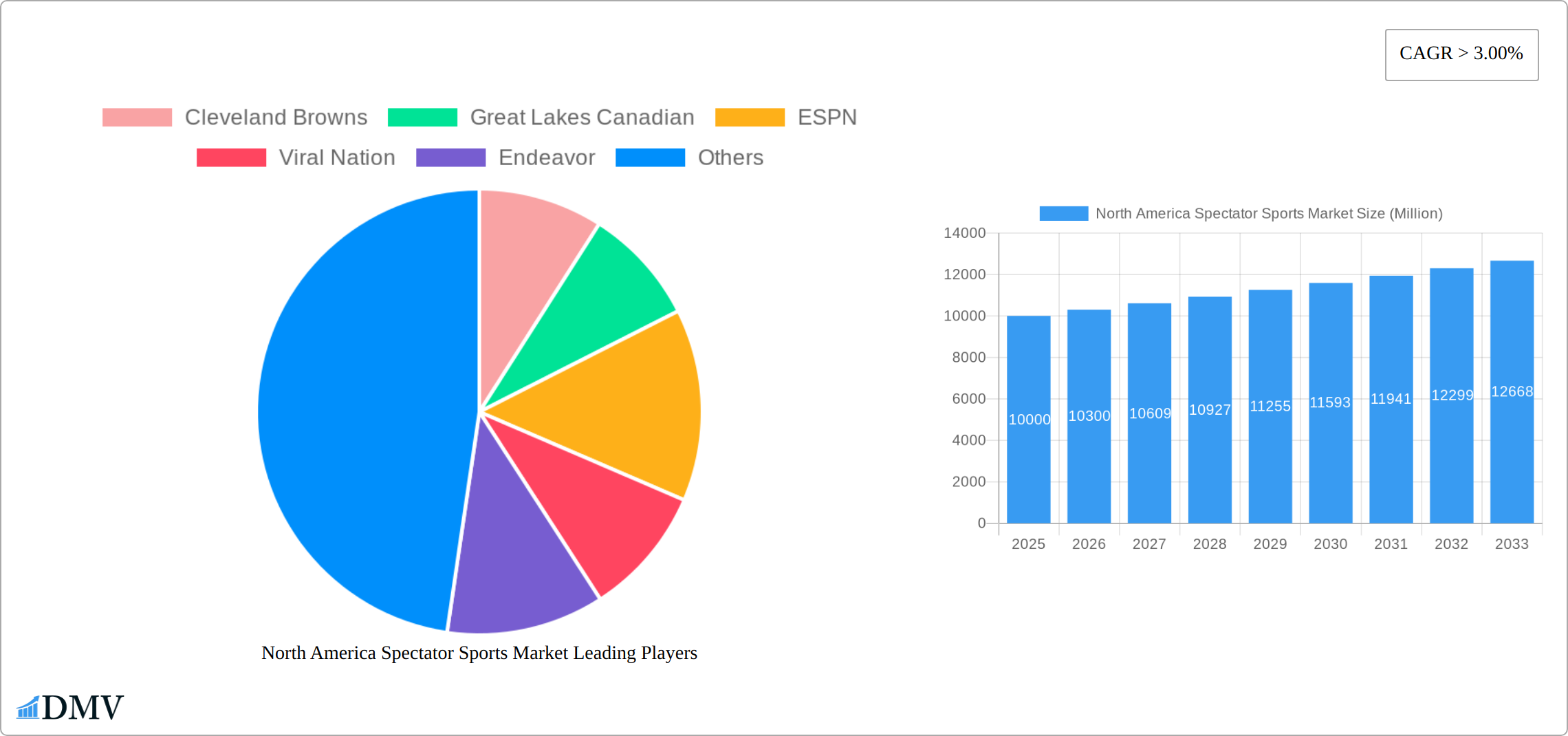

North America Spectator Sports Market Company Market Share

North America Spectator Sports Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America spectator sports market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study offers invaluable insights for stakeholders seeking to understand market trends, growth opportunities, and competitive dynamics within this dynamic sector. The report analyzes key segments including By Revenue Source (Media Rights, Merchandising, Tickets, Sponsorship), By Country (United States, Canada, Rest of North America), and By Sports (Baseball, Basketball, Football, Hockey, Other Sports). The total market value in 2025 is estimated at $xx Million, poised for significant growth in the coming years.

North America Spectator Sports Market Composition & Trends

This section delves into the intricate structure of the North American spectator sports market, evaluating its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a relatively concentrated landscape with a few dominant players, particularly in specific sports and revenue streams. However, the rise of digital platforms and alternative entertainment options presents both challenges and opportunities for traditional players.

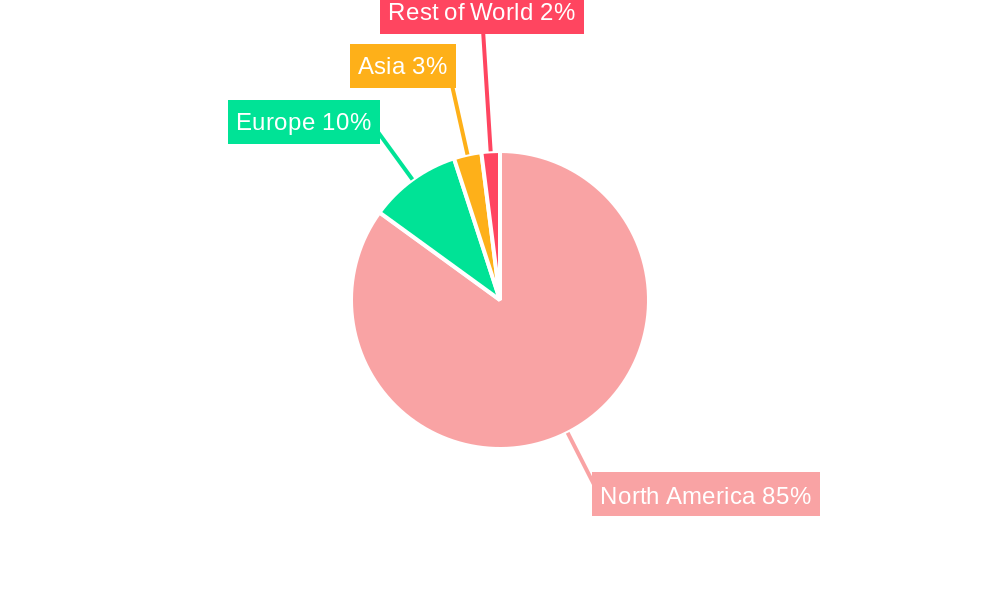

- Market Share Distribution: The United States holds the largest market share, followed by Canada and the Rest of North America. Specific market share figures for each country and segment are detailed within the report, highlighting the dominance of specific sports leagues and teams (e.g., NFL, MLB, NBA).

- M&A Activities: The report analyses significant M&A deals in the historical period (2019-2024) and projected activity for the forecast period. Total deal values are estimated at $xx Million in the historical period with projected increased activity during the forecast period. Key deals involving companies like Endeavor and Wasserman Media are highlighted, showcasing the strategic moves reshaping the industry landscape. These activities reflect a trend towards consolidation and vertical integration within the market.

- Innovation Catalysts: Technological advancements, such as enhanced broadcasting technologies, fan engagement platforms, and data analytics, are driving market innovation. Regulatory changes impacting media rights, sponsorship deals, and player contracts also significantly influence market trends. Competition from alternative forms of entertainment necessitates continuous innovation in the sector.

North America Spectator Sports Market Industry Evolution

This section provides a comprehensive analysis of the market's growth trajectory, analyzing technological advancements, shifting consumer preferences, and evolving industry dynamics. The report illustrates how the market has evolved from 2019 to 2024, providing insights into growth rates and adoption metrics for key technologies and consumer trends. The historical period (2019-2024) witnessed a [growth rate]% Compound Annual Growth Rate (CAGR), and the report projects a [growth rate]% CAGR for the forecast period (2025-2033), driven by factors like increasing media rights revenue, escalating sponsorship deals, and technological advancements improving the fan experience. The influence of changing consumer behaviors, with a growing demand for digital content and immersive fan experiences, is also analyzed. This includes the increasing use of mobile platforms for ticket purchases and engagement with sports content.

Leading Regions, Countries, or Segments in North America Spectator Sports Market

This section identifies the dominant regions, countries, and segments within the North American spectator sports market.

By Revenue Source:

- Media Rights: This segment consistently generates the largest revenue, fueled by lucrative broadcasting contracts and the growing popularity of streaming services.

- Sponsorship: This segment contributes significantly, with corporations investing heavily to associate themselves with popular teams and leagues.

- Tickets: Ticket sales remain a significant revenue stream, though their proportion is potentially decreasing due to factors like the increasing popularity of watching games at home.

- Merchandising: Merchandise sales represent a significant revenue segment, although its growth is dependent on the popularity of specific teams and leagues.

By Country:

- United States: The United States dominates the market, boasting major professional leagues with enormous global appeal. Its larger population, established sports culture, and robust media landscape contribute to its dominance.

- Canada: Canada holds a strong secondary position, supported by its own thriving professional leagues and a passionate sports fanbase.

- Rest of North America: This segment represents a smaller but potentially growing market with opportunities for expansion and development.

By Sport:

- Football (NFL): Football enjoys immense popularity, making it a significant revenue generator through broadcasting rights and merchandise sales.

- Baseball (MLB): Baseball remains a mainstay, although its popularity has seen some fluctuations, influencing its market share.

- Basketball (NBA): Basketball’s popularity continues to rise, especially globally, resulting in robust revenue streams.

- Hockey (NHL): Hockey maintains a dedicated following, particularly in Canada and the northeastern United States.

- Other Sports: This segment encompasses a diverse range of sports, each with their own unique market characteristics and growth potential.

Key drivers for the dominance of certain regions, countries, and segments are discussed, including investment trends, regulatory support, and the cultural significance of specific sports.

North America Spectator Sports Market Product Innovations

Recent innovations focus on enhancing the fan experience, including virtual reality (VR) and augmented reality (AR) technologies, immersive mobile apps, and personalized content delivery. These innovations aim to bridge the gap between in-stadium and at-home viewing experiences, creating engaging and interactive content across all platforms. The focus on data analytics contributes to improved player performance and strategic decision-making for teams and leagues.

Propelling Factors for North America Spectator Sports Market Growth

Several factors propel the growth of the North American spectator sports market, including:

- Technological advancements: Digital platforms are enhancing fan engagement, creating new revenue streams, and optimizing operational efficiency.

- Economic growth: A strong economy fuels increased discretionary spending on entertainment, benefiting the spectator sports industry.

- Favorable regulatory environment: Supportive regulations promote investment and growth, further bolstering market expansion.

Obstacles in the North America Spectator Sports Market

The North American spectator sports market, while robust, navigates a landscape of persistent and evolving challenges. Key obstacles include:

- Evolving Regulatory and Legal Frameworks: Beyond standard media rights, sponsorships, and player contracts, the market grapples with increasingly complex data privacy regulations (e.g., CCPA, GDPR implications for US operations), evolving gambling and sports betting laws, and international trade agreements that can impact cross-border player movement and broadcasting rights. Ensuring compliance across diverse jurisdictions is a significant undertaking.

- Sophisticated Supply Chain Management: While general disruptions remain a concern, the focus is now on building more resilient and agile supply chains. This includes diversifying manufacturing locations, investing in advanced inventory management systems, and exploring on-demand production models for merchandise to mitigate the impact of geopolitical events, labor shortages, and transportation bottlenecks on timely product availability and profitability.

- Hyper-Intense Competition and Shifting Fan Engagement: The competition is not just between leagues and teams, but also from a growing array of alternative entertainment options, including streaming services, esports, and immersive digital experiences. This necessitates a constant re-evaluation of fan engagement strategies, moving beyond traditional offerings to provide dynamic, interactive, and personalized experiences that capture and retain attention in a crowded marketplace.

Future Opportunities in North America Spectator Sports Market

The North American spectator sports market is poised for significant growth, driven by strategic expansion, technological integration, and data-driven insights. Promising future opportunities include:

- Strategic Market Penetration and Diversification: Beyond established markets, opportunities lie in tapping into underserved regions and demographic segments, including rapidly growing urban centers, international fan bases with increasing purchasing power, and the cultivation of new fan demographics through accessible entry points and tailored content. Exploring niche sports and emerging leagues also presents untapped growth potential.

- Immersive Technology Integration and Experiential Innovation: The future is in creating unparalleled fan experiences through the adoption of cutting-edge technologies. This includes leveraging Augmented Reality (AR) and Virtual Reality (VR) for enhanced stadium viewing, interactive training simulations, and virtual fan meet-and-greets. The integration of 5G for seamless real-time content delivery, AI-powered chatbots for fan support, and advanced in-stadium connectivity will further elevate engagement and open lucrative new revenue streams through premium digital offerings and personalized fan journeys.

- Advanced Data Analytics for Hyper-Personalization and Operational Excellence: Harnessing the full potential of data analytics is paramount. This involves moving beyond basic fan segmentation to sophisticated predictive modeling for personalized content recommendations, targeted marketing campaigns, and dynamic pricing strategies. Furthermore, data analytics will be crucial for optimizing team performance, enhancing player development, streamlining operational efficiency across venues, and identifying emerging fan trends to stay ahead of the competitive curve.

Major Players in the North America Spectator Sports Market Ecosystem

- Cleveland Browns

- Great Lakes Canadian

- ESPN

- Viral Nation

- Endeavor

- Wasserman Media

- BC Lions

- Austin FC

- CF Montreal

- US Sports Management

Key Developments in North America Spectator Sports Market Industry

- August 2023: Catena Media significantly expanded its presence in the crucial US sports market by forging a three-year content and commercial media agreement with The Sporting News, a venerable and trusted sports information brand. This partnership aims to leverage Catena Media's expertise in affiliate marketing and audience engagement with The Sporting News' established editorial authority.

- August 2023: Playmaker Capital Inc. bolstered its footprint in the vibrant Quebec sports media landscape with the strategic acquisition of La Poche Bleue. This move is expected to enhance Playmaker Capital's content offerings and audience reach within this key Canadian market, aligning with their broader strategy of consolidating and growing sports media assets.

Strategic North America Spectator Sports Market Forecast

The North American spectator sports market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and a strong economic outlook. The forecast period will witness significant growth across all segments, particularly those leveraging digital technologies and personalized fan experiences. The market's dynamism, coupled with ongoing innovation, ensures that this sector remains an attractive investment and growth opportunity for years to come.

North America Spectator Sports Market Segmentation

-

1. Sports

- 1.1. Baseball

- 1.2. Basketball

- 1.3. Football

- 1.4. Hockey

- 1.5. Other Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

North America Spectator Sports Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Spectator Sports Market Regional Market Share

Geographic Coverage of North America Spectator Sports Market

North America Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sports Event In North America Driving The Market

- 3.3. Market Restrains

- 3.3.1. A Large number of sports fan engagement is limited to a few sports

- 3.4. Market Trends

- 3.4.1. Rising Sports Viewership Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 5.1.1. Baseball

- 5.1.2. Basketball

- 5.1.3. Football

- 5.1.4. Hockey

- 5.1.5. Other Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleveland Browns

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Great Lakes Canadian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ESPN

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viral Nation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Endeavor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wasserman Media

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BC Lions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Austin FC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CF Montreal

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Sports Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cleveland Browns

List of Figures

- Figure 1: North America Spectator Sports Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Spectator Sports Market Share (%) by Company 2025

List of Tables

- Table 1: North America Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 2: North America Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 5: North America Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: North America Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Spectator Sports Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Spectator Sports Market?

Key companies in the market include Cleveland Browns, Great Lakes Canadian, ESPN, Viral Nation, Endeavor, Wasserman Media, BC Lions, Austin FC, CF Montreal, US Sports Management.

3. What are the main segments of the North America Spectator Sports Market?

The market segments include Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 235.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Sports Event In North America Driving The Market.

6. What are the notable trends driving market growth?

Rising Sports Viewership Driving The Market.

7. Are there any restraints impacting market growth?

A Large number of sports fan engagement is limited to a few sports.

8. Can you provide examples of recent developments in the market?

August 2023: Catena Media entered into a three-year content and commercial media partnership with The Sporting News, existing as a sports publisher brand in the United States. The agreement centers primarily on the United States, where The Sporting News has a national presence with a large audience across multiple sports. Under the agreement, Catena Media will create dedicated digital content for sports, casino gaming, and fantasy sports audiences for Sporting News.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Spectator Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Spectator Sports Market?

To stay informed about further developments, trends, and reports in the North America Spectator Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence