Key Insights

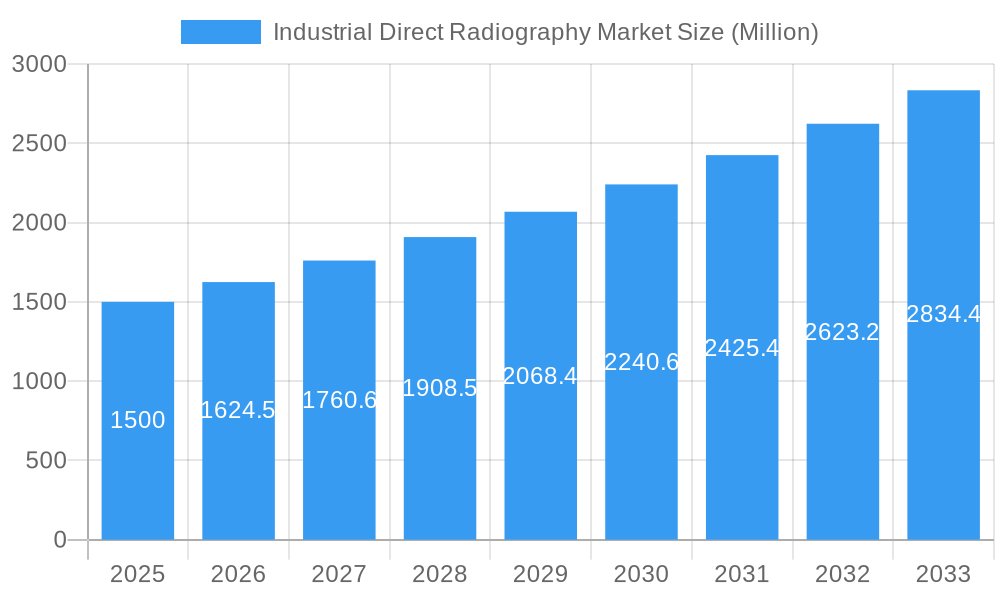

The Industrial Direct Radiography (IDR) market, valued at approximately $0.8 billion in 2025, is projected for substantial growth. Driven by increasing demand across key sectors and technological advancements, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 7.9%. This robust growth trajectory indicates a significant market expansion, with projected market values set to rise considerably by the report's conclusion. Key drivers include the expanding healthcare sector, demanding stringent quality control in medical device and pharmaceutical production, alongside the burgeoning aerospace and petrochemical industries' need for rigorous non-destructive testing (NDT) to ensure safety and operational efficiency. Furthermore, continuous advancements in IDR technology, such as enhanced image resolution, accelerated processing capabilities, and improved portability, are increasing its adoption across diverse applications. Stringent regulatory mandates for improved safety and quality assurance in various industries are also contributing to this demand. While initial equipment investment costs and the requirement for skilled personnel present potential challenges, the overall market outlook remains highly positive, propelled by these significant growth catalysts.

Industrial Direct Radiography Market Market Size (In Million)

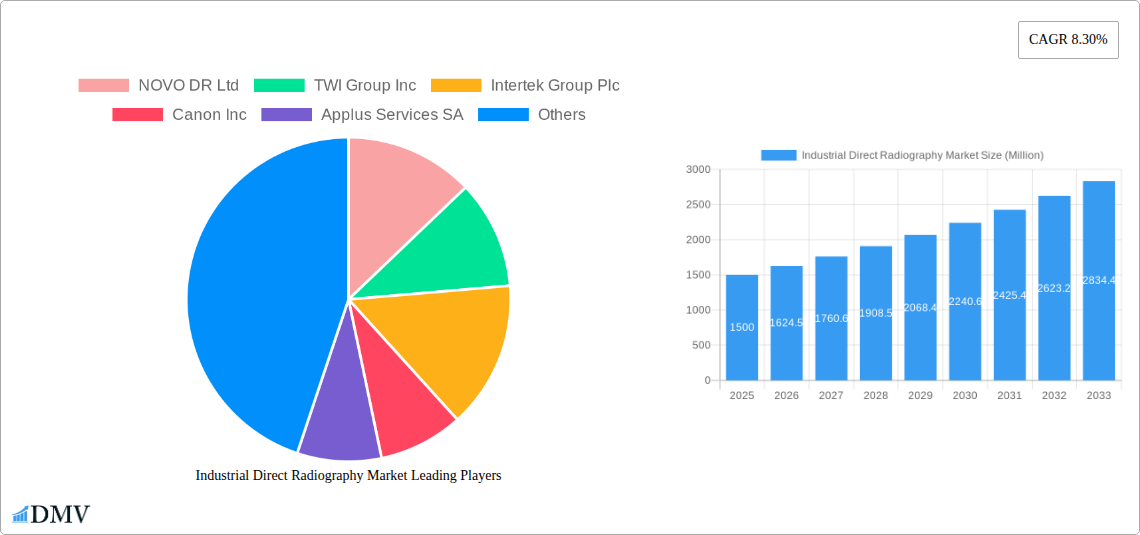

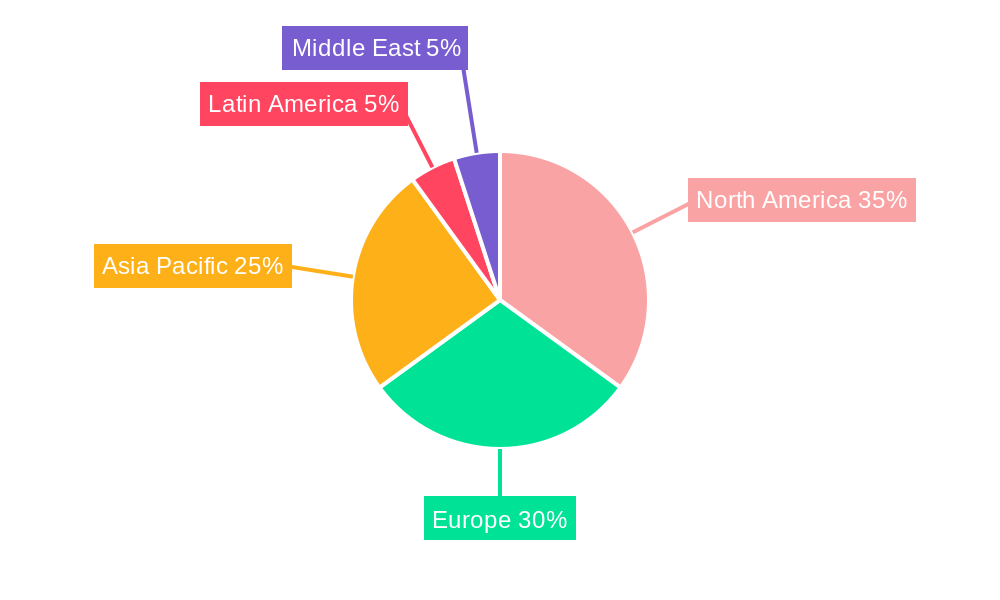

The competitive IDR market features a blend of established industry leaders and innovative emerging companies. Prominent players are leveraging their extensive expertise and technological capabilities to solidify their market positions. Simultaneously, smaller entities are focusing on pioneering new solutions and targeting specialized applications to capture market share. Regional market dynamics are expected to vary, with established industrial bases and stringent regulatory environments supporting significant market presence in North America and Europe. However, the Asia-Pacific region is poised for the most rapid expansion, fueled by accelerating industrialization and infrastructure development. The evolving landscape of technological innovations, shifting regulatory frameworks, and regional economic expansion will collectively define the future trajectory of the Industrial Direct Radiography market.

Industrial Direct Radiography Market Company Market Share

Industrial Direct Radiography Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Industrial Direct Radiography Market, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report's value is enhanced by incorporating critical data points, avoiding placeholders, and providing specific numerical figures wherever possible. The total market size in 2025 is estimated at $XX Million, projected to reach $YY Million by 2033.

Industrial Direct Radiography Market Composition & Trends

This section delves into the intricate structure of the Industrial Direct Radiography Market, examining key aspects influencing its evolution. We analyze market concentration, revealing the market share distribution amongst key players such as NOVO DR Ltd, TWI Group Inc, Intertek Group Plc, Canon Inc, and others. The report further explores the innovative technologies driving market growth, alongside an in-depth examination of the regulatory landscape and the impact of substitute products. A detailed analysis of end-user profiles across diverse sectors like healthcare, petrochemical, and aerospace is also included, alongside an assessment of recent mergers and acquisitions (M&A) activities, including estimated deal values. The competitive landscape is meticulously mapped, highlighting strategic partnerships and competitive dynamics. The analysis identifies key trends shaping the market, encompassing technological advancements, evolving regulatory frameworks, and shifting consumer preferences. Finally, the section provides an in-depth exploration of market concentration, analyzing the market share distribution of key players and assessing the overall competitiveness of the market.

- Market Concentration: High/Medium/Low (specify, based on data analysis). Herfindahl-Hirschman Index (HHI) calculation included.

- Innovation Catalysts: Advancements in X-ray technology, AI-powered image analysis.

- Regulatory Landscape: Analysis of key regulations impacting the market in major regions.

- Substitute Products: Discussion of alternative non-destructive testing (NDT) methods and their impact.

- End-User Profiles: Detailed breakdown of end-user industries and their specific needs.

- M&A Activities: Summary of significant mergers and acquisitions, including deal values (e.g., Deal A: $XX Million).

Industrial Direct Radiography Market Industry Evolution

This section provides a comprehensive overview of the historical and projected evolution of the Industrial Direct Radiography Market. We analyze the market's growth trajectory, identifying key periods of expansion and contraction based on historical data from 2019-2024 and projecting future growth rates for 2025-2033. This analysis also incorporates the impact of technological advancements, highlighting the adoption rates of key technologies like digital radiography and advanced image processing techniques. The influence of shifting consumer demands, including the increased demand for higher resolution images and faster turnaround times, is also evaluated. Detailed analysis of market growth drivers, technological innovation and evolving customer preferences are included, backed by substantial data points. We further analyze the impact of macroeconomic factors, technological disruptions, and evolving regulatory landscapes on the growth trajectory of the Industrial Direct Radiography Market. The analysis is supported by specific data points like annual growth rates and adoption metrics for new technologies.

Leading Regions, Countries, or Segments in Industrial Direct Radiography Market

This section pinpoints the leading regions, countries, or segments within the Industrial Direct Radiography Market based on revenue generation and market share. We provide a detailed analysis of the dominant segment from By End-user Industry: Healthcare, Petrochemical, Aerospace, Chemical, Military, Construction, Other End-user Industries. The analysis investigates the reasons behind the dominance, including economic factors and specific regional characteristics.

- Dominant Segment: [Specify the dominant segment, e.g., Aerospace]

- Key Drivers (Aerospace Example):

- High investment in aerospace manufacturing and maintenance.

- Stringent quality control regulations in the aerospace industry.

- Growing demand for lightweight and high-performance materials.

- Increased adoption of advanced imaging technologies for defect detection.

- In-depth Analysis: Paragraphs elaborating on each key driver, providing context and supporting data. Similar detailed analysis for other significant segments will also be included.

Industrial Direct Radiography Market Product Innovations

Recent years have witnessed significant advancements in Industrial Direct Radiography technology. These innovations include the development of higher-resolution detectors, improved software for image processing and analysis, and the integration of artificial intelligence (AI) for automated defect detection. These advancements have led to increased accuracy, faster inspection times, and reduced operational costs. Furthermore, manufacturers are increasingly focusing on developing portable and user-friendly systems to cater to diverse inspection needs across various industries. The unique selling propositions (USPs) of leading products, including features like enhanced image clarity and advanced analytical capabilities, are detailed.

Propelling Factors for Industrial Direct Radiography Market Growth

Several key factors are driving the growth of the Industrial Direct Radiography Market. Technological advancements, such as the development of digital radiography systems and improved image processing software, are significantly enhancing the efficiency and accuracy of inspections. Economic factors, such as the increasing demand for quality control in various industries and the growing need for non-destructive testing methods, are further fueling market growth. Favorable regulatory environments in several key markets are also supporting the adoption of Industrial Direct Radiography. Examples of these factors, supported by concrete data where possible, are provided to substantiate these findings.

Obstacles in the Industrial Direct Radiography Market

Despite the promising growth outlook, several challenges hinder the expansion of the Industrial Direct Radiography Market. Stringent regulatory requirements related to radiation safety and environmental protection can increase operational costs and complexity for businesses. Supply chain disruptions can impact the availability of critical components, leading to production delays and increased costs. Intense competition among established players and emerging companies puts downward pressure on prices and margins. These obstacles are discussed and quantified with data wherever possible, providing a realistic assessment of the market dynamics.

Future Opportunities in Industrial Direct Radiography Market

The future of the Industrial Direct Radiography Market holds significant potential. Emerging markets in developing economies, coupled with the increasing demand for advanced NDT techniques in various industries, present significant opportunities for growth. Advancements in artificial intelligence (AI) and machine learning (ML) offer potential to further enhance the accuracy and efficiency of radiographic inspection. The adoption of new materials and manufacturing processes will lead to new applications for Industrial Direct Radiography. These opportunities are elaborated upon in detail, highlighting their potential impact on the market landscape.

Major Players in the Industrial Direct Radiography Market Ecosystem

- NOVO DR Ltd

- TWI Group Inc

- Intertek Group Plc

- Canon Inc

- Applus Services SA

- Durr NDT GmbH & Co KG

- Vidisco Ltd

- Koninklijke Philips N V

- Fujifilm Corporation

- Mistras Group Inc

- OR Technology

- Stanley Inspection

- General Electric Corporation

Key Developments in Industrial Direct Radiography Market Industry

- [Month/Year]: Launch of a new digital radiography system by [Company Name], featuring improved image resolution and automated defect detection. This significantly enhances the speed and accuracy of inspection processes, increasing market demand.

- [Month/Year]: Acquisition of [Company A] by [Company B], expanding market share and consolidating industry leadership. This leads to increased competition and innovation in the market.

- [Month/Year]: Introduction of a new regulatory standard impacting the use of Industrial Direct Radiography, leading to increased demand for compliant equipment and services.

- [Month/Year]: Development of a new software solution by [Company Name] which enhances image analysis and reduces inspection time, increasing efficiency and adoption rates.

Strategic Industrial Direct Radiography Market Forecast

The future of the Industrial Direct Radiography Market is characterized by robust growth, driven by technological innovation and increasing adoption across various industries. The market's expansion will be fueled by continuous advancements in digital radiography technology, improved image analysis software, and the integration of artificial intelligence. Emerging applications in new sectors, coupled with favorable regulatory environments, will further contribute to market growth. The potential for market expansion is significant, with projections pointing towards a substantial increase in market size over the next decade. The report concludes with a strong emphasis on seizing opportunities presented by market expansion, particularly in new industries and geographies.

Industrial Direct Radiography Market Segmentation

-

1. End-user Industry

- 1.1. Healthcare

- 1.2. Petrochemical

- 1.3. Aerospace

- 1.4. Chemical

- 1.5. Military

- 1.6. Construction

- 1.7. Other End-user Industries

Industrial Direct Radiography Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Industrial Direct Radiography Market Regional Market Share

Geographic Coverage of Industrial Direct Radiography Market

Industrial Direct Radiography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Demand for Timelier

- 3.2.2 Safer and More Detailed Inspection is Helping in Market Expansion

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Healthcare to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Healthcare

- 5.1.2. Petrochemical

- 5.1.3. Aerospace

- 5.1.4. Chemical

- 5.1.5. Military

- 5.1.6. Construction

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Healthcare

- 6.1.2. Petrochemical

- 6.1.3. Aerospace

- 6.1.4. Chemical

- 6.1.5. Military

- 6.1.6. Construction

- 6.1.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Healthcare

- 7.1.2. Petrochemical

- 7.1.3. Aerospace

- 7.1.4. Chemical

- 7.1.5. Military

- 7.1.6. Construction

- 7.1.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Healthcare

- 8.1.2. Petrochemical

- 8.1.3. Aerospace

- 8.1.4. Chemical

- 8.1.5. Military

- 8.1.6. Construction

- 8.1.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Healthcare

- 9.1.2. Petrochemical

- 9.1.3. Aerospace

- 9.1.4. Chemical

- 9.1.5. Military

- 9.1.6. Construction

- 9.1.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Healthcare

- 10.1.2. Petrochemical

- 10.1.3. Aerospace

- 10.1.4. Chemical

- 10.1.5. Military

- 10.1.6. Construction

- 10.1.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NOVO DR Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TWI Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canon Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applus Services SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Durr NDT GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vidisco Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fujifilm Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mistras Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OR Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stanley Inspection

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 General Electric Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 NOVO DR Ltd

List of Figures

- Figure 1: Global Industrial Direct Radiography Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Europe Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Latin America Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 19: Middle East Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Industrial Direct Radiography Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Direct Radiography Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Industrial Direct Radiography Market?

Key companies in the market include NOVO DR Ltd, TWI Group Inc, Intertek Group Plc, Canon Inc, Applus Services SA, Durr NDT GmbH & Co KG, Vidisco Ltd, Koninklijke Philips N V, Fujifilm Corporation, Mistras Group Inc, OR Technology, Stanley Inspection, General Electric Corporation.

3. What are the main segments of the Industrial Direct Radiography Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Demand for Timelier. Safer and More Detailed Inspection is Helping in Market Expansion.

6. What are the notable trends driving market growth?

Healthcare to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Direct Radiography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Direct Radiography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Direct Radiography Market?

To stay informed about further developments, trends, and reports in the Industrial Direct Radiography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence