Key Insights

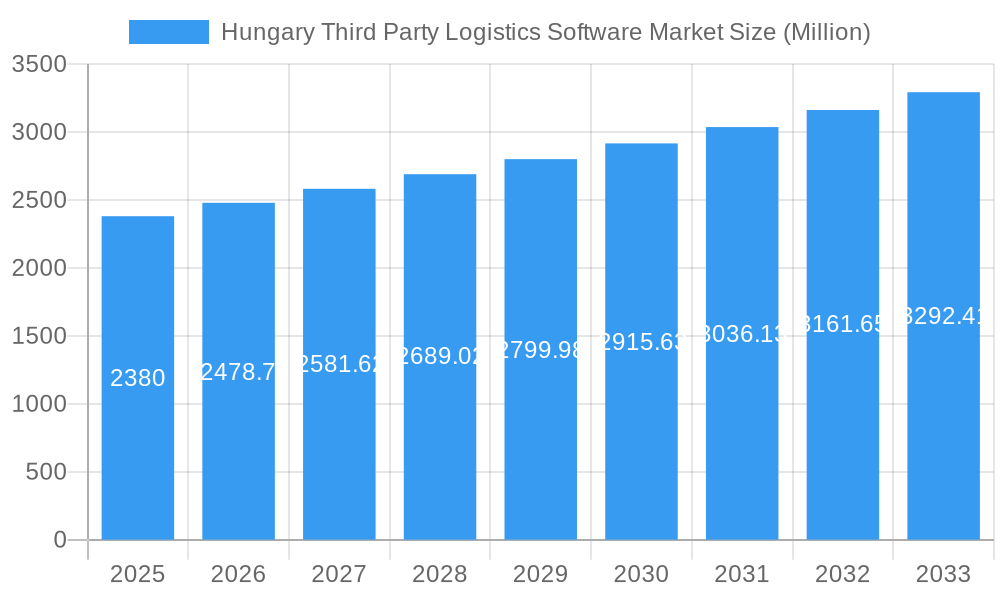

The Hungarian third-party logistics (3PL) software market, valued at €2.38 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of digital technologies within the logistics sector and the expanding e-commerce landscape in Hungary. A Compound Annual Growth Rate (CAGR) of 4.08% from 2025 to 2033 indicates a steady market expansion, fueled by several key factors. The rise of e-commerce necessitates efficient and scalable logistics solutions, boosting demand for sophisticated software to manage warehousing, transportation, and last-mile delivery. Furthermore, the growth of sectors like automotive manufacturing, oil & gas, and pharmaceuticals in Hungary contributes significantly to this market's expansion. These industries rely heavily on optimized supply chains, demanding robust 3PL software solutions to manage inventory, track shipments, and streamline operations. The market is segmented by services (domestic & international transportation management, value-added warehousing & distribution) and end-users (automotive, oil & gas, construction, retail, and healthcare). Competition is fierce, with established global players like DHL and UPS alongside regional logistics providers like Ekol Logistics and Raben Trans European Hungary vying for market share. The continued investment in infrastructure development and government support for digital transformation will further propel the growth of the Hungarian 3PL software market in the coming years.

Hungary Third Party Logistics Software Market Market Size (In Billion)

The competitive landscape involves both multinational giants and established domestic players. While large multinational companies offer comprehensive solutions and global reach, smaller, regional players often provide more specialized services tailored to the specific needs of Hungarian businesses. This dynamic market encourages innovation and drives the development of specialized software that addresses the unique challenges of the Hungarian logistics landscape. The market's growth is, however, subject to potential restraints such as economic fluctuations, cybersecurity concerns associated with digitalization, and the need for skilled professionals to implement and manage these sophisticated systems. Despite these challenges, the long-term outlook for the Hungarian 3PL software market remains positive, with continued growth expected throughout the forecast period.

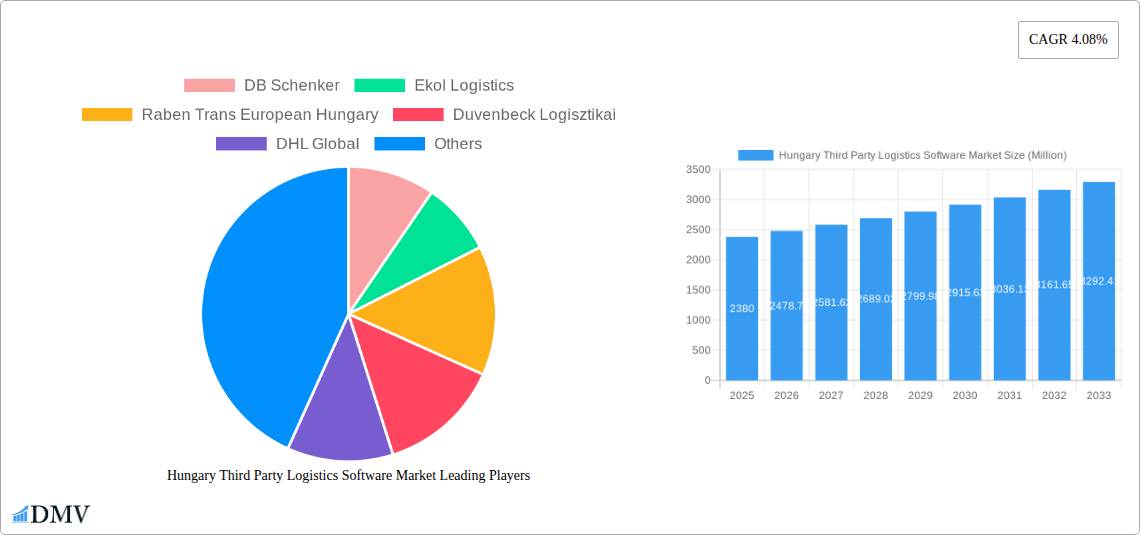

Hungary Third Party Logistics Software Market Company Market Share

Hungary Third Party Logistics Software Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Hungary Third Party Logistics (3PL) Software Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes rigorous data analysis to provide stakeholders with actionable insights to navigate this rapidly evolving market. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Hungary Third Party Logistics Software Market Composition & Trends

This section delves into the competitive landscape of the Hungarian 3PL software market. We examine market concentration, identifying the leading players and their respective market share. The report analyzes innovation catalysts, such as technological advancements and evolving customer demands, shaping the market's trajectory. Further, it explores the regulatory landscape, pinpointing key regulations impacting market operations and growth. The impact of substitute products and their competitive influence is also examined. Finally, a detailed analysis of mergers and acquisitions (M&A) activities within the sector is presented, including deal values and their implications for market consolidation. End-user profiles across various sectors are examined, providing insights into their specific software needs and adoption rates.

- Market Share Distribution: DB Schenker holds approximately xx% market share, followed by DHL Global at xx%, and Ekol Logistics at xx%. The remaining market share is distributed among other players, including Raben Trans European Hungary, Duvenbeck Logisztikai, Fiege, UPS Healthcare Hungary Zrt, Waberers International, Karzol - Trans, Liegl & Dachser, TNT Express Hungary Kft, DSV Hungaria, Hunland Trans, and Gartner Intertrans Hungaria.

- M&A Activity: Recent deals have shown a focus on expanding warehousing capabilities and geographical reach. Total M&A deal value for the period 2019-2024 is estimated at xx Million.

- Regulatory Landscape: The report details relevant Hungarian regulations impacting data privacy, cybersecurity, and transportation logistics.

Hungary Third Party Logistics Software Market Industry Evolution

This section provides a comprehensive analysis of the Hungary 3PL software market’s evolution, charting its growth trajectory from 2019 to 2033. We examine the influence of technological advancements, such as cloud computing, AI, and IoT, on market growth. The report details how shifting consumer demands, including increased demand for real-time visibility and data-driven insights, are driving software adoption. Furthermore, the analysis explores the impact of macroeconomic factors and industry trends on market expansion. Specific data points on growth rates and adoption metrics, segmented by service type and end-user, are provided. The analysis also considers the impact of global supply chain disruptions and their influence on the market's growth pattern during the historical period and future forecast.

Leading Regions, Countries, or Segments in Hungary Third Party Logistics Software Market

This section identifies the leading segments within the Hungarian 3PL software market, providing a detailed analysis of their dominant positions. The analysis covers both services (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and end-users (Automobile & Manufacturing, Oil & Gas and Chemicals, Construction, Distributive Trade, Pharma & Healthcare).

Key Drivers (By Service):

- Domestic Transportation Management: Strong domestic trade and e-commerce growth drive the adoption of domestic transportation management software.

- International Transportation Management: Hungary's strategic location in Central Europe fuels demand for software solutions managing international shipments.

- Value-added Warehousing and Distribution: Growing demand for efficient warehouse management and optimized distribution networks fuels the adoption of specialized software.

Key Drivers (By End-User):

- Automobile & Manufacturing: High automation and supply chain complexity in this sector creates high demand for sophisticated 3PL software.

- Pharma & Healthcare: Stringent regulatory requirements and focus on cold chain logistics drive adoption of specialized software with features like temperature monitoring and traceability.

- Distributive Trade: The expansion of e-commerce necessitates real-time inventory management and efficient last-mile delivery solutions.

The report provides a detailed analysis of the factors contributing to the dominance of each segment, including investment trends, regulatory support, and market size projections.

Hungary Third Party Logistics Software Market Product Innovations

Recent innovations in Hungary's 3PL software market include the integration of AI-powered predictive analytics for optimized route planning and improved warehouse management. Cloud-based solutions offer scalability and enhanced data security, while mobile-first interfaces provide real-time visibility across the supply chain. These innovations deliver enhanced efficiency, reduced costs, and improved customer satisfaction, emphasizing features like automated reporting and seamless integration with existing enterprise systems.

Propelling Factors for Hungary Third Party Logistics Software Market Growth

The growth of the Hungarian 3PL software market is propelled by several factors. Technological advancements, particularly in AI and machine learning, are enabling smarter logistics solutions. Economic growth and rising e-commerce adoption contribute to increased demand for efficient supply chain management. Government initiatives supporting digitalization and logistics infrastructure development further stimulate market expansion.

Obstacles in the Hungary Third Party Logistics Software Market

The market faces challenges such as cybersecurity threats and the need for robust data protection measures. Supply chain disruptions, exacerbated by global events, can impact software adoption and implementation. Intense competition among 3PL providers necessitates continuous innovation and differentiation to maintain a competitive edge.

Future Opportunities in Hungary Third Party Logistics Software Market

Future opportunities lie in the adoption of blockchain technology for enhanced supply chain transparency and traceability. The integration of IoT devices for real-time asset monitoring and predictive maintenance offers further growth potential. Expansion into niche sectors like sustainable logistics and green supply chain management creates new market opportunities.

Major Players in the Hungary Third Party Logistics Software Market Ecosystem

- DB Schenker

- Ekol Logistics

- Raben Trans European Hungary

- Duvenbeck Logisztikai

- DHL Global

- Fiege

- UPS Healthcare Hungary Zrt

- Waberers International

- Karzol - Trans

- Liegl & Dachser

- TNT Express Hungary Kft

- DSV Hungaria

- Hunland Trans

- Gartner Intertrans Hungaria

Key Developments in Hungary Third Party Logistics Software Market Industry

- August 2022: Rhenus Warehousing Solutions acquires DKI Logistics A/S and DKI Automatic A/S, expanding its European footprint.

- October 2022: Red Arts Capital's Partners Warehouse acquires Flex Logistics, adding significant warehousing capacity. This acquisition underscores the ongoing consolidation within the 3PL sector.

Strategic Hungary Third Party Logistics Software Market Forecast

The Hungarian 3PL software market is poised for significant growth, driven by technological innovation, e-commerce expansion, and government support for digitalization. Future opportunities lie in integrating advanced technologies such as AI, blockchain, and IoT to optimize supply chain operations and create more resilient and efficient logistics networks. The market's strong growth trajectory is expected to continue, presenting lucrative opportunities for both established players and new entrants.

Hungary Third Party Logistics Software Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Automobile & Manufacturing

- 2.2. Oil & Gas and Chemicals

- 2.3. Construction

- 2.4. Distribu

- 2.5. Pharma & Healthcare

Hungary Third Party Logistics Software Market Segmentation By Geography

- 1. Hungary

Hungary Third Party Logistics Software Market Regional Market Share

Geographic Coverage of Hungary Third Party Logistics Software Market

Hungary Third Party Logistics Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Perishable Goods; Expanding E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Infrastructure Limitations; Skilled Labor Shortage

- 3.4. Market Trends

- 3.4.1. Growth in the Demand for Warehousing Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Third Party Logistics Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automobile & Manufacturing

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Construction

- 5.2.4. Distribu

- 5.2.5. Pharma & Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ekol Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raben Trans European Hungary

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duvenbeck Logisztikai

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Global

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fiege

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPS Healthcare Hungary Zrt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Waberers International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karzol - Trans**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Liegl & Dachser

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TNT Express Hungary Kft

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV Hungaria

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hunland Trans

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Gartner Intertrans Hungaria

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Hungary Third Party Logistics Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Third Party Logistics Software Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Hungary Third Party Logistics Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Hungary Third Party Logistics Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Hungary Third Party Logistics Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Third Party Logistics Software Market?

The projected CAGR is approximately 4.08%.

2. Which companies are prominent players in the Hungary Third Party Logistics Software Market?

Key companies in the market include DB Schenker, Ekol Logistics, Raben Trans European Hungary, Duvenbeck Logisztikai, DHL Global, Fiege, UPS Healthcare Hungary Zrt, Waberers International, Karzol - Trans**List Not Exhaustive, Liegl & Dachser, TNT Express Hungary Kft, DSV Hungaria, Hunland Trans, Gartner Intertrans Hungaria.

3. What are the main segments of the Hungary Third Party Logistics Software Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Perishable Goods; Expanding E-commerce Market.

6. What are the notable trends driving market growth?

Growth in the Demand for Warehousing Sector.

7. Are there any restraints impacting market growth?

Infrastructure Limitations; Skilled Labor Shortage.

8. Can you provide examples of recent developments in the market?

October 2022: Red Arts Capital has announced that its portfolio company, Partners Warehouse, recently finished the add-on acquisition of Flex Logistics, a third-party logistics (3PL) company in Southern California, which holds nearly 900,000 square feet of warehousing space. This was done as part of Red Arts Capital's ongoing effort to acquire top supply chain and logistics companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Third Party Logistics Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Third Party Logistics Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Third Party Logistics Software Market?

To stay informed about further developments, trends, and reports in the Hungary Third Party Logistics Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence