Key Insights

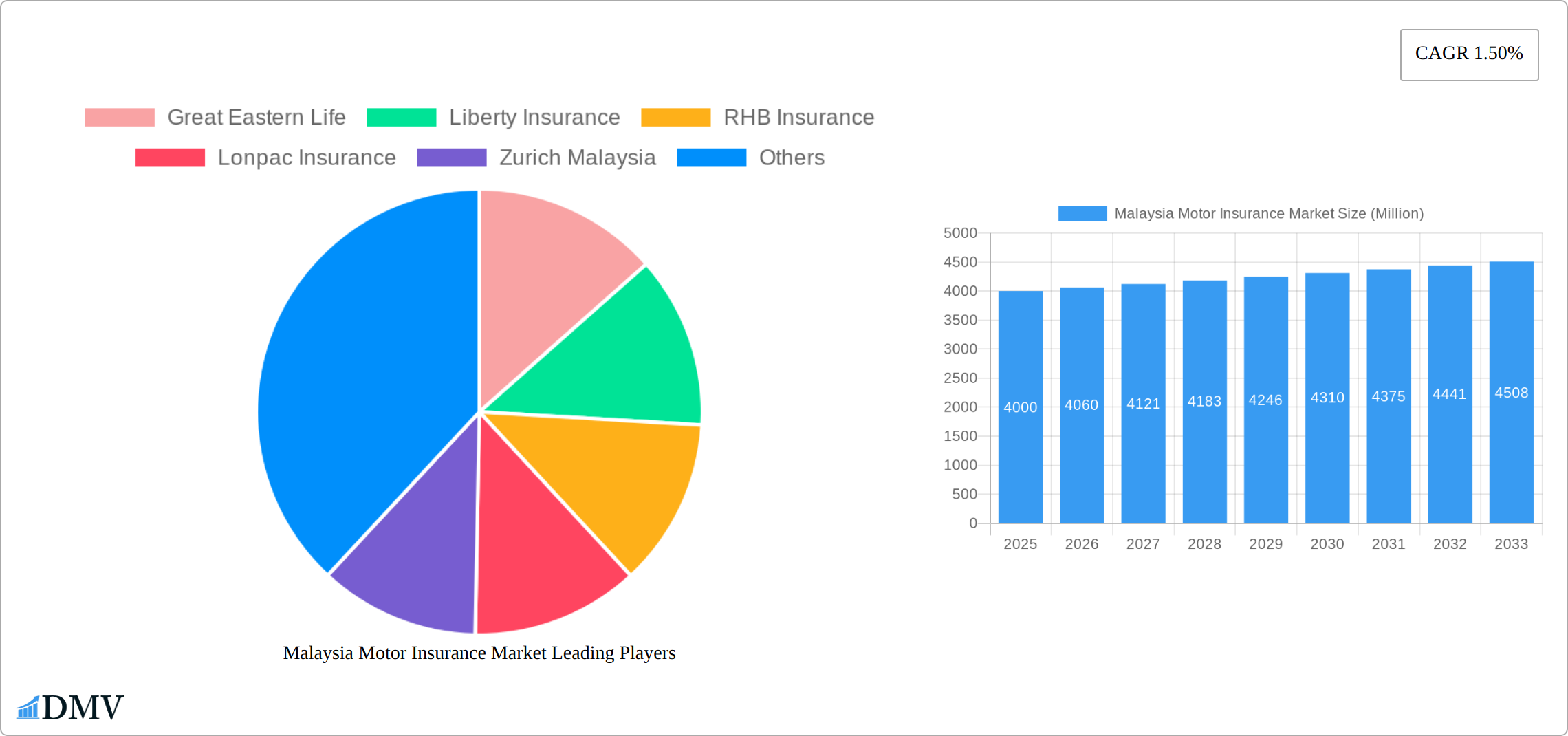

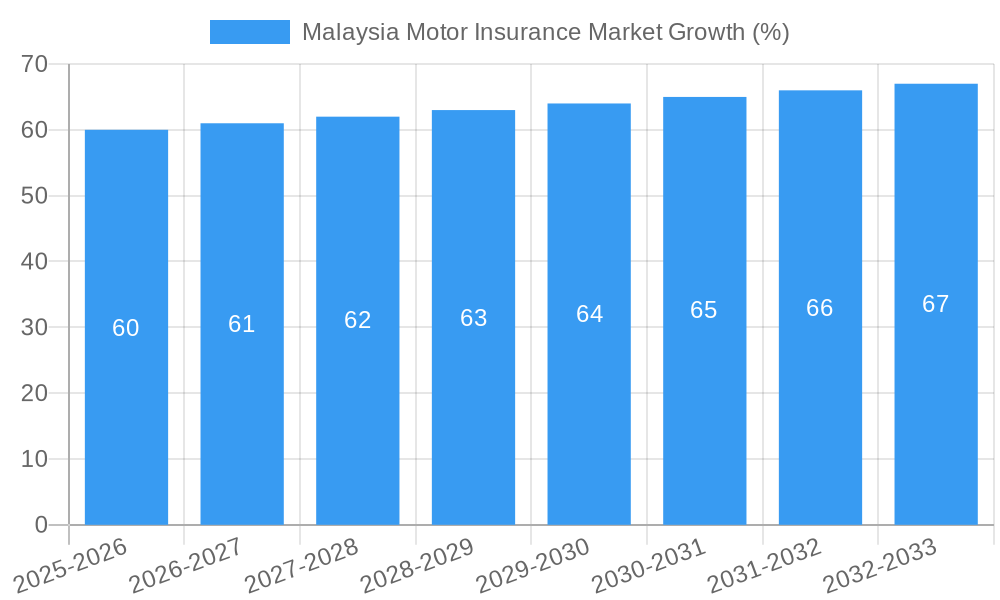

The Malaysia motor insurance market, valued at approximately RM 4 billion (estimated based on typical market size for a Southeast Asian nation with similar economic indicators) in 2025, is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 1.50% from 2025 to 2033. This growth is fueled by several key drivers. The increasing number of vehicles on Malaysian roads, driven by a growing middle class and expanding economy, significantly contributes to the market's expansion. Furthermore, rising awareness of the importance of insurance coverage and stricter government regulations enforcing compulsory insurance are bolstering market demand. Technological advancements, such as the adoption of telematics and online insurance platforms, are streamlining processes and improving customer experience, further propelling market growth. However, the market faces challenges like intense competition among established players and the rising cost of claims due to increasing repair expenses and traffic accidents. The market is segmented by distribution channels (agents, brokers, banks, online, others) and insurance types (third-party liability and comprehensive), with a significant portion of the market being held by established players like Great Eastern Life, Liberty Insurance, RHB Insurance, and others. The market also includes players in the Takaful sector, catering to the Muslim population's specific insurance needs.

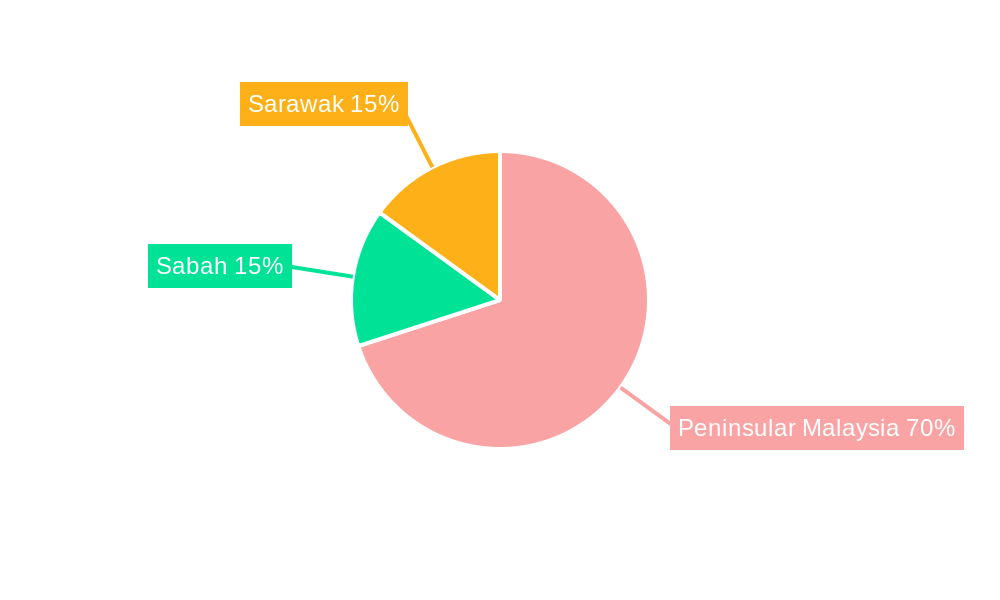

The segment analysis reveals that online distribution channels are experiencing rapid growth, reflecting evolving consumer preferences and the convenience of digital platforms. The comprehensive insurance segment generally commands higher premiums than third-party liability, reflecting its broader coverage. Regional variations within Malaysia exist, with higher vehicle density in urban areas leading to increased demand in these regions. Future growth will depend on factors such as economic stability, regulatory changes, and the successful adoption of innovative technologies within the insurance sector. The competitive landscape indicates a need for insurers to focus on strategic partnerships, product differentiation, and enhanced customer service to maintain their market share in this dynamic market.

Malaysia Motor Insurance Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the Malaysian motor insurance market, offering invaluable insights for stakeholders from 2019 to 2033. Covering market size, segmentation, competitive landscape, and future trends, this report is an essential resource for strategic planning and investment decisions. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market value in Million is used throughout the report.

Malaysia Motor Insurance Market Composition & Trends

This section dissects the Malaysian motor insurance market's structure, evaluating market concentration, innovation, regulation, substitute products, customer profiles, and mergers and acquisitions (M&A) activity. The market displays a moderately concentrated landscape, with key players commanding significant shares. Innovation is driven by technological advancements in telematics and data analytics, enabling personalized pricing and risk assessment. The regulatory environment, shaped by Bank Negara Malaysia, influences product offerings and operational practices. Substitute products, such as self-insurance schemes for low-risk drivers, exert some competitive pressure.

- Market Share Distribution (2024): Great Eastern Life (xx%), Liberty Insurance (xx%), RHB Insurance (xx%), Lonpac Insurance (xx%), Zurich Malaysia (xx%), Pacific Orient (xx%), MSIG Malaysia (xx%), Takaful IKLHAS (xx%), Takaful Malaysia (xx%), Allianz (xx%). Note: These figures represent estimates based on available market data.

- M&A Activity (2019-2024): A total estimated value of xx Million was involved in M&A transactions within the Malaysian motor insurance sector during this period. Specific deal details are analyzed within the report.

- End-User Profiles: The report details the demographics and risk profiles of various customer segments, influencing insurance product design and pricing strategies.

Malaysia Motor Insurance Market Industry Evolution

This section meticulously charts the evolution of the Malaysian motor insurance market, examining growth trajectories, technological impacts, and evolving consumer preferences. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven by factors such as rising vehicle ownership and increasing awareness of insurance benefits. Technological advancements, particularly the integration of telematics in motor insurance products, have significantly influenced market dynamics. Consumer demands are shifting towards greater personalization, digital convenience, and value-added services. The adoption of online distribution channels is steadily increasing, with xx% of policies sold online in 2024. Further analysis of specific technological advancements and their adoption rates within the Malaysian market is included in the full report.

Leading Regions, Countries, or Segments in Malaysia Motor Insurance Market

This section identifies the dominant segments within the Malaysian motor insurance market, focusing on distribution channels and insurance types. Analysis pinpoints key factors driving this dominance and compares growth potential between segments.

- Distribution Channels:

- Agents: Remain a significant channel, leveraging strong customer relationships.

- Online: Experiencing rapid growth, fueled by increasing internet penetration and consumer preference for digital convenience.

- Brokers: Maintain a strong presence, offering comparative options and expert advice.

- Insurance Types:

- Comprehensive: Displays robust growth, reflecting a rising demand for wider coverage.

- Third-Party Liability: Continues to be the most prevalent type, driven by affordability and regulatory requirements.

Key Drivers: Investment in digital infrastructure, regulatory support for online platforms, and increasing consumer awareness are significant drivers in the growth of the online distribution channel. The expansion of comprehensive insurance is driven by consumer preferences for enhanced protection and the rising cost of vehicle repairs.

Malaysia Motor Insurance Market Product Innovations

The Malaysian motor insurance market showcases continuous product innovation, encompassing telematics-based usage-based insurance (UBI) programs that offer personalized premiums based on driving behavior, and bundled insurance packages incorporating roadside assistance and other value-added services. These innovations aim to cater to evolving consumer preferences and enhance customer experience, using technology to improve risk assessment accuracy and operational efficiency.

Propelling Factors for Malaysia Motor Insurance Market Growth

Growth in the Malaysian motor insurance market is driven by several key factors. The rise in vehicle ownership fueled by economic growth and increasing urbanization directly impacts the demand for motor insurance. Government regulations promoting road safety and mandatory insurance coverage contribute significantly. Finally, technological advancements, including telematics and data analytics, enable innovative product offerings and improved risk management, thereby further stimulating market expansion.

Obstacles in the Malaysia Motor Insurance Market

The Malaysian motor insurance market faces challenges including stringent regulatory requirements that increase operational costs and complexity. The competitive landscape, with numerous players vying for market share, creates pricing pressures. Fraudulent claims pose a significant risk, requiring robust anti-fraud measures. Lastly, economic downturns can impact consumer spending on insurance products.

Future Opportunities in Malaysia Motor Insurance Market

Future growth opportunities include expanding into underserved rural areas, leveraging data analytics for more precise risk assessment and personalized products, and developing innovative insurance products targeting specific customer segments. Further growth can also be generated by increased utilization of digital technologies for enhanced customer experience and operational efficiency.

Major Players in the Malaysia Motor Insurance Market Ecosystem

- Great Eastern Life

- Liberty Insurance

- RHB Insurance

- Lonpac Insurance

- Zurich Malaysia

- Pacific Orient

- MSIG Malaysia

- Takaful IKLHAS

- Takaful Malaysia

- Allianz

Key Developments in Malaysia Motor Insurance Market Industry

- December 2022: The General Insurance Association of Malaysia (PIAM) and Malaysian Takaful Association (MTA) launched the PIAM-MTA 2022 nationwide Road Safety Campaign.

- 2022: Etiqa General Insurance Bhd and Syarikat Takaful Malaysia Am Bhd (Takaful Malaysia) won the Motor Insurance and Takaful Award 2021/22.

Strategic Malaysia Motor Insurance Market Forecast

The Malaysian motor insurance market is poised for sustained growth over the forecast period (2025-2033). Continued economic expansion, rising vehicle ownership, and technological advancements will drive market expansion. The increasing adoption of digital distribution channels and the development of innovative insurance products will further contribute to market growth. The market is expected to experience a CAGR of xx% during this period.

Malaysia Motor Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Third Party Liability

- 1.2. Comprehensive

-

2. Distribution channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Malaysia Motor Insurance Market Segmentation By Geography

- 1. Malaysia

Malaysia Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Motor Vehicles In The Region; Increasing competition among the players decreasing insurance price.

- 3.3. Market Restrains

- 3.3.1. Fluctuating Inflation Rate affecting sales of Motor vehicle; Negative Impact of Covid On per capita Income in Malaysia

- 3.4. Market Trends

- 3.4.1. Phase Liberalization Of The Industry And New Insurance Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Third Party Liability

- 5.1.2. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. China Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. India Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Great Eastern Life

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Liberty Insurance

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 RHB Insurance

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Lonpac Insurance

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Zurich Malaysia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pacific Orient

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 MSIG Malaysia**List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Takaful IKLHAS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Takaful Malaysia

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Allianz

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Great Eastern Life

List of Figures

- Figure 1: Malaysia Motor Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Motor Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Motor Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Malaysia Motor Insurance Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: Malaysia Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Malaysia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Malaysia Motor Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 14: Malaysia Motor Insurance Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 15: Malaysia Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Motor Insurance Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Malaysia Motor Insurance Market?

Key companies in the market include Great Eastern Life, Liberty Insurance, RHB Insurance, Lonpac Insurance, Zurich Malaysia, Pacific Orient, MSIG Malaysia**List Not Exhaustive, Takaful IKLHAS, Takaful Malaysia, Allianz.

3. What are the main segments of the Malaysia Motor Insurance Market?

The market segments include Insurance Type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Motor Vehicles In The Region; Increasing competition among the players decreasing insurance price..

6. What are the notable trends driving market growth?

Phase Liberalization Of The Industry And New Insurance Products.

7. Are there any restraints impacting market growth?

Fluctuating Inflation Rate affecting sales of Motor vehicle; Negative Impact of Covid On per capita Income in Malaysia.

8. Can you provide examples of recent developments in the market?

In 2022, the General Insurance Association of Malaysia(PIAM) and Malaysian Takaful Association(MTA) launched the year-long PIAM-MTA 2022 nationwide Road Safety Campaign in Kuala Lumpur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Malaysia Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence