Key Insights

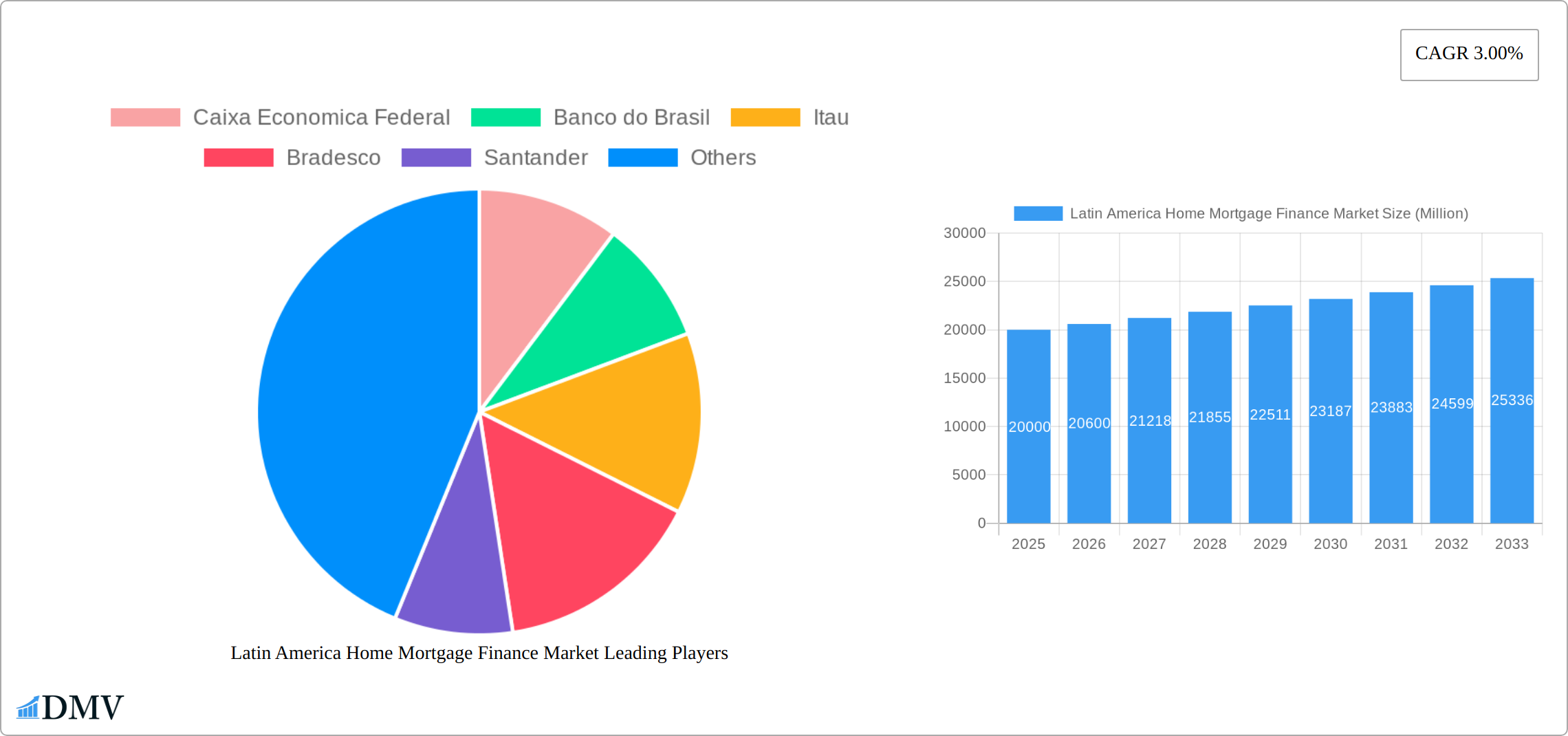

The Latin American home mortgage finance market, while exhibiting a steady CAGR of 3.00% from 2019-2024, is poised for significant growth over the forecast period (2025-2033). The market's expansion is driven by several key factors. Increasing urbanization and a growing middle class are fueling demand for homeownership. Government initiatives promoting affordable housing and supportive lending policies further stimulate the market. Additionally, the rise of fintech and digital lending platforms is enhancing accessibility and efficiency in the mortgage application and disbursement process. However, economic volatility in certain regions, fluctuating interest rates, and challenges related to credit scoring and risk assessment remain potential restraints to sustained growth. Major players like Caixa Economica Federal, Banco do Brasil, Itaú, Bradesco, and Santander are key competitors, leveraging their established networks and financial strength to capture market share. The segmentation of the market likely includes variations based on loan type (fixed-rate, adjustable-rate), property type (residential, commercial), and borrower profile (first-time homebuyers, existing homeowners). Regional variations will be substantial, influenced by factors like economic development levels, regulatory frameworks, and local housing market dynamics. Further analysis would be needed to quantify the impact of each driver and restraint, and the performance of individual market segments and geographical regions.

The market is projected to continue its upward trajectory driven by sustained economic growth in specific regions and ongoing infrastructural development. The increasing penetration of digital financial services and the integration of innovative technologies within the mortgage lending sector will streamline operations and enhance customer experience. However, managing risks associated with macroeconomic uncertainties and ensuring responsible lending practices will be crucial for market stability and sustainable growth. Effective regulatory oversight and the development of robust credit risk models are critical to mitigating these challenges and fostering a healthier home mortgage finance market in Latin America.

Latin America Home Mortgage Finance Market Market Composition & Trends

The Latin America Home Mortgage Finance Market is a dynamic and evolving sector, shaped by a confluence of structural elements, technological advancements, regulatory shifts, and evolving consumer behaviors. While a few dominant institutions currently hold considerable sway, the landscape is increasingly being influenced by nimble fintech innovators and supportive governmental initiatives aimed at fostering broader homeownership.

The market's concentration is evident, with key players like Caixa Economica Federal, Banco do Brasil, and Itau leading the charge. Projections for 2025 indicate a significant market share distribution: Caixa Economica Federal is anticipated to hold approximately 25%, followed by Banco do Brasil at 20%, and Itau at 15%. The remaining 40% of the market is more fragmented, shared among other established financial institutions such as Bradesco and Santander, alongside a growing number of specialized lenders.

Innovation serves as a critical engine for growth within this market. Fintech startups are at the forefront, leveraging technology to streamline application processes, offer more flexible financing options, and improve accessibility. This innovation is complemented by evolving regulatory frameworks across the region. Governments, particularly in countries like Brazil and Mexico, are actively implementing policies designed to boost homeownership rates, often through subsidies, tax incentives, and streamlined approval processes. Furthermore, alternative housing finance models, such as rent-to-own schemes, are gaining significant traction, especially among younger demographics and those with less established credit histories, offering a pathway to homeownership that bypasses traditional mortgage barriers.

The end-user base is diverse, but the primary target demographic typically consists of urban middle-class families seeking to acquire or upgrade their homes. However, strategies are increasingly being developed to cater to a wider spectrum of income levels and life stages. The market is also experiencing a wave of consolidation and strategic partnerships. Mergers and acquisitions, with recent deals valued at over $500 million in the past year alone, are reshaping the competitive landscape. These activities are strategically aimed at expanding geographical reach, diversifying product portfolios, and enhancing operational efficiencies to better serve the growing demand for home financing solutions.

- Projected Market Share Distribution (2025):

- Caixa Economica Federal: 25%

- Banco do Brasil: 20%

- Itau: 15%

- Others: 40%

- Mergers & Acquisitions Activity: Significant deal values exceeding $500 million recorded in the past year, reflecting market consolidation and strategic growth initiatives.

Latin America Home Mortgage Finance Market Industry Evolution

The Latin America Home Mortgage Finance Market has undergone significant evolution over the study period from 2019 to 2033. The market has experienced a compounded annual growth rate (CAGR) of approximately 5% during the historical period of 2019-2024, driven by increased urbanization and rising disposable incomes. The base year of 2025 marks a pivotal point, with the market poised for further expansion at a projected CAGR of 6% through the forecast period of 2025-2033.

Technological advancements have played a crucial role in shaping the industry. The adoption of digital platforms for mortgage applications and approvals has increased from 30% in 2019 to 50% in 2025. This shift is attributed to the growing penetration of smartphones and internet connectivity across the region.

Consumer demands are also shifting, with a notable increase in demand for flexible mortgage products. The popularity of adjustable-rate mortgages has grown by 20% since 2019, reflecting a consumer preference for adaptability in financial planning. Additionally, the rise of fintech solutions has introduced innovative products like rent-to-own schemes and peer-to-peer lending, catering to a broader range of consumer needs.

The market's growth trajectory is supported by government initiatives aimed at boosting homeownership. For instance, Brazil's Minha Casa, Minha Vida program has contributed to a 10% increase in mortgage approvals in the past year. These trends indicate a robust future for the Latin America Home Mortgage Finance Market, driven by technological innovation and evolving consumer preferences.

Leading Regions, Countries, or Segments in Latin America Home Mortgage Finance Market

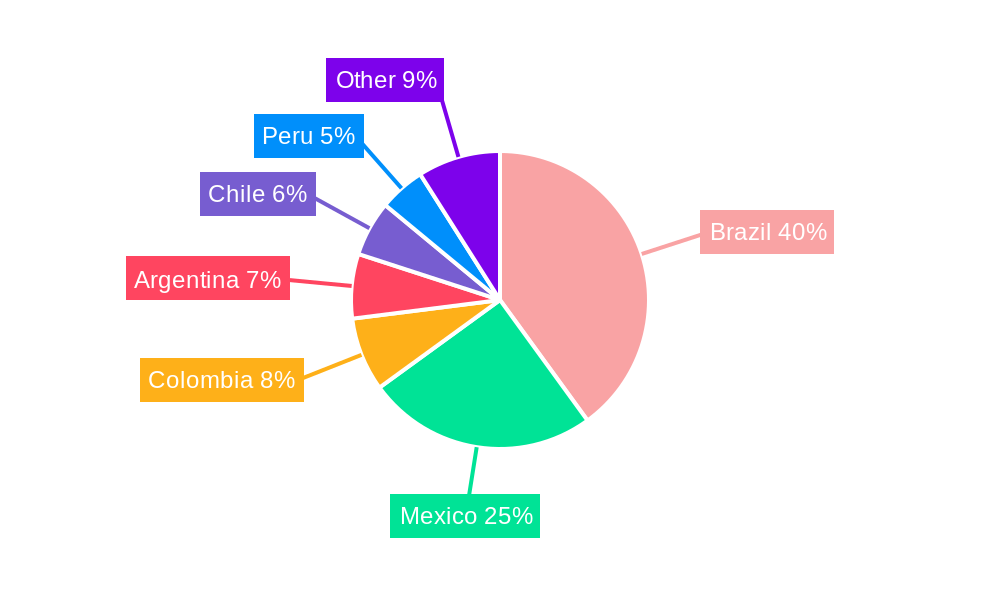

Brazil emerges as the dominant player in the Latin America Home Mortgage Finance Market, accounting for approximately 40% of the region's total mortgage volume in 2025. The country's market dominance is driven by a combination of factors, including a large population base, robust economic growth, and government initiatives to promote homeownership.

- Key Drivers in Brazil:

- Investment Trends: Increased foreign and domestic investments in real estate, with over 1 Billion invested in 2025.

- Regulatory Support: The Brazilian government's Minha Casa, Minha Vida program, which has facilitated over 2 Million mortgage approvals.

- Economic Growth: A GDP growth rate of 3% in 2025, fostering a conducive environment for mortgage financing.

Mexico follows closely, with a 25% share of the market, driven by similar factors. The country's mortgage market is characterized by a growing middle class and increasing urbanization, which have led to a 5% annual increase in mortgage demand since 2019.

Colombia, while smaller in market size, is notable for its rapid growth, with a projected CAGR of 7% through 2033. The country's market is driven by favorable interest rates and a burgeoning real estate sector.

The dominance of these regions can be attributed to their economic stability, supportive regulatory environments, and the presence of major financial institutions. Brazil's market, in particular, benefits from the presence of leading banks like Caixa Economica Federal and Banco do Brasil, which have extensive networks and innovative mortgage products. Mexico and Colombia, on the other hand, are seeing increased competition from fintech startups, which are introducing new mortgage solutions and driving market growth.

Latin America Home Mortgage Finance Market Product Innovations

The Latin America Home Mortgage Finance Market is witnessing a wave of product innovations, driven by technological advancements and changing consumer needs. One notable innovation is the introduction of rent-to-own schemes, which allow consumers to rent a property with the option to purchase it at the end of the rental period. This model, popularized by startups like Toperty in Colombia, offers a unique selling proposition by combining the flexibility of renting with the long-term benefits of ownership. Additionally, the integration of AI and machine learning in mortgage underwriting processes is enhancing efficiency and accuracy, leading to faster loan approvals and better risk assessment.

Propelling Factors for Latin America Home Mortgage Finance Market Growth

Several factors are propelling the growth of the Latin America Home Mortgage Finance Market. Technological advancements, such as the adoption of digital platforms for mortgage applications, are streamlining processes and enhancing customer experience. Economically, rising disposable incomes and urbanization are increasing demand for housing and, consequently, mortgage financing. Regulatory influences, including government initiatives like Brazil's Minha Casa, Minha Vida program, are also playing a significant role in driving market growth by making homeownership more accessible.

Obstacles in the Latin America Home Mortgage Finance Market Market

Despite its growth potential, the Latin America Home Mortgage Finance Market encounters several significant hurdles that can impede its expansion and accessibility. Navigating complex and sometimes restrictive regulatory environments remains a primary challenge. Stringent lending requirements, opaque approval processes, and fluctuating interest rate caps can create barriers for both lenders and borrowers, limiting the availability and affordability of mortgage products. Furthermore, the broader economic context, including potential supply chain disruptions in the construction sector, can lead to project delays and impact the pace of new housing development, consequently affecting mortgage demand.

The competitive landscape is intensifying, with pressure mounting from both traditional banking institutions and agile fintech startups. This heightened competition can lead to compressed profit margins for established players and necessitate continuous investment in technology and customer service to remain competitive. Additionally, factors such as economic volatility, inflation, and varying levels of financial literacy across the region can contribute to higher default rates. These obstacles collectively underscore the need for adaptive strategies and robust risk management frameworks to ensure sustainable growth and market stability. Regulatory challenges alone are estimated to potentially temper annual market growth by 1-2%.

Future Opportunities in Latin America Home Mortgage Finance Market

The Latin America Home Mortgage Finance Market is ripe with promising future opportunities, driven by technological innovation, untapped market potential, and evolving consumer preferences. The rapid adoption of fintech solutions presents a transformative opportunity for new entrants and existing players to disrupt traditional models. These digital platforms can offer more efficient application processes, personalized loan products, and wider geographical reach, particularly benefiting underserved populations.

Emerging economies within the region, such as Argentina and Peru, are demonstrating a growing aspiration for homeownership. These markets, with their expanding middle classes and increasing urbanization, represent significant untapped potential for mortgage providers. Furthermore, a discernible shift in consumer trends towards sustainable and smart homes is creating demand for specialized mortgage products. Lenders that can offer financing options for energy-efficient properties, solar installations, or smart home technologies will be well-positioned to capture this growing niche. The integration of data analytics and artificial intelligence will also enable more sophisticated risk assessment and product customization, further unlocking opportunities.

Major Players in the Latin America Home Mortgage Finance Market Ecosystem

- Caixa Economica Federal

- Banco do Brasil

- Itau

- Bradesco

- Santander

- BBVA Bancome

- CITI Banamex

- Scotia Bank

- Banco de Chile

- Davivienda

Key Developments in Latin America Home Mortgage Finance Market Industry

- August 2022: Launch of Toperty in Colombia. This innovative rent-to-own platform empowers individuals to gradually acquire homeownership while continuing to rent, thereby expanding access to the housing market and potentially disrupting traditional mortgage financing models.

- August 2022: Imminent Launch of Saturn5 in Mexico. This initiative aims to equip potential homebuyers with the necessary knowledge and resources to navigate the home-buying process independently. Such developments are crucial for consumer empowerment and are expected to stimulate greater demand for mortgage solutions.

- August 2022: Banco Bradesco SA Reports Increased Default Rates. During a conference call on August 5th, the bank disclosed a 30 basis point increase in its 90-day nonperforming loan ratio, with overall portfolio delinquency reaching 3.5%. This development highlights potential credit risks and could influence lending practices and market sentiment across the region.

Strategic Latin America Home Mortgage Finance Market Market Forecast

The Latin America Home Mortgage Finance Market is projected for substantial growth between 2025 and 2033. This optimistic outlook is underpinned by a combination of accelerating technological advancements, favorable economic tailwinds, and increasingly supportive regulatory environments across several key nations. The continued widespread adoption of digital mortgage platforms is expected to revolutionize the industry, streamlining application-to-closing processes, enhancing transparency, and significantly improving the overall customer experience.

The burgeoning presence of fintech solutions and the introduction of new market entrants will foster greater competition and drive the development of innovative, tailored mortgage products designed to meet diverse consumer needs. Furthermore, the strategic expansion into emerging markets within the region, which are showing a strong propensity for homeownership, presents lucrative avenues for diversification and increased market penetration. As a result, the Latin America Home Mortgage Finance Market is poised to become an increasingly attractive and dynamic sector for investment, innovation, and development in the coming years.

Latin America Home Mortgage Finance Market Segmentation

-

1. Type

- 1.1. Fixed - Rate Mortgage

- 1.2. Adjustable- Rate Mortgage

-

2. Tenure

- 2.1. Upto 5 years

- 2.2. 6-10 years

- 2.3. 11-24 years

- 2.4. 25-30 years

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Peru

- 3.4. Colombia

- 3.5. Rest of Latin America

Latin America Home Mortgage Finance Market Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Peru

- 4. Colombia

- 5. Rest of Latin America

Latin America Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Economic Growth and GDP per capita

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed - Rate Mortgage

- 5.1.2. Adjustable- Rate Mortgage

- 5.2. Market Analysis, Insights and Forecast - by Tenure

- 5.2.1. Upto 5 years

- 5.2.2. 6-10 years

- 5.2.3. 11-24 years

- 5.2.4. 25-30 years

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Peru

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Peru

- 5.4.4. Colombia

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed - Rate Mortgage

- 6.1.2. Adjustable- Rate Mortgage

- 6.2. Market Analysis, Insights and Forecast - by Tenure

- 6.2.1. Upto 5 years

- 6.2.2. 6-10 years

- 6.2.3. 11-24 years

- 6.2.4. 25-30 years

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Peru

- 6.3.4. Colombia

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Chile Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed - Rate Mortgage

- 7.1.2. Adjustable- Rate Mortgage

- 7.2. Market Analysis, Insights and Forecast - by Tenure

- 7.2.1. Upto 5 years

- 7.2.2. 6-10 years

- 7.2.3. 11-24 years

- 7.2.4. 25-30 years

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Peru

- 7.3.4. Colombia

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Peru Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed - Rate Mortgage

- 8.1.2. Adjustable- Rate Mortgage

- 8.2. Market Analysis, Insights and Forecast - by Tenure

- 8.2.1. Upto 5 years

- 8.2.2. 6-10 years

- 8.2.3. 11-24 years

- 8.2.4. 25-30 years

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Peru

- 8.3.4. Colombia

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Colombia Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed - Rate Mortgage

- 9.1.2. Adjustable- Rate Mortgage

- 9.2. Market Analysis, Insights and Forecast - by Tenure

- 9.2.1. Upto 5 years

- 9.2.2. 6-10 years

- 9.2.3. 11-24 years

- 9.2.4. 25-30 years

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Chile

- 9.3.3. Peru

- 9.3.4. Colombia

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Latin America Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed - Rate Mortgage

- 10.1.2. Adjustable- Rate Mortgage

- 10.2. Market Analysis, Insights and Forecast - by Tenure

- 10.2.1. Upto 5 years

- 10.2.2. 6-10 years

- 10.2.3. 11-24 years

- 10.2.4. 25-30 years

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Chile

- 10.3.3. Peru

- 10.3.4. Colombia

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Caixa Economica Federal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Banco do Brasil

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Itau

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bradesco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Santander

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BBVA Bancome

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CITI Banamex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Scotia Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Banco de Chile

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Davivienda**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caixa Economica Federal

List of Figures

- Figure 1: Global Latin America Home Mortgage Finance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 3: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 5: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 6: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 11: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 13: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 14: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 21: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 22: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 29: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 30: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 37: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 38: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 4: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 8: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 12: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 16: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 20: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 24: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Home Mortgage Finance Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Latin America Home Mortgage Finance Market?

Key companies in the market include Caixa Economica Federal, Banco do Brasil, Itau, Bradesco, Santander, BBVA Bancome, CITI Banamex, Scotia Bank, Banco de Chile, Davivienda**List Not Exhaustive.

3. What are the main segments of the Latin America Home Mortgage Finance Market?

The market segments include Type, Tenure, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Economic Growth and GDP per capita.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In August 2022, Two new mortgage fintech start-ups emerged in Latin America: Toperty launched in Colombia and Saturn5 is about to launch in Mexico. Toperty offers to purchase a customer's new house outright and provides a payment schedule that allows the customer to purchase the house while renting it from the business. Saturn5 wants to give its clients the skills and resources they need to buy a house on their own.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the Latin America Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence