Key Insights

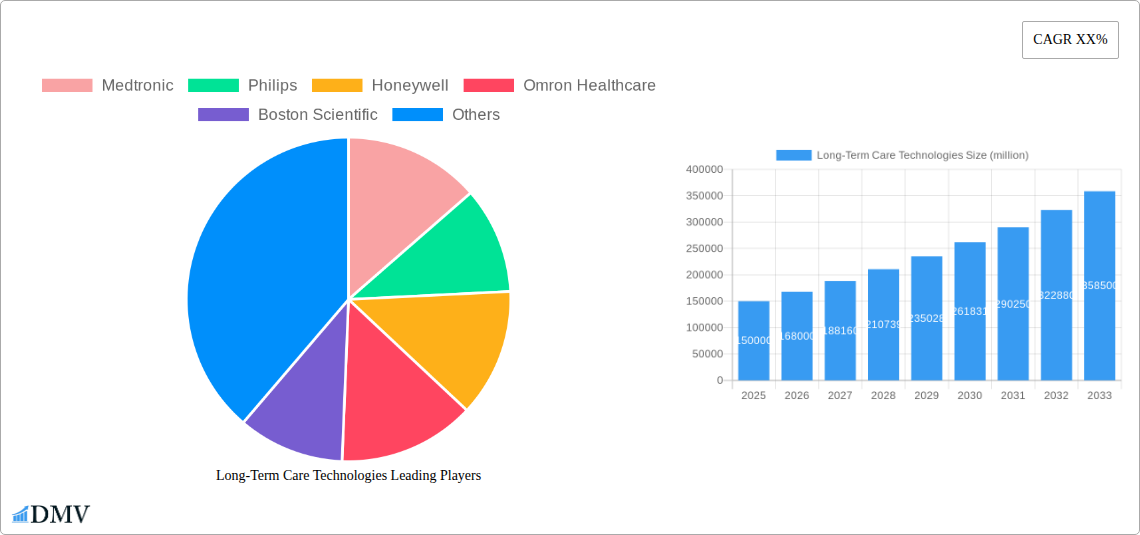

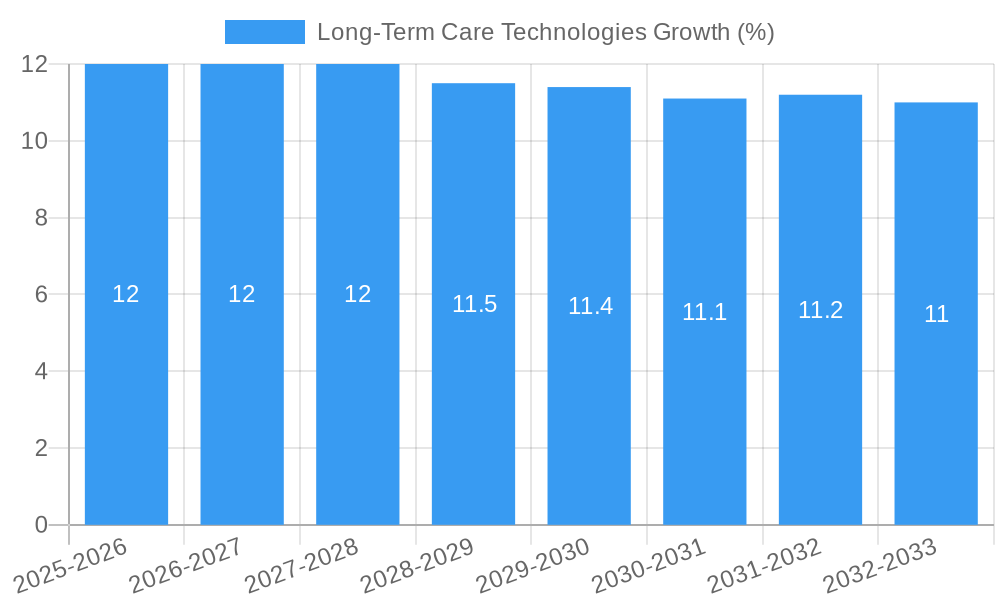

The global Long-Term Care Technologies market is poised for significant expansion, projected to reach a substantial market size of approximately $150,000 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 12% throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating demand for continuous and effective care solutions for aging populations and individuals with chronic conditions. Key drivers include the increasing prevalence of age-related diseases, a growing preference for home-based care, and advancements in remote patient monitoring and telehealth technologies that enhance accessibility and reduce healthcare costs. The market is witnessing a dynamic shift towards more personalized and proactive care, with technologies enabling early detection of health issues and facilitating timely interventions, thereby improving patient outcomes and reducing hospital readmissions.

The market is segmented into diverse applications and types, reflecting the multifaceted needs of long-term care. Hospitals and nursing homes remain significant adopters, leveraging these technologies for enhanced patient management and operational efficiency. However, the home care organization segment is experiencing particularly rapid growth, driven by individuals' desire to maintain independence and comfort in familiar surroundings. Within technology types, Home Telehealth and Safety Monitoring are emerging as dominant forces, offering solutions ranging from vital sign monitoring and medication management to fall detection and emergency alerts. Leading companies like Medtronic, Philips, and Honeywell are at the forefront of innovation, introducing sophisticated devices and platforms that integrate seamlessly into existing care frameworks. Despite this optimistic outlook, restraints such as high initial investment costs for some advanced technologies and data privacy concerns could present challenges, though ongoing technological advancements and supportive government initiatives are expected to mitigate these factors, ensuring continued market momentum.

Long-Term Care Technologies Market Composition & Trends

The global Long-Term Care Technologies market is poised for significant expansion, driven by an aging global population and increasing demand for innovative solutions that enhance quality of life for individuals requiring ongoing care. Market concentration is moderate, with leading players like Medtronic, Philips, Honeywell, Omron Healthcare, Boston Scientific, and Biotronik vying for market share. Innovation catalysts are abundant, fueled by advancements in AI, IoT, wearable devices, and remote patient monitoring. The regulatory landscape is evolving, with governments worldwide implementing policies to support the adoption of these technologies and ensure patient safety. Substitute products, while present in traditional care models, are gradually being overshadowed by the efficiency and effectiveness of technological solutions. End-user profiles range from individuals preferring to age in place at home to residents in assisted living facilities and nursing homes, all seeking improved health outcomes and independence. Mergers and acquisitions (M&A) activities are expected to accelerate as companies seek to expand their product portfolios and market reach. For instance, recent M&A deals in the broader healthcare technology sector have reached values in the tens of millions, indicating a strong appetite for strategic consolidation. The market share distribution reflects a dynamic competitive environment, with established giants and agile startups contributing to the evolving ecosystem. The study meticulously analyzes these intricate market dynamics throughout the period of 2019–2033, with the base year set at 2025, offering an unparalleled understanding of the forces shaping the industry.

Long-Term Care Technologies Industry Evolution

The Long-Term Care Technologies industry has witnessed a profound evolution, transforming the way chronic conditions are managed and daily living is supported for the elderly and individuals with disabilities. From the historical period of 2019–2024, we observed the nascent stages of widespread adoption, characterized by a growing awareness of the benefits offered by remote monitoring and assistive devices. As we move into the forecast period of 2025–2033, the trajectory of market growth is projected to be exceptionally robust, with an anticipated Compound Annual Growth Rate (CAGR) of approximately xx%. This accelerated growth is underpinned by significant technological advancements. The integration of artificial intelligence (AI) into diagnostic tools and personalized care plans is revolutionizing patient outcomes. Internet of Things (IoT) connectivity is enabling seamless data flow between devices, caregivers, and healthcare providers, fostering a more proactive and responsive care environment. Wearable sensors, once novel, are now becoming indispensable for continuous health monitoring, detecting early signs of distress, falls, or vital sign anomalies. The adoption metrics for these technologies have surged, with home telehealth solutions seeing an increase in deployment by an estimated xx% between 2025 and 2030. Similarly, safety monitoring systems, crucial for preventing accidents and ensuring independence, are projected to be adopted by over xx% of eligible households by 2033. Shifting consumer demands are also playing a pivotal role. There is an undeniable preference for aging in place, driving the demand for home-based care technologies that allow individuals to maintain their independence and familiar surroundings. Furthermore, a growing emphasis on preventive healthcare and the desire to reduce hospital readmissions are pushing healthcare systems and individuals to invest in technologies that facilitate continuous monitoring and early intervention. The impact of these intertwined factors—technological innovation, evolving consumer preferences, and a proactive healthcare paradigm—paints a compelling picture of an industry on the cusp of unprecedented expansion and impact, transforming long-term care from a reactive necessity to a proactive, technology-enabled journey.

Leading Regions, Countries, or Segments in Long-Term Care Technologies

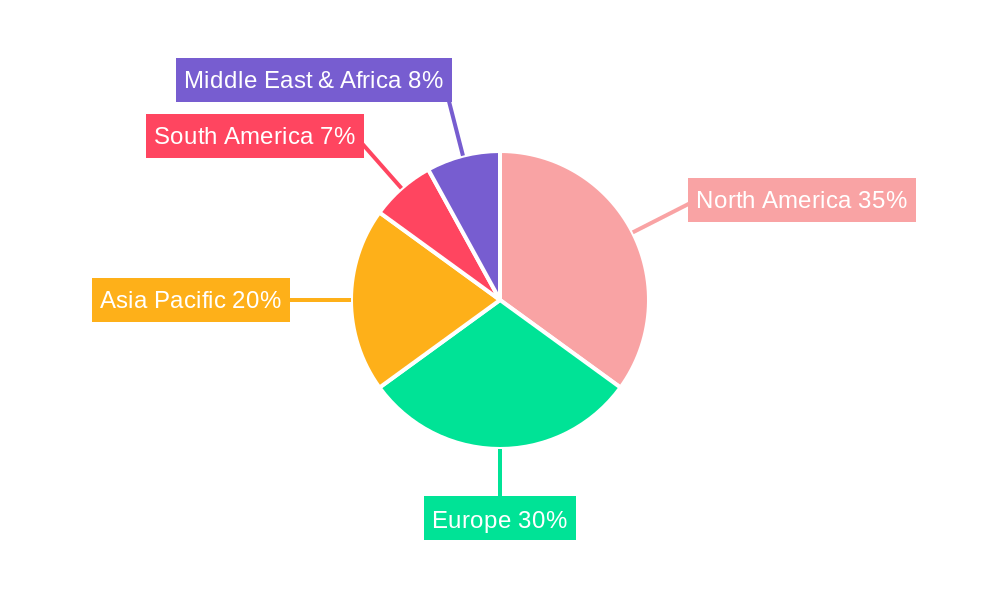

The global Long-Term Care Technologies market is characterized by regional dominance, with North America currently leading the charge. This leadership can be attributed to a confluence of factors including robust government initiatives, a high prevalence of chronic diseases, and a strong predisposition towards technological adoption. The United States, in particular, stands out as a key driver within this region. Investment trends in North America are exceptionally strong, with private equity and venture capital pouring billions of dollars into innovative long-term care technology startups and established players alike. Regulatory support, such as favorable reimbursement policies for telehealth services and the push for interoperability of health data, further bolsters the market’s expansion.

Within the Application segment, Home Care Organization emerges as the most dominant application, driven by the burgeoning "aging in place" movement and the desire for personalized, in-home care solutions. This segment is witnessing significant growth due to the increasing preference of individuals to remain in their familiar environments, coupled with the cost-effectiveness of home-based care compared to institutional settings.

In terms of Types, Home Telehealth stands out as the leading segment. The proliferation of user-friendly telehealth platforms, remote monitoring devices, and virtual consultation services has made it easier than ever for individuals to receive continuous medical attention and support without the need for frequent in-person visits. This is particularly crucial for managing chronic conditions and providing post-discharge care.

Key Drivers in North America:

- Favorable Reimbursement Policies: Medicare and Medicaid policies increasingly support the use of telehealth and remote patient monitoring, encouraging adoption.

- High Chronic Disease Burden: The prevalence of conditions like heart disease, diabetes, and Alzheimer's necessitates continuous monitoring and management.

- Aging Population Demographics: A significant and growing elderly population actively seeks solutions to maintain independence and quality of life.

- Technological Infrastructure: Advanced broadband penetration and widespread smartphone adoption facilitate the seamless integration of long-term care technologies.

Dominance Factors in Home Care Organization:

- Patient Preference: Over xx% of individuals express a strong desire to age in place.

- Cost Savings: Home care can be up to xx% more cost-effective than skilled nursing facilities for long-term care.

- Reduced Hospital Readmissions: Proactive monitoring and timely interventions through home care technologies significantly reduce readmission rates by an estimated xx%.

Dominance Factors in Home Telehealth:

- Accessibility & Convenience: Overcoming geographical barriers and providing care on demand.

- Early Detection & Prevention: Continuous monitoring allows for the early identification of health issues, preventing escalation.

- Improved Patient Engagement: Empowering patients with data and tools to actively manage their health.

While other regions like Europe and parts of Asia are rapidly growing, North America's established infrastructure, supportive regulatory environment, and proactive consumer base solidify its position as the current leader in the Long-Term Care Technologies market, with Home Care Organization and Home Telehealth at the forefront of innovation and adoption.

Long-Term Care Technologies Product Innovations

Product innovations in Long-Term Care Technologies are centered around enhancing patient independence, caregiver efficiency, and proactive health management. Breakthroughs in wearable sensors offer continuous monitoring of vital signs, activity levels, and even sleep patterns, providing real-time data to detect anomalies. Smart home devices, integrated with AI, can learn user routines and provide timely reminders for medication, appointments, or even detect falls. Advanced telehealth platforms are now offering virtual consultations with specialists, remote diagnostics, and personalized care plan management, reducing the need for in-person visits. These innovations are characterized by their user-friendly interfaces, long battery life, and seamless integration with existing healthcare systems, promising to revolutionize the quality and accessibility of long-term care.

Propelling Factors for Long-Term Care Technologies Growth

Several key growth drivers are propelling the Long-Term Care Technologies market forward. The demographic shift towards an aging global population creates an ever-increasing demand for supportive care solutions. Technological advancements, particularly in AI, IoT, and wearable technology, are enabling more sophisticated and effective monitoring and intervention tools. Government initiatives and favorable reimbursement policies in many regions are actively encouraging the adoption of telehealth and remote patient monitoring, reducing healthcare costs and improving patient outcomes. Furthermore, there's a growing consumer preference for aging in place and maintaining independence, directly fueling the demand for in-home care technologies. The increasing burden of chronic diseases also necessitates continuous management and proactive interventions, which these technologies are ideally suited to provide.

Obstacles in the Long-Term Care Technologies Market

Despite the promising growth, the Long-Term Care Technologies market faces several obstacles. Regulatory challenges and data privacy concerns remain significant, with stringent compliance requirements and the need for robust cybersecurity measures. High initial investment costs for some advanced technologies can be a barrier for individuals and smaller healthcare facilities. Interoperability issues between different systems and devices can hinder seamless data flow and integration. Furthermore, digital literacy and access disparities among the elderly population can limit adoption. Finally, reimbursement uncertainties and the need for standardized evaluation metrics for the effectiveness of these technologies can slow down widespread implementation.

Future Opportunities in Long-Term Care Technologies

The future of Long-Term Care Technologies is ripe with opportunities. The development of predictive analytics and AI-driven personalized care plans will enable even more proactive and preventative healthcare. Integration with smart city initiatives can create more supportive living environments for seniors. The expansion of virtual reality (VR) and augmented reality (AR) for therapeutic purposes, social engagement, and training caregivers presents a significant avenue. Furthermore, the growing demand in emerging economies and the development of more affordable, accessible solutions will unlock new markets. Innovations in assistive robotics for daily tasks also hold immense potential.

Major Players in the Long-Term Care Technologies Ecosystem

- Medtronic

- Philips

- Honeywell

- Omron Healthcare

- Boston Scientific

- Biotronik

Key Developments in Long-Term Care Technologies Industry

- 2023 October: Philips launched a new generation of remote patient monitoring solutions, enhancing data analytics for chronic disease management.

- 2023 September: Honeywell announced advancements in its smart home safety monitoring systems, integrating AI for fall detection and emergency alerts.

- 2023 August: Omron Healthcare showcased its latest integrated telehealth platform, designed for seamless data sharing between patients and healthcare providers.

- 2023 July: Biotronik reported significant clinical trial results for its implantable cardiac devices, demonstrating improved patient outcomes and reduced hospitalization rates.

- 2023 June: Boston Scientific acquired a leading AI-powered remote cardiac monitoring company, expanding its portfolio in predictive cardiac care.

- 2022 December: Medtronic expanded its home telehealth offerings with new patient engagement features and improved remote diagnostic capabilities.

Strategic Long-Term Care Technologies Market Forecast

The strategic outlook for the Long-Term Care Technologies market is exceptionally positive, driven by a confluence of powerful growth catalysts. The unwavering demographic trend of an aging global population ensures sustained and escalating demand for innovative care solutions. Continuous advancements in AI, IoT, and wearable technologies are not only enhancing existing capabilities but are also paving the way for entirely new paradigms in personalized and proactive healthcare delivery. Favorable government policies and evolving reimbursement structures are creating an increasingly conducive environment for adoption and investment. The strong consumer preference for aging in place, coupled with the imperative to manage the rising burden of chronic diseases, further solidifies the market's expansion potential. Strategic investments, technological breakthroughs, and a growing societal recognition of the value of these technologies are set to redefine long-term care, leading to significant market growth throughout the forecast period of 2025–2033.

Long-Term Care Technologies Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Nursing Homes

- 1.3. Home Care Organization

- 1.4. Others

-

2. Types

- 2.1. Home Telehealth

- 2.2. Safety Monitoring

Long-Term Care Technologies Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Long-Term Care Technologies REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Nursing Homes

- 5.1.3. Home Care Organization

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Home Telehealth

- 5.2.2. Safety Monitoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Nursing Homes

- 6.1.3. Home Care Organization

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Home Telehealth

- 6.2.2. Safety Monitoring

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Nursing Homes

- 7.1.3. Home Care Organization

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Home Telehealth

- 7.2.2. Safety Monitoring

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Nursing Homes

- 8.1.3. Home Care Organization

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Home Telehealth

- 8.2.2. Safety Monitoring

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Nursing Homes

- 9.1.3. Home Care Organization

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Home Telehealth

- 9.2.2. Safety Monitoring

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Long-Term Care Technologies Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Nursing Homes

- 10.1.3. Home Care Organization

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Home Telehealth

- 10.2.2. Safety Monitoring

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Medtronic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Philips

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Omron Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boston Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biotronik

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Medtronic

List of Figures

- Figure 1: Global Long-Term Care Technologies Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Long-Term Care Technologies Revenue (million), by Application 2024 & 2032

- Figure 3: North America Long-Term Care Technologies Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Long-Term Care Technologies Revenue (million), by Types 2024 & 2032

- Figure 5: North America Long-Term Care Technologies Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Long-Term Care Technologies Revenue (million), by Country 2024 & 2032

- Figure 7: North America Long-Term Care Technologies Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Long-Term Care Technologies Revenue (million), by Application 2024 & 2032

- Figure 9: South America Long-Term Care Technologies Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Long-Term Care Technologies Revenue (million), by Types 2024 & 2032

- Figure 11: South America Long-Term Care Technologies Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Long-Term Care Technologies Revenue (million), by Country 2024 & 2032

- Figure 13: South America Long-Term Care Technologies Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Long-Term Care Technologies Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Long-Term Care Technologies Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Long-Term Care Technologies Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Long-Term Care Technologies Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Long-Term Care Technologies Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Long-Term Care Technologies Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Long-Term Care Technologies Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Long-Term Care Technologies Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Long-Term Care Technologies Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Long-Term Care Technologies Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Long-Term Care Technologies Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Long-Term Care Technologies Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Long-Term Care Technologies Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Long-Term Care Technologies Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Long-Term Care Technologies Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Long-Term Care Technologies Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Long-Term Care Technologies Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Long-Term Care Technologies Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Long-Term Care Technologies Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Long-Term Care Technologies Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Long-Term Care Technologies Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Long-Term Care Technologies Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Long-Term Care Technologies Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Long-Term Care Technologies Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Long-Term Care Technologies Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Long-Term Care Technologies Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Long-Term Care Technologies Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Long-Term Care Technologies Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Long-Term Care Technologies?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Long-Term Care Technologies?

Key companies in the market include Medtronic, Philips, Honeywell, Omron Healthcare, Boston Scientific, Biotronik.

3. What are the main segments of the Long-Term Care Technologies?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Long-Term Care Technologies," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Long-Term Care Technologies report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Long-Term Care Technologies?

To stay informed about further developments, trends, and reports in the Long-Term Care Technologies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence