Key Insights

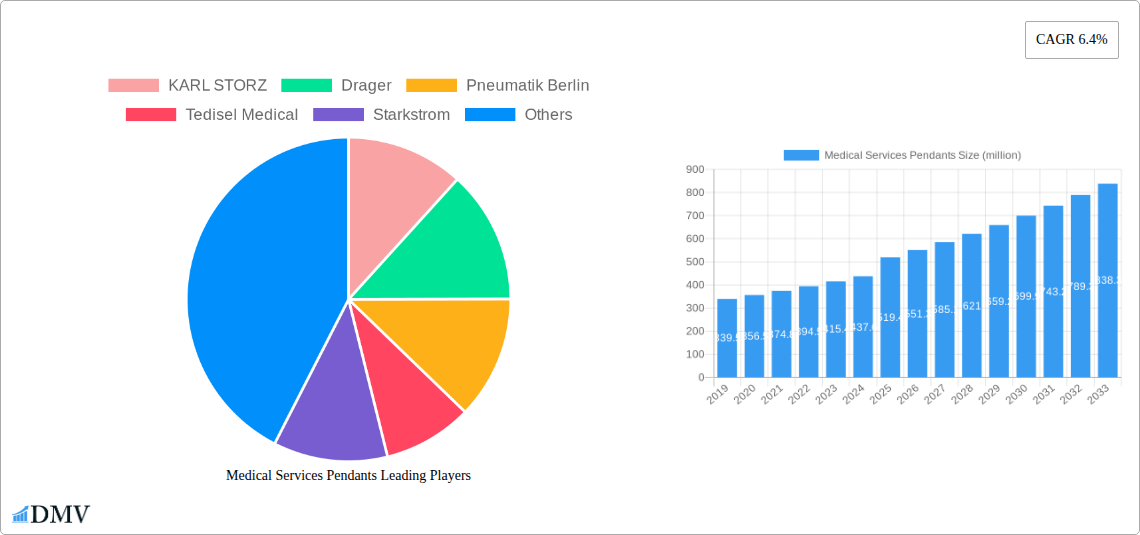

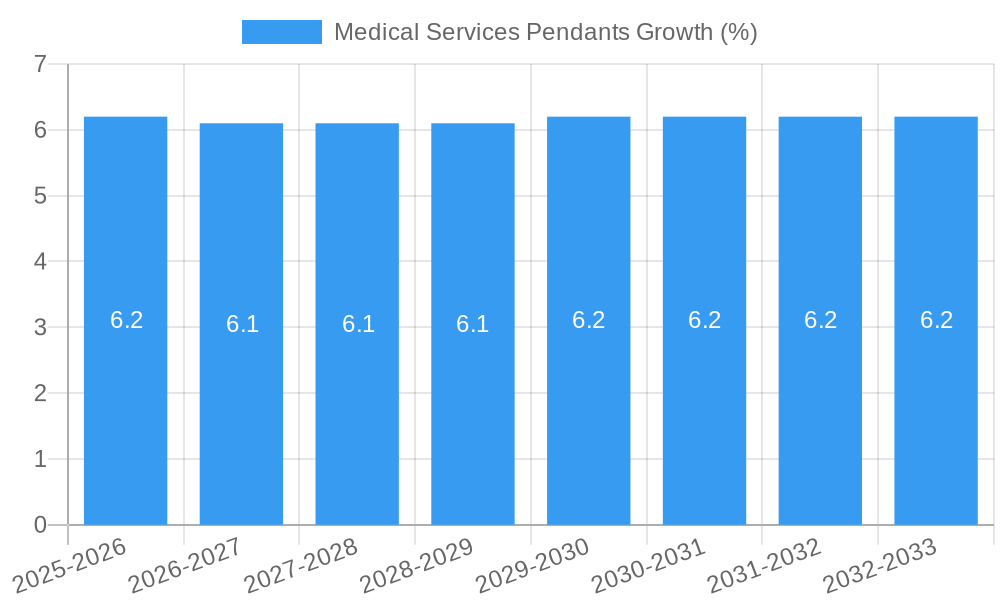

The global Medical Services Pendants market is poised for robust expansion, projected to reach a substantial USD 519.4 million in 2025 with a compelling Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This growth is primarily fueled by the increasing demand for advanced healthcare infrastructure, particularly in operating rooms and intensive care units (ICUs), where these essential medical equipment are indispensable for efficient patient care and surgical procedures. The trend towards technologically advanced surgical suites and the rising complexity of medical interventions necessitate integrated solutions that pendants provide, offering organized access to vital medical gases, electrical outlets, and data ports. Furthermore, the growing emphasis on patient safety and infection control protocols in healthcare settings directly supports the adoption of these pendants, which help streamline workflows and minimize the risk of contamination.

Key growth drivers include the continuous innovation in pendant design, incorporating features like enhanced maneuverability, integrated lighting, and digital connectivity to support the evolving needs of modern healthcare facilities. The expansion of healthcare services, especially in emerging economies, and the increasing investment in upgrading existing medical infrastructure are also significant catalysts for market expansion. While the market demonstrates strong upward momentum, potential restraints such as high initial investment costs for advanced pendant systems and the need for skilled personnel for installation and maintenance could pose challenges. However, the undeniable benefits in terms of operational efficiency, improved patient outcomes, and enhanced safety are expected to outweigh these concerns, propelling the market forward. The market is segmented into Operating Room, ICU, and Others applications, with Single Arm Pendant Systems and Multi Arm Pendant Systems representing key product types, catering to diverse healthcare needs.

Medical Services Pendants Market: Comprehensive Insights and Forecast (2019-2033)

This in-depth report offers a meticulous analysis of the global Medical Services Pendants market, providing unparalleled insights for stakeholders navigating this dynamic sector. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, major players, key developments, and a strategic forecast. Leveraging high-ranking keywords and precise data, this report is optimized for maximum search visibility and provides actionable intelligence for strategic decision-making.

Medical Services Pendants Market Composition & Trends

The Medical Services Pendants market exhibits a moderate to high level of concentration, with key players like KARL STORZ, Drager, and Maquet holding significant market share, estimated to be between 15% and 20% collectively. Innovation catalysts are primarily driven by the increasing demand for integrated surgical environments and advancements in medical technology, such as robotic surgery and minimally invasive procedures. The regulatory landscape is stringent, with a focus on patient safety and device efficacy, impacting product development and market entry strategies. Substitute products, such as traditional ceiling-mounted equipment, are gradually being phased out in favor of more flexible and ergonomic pendant systems. End-user profiles range from large hospital networks and specialized surgical centers to smaller clinics, each with unique requirements for pendant configurations and functionalities. Merger and acquisition (M&A) activities are a notable trend, with several strategic deals in the past five years aimed at consolidating market presence and expanding product portfolios. For instance, the acquisition of a mid-sized pendant manufacturer by a leading medical equipment supplier in 2022 was valued at approximately $75 million, signaling a move towards vertical integration. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period. The total market value is estimated to reach over $2,500 million by 2033, from a base value of $1,400 million in 2025.

Medical Services Pendants Industry Evolution

The Medical Services Pendants industry has undergone a profound transformation over the historical period (2019–2024) and is poised for accelerated growth in the coming years. Initially, the market was characterized by the dominance of single-arm pendant systems, primarily utilized in standard surgical settings. However, the escalating complexity of surgical procedures and the growing adoption of advanced medical equipment, including multiple imaging modalities and robotic surgical systems, necessitated the development of more sophisticated, multi-arm pendant solutions. This shift has been a pivotal driver in the industry's evolution. Technological advancements have been central to this progression, with manufacturers increasingly integrating features such as articulated arms, dynamic load-bearing capacities, and integrated gas and electrical outlets. The adoption of modular designs has also become a significant trend, allowing for greater customization and easier maintenance, thereby enhancing operational efficiency in hospitals. Furthermore, the rise of smart hospitals and the increasing emphasis on infection control have spurred innovation in materials and design, leading to more hygienic and easily cleanable pendant surfaces. Consumer demand has also played a crucial role. Surgeons and operating room staff now expect ergonomic designs that minimize physical strain, improve workflow, and provide unobstructed access to patients and equipment. This has pushed manufacturers to invest heavily in research and development, focusing on user-centric designs and intuitive control interfaces. The market size, which stood at approximately $1,200 million in 2019, is projected to reach over $2,500 million by 2033, demonstrating a robust growth trajectory. The CAGR from 2019 to 2033 is estimated to be around 6.5%. The adoption rate of advanced multi-arm pendant systems has seen a substantial increase, from around 30% in 2019 to an estimated 60% by 2025, indicating a clear industry-wide shift towards more comprehensive solutions. The integration of digital technologies, such as real-time monitoring and data management capabilities within pendant systems, is another significant evolutionary step that will continue to shape the market.

Leading Regions, Countries, or Segments in Medical Services Pendants

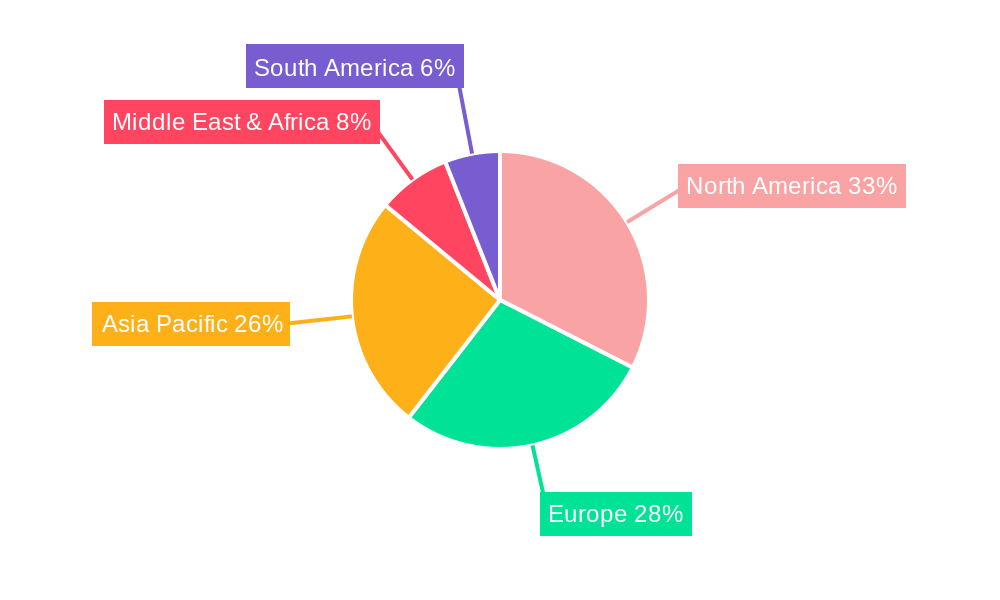

The Operating Room segment, coupled with the dominance of Multi-Arm Pendant Systems, represents the leading edge of the Medical Services Pendants market globally. This dominance is driven by a confluence of factors including intense investment trends in advanced surgical infrastructure, robust regulatory support for state-of-the-art medical facilities, and the inherent benefits these systems offer in complex surgical environments.

Operating Room Dominance:

- High Procedure Volume: Operating rooms globally perform the highest volume of intricate medical procedures, necessitating highly organized and accessible equipment. Medical service pendants provide a centralized hub for essential medical gases, power, and data, optimizing workflow and reducing clutter.

- Technological Integration: The increasing adoption of advanced surgical technologies, such as robotic surgery systems (e.g., Da Vinci), advanced imaging equipment (e.g., C-arms, ultrasound), and sophisticated anesthesia machines, requires extensive power, data, and gas connections. Multi-arm pendants are specifically designed to accommodate the diverse and numerous requirements of these integrated systems.

- Ergonomics and Efficiency: Surgeons and surgical teams prioritize ergonomic design to minimize physical strain and maximize efficiency during long and complex operations. Medical service pendants, particularly those with articulated arms, allow for precise positioning of equipment, ensuring optimal access and visibility for the surgical team.

- Infection Control: The design of modern operating rooms emphasizes infection control. Medical service pendants, with their ability to keep cables and hoses off the floor, contribute significantly to maintaining a sterile environment and simplifying cleaning protocols.

Multi-Arm Pendant System Prevalence:

- Versatility and Scalability: Multi-arm pendant systems offer unparalleled versatility. They can support a wider array of equipment simultaneously compared to single-arm systems, catering to the diverse needs of various surgical specialties, from neurosurgery to cardiology. Their modular nature allows for scalability, enabling hospitals to adapt their setups as technology evolves.

- Reduced Retooling: In dynamic surgical environments, the ability to quickly reconfigure equipment without extensive rewiring or repositioning of fixed infrastructure is crucial. Multi-arm pendants facilitate this by allowing easy attachment and detachment of various medical devices.

- Increased Safety and Reliability: By consolidating and organizing critical utilities, multi-arm pendants reduce the risk of accidental disconnections or cable tangling, thereby enhancing patient and staff safety. The robust construction of these systems ensures reliable performance under demanding conditions.

- Investment in Modern Healthcare Infrastructure: Developed economies, such as North America and Europe, are continuously investing in upgrading their healthcare infrastructure. This includes the widespread adoption of advanced operating rooms equipped with multi-arm medical service pendants. Countries like the United States and Germany are leading in this regard, with an estimated 70% of their new and renovated operating rooms featuring multi-arm pendant systems. The market value for multi-arm pendant systems in operating rooms alone is estimated to be over $1,200 million by 2025.

The forecast period (2025–2033) is expected to see continued growth in the adoption of multi-arm pendant systems within operating rooms, driven by ongoing technological advancements and the global push for more efficient and safer surgical environments. The market share of multi-arm pendants in operating rooms is projected to expand to approximately 75% by 2033.

Medical Services Pendants Product Innovations

Recent product innovations in Medical Services Pendants are focused on enhancing modularity, automation, and integration. Manufacturers are developing pendants with advanced robotic arm articulation, allowing for precise, hands-free positioning of critical equipment and cameras, particularly for minimally invasive procedures. The integration of smart sensors for real-time monitoring of gas supply, power usage, and device status is a growing trend, offering predictive maintenance capabilities and improved operational oversight. Furthermore, enhanced features for cable management, antimicrobial surfaces, and customizable lighting solutions are being incorporated to meet stringent hygiene standards and improve the surgical environment's efficiency and comfort. Performance metrics such as load-bearing capacity (up to 200 kg for robust systems), articulation range (340-degree rotation), and quick-connect utility ports are key differentiators in the current market.

Propelling Factors for Medical Services Pendants Growth

Several key factors are propelling the growth of the Medical Services Pendants market. Firstly, the increasing global demand for advanced surgical procedures, including minimally invasive and robotic surgeries, necessitates sophisticated infrastructure like modern medical service pendants. Secondly, the continuous expansion and upgrading of hospital facilities worldwide, especially in emerging economies, directly drives the demand for these essential medical equipment. Thirdly, government initiatives promoting healthcare infrastructure development and technological adoption further fuel market expansion. Finally, the growing emphasis on improving patient safety and operational efficiency within healthcare settings encourages hospitals to invest in integrated and ergonomic pendant solutions. The market is projected to grow at a CAGR of approximately 6.5% from 2019 to 2033.

Obstacles in the Medical Services Pendants Market

Despite robust growth, the Medical Services Pendants market faces several obstacles. High initial investment costs for advanced pendant systems can be a significant barrier for smaller healthcare facilities or those with limited budgets. Stringent regulatory compliance and certification processes can delay product launches and increase development expenses, estimated to add 10-15% to product costs. Furthermore, supply chain disruptions, particularly for specialized components, can impact production timelines and increase costs, as witnessed during recent global logistics challenges. Intense competition among established players and new entrants also exerts pressure on pricing, potentially impacting profit margins. The market is estimated to be worth $2,500 million by 2033.

Future Opportunities in Medical Services Pendants

Emerging opportunities in the Medical Services Pendants market lie in several key areas. The growing trend towards remote patient monitoring and telehealth creates possibilities for integrated diagnostic and communication modules within pendant systems. Expansion into developing markets with improving healthcare infrastructure offers substantial growth potential. Furthermore, the development of AI-powered pendants that can dynamically adjust equipment positioning based on surgical needs presents a significant technological frontier. The increasing demand for specialized pendants tailored for niche surgical applications, such as outpatient surgery centers and emergency response units, also represents a promising avenue for innovation and market penetration.

Major Players in the Medical Services Pendants Ecosystem

- KARL STORZ

- Drager

- Pneumatik Berlin

- Tedisel Medical

- Starkstrom

- TLV Healthcare

- Novair Medical

- Brandon Medical

- KLS Martin

- MZ Liberec

- AMCAREMED TECHNOLOGY

- Surgiris

- Trumpf

- Maquet

- INMED-Karczewscy

- Johnson Medical

- Heal Force

- Comen

- Shanghai Fepton Medical Equipment

- Ningbo Flow Medical Technology

- Shanghai Zhenghua Medical Equipment

- Shanghai Huifeng Medical Instrument

Key Developments in Medical Services Pendants Industry

- 2022/08: KARL STORZ launches a new line of advanced integrated surgical towers featuring enhanced pendant connectivity for robotic surgery.

- 2021/11: Drager announces a strategic partnership with a leading medical imaging company to integrate advanced imaging capabilities into their pendant systems.

- 2023/04: Tedisel Medical expands its production capacity by 30% to meet growing global demand for its multi-arm pendant solutions.

- 2022/07: Brandon Medical acquires a smaller competitor, strengthening its presence in the UK market for surgical pendants.

- 2023/01: Maquet introduces a new generation of energy and gas pendants with advanced automation features for operating rooms.

- 2021/09: Shanghai Zhenghua Medical Equipment showcases innovative infection control features on its latest pendant designs.

- 2024/03: KLS Martin develops a compact single-arm pendant system optimized for smaller surgical suites and procedure rooms.

- 2023/06: AMCAREMED TECHNOLOGY receives CE certification for its updated line of ICU medical gas pendants.

Strategic Medical Services Pendants Market Forecast

The strategic forecast for the Medical Services Pendants market points towards continued robust growth driven by technological innovation and an increasing global demand for sophisticated healthcare infrastructure. The expansion of multi-arm pendant systems in operating rooms and ICUs, coupled with the integration of smart technologies and automation, will be key growth catalysts. Emerging economies present significant untapped potential, while developed markets will focus on upgrading existing facilities with cutting-edge solutions. The market is projected to reach over $2,500 million by 2033, with a CAGR of approximately 6.5%. The strategic focus for market participants will be on product differentiation, addressing evolving user needs, and navigating the complex regulatory landscape to capitalize on these expanding opportunities.

Medical Services Pendants Segmentation

-

1. Application

- 1.1. Operating Room

- 1.2. ICU

- 1.3. Others

-

2. Types

- 2.1. Single Arm Pendant System

- 2.2. Multi Arm Pendant System

Medical Services Pendants Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Services Pendants REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Operating Room

- 5.1.2. ICU

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Single Arm Pendant System

- 5.2.2. Multi Arm Pendant System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Operating Room

- 6.1.2. ICU

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Single Arm Pendant System

- 6.2.2. Multi Arm Pendant System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Operating Room

- 7.1.2. ICU

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Single Arm Pendant System

- 7.2.2. Multi Arm Pendant System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Operating Room

- 8.1.2. ICU

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Single Arm Pendant System

- 8.2.2. Multi Arm Pendant System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Operating Room

- 9.1.2. ICU

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Single Arm Pendant System

- 9.2.2. Multi Arm Pendant System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Services Pendants Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Operating Room

- 10.1.2. ICU

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Single Arm Pendant System

- 10.2.2. Multi Arm Pendant System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 KARL STORZ

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Drager

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pneumatik Berlin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tedisel Medical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Starkstrom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TLV Healthcare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novair Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Brandon Medical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KLS Martin

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MZ Liberec

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AMCAREMED TECHNOLOGY

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Surgiris

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Trumpf

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maquet

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 INMED-Karczewscy

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Johnson Medical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Heal Force

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Comen

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shanghai Fepton Medical Equipment

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ningbo Flow Medical Technology

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Shanghai Zhenghua Medical Equipment

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Shanghai Huifeng Medical Instrument

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 KARL STORZ

List of Figures

- Figure 1: Global Medical Services Pendants Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Medical Services Pendants Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Medical Services Pendants Revenue (million), by Application 2024 & 2032

- Figure 4: North America Medical Services Pendants Volume (K), by Application 2024 & 2032

- Figure 5: North America Medical Services Pendants Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Medical Services Pendants Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Medical Services Pendants Revenue (million), by Types 2024 & 2032

- Figure 8: North America Medical Services Pendants Volume (K), by Types 2024 & 2032

- Figure 9: North America Medical Services Pendants Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Medical Services Pendants Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Medical Services Pendants Revenue (million), by Country 2024 & 2032

- Figure 12: North America Medical Services Pendants Volume (K), by Country 2024 & 2032

- Figure 13: North America Medical Services Pendants Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medical Services Pendants Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Medical Services Pendants Revenue (million), by Application 2024 & 2032

- Figure 16: South America Medical Services Pendants Volume (K), by Application 2024 & 2032

- Figure 17: South America Medical Services Pendants Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Medical Services Pendants Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Medical Services Pendants Revenue (million), by Types 2024 & 2032

- Figure 20: South America Medical Services Pendants Volume (K), by Types 2024 & 2032

- Figure 21: South America Medical Services Pendants Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Medical Services Pendants Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Medical Services Pendants Revenue (million), by Country 2024 & 2032

- Figure 24: South America Medical Services Pendants Volume (K), by Country 2024 & 2032

- Figure 25: South America Medical Services Pendants Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Medical Services Pendants Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Medical Services Pendants Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Medical Services Pendants Volume (K), by Application 2024 & 2032

- Figure 29: Europe Medical Services Pendants Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Medical Services Pendants Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Medical Services Pendants Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Medical Services Pendants Volume (K), by Types 2024 & 2032

- Figure 33: Europe Medical Services Pendants Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Medical Services Pendants Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Medical Services Pendants Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Medical Services Pendants Volume (K), by Country 2024 & 2032

- Figure 37: Europe Medical Services Pendants Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Medical Services Pendants Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Medical Services Pendants Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Medical Services Pendants Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Medical Services Pendants Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Medical Services Pendants Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Medical Services Pendants Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Medical Services Pendants Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Medical Services Pendants Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Medical Services Pendants Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Medical Services Pendants Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Medical Services Pendants Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Medical Services Pendants Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Medical Services Pendants Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Medical Services Pendants Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Medical Services Pendants Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Medical Services Pendants Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Medical Services Pendants Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Medical Services Pendants Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Medical Services Pendants Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Medical Services Pendants Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Medical Services Pendants Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Medical Services Pendants Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Medical Services Pendants Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Medical Services Pendants Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Medical Services Pendants Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Services Pendants Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Services Pendants Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Medical Services Pendants Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Medical Services Pendants Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Medical Services Pendants Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Medical Services Pendants Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Medical Services Pendants Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Medical Services Pendants Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Medical Services Pendants Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Medical Services Pendants Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Medical Services Pendants Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Medical Services Pendants Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Medical Services Pendants Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Medical Services Pendants Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Medical Services Pendants Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Medical Services Pendants Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Medical Services Pendants Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Medical Services Pendants Volume K Forecast, by Country 2019 & 2032

- Table 81: China Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Medical Services Pendants Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Medical Services Pendants Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Services Pendants?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Medical Services Pendants?

Key companies in the market include KARL STORZ, Drager, Pneumatik Berlin, Tedisel Medical, Starkstrom, TLV Healthcare, Novair Medical, Brandon Medical, KLS Martin, MZ Liberec, AMCAREMED TECHNOLOGY, Surgiris, Trumpf, Maquet, INMED-Karczewscy, Johnson Medical, Heal Force, Comen, Shanghai Fepton Medical Equipment, Ningbo Flow Medical Technology, Shanghai Zhenghua Medical Equipment, Shanghai Huifeng Medical Instrument.

3. What are the main segments of the Medical Services Pendants?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 519.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Services Pendants," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Services Pendants report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Services Pendants?

To stay informed about further developments, trends, and reports in the Medical Services Pendants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence